All major US equity indices closed lower on the final trading day of 2021, while the majority of APAC and European markets were closed in observance of the New Year's holiday. US government bonds closed almost flat on the day. CDX-NA and European iTraxx closed almost unchanged across IG and high yield. Natural gas, copper, silver, and gold closed higher, while the US dollar and oil were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; Russell 2000 -0.2%, DJIA -0.2%, S&P 500 -0.3%, and Nasdaq -0.6%.

- Final 2021 US equity index performance: S&P 500 +26.9%, Nasdaq +21.4%, DJIA +18.7%, and Russell 2000 +13.7%.

- 10yr US govt bonds closed flat/1.51% yield and 30yr bonds -1bp/1.91% yield, which is +60bps and +26bps on the year, respectively.

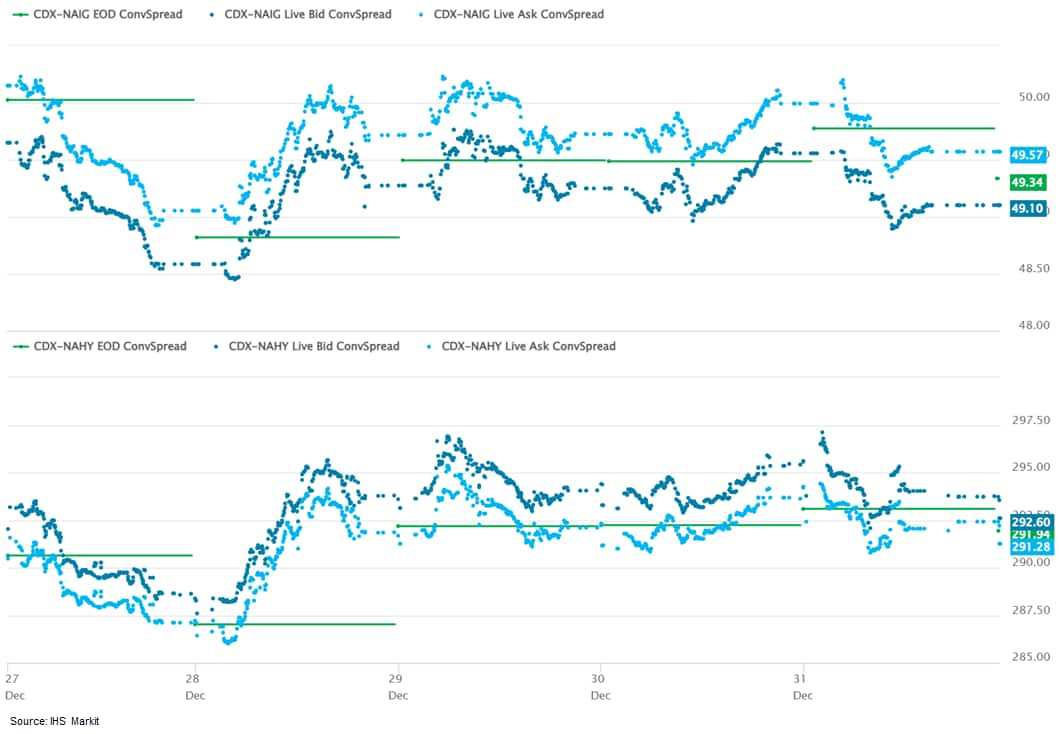

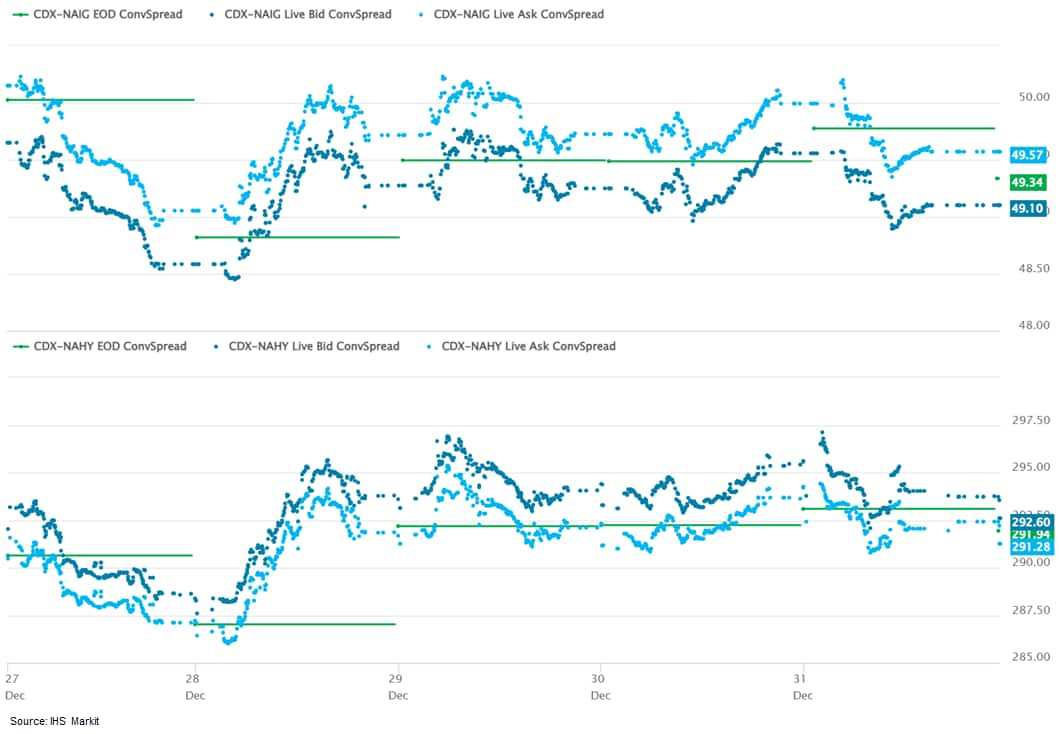

- CDX-NAIG closed -1bp/49bps and CDX-NAHY -1bp/292bps, which is -1bp and +1bp week-over-week, respectively.

- DXY US dollar index closed -0.4%/95.6, which ended 2021 +6.3% on the year.

- Gold closed +0.8%/$1,829 per troy oz, silver +1.3%/$23.35 per troy oz, and copper +1.6%/$4.46 per pound.

- Crude oil closed -2.3%/$75.21 per barrel and natural gas closed +3.6%/$3.56 per mmbtu.

- In Boston, coronavirus levels measured in wastewater are spiking to more than quadruple last winter's surge. In Miami, more than a quarter of people are testing positive for Covid. And a San Francisco medical leader estimates that, based on his hospital's tests, one of every 12 people in the city with no Covid symptoms actually has the virus. Some projections are for a peak of more than one million cases a day by as early as mid-January. "That seems totally plausible to me, given that we're already at almost 600,000," said Sam Scarpino, managing director of pathogen surveillance at the Rockefeller Foundation's Pandemic Prevention Institute. (Bloomberg)

- US seasonally adjusted initial claims for unemployment insurance fell by 8,000 to 198,000 in the week ended 25 December. The current level of claims is well below the 2019 average (218,000) as employers are trying to retain existing employees amid tight labor markets; indeed, the layoffs and discharges rate is at a record low. The not seasonally adjusted (NSA) tally of claims—at 256,146—is below the level of claims in the comparable week in 2019, when there were 312,524 claims. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs) fell by 140,000 to 1,716,000 in the week ended 18 December, hitting its lowest since 7 March 2020. The insured unemployment rate fell 0.1 percentage point to 1.3%.

- In the week ended 11 December, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) edged higher 1,287 to 117,721.

- In the week ended 11 December, continuing claims for Pandemic Unemployment Assistance (PUA) rose by 3,658 to 137,421. The number of claims under PUA and PEUC should continue to trend lower in coming weeks as states work through retroactive claims.

- In the week ended 11 December, the unadjusted total of continuing claims for benefits in all programs rose by 39,363 to 2,177,355.

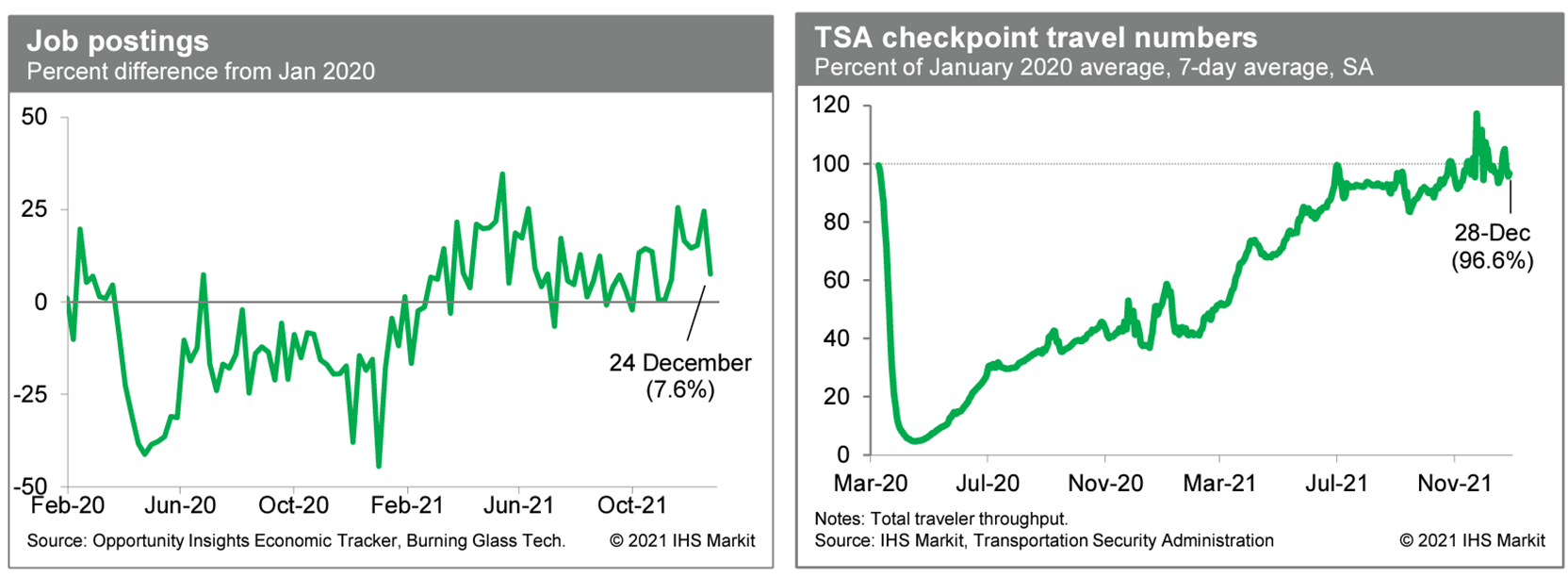

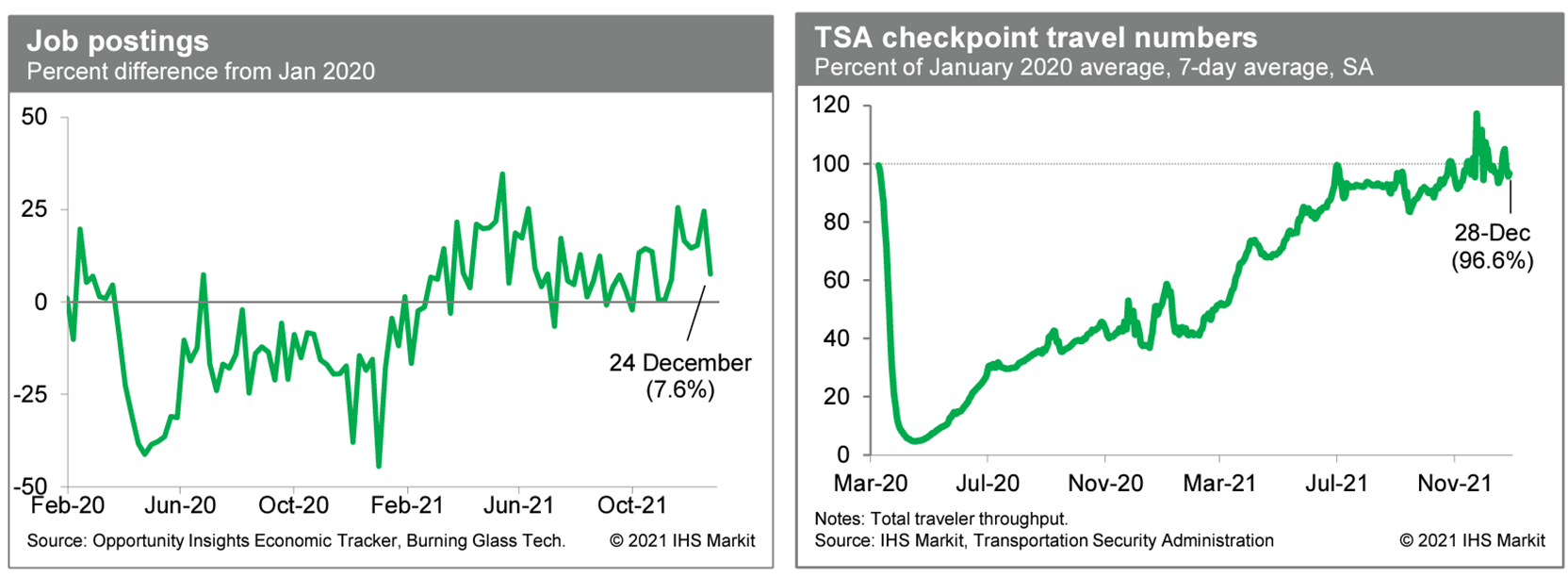

- Job postings declined last week to 7.6% above the January 2020 level, according to the Opportunity Insights Economic Tracker. Although down somewhat from the five prior weekly readings, the latest reading is still above averages over much of the summer and fall, suggesting that labor demand remains firm, if easing somewhat in the latest reading. In addition, averaged over the last seven days, and after seasonal adjustment, passenger throughput at US airports was just 3.4% below the January 2020 level, according to our estimate based on daily data from the Transportation Security Administration (TSA). So far, demand for air travel shows little sign of weakening in the face of the rapidly spreading Omicron variant of the COVID-19 virus. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Total US frozen vegetable stocks, excluding potatoes, have fallen to 2.56 billion pounds, down 2% m/m and down 2% y/y on 30 November. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- Frozen cut corn stocks lead with 672.5 million lb, up 4 y/y and down 7% m/m, while frozen corn cob stocks reached 326.8 million lb, up 7% y/y and down 9% m/m.

- Green bean (regular cut) stocks fell 9% y/y and 7% m/m to 200.0 million lb. On the other hand, the inventory of frozen diced carrots rose 13% y/y and 59% m/m to 161.5 million lb.

- Frozen green pea stock is down 7% y/y to 241.1 million lb.

- Frozen potato stock is down 5% y/y to 1.1 billion lb. This includes 915.5 million lb of frozen French fries, down 6% y/y.

- Electric vehicle (EV) manufacturer Rivian is postponing deliveries of its R1T pick-up and R1S sport utility vehicle (SUV) with a bigger battery pack (called the "Max" pack) until 2023, reports Reuters, citing a letter from company CEO RJ Scaringe to customers. According to the report, Scaringe said that the majority of the 71,000 pre-orders for the two EV models in the United States and Canada were for the versions with the smaller, 314-mile-range battery pack (called the "Large" pack). The report states that a Rivian customer posted Scaringe's letter to US social news and discussion website Reddit. Reportedly, the letter said, "In order to serve the largest number of preorder holders, we will be prioritizing building the Adventure Package with Large pack battery during the next year… [W]e value your loyalty and commitment and will be reaching out to you in January to gauge your interest in reconfiguring to an Adventure Package with Large pack battery so that you can take delivery in 2022." The bigger, "Max" battery pack is expected to provide 400 miles of range on one charge. The report says that only 20% of the pre-orders were for EVs with the Max pack. In early 2022, Rivian is to introduce a feature on customers' accounts that will display their current delivery timeline. Some customers reportedly placed orders in 2018. Delays to the launch programs of EV startup companies, or to the EV programs of established automakers, are reasonably common. In Rivian's case, the company stated during its first-quarter earnings call that it was experiencing production challenges, including supply-chain constraints, the coronavirus disease 2019 (COVID-19) pandemic, a tight labor market, and short-term issues around building EV battery modules. The statement that about 80% of Rivian's pre-orders were for the versions of the EVs with the smaller battery pack indicates that consumers may be more willing to buy EVs with a range of about 300 miles than was presumed, or that consumers may be choosing lower-range versions to keep down the price of an already expensive product. (IHS Markit AutoIntelligence's Stephanie Brinley)

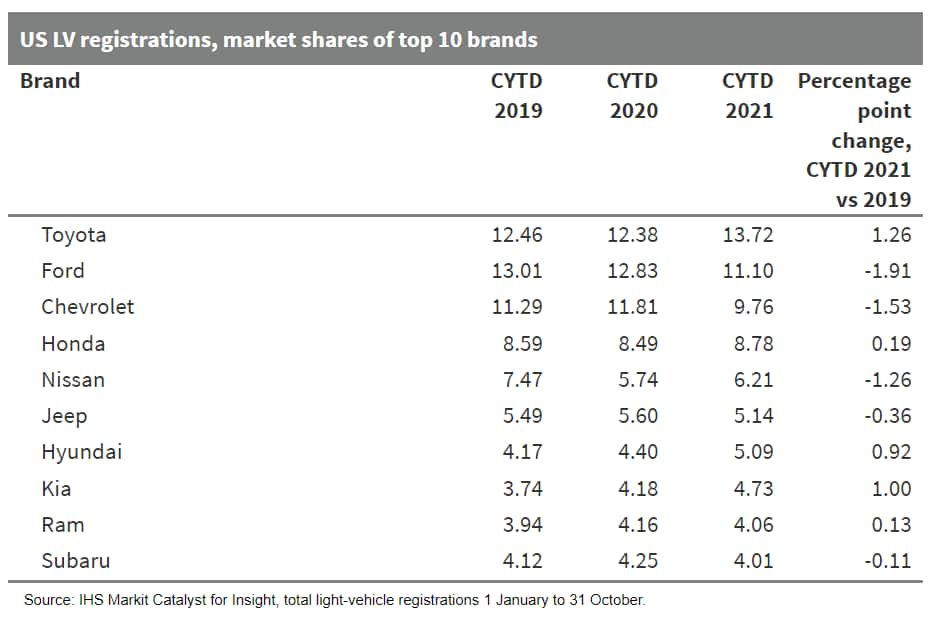

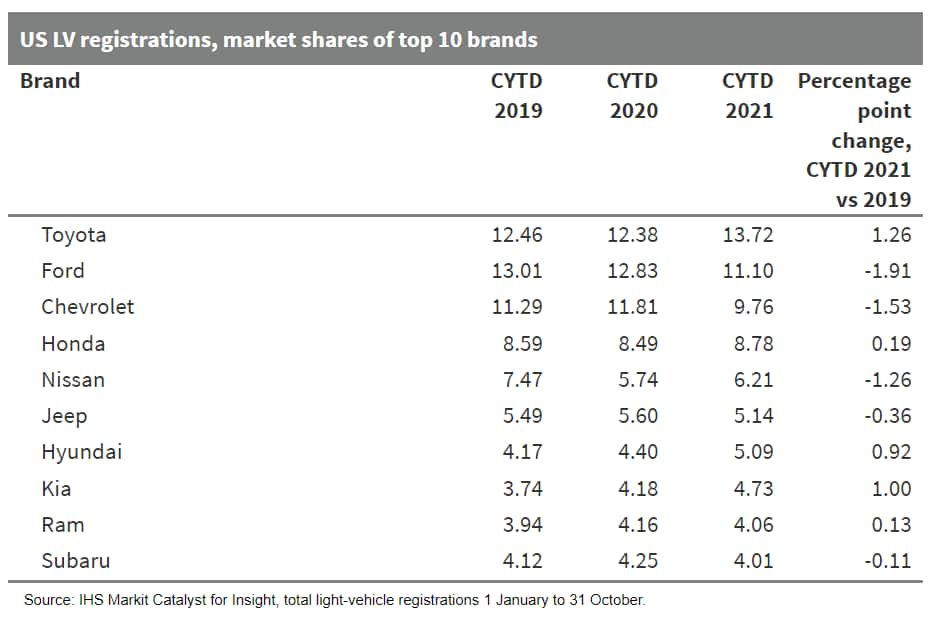

- In this report, IHS Markit looks at US light-vehicle registrations by brand and segment, comparing the calendar year to date (CYTD) from January to October in 2019 and 2021. Through the COVID-19 pandemic and supply chain issues, several segments and brands have improved their market positions, while the decline of car registrations has continued. As 2021 nears its end, US light-vehicle registrations in the full year are expected to be about 15 million units, up from 14.6 million units in 2020. However, this forecast is down from expectations earlier in the year that consumer behavior and demand could support a return to a market of over 16 million units this year. Although the semiconductor and other supply chain issues began to appear in late 2020 and early 2021, it was in the third quarter that light-vehicle production was most impacted by the issues, and light-vehicle sales and registrations have tumbled sharply since September. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- Most major European equity markets were closed in observance of the New Year's holiday; UK -0.3% and France -0.3%.

- Final 2021 European equity index performance: France +28.9%, Italy +23.0%, Germany +15.8%, UK +14.3%, and Spain +7.9%.

- Final 2021 10yr European govt bond yields and change in yield: Germany -0.18% yield/+39bps, Spain 0.57% yield/+53bps, France 0.21% yield/+55bps, Italy 1.18% yield/+63bps, and UK 0.97% yield/+77bps.

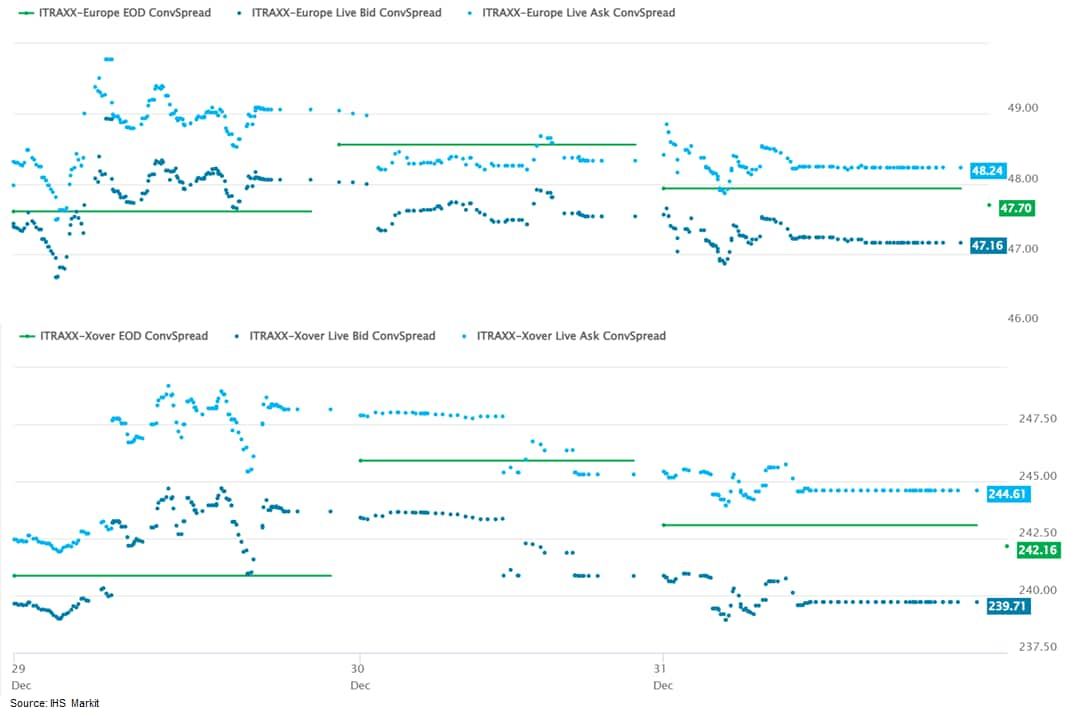

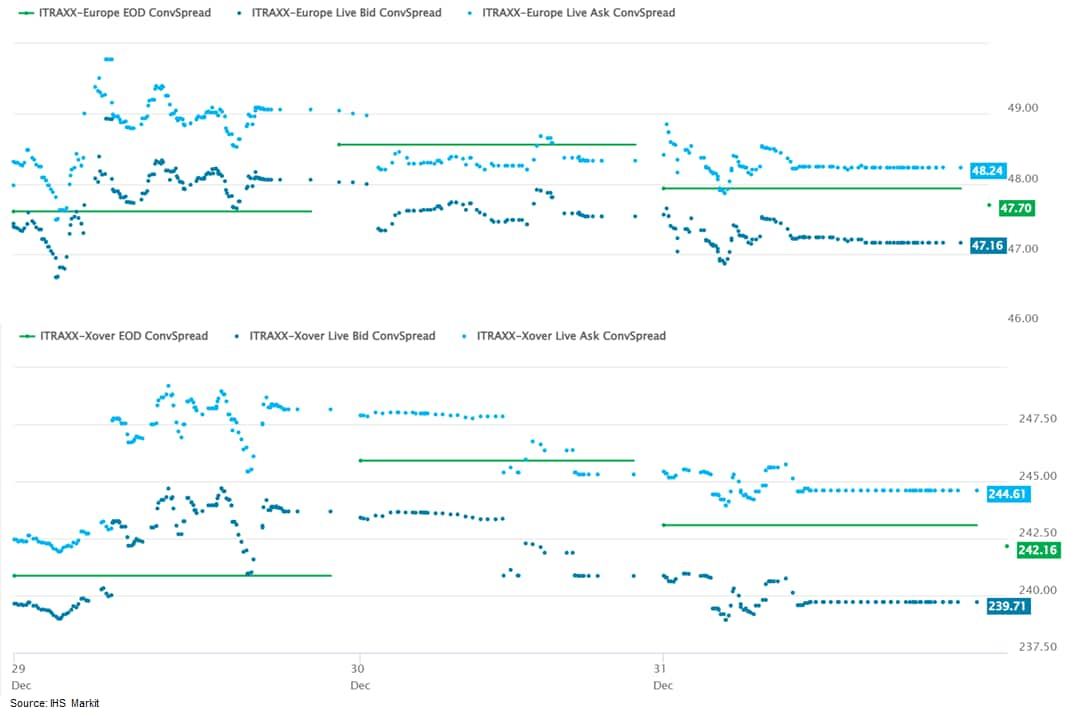

- iTraxx-Europe closed flat/48bps and iTraxx-Xover -1bp/242bps, which is flat and +1bp week-over-week, respectively.

- Brent crude closed -2.2%/$77.78 per barrel.

- Mercedes-Benz has selected Cerence for conversational artificial intelligence (AI)-powered electric vehicle (EV) use cases and Cerence emergency vehicle detection (EVD), integrated with the Mercedes-Benz User Experience (MBUX) in the Mercedes-Benz EQS EV, according to a press release by Cerence. "Intuitive technology and a simple, easy-to-use interface are important elements in the electric vehicle user experience as drivers demand increasingly smart and high-tech capabilities. We're excited to partner with Mercedes-Benz AG as they bring a new generation of luxury EVs to market with specific capabilities that make the ownership and driving experience safer and more enjoyable than ever," said Cerence CEO Stefan Ortmanns. The EQS will be the first vehicle to use Cerence's EVD, which alerts drivers of approaching emergency vehicles. Cerence EVD uses the vehicle's microphones to detect varying types and styles of emergency vehicle sirens accurately. The voice assistant helps inform the driver about the vehicle's battery status and ability to reach a location with a question like "Is a roundtrip to work possible with my current battery?" It helps search and filter EV charging locations by factors like distance, availability, charging speed, and plug type. It also provides proactive notification for low battery and ability to extend range by limiting certain features. (IHS Markit AutoIntelligence's Jamal Amir)

- The offshore transformer station for one of the two topsides of the Hollandse Kust (zuid) Alpha platform is successfully installed on the jacket on 26th December 2021. The offshore transformer will connect the offshore wind farm area with the same name to the Dutch onshore high-voltage grid. Hollandse Kust (zuid) Alpha is the first connection of an offshore wind farm to the Maasvlakte, with a capacity of 700 MW.The contractor Petrofac has been working on the fabrication of two high voltage alternating current (HVAC) transformer stations Alpha and Beta at the Drydocks World fabrication yard in Dubai, since last one year. Mammoet, a specialist in heavy transport and lifting, took forward the weighing and loading of the 3,830-tonne Alpha topside onto the transport vessel Tai An Kou on mid of November. The wind farm Hollandse Kust (zuid) developed by wind farm developer Vattenfall is expected to be fully operational in 2023. The Beta topside, also with a capacity of 700 MW, is expected to be installed in the first quarter of next year. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- After a strong start to the fourth quarter of 2021, Russia's industrial-sector growth stood at 7.0% y/y in November, slightly easing from 7.4% y/y growth in October. (IHS Markit Economist Lilit Gevorgyan)

- Detailed data released by the Russian Federal State Statistics Service (Rosstat) showed broad-based y/y growth in November. Specifically, the mining sector held up its double-digit y/y growth momentum, which started in October. The sub-index increased by 10.2% y/y in November, compared with y/y gains of 11.1% in October and 9.2% in September.

- Coal extraction was up by 11.4% y/y in November, while crude oil and natural gas output was also up by 8.9% y/y. Rosstat reported a continued expansion in natural gas and gas condensate output, up by 4.8% y/y and 12.3% y/y, respectively, in November.

- Manufacturing-sector y/y growth increased in November to 5.3%, from 5.0% in the previous month. This was driven by an 18.6% y/y jump in production of beverages and 6.5% y/y growth in food manufacturing, a key contributor to the overall index. Printing, non-metal product, electronics, and furniture product output also supported the expansion of the manufacturing sector.

- The month-on-month (m/m) comparison, however, painted a different picture. Industrial-sector growth, on seasonal- and calendar-adjusted basis, was only 0.2% in November, following a strong 5.1% m/m gain in October.

- This weakness was mainly due to a drag in the mining sector. The latter shrunk by 1.9% m/m in November, arguably from a high 4.9% m/m growth in the previous month. The extractive output fall was compensated by a 0.8% m/m increase in manufacturing production, and a 9.9% m/m rise in electricity, gas, and steam supply.

- On 22 December 2021, Director of the Public Sector at Algeria's Ministry of Industry Hocine Bendif announced that businesses belonging to individuals found guilty on corruption charges would be nationalized and operated by the government. The newly nationalized firms would also be subject to restructuring. According to Bendif, the process had recently begun with two firms specialized in agribusiness belonging to the KouGC group, owned by the Kouninef brothers, sentenced in 2020 to terms ranging up to 20 years in prison on charges of corruption and money laundering. The government's announcement to nationalize firms associated with past corruption and "undue privileges", in particular owned by individuals close to former President Abdelaziz Bouteflika, indicates a significant change in Algeria's decade-long economic strategy. That strategy focused in large part on privatization, moving away from a statist-oriented economy. Corruption investigations concerning figures close to former President Abdelaziz Bouteflika and his inner circle are highly politicized and are probably intended to instill support and trust from the population. Nationalization has traditionally been popular, in particular by labor unions during disputes with private companies (see Algeria: 28 March 2013: Civil Unrest: Protests in the oil-rich south demanding employment are unlikely to be replicated to the same scale in northern industrial areas). Other large businesses currently under investigation include the ETRHB, Mazouz, and Tahkout businesses. Nationalization is likely to serve the government's import-substitution policy, aimed at reducing Algeria's heavy import bill given declining foreign reserves (depleted by over 60% since 2014). This is particularly the case for the manufacturing and agri-food sectors. Foreign companies are unlikely to be targeted but business partners, nonetheless, risk being affected. Existing contracts with Algerian firms undergoing or soon to undergo the nationalization process are highly likely to be reviewed and altered, or fully cancelled, especially if accusations of corruption or bribery emerge regarding their original agreements (including over "undue privileges"). Contract renewals and new contracts are likely to be subjected to increased governmental scrutiny and requirements to operate locally (over local content for instance). (IHS Markit Country Risk's Jihane Boudiaf)

- The central bank of the eight-nation West African Economic and Monetary Union (known by its French acronym of UEMOA) has maintained its benchmark interest rate at 2.0%, the bank's monetary policy committee (MPC) announced on 9 December. The West African CFA franc zone comprises Benin, Burkina Faso, Côte d'Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo. (IHS Markit Economist Anton Casteleijn)

- The MPC meeting of the Central Bank of West African States (Banque Centrale des États de l'Afrique de l'Ouest: BCEAO), was held by videoconference under the chairmanship of Tiémoko Kone, governor of the BCEAO. The minimum rate for open-market operations remained at 2.0%, the marginal lending rate at 4.0%, while the reserve requirement ratio for banks in the monetary union also remained unchanged at 3.0%.

- The economic recovery in the UEMOA region continued in the third quarter of 2021, with a 6.7% year on year (y/y) increase in real GDP, after a 7.7% increase in the previous quarter. The sustained recovery across all sectors was supported mainly by sustained domestic demand strength and sustained improvement across all sectors.

- Economic growth is mostly driven by a rebound in private consumption and private investment and reflects the relaxation of lockdown constraints and the return of foreign direct investment. The West African bloc's level of foreign-exchange reserves fell slightly to 6.1 months of import cover at the end of September 2021, compared with 6.2 months at the end of June, while the average rate on bank loans fell 14 basis points in the third quarter of 2021 to 6.22%.

Asia-Pacific

- Most major APAC equity markets were closed in observance of the New Year's holiday; India +0.8%, and Mainland China +0.6%.

- Final 2021 APAC equity index performance: India +22.0%, Australia +13.0%, Japan +4.9%, Mainland China +4.8%, South Korea +3.6%, and Hong Kong -14.1%.

- China Evergrande Group halted trading (2 January) in its shares following local media reports that the company has been ordered to tear down apartment blocks in a development in Hainan province. The shares were suspended pending an announcement containing inside information, Evergrande said in a brief statement. A local government in Hainan told Evergrande to demolish 39 buildings in 10 days because the building permit was illegally obtained, Cailian reported on Saturday. The project is on artificially built islands off the coast of Hainan. (Bloomberg)

- Mainland China's official composite output Purchasing Managers' Index™ (PMI™), covering both manufacturing and non-manufacturing sectors, stayed at 52.2 in December and unchanged from the figure a month ago, reflecting in slowing manufacturing production and improvement in services. (IHS Markit Economist Yating Xu)

- China's official manufacturing PMI™ rose by 0.2 percentage point to 50.1, marking the second consecutive month of increase following the power crunch-driven contraction in October and September. The headline recovery in December was largely driven by slower contraction in the new orders and inventory of purchased materials and finished goods segments resulting from the continuous decline in input and output prices. However, production growth moderated, and the new export orders segment registered deeper contraction. The manufacturing growth outlook improved steadily with the expectation sub-index rising for the third consecutive month, but at 55.3 the reading remains well below the pre-pandemic average.

- By firm scale, the headline recovery in manufacturing PMI™ was led by larger firms with PMI™ of large and medium-sized firms rose by 1.1 and 0.1 points respectively to 51. However, PMI for small firms declined by 2 points to 46.5%. By sector, the PMI™ for the high-tech manufacturing, equipment manufacturing, and manufacturing of consumption goods sectors remained in expansion territory, while that for energy-intensive sectors contracted at a slower pace.

- China's non-manufacturing Business Activity Index increased by 0.4 percentage point to 52.7, staying in expansion territory for the fourth consecutive month. Expansion in the construction sector weakened owing to the cold weather and the upcoming New Year and Spring Festival holidays, according to comments from a senior statistician from the NBS. Services growth accelerated as the airline, catering, and entertainment sub-indexes that were hit hard by the pandemic in November recovered to expansion territory in December, and the monetary and capital market services segments maintained robust growth. However, the new orders sub-index of the services segment remained in contraction for seventh consecutive month and the expectations sub-index further declined.

- Evergrande New Energy Vehicle Group (Evergrande), the new energy vehicle (NEV) division of China's property giant Evergrande Group, began production of its first model on 30 December. According to Cailian, production for the Hengchi 5, has already begun at Evergrand's Tianjin plant. Hengchi 5 is a battery electric sport utility vehicle. The model is 4,725 mm long with a wheelbase of 2,780 mm. Evergrande has hit a new milestone in its effort to tap into China's booming NEV sector with the start of production of the Hengchi 5. The arrival of this new model, however, is unlikely to immediately help Evergrande to regain lost confidence among investors as its parent company, Evergrande Group, has been grappling with severe debt issues in the past few months. Evergrande announced in 2019 a series of costly projects to construct its own vehicle manufacturing facilities, including an investment of CNY160 billion (USD25 billion) to build a manufacturing base in Guangzhou and CNY120 billion for a manufacturing site in Shenyang. These projects helped the company to acquire a vast amount of land from local governments for the construction of manufacturing facilities as well as residential buildings. In a company filling to the Hong Kong Stock Exchange published on 26 November, Evergrande said it has returned the undeveloped lands of approximately 2,663,300 square metres designated for living projects and industrial use and involving seven projects at a total amount of CNY1.284 billion. The proceeds are primarily used for project construction and payment of wages for migrant workers, and land payment for the remaining land plots. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Baidu has unveiled open-source autonomous vehicle (AV) platform Apollo 7.0 at its AI conference Baidu Create 2021, reports Gasgoo. The Apollo 7.0 offers a series of upgrades such as the one-stop practice cloud platform Apollo Studio, leading simulation service, and highly efficient new models. It is based on four open-source platforms including cloud service, open-source software, hardware development, and vehicle authentication. Baidu launched its AV platform, Apollo, in July 2017 and has attracted more than 210 partners for it. To date, the platform has completed 11 iterations, attracting over 80,000 developers across 135 countries globally. Baidu has tested its robotaxi service in five Chinese cities: Beijing, Shanghai, Guangzhou, Changsha, and Cangzhou. To date, Baidu's Level 4 autonomous test vehicles have completed over 10 million miles, and it says its robotaxi service, Apollo Go, will be available in 65 cities by 2025 and 100 cities by 2030. It has also developed an autonomous minibus, named Apolong, which has been in production since 2018. The minibus has been deployed in 22 urban parks in Chinese cities and has served 120,000 users while travelling a total of 120,000 km. (IHS Markit AutoIntelligence's Surabhi Rajpal)

- Dongfeng Motor's autonomous technology arm, Dongfeng Yuexiang, in cooperation with QCraft has developed and started trial service of a driverless bus in Chinese city Wuhan, reports Gasgoo. The bus has started limited trial operation on Wuhan's Economic and Development District, transporting people from Chuanjiangchi Subway Station to Amble Park. The companies will initially deploy a fleet of 50 vehicles and in future aim to expand their fleet size to 300 vehicles. Being fully autonomous, the bus is designed without a driver's seat and is powered by QCraft's autonomous vehicle (AV) solution, Driven-by-QCraft. It features Level 4 autonomous capability, navigating through various complex traffic scenarios. (IHS Markit AutoIntelligence's Surabhi Rajpal)

- China's Sinopec has increased its January paraxylene (PX) and purified terephthalic acid (PTA) contract price nominations, while decreasing its monoethylene glycol (MEG) ones, two sources said late Thursday. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- Sinopec nominated its January PX at RMB6700/mt ($1,051/mt), its PTA at RMB5000/mt, and MEG at RMB5200/mt.

- This is a month-on-month increase of RMB200/mt for PX, up RMB100/mt for PTA, but down RMB100/mt for MEG.

- In comparison, Sinopec's December PX nomination was RMB6500/mt, its PTA one was at RMB4900/mt, and MEG at RMB5300/mt.

- Sinopec settled its December PX term contracts at RMB6125/mt or RMB6105/mt on cash basis, its PTA at RMB4680/mt, and its MEG at RMB5020/mt.

- The company's contract nominations or offers are typically adjusted near the end of the month, to derive actual settlement prices for its term customers.

- Taiwan Power Company (Taipower) and Foxwell have selected Vestas to supply turbines for the 300MW second phase of Taiwan Power Company offshore wind farm project. Vestas will deliver 31 units of V174-9.5MW turbines which will be mounted on jacket foundations. This phase two of the project follows the development of the 109.2MW phase one project which was completed this year. TPC offshore wind farm phase 1 includes 21 unites of 5.2MW wind turbines which are installed on a jacket with a transition piece, anchored to the seabed by four steel pin piles. The project is due to be commissioned in few weeks. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- McDonald's Co. Japan will put medium- and large-size serving French fries back on the menu on 31 December after their sales were suspended for a week due to a product shortage. US freight forwarder Flexport Inc will fly three planes loaded with potatoes to Japan. Sales will resume from 10:30 am on Friday 31 December. Mc Donald's was forced to offer fries only in small sizes as potato imports from North America were delayed by flooding near a Vancouver port which has exacerbated the existing logistics disruptions caused by the pandemic. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- Hyundai plans to temporarily halt operations at its Asan plant in South Korea for four weeks from 3 to 28 January to upgrade its facilities to produce electric vehicles (EVs) at the plant from next year, reports the Maeil Business Newspaper. The automaker plans to resume operations at the 300,000-unit-a-year Asan plant, which produces the Sonata and Grandeur sedans, on 3 February. Hyundai also stopped production at the Asan plant for four weeks in July for the facility's conversion. It plans to adjust the facility to manufacture both conventional cars and EVs together without adding new lines. The plant will be producing the IONIQ 6, which the automaker plans to launch next year in line with its mid- to long-term EV strategy. Recently, Hyundai Motor Group raised its global EV sales target for 2026 to 1.7 million units from a little over 1 million units. The South Korean automotive group, comprising the Hyundai, Kia, and Genesis brands, has accelerated its transition to zero-emission vehicles (ZEVs) with plans to double its EV line-up to "at least" 13 models by 2026. In a bid to achieve the target and to meet rising demand for EVs, Hyundai and Kia are set to roll out several EVs in 2022: the Genesis GV60, an electric version of the Genesis GV70, the Kia Niro EV, and the Hyundai IONIQ 6. IHS Markit forecasts that global production of Hyundai Motor Group's light vehicles, including those of affiliate Kia, will grow to around 7.8 million units in 2025, up from 6.2 million units in 2020. We also forecast that the group's global production of alternative-powertrain vehicles will grow to around 2.1 million units in 2025, up from about 617,200 units in 2020. Of the group's total production of alternative-powertrain vehicles, EV production will stand at around 893,000 units in 2025, up from 174,600 units in 2020. (IHS Markit AutoIntelligence's Jamal Amir)

- Amara Raja Batteries plans to invest an undisclosed amount in InoBat Auto, a European technology developer and manufacturer of batteries for e-mobility. According to a company statement, this investment will enable Amara Raja to have access to expertise that will support it in manufacturing batteries for e-mobility applications. This will also open new research and development (R&D) avenues for Amara Raja while allowing it to adapt InoBat's battery technology to the markets that it already serves. Marian Bocek, CEO of InoBat Auto, said, "Today's announcement is strategically important for InoBat and its planned gigafactories across various parts of Europe. It shows that unique collaborative partnerships are vital for driving forward the uptake of E-mobility solutions globally, including the emerging markets. Furthermore, it paves the way for our further expansion and the application of our own "cradle-to-cradle" approach." Amara Raja Batteries is one of the largest Indian manufacturers of energy storage products for both industrial and automotive applications. It supplies automotive batteries to Ashok Leyland, Ford India, Honda, Hyundai, Mahindra & Mahindra, Maruti Suzuki, and Tata Motors. (IHS Markit AutoIntelligence's Surabhi Rajpal)

Posted 31 December 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.