All major APAC and European equity indices closed higher, while the US was mixed. US and benchmark European government bonds closed sharply higher. CDX-NA and European iTraxx closed tighter across IG and high yield. The US dollar, natural gas, silver, and gold closed higher, copper was flat, and oil was lower on the day. The main focus tomorrow will be the US non-farm payroll report at 8:30am ET.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed, with the Nasdaq +0.8% and S&P 500 +0.4% closing at new record highs; Russell 2000/DJIA -0.1%.

- 10yr US govt bonds closed -8bps/1.53% yield and 30yr bonds -6bps/1.97% yield.

- CDX-NAIG closed -1bp/50bps and CDX-NAHY -4bps/293bps.

- DXY US dollar index closed +0.5%/94.35.

- Gold closed +1.7%/$1,794 per troy oz, silver +2.9%/$23.91 per troy oz, and copper flat/$4.32 per pound.

- Crude oil closed -2.5%/$78.81 per barrel and natural gas closed +0.8%/$5.83 per mmbtu.

- US oil production will grow 800,000 b/d entry to exit in 2022. Onshore production will contribute 550,000 b/d—with slightly over 50% of growth coming from private companies, while public operators shift form maintenance mode to 2-5% growth. Strong Gulf of Mexico growth comes from both the basing effect of Hurricane Ida and the start-up of new projects (Spruance, Vito, and Mad Dog Phase 2). Entry-to-exit growth in 2023 reaches 600,000 b/d, reflecting continued cash harvest as WTI eases owing to strong 2022 global supply and a tapering COVID-19 restart. (IHS Markit Energy Advisory's Raoul LeBlanc, Reed Olmstead, Narmadha Navaneethan, Imre Kugler, and Prescott Roach)

- Producers are restraining reinvestment of the cash bonanza from rising prices in line with our expectations, resulting in minimal changes to the IHS Markit production outlook. While the production outlook rose less than 100,000 b/d compared with the previous forecast, free cash flow has ballooned to $87 billion, which should offer a competitive (perhaps even compelling) yield for the publicly listed operators.

- Reinvestment of the incremental dollar remains the key corporate decision determining US supply growth. Both debt repayment—to achieve debt/EBITDA ratios under 1.5x—and substantial share price reflation are necessary preconditions before executives risk the embryonic credibility of their business model by returning to hypergrowth, or even a hybrid returns plus growth strategy. The 2021-23 cash surplus should more than compensate for the previous decade of deficits (although not on a discounted basis). Accelerated balance sheet repair should mostly end in 2022, shifting surplus cash toward buybacks if shares do not reflate, and reinvestment if they do.

- Our large jump in annual capex from $60 billion to $87 billion (45%) seems out of step with the discipline story and the low-growth headline, but a decomposition analysis shows the figure results from the compounding effect of reasonable assumptions for five drivers: 1) modest (7-9%) service cost reflation, 2) fewer drilled but uncompleted well (DUC) conversions, 3) base decline increase from the robust rise in activity over the course of 2021, 4) rapidly expanding budgets of smaller private operators, and 5) diluted overall capital efficiency due to low-grading and lower well performance exhibited by private operators.

- The Permian remains the growth engine but loses a step in 2022. A few factors decelerate growth: the 570,000 b/d growth in 2021 is revving up the base decline for 2022 by 400,000 b/d, tempering overall oil growth to just 400,000 b/d. Independents will ramp up rigs in 2022, but private companies will continue to respond more aggressively to price signals and make up more than 50% of activity in 2022. Most of these increases are from micro-private operators running a single rig, often in legacy plays or non-core areas.

- US productivity (output per hour in the nonfarm business sector) declined at a 5.0% annual rate in the third quarter, more of a decline than we had expected, following an increase of 2.4% in the second quarter that was revised up 0.3 percentage point. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- Compensation per hour rose at a 2.9% annual rate in the third quarter and at a 3.5% rate in the second quarter. The second-quarter increase was revised up 0.1 percentage point. Compensation per hour has risen at a 5.9% annual rate from the fourth quarter of 2019, far higher than the 1.6% annualized increase in productivity over that span. The marked increase in compensation per hour reflects pandemic-induced effects on employment: employment in lower-wage sectors has declined relative to employment in higher-wage sectors.

- Unit labor costs surged in the early stages of the pandemic, as compensation per hour rose much more than productivity. The rise in unit labor costs had slowed on average in more recent quarters but jumped again in the third quarter. After declining at a 0.9% rate over the first half of 2021, unit labor costs rose at an 8.3% rate in the third quarter. Over the last four quarters, unit labor costs have risen 4.8%, up from a 0.1% increase over the four quarters ending in the second quarter.

- Hours rose at a 7.0% rate in the third quarter, continuing a strong recovery that began in the third quarter of 2020. Over the last five quarters, hours have risen 15.7% (not annualized), reversing nearly all of the 14.5% decline over the first two quarters of 2020.

- Seasonally US adjusted initial claims for unemployment insurance decreased by 14,000 to 269,000 in the week ended 30 October, hitting its lowest level since 14 March 2020. With new COVID-19 cases down well more than one-half from the peak at the beginning of September and consumer spending expected to post strong gains in the fourth quarter, hiring should continue to improve and the level of claims should continue trending towards its pre-pandemic steady state. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 134,000 to 2,105,000 in the week ended 23 October, hitting its lowest since 14 March 2020. The insured unemployment rate edged down 0.1 percentage point to 1.6%.

- In the week ended 16 October, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 10,695 to 233,684.

- In the week ended 16 October, continuing claims for Pandemic Unemployment Assistance (PUA) rose by 7,096 to 277,109. Because no benefits can be paid for weeks of unemployment after 4 September, the 511,000 individuals still receiving benefits under these federal programs are likely being paid for backdated weeks of unemployment as some states continue to process such claims retroactively.

- In the week ended 16 October, the unadjusted total of continuing claims for benefits in all programs fell by 157,731 to 2,672,948. With the expiration of pandemic-related benefits, claims under all programs have declined sharply—there were 11,250,306 claimants in the week ended 4 September.

- US employers announced 22,822 planned layoffs in October, according to Challenger, Gray & Christmas up 27.5% from September. The total for October is 72% lower than the October 2020 reading. For the year to date, 288,043 job cuts have been announced, down from the 2,162,928 job cuts announced over the same period in 2020 and the lowest January-October total on record (Challenger began tracking job-cut announcements in January 1993). (IHS Markit Economist Juan Turcios)

- Job cut decisions are being affected by forthcoming and already-existing vaccine mandates. In October, 5,071 of the announced job cuts were attributed to workers' refusal to comply with vaccine mandates. This was roughly 22% of the total announced job cuts for the month.

- According to Andrew Challenger, senior VP of Challenger, Gray, & Christmas, "We know companies are holding tight to their workers and are in fact looking for workers. However, we also know that for many employers, a federal vaccine mandate from OSHA is forthcoming, and for many government employees and contractors, as well as for health care providers, mandates already exist. This complicates hiring and retention efforts."

- So far this year, employers have cited COVID-19 as a reason for 8,766 planned job cuts. Over the last three months, COVID-19 has only been cited a total of 816 times as a reason for planned job cuts despite the surge in cases due to the Delta variant. Employers have cited other reasons, including closing (59,367), restructuring (51,375), market conditions (48,629), demand downturn (48,619), and acquisition/merger (12,315), more frequently than COVID-19 as causes of job-cut announcements this year.

- Last year, COVID-19 was the leading reason cited for job-cut announcements. As of October, COVID-19 is the 9th leading reason for job-cut announcements in 2021. Interestingly, vaccine refusal is now the 10th leading reason cited for job-cut announcements, at a total of 6,843 as of October.

- Global CO2 emissions in 2021 are on a pace to make up nearly all of the decline experienced in 2020 due to the economic slowdown created by the COVID-19 pandemic, according to findings released 4 November by the Global Carbon Project at COP26. (IHS Markit Net-Zero Business Daily's Kevin Adler)

- CO2 emissions are projected to reach 36.4 billion metric tons (mt) in 2021, just 0.8% below the record of 36.7 billion mt in 2019, and nearly a 5% rise from 2020's level. This has driven the global CO2 concentration to 415 ppm in 2021, compared to 277 ppm in 1750.

- The report said China and India were chiefly responsible for the overall increase in global CO2 emissions.

- "Reaching net zero CO2 emissions by 2050 entails cutting global CO2 emissions by about 1.4 billion tons each year on average," he said. "Emissions fell by 1.9 billion tons in 2020. So, to achieve net zero by 2050, we must cut emissions every year by an amount comparable to that seen during COVID."

- Looking at a long-term trend, the 2021 forecast is that global CO2 emissions will be 36.4% higher in 2021 than in 1990.

- While the overall trajectory highlights the immense challenge of carbon reduction, an adjustment in Global Carbon Tracker's accounting for land use in this year's report suggests that the increase in emissions is not as high as reported earlier. Previously, the GCP data showed global CO2 emissions increasing by 15 billion mt from 2011 through 2019, but this new report revises that increase down to 0.8 billion mt, due to a higher annual credit for land sinks.

- The Global Carbon Tracker said that coal contributed 40% of global emissions, followed by oil (32%) and natural gas (21%). Coal and gas will surpass their pre-pandemic emissions levels this year, but the report said "oil emissions remain around 6% below 2019 levels, and this persistent reduction is one of the main reasons 2021 [total] emissions did not set a new record."

- Shareholders may now have a say on how companies announce their net-zero goals to limit GHG emissions across their supply chains. The US Securities and Exchange Commission (SEC) issued a legal bulletin 3 November that said its staff will no longer use the "ordinary business" or "economic" relevance" exceptions to its Rule 14a-8 to exclude proposed resolutions that bring up issues of social significance. (IHS Markit Net-Zero Business Daily's Amena Saiyid)

- Rule 14a-8 lists criteria for submitting and including votes on shareholder resolutions. The rule until this summer allowed major companies to exclude votes on shareholder resolutions that sought greater transparency on carbon reduction plans on the grounds that they were already included in "ordinary business plans."

- The SEC bulletin, which has the backing of SEC Chairman Gary Gensler, said it would rescind its earlier sets of non-binding bulletins, where the staff took "a company-specific approach in evaluating significance, rather than recognizing particular issues or categories of issues as universally 'significant.'"

- "Going forward," the SEC said, "the staff will realign its approach for determining whether a proposal relates to "ordinary business" with the standard the Commission initially articulated in 1976, which provided an exception for certain proposals that raise significant social policy issues, and which the Commission subsequently reaffirmed in the 1998 Release."

- Gensler said the bulletin will provide greater clarity to companies and shareholders on these matters, "so they can better understand when exclusions may or may not apply."

- California-based Impossible Foods is accelerating its international expansion with the launch of its flagship plant-based burger in Australia and New Zealand. The company's flagship product, Impossible Beef Made From Plants (known as Impossible Burger in other markets), is now available at all 150+ locations of Australia's burger brand, Grill'd, and also at Butter—a fried chicken concept with several locations in the greater Sydney area. (IHS Markit Food and Agricultural Policy's Max Green)

- In New Zealand, Impossible Beef will debut at burger chain Burger Burger along with a number of other restaurants in Auckland.

- Earlier this year, regulatory body, Food Standards Australia New Zealand (FSANZ), approved Impossible Foods' key ingredient, heme (soy leghemoglobin), for use in plant-based meat products, paving the way for the commercial launch in both markets.

- In its approval, FSANZ noted that the decision "supports greater consumer choice for meat analogue products with a source of iron which may benefit consumers wanting to reduce or eliminate animal products from their diet." The body added that approval of the ingredient "supports greater consistency with international food regulations, industry innovations and creates trade opportunities for Australia and New Zealand."

- Impossible Foods' products are already available in the US, Canada, Singapore, and Hong Kong, and were recently launched in the UAE, the company's first market in the Middle East. Impossible Foods' stated mission is to be sold in every major market globally where conventional meat from animals is sold.

- Waymo has started mapping New York City roads, according to a company post. Waymo says that it has designed the Waymo Driver autonomous technology to handle the complex and dynamic situations found in a city such as New York, with "bustling avenues, unusual road geometries, complex intersections, and constantly evolving layouts". However, Waymo says that, initially, its vehicles in New York City will be manually operated as the company builds its specific city map. In addition, the Waymo post states that the city's weather, including heavy rain and dense snowfall that does not occur in the other cities it has tested in so far, will mean operation of the technology in New York "will build on the driving we've completed to date in snow and rain… Experiencing icy, snowy conditions will allow continued improvement of the Waymo Driver in the real world, and we will apply those learnings across our entire fleet." The initial operation area will be south of Central Park, extending through the financial district and to a small section of New Jersey through the Lincoln Tunnel. Waymo will start with five hybrid Chrysler Pacifica vehicles during the day, and later will add manually driven Jaguar i-Pace electric sport utility vehicles (SUVs) on the same streets. Waymo states that, leading up to the deployment, it has worked with city regulators and policy makers, ensuring they are informed of the testing process and progress. The New York City area is a difficult environment for autonomous vehicles to negotiate. However, in addition, the city's regulations require a driver to have one hand on the steering wheel. Waymo did not provide any timeline for how it expects the New York program to progress. Unlike in California and other areas where Waymo and other companies are testing self-driving technology, autonomous vehicle (AV) testing is not allowed in the city. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Fisker has reported its financial results for the third quarter of 2021. As of 30 September 2021, Fisker has cash and cash equivalents of USD1.40 billion, up from USD991 million at the end of 2020. Loss from operations was USD106.5 million, including USD1.0 million in stock-based compensation expenses, and its net loss was USD109.8 million, with net cash used in operating activities of USD103.4 million and cash paid for capital expenditures of USD15.8 million. Over the third quarter, Fisker increased its balance sheet with green convertible senior notes due in 2026 and raising USD667.5 million. The startup automaker says that the sourcing for its first vehicle, the Fisker Ocean, is "largely complete," including batteries from CATL. Serial production sourcing of more than 90% of its bill of materials is complete as of 3 November 2021, and the prototype body shop in Austria is fully operational. Fisker affirms it is on track for the Ocean to start production in November 2022, with ramp-up in 2023. Fisker reports more than 18,600 reservations (net of cancellations) as of 2 November, including 1,400 fleet reservations, and says that more than 72,000 people have registered in the app. This compares with more than 16,000 reservations reported in May. Fisker expects reservations to increase with further specification and pricing announcements, with the production vehicle to be shown at the 2021 Los Angeles auto show on 17 November. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- All major European equity indices closed higher; France/Italy +0.5%, Germany/UK +0.4%, and Spain +0.1%.

- 10yr European govt bonds closed sharply higher; UK -13bps, Italy -11bps, Spain -8bps, France -7bps, and Germany -6bps.

- iTraxx-Europe closed -2bps/49bps and iTraxx-Xover -10bps/248bps.

- Brent crude closed -1.8%/$80.54 per barrel.

- With insect production set to rocket over the coming decade as increasing numbers gain novel food approval or are used in fish, pig or chicken feed, the question comes about what to do with the mountain of frass - waste matter - that insects produce. As one insect industry spokesperson quipped to IHS Markit, "insects poo a lot!" (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Yet with energy costs soaring in Europe, chemical fertilizer prices have also risen, prompting a shift to manure, a point that Agriculture Commissioner Janusz Wojciechowski stressed at an 11 October press conference on the side-lines of the EU Council of agriculture ministers.

- Wojciechowski underlined that using more manure and less chemical fertilizer "is the direction of the future." The shift could help meet the Farm to Fork (F2F) strategy's goals of cutting chemical fertilizer use by 20% by 2030, the Commission made clear.

- While not conventional manure, insect frass could be a valuable resource as a fertilizer and is already used for that purpose in some member states, but there are no common EU rules on its use. A draft implementing regulation going through the EU's regulatory procedure with scrutiny could change all that by allowing widespread frass use.

- Another F2F goal with which insects could help is cutting food waste, if more products were allowed in their feed - or substrate - and the International Platform of Insects for Food and Feed (IPIFF), a trade association, has been pushing for the EU to relax its strict rules. Currently insects can only be fed on plant-based materials and not any waste food containing animal products, such as former foodstuffs like a meat pizza.

- The Volkswagen (VW) Group has announced that it is to take a stake in EIT InnoEnergy, an alternative energy investment fund, in which the European Union (EU) is a major investor, according to a company statement. VW will partner with EIT InnoEnergy to invest in technologies and business models to 'achieve economic breakthroughs which will contribute to the decarbonization of the transport sector and accelerate the shift to electromobility.' Commenting on the investment Jens Wiese, Head of Group M&A, Investment Advisory and Partnerships at VW, said, "In order to decarbonize the transport sector, we will need a wide range of innovations. In addition to our own activities, in the future we will also increasingly rely on cooperation with start-ups to achieve this. The partnership with EIT InnoEnergy will help us find the most promising companies from all areas of the energy transition, which we can then support in scaling their business models." VW and EIT InnoEnergy have already been co-operating for five years, with both organizations working together on the European Battery Alliance (EBA), with VW's stake in Swedish startup Northvolt a key element in this project. (IHS Markit AutoIntelligence's Tim Urquhart)

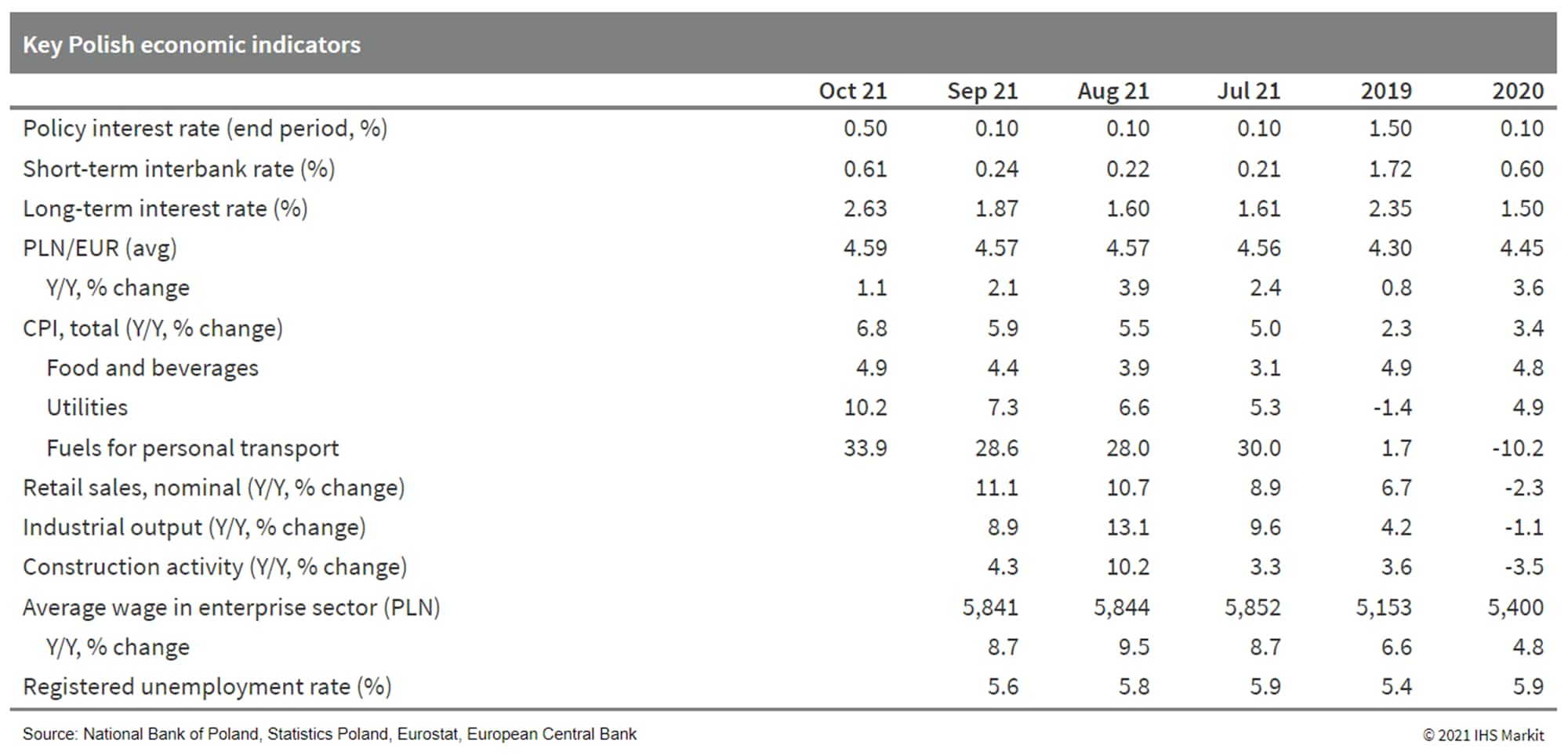

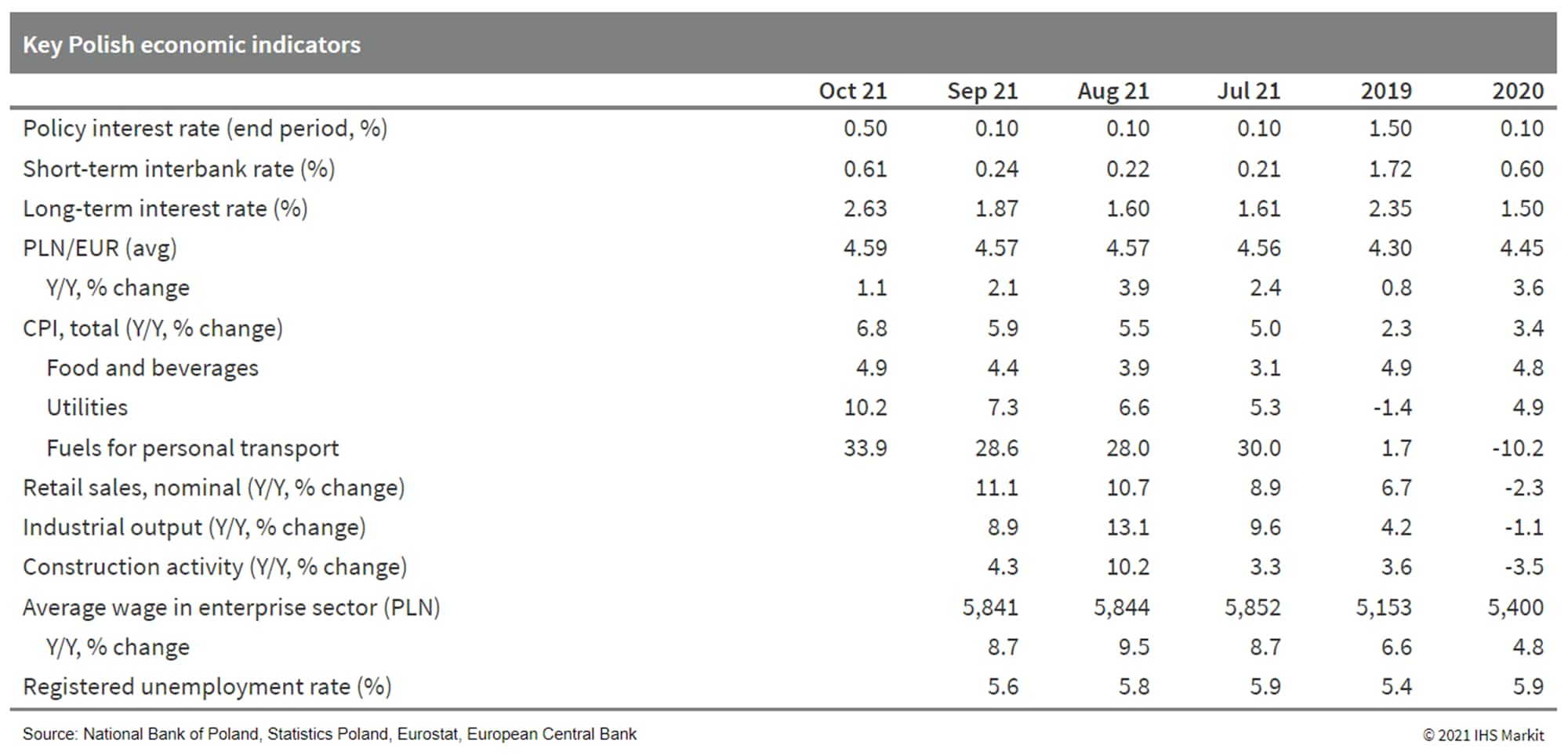

- During its session on 3 November, Poland's Monetary Policy Council raised the policy interest rate to 1.25%, up from 0.50% previously. This marked the second straight month of monetary tightening, bringing the policy rate from a historic low of 0.1%. (IHS Markit Economist Sharon Fisher)

- The Lombard and deposit rates were also increased by 75 basis points and now stand at 1.75% and 0.75%, respectively. The rediscount and discount rates are currently at 1.30% and 1.35%.

- Surging inflation was the main justification for the latest rate hike, particularly given the negative impact on the more vulnerable population. Preliminary data indicate that consumer price inflation reached a 20-year high of 6.8% year on year (y/y) in October while increasing by 1.0% month on month (m/m).

- The NBP continued to argue that the main drivers of October inflation remained outside the control of domestic monetary policy, including higher prices of energy and agricultural commodities and disruptions in supply chains and international transport. Energy and fuel costs soared by 10.2% and 33.9% y/y, respectively, while food prices were up by 4.9% y/y.

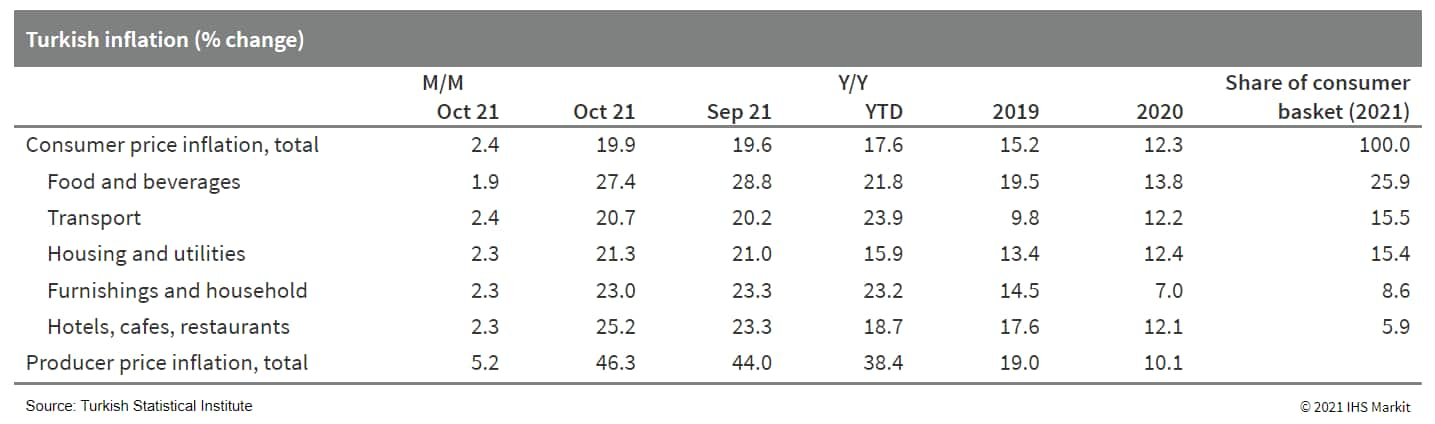

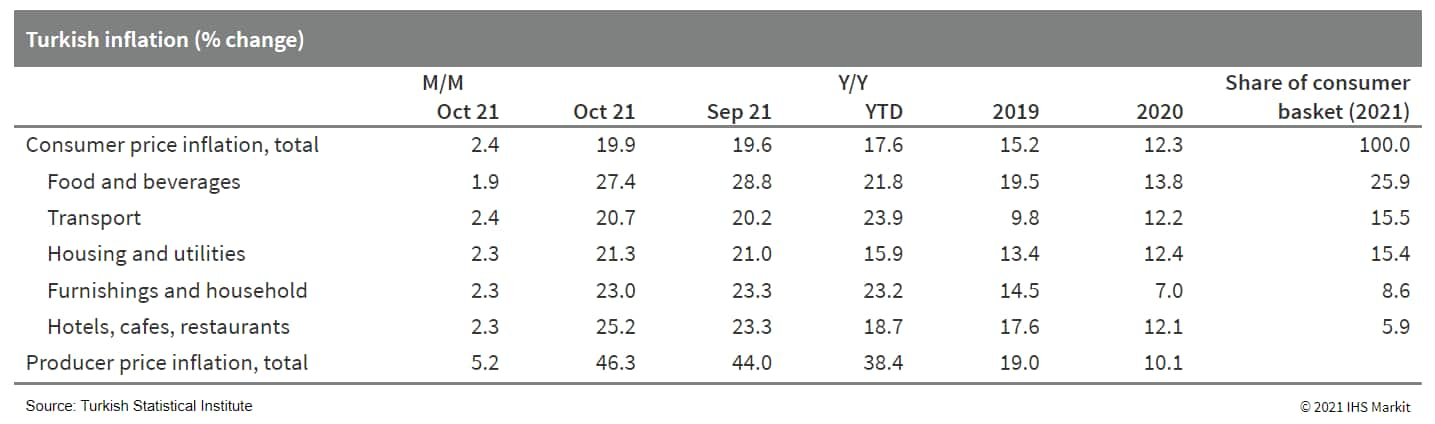

- Both Turkish consumer and producer price inflation continued to build in October, according to the latest data from the Turkish Statistical Institute (TurkStat). That month, annual consumer price inflation pushed up to 19.89%, rising by over 0.4 percentage point from the previous month and exactly eight percentage point higher than it had been a year earlier. (IHS Markit Economist Andrew Birch)

- In October, the consumer prices of food had posted the most extreme annual increase, up by 27.41%. However, food price inflation has actually been subsiding slightly since an August peak. Annual energy price inflation, on the other hand, continued to build in October, rising by nearly 0.5 percentage point from September to reach 25.41%.

- Stripping out these and other highly volatile prices, the annual core inflation rate was lower overall, at 16.82% as of October 2021. Core inflation actually subsided very slightly from September, when it had reached 16.98%. Although the easing of core inflation was meagre, it may provide justification for the Central Bank of the Republic of Turkey (TCMB) to cut its main policy rate again, as it is indexed to that rate.

- Meanwhile, annual producer price inflation soared in October to reach 46.31%, the highest rate it has been since the Justice and Development Party took office in 2002. Soaring energy costs and the sharp depreciation of the lira are fueling the rapid producer price increases.

Asia-Pacific

- All major APAC equity indices closed higher; Japan/Mainland China +0.8%, Hong Kong +0.8%, India/Australia +0.5%, and South Korea +0.3%.

- The Asian Development Bank (ADB) said it secured fresh funding to develop post-pandemic green infrastructure projects and expedite the phaseout of coal power in Southeast Asia. (IHS Markit Net-Zero Business Daily's Max Lin)

- Four donor countries and organizations pledged $665 million to ADB's Green Recovery Platform (GRP), according to the Manila-based development bank.

- Also, Japan committed $25 million in seed money to the ADB's Energy Transition Mechanism (ETM), which could eventually retire 30 GW of coal power in Indonesia, the Philippines, and Vietnam and reduce their combined CO2 emissions by 20%.

- The announcements made this week came as rich nations scrambled to fulfill their $100 billion-per-year climate finance promise to developing countries in the hope of achieving a successful COP26 outcome.

- The Association of Southeast Asian Nations (ASEAN) needs $210 billion per year to build low-carbon, climate-resilient infrastructure during the energy transition, according to ADB estimates. The current funding gap exceeds $100 billion per year.

- In a bid to promote such infrastructure projects as Southeast Asia recovers from the COVID-19 pandemic, ADB aims to raise $7 billion in capital via the GRP eventually, Asakawa said.

- Electric vehicle (EV) manufacturer Fisker has announced a deal with Chinese battery-maker Contemporary Amperex Technology Co Ltd (CATL) for more than 5 gigawatt-hours (GWh) of annual battery capacity for the upcoming Fisker Ocean sport utility vehicle (SUV). The agreement runs from 2023 to 2025, but no financial terms were disclosed. According to a company statement, Fisker is to use CATL's dual-chemistry battery-cell capability to optimize the performance, application, cost, and market position of the Fisker Ocean and its option package line-up. CATL is to supply two solutions to Fisker: one with a high-capacity lithium nickel manganese cobalt (NMC) cell chemistry and a second involving a high-value pack using CATL's latest lithium iron phosphate (LFP) chemistry. The two companies are to work together to optimize the battery pack for the packaging requirements of the Fisker Ocean. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Preliminary data show that Hong Kong SAR's real GDP expanded 5.4% year on year (y/y) in the third quarter of 2021, after jumping 7.6% y/y in the second quarter and 8% y/y in the first quarter, which marked the fastest expansion since the first quarter of 2006. For the first three quarters of the year, real GDP climbed 7% y/y, following six straight quarters of contraction that began in mid-2019. (IHS Markit Economist Ling-Wei Chung)

- Domestic demand continued to provide the main impetus to the economy as contained local infections supported consumer and business sentiment and spending. Domestic demand contributed 8.7 percentage points to third-quarter growth as private consumption added 4.4 percentage points and fixed investment contributed 1.8 percentage points. On the other hand, net exports remained negative in the third quarter, subtracting 3.3 percentage points from GDP growth, as the pick-up in domestic demand bolstered import growth, which outpaced export expansions.

- Merchandise exports continued to expand at a double-digit pace, albeit at a slower rate in the third quarter. Exports of goods climbed 14.3% y/y, after jumping 20.5% y/y in the second quarter. It also represented a second straight quarter of deceleration. Exports to all major markets continued to climb at the double-digit pace in the third quarter, except Vietnam due to the worsening outbreak conditions there. In September alone, merchandise exports expanded 16.5% y/y, slowing from a 25.9% y/y jump in August. It also marked the slowest reading since December 2020, although the deceleration was attributed partially to an unfavorable comparison base.

- In particular, accounting for about 60% of total exports, shipments to mainland China increased 11.2% y/y in September, decelerating markedly from a 30% y/y surge in August and also represented the lowest reading since November last year.

- Fixed investment climbed 11% y/y in the third quarter, after surging 23.9% y/y in the second quarter. Although part of the gain was boosted by a low comparison base, business spending strengthened as overall business sentiment improved, supported by the stabilized local pandemic conditions, the corresponding relaxation in social distancing measures, and robust overseas demand. In addition, the property market has remained active in the third quarter and resulted in the increase in the costs of ownership transfer. That said, mainland China's crackdown on business as well as volatilities in the local stock market somewhat restrained business sentiment.

- South Korean automakers posted a 22.3% y/y plunge in their combined global vehicle sales to 548,162 units in October, according to data released by the five major domestic manufacturers, as reported by the Yonhap News Agency and compiled by IHS Markit. The five automakers reported a 21.5% y/y decline in their combined domestic sales last month to 106,424 units, while their combined overseas sales went down by 22.4% y/y to 441,738 units. (IHS Markit AutoIntelligence's Jamal Amir)

- The country's best-selling automaker, Hyundai, posted a global sales decline of 20.7% y/y to 307,039 units in October. Its domestic sales totaled 57,813 units, down 12.0% y/y, while its overseas sales decreased by 22.5% y/y to 249,226 units. Global sales of its affiliate, Kia, fell by 18.9% y/y to 217,872 units, with its domestic sales down 21.2% y/y to 37,837 units and its overseas sales down 18.4% y/y to 180,035 units.

- The plunge in South Korean OEMs' combined global sales during October was mainly due to the global semiconductor shortage and the prolonged COVID-19 virus pandemic, which continued to weigh down on vehicle production and sales. South Korea relies heavily on overseas sources for automotive chips. The current shortage has disrupted automakers' production in the country and the issue is expected to continue to have an impact as manufacturers ramp up production of next-generation electric vehicles (EVs).

- Automakers are readjusting their vehicle production volumes while competing with electronics companies to acquire more chips to minimize the reduction in output.

- As the global semiconductor shortage has intensified because of lockdown measures to prevent the spread of the COVID-19 virus in Southeast Asia, we expect vehicle production in South Korea to be significantly affected throughout this year. As a result, we now expect light-vehicle production in the country, including passenger vehicles and light commercial vehicles, to decline by 1.9% y/y in 2021 to 3.39 million units.

- MG Motor India and CamCom have announced their strategic partnership to facilitate artificial intelligence (AI)-enabled vehicle inspection for repair and service assessment, reports ET Auto. "The AI-enabled solution will save time for operations and provide greater transparency to customers," said Gaurav Gupta, chief commercial officer at MG Motor India. Last year, CamCom completed a pilot project at MG as part of the MG Developer Program and Grant, an innovation platform designed to encourage developers and innovators to create new applications and experiences for automobiles. MG Motor India has collaborated with the defect/damage assessment AI platform to expand the use of the technology and solutions into a greater number of workshops. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 04 November 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.