Most major APAC equity markets closed higher, while all major European and most US indices closed lower. US and benchmark European government bonds closed higher. European iTraxx and CDX-NA closed wider across IG and high yield. The US dollar and oil closed higher, natural gas was flat, and copper, gold, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for DJIA +0.1%; DJIA +0.1%, S&P 500 -0.7%, Russell 2000 -1.3%, and Nasdaq -1.9%.

- 10yr US govt bonds closed -1bp/1.59% yield and 30yr bonds -2bps/2.27% yield.

- CDX-NAIG closed +1bp/51bps and CDX-NAHY +3bps/288bps.

- DXY US dollar index closed +0.4%/91.29.

- Gold closed -0.9%/$1,776 per troy oz, silver -1.5%/$26.56 per troy oz, and copper -0.2%/$4.52 per pound.

- Crude oil closed +1.9%/$65.69 per barrel and natural gas closed flat/$2.97 per mmbtu.

- US manufacturers' orders rose 1.1% in March, while shipments rose 2.1% and inventories rose 0.7%. Orders and shipments of core capital goods (nondefense, excluding aircraft) were revised somewhat higher through March. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- In response to the details in this report that feed into our GDP tracking, we raised our estimate of first-quarter GDP growth 0.1 point to 6.4% and held our forecast of second-quarter GDP growth at 9.1%.

- For both orders and shipments, March's gains followed declines in February and left both well above their pre-pandemic trends.

- While anecdotal reports point to restraint in activity from supply-chain issues, the performance of the manufacturing sector has been robust.

- The goods sector of the US economy has been boosted by surging demand for consumer goods as a stand-in for services forgone owing to the pandemic. Supply-chain issues likely reflect the possibility that manufacturers simply did not plan for this type of demand.

- Another source of strength in the goods sector is capital equipment, as businesses get back on track with capital expansion plans that were put on hold (or otherwise disrupted) during the pandemic.

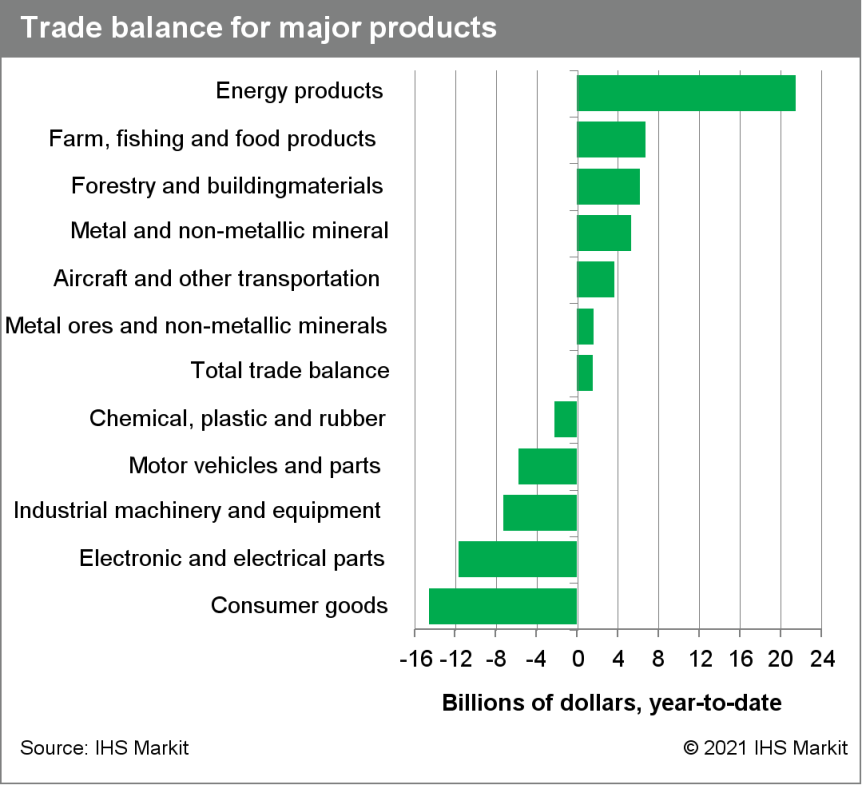

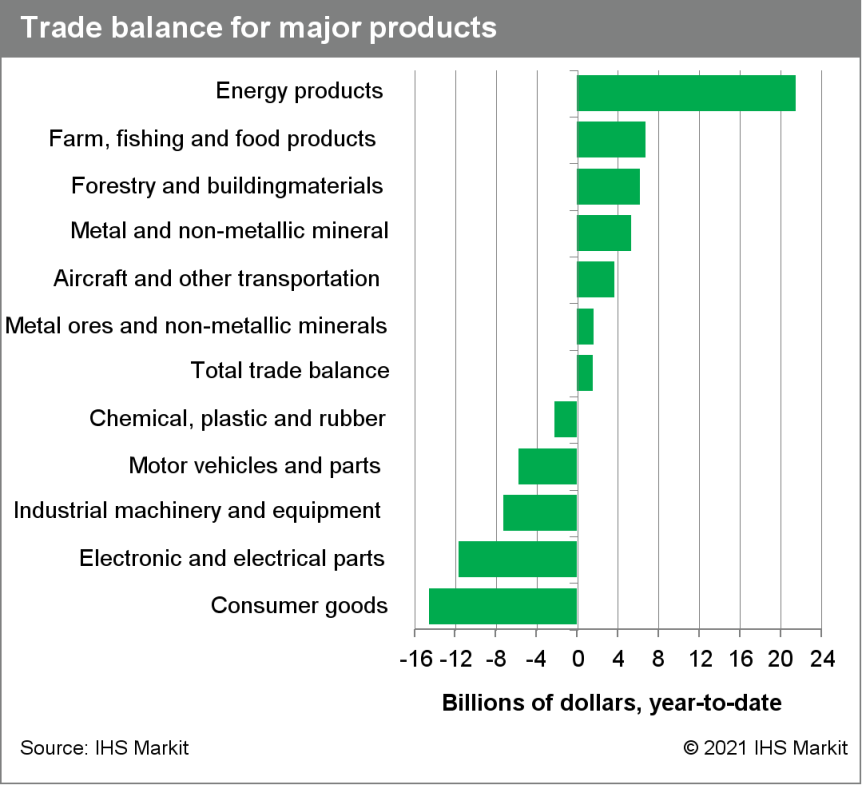

- The US trade deficit (nominal) widened to a record-high $74.5 billion in March as imports increased more than exports. The trade in goods deficit (nominal) also set a record, increasing $3.6 billion to $91.6 billion; the real deficit in goods also climbed to a record high. (IHS Markit Economist Patrick Newport)

- Cold weather in the South and the Lunar New Year holiday, which began on 11 February, suppressed imports and exports in February. March's surge in both is partly payback for these idiosyncrasies. The strong gains, though, were mostly attributable to domestic and foreign demand picking up and to a spike in exports of nonmonetary gold.

- Nominal exports of goods increased 8.9%, but 6.5% if one excludes nonmonetary gold; real goods exports grew 6.6%. Exports are still not back to normal—real goods exports in the first quarter were 2.4% below the level of the fourth quarter of 2019, the last pre-pandemic quarter.

- Nominal imports jumped 7.0% with solid gains across the board: all six major categories of imports (nominal) grew more than 5%, which has never happened before. Real imports of goods increased an annualized 8.5% in the first quarter to a record high. Imports of semiconductors also soared to a record high, growing at a 56% annual rate in the first quarter.

- The surplus in services has dwindled from $22.4 billion in January 2020 to $17.1 billion in March 2021. Imports and exports of travel and transport collapsed last year when the pandemic struck; these categories remain in a deep hole.

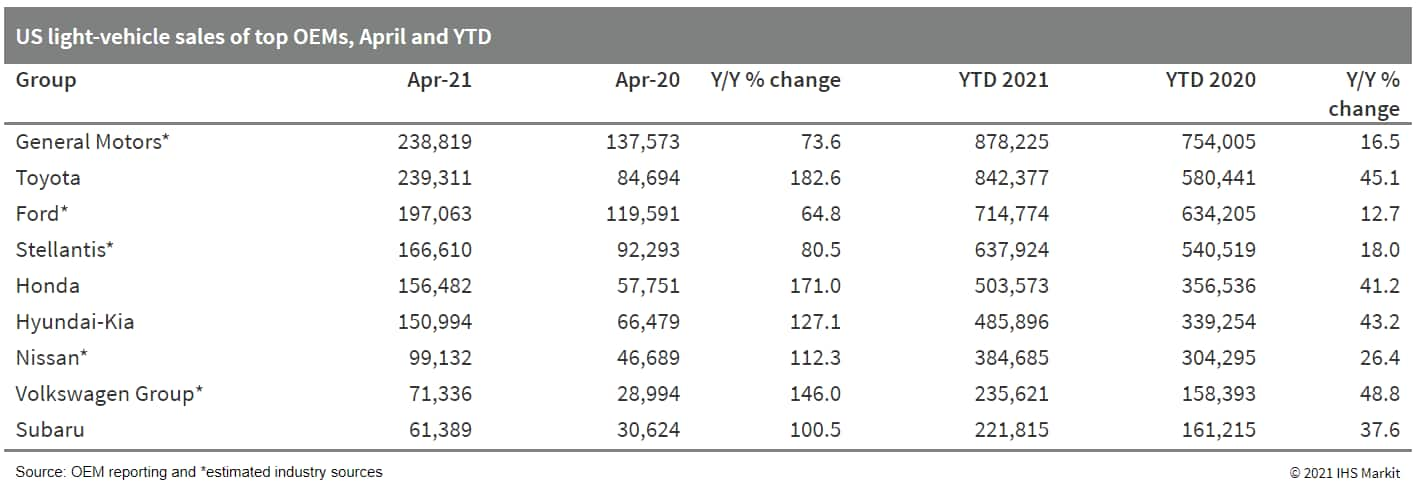

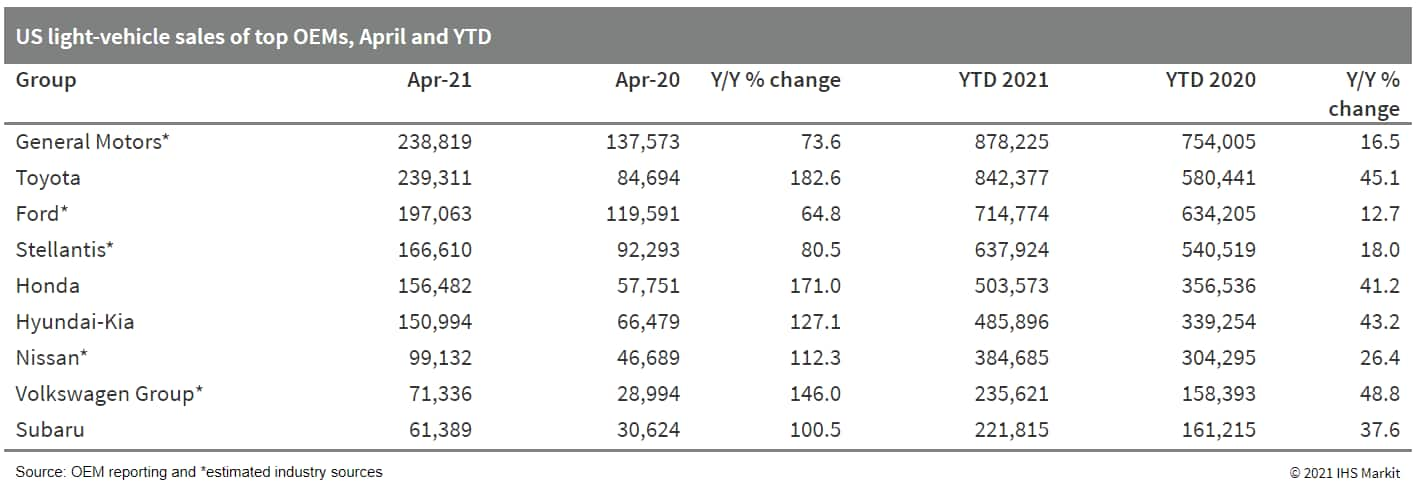

- In spite of supply pressures, US auto sales continue to motor, as the seasonally adjusted annual rate (SAAR) in April is estimated to be in the range of 18.2-18.5 million units. In April 2020, sales were constrained by COVID-19 pandemic-related restriction measures; in 2021, while the industry is facing a shortage of semiconductors, which is slowing production, the issue has not yet slowed sales. With an estimated SAAR of 18.2-18.5 million units at the time of writing, reported US light-vehicle sales in April indicate sustained levels of demand in the wake of the strong result in March (a SAAR reading of 17.8 million units) and despite automakers' announced impacts on production from various supply-chain issues. The estimated SAAR figure would make it the sixth-highest monthly reading on record. While there could be some reckoning later in the year because of the strong pace of sales bumping against the slower production level, consumers appear undeterred and consumers continue to make vehicle purchases whatever inventory is available. Given that inventory issues will only be amplified by the strong sales rate, we expect there to be some retreat from the strong pace of sales in March and April in the monthly readings in the immediate term. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous vehicle (AV) LiDAR sensor manufacturer AEye has gone public through a merger agreement with CF Finance Acquisition Corp. III, a special-purpose acquisition company (SPAC). This will bring market value of the combined entity to USD1.52 billion, reports Automotive News. The valuation dipped from its earlier estimation of USD2 billion, and the companies attributed the terms of the amended deal to "changing conditions" in the automotive LiDAR industry. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Westlake Chemical (Houston, Texas) says higher sales prices and integrated margins for polyethylene (PE) and polyvinyl chloride (PVC) plus strong demand in the downstream building products business drove a sharp year-over-year (YOY) increase in first-quarter profits. Net income for the quarter totaled $242 million, up 149% YOY from $97 million, on sales of $2.357 billion, up 22% YOY from $1.932 billion. Earnings per diluted share came to $1.87, beating the consensus estimate of $1.56, as compiled by Zacks Investment Research. (IHS Markit Chemical Advisory)

- The vinyls segment reported income from operations of $200 million, up 173% YOY from $73 million on higher sales prices and integrated margins for PVC resin and higher earnings in the downstream building products business.

- Income from operations in the olefins segment totaled $180 million, up 190% YOY from $62 million on higher sales prices and integrated margins driven by continued strong global demand, partially offset by lower sales volumes, lost production, and increased maintenance expense resulting from the winter storm, as well as higher feedstock and fuel costs.

- Container price rises continue, hitting the agribusiness commercial traffic in the US, the EU and Asia and the delayed timeframes are not being reduced, trading sources explained during the International Peanut Forum, held from 28-30 April. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Container shortages due to abandoned containers in wrong ports and rising fuel price have boosted premium-service prices just when China is revealing a robust recovery.

- "We estimate that around 28% of cargo capacity is lost in the global sea freight market, which total 24.5 million TEUs, just when the offer is gradually concentrated in few companies. Seven firms have 77% of the total cargo capacity," said Jon Beech, director of the UK forwarder RBF Cargocare Limited.

- Average prices reached USD2,800 per 20ft container and USD3,500 per 40ft container in western US ports, up from USD1,150 and USD1,450 in April 2020. East US port prices reached USD3,800 and USD4,800 respectively, 72% and 78% higher.

- Ford and BMW both participated in the latest funding round for solid-state battery start-up Solid Power, with which both automakers have already been working. Volta Energy Technologies is the third and only other participant in this funding round. The funding round raised USD130 million, although neither Ford nor BMW confirmed individual investment amounts. According to statements from Ford and BMW, the two automakers are now equal equity owners of Solid Power. BMW has been working with the startup since 2018, and Ford since 2019; and representatives from each of the automakers will join the board of directors. Solid Power has already delivered automotive-capable 20 ampere hour (Ah) multi-layer all solid-state batteries on a continuous roll-to-roll production line, which uses industry standard lithium-ion production processes and equipment. With the next phase of partnership development and funding, Solid Power has committed to delivering full-scale 100 Ah cells for automotive qualification testing and vehicle integration by BMW and Ford beginning in 2022. (IHS Markit AutoIntelligence's Stephanie Brinley)

- After two consecutive surpluses to begin 2021, Canada's merchandise trade balance reversed in March, registering a deficit of $1.1 billion. (IHS Markit Economist Evan Andrade)

- The deficit was caused by a broad 5.5% month on month (m/m) increase in nominal imports to $51.8 billion, while exports ticked up 0.3% m/m to $50.6 billion.

- Export volumes were down 0.2% m/m, while import volumes were up a solid 6.8% m/m.

- The relatively modest deficit this month should leave Canada with its first quarterly trade surplus since the end of 2016.

- Mexican GDP increased by 0.4% quarter on quarter (q/q) during the first quarter of 2021, according to a "flash" estimate released by the National Institute of Statistics and Geography (INEGI). Output had increased by 3.3% q/q and by 12.4% q/q during the fourth and third quarters of 2020, respectively. This is based on seasonally adjusted data. (IHS Markit Economist Rafael Amiel)

- On a year-on-year (y/y) basis, GDP contracted by 3.8% during the first quarter. GDP is still 4.1% below its pre-pandemic level during the fourth quarter of 2019.

- Although INEGI did not release a detailed breakdown of components alongside the flash estimate, it specified that services were the driver of the quarterly expansion, while the industry was flat and the always volatile agriculture sector declined.

- The Monthly Index of Economic Activity (MIEA) for January and February, released earlier, indicated monthly contractions and was pointing to a decline in first-quarter GDP, so the expansion, albeit small, comes as a surprise. Thus, in March, the expansion of services must have been sizeable enough to bring full-quarter growth to positive territory (IHS Markit estimates that MIEA expanded by 2.1% month on month (m/m) over February).

Europe/Middle East/Africa

- All major European equity indices closed lower; UK -0.7%, Spain -0.7%, France -0.9%, Italy -1.8%, and Germany -2.5%.

- 10yr European govt bonds closed sharply higher; UK -5bps, Germany -4bps, France -3bps, and Italy/Spain -2bps.

- iTraxx-Europe closed +1bp/51bps and iTraxx-Xover +5bps/254bps.

- Brent crude closed +2.0%/$68.88 per barrel.

- Tesla production at its Germany plant, which is still under construction, has now been delayed to January 2022, according to media reports. Automobilwoche cites company sources as saying that the team in charge of the plant has been given six more months to complete the project, although Tesla has reportedly not confirmed directly. The sources say that the further delay is due to problems getting the plant ready for battery pack production and getting regulatory approval. During the earnings call for the first quarter of 2021 on 26 April, however, Tesla had indicated that the plant would be producing vehicles in late 2021 instead of an earlier target for July 2021. The Automobilwoche sources have said that battery production will not start by the end of 2021, although construction of the main factory structure, the press shop and the paint shop are well advanced. The plans for the plant to eventually produce 500,000 units per year are unchanged; the plant is expected to produce the Model Y first, instead of the Model 3. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Swiss company Morand is looking to launch a new battery electric vehicle (BEV) hypercar by 2023, according to an Autocar report. Unlike other BEV hypercars, Morand is looking to develop a hybrid powertrain with a conventional ICE component as well as the BEV. The car will feature a carbon composite monocoque, similar to the technology used by Lotus and Rimac in their BEV hypercars but uniquely Morand will look to clothe the monocoque in Amplitex, which is a sustainable flax-based composite. The BEV's specification will have output of 1,950bhp which will be created by a 70kWh battery producing 1400kW, and which will weigh 400kg including casing, cables and electronics. (IHS Markit AutoIntelligence's Tim Urquhart)

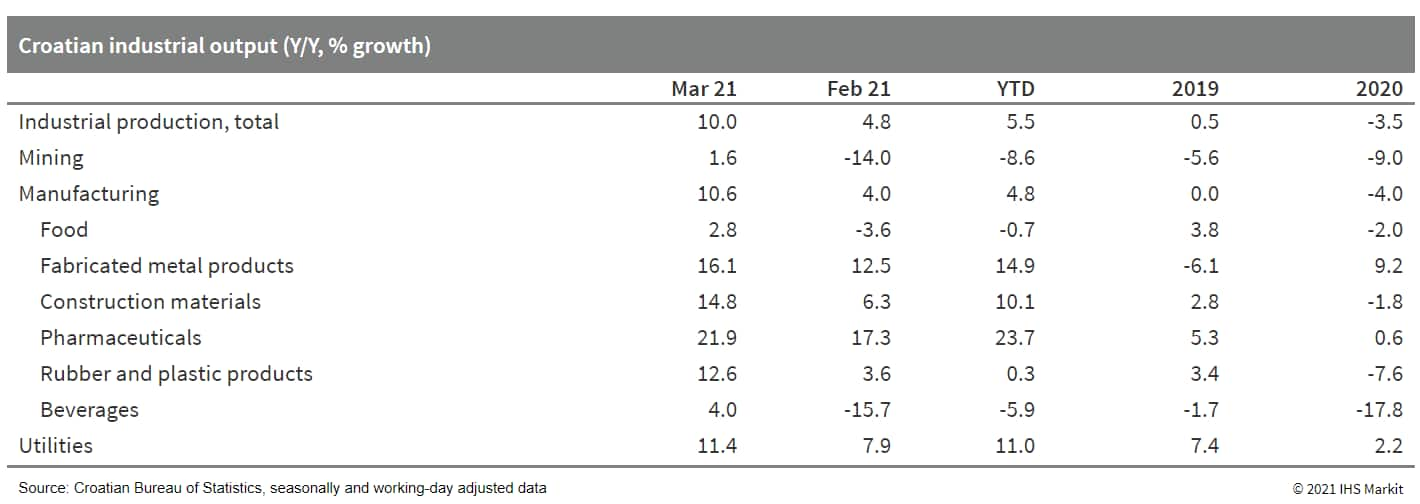

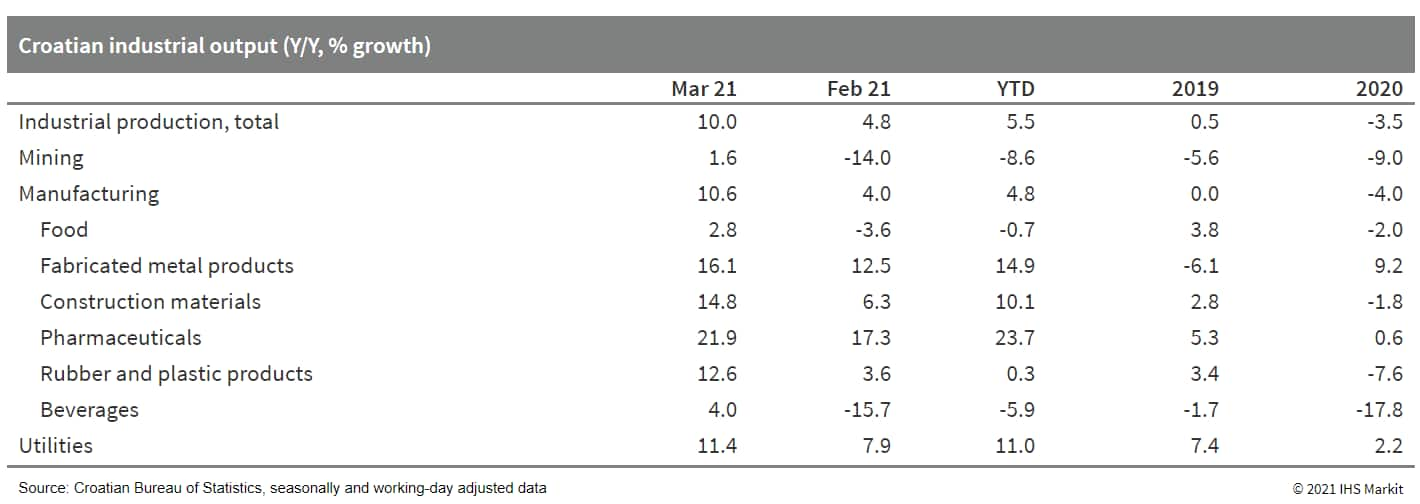

- As it has throughout much of the rest of Central and Eastern Europe, Croatian industrial production remained robust during the first quarter of 2021. In January to March 2021, industrial production grew by around 5.5% year on year (y/y), with growth steadily accelerating throughout the first three months of the year. (IHS Markit Economist Andrew Birch)

- The country's heavy infrastructure spending as part of its greater utilization of EU development funds led to a strong expansion of capital investment goods. However, the uptick in the European production cycle also drove forward the production of intermediate goods, which rose by 6.5% y/y in the first quarter.

- Meanwhile, however, retail trade activity showed the negative effect of the escalation of COVID-19-virus lockdown measures in the first quarter. After continuing to rise month on month (m/m) in seasonally adjusted data, total retail trade activity sloughed by 2.4% m/m in March.

- Russia has made the first batch of its COVID-19 vaccine for animals ready for distribution domestically. The Federal Veterinary and Phytosanitary Surveillance Service (Rosselkhoznadzor) said 17,000 doses of Carnivak-Cov have been manufactured at the Federal Center for Animal Health. Rosselkhoznadzor claims Carnivak-Cov is the world's first registered vaccine for protection against COVID-19 infection in animals. The agency previously revealed Carnivak-Cov is "planned to be purchased by both domestic fur farms and commercial structures from Greece, Poland and Austria". It added there has also been interest from the US, Canada and Singapore. In February this year, Zoetis provided a supply of an experimental SARS-CoV-2 vaccine for emergency use in great apes at San Diego Zoo. (IHS Markit Food and Agricultural Policy's Sian Lazell)

- The Russian government appears to be taking its first tentative steps towards introducing low or zero-emission vehicles (ZEVs) onto the Russian vehicle market. According to a Business World Magazine report, Industry and Trade Minister Denis Manturov spoke last week at a business conference and confirmed the government would look to introduce legislation to oblige carmakers to have a share of green cars, running on electricity, hydrogen, or natural gas as part of their Russian sales portfolio by 2030. (IHS Markit AutoIntelligence's Tim Urquhart)

- Greece will stop burning coal at power plants in 2025, three years earlier than expected, State Secretary for Energy Alexandra Sdoukou announced 22 April. Greece is the tenth European country to have already exited coal-fired generation or announced a plan to do so by 2025, according to nonprofit Europe Beyond Coal. The state's decision to move forward a planned 2028 coal phase-out date aligns with the target of state-controlled utility and coal mine operator Public Power Corporation (PPC). PPC's move is in anticipation of future EU regulations, for example limiting the use of solid fuel such as coal, that could potentially result from the EU's Green Deal package that will implement the bloc's recently-agreed 55% emissions target, or the EU financing offered to fossil fuel-dependent nations through the Just Transition Mechanism. (IHS Markit Climate and Sustainability News' Cristina Brooks)

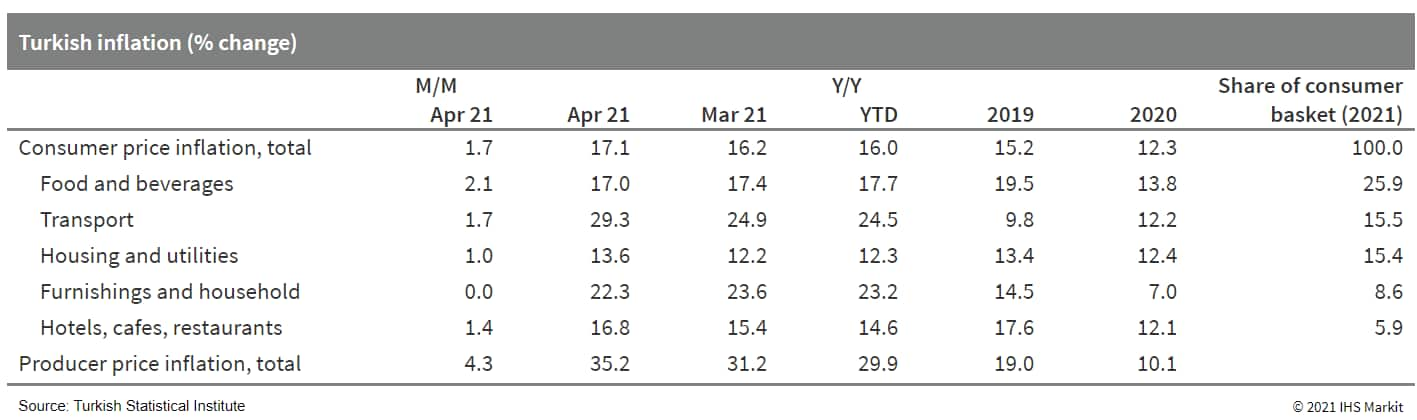

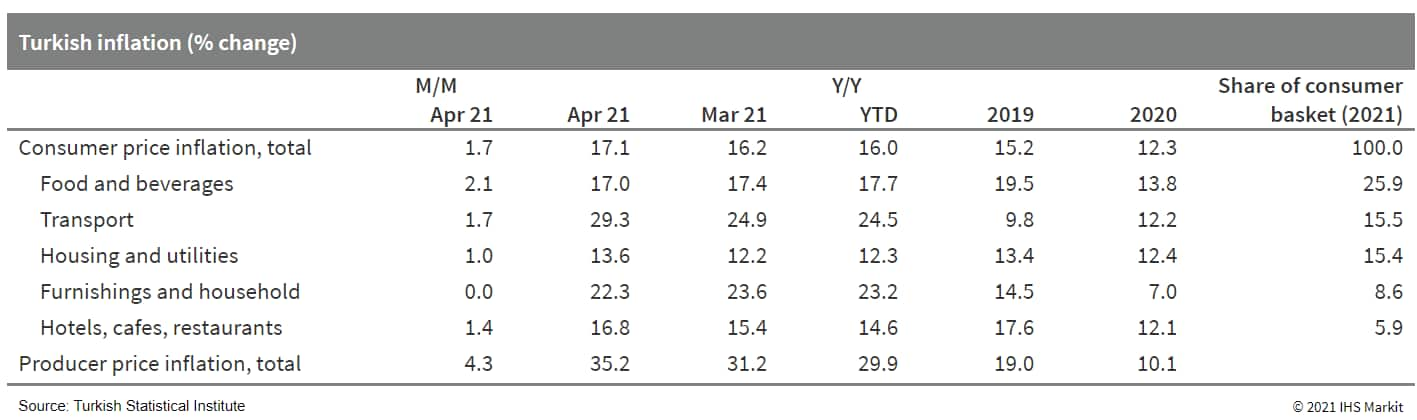

- As anticipated, Turkish annual consumer price inflation accelerated again in April, rising to 17.1% according to the Turkish Statistical Institute (TurkStat). Annual inflation has climbed to within 200 basis points of the current, main policy rate - the one-week repo rate - which sits at 19.0%. (IHS Markit Economist Andrew Birch)

- Energy price growth has been accelerating in 2021, reacting to global supply pressures. Meanwhile, although it has decelerated, agricultural price inflation remains elevated, providing a strong impetus to headline inflation. However, the greater impact on inflation in Turkey has been the sharp rise of import prices due to the severe lira losses once again from end-February to end-April.

- Also contributing to elevated inflation, consumer expectations of price growth have increased, raising the barrier to reversing the current acceleration. Anecdotal evidence suggests that TurkStat may be underreporting inflation due to political pressures and/or administrative restraints on consumer prices.

- Surging producer price inflation - reaching 35.2% in April, the highest since the 2018 currency crisis - provides a compelling argument that price pressures in Turkey are higher than are being reported in the consumer price index.

- In a press release, Saudi Aramco reported first-quarter 2021 net income of $21.7 billion (81.4 billion Saudi riyals), up 30% from $16.7 billion in the first quarter of 2020. The increase in the earnings was primarily driven by higher crude oil prices, improved downstream margins and the consolidation of SABIC's results, partly offset by lower crude oil volumes sold, the company said. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Net cash provided operating activities was $26.5 billion, up about 18% from $22.4 billion in the first quarter of 2020. First-quarter 2021 capital expenditure was $8.2 billion, up about 11% from $7.4 billion a year ago. Averaged realized crude oil price was $60.2/bbl, up about 16% from $51.8/bbl a year-ago period.

- Upstream segment's EBIT (earnings before interest, income taxes and zakat) for the first quarter of 2021 was $40 billion, up 6% from $37.6 billion a year ago.

- Downstream EBIT for the first quarter of 2021 was $4.4 billion, up from an EBIT loss of $5.1 billion a year ago, primarily due to continued recovery in global economic conditions leading to higher margins and also inventory re-valuation gains.

- Total hydrocarbon production for the first three months of 2021 was 11.5 MMboe/d (75% oil).

- Intel Corp. has announced plans to invest USD600 million to expand its research and development (R&D) centers in Israel, reports Reuters. The announcement was made during a one-day visit by Intel CEO Pat Gelsinger to Israel as part of a European tour. The company is investing USD400 million into its subsidiary Mobileye unit headquartered in Jerusalem by turning it into an R&D campus to develop autonomous car technologies. In addition, it will invest USD200 million in building an R&D center, called IDC12, in the northern port city of Haifa. The company claims it to be a "mega chip design" facility with a capacity of 6,000 employees. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Bank of Uganda (BoU) maintained its benchmark policy rate at 7% at its monetary policy committee (MPC) meeting on 14 April. The central bank rate (CBR) was lowered from 8.0% to 7.0% in June 2020. (IHS Markit Economist Alisa Strobel)

- The central bank's MPC announced that it would maintain the CBR at 7% in April given a higher inflation outlook and uncertainty surrounding global macroeconomic developments. The MPC also maintained the band on the CBR at plus or minus 2 percentage points, while the margin on the rediscount rate and bank rate was left unchanged at 3 and 4 percentage points on the CBR, respectively. The rediscount rate and the bank rate were maintained at 10% and 11%, respectively, at the MPC meeting.

- At its MPC meeting, the BoU highlighted that the external sector improved in the 12 months to February 2021. The improvement in the overall balance of payments was mainly due to disbursements of loans from the International Monetary Fund (IMF) and the World Bank, among others. The BoU also stated that the stock of private-sector credit (PSC) grew by 9.4% in the quarter to February 2021, from 8% in the previous quarter, suggesting a gradual recovery in domestic economic activity.

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong +0.7%, South Korea +0.6%, Australia +0.6%, and India -1.0%.

- China GDP forecasts are getting boosted up slightly as expectations for continued strength from last year roll through into the first quarter data. IHS Markit bumped up expected growth rates from 7.8% to 7.9% on higher levels of economic activity. Prompt demand from Chinese refiners is slower than earlier in the year, but domestic product demand is continuing to grow, lifting the outlook for fuels consumption. IHS Markit expects China's total oil demand to grow by 1.54 MMb/d y/y in our base case, a 226,000 b/d increase versus our forecast last month, in view of strong March consumption and favorable economic outlooks. On the crude side, April is likely to be the bottom of the dip in refinery throughputs, with runs recovering from here and moving closer to 14 MMb/d by the end of summer with the commissioning of the 400,000 b/d Zhejiang Petrochemical Phase II. This demand is key in absorbing new streams of Mideast oil flowing to market starting this month. So far, the Brent-Dubai exchange of futures for swaps (EFS) is holding steady around $3.50/bbl, in a sign that these volumes are not crushing the value of medium sour grades relative to Atlantic Basin light sweet oil. (IHS Markit Energy Advisory's Roger Diwan, Karim Fawaz, Ian Stewart, Edward Moe, and Sean Karst)

- CITIC's Sino Iron project has magnetite mining and processing operations in Western Australia. It is one of the country's biggest magnetite operations and is also the largest seaborne supplier of magnetite concentrate to China, by traded volume. As per Commodities at Sea, during 2020, the Sino Iron project shipped 20.7mt of shipments out of Cape Preston. Out of total shipments in 2020, shipments to East China, North China, South China, and South East Asia stood at 13.6mt, 3.1mt, 3.1mt, and 0.9mt, respectively. Shipments in 1Q21 continued to remain healthy at 5.4mt, up 12% y/y. On 03 May 2021, there was a fire incident at the processing plant; however, as per the company the fire was out now, and damage is still being assessed. As per sources, fire occurred at an obsolete, non-operational sampler within the tailings thickener area and production has been ceased temporarily as a precautionary measure. Presently, MV Diamond Power (107,235dwt), MV Kumano Maru (106,507 dwt), and MV Magsenger 8 (115,455 dwt) are anchored to load at the transshipment facility. (IHS Markit Maritime and Trades' Pranay Shukla)

- Chinese electric vehicle (EV) startup AIWAYS has unveiled the first pictures of the production version of its U6 sport utility vehicle (SUV), according to an Electrive report. The model, based on the startup's self-developed scalable platform AIWAYS MAS (More Adaptable Structure), is due to be launched in China and Europe this year. The model incorporates all the details of the AIWAYS U6 ion concept. The AIWAYS U6 is a D-segment SUV based on the MAS platform, which it shares with the U5 SUV. The automaker plans to begin sales of the U6 in China in October, followed by Europe in April next year, according to IHS Markit's light-vehicle sales forecast data. We expect global sales of the U6 to be around 3,200 units this year and around 14,000 units next year. In the electric mobility space, AIWAYS recently partnered with Blue Park Smart Energy, a BAIC BJEV-backed company engaged in the battery-swapping business, to co-operate on development of battery-swappable vehicles and battery-swapping technologies. The two partners plan to deploy at least 20,000 vehicles featuring swappable battery packs across 17 cities in China and to build more than 200 battery-swapping stations. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Preliminary data show that Taiwan's economy strengthened further, hitting the fastest growth in slightly more than a decade, which was fueled by booming exports, along with stronger investment demand and resumed growth in consumer spending. Real GDP surged 8.2% year on year (y/y) in the first quarter of 2021, marking the fastest expansion since the third quarter of 2010. It accelerated from an already-strong gain of 5.1% y/y in the fourth quarter of 2020. (IHS Markit Economist Ling-Wei Chung)

- The key driving force of the first-quarter 2021 economic expansion continued to come from strong net exports, contributing 4.5 percentage points to GDP growth, as exports soared at the pace not seen in more than a decade, outpacing the rebound in imports.

- Domestic demand rebounded in the first quarter as well, with investment spending turning surprisingly stronger and private consumption returning to growth. Domestic demand contributed 3.6 percentage points to first-quarter growth, with gross investment adding 2 percentage points and private consumption adding 1 percentage point.

- Merchandise exports soared 24.5% y/y (in US dollar terms, or 17.5% y/y in Taiwan dollar terms) in the first quarter as shipments to all major markets surged at the double-digit pace, except those to Japan. It was led by a 35.5% y/y jump in shipments to mainland China, followed by 22-24% y/y surges in those to the US and ASEAN and a 14% y/y expansion in exports to Europe.

- Benefitting from booming technology demand, shipments of electronics as well as information and communication products continued to surge, up 28.4% y/y and 29.7% y/y, respectively.

- SsangYong Motor's parent company Mahindra & Mahindra (M&M) has announced that it will support the electric vehicle (EV) business of SsangYong, reports ET Auto. M&M aims to develop and supply the electric sport utility vehicle (SUV) drivetrain on its Mahindra Electric Scalable Modular Architecture (MESMA) 350 platform. The MESMA platform, which is an indigenously designed and developed electric architecture, is suitable for converting existing internal combustion engine (ICE) vehicles to electric or for developing EVs from scratch. (IHS Markit AutoIntelligence's Tarun Thakur)

- Mahindra and Mahindra (M&M) has joined auto manufacturers like Maruti Suzuki, MG, and Toyota and planned a shutdown of its plants, reports The Economic Times. M&M advanced the scheduled annual maintenance shutdown of its plants (which was originally planned in June) for four days in May in a staggered manner, due to the second wave of the coronavirus disease 2019 (COVID-19) virus pandemic in India. Commercial vehicle (CV) manufacturer Ashok Leyland also revealed plans to scale down production as well as run plant operations only for 7-15 days in May. (IHS Markit AutoIntelligence's Tarun Thakur)

- Reliance Industries says that EBITDA dropped 4.6% year on year (YOY) at its oil-to-chemicals (O2C) business, to 114.0 billion Indian rupees ($1.5 billion), in the fiscal fourth quarter ended 31 March. Quarterly sales for the sector were Rs1.0 trillion, up 4.4% YOY, because of higher realization across product portfolios and higher volumes. (IHS Markit Chemical Advisory)

- In the polymers business, prices of polypropylene (PP), polyethylene (PE), and polyvinyl chloride (PVC) strengthened during the quarter by 19%, 16%, and 18%, respectively, quarter on quarter (QOQ).

- Prices of PP and low-density polyethylene (LDPE) reached multiyear highs and PVC prices were at an all-time high level during the quarter. The company says that margins of PP over naphtha increased by 43% ($285/metric ton), and PVC margins over naphtha and ethylene dichloride rose 9% ($682/metric ton) on a QOQ basis.

- Polymer demand was buoyant led by growth in health & hygiene, e-commerce, and fast-moving consumer goods (FMCG), and the revival of the auto industry. Polymer demand in the fourth quarter grew by 12% YOY and dropped 2% QOQ owing to lower imports and turnarounds at domestic plants.

- In the intermediates and polyesters business, prices of para-xylene (p-xylene), purified terephthalic acid (PTA), and ethylene glycol (EG) strengthened during the quarter by 37%, 36%, and 35% QOQ, respectively, owing to increased feedstock prices and improved downstream demand.

- P-xylene, PTA, and monoethylene glycol (MEG) margins increased by 38% ($195/metric ton), 34% ($226/metric ton), and 33% ($291/metric ton), respectively, amid fall in the China port inventory and supply disruption.

- Downstream polyester deltas were weaker with strong intermediates market. Integrated players benefited during the quarter with chain deltas shifting to fiber intermediates, it adds.

Posted 04 May 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.