US and most European equity indices closed higher, while most major APAC markets were lower. US government bonds and most benchmark European bonds closed slightly lower. European iTraxx and CDX-NA closed modestly tighter across IG and high yield. The US dollar and oil closed higher, while gold, silver, and copper were all lower.

Americas

- US equity indices closed higher; Russell 2000 +2.0%, Nasdaq +1.2%, and DJIA/S&P 500 +1.1%.

- 10yr US govt bonds closed +1bp/1.15% yield and 30yr bonds closed +1bp/1.94% yield.

- The difference between the yields on the 30-year Treasury and the shorter-term five-year note reached 147.3 basis points on Thursday, the widest since October 2015. Investors said the development reflected the prospects of a large additional injection of economic stimulus from the Biden administration, along with the stronger global growth expected as vaccination drives gather pace. (FT)

- CDX-NAIG closed -1bp/51bps and CDX-NAHY -8bps/289bps.

- DXY US dollar index closed +0.4%/91.53.

- Gold closed -2.4%/$1,791 per ounce, silver -2.5%/$26.23 per ounce, and copper -0.6%/$3.55 per pound.

- Crude oil closed +1.0%/$56.23 per barrel.

- Seasonally adjusted (SA) US initial claims for unemployment insurance fell by 33,000 to 779,000 in the week ended 30 January. The not seasonally adjusted (NSA) tally of initial claims fell by 23,525 to 816,247. Even as initial claims trend down, they remain at historically high levels—the high during the Great Recession was 665,000. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 193,000 to 4,592,000 in the week ended 23 January. The insured unemployment rate edged down 0.2 percentage point to 3.2%.

- There were 348,912 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 30 January. In the week ended 16 January, continuing claims for PUA fell by 125,969 to 7,217,713.

- In the week ended 16 January, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 289,910 to 3,603,098. With the latest extension to 24 weeks for PEUC, eligible recipients can receive up to 50 weeks of unemployment benefits between the regular state programs and PEUC.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 16 January, the unadjusted total fell by 486,405 to 17,835,525; a year earlier, this total was 2,108,515.

- US employers announced 79,552 planned layoffs in January, according to Challenger, Gray & Christmas—up 3.3% from December's 77,030. January's total was the highest January reading since 2009 and was 17.4% higher than the number of cuts announced in January 2020, prior to the onset of the pandemic. (IHS Markit Economist Juan Turcios)

- January was the 11th month to report job-cut announcements specifically because of the COVID-19 pandemic, which totaled 4,620 for the month. Employers cited other reasons including a downturn in demand (29,822), restructuring (19,526), and market conditions (15,056) more frequently than COVID-19 as causes of job-cut announcements in January.

- Last year, 2,304,755 job cuts were announced, 289% higher than in 2019. The yearly total was the highest on record and surpassed the previous annual record of 1,956,876 announced job cuts in 2001 by 17.8% (Challenger began tracking job-cut announcements in January 1993). The bulk of those job-cut announcements were concentrated in the second and third quarters.

- Of the 2,304,755 total job cuts announced over 2020, nearly half (1,109,656) were because of COVID-19, according to employers. COVID-19 was the leading reason cited for job-cut announcements last year but was cited less frequently toward the end of the year.

- Amid disruptions stemming from COVID-19, US productivity (output per hour) and compensation per hour in the nonfarm business sector each rose sharply during the second quarter, but they diverged in the third and fourth quarters. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- Productivity declined at a 4.8% annual rate in the fourth quarter following increases in the third and fourth quarters (10.6% and 5.1%, respectively). Hours worked rose 10.7% in the fourth quarter following a 37.1% increase in the third quarter. For the year, productivity rose 2.5% as hours declined 5.0%.

- Compensation per hour increased at a 1.7% rate in the fourth quarter after declining 2.2% in the third. Over the second half of 2020, compensation per hour edged lower at a 0.3% rate after surging 16.5% over the first half.

- Productivity declined more than we expected in the fourth quarter while compensation per hour increased by less than expected. Unit labor costs rose at a 6.8% pace in the fourth quarter, 1.2 percentage points above our estimate.

- Manufacturers' orders rose 1.1% in December, while manufacturers' shipments rose 1.7%. The increase in orders was slightly above expectations. Meanwhile, inventories rose 0.3% in December, ahead of the Bureau of Economic Analysis (BEA)'s assumption, and November inventories were revised higher. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- As of December, manufacturers' shipments were 0.9% above February 2020, and manufacturers' orders were only 0.6% below February 2020; that is, at least by this measure, the recovery in the manufacturing sector is essentially complete.

- With goods production fully recovered, continued broad recovery hinges on services, much of which is "in-person" spending. Recovery here depends on the spread of the virus and the extent to which individuals, businesses, and local governments are willing to re-engage the services economy.

- General Motors (GM) is the latest automaker whose production is being affected by the semiconductor shortage facing the auto industry globally, involving the company's plants in the United States, Canada, Mexico, and South Korea, reports Reuters. According to the report, GM is to stop production for one week starting on 8 February at its plants in Fairfax, Kansas, United States; Ingersoll, Ontario, Canada; and San Luis Petosi, Mexico. In addition, GM's Bupyeong 2 plant in South Korea will run at half capacity during the same week. GM has not indicated how much production it expects to be lost. However, the plants were selected for the production slowdown to ensure sufficient microchip supply for higher-margin and higher-selling products, including full-size pick-ups and sport utility vehicles (SUVs), as well as the Chevrolet Corvette. GM indicated that it intends to make up as much of the lost production as possible later in the year. As of the week ending 29 January, IHS Markit's estimate of the impact of the microchip shortage on global auto production was about 628,000 units in 2021. However, the situation is very fluid and that figure is likely to change with automakers' announcements early in February, including from GM. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Amazon has started testing its Rivian-produced electric vans in Los Angeles and making customer deliveries with the vans, according to an Amazon blog post. The testing will expand to 15 other cities in 2021, although Amazon did not indicate whether these will be cities in California or elsewhere in the United States. The company said that it had begun testing four months earlier, but it is now using the vehicles for customer deliveries and on customer routes. Ongoing testing work includes performance and safety durability in various climates and geographies; full production is still scheduled for late 2021. The test vehicles were produced by Rivian at its Plymouth, Michigan, facilities; the production vehicle will be built at Rivian's Illinois production facility. In preparation for the fleet, Amazon also reported that it has installed thousands of electric vehicle (EV) charging stations at its delivery stations across North America and Europe. The announcement is significant in indicating that the program is moving forward quickly and on schedule. Amazon placed its orders for 100,000 EV vans in 2019. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Aptiv has released its financial results for the fourth quarter and full year 2020. In the fourth quarter, the automotive industry further normalized, aside from sporadic supply-chain disruptions, after production shutdowns in the second quarter. Aptiv reports that its sales increased 17% during the fourth quarter compared with the same period of 2019, to USD4.2 billion. For the full year 2020, however, Aptiv posted a 9% decrease in revenue to USD13.1 billion; this was most directly tied to a 46% year-on-year (y/y) decline in revenue in the second quarter on the back of production disruption caused by the COVID-19 virus pandemic. The automotive industry supplier reported net income of USD283 million in the fourth quarter, an increase from net income of USD230 million in the corresponding period a year earlier. Revenue increased 10% in Asia (including a 9% rise in China), 37% in South America, 20% in Europe, and 11% in North America. (IHS Markit AutoIntelligence's Stephanie Brinley)

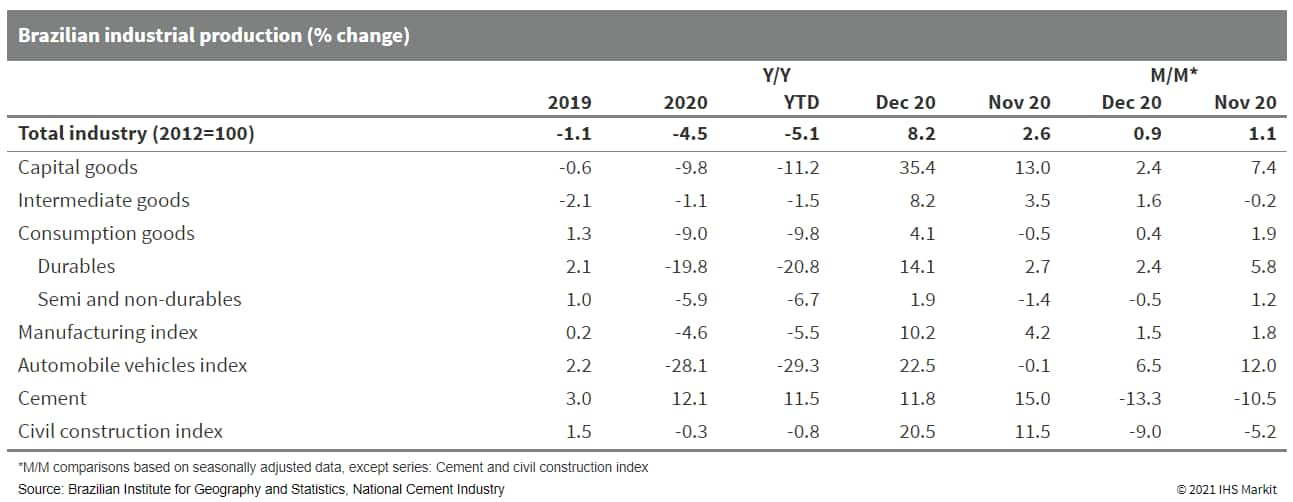

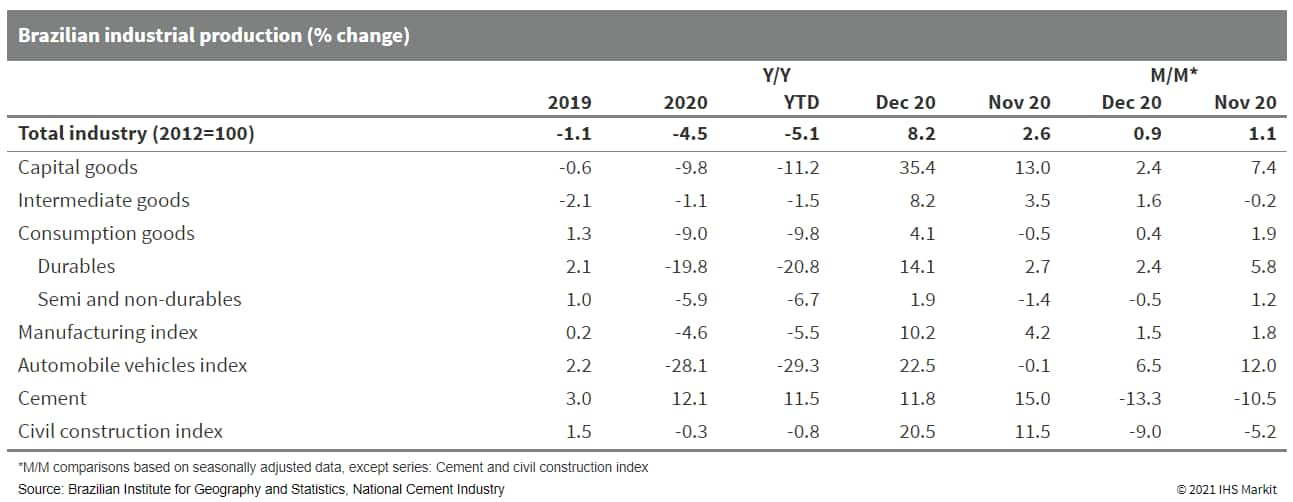

- The Brazilian Institute of Geography and Statistics (Instituto Brasileiro de Geografia e Estatística - IBGE) shows that in December 2020, industrial output grew by 8.2% compared with December 2019, driven by strong production of capital goods as well as durable goods. However, growth deceleration is expected based on lower demand resulting from lower fiscal stimulus. (IHS Markit Economist Rafael Amiel)

- For the full-year 2020, industrial production (IP) plunged by 4.5% as many factories were closed during March and April. IP had recovered to pre-pandemic levels in September and strong growth continued during the final quarter of the year.

- Intermediate goods, which account for more than half of the index, were down by 1.1% in the full year, while production of capital goods and durable goods still has ample room to catch up.

- As per IHS Markit's Commodities at Sea, during January 2021, Brazilian iron ore and pellet shipments stood at a healthy 28.2mt, up 28% y/y. During the reported month, total Brazilian iron ore and pellet shipments to China (Mainland) stood at 20mt (up 37% y/y). Thus, representing 71% of all Brazilian cargoes to China (Mainland) versus 66% a year ago. For 1Q21, Brazilian iron ore and pellet exports forecasted at 84.5mt (up 28% from previous year levels) and for full 2021 at 375mt (up 11% y/y). (IHS Markit Maritime and Trade's Pranay Shukla)

Europe/Middle East/Africa

- Most European equity markets closed higher; Italy +1.7%, Spain +1.4%, Germany +0.9%, and UK -0.1%.

- Most 10yr European govt bonds closed lower except for Italy -4bps; UK +7bps and Germany/France/Spain +1bp.

- iTraxx-Europe closed -1bp/48bps and iTraxx-Xover-5bps/244bps.

- Brent crude closed +0.7%/$58.84 per barrel.

- The U.K. will require travelers from coronavirus hot spots to quarantine starting Feb. 15, the government said, adding flesh to a policy first announced last month. Arrivals from countries on the U.K.'s travel ban list will be required to isolate for 10 days in government-approved accommodation, the Department for Health and Social Care said Thursday. The government is seeking bids from hotels near airports and ports to support the program. (Bloomberg)

- Siemens Gamesa has scored a mega deal worth GBP6.5 billion (USD8.9 billion) as the preferred bidder for the supply and installation of its newest 14+ MW offshore wind turbines for the East Anglia Hub. The two companies will work together to lower the cost of power for the next round of Contracts for Difference bids schedules later this year. Siemens Gamesa will focus on developing its turbine design to achieve further efficiencies and maximize local supply chain opportunities. The East Anglia Hub consists of offshore wind farms East Anglia ONE, TWO, and THREE in the southern North Sea, and are developed ScottishPower Renewables, a subsidiary of Iberdrola. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Jazz Pharmaceuticals (US/Ireland) has agreed to acquire GW Pharmaceuticals in a USD7.2-billion cash-and-stock deal, which is the largest merger and acquisition deal of the year so far and a probable indicator that the merger and acquisition environment in 2021 is on course to be highly active. In value terms, this is the fourth-largest deal observed by IHS Markit in the past 14 months. The companies announced on 3 February that Jazz Pharma will pay USD220 per depository share, which amounts to a premium of about 50%. This comprises USD200 in cash plus USD20 in Jazz Pharma shares. The buyout by Jazz Pharma will give the company rights to GW Pharmaceuticals' oral cannabidiol-derived drug Epidiolex, which is approved for use in the European Union and the US as a treatment for Lennox-Gastaut syndrome and Dravet syndrome, two rare and severe forms of childhood-onset epilepsy. Including the US FDA's approval of Epidiolex in a new indication for tuberous sclerosis complex in July 2020, GW Pharmaceuticals has previously forecast that the drug treatment could generate sales in 2020 amounting to USD510 million. The combined new business entity will be well-positioned in the sleep disorder and epilepsy therapeutic areas and the oncology space. (IHS Markit Life Sciences' Eóin Ryan)

- The European Commission could end funding to promote red and processed meats under a review of the EU's €200 million annual "promotion of agricultural products" policy announced on 4 February as part of a new Europe's Beating Cancer Plan. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Between 2016 and 2019, 24% of the EU agricultural promotion policy budget was allocated to campaigns promoting meat and meat products, for example the €1.4 million "Pork Lovers Europe" marketing drive or the €4.5 million "Proud of EU beef" initiative.

- With prevention a key pillar of the Cancer Plan, the Commission wants to reduce exposure to risk factors for cancer, including dietary ones. The aim of the review, which should bring proposals at the end of this year, is to bring the agricultural promotion policy more in line with healthy eating recommendations, including lowering consumption of red and processed meat.

- "Diet can influence cancer risk many years before the diagnosis of cancer, already during childhood. Diets with ample intake of fruits and vegetables, whole grains instead of refined grains, and low intake of red meat and processed meat, sugar-sweetened beverages, and salt will reduce the risk not only of cancer, but also of cardiovascular disease, diabetes, and overall mortality," writes the Commission in response to a question on actions it will be taking on food in a question-and-answer paper on the Cancer Plan.

- The promotion policy review is also linked to the Farm to Fork (F2F) Strategy, which aims to make food and farming more sustainable. "The Commission is undertaking a review of the promotion policy for agricultural products, with a view to enhancing its contribution to sustainable production and consumption, and in line with the shift to a more plant-based diet, with less red and processed meat and other foods linked to cancer risks and more fruit and vegetables," states the Cancer Plan itself.

- Moreover, the Commission pledges to propose a revision of the EU school fruit, vegetables and milk scheme to make more healthy products available to children.

- The German passenger car market posted a highly accelerated 31.1% y/y decline in January to 169,754 units, according to the latest set of data released by the Federal Motor Transport Authority (Kraftfahrt-Bundesamt: KBA). The principal reason for the marked decline last month, which followed an increase of 9.9% y/y in December 2020, was the return of the VAT rate from 16% to its pre-COVID-19 level of 19% on 1 January. The January sales numbers were always likely to be painful reading for the German market's major players as a result of the VAT rate returning to its pre-pandemic level and the resultant pull-forward effect seen in December last year. For the full year 2021, IHS Markit sees the German passenger car market coming in at 3.16 million units, which is a strong improvement on 2020's 2.92 million units, although it will lag behind 2019's pre-pandemic figure of 3.61 million units. (IHS Markit AutoIntelligence's Tim Urquhart)

- France's inflation rate, as measured by the "flash" Harmonised Index of Consumer Prices (HICP) stood at 0.8% in January, according to a "flash" estimate released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). Inflation had stagnated in December 2020. (IHS Markit Economist Diego Iscaro)

- The inflation rate in January was the highest since July 2020, when it had spiked due to the effect of the delayed summer sales. Inflation averaged 0.5% in 2020.

- In January, the delay in winter sales (they started on 20 January, as opposed to 8 January in 2020) led an acceleration in prices of manufacturing goods prices, which rose by 1.0% year on year (y/y). Prices of manufactured goods had contracted by 0.9% in December and 0.2% in 2020.

- The increase in manufactured goods prices explained around 70% of the acceleration in the inflation rate in January. Increasing prices of services (+0.9% y/y, following +0.7% y/y in December) and a less intense decline in energy prices (-5.9% y/y, after a fall of 7.0% y/y in December).

- Food prices rose by 1.0% y/y in January, unchanged from December. Meanwhile, tobacco prices continued to rise strongly, increasing by 12.7% y/y following a rise of 12.5% y/y during the previous month.

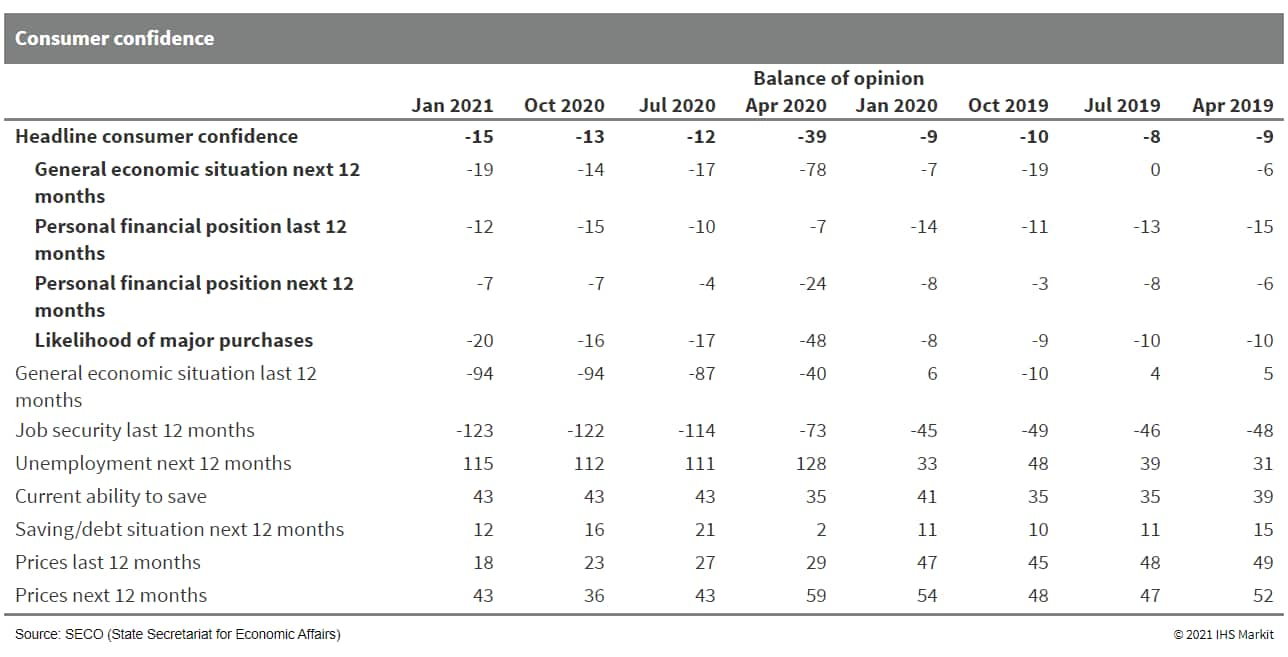

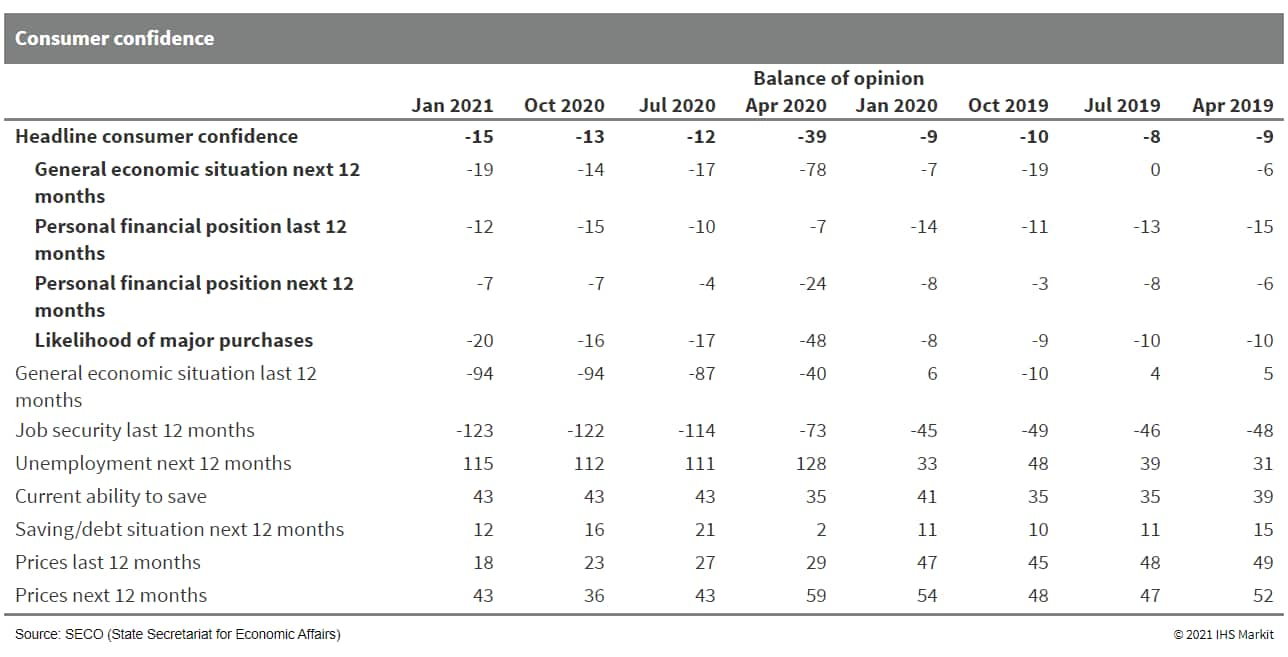

- According to the State Secretariat for Economic Affairs (SECO), the quarterly index of Swiss consumer sentiment - seasonally and calendar-adjusted and compiled from a survey of around 1,400 randomly chosen households (although structured across language regions) - slipped slightly further from last October's -13 to -15 in January. This nonetheless remains well clear of the April 2020 all-time low of -39 and only modestly below the January 2020 pre-pandemic level of -10, but it also continues to undershoot the long-term average of -5. (IHS Markit Economist Timo Klein)

- Fugro's Robodock project has received a subsidy of USD3.9 million (EUR3.3 million) from Rijksdienst voor Ondernemend Nederland (RVO) to develop an uncrewed drone based maintenance platform for offshore wind projects. The aim of the project is to develop a platform from which unmanned vessels and drones can perform inspection and maintenance tasks above as well as below water. Robodock will provide recharging facility for the drones, establish communication with the shore, and monitor safety and environment around the wind farm. Fugro has partnered with three other companies and a research institute for this project. (IHS Markit Upstream Costs and Technology's Neeraj Kumar Tiwari)

- Tikkurila says that its board has unanimously recommended that the company's shareholders accept an improved tender offer from PPG Industries of approximately €1.52 billion ($1.82 billion), or €34.00/share. The offer represents a premium of approximately 8.8% over AkzoNobel's competing bid of €1.4 billion or €31.25/share submitted on 18 January. Analysts at Bernstein (London, UK) note that PPG's proposed deal "has a high likelihood of going through," since some of Tikkurila's major shareholders including Oras Invest, representing a total stake of 29.34% in the company, have unconditionally agreed to sell their shares to PPG. Meanwhile, PPG says it expects the deal to close as early as March, or early in the second quarter of 2021. PPG submitted its initial offer for Tikkurila of €1.1 billion, or €25/share, on 18 December 2020. PPG raised its offer to €1.24 billion, or €27.75/share, on 5 January, in response to a competing offer by Hempel. Tikkurila's board recommended on 15 January that shareholders accept the revised offer by PPG. (IHS Markit Chemical Advisory)

- The Baltyk I project, owned by Poland's Polenergia and Equinor, have signed an agreement through their company MFW Baltyk I, with Polish grid operator Polskie Sieci Elektroenergetyczne (PSE). The agreement will allow the connection of the 1,560 MW Baltyk I project offshore wind farm to the Polish electricity distribution network, after complying with the specifications laid out by PSE in early 2019. Besides the Baltyk I project, Polenergia and Equinor are jointly developing two other projects - Baltyk II and Baltyk III. The later two projects each have a capacity of 720 MW, bringing the total capacity of the three projects to 3 GW if fully realized. The projects are located in water depths of 20 to 40 meters, and are expected to come online as early as 2025. (IHS Markit Upstream Costs and Technology's Melvin Leong)

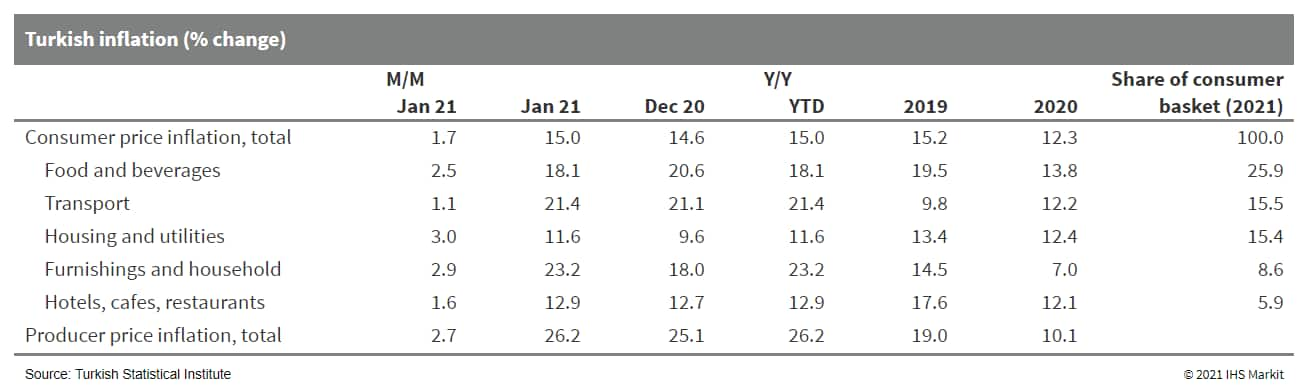

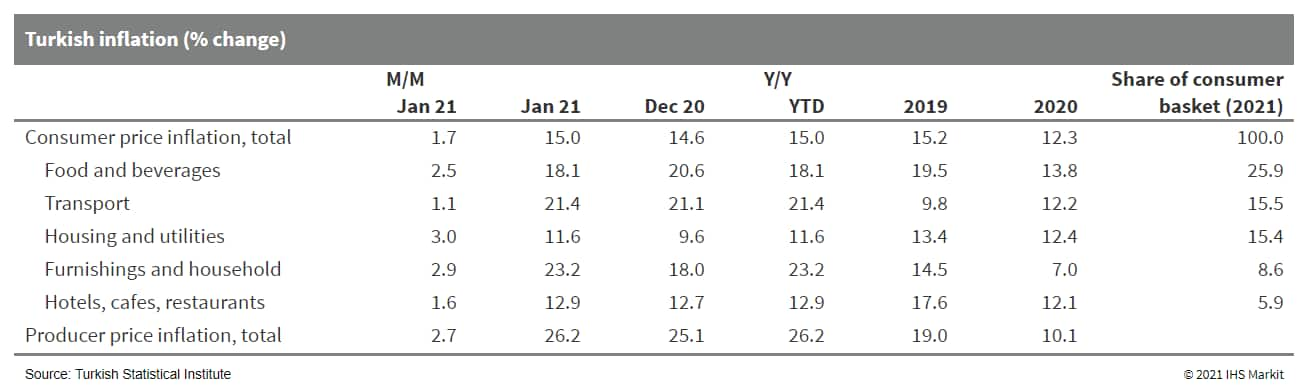

- Annual consumer price inflation in Turkey continued to accelerate as 2021 began, rising to 15.0% in January. Sharp losses in the lira in November continue to contribute to inflationary pressures, even as the Turkish currency has since recovered strongly. The Turkish central bank has become much more defensive since November, aiming to confine the continued acceleration of inflation. The bank has also urged the government to take action to rein in inflation. (IHS Markit Economist Andrew Birch)

- In January 2021, Turkey registered 15.0% annual consumer price inflation, continuing the steady acceleration that began in October 2020. Annual inflation is now back at its highest level since August 2019.

- Over the past year, surges in the cost of transportation and food and beverages have been primary contributors to the upward movement in consumer price growth. However, limited consumer activity has kept price gains in clothing and footwear, recreation and culture, and hotels, cafes, and restaurants lower.

- Vigorous credit expansion and sharp lira losses in November 2020 are continuing to exert upward inflationary pressures, even as the Central Bank of the Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB) has since taken measures to combat those influences. The recent rise in commodity prices is also continuing to fuel price growth. According to consumer surveys, the perpetual, double-digit rate of inflation has solidified inflationary expectations, further adding another barrier to future deceleration of price growth.

Asia-Pacific

- Most APAC equity markets closed lower; South Korea -1.4%, Japan -1.1%, Australia -0.9%, Hong Kong -0.7%, Mainland China -0.4%, and India +0.7%.

- Tesla's supercharger production facility has begun operations in China. According to the company, its third-generation fast charging pile, the V3 Supercharging, officially started to roll off the assembly line at the facility yesterday (3 February). Tesla's fast-expanding charging network has played a critical role in helping the company to accelerate the adoption of its electric vehicles (EVs). The launch of the Tesla Model Y and the 2021 version of the Model 3 in January will further boost demand for Tesla vehicles in the Chinese market, while also placing strain on its charging network. With an annual capacity of 10,000 Tesla Superchargers, the production facility will enable the EV manufacturer to increase the availability of its charging infrastructure across China. As of the end of 2020, Tesla said it had more than 730 Supercharging stations in the country, of which 410 were built during the last year. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese state-owned automaker FAW Group is considering acquiring Brilliance China Automotive Holdings for about USD7.2 billion, reports Reuters, citing people with direct knowledge of the matter. Brilliance, which is listed on the Hong Kong Stock Exchange, is the joint-venture (JV) partner of BMW in China. Under the reported plan, FAW would first purchase 30.43% of Brilliance shares owned by Huachen Automotive Group, Brilliance's main shareholder, and 11.89% held by the state-controlled Liaoning Provincial Transportation Investment Group. The rest of Brilliance's shares would be acquired through a mandatory bid. The report adds that FAW is looking for other investors to participate. Huachen, owned by the government of Liaoning province, has long been struggling with the poor performance of local brands introduced by Brilliance. The automaker's passenger vehicle brand, Zhonghua, for instance, recorded sales of only 1,045 units in the first three quarters of 2020. However, thanks to the strong sales performance of the BMW Brilliance JV, Brilliance still reported a net profit of CNY6.763 billion (USD1.046 billion) in 2019. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Renault Group plans to deploy electric vehicles (EVs) built by one of its Chinese joint ventures (JVs) for ride-hailing services in 2022, reports Automotive News China. The mid-size sedan, dubbed the EZoom Yi, which is expected to go on sale this year in China, is manufactured by JMEV, a JV between Renault and Jingliang Motors. The EZoom Yi has a power output of about 150 hp from its electric motor and has between 350 and 400 km of range. Renault is one of the leaders in the French electric mobility field and is aggressively expanding its presence across the electric ecosystem. Renault, in partnership with Ferrovial, is already running an electric car-sharing service, called ZITY. The automaker recently created the Mobilize mobility business, which aims to develop profitability in new areas such as data, mobility, and energy-related services for the benefit of vehicle users, and which is planned to generate more than 20% of group revenues by 2030, by providing solutions and services to other brands and external partners. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Pork and poultry prices have started to stabilize in China after rising steadily in the lead up to the Lunar New Year celebrations, which get underway towards the end of next week. (IHS Markit Food and Agricultural Commodities' Max Green)

- Having increased steadily for two months, wholesale prices for pork decreased in the final two weeks of January to stand at CNY45.8 per kg (USD7.08/kg). A report from the Chinese agriculture ministry said this was partly because slaughterhouses started ramping up supplies of lighter weight pigs. The Chinese government has also played a part by releasing thousands of tons of pork from central reserves.

- By the end of 2020, China saw its live-pig inventory reach 406.5 million, recovering to 92.1% of the 2017 level. The stock of breeding sows stood at 41.61 million, doubling from the level at the end of 2019, according to the National Development and Reform Council (NDRC). Chinese authorities say they are confident supplies of pigs will continue rising as the year progresses.

- Some doubts were raised last week when Reuters reported that a new variant of African Swine Fever (ASF) had been found in pigs on some large Chinese pig farms. However, New Hope Group, China's fourth largest pig producer, subsequently played down these fears - saying the variants had not been detected recently. In comments reported by Bloomberg, New Hope's chief science officer Yan Zhichun said methods employed by local companies were effective at controlling the spread of the virus strains.

- Wholesale chicken prices stayed at CNY17.34 per kg in the final week of January - unchanged on the previous week - having risen by 5% over the previous two months. Egg prices followed a similar trend, slipping back following two months of increases.

- Beef prices were almost unchanged on the previous week at CNY72.61 per kg having gained about 3% since November. The upward surge in sheep meat prices maintained momentum however - with a further 0.4% w/w increase taking wholesale prices to almost CNY69 per kg - up from just CNY64 per kg in November.

- South Korea's Ministry of Trade, Industry, and Energy plans to raise KRW200 billion (USD179.3 million) this year to nurture alternative-powertrain vehicles and other future vehicle technologies, reports the Yonhap News Agency. The ministry has signed a memorandum of understanding (MOU) with a slew of industrial and financial partners, including Hyundai Motor Group. Of the total fund, the South Korean government will contribute KRW50 billion, Hyundai and the Korea Evaluation Institute of Industrial Technology will each provide KRW30 billion, and the Industrial Bank of Korea plans to allocate KRW10 billion. The fund will be spent on developing parts for alternative-powertrain vehicles and future vehicles, such as autopilot technologies. It will also be used to build the infrastructure for alternative-powertrain vehicles, such as charging stations for electric and fuel-cell vehicles. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 04 February 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.