All major European and most US equity indices closed lower, while APAC markets were mixed. US and benchmark European government bonds closed sharply higher. European iTraxx and CDX-NA closed wider across IG and high yield. The US dollar and gold closed higher, while oil, natural gas, copper, and silver closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except Nasdaq +0.2%, which closed at new all-time record high. S&P 500 -0.2%, DJIA -0.6%, and Russell 2000 -1.4%.

- Investors have mostly shrugged off inflation fears, however, concerns surrounding rising delta variant cases and the potential disruption of the global economic recovery has resulted in variations in major equity market performance, such as that between more restrained Asian stocks and new all-time highs in the US. The continued solid upturn in the J.P.Morgan Global Manufacturing PMI also saw regional variations, with extended strength in the eurozone and the US, while Asia continued to underperform. Investors reacted with variants in monthly factor performance by taking on more risk and exposure to momentum stocks, while shunning previously outperforming deep value shares across many regional markets. (IHS Markit Research Signals)

- US: Value measures such as Forward 12-M EPS-to-Enterprise Value were particularly weak performers among large caps, while higher risk small cap shares ranked in the bottom decile of 60-Month Beta outperformed

- Developed Europe: Investors tempered their optimism in high momentum shares gauged by Rational Decay Alpha with low risk exposure to names captured by 24-Month Value at Risk

- Developed Pacific: High quality firms were especially rewarded, as represented by Inventory Turnover Ratio

- Emerging markets: Investors took on a renewed interest in high momentum, high risk names, as confirmed by outperformance of Rational Decay Alpha and underperformance of 24-Month Value at Risk, respectively

- 10yr US govt bonds closed -9bps/1.35% yield and -7bps/1.98% yield. 10s are 39bps below the 2021 peak closing yield of 1.74% and 30s are 50bps below the multi-year peak closing yield of 2.48% set on the 18 March.

- CDX-NAIG closed +1bp/48bps and CDX-NAHY +4bps/273bps.

- DXY US dollar index closed +0.3%/92.55.

- Gold closed +0.6%/$1,794 per troy oz, silver -1.2%/$26.17 per troy oz, and copper -0.6%/$4.25 per pound.

- Crude oil closed -2.4%/$73.37 per barrel and natural gas closed -1.7%/$3.64 per mmbtu, with the former reaching an almost 7-year intraday high of $76.94 per barrel at 4:20am ET and then declining 4.7% to $73.29 per barrel by 12:30pm ET.

- After five days of failed talks, OPEC+ ministers cancelled a formal meeting on 5 July 2021 to decide on how and by how much to increase oil supply from August on. Informal negotiations are continuing, but there is no indication as to when a new formal meeting will be convened. In an official communique, OPEC said the date of the next meeting would be decided in 'due course'. The OPEC+ group and the UAE now have a narrow time window of two weeks to resolve their differences and re-establish collective production guidance to the global market before August production levels are set and commercial considerations make themselves felt. (IHS Markit Energy Advisory's Roger Diwan, Karim Fawaz, Ian Stewart, Edward Moe, and Sean Karst)

- An agreement on increasing production by 400,000 b/d monthly from August through December was seemingly in place, but the negotiations reached an impasse when the UAE, the third largest producer in OPEC, refused to accept an extension of the current output restraint agreement to the end of 2022, unless it got a bigger quota. The UAE reasoned that its oil output capacity had grown, and the 2018 production level used for its baseline unfairly penalized it by allocating it a smaller quota than it deserves. The UAE apparently wants its baseline, which would define its share of the OPEC+ output pie, to be raised by nearly 700,000 b/d in any extension of the current agreement, or possibly a new agreement. It has signaled flexibility on the potential timing as long as the principle is accepted and adjustments scheduled.

- Fundamental dichotomy at the heart of core OPEC. The UAE captured headlines as the source of the negotiation impasse, but the Saudi proposal reflected an intent to formalize an extended management framework. While the UAE's decision to push back on the agreement has roots in broader strategic considerations, the Saudi proposal itself was also a clear source of friction that exacerbated strategic differences.

- Data from Israel suggest Pfizer Inc.'s vaccine is less effective at protecting against infections caused by the Delta variant of COVID-19 but retains its potency to prevent severe illness from the highly contagious strain. The vaccine protected 64% of inoculated people from infection during an outbreak of the Delta variant, down from 94% before, according to Israel's Health Ministry. It was 94% effective at preventing severe illness in the same period, compared with 97% before, the ministry said. (WSJ)

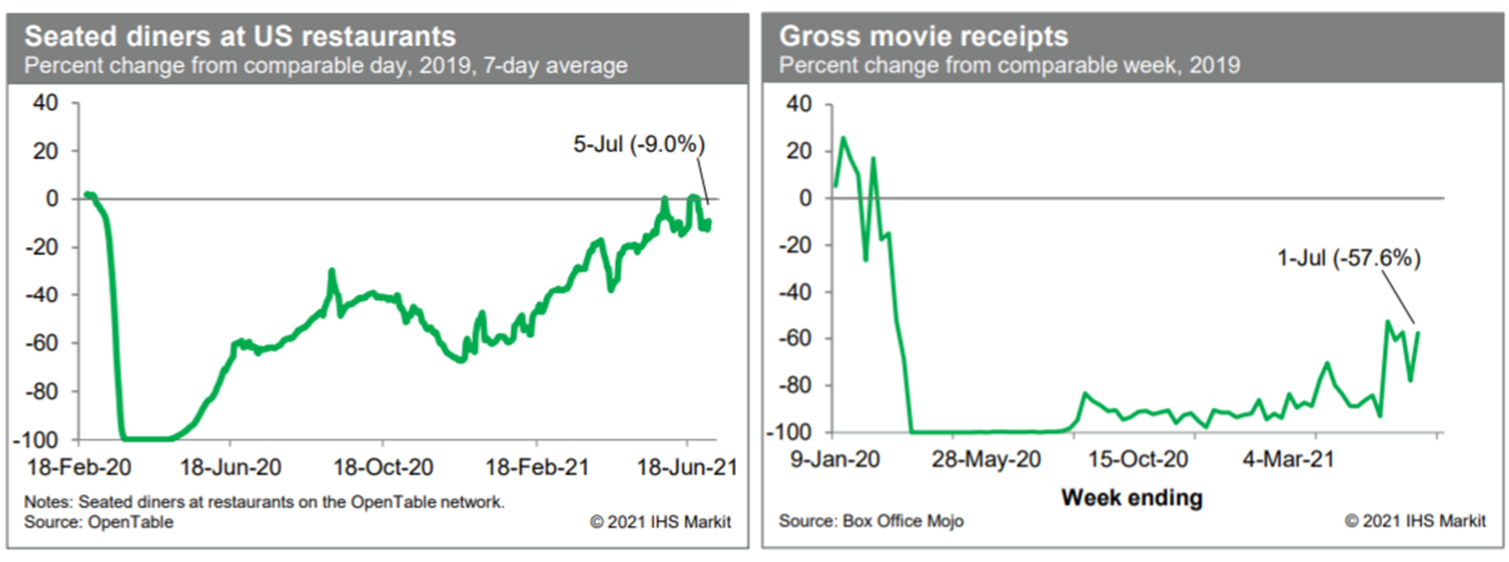

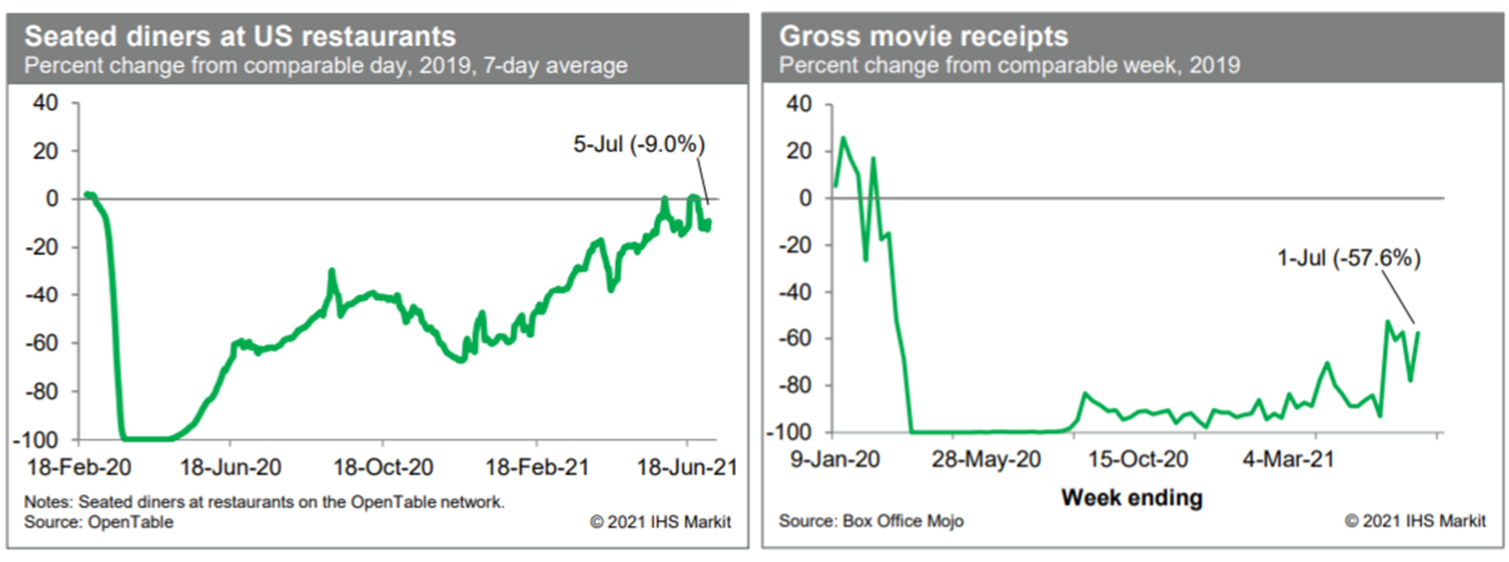

- Averaged over the last week, the count of seated diners on the OpenTable platform was 9.0% below the comparable period in 2019. Since Memorial Day weekend, this average has touched zero (relative to 2019) twice. In essence, restaurant activity appears to have nearly fully recovered. Meanwhile, box office revenues last week were 57.6% below the comparable week in 2019, close to readings in four of the last five weeks. The recovery in movie-theater activity—an indoor and socially dense activity that has been disrupted by streaming services—still has a long way to go. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Hyundai Motor Company has announced an investment of USD100 million in SolidEnergy System (SES), a US lithium-metal battery startup company, reports Reuters. The investment in the purchase of a stake in the startup will help Hyundai in securing SES's battery technology. Hyundai has signed a joint development agreement (JDA) and an equity investment contract with SES. SES separated from the Massachusetts Institute of Technology (MIT) in 2012. SES works on the development of lithium (Li)-metal batteries (LMBs). These batteries are more efficient and have higher energy density than lithium-ion batteries (LIBs), as well as conventional graphite batteries. SES offers Li-metal technology in the Apollo Cell format for automotive applications. SES shareholders include General Motors (GM), which invested USD139 million in SES in April 2021 to boost its battery development. (IHS Markit AutoIntelligence's Tarun Thakur)

- Patterson-UTI has announced it will acquire Pioneer Energy Services for approximately USD295 million, which includes the retirement of all Pioneer Energy Services' debt. Consideration for the acquisition includes issuance of 26,275,000 shares of Patteron-UTI common stock plus payment of USD30 million. Subject to regulatory and shareholder approval, the deal should close in the fourth quarter of 2021. With the acquisition, Patterson-UTI gains 16 super-spec drilling rigs in the US and extends its geographic reach with eight pad-capable rigs in Colombia. (IHS Markit Upstream Costs and Technology's Chris Alexander)

- Costa Rica's Congress approved on 1 July the first reading of a bill to approve the three-year, USD1.75-billion Extended Fund Facility (EFF) agreed with the International Monetary Fund (IMF) in January 2021. Prior to definitive passage of the bill, a second vote is required and scheduled for 12 July. The original agreement with the IMF entailed approval of the Public Employment Bill by May 2021; this was approved by Congress on 17 June in its first reading but still requires approval from the Constitutional Court of the Supreme Court and a second plenary vote. Six other bills are awaiting discussion and Congressional approval. These include legislation to create a global income tax system, setting a maximum tax rate of 27.5% for personal income tax from 2023, introducing a new tax on lottery prizes, eliminating tax exemptions, and imposing a four-year corporate tax of up to 30% on the profits of 14 public companies. Definitive approval of the EFF on 12 July would permit the IMF's first disbursement of USD290 million to Costa Rica, but further disbursements would be conditional on the government gaining congressional approval for the wider fiscal measures agreed with the IMF. (IHS Markit Country Risk's Veronica Retamales Burford)

- The Central Bank of Chile (Banco Central de Chile: BCC) reported that the country's unadjusted monthly economic activity indicator, which is a proxy for GDP, accelerated from 14.1% year on year (y/y) in April to 18.1% y/y during May, setting a new historical record. (IHS Markit Economist Claudia Wehbe)

- The strong positive unadjusted result was mainly driven by contributions in services and commercial activities followed by goods production, because of the lowest comparison base recorded during 2020 in May and also to better adaptation of households and businesses to lockdowns and mobility restrictions during the coronavirus disease 2019 (COVID-19)-virus pandemic.

- The 51.3% y/y increase in commercial activity was propelled by gains in wholesale and retail trade. The 16.8% y/y rise in services was led by personal services, mainly education and healthcare. Gains in manufacturing production explained a 7.5% y/y rise in goods production. The 8.2% y/y gain in the production of other goods category was mainly fueled by construction, which more than offset a modest drop in mining activity.

Europe/Middle East/Africa

- Major European equity indices closed lower; Italy -0.8%, UK -0.9%, France -0.9%, Germany -1.0%, and Spain -1.0%.

- 10yr European govt bonds closed sharply higher; UK -8bps, Germany/France/Italy -6bps, and Spain -5bps.

- iTraxx-Europe closed +1bp/47bps and iTraxx-Xover +6bps/233bps.

- Brent crude closed -3.4%/$74.53 per barrel.

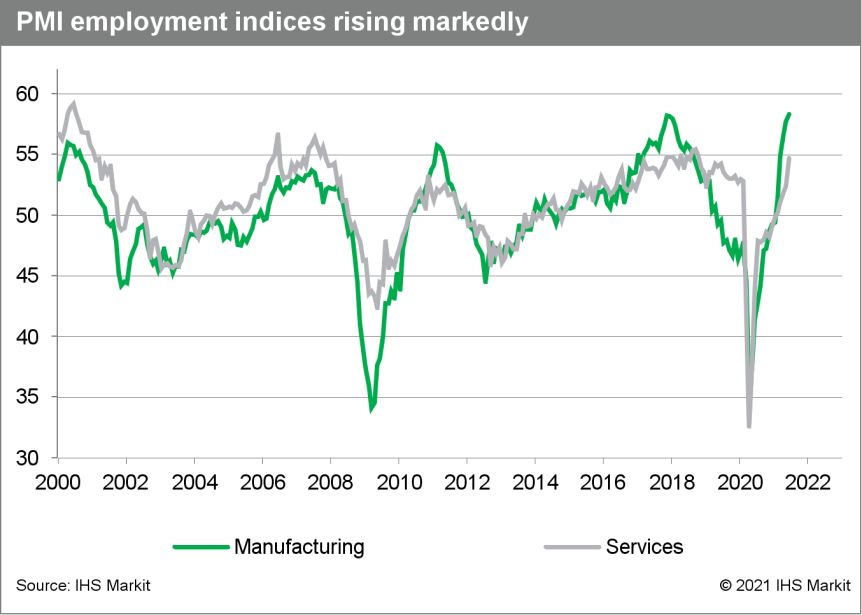

- Eurozone unemployment dropped by 306,000 in May, the third straight decline and the biggest since November 2020. The three-month moving average decline was 154,000 as of May, roughly three times April's equivalent fall. (IHS Markit Economist Ken Wattret)

- The harmonized unemployment rate fell from 8.1% to 7.9% in May, down by 0.6 percentage point compared with the post-COVID-19 pandemic peak in August and September 2020.

- Since the initial wave of COVID-19 in March 2020, the eurozone unemployment rate has risen by just 0.8 percentage point net, a surprisingly modest increase when set against the huge output and expenditure losses during the pandemic. As of the first quarter, the latest data available, eurozone GDP was still 5.1% below its pre-pandemic level in the fourth quarter of 2019.

- A comparison with the post-global financial crisis (GFC) period highlights the remarkable recent resilience of eurozone labor markets. Between early 2008 and mid-2010, during a less severe recession, the eurozone unemployment rate rose by 3 percentage points (from a similar trough of 7.3% up to a peak of 10.3%).

- Eurozone retail sales volumes rebounded by 4.6% month on month (m/m) in May, albeit following a 3.9% m/m drop in April. Strong m/m rebounds in France (9.9%) and Germany (4.2%) were key to May's rebound, again following weakness in April. Following May's bounce, eurozone retail sales volumes are now 3.4% above their pre-pandemic level back in February 2020.

- Germany's ZEW gauge of expectations slipped to 63.3 from 79.8, the lowest since January and below all estimates in a Bloomberg survey. Still, a measure of current conditions turned positive for the first time in two years, indicating more respondents described the situation as good than bad. (Bloomberg)

- Germany May factory orders fell 3.7% M/M vs +0.9% expected, prior -0.2%. Domestic orders grew by 0.9% while foreign orders declined by 6.7% in May. Outside Euro zone orders tumbled 9.3%. (Seeking Alpha)

- The Volkswagen (VW) Group's software unit, Cariad, and Audi will team up with a number of technology partners to work on autonomous vehicle (AV) technology with the aim to bring the results of the research to production. According to Automotive News Europe (ANE), they will form a working group under the umbrella organization The Autonomous, which is dedicated to developing AV technology, with the aim to develop 'safe software' that will contribute to eventual mass adoption of this technology in production vehicles. The other participating members are sensor fusion software specialist BASELABS, software developer CoreAVI, Japanese automotive component supplier Denso, Germany's Fraunhofer Institute for Experimental Software Engineering (IESE), Dutch semiconductor maker NXP, the Swedish Royal Institute of Technology and autonomous software provider TTTech Auto. (IHS Markit AutoIntelligence's Tim Urquhart)

- French hypercar manufacturer Bugatti, which was 100% owned by the Volkswagen (VW) Group, has been folded into a new entity with Croatia's Rimac to form Bugatti Rimac LLC, according to a company statement. The new entity will be 55% owned by a new company called the Rimac Group, which the Rimac Automobili hypercar company and the newly formed Rimac Technology are part of. Rimac Technology will continue to work with other OEMs by developing and sharing high level electric vehicle (EV) technology. The other 45% of the Bugatti Rimac LLC entity will be owned by Porsche AG. The ownership structure of the Rimac Group sees founder Mate Rimac retain a 37% stake in the company, and Porsche retains the same 24% stake it held in the previous Rimac entity, Rimac Automobili. Hyundai also retains the same shareholding it had in Rimac Automobile in the new Rimac Group with a 12% holding, and other investors hold the remaining 27% of the newly constituted company. Porsche chairman Oliver Blume and deputy chairman Lutz Meschke will both serve as supervisory board members at the new joint venture (JV). (IHS Markit AutoIntelligence's Tim Urquhart)

- Fred Olsen Windcarrier (FOWIC) has confirmed that one of the contract awards it announced in May 2021 is for a turbine transport and installation (T&I) scope for Vestas at Iberdrola's Baltic Eagle wind farm offshore Germany. The T&I of 50 x V174-9.5 MW turbines will take place in 2024, with FOWIC's DP2 jackup Blue Tern, which has a maximum working water depth of 65 meters. The unit has a 1,200-metric-ton main crane capacity. FOWIC has previous Baltic Sea wind farm T&I experience, having deployed jackup Brave Tern to the Wikinger project in 2017. The three T&I contracts FOWIC disclosed in May 2021, including the Baltic Eagle award, have a combined value of USD147 million (EUR124 million). (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- Danish GDP losses in 2020 and the first quarter of 2021 caused by the COVID-19 virus pandemic turned out to be much shallower than initially estimated, in early 2021, growing net trade contributed positively to much smaller declines in the headline growth. (IHS Markit Economist Michal Plochec)

- In the final release, Statistics Denmark revised up its detailed real GDP estimates for the first quarter of 2021, to -1.0% quarter on quarter (q/q) from -1.3% q/q. The fourth quarter of 2020 has also been revised up, to 0.9% q/q from 0.8% q/q).

- When looking at the detailed expenditure breakdown, the main drag on growth in the first quarter remained private consumption, but it is now estimated to have contracted by 4.4% q/q (instead of 4.9%). The main factor behind the upward revision was net trade, as exports are now estimated to have increased by 3.9% q/q in the first quarter while imports declined by 3.4% q/q. This implies a much wider trade surplus, as before the revision the first quarter's exports and imports had been reported to have grown by 6.1% and 1.6% respectively, and the reported positive gap had been significantly smaller.

- Annual figures have also been revised up. GDP in 2020 is now estimated to have contracted by only 2.1% year on year (y/y), revised up from -2.7%, which was already one of the best results in Europe.

- Bank financing growth is weakening in Emerging Europe as loan moratoria will be expiring. Loans that were put under moratoria during the COVID-19 virus shock comprise the highest share of loan portfolio in Hungary, Slovenia, and Croatia, according to the Euro Banking Association (EBA). In Hungary, moratoria were automatic unless customers asked to opt out, while Croatian and Slovenian economies contracted the most in 2020, by 7.7% and 6.1%, respectively. (IHS Markit Economist Vaiva Seckute)

- The non-performing loans (NPL) ratios in March increased slightly only in Poland, Latvia, and Czechia and decreased in most of the other countries in the region. In addition, the number of loans under moratoria has declined in Emerging Europe owing to a lower take-up of new moratoria and an increasing number of borrowers that started to repay their loans.

- However, a large share of loans that were put under moratoria is currently classified as stage 2 (still performing, but exhibiting increasing credit risk). For example, although Romania and Slovakia are not the leaders in terms of loans under moratoria, around 50% of those loans are under stage 2.

- Stage 2 loans under moratoria comprise the largest share of loan portfolio in Slovenia, Slovakia, Romania, Poland, and Bulgaria. Bulgaria and Poland had higher total NPL ratios than other countries in the region. The Bulgarian National Bank, however, is reporting a somewhat lower NPL ratio, namely 4.8% for the first quarter. The higher NPL level in the country is related to legacy bad loans from the global financial crisis and the collapse of Corpbank in 2014.

- The loan stock to NFCs has been decreasing in most Emerging Europe countries in 2021 as banks have tightened lending standards for corporates, especially those in the COVID-19-virus-affected industries such as retail and hospitality. Loan stock growth to households continued rising in all countries, sustained by robust demand for housing loans however, the pace of growth has decelerated significantly in some, namely Hungary, Bulgaria, Croatia, Poland, and Slovenia.

- On 1 July, the Central Bank of the Republic of Turkey (CBRT) announced an update on reserve requirements "to improve the effectiveness of monetary transmission mechanism". In particular, the decision raises the required reserve ratio for foreign-exchange deposits by 200 basis points for all maturity brackets, effective from 19 July. Moreover, in an effort to boost lira deposits, the CBRT will also apply an additional remuneration rate on required reserves denominated in local currency and will exempt deposits converted into local currency from the reserve requirement liabilities. (IHS Markit Banking Risk's Greta Butaviciute)

Asia-Pacific

- APAC equity markets closed mixed; South Korea +0.4%, Japan +0.2%, India 0%, Mainland China -0.1%, Hong Kong -0.3%, and Australia -0.7%.

- China's cyberspace regulator had reportedly suggested that Didi Chuxing (DiDi) should delay its initial public offering (IPO) and to evaluate its network security. The recommendation by Cyberspace Administration of China (CAC) was made weeks before DiDi went public, reports Reuters. DiDi recently launched an IPO in the US that valued the company at USD67.5 billion. Following this, the CAC ordered the removal of DiDi's app from app stores to protect "national security and the public interest", after finding that the ride-hailing giant had illegally collected users' personal information. The regulator is concerned that DiDi's vast data troves would fall into foreign hands because of the increased public exposure that comes with US listing. DiDi collects a large amount of real-time mobility data every day, of which some is used for building autonomous vehicle technologies and traffic analysis. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Freetech, an autonomous vehicle (AV) startup, has raised more than USD100 million in a Series A funding round from China Internet Investment Fund, Huiyou Capital, and Dongfeng Bank of Communications, among others. Freetech plans to use the infused capital towards scaling the production of its solutions, which include vehicle perception and control using cameras, radar, and sensors, reports KrASIA. Freetech was established in 2016 and focuses on developing new Level 3 autonomous capabilities, in addition to supplying its current Level 2+ offerings. The company claims that it supplies its intelligent driving products to over 40 automakers including FAW Group, SAIC Motor, Changan Automobile, Geely Auto, and Dongfeng Motor. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Hengyang city in China has launched an intelligent transportation project with an investment of CNY500 million (USD80 million). The autonomous vehicle (AV) project is led by Mogo Auto Intelligence and Telemetics Information Technology. Under the project, Mogo Auto is to provide a Smart City Transportation Brain for real-time monitoring and overall scheduling to meet citizens' transportation demands. The project is claimed to be the largest of all Level 4 autonomous trials so far, with a designed mileage of 200 kilometers (km). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Shandong province in China launched its first hydrogen-powered intercity vehicle network at the end of June, including 170 cold-chain and slag trucks, reports Global Government News. According to the report, the vehicles are to operate between the eastern city of Qingdao and Linyi city in the west of the province. The vehicles are expected to help reduce the province's overall carbon-dioxide emissions by 20,000 metric tons a year. The manufacturer of the trucks, Qingdao Dexian New Energy Automobile Manufacturing, claims that each truck has a range of up to 450 kilometers and can be filled in five minutes. (IHS Markit AutoIntelligence's Nitin Budhiraja)

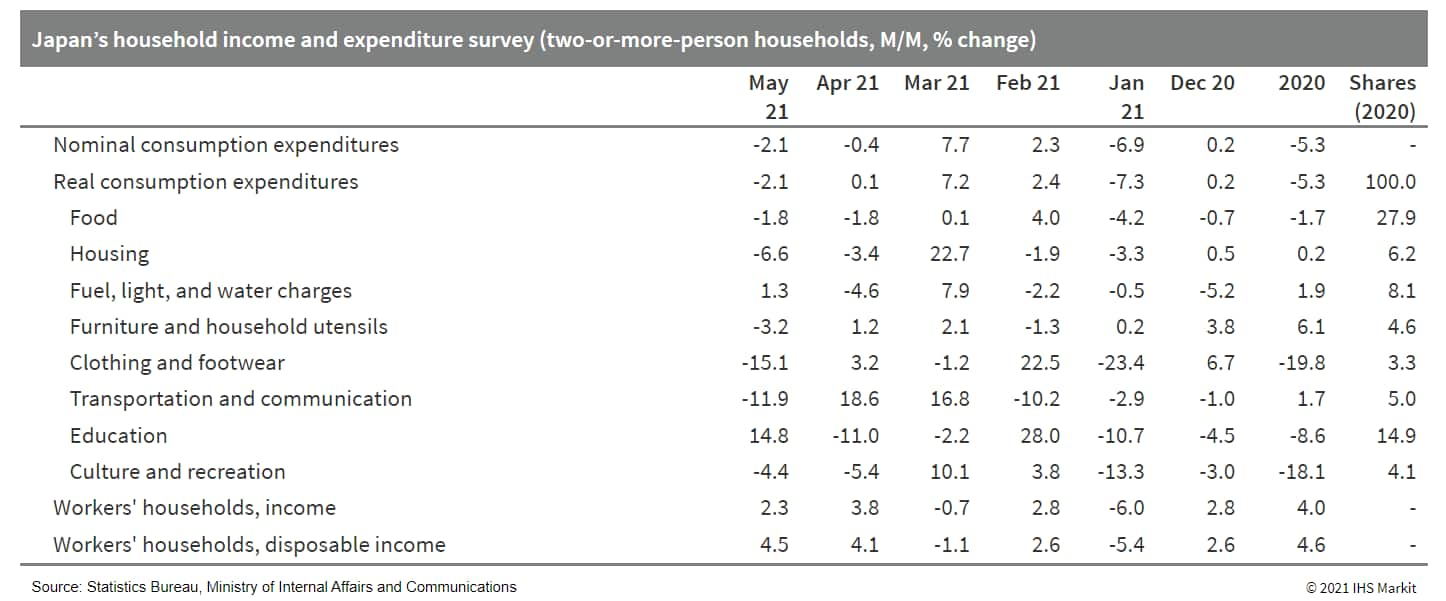

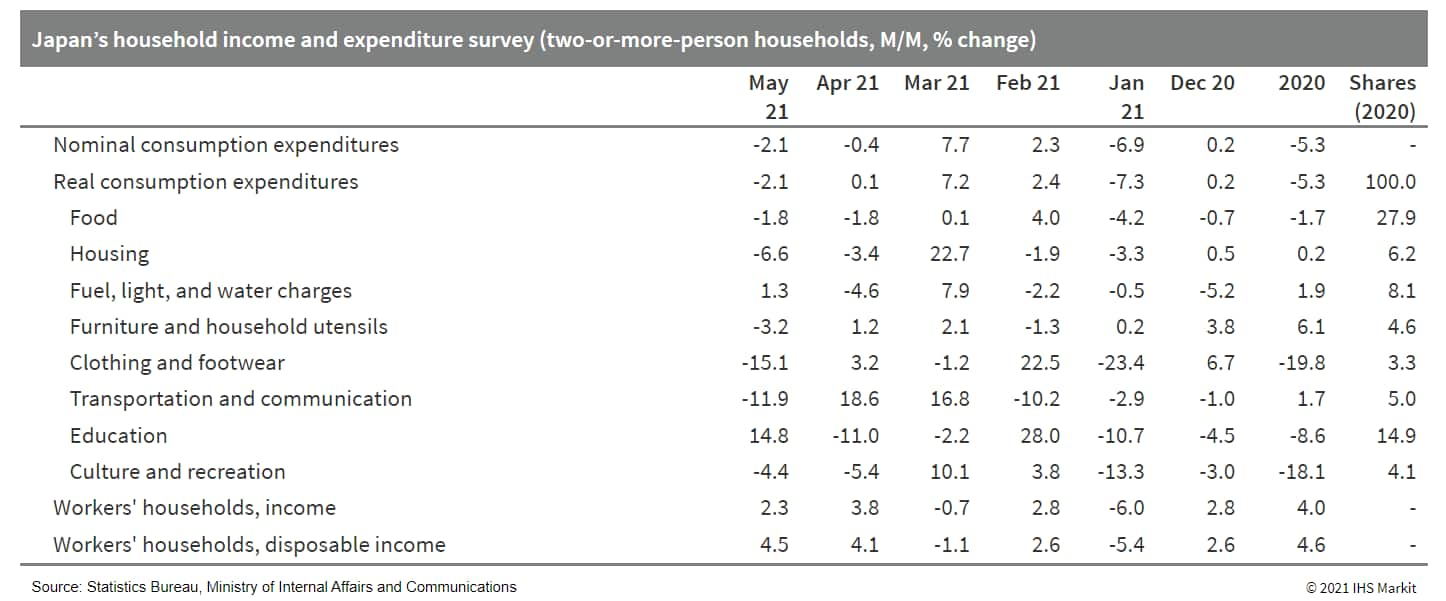

- Japan's real household expenditures fell by 2.1% month on month (m/m) on a seasonally adjusted base in May following three consecutive months of growth. Low base effects continued to support robust year-on-year (y/y) growth at an 11.6% rise. The m/m weakness largely reflected declines in clothing and footwear and transportation and communication because of the negative effects of COVID-19 containment measures. However, the negative effects were softer than those of the second state of emergency in the first quarter of 2021. (IHS Markit Economist Harumi Taguchi)

- Nominal monthly average cash earnings fell by 0.8% m/m on a seasonally adjusted base in May but rose by 1.9% y/y. The m/m weakness was due largely to a 4.5% decline in total hours worked from the previous month, reflecting cuts in operating hours under the state of emergency in many prefectures.

- Total hours worked rose by 6.8% from a year earlier largely thanks to low base effects. An increase in the number of employees also helped lift cash earnings.

- Vietnamese conglomerate Vingroup JSC chairman Pham Nhat Vuong plans to invest USD2 billion to penetrate the United States' electric vehicle (EV) market, reports the Vietnam News Brief Service. The conglomerate plans to sell 15,000 EVs in the US next year and raise annual sales to 160,000-180,000 units in the future, which is equivalent to 1% of the country's vehicle market share, highlights the report. (IHS Markit AutoIntelligence's Jamal Amir)

- Malaysia's monthly frequency data for April and May were inconclusive, with April export numbers falling, but other sectors growing in the prior month. However, these data will be significantly affected by the negative effects of the COVID-19 lockdown that started in June. (IHS Markit Economist Dan Ryan)

- Malaysia's central bank continues to hold steady, with the policy rate still at 1.75%. The ringgit has remained in a narrow range around 4.14 per US dollar despite the lockdown in June.

- Industrial production for the second quarter is looking poor, with a sharp drop in March being only partially offset by a small increase in April. However, wholesale sales, both nominal and real, showed a strong positive correction in April that offers a good start for their second-quarter levels.

- Labor data for April showed promise for the second quarter, with the unemployment rate falling to 4.5%, well below the 4.9% average of the first quarter.

Posted 06 July 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.