European equity markets closed sharply higher, while US and APAC markets were mixed. US government bonds sold off sharply on the Democrat's dual victories in the US Senate run-off elections, with European bonds also lower on the day. European iTraxx indices closed tighter across IG/high yield and CDX-NA closed almost flat after being tighter most of the day. Oil and copper were higher, while gold and silver closed lower. Today's ADP US private employment report came in much weaker than expected, so all eyes will now be on tomorrow morning's US weekly jobless claims report and Friday's US non-farm payrolls report.

Americas

- US equity markets closed mixed, with the Russell 2000 +4.0% reporting its best daily performance since late-April; DJIA +1.4%, S&P 500 +0.6%, and Nasdaq -0.6%.

- The U.S. Capitol was declared secure on Wednesday evening, about four hours after a mob of President Donald Trump's supporters stormed the building and forced debate on Joe Biden's victory in the Electoral College to be suspended. The Secretary of the Army said 1,100 National Guard troops had been deploying to the Capitol to bolster local police and other forces, some of which were seen massing on street corners near the main congressional building. Washington Mayor Muriel Bowser ordered a 6 p.m. curfew after a day of chaos and violence. (Bloomberg)

- US govt bonds sold off sharply on the morning announcements confirming that Democrat Raphael Warnock won his US Senate contest and polls indicated that fellow Democrat Jon Ossoff was also highly likely to win.

- 10yr US govt bonds closed +8bps/1.04% yield, which is the first close above 1.00% since 19 March.

- 30yr govt bonds closed +11bps/1.82% yield, which is the highest close since 26 February.

- CDX-NAIG closed flat/52bps and CDX-NAHY -1bps/302bps, with the latter being as tight as -9bps at 11:23am EST.

- DXY US dollar index closed +0.1%/89.53.

- Gold closed -2.3%/$1,909 per ounce, silver -2.2%/$27.04 per ounce, and copper +0.3%/$3.65 per pound.

- Crude oil closed at +1.4%/$50.63 per barrel, which is the highest close since 24 February.

- Minutes from the meeting of the Federal Open Market Committee (FOMC) held on 15 and 16 December 2020 were released this afternoon (6 January). The most substantive discussions centered on evolving risks to the economic outlook over the short- and medium-runs; the form of outcome-based guidance for asset purchases and future considerations related to that guidance; and prospects for inflation moderately overshooting the 2% longer-run objective. (IHS Markit Economists Ken Matheny and Chris Varvares)

- The most consequential decision taken at the December meeting was to provide qualitative, outcome-based guidance for large-scale asset purchases. There was unanimous agreement to "enhance" the FOMC's communication about asset purchases by issuing qualitative, outcome-based guidance that such purchases would continue "until substantial further progress has been made toward reaching the Committee's maximum employment and price stability goals."

- All FOMC participants felt it was appropriate to continue the Treasury and MBS purchases, with a couple open to weighting purchases of Treasury securities toward longer maturities. With relatively few participants in favor of such a change, it is unlikely that average maturity of purchases will be increased barring a deterioration in the outlook.

- The seasonally adjusted final IHS Markit US Services PMI Business Activity Index registered 54.8 in December, down notably from 58.4 in November and also lower than the earlier released 'flash' estimate of 55.3. Although the rate of expansion was slightly stronger than the series average, it marked a significantly slower upturn in output, as a rise in virus cases dampened client demand. The latest increase in total new business was the slowest for four months. The loss of growth momentum reportedly stemmed from difficulties among consumer-facing firms following another surge in virus cases and additional social distancing restrictions. (IHS Markit Economist Chris Williamson)

- US manufacturers' orders rose 1.0% in November, while manufacturers' shipments rose 0.7%. The former was close to the consensus expectation. (IHS Markit Economist Ben Herzon and Lawrence Nelson)

- Manufacturers' inventories, meanwhile, rose 0.7% in November and, factoring in a small upward revision to October, were in line with our expectations through November.

- Orders and shipments of nondefense capital goods excluding aircraft (core capital goods) were little revised through November. Taken together, the details of this report that feed into our GDP tracking left our estimate of fourth-quarter GDP growth unrevised at 3.0% and our forecast of first-quarter GDP unrevised at 2.4%.

- Nominal shipments of petroleum refineries have recovered just over one-half of a sharp two-month decline last spring. This mainly reflects reduced oil prices; from February through November, nominal shipments of petroleum refineries declined 23%, while domestic oil prices declined 19%.

- Outside of petroleum refineries, nominal shipments have fully recovered and, as of November, were 1.4% above the February level.

- This highlights the relative strength of the goods sector (relative to services). By our estimates, US GDP of goods has fully reversed the pandemic-induced decline, while GDP of services is still lagging.

- In addition to a relatively healthy goods sector generally, today's report highlights the relative strength of equipment spending. Orders and shipments of core capital goods have surged past their pre-pandemic trends, indicating robust near-term growth of equipment spending.

- The number of employees at U.S. businesses unexpectedly declined in December for the first time since April, underscoring the immediate economic impact of mounting coronavirus cases across the country. Company payrolls decreased by 123,000 during the month, concentrated in leisure and hospitality and retail, according to ADP Research Institute data released Wednesday. The prior month was revised down slightly to a 304,000 gain. The median projection in a Bloomberg survey of economists called for an increase of 75,000 in December. Private payrolls remain almost 10 million short of pre-pandemic levels. (Bloomberg)

- PPG Industries says it has raised its offer for Tikkurila to €1.24 billion ($1.52 billion), or €27.75/share, in response to Tikkurila's receipt of an undisclosed rival bid. PPG announced the acquisition of Tikkurila for an original price of €1.1 billion, or €25/share, on 18 December. The revised offer represents an 84.5% premium on Tikkurila's closing price as of 17 December, the last trading day before the deal was announced. Tikkurila is a major producer of decorative paints and coatings, with operations in 11 countries, principally in northern Europe. The company reported €564 million in revenue in 2019. "We will be able to extend the reach of the strong Tikkurila products, and immediately utilize Tikkurila's well-established distribution network across the Nordic region for a wide variety of PPG products," says PPG chairman and CEO Michael McGarry. "From a cost standpoint, the Tikkurila management team has implemented a broad margin-improvement program over the last couple of years, and we will continue that momentum with supply-chain and other traditional acquisition-related synergies." The tender offer for all outstanding shares in Tikkurila will commence on or about 15 January, and the deal is expected to close in the second quarter of this year. PPG has announced multiple significant acquisitions in recent weeks. Earlier today, it announced the acquisition of VersaFlex, a maker of specialty coatings for industrial and infrastructure end markets, and in November the company said it would acquire transportation coatings maker Ennis-Flint. (IHS Markit Chemical Advisory)

- General Motors (GM) is reported to be planning to build an electric utility vehicle for the Honda brand at a Mexico facility and an electric vehicle (EV) for the Acura brand at a US plants, according to media reports. Automotive News reports that the Acura project will be produced at GM's Spring Hill (Tennessee, US) plant, while the Honda product would be produced at Ramos Arizpe (Mexico). The report indicates the Honda could go into production in 2023 and the Acura product in 2024. Automotive News notes that GM declined to comment on future product, and quotes a Honda spokesperson as saying the company "looks forward to sharing new information on our North American electrification strategy later this year." In 2020, GM and Honda announced plans first for GM to jointly develop EVs for Honda on GM's Utium battery platform as well as later announcing plans to form a North American product alliance. Although neither GM nor Honda have confirmed or denied the recently revealed production plans, producing the Honda variant in Mexico would suggest it would share more with planned Chevrolet EV products, expected to be produced at Ramos Arizpe, while the Acura could be more closely aligned with Cadillac products planned to be produced at Spring Hill. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Lactalis Brazil, the largest milk processor in the country, has said that it is aiming to make Brazil a hub for exporting its products to South and Central America countries. In 2020, the company's shipments from Brazil rose by almost 170% y/y, to 3,400 tons with foreign sales favored by a good exchange rate. Most of the trading took place between Lactalis' business units, with products manufactured in Brazil under international brands, such as Parmalat and Président, sold in Uruguay, Chile, Paraguay, Argentina, Colombia, and Peru. The Dominican Republic is set to join the recipient list soon, said Guilherme Portella, communication director at Lactalis Brazil. The company also extended its portfolio of exports from four product-types in 2019 (UHT milk in bottles, flavored milk, condensed milk and sour cream), to ten types in 2020, which now also includes butter, cheese, curd and canned condensed milk, in cans. (IHS Markit Food and Agricultural Commodities' Ana Andrade)

- Bolivia's banking regulator, the Financial System Supervision Authority (Autoridad de Supervisión del Sistema Financiero: ASFI), released an order on 28 December stating that banks must withhold all of their 2020 profits and reserve them as capital, therefore banning dividend payments through 2021. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- This regulation is stricter by national standards. Since 2015, the ASFI has been forcing banks to retain at least 50% of their profits. IHS Markit interprets this doubling of the percentage as an indication that the regulator considers the sector's capital buffers to be in need of strengthening, taking into account the likely concretization of asset-quality deterioration in 2021.

- As of September 2020, Bolivian banks had a capital adequacy ratio (CAR) of 13.1%, parallel to a low shareholders' equity-to-total assets ratio of 6.8%. According to news sources, the sector's profits between January and November 2020 stood at BOB1.15 billion (USD170 million), equivalent to 0.5% of total assets in the sector. This means that the leverage ratio will have a maximum jump to 7.7% of total assets.

- Despite this moderate improvement in capitalization, we consider the sector to have inadequate levels of capital. This is risk negative for banks given that the economic deterioration caused by the COVID-19-virus pandemic has not yet translated into a rise in impairment. IHS Markit estimates that real GDP will end 2020 with an 8.8% contraction.

- As with the broader region, we expect non-performing loans (NPLs) to rise in Bolivia through 2021. Furthermore, despite a low NPL ratio at 1.7% as of September 2020, provisions are insufficient to cover it, as demonstrated by the coverage ratio at 88.4% over the same period, revealing that some proportion of the sector's capital will be threatened as the year unfolds.

Europe/Middle East/Africa

- European equity markets closed sharply higher; UK +3.5%, Spain +3.2%, Italy +2.4%, Germany +1.8%, and France +1.2%.

- 10yr European govt bonds closed lower across the region; UK/France +3bps, Spain/Germany +2bps, and Italy +1bp.

- iTraxx-Europe closed -1bp/48bps and iTraxx-Xover -8bps/247bps.

- Brent crude closed +1.3%/$54.30 per barrel, which is the highest close since 24 February.

- With most of the UK facing a lockdown in early 2021, the UK economy is heading for a deeper double-dip recession. (IHS Markit Economist Raj Badiani)

- The second national lockdown in England during November, followed by tough regional restrictions across most of the UK, probably triggered fresh GDP losses during the final quarter of 2020, with the economy likely to have contracted by between 2.0% quarter on quarter (q/q) and 3.5% q/q.

- This is less damaging than when real GDP fell by 18.8% q/q in the second quarter of 2020 during the first shutdown. Manufacturing and construction firms, alongside schools, remained open during the final quarter of 2020.

- On the flipside, there is some evidence that the economy received a boost from Brexit-related stockpiling before the transition period expired on 31 December 2020.

- With the UK now enduring a third lockdown, which includes the closure of schools, the UK is set to endure further GDP losses in the first quarter of 2021. Again, the service sector will be the most exposed, largely reflecting tighter restrictions on consumer-facing services. Again, manufacturing and construction firms will continue to operate, helping to soften the impact on overall economic activity.

- Effective vaccination rollout plan required to spark strong growth from Q2

- The key to halting the current loop of easing restrictions triggering rising infections is a rapid and effective COVID-19 vaccination rollout.

- This will allow a sustained easing of restrictions and lay the foundations for a strong economic rebound from the second half of 2021 and in 2022.

- A key driver will be a sharp rebound in consumer spending, aided by accumulating household savings during the pandemic. Indeed, the household savings rate stood at historical highs of 27.4% and 16.9% of disposable income in the second and third quarters of 2020, respectively.

- Plant-based food company Livekindly Collective has further expanded its portfolio with the acquisition of No Meat, an alternative protein line owned by UK frozen foods retailer Iceland Foods. No Meat's plant-based products include the No Bull burger, No Bull mince and 'meat' balls, No Porkies sausages and burgers and No Chick fillets and strips. The products are currently available in stores owned by Iceland, Asda and Ocado in the UK. US-based Livekindly said the acquisition underlines its ambition to "spearhead the global shift to environmentally friendly meat alternatives". "This acquisition is very complementary to our current portfolio further strengthening our position in the frozen sector of the fast-growing plant-based meat category", says Domenico Speciale, General Manager for Livekindly Collective in the UK. "This acquisition is a big step in delivering our mission of making plant-based food the new norm." Andrew Staniland, Trading Director - Frozen at Iceland Foods said partnering with Livekindly Collective would help bring the No Meat brand to new consumers globally while also expanding Iceland Foods' plant-based product offering in the UK. The new partnership will launch in January 2021 when Iceland will provide new and exclusive No Meat products as part of a "Veganuary Sale". (IHS Markit Food and Agricultural Commodities' Max Green)

- Autonomous vehicle (AV) software startup Oxbotica has raised USD47 million in a Series B funding round, reports VentureBeat. The financing round was led by the venture arm of oil giant BP in participation with BGF, Halma, HostPlus, IP Group, Tencent, Venture Science, and funds advised by Doxa Partners. The company plans to use the capital to accelerate commercial deployment of its software platform across key industries and markets. Oxbotica was founded in 2014 as an AV software company, headquartered in Oxfordshire. The company specialises in building artificial intelligence software for controlling AVs and cloud-based software that optimises the route of the vehicle on the road. Oxbotica's software is deployed for use in AV trials as part of Project Endeavour and Project DRIVEN. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Volkswagen (VW) CEO Herbert Diess has said that he is concerned about the difficulties 'old auto' is having in proving to the markets that they will not be left behind in a technology race with disruptors like Tesla and Apple. In a Bloomberg interview, Diess said that getting the message across that VW would not be left behind in the race for new automotive technology was central to his recently announced program of reforms for the company (see Germany: 15 December 2020: VW Group CEO wins supervisory board backing for reforms but no contract extension). He said, "Despite all efforts, we are currently in a rather more difficult situation than in 2018, when I took office. What really has changed -- and what I had not expected to this extent -- is the view of capital markets on our industry." Commenting on the difference in valuations between tech and traditional auto companies and how this has affected their respective access to capital, Diess added, "We haven't sufficiently proved yet that we can hold our ground in the new competitive environment -- our valuation is still located in 'old auto'… This leads to a grave disadvantage for us in terms of access to required resources." While traditional automotive companies have performed averagely to poorly in recent years on the markets, the tech companies' market capitalization has risen exponentially, as has their ability to raise fresh capital cheaply. Tesla is seen by the markets as a tech company, rather than a traditional company, and despite a valuation that even its own CEO has previously described as unrealistic, its share price has continued to rise. (IHS Markit AutoIntelligence's Tim Urquhart)

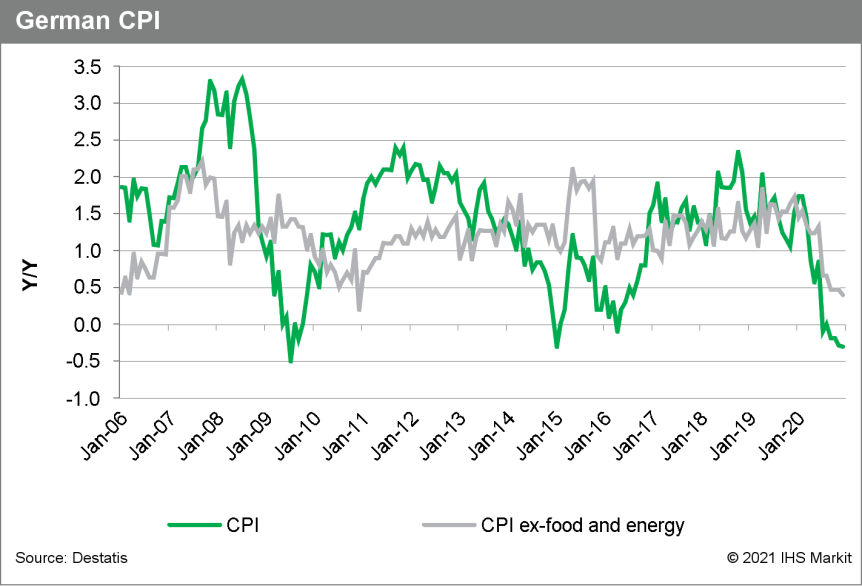

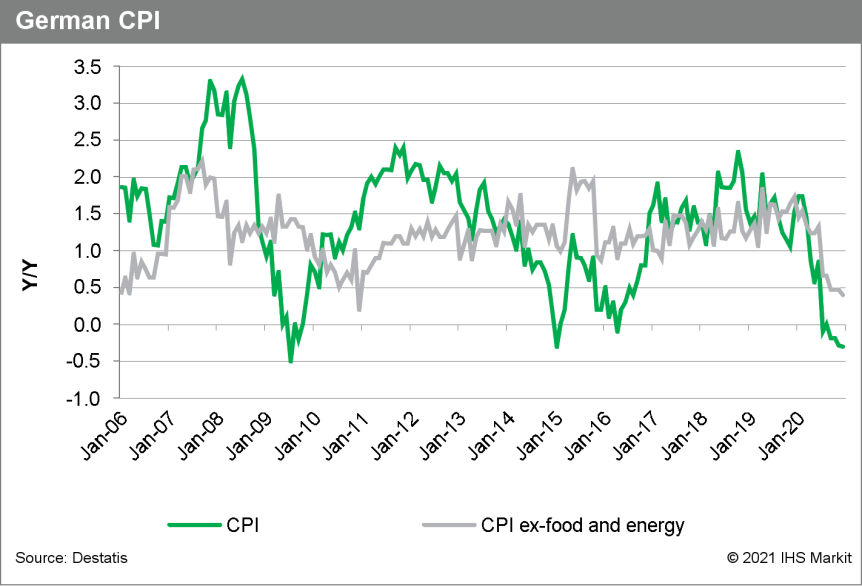

- Germany's Federal Statistical Office (FSO) has reported, based on data from various regional states, that the country's national consumer price index (CPI) increased by 0.5% month on month (m/m) in December 2020, about 0.1 percentage point firmer than the average monthly change in December in recent years. The annual inflation rate remained at -0.3%. The EU-harmonized CPI measure posted a reading of 0.6% m/m, its year-on-year (y/y) rate thus staying at -0.7%. (IHS Markit Economist Timo Klein)

- The detailed breakdown of the German national data will only be published with the final numbers on 19 January, but components are available, for instance, from the largest and most populous state of North Rhine-Westphalia (NRW). CPI inflation in this state stood at 0.5% m/m, leaving its y/y rate at -0.4%.

- Energy prices in NRW rebounded by 1.4% m/m, pushing up their y/y rate from -6.8% to -5.5%. The main other categories showing rising prices during December were recreation and entertainment (4.5% m/m; mostly but not entirely seasonal, linked to package tour prices surging 22.2%), furniture/household goods (0.6%), and "miscellaneous goods and services" (0.4%). These forces were broadly offset by cheaper clothing/shoes (-5.3% m/m), food (-0.8%), and alcohol/tobacco (-0.8%).

- With respect to changes in y/y rates, inflation was boosted the most - taking weights into account - by transport (from -3.2% to -2.5%), housing/utilities (from 0.1% to 0.3%), recreation and entertainment (from 0.6% to 1.0%), and "miscellaneous goods and services" (from 0.7% to 1.1%). These were offset by sharp declines for food (from 1.0% to -0.1% y/y) and especially clothing/shoes (from -2.2% to -6.3%).

- NRW's core rate of inflation without food and energy remained steady at 0.3% y/y in December. Apparently, increases in the recreation and entertainment and furniture/household goods categories were offset roughly by the price plunge for clothing/shoes.

- Service-sector inflation in NRW was stable at 0.9% y/y, while goods inflation edged down slightly further from -1.7% to -1.8% y/y.

- German inflation broadly corresponded to expectations in December and remained in moderately negative territory. Importantly, however, the re-imposition in January of the higher VAT rates that had prevailed until June 2020 will push inflation back up to around 0.3% at first in early 2021, followed by around 1% in mid-2021 and nearly 2% in late 2021, the latter owing to VAT-related base effects in combination with the projected economic recovery as the COVID-19 virus pandemic is slowly overcome.

- Audi has taken another step towards making its production facilities fully carbon neutral with a new technology aimed at more efficient plastic recycling. According to an Autocar report, Audi will switch from the mechanical reconstitution of waste plastic materials, such as fuel tanks, wheel trim parts, and radiator grilles, towards a form of chemical recycling. Audi and the Karlsruhe Institute of Technology will seek to convert such materials into pyrolysis oil, which can be used to make new plastic for cars, thus saving energy and cost. Audi's head of Procurement Strategy, Marco Philippi, said, "We want to make efficient use of resources, and chemical recycling has great potential for this." Audi has presumably conducted a study on the overall environmental benefit of shifting to this plastic recycling technique since there is an obvious possible environmental downside in using chemicals for recycling plastics as any chemical waste will have to be disposed of responsibly. However, there appears to be a benefit in terms of reduced energy consumption in not using large industrial equipment for such tasks. (IHS Markit AutoIntelligence's Tim Urquhart)

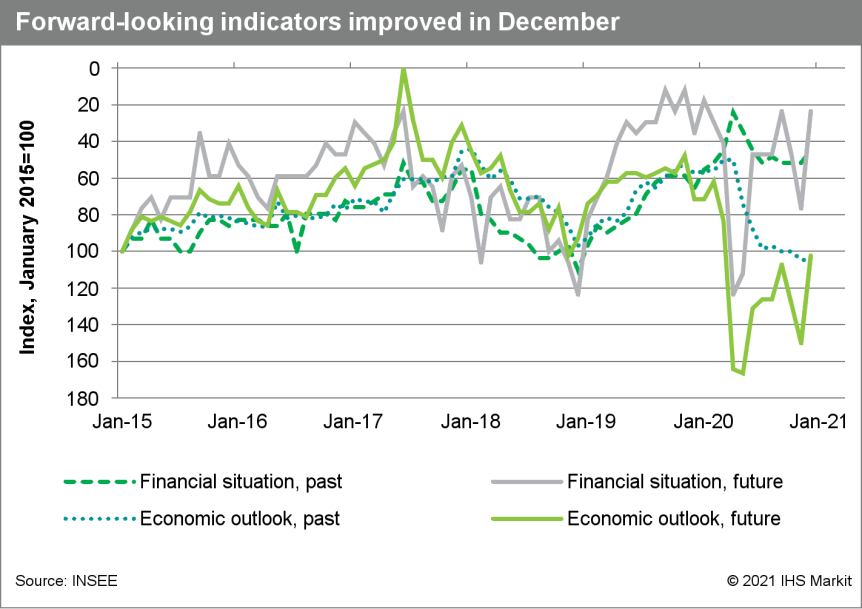

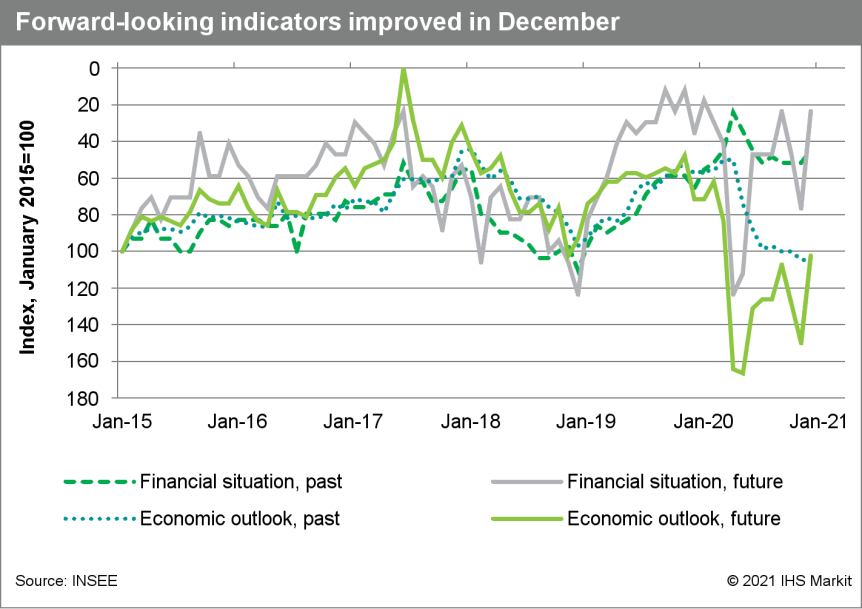

- France's consumer confidence index increased from 89 in November, which was a near two-year low, to 95 in December. The confidence index had collapsed from 104 in March to 95 in April, and has since ranged between 89 and 96. (IHS Markit Economist Diego Iscaro)

- The November index demonstrated a large deterioration of the forward-looking elements of the survey resulting from the introduction of the new national lockdown in late October. Following the partial relaxation of some of the measures in late November, these sub-indices rebounded in December (see chart). The survey was conducted between 25 November and 15 December.

- In particular, the index measuring households' views on the economic outlook has improved to its highest level since March 2020. Households' views on their financial outlooks also improved, matching the level in September.

- The index measuring unemployment expectations, which had reached its highest level since mid-2013 in November, declined to its lowest level since April. Similarly, the index measuring major purchase intentions over the coming year has more than recovered from its November collapse, rising to its highest level since February 2020.

- This was accompanied by a decline in the index measuring households' saving intentions, which fell to a four-month low.

- Although the December figures are encouraging, the number of COVID-19 cases has continued to increase since the survey was conducted, prompting the authorities to delay some of the planned relaxation in restrictions. It remains to be seen whether this, combined with an underwhelming start of the vaccination program in France, will damage sentiment in January.

- Households' incomes have been protected by strong fiscal support, driving a large increase in savings. Improving confidence, if sustained, may lead to some of this pent-up demand being unleashed as and when restrictions are gradually eased.

- Angelini Pharma (Italy) has entered a definitive merger agreement to acquire Arvelle Therapeutics (Switzerland). The terms of the deal require Angelini to pay an initial sum of USD610 million. A further USD350 million will be due, provided that Arvelle's epilepsy candidate cenobamate generates undisclosed revenue targets, subject to regulatory approval in Europe. The all-cash transaction is therefore valued at up to USD960 million. The takeover will enable Angelini to gain exclusive licensing rights to the drug-resistant, partial (focal)-onset seizure drug cenobamate in adults in the European Union, European Economic Area, Switzerland, and the United Kingdom. Arvelle secured licensing rights to cenobamate in Europe from SK Biopharmaceuticals (South Korea) in a USD530-million deal in 2019 (see Switzerland - South Korea: 19 February 2019: SK Biopharmaceuticals signs USD350-mil. licensing agreement with Arvelle for cenobamate in Europe). SK Biopharmaceuticals is entitled to further milestone payments of up to USD430 million, pending regulatory and commercial milestones. The South Korean firm has sold a 12% stake that it held in Arvelle to Angelini. A decision on whether to recommend cenobamate for approval by the European Medicines Agency (EMA) is expected in 2021. The UK Medicines and Healthcare Products Regulatory Agency (MHRA) granted cenobamate a promising innovative medicine (PIM) designation in August 2020. As such, cenobamate is expected to be a candidate for the early access to medicines scheme (EAMS) in the UK, which is tailored towards expedited patient access of therapies nearing the end of the development program in areas of unmet medical need. Cenobamate is approved by the US FDA under the brand name Xcopri for the treatment of partial (focal) seizures in adults. The acquisition of Arvelle should drive Angelini's ambitions to carve out a larger market share in the central nervous system (CNS) therapeutic area in the European market. (IHS Markit Life Sciences' Eóin Ryan)

- Russian Federal State Statistical Service (RosStat) revised its "flash" estimate of a 3.6% year-on-year (y/y) contraction for the third quarter of 2020 to 3.4% y/y. This compares to a y/y fall of 8.0% in the second quarter, when the brunt of the containment measures against the coronavirus disease COVID-19 virus pandemic sent all sectors of the economy into deep contraction, with the exception of exports and public consumption. (IHS Markit Economist Lilit Gevorgyan)

- The latter continued to expand in the third quarter as well. However, government consumption was small to offset the drag from underperformance of all other expenditure components.

- More specifically, private consumption fell by 8.4% y/y during July-September, compared to a sharp fall of 22.1% in the previous quarter. This reflects the easing of the restrictive anti-pandemic measures through the third quarter and the realisation of some of the pent-up demand.

- Weak domestic demand drove sharp declines in imports, which fell by 20.1% y/y in the third quarter, only somewhat easing from 22.5% y/y fall during April-June. This implies that the recovery in private consumption was mainly in the domestic services.

- Export data paint a contradictory picture. Although the sector bucked the trend and even posted small growth in the second quarter, Russian exports significantly declined in the third quarter. Two main factors explain this.

- Firstly, the low statistical base effect had a positive impact on the third-quarter results. In the second quarter of 2019, Russian exports shrunk by 5.3% y/y when its oil exports were halted due to the contamination of crude oil shipped through a key EU-bound Druzhba (Friendship) pipeline.

- Secondly, Russian exports, including of crude oil, maintained their levels well into May due to an initial impasse within the OPEC+ over the crude oil production cuts. External demand slumped significantly in the third quarter, leading to an 8.5% y/y fall in exports.

- Net exports remained in positive territory in the third quarter but they dropped to USD0.7 billion, from USD1.6 billion in the previous quarter.

- Under our current assumptions, Russian real GDP will contract by 4.3% in 2020, followed by only modest gains of 1.9% in 2021. Available sentiment and hard data for the remainder of 2020 suggests a decline in economic activity due to the second wave of COVID-19.

- Russian authorities have now admitted that they have significantly underestimated the deaths caused by the virus, potentially revising the figure from 57,000 to 186,000 in 2020, putting Russia in third place in terms of deaths after the US and Brazil.

- Ford will begin conducting autonomous vehicle (AV) trials in the coming weeks in Israel, after receiving approval from the Transportation Ministry, reports Haaretz. It will deploy the Ford Fusion, which is equipped with cameras, radar, and LiDAR, and will be operated by its research and development (R&D) center in Israel. The aim of these trials is to enable the "R&D team to personally see the algorithms they have developed operating in real-road conditions". Udi Danino, CEO and founder of SAIPS, which is responsible for the development of Ford's AV, said, "After four years of working by remote, we realized that we need to move to the next stage. Until now, we've been developing software, sending it to the United States, getting feedback and so on. We want to shorten the process". Ford has delayed plans to launch an AV until 2022, largely on the COVID-19 virus pandemic and technology development, but its work has not abated. Ford has been testing goods-delivery services in Miami, Austin (Texas), and Washington DC, with the company believing that, in future, goods deliveries will be a key AV service. Ford plans to launch a robotaxi service in several US cities by the end of 2022. The taxis will be equipped with Level 4 autonomous technology, allowing the vehicle to drive without human intervention, but its applications are limited to specific conditions. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- APAC equity markets closed mixed; Australia -1.1%, South Korea -0.8%, India -0.5%, Japan -0.3%, Hong Kong +0.2%, and Mainland China +0.6%.

- Chinese imports of US almonds totaled 99 million pounds in the 2019-20 season (August-July), 23% less year-on-year and 42% less than in the 2017-18 season, according to data from the Almond Board of California (ABC) provided during the virtual 2020 Almond Conference (December 2020). (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- The trade war between China and the US has badly hit the Californian almond industry and Chinese importers are keeping an eye on the Australian industry to diversify supply.

- China will remain a key market for Californian almonds and the ABC expressed its optimism in the long-term due to positive data, listed below:

- Nuts are considered as the main snack for Chinese consumers, whose concerns about food combining health and nice flavor have been gradually rising.

- Lockdown due to Covid-19 has led to booming e-sales of snacks.

- Generation Z consumers (between 20-30 years old) are pushing up sales of products linked with Vitamin E, essential for skin care. And almond is a nut with a high proportion of this vitamin.

- As a result, the ABC has been launching promotion programs focused on highlighting e-sales of almonds as a vitamin E source. Participants obtained discounts in almond e-purchases.

- NavInfo has partnered with Inceptio Technology to provide its high-definition (HD) map for the development of autonomous trucks, which will go into volume production at the end of 2021. Under this partnership, NavInfo will supply its one-stop mapping service, OneMap, to Inceptio for the latter to build a fleet of autonomous trucks deployed for logistics business, reports Gasgoo. NavInfo is a navigation map service provider to global automakers including SAIC, BMW, Volkswagen Group, General Motors, Volvo, Toyota, and Nissan. In 2019, Beijing's municipal authority has issued a temporary license plate for the testing of autonomous vehicles to NavInfo. Inceptio focuses on developing Level 3 and Level 4 autonomous truck technologies and has partnerships with truck makers such as Dongfeng Automobile, Sinotruk Hong Kong, and Foton. Recently, the company has secured a USD120-million investment in a funding round led by Chinese electric vehicle battery maker CATL. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- New vehicle sales in Australia posted a 13.7% year-on-year (y/y) decline in 2020 to 916,968 units, according to data from the Federal Chamber of Automotive Industries (FCAI). A total of 454,701 sport utility vehicles (SUVs) were sold during 2020, down 5.9% y/y. The SUV segment, however, continued to gain market share during the year with a share of 49.6%, up from 45.5% in 2019. Passenger car sales totaled 222,103 units, a fall of 29.7% y/y, with a market share of 24.2%. Light commercial vehicles (LCVs) took a 22.4% market share, contracting 8.9% y/y to 205,597 units during 2020. Toyota remains the leading automaker with a 22.3% market share, followed by Mazda with a 9.3% market share and Hyundai with a 7.1% market share. Ford and Mitsubishi trailed the top three with market shares of 6.5% and 6.4% respectively. The top five highest selling vehicles for the year were the Toyota Hilux with 45,176 sales, Ford Ranger with 40,973 sales, Toyota RAV4 with 38,537 sales, Toyota Corolla with 25,882 sales, and Toyota Land Cruiser with 25,142 sales. New vehicle sales in Australia recorded a double-digit decline during the COVID-19 virus pandemic. Sales in the fourth quarter of 2020 have begun to improve, leading the market to a recovery path heading into 2021. IHS Markit forecasts that Australian light-vehicle sales, which include light passenger vehicles and LCVs, will bounce back in 2021, with an increase of around 8% y/y to 974,000 units. This total will still be lower than in 2019 when around 1.05 million light vehicles were sold in the market. (IHS Markit AutoIntelligence's Abby Chun Tu)

Posted 06 January 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.