Most major European equity indices closed higher, all major US indices closed lower, and APAC markets were mixed. The more hawkish-than-expected tone of the 2:00pm ET release of last month's FOMC meeting minutes triggered a sharp sell-off in US equities, rates, and credit. CDX-NA closed wider across IG and high yield, iTraxx-Xover was also wider on the day, and iTraxx-Europe closed almost unchanged. Natural gas, oil, gold, and silver closed higher, while the US dollar and copper closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- The minutes of the last meeting of the Federal Open Market Committee (FOMC), held on 14-15 December, were released this afternoon. At that meeting, the Committee announced a revised plan to wind down bond purchases several months sooner than the original plan announced on 3 November. An earlier end to bond purchases, in the view of policymakers, creates more space for the Committee to begin to raise interest rates earlier than it previously anticipated might be appropriate. At this meeting, however, no changes were made to interest rates, including the target for the federal funds rate of a range of 0% to 0.25%. Discussion of economic developments and risks by policymakers at the December meeting support our expectation that the first increase in the federal funds rate target will occur between March and June, with May the most likely time for that move. At the December meeting, the FOMC held the first of what is likely to be several discussions regarding the size and composition of the Fed's balance sheet over the longer run. Elements of that discussion suggest that the Fed will begin to trim the size of its bond portfolio within several months of beginning to raise interest rates, and that the size of the Fed's portfolio will be reduced more quickly (in dollar terms) than during the previous episode of balance-sheet normalization, from 2017 to 2019. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- All major US equity indices closed lower; DJIA -0.9%, S&P 500 -1.9%, Russell 2000 -3.3%, and Nasdaq -3.3%.

- 10yr US govt bonds closed +5bps/1.70% yield and 30yr bonds +2bps/2.09% yield.

- CDX-NAIG closed +2bps/52bps and CDX-NAHY +11bps/305bps.

- DXY US dollar index closed -0.1%/96.17.

- Gold closed +0.6%/$1,825 per troy oz, silver +0.5%/$23.17 per troy oz, and copper -1.4%/$4.41 per pound.

- Crude oil closed +1.1%/$77.85 per barrel and natural gas closed +3.6%/$3.71 per mmbtu.

- Private job growth, according to payroll processing firm ADP, totaled 807,000 for the month, well ahead of the Dow Jones estimate for 375,000 and the November gain of 505,000. The November total was revised lower from the initially reported 534,000. The total was the best for the job market since May 2021′s 882,000 figure, according to the ADP data. Hiring was broad-based, though leisure and hospitality led with 246,000 new positions. Trade, transportation and utilities contributed 138,000, professional and business services increased by 130,000, and education and health services added 85,000. (CNBC)

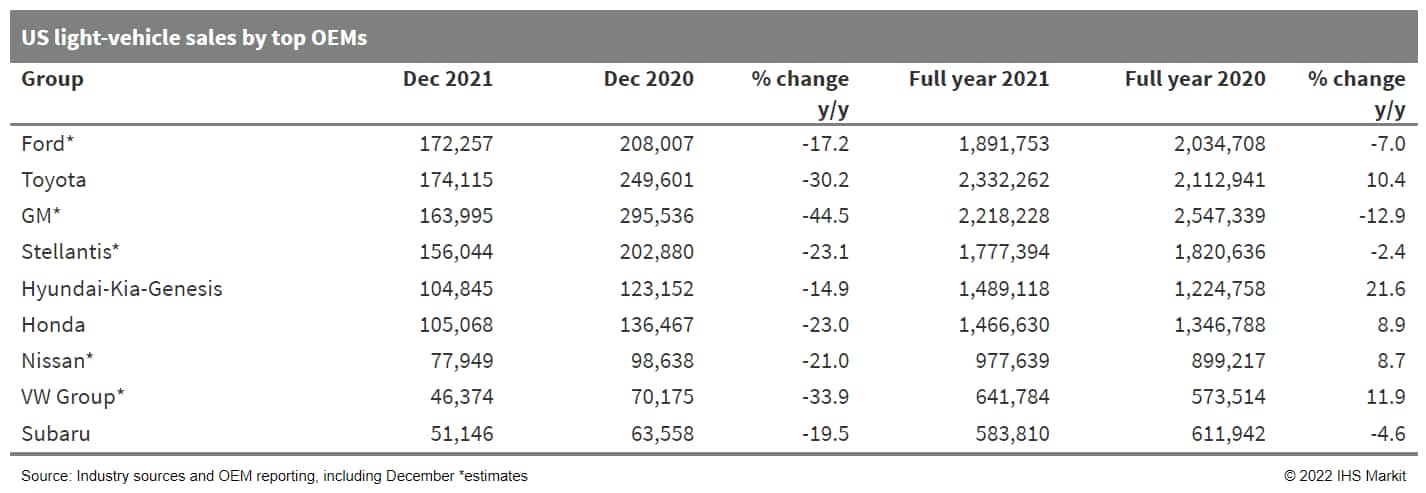

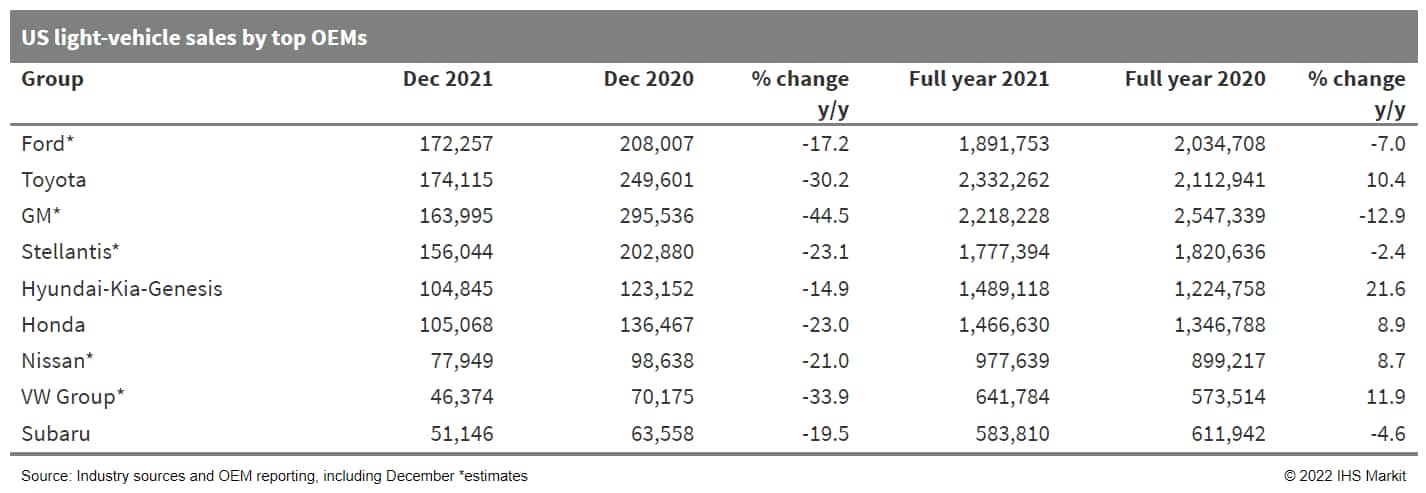

- The lack of inventory pushed US light-vehicle sales down by 24.6% y/y in December 2021; full-year sales are up 3.4%. Although the pace of sales increased mildly for the third consecutive month, demand continues to be subdued by new vehicle inventory constraints. Sales in 2021 reflect the limited upside to demand growth given current inventory conditions. December results reflect low year-end clearance volume, a result of limited inventory, which will continue to push against sales levels moving into 2022. Overall, volume growth for 2022 is projected at an inventory-limited 15.5 million units. The lack of inventory is overcoming favorable consumer interest and buying conditions to hold volume down. However, 2023 and 2024 are forecast to spike again, as production recovers to help meet pent-up demand. (IHS Markit AutoIntelligence's Stephanie Brinley)

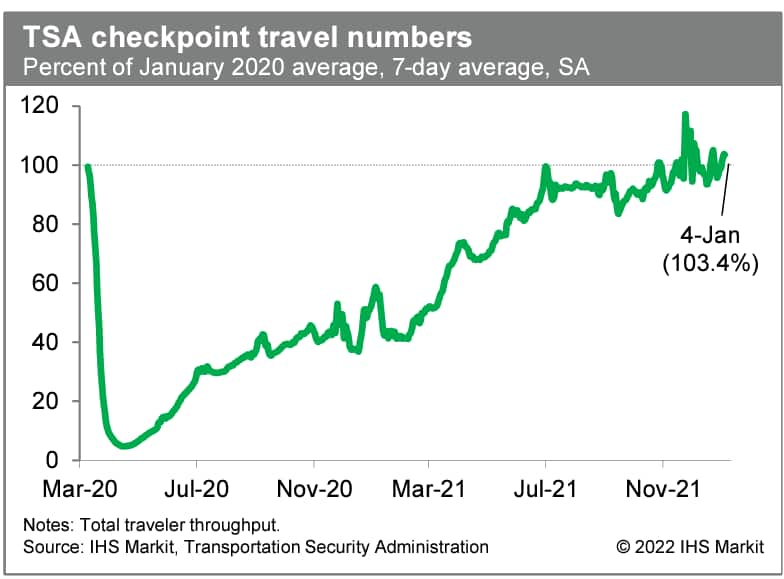

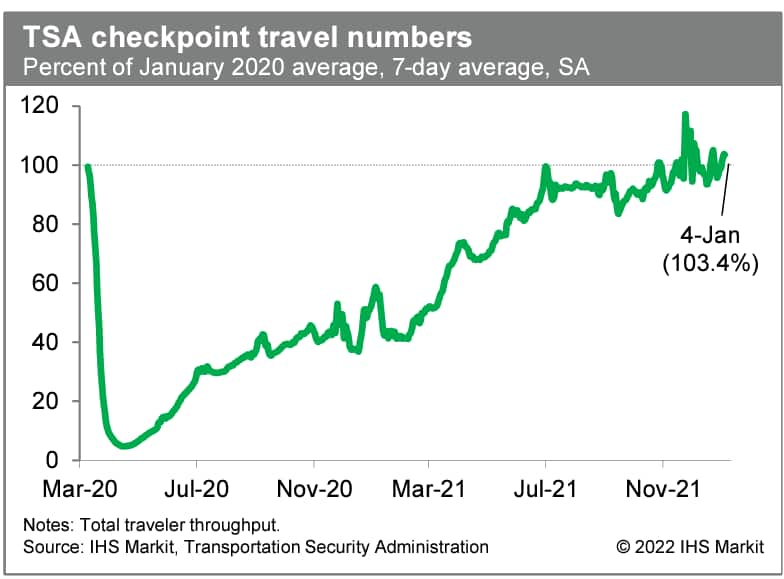

- Averaged over the last seven days, and after seasonal adjustment, passenger throughput at US airports was 3.4% above the January 2020 level (our estimate based on daily data from the Transportation Security Administration). Despite highly publicized flight cancelations, overall passenger traffic appears to be little affected by the current wave of COVID-19 infections. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- On January 3, three affiliates of Montana-based Gallatin Power filed notices with the Public Utilities Commission of Nevada of new applications filed with the US Bureau of Land Management on 4,500 MW of new solar/battery projects. The company said it would seek permits from the Commission for these projects once they clear BLM's environmental review process. The notices were from (IHS Markit PointLogic's Barry Cassell):

- Bonnie Clare Solar LLC - The Bonnie Clare Solar Project would consist of a 1,500-MW (ac) photovoltaic solar facility, a battery energy storage system and a 230 kV generation-tie line in Nye County, Nevada. The power line would interconnect this project to the proposed Amargosa Substation. The project site is on BLM-managed land about 10 miles northwest of Beatty in Nye County. The project would include up to 1,000-MW of DC-coupled battery capacity, and up to 500 MW of AC-coupled battery capacity. The battery duration would be 4-8 hours.

- Orken Solar LLC - It plans a 1,500-MW photovoltaic solar facility, a battery energy storage system and a 230-kV generation-tie line in Nye County, Nevada. The tie line would also run to the proposed Amargosa Substation. The project site is on BLM-managed land about 43 miles north-northwest of Pahrump in the Amargosa Valley. The project would also include up to 1,000-MW of DC-coupled battery capacity, and up to 500 MW of AC-coupled battery capacity. The battery duration would be 4-8 hours.

- American Glory Solar LLC - The American Glory Solar Project would consist of a 1,500-MW photovoltaic solar facility, a battery energy storage system and a 230-kV generation-tie line to the proposed Amargosa Substation in Esmerelda County, Nevada. The project site is on BLM-managed land about 5 miles north-northwest of Silver Peak. The project would also include up to 1,000-MW of DC-coupled battery capacity, and up to 500 MW of AC-coupled battery capacity. The battery duration would be 4-8 hours.

- USDA has approved New York state hemp production, just before the 1 January deadline set by the former. New York state is the largest US hemp origin, with 800 registered industrial growers on 30,000 acres. The state is currently accepting applications. All licensed growers under the previous pilot research program must reapply to plant hemp in 2022. New York State Department of Agriculture and Markets is now accepting applications and all currently licensed growers under the pilot research program must reapply to grow hemp in 2022. "Under this new plan, our growers will have stability and consistency and regulations moving forward, with continued guidance and support from the department," New York agricultural commissioner, Richard A. Ball, said. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Ford has announced it will increase production of the F-150 Lightning electric vehicle (EV) pick-up to 150,000 units per annum (upa) by mid-2023; a specific investment figure was not disclosed. In a statement released on 4 January 2022, the automaker said it is planning to increase production capacity for the Lightning from an earlier plan for 80,000 upa to 150,000 upa. Ford also announced that reservations will start being converted to orders on 6 January 2022. As there are more reservation holders than Ford can build trucks for the 2022 model year, Ford will invite them to place orders later for future model years. Although Ford has not specified an investment or said how the production increase will be implemented, the company says, "To deliver this latest increase, a small task force of employees from manufacturing, purchasing, strategy, product development and capacity planning are finding ways to quickly adapt and expand production of the groundbreaking pickup. Ford is working with key suppliers - as well as with its own manufacturing facilities Rawsonville Components Plant and Van Dyke Electric Powertrain Center - to find ways to increase capacity of electric vehicle parts, including battery cells, battery trays and electric drive systems." Ford also notes that more than 75% of its reservation holders are new to the Ford brand. (IHS Markit AutoIntelligence's Stephanie Brinley)

- TuSimple has expanded its partnership with NVIDIA to build an advanced computer for its trucks, according to a company statement. The computer, known as an advanced autonomous domain controller (ADC), will be specifically engineered for TuSimple's Level 4 autonomous trucking applications. The ADC design will incorporate the NVIDIA DRIVE Orin system-on-a-chip (SoC), which is designed for artificial intelligence (AI)-based autonomous vehicle (AV) applications. NVIDIA DRIVE Orin has more than 250 TOPS (trillion operations per second) of compute performance and has a processing performance seven times higher than that of the company's previous SoC, Xavier. Cheng Lu, president and CEO of TuSimple, said, "A high-performance, production-ready ADC is a critical piece to scaling our AFN, and we are taking a hands-on role to advance its development with the help of NVIDIA. We believe this move provides us a significant competitive advantage in speeding time to market and further extending our industry leadership position." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Central Bank of Chile (Banco Central de Chile: BCC) has reported that the country's unadjusted monthly economic activity indicator - a proxy for GDP - decelerated modestly to 14.3% year on year (y/y) in November2021, from 15.0% y/y during October 2021. The large number resulted from a low comparison base recorded a year earlier; November 2021 had the same number of working days compared with November 2020. (IHS Markit Economist Claudia Wehbe)

- Services contributed the most and had a 20% y/y gain, especially personal services such as education and healthcare, followed by contributions in entrepreneurial services, restaurants and hotels, and transportation, mainly reflecting household-support measured, eased constrains on mobility, and increased reopening of the economy.

- Wholesale and retail trade fueled a 16.7% y/y increase in commercial activity, mainly in retail sales of supermarkets, apparel and shoes, and household appliances, as well as wholesales of household equipment, and automobile sales. Meanwhile, a 3.3% y/y gain in the production of goods category was propelled by construction and manufacturing but pulled downward by a decrease in mining activity.

- In seasonally adjusted terms, mining, industries, and commerce were down, while services led Chile's poor 0.3% month-on-month overall result during November 2021.

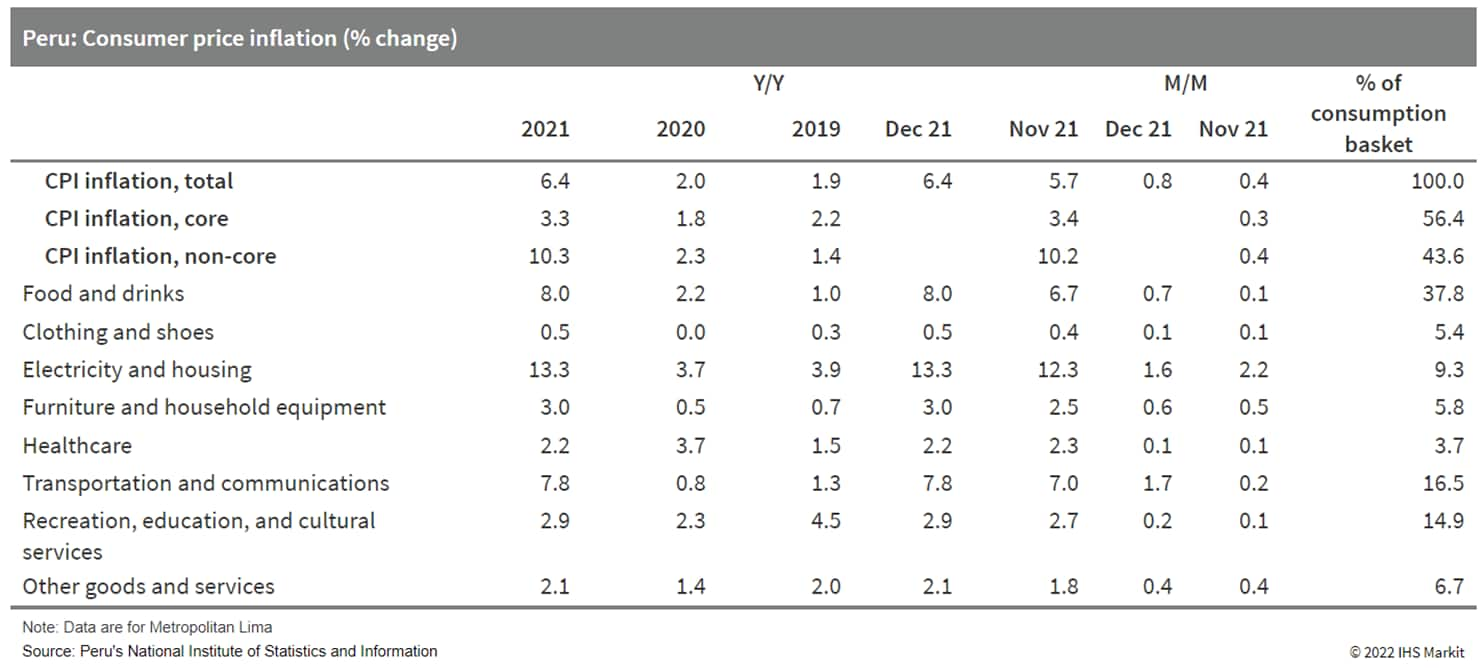

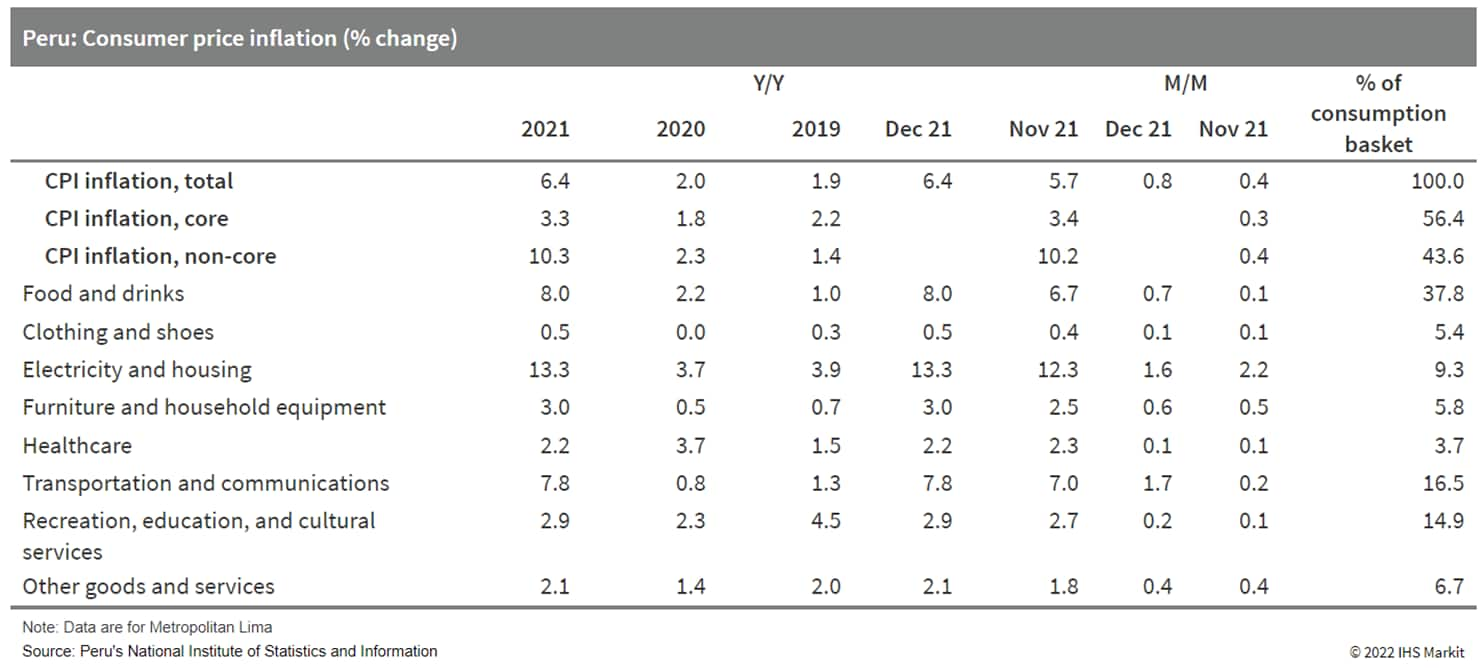

- Peru's consumer price inflation rose by 0.8% month on month (m/m) in the final month of 2021, above our projection of 0.5% and well exceeding the 2015-19 average of 0.3% for December 2021. Annual inflation finished 2021 at 6.4%, the highest full-year result since 2008. (IHS Markit Economist Jeremy Smith)

- The food and beverages and transportation and communications categories accounted for about two-thirds of price increases in December 2021. These movements followed typical year-end seasonal patterns - large increases were recorded for bus and airfares and meats for holiday meals - but were larger in magnitude than usual. Most transportation fuels declined in price, in line with the general downward trend in international crude oil prices in November and December 2021.

- Excluding the volatile food and energy categories, annual inflation reached 3.2% in December, continuing a gradual upward path and exceeding the Central Reserve Bank of Peru (Banco Central de Reserva del Perú; BCRP)'s 1-3% target range for the first time.

- The wholesale price index (WPI) increased by 0.4% m/m; December was the first occasion since November 2020 that monthly CPI gains outpaced the WPI. Nonetheless, the WPI rose by 13.6% y/y, more than double the CPI inflation.

Europe/Middle East/Africa

- Most major European equity markets closed higher except for Spain -0.1%; France +0.8%, Germany +0.7%, Italy +0.7%, and UK +0.2%.

- 10yr European govt bonds closed mixed; Germany/UK flat, France +1bp, Spain +2bps, and Italy +3bps.

- iTraxx-Europe closed flat/48bps and iTraxx-Xover +3bps/243bps.

- Brent crude closed +1.0%/$80.80 per barrel.

- France's consumer confidence headline index increased from 98 in November to 100 in December 2021, according to figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). (IHS Markit Economist Diego Iscaro)

- December's reading was the highest in three months. The headline index now stands at its long-term average.

- Households were more positive about the general economic outlook for the coming year, while they also reported some improvement in their past standard of living and financial situation.

- Moreover, the number of households considering making a major purchase over the coming 12 months rose for the first time in three months, and now stands above its long-term average.

- Households were less sanguine about the outlook for the labour market in December. However, the index measuring expected unemployment remained well below its long-term average, despite increasing vis-à-vis November.

- Unsurprisingly, the number of households reporting higher prices during the last year rose again in December, and sits at a level not seen since 2012. However, the share of households that expect prices to be on the rise over the coming year fell for the second successive month in December.

- The passenger car market in Ireland has grown by 18.8% year on year (y/y) in 2021. According to the latest data released by the Society of the Irish Motor Industry (SIMI) and published by beepbeep.ie, volumes increased to 104,932 units from 88,325 units. The leading brand during the year was Toyota with 13,053 units, a gain of 30.3% y/y. This was followed by Volkswagen (VW); its volumes improved by 18% y/y to 12,617 units, and Hyundai has increased 31.3% y/y to 10,740 units. Registrations in Ireland's light commercial vehicle (LCV) market grew by 32.3% y/y to 28,741 units in 2021, while registrations in the medium and heavy commercial vehicle (MHCV) category expanded by 31.5% y/y to 2,716 units. After the big falls during 2020 caused by measures to prevent the spread of the COVID-19 virus, the Irish passenger car market has made a significant recovery in 2021. However, demand remains weak compared to before to the pandemic in 2019, with volumes being down by around 10.4%. Also, reflecting the challenges faced by the market in the lead-up to the pandemic, volumes in 2021 are 28.5% below those recorded in 2016, not helped by used car imports from the UK. However, SIMI has highlighted that grants for battery electric vehicles (BEVs) from the Sustainable Energy Authority of Ireland (SEAI) continue to lift volumes of this type of vehicle. Data show that during 2021, battery electric passenger car registrations more than doubled to 8,646 units, meaning that its market share has been lifted to 8.2% in 2021 versus 4.5% in 2020. The extension of these measures in the budget will hopefully ensure that this trajectory continues, although this could come at the expense of plug-in hybrids (PHEVs) which have had their benefits withdrawn entirely. (IHS Markit AutoIntelligence's Ian Fletcher)

- In the first 11 months of 2021, Turkey's merchandise-trade deficit fell to USD39.350 billion, according to data from the Turkish Statistical Institute (TurkStat). The gap was down by nearly USD6 billion year on year (y/y). (IHS Markit Economist Andrew Birch)

- A substantial shift in the flow of non-monetary gold accounted for the substantial, y/y narrowing in the merchandise-trade deficit, however. The gold trade switched from a USD18.384-billion deficit in January-November 2020 to a USD3.249-billion surplus in the same period of 2021. Turkey switched from hoarding gold as a safeguard in 2020 to sending it back abroad in 2021.

- Without the dramatic shift of the gold trade, Turkey's trade deficit through November would have widened from a deficit of USD26.945 billion in 2020 to a gap of USD42.598 billion in 2021. Weak European demand and shipping constraints limited overall exports at the same time that high global commodity prices drove up the dollar value of imports.

- The lira plunge in the fourth quarter of 2021 contributed to strong export gains in November, increasing Turkish goods' international competitiveness. Imports also rose vigorously in November, however, defying the impact of the weaker lira. Increased domestic demand from expansionary policies and high global commodity prices kept the value of imports growing rapidly that month.

- Saudi Arabia's current account posted a surplus of SAR81.4 billion (USD22.2 billion), the highest in three years, according to the Saudi Arabian Monetary Authority (SAMA). It compared with a surplus equal to SAR32.7 billion in the second quarter and a small deficit of SAR2.6 billion reported for the third quarter 2020. (IHS Markit Economist Ralf Wiegert)

- The oil export rebound is still ongoing. Oil shipments soared 93.9% on the year in the third quarter, pushing the annual rate for total exports 71.8% at the same time. The goods account reported a surplus at a post-pandemic high of SAR142 billion, roughly three times the size of the surplus in the third quarter a year ago. Goods imports rebounded as well, but their pace was more muted, at 19.3% in the third quarter following a decline of similar percent size in the third quarter 2020.

- Direct investment inflows, which had surged in the second quarter 2021 on the sale of Saudi Aramco's pipeline network, was down to SAR6.6 billion in the third quarter, roughly the same level as in the first quarter (SAR6.7 billion) but higher compared to the third quarter in 2020 (SAR4.1 billion). Direct investments remain below the ambitious targets spelled out in the Vision 2030.

- The International Monetary Fund (IMF) has completed the first review of its three-year Extended Credit Facility (ECF) support program with the Democratic Republic of Congo (DRC) and has approved the disbursement of USD212.3 million. (IHS Markit Economist Alisa Strobel)

- The IMF on 15 July 2021 approved a 36-month ECF arrangement for about USD1.52 billion for the DRC and had the first review on 15 December 2021. The completion of the first review enabled the immediate disbursement of USD212.3 million to help meet the balance of payment needs.

- The ECF follows an emergency support from the IMF to the DRC under the Rapid Credit Facility in December 2019 and April 2020, for a total of USD731.7 million. In its statement, the IMF highlighted that despite the coronavirus disease 2019 (COVID-19) pandemic, the rebound in economic activity has been stronger than initially projected and program performance is satisfactory.

- IHS Markit foresees the DRC's real GDP growth to reach 6% in 2022, supported by ongoing strength in the extractive sector as well as a recovery in non-extractive sector growth, although domestic consumption is likely to hampered by high price pressures in the economy, which are nevertheless set to remain at around 5% in annual average headline inflation in 2022.

Asia-Pacific

- Major APAC equity indices closed mixed; India +0.6%, Japan +0.1%, Australia -0.3%, Mainland China -1.0%, South Korea -1.2%, and Hong Kong -1.6%.

- Chinese regulators have issued additional requirements for foreign listings and share sales, but have not completely blocked access to US capital markets. The China Securities Regulatory Commission (CSRC) issued proposals on 24 December establishing tighter regulatory requirements for foreign share listings by Chinese firms. These extend domestic regulatory coverage to previously exempt Variable Interest Entities (VIEs) owned outside China. Firms now need to present the draft prospectus and relevant opinions from industry regulators within three days of filing application documents outside China or announcing a planned transaction internationally. CSRC will then sanction or block the planned deal, requesting additional clearances if appropriate. In parallel, on 27 December, the National Development and Reform Commission (NDRC) announced that Chinese firms operating in sectors where foreign investment is limited require specific clearance from regulators before undertaking international share listings. Additionally, the Cyberspace Administration of China completed a consultation on 13 December regarding further controls from a cybersecurity perspective, with final guidelines due shortly. The CSRC and NDRC guidelines are provisional and CSRC has solicited market feedback by 23 January. Although CSRC has stated that its new requirements do not apply retroactively to existing listings, uncompleted existing filings may be subject to them. (IHS Markit Country Risk's Brian Lawson, David Li, and Yating Xu)

- GAC AION, the electric vehicle subsidiary of GAC Motor Group, has said it will invest CNY1.81 billion (USD285 million) in a new plant in China. The production facility, to be completed by the end of 2022, will have a capacity of 200,000 units per annum (upa). GAC AION has previously announced that production capacity at its current production plant in Guangzhou will be increased from 100,000 upa to 200,000 upa at the beginning of 2022. This second plant will boost the automaker's total production capacity to 400,000 upa. These expansion projects will support the growth of the AION brand, which has already launched four models on the market: the AION S, LX, Y, and V. According to GAC AION's latest report, its sales reached 123,660 units in 2021, up 119% year on year. Sales of GAC AION's latest model, the AION LX Plus, will begin this month. The electric sport utility vehicle will feature GAC's latest electrification technologies and is said to have a driving range of up to 1,000 kilometers. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Pony.ai's autonomous trucking business unit, PonyTron, has formed a joint venture (JV) with Chinese logistics firm Sinotrans, according to a company statement. The companies will jointly build a smart logistics network by deploying autonomous trucking technologies. The JV is expected to begin operations in early 2022 with an intelligent logistics fleet of over 100 trucks. James Peng, co-founder and CEO of Pony.ai, said, "Intelligent technologies are driving the transformation of mobility and transportation. Sinotrans is a world-leading logistics firm and Pony.ai offers world-class autonomous driving technologies. This strong partnership will create a benchmark for the massive commercial deployment of autonomous technologies, and will improve the efficiency and quality of the logistics sector". (IHS Markit Automotive Mobility's Surabhi Rajpal)

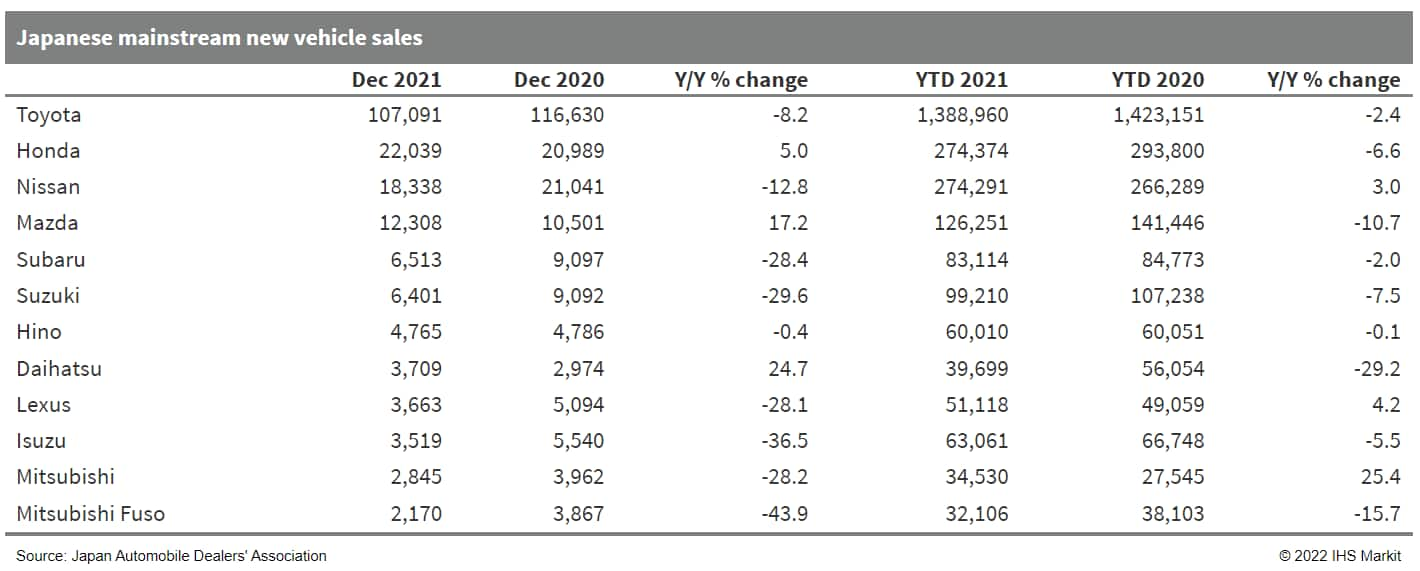

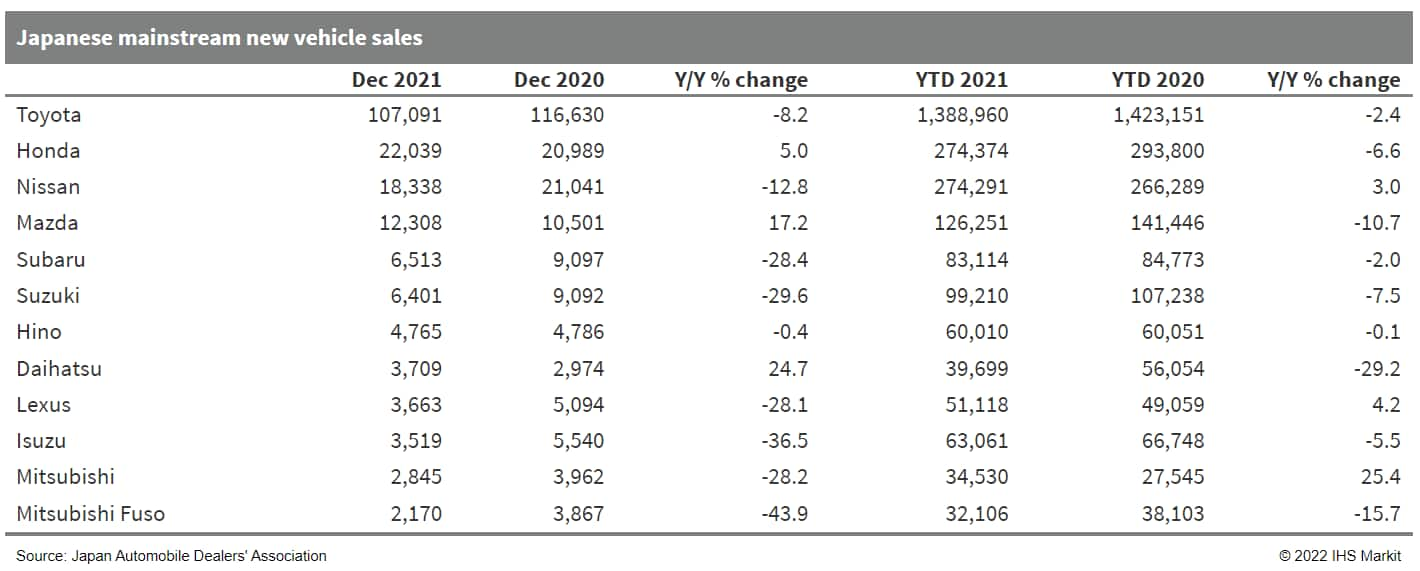

- Japanese sales of new vehicles, including mainstream registered vehicles and minivehicles, stood at 336,442 units during December, an 11.4% year-on-year (y/y) decline. In the full year 2021, sales of new vehicles in Japan were down by 3.3% y/y to 4.448 million units. The figures for mainstream registered vehicles are reported by the Japan Automobile Dealers Association (JADA), while the Japan Mini Vehicles Association reports the minivehicle sales data. New vehicle sales in Japan grew in the first half of 2021 thanks to a low base of comparison in 2020, when customers trimmed their spending following the October 2019 consumption tax rise and the COVID-19 virus pandemic that began in early 2020 and the resulting lockdowns imposed to curb the spread of the virus. During the third quarter, there was a renewed resurgence in COVID-19 cases and the government's decision to suspend subsidies for eating out and tourism in areas experiencing outbreaks weighed down on consumer spending and resulted in a decline in sales again. In an effort to contain the COVID-19 virus, a state of emergency was extended many times, even during the Olympic Games, during the summer season in Tokyo and surrounding areas until the end of September. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- At the CES 2022 show in Las Vegas (United States), Seoul Robotics has introduced its Level 5 Control Tower (LV5 CTRL TWR), a mesh network of sensors and computers on infrastructure that controls vehicles autonomously. According to a company statement, the solution employs 5G technology to automate thousands of cars with only a few sensors, solving first- and last-mile autonomy. It can automate vehicles from multiple vantage points and can handle the movement of hundreds of vehicles simultaneously. The LV5 CTRL TWR is based on Seoul Robotics' SENSR 3D software, which is compatible with nearly all LiDAR and 3D data sensors. HanBin Lee, CEO of Seoul Robotics, said, "Level 5 mobility has been proven to be more challenging to achieve than expected - until now. LV5 CTRL TWR has massive potential to fuel autonomous mobility, and we are thrilled to continue expanding upon the implementation of this technology with BMW and other partners." Seoul Robotics, based in South Korea, is a computer vision company that focuses on building a perception platform that uses AI and machine-learning technologies. The company is currently working with BMW to automate last-mile fleet logistics at its manufacturing facility in Munich (Germany). Seoul Robotics' LV5 CTRL TWR solution places sensors equipped with 3D perception software on infrastructure instead of vehicles to automate them. The company believes that this solution has the potential to transform operations for a wide range of business applications, ranging from vehicle distribution centers to car rental companies and trucking logistics. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Indonesia's PT Trans Pacific Petrochemical Indotama (TPPI) said it has completed the Final Investment Decision (FID) on a previously announced plan to expand its paraxylene (PX) and reformer capacities to meet a domestic supply shortfall and growing demand. It has reached the FID to increase its paraxylene (PX) capacity by 30% to 780,000 mt/yr and its reformer capacity by 10% to 55,000 b/d at its site in Tuban, East Java, the subsidiary of state oil and gas company PT Pertamina in a statement on Monday. (IHS Markit Chemical Market Advisory Service's Trisha Huang)

- The 'Aromatic Revamping Project' will include modifications to the heater, continuous catalytic reforming (CCR) unit and Distal Column Tray, TPPI said. The existing Parex Adsorbent Unit will be replaced with a new type and the Isomar and Tatoray Catalyst Units will also be replaced.

- The project is expected to cost $200 million in total but has the potential to save the current account deficit by up to $410 million/yr, TPPI said, quoting figures given on Dec. 20, 2021 by PT Kilang Pertamina International president director Djoko Priyono.

- The revamp is expected to be completed this year, according to a Nov. 30, 2020 statement.

- TPPI expects the expansion to cover the shortage of domestic aromatics product supply, reduce the country's reliance on imports and meet projected petrochemical demand growth of 5% a year in the next 10 years, it said.

- Demand for petrochemicals such as polypropylene, polyethylene, PX and benzene will increase to 7.6 million mt/yr while the current domestic production capacity is only 1.6 million mt/yr, TPPI said.

- Indonesia's PX demand is around 1 million mt/yr and the country's only other producer is Pertamina's Cilacap refinery which has a capacity of 270,000 mt/yr, according to the IHS Markit Chemical Supply and Demand database and Chemical Economics Handbook.

- With PX plant operating rates in 2021 estimated at around 40% of capacity, the country's PX imports in 2021 were estimated at around 600,000 mt, according to the database.

- Preliminary data from the General Statistics Office of Vietnam have revealed that Vietnam's real GDP posted a 5.22% year-on-year (y/y) expansion in the fourth quarter of 2021, up from a revised 6.02% y/y contraction. Vietnam's annual growth slowed to 2.58% y/y in 2021, down from 2.90% y/y in 2020, as the country continues to grapple with the lingering COVID-19 threat. (IHS Markit Economist Jola Pasku)

- Vietnam's economy gradually recovered in the fourth quarter of 2021 after the third-quarter output was dampened by the most intense COVID-19 virus outbreak and strict mobility curbs. On the supply side, the industry and construction sector led in terms of growth - up 5.6% y/y and contributing 53% to overall growth. Services (up 5.4%) came in second, followed by the agricultural sector (up 3.2%).

- High-frequency data reflected improvements in both trade and manufacturing production in the fourth quarter of 2021 with the gradual relaxation of COVID-19 containment measures.

- Exports recorded double-digit y/y growth (up 16%), with the electronics, textiles, and oil categories leading in terms of y/y improvements. On the manufacturing front, industrial production activities returned to the pre-outbreak growth trajectory with a 25% y/y expansion in December.

- Since September, the pace of contraction in retail sales of goods and services has continued to ease. However, concerns over the emergence of Omicron-variant cases are adding a fresh wave of uncertainty over the short-term trajectory. Vietnam registered a record number of 21,696 COVID-19 cases on 4 January 2022; considering that 72% of the population are fully vaccinated, the outlook has become increasingly more vulnerable. In Hanoi, authorities have expanded the areas where restaurants are banned from operating in response to new infections, stoking concerns that more stringent restrictions will follow suit.

- The repercussions of the COVID-19-related disruption have not been as significant on the investment drive, based on pledged foreign direct investment (FDI) data. Pledged FDI rose 9.2% y/y during 2021 to USD31.2 billion, suggesting a relatively unshaken confidence on Vietnam's prospects. Realized FDI fell by 1.2% y/y to USD19.7 billion for the year, which is likely to be a temporary setback. Assuming no renewed national lockdown measures, real GDP growth is projected to expand in the low-6.0% range in 2022 before picking up to 6.9% in 2023.

Posted 05 January 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.