US and APAC equity indices closed mixed, while all major European markets were lower. US and benchmark European government bonds closed sharply lower. European iTraxx and CDX-NA closed almost unchanged across IG and high yield. Silver, natural gas, gold, and copper closed higher, while the US dollar and oil closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed; Nasdaq +0.2%, S&P 500 0%, DJIA -0.2%, and Russell 2000 -0.5%.

- 10yr US govt bonds closed +4bps/1.33% yield and 30yr bonds +5bps/1.95% yield, selling off 3bps and 6bps, respectively, within 10min after the US non-farm payroll report.

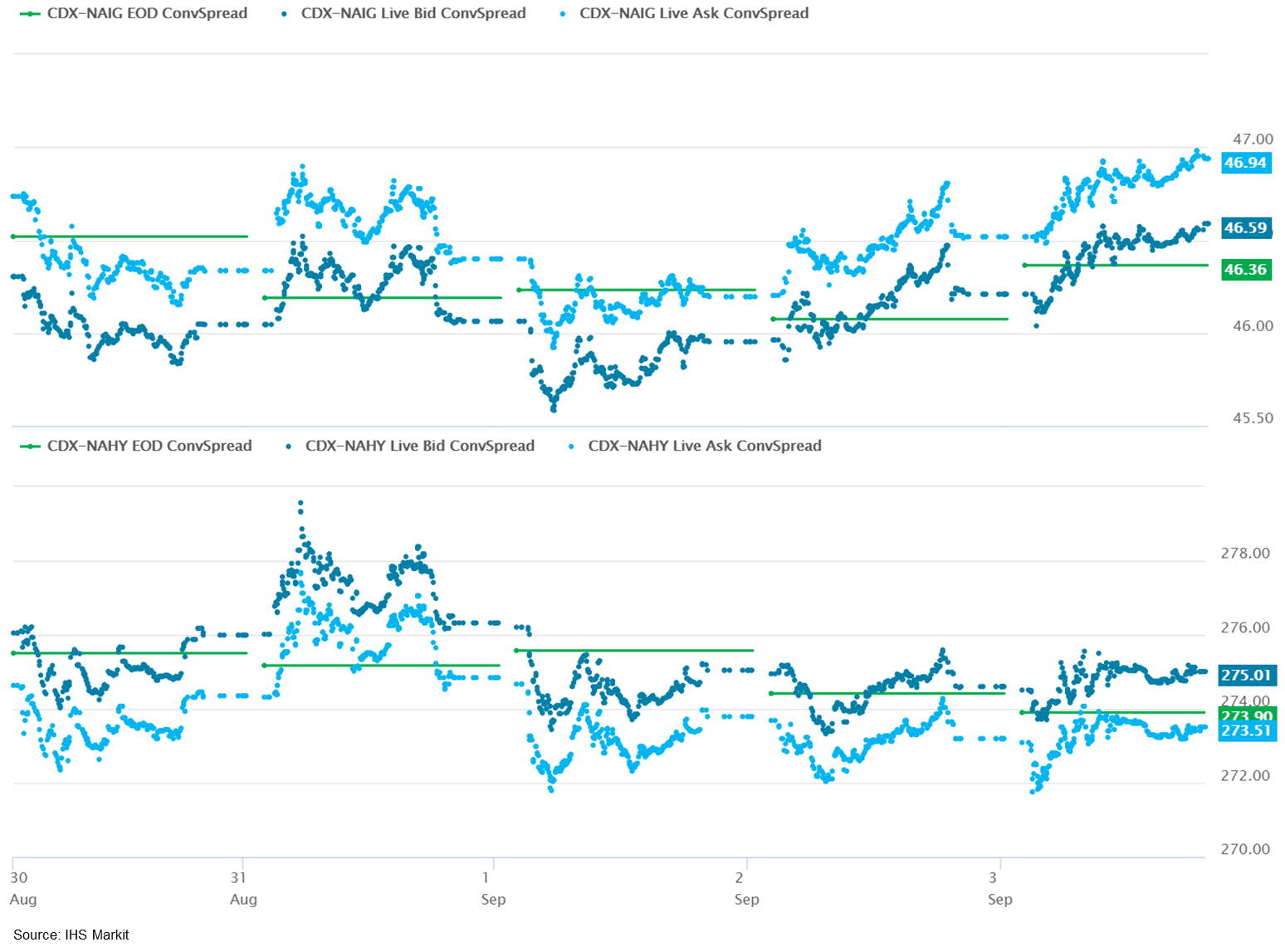

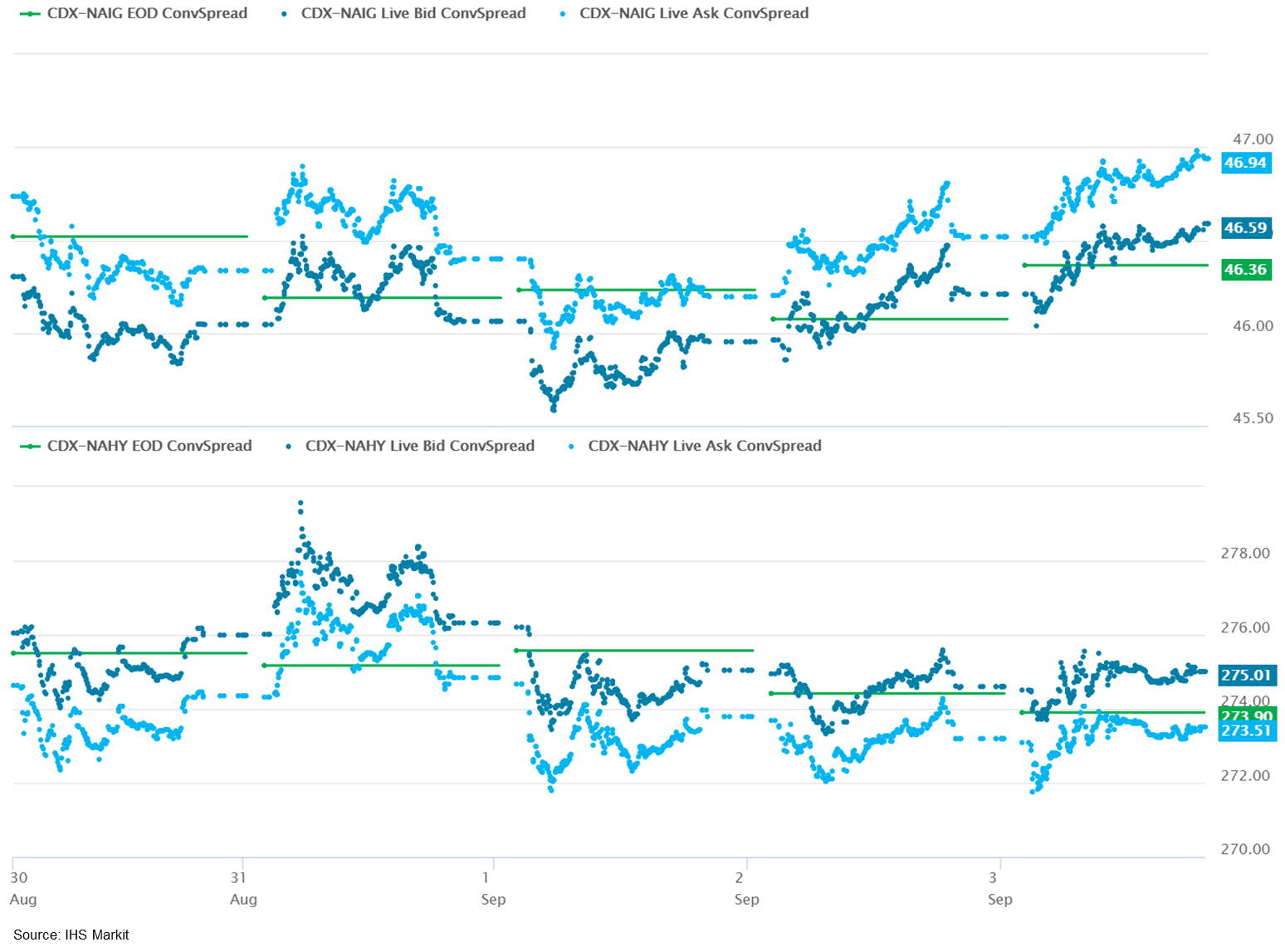

- CDX-NAIG closed +1bp/47bps and CDX-NAHY flat/274bps, which is flat and -2bps week-over-week, respectively.

- DXY US dollar index closed -0.2%/92.04, declining 0.3% seconds after the release of the weaker than expected US non-farm payroll report.

- Gold closed +1.2%/$1,834 per troy oz, silver +3.7%/$24.80 per troy oz, and copper +0.7%/$4.33 per pound.

- Crude oil closed -1.0%/$69.29 per barrel and natural gas closed +1.5%/$4.71 per mmbtu.

- US nonfarm payroll employment rose only 235,000 in August, well short of expectations. The unemployment rate declined 0.2 point to 5.2%, as a solid gain in civilian employment outpaced a modest gain in the labor force. (IHS Markit Economists Ben Herzon and Michael Konidaris)

- The broad outlines of this report are consistent with our expectation for a slowing of GDP growth from 6.7% in the second quarter (our estimate) to 3.4% in the third quarter (our latest GDP tracking).

- The deceleration in payroll employment in August was concerning but was not as bad as it seemed; part of it was a seasonal issue. One-third of the slowdown was in public education services. Before seasonal adjustment, there was an increase in public education that was not too far from the recent August norm. By contrast, over June and July, there were declines that were much smaller than normal, as the level of employment was already depressed. This artificially raised seasonally adjusted employment gains in June and July, setting up a sharp slowdown in August.

- About one-half of the deceleration in payrolls, however, was in accommodation and food services, and that was concerning. Employment in this sector actually declined following robust gains in prior months. It suggests that the surge of new COVID-19 infections is taking a toll on real activity.

- Another area of concern in the report was the labor force, where the participation rate has been rising but only slowly and is still well below the pre-pandemic level. The relative paucity of persons willing to work is perhaps the most restrictive supply constraint now.

- The lack of available labor is putting upward pressure on wage gains, especially in leisure and hospitality, where the wage rate rose 1.3% in August and at a stunning, 15.0% average annual rate so far this year.

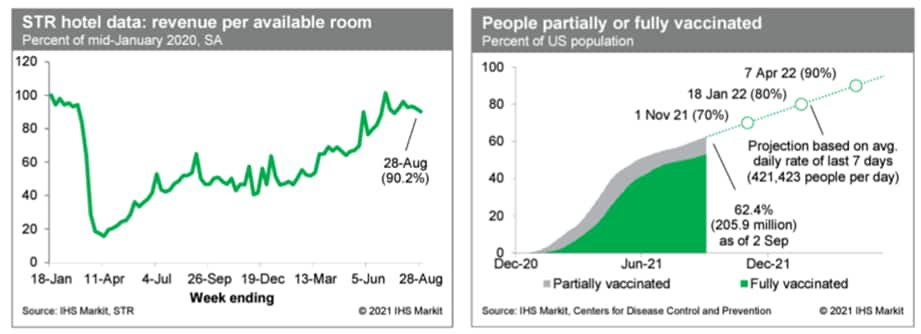

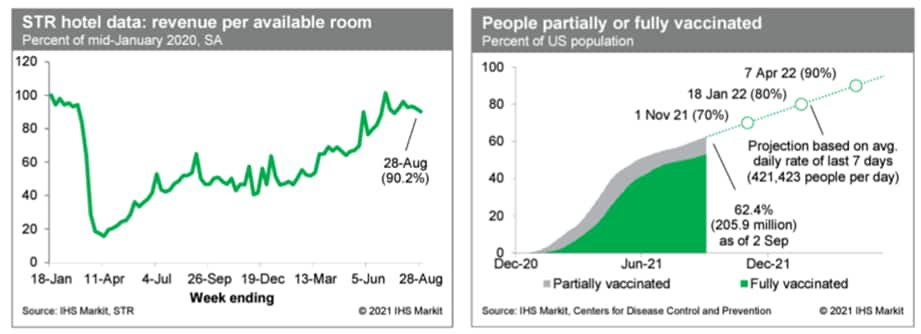

- Revenue per available room at US hotels, after seasonal adjustment, declined last week to 90.2% of the mid-January 2020 level (our estimate based on weekly data from STR). By this measure, hotel activity has been drifting lower in recent weeks, likely reflecting a pullback of travel in response to the recent surge in new COVID-19 infections. Meanwhile, averaged over the last seven days, about 421,000 people per day received a first (or only) dose of a COVID-19 vaccination, down somewhat from the prior week's rate of about 439,000 per day. As of yesterday, 205.9 million US residents, or about 62.4% of the population, were at least partially vaccinated against COVID-19. At the current rate, the US would achieve widespread vaccination (70-80%) by late this year or early next year. (IHS Markit Economists Ben Herzon and Joel Prakken)

- The seasonally adjusted final IHS Markit US Services PMI Business Activity Index registered 55.1 in August, down from 59.9 in July and broadly in line with the earlier released 'flash' estimate of 55.2. The latest data signaled a strong upturn in business activity across the U.S. service sector, albeit the slowest since December 2020. The rise in output was often linked to a sustained upturn in client demand and a further increase in new business. (IHS Markit Economist Chris Williamson)

- Stellantis has announced an agreement to acquire First Investors Financial Services for USD285 million; the move is the first step to creating its own captive finance arm. First Investors is an auto finance company and therefore will bring the right business offerings for the automaker. First Investors gives Stellantis a platform to create its own financing arm, a goal the company has had for several years but was delayed after the surprise passing of former FCA CEO Sergio Marchionne. Now that the PSA-FCA merger is complete, the company is able to move forward. The cash deal is expected to close by the end of 2021. With a captive finance arm, the company is in a better position to offer attractive consumer financing, which can lead to improved brand loyalty, as well as provide assistance to dealers with floor planning and by financing their vehicle showrooms. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Nikola and Bosch announced a deal for Nikola to assemble Bosch fuel-cell power modules at Nikola's Arizona facility. Nikola will adapt the fuel-cell power modules for use in the Nikola Tre and Nikola Two in the US. Bosch will supply fully assembled fuel-cell power modules as well as major components to Nikola, including the fuel-cell stack, for Nikola to assemble, the statement says. Nikola and Bosch will work together for sourcing of remaining components. The companies have defined together a scalable and modular approach, which is based on use of multiple fuel-cell power modules using the Bosch heavy-duty commercial fuel-cell stack. Nikola says the fuel-cell power modules are expected to launch in 2023, first in the Class 8 regional-haul Tre, where it is expected to have a range of 500 miles. Nikola is planning to expand capacity for use in the Class 8 long-haul Two, where range is expected to be about 900 miles. The trucks will use common fuel-cell power modules in 200 kW and 300 kW configurations. (IHS Markit AutoIntelligence's Stephanie Brinley)

- USDA's Food Safety and Inspection Service (FSIS), has published a much-anticipated Advanced Notice of Proposed Rulemaking (ANPR) seeking comments on how cell-based meat products should be labeled when they appear on the US consumer market. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

- Published in the Federal Register on September 3, the ANPR calls on stakeholders to submit their views on whether FSIS should require that product names for cell-based meats be different from the names of meats that come from slaughtered animals and what terms would appropriate to use for the novel meat products.

- The agency also wants to know whether it should establish a standard of identity for the new cell-cultured products and what terminology it should use for products that contain a mix of both meat from slaughtered animals and cell-cultured meats.

- Asking stakeholders to weigh in on the use of terms such as "cell-cultured" and "cell-cultivated," the agency is also seeking information on whether the use of such terms would be associated with benefits and costs to industry. Since some companies in the emerging cell-based meat sector have expressed preference for the term "cell-cultured," the agency is also asking how such products should be differentiated from other foods on the market that already use the term "cultured" or "culture" in their product names and standard of identity, such as "cultured celery powder."

- The ANPR also raises the controversial issue of whether traditional meat terminology - such as "pork loin" - should be allowed for use in cell-based product labeling and identity standards and whether those terms should be accompanied by additional qualifying language.

- All members of the Central Bank of Chile's (Banco Central de Chile: BCC)'s board agreed to raise the monetary policy rate by 75 basis points (bps) to 1.5% from 0.75% during the board meeting on 31 August, totaling a 100-bp increase with its second consecutive move. (IHS Markit Economist Claudia Wehbe)

- Domestically, consumer prices jumped by 0.8% in July after advancing by 0.1% month on month (m/m) in June. The result was mainly driven by rising prices in the transportation and food and non-alcoholic beverages categories. In contrast, a drop in prices in the garment and shoes category had a modest negative effect on overall inflation.

- Annual inflation accelerated to 4.54% from 3.8% in June, while core consumer price inflation that excludes food and energy prices also spiked to 3.8% from 3.1%.

- Chile's unadjusted monthly economic activity indicator, a proxy for GDP, slowed from a revised 20.6% year on year (y/y) in June to 18.1% y/y during July, still another historical record. The result was mainly driven by contributions in services.

Europe/Middle East/Africa

- Most major European equity indices closed lower; UK/Germany -0.4%, Italy -0.6%, France -1.1%, and Spain -1.3%.

- 10yr European govt bonds closed lower; Spain +1bp, France +2bps, Germany/UK +3bps, and Italy +4bps.

- iTraxx-Europe closed flat/45bps and iTraxx-Xover +2bps/229bps, which is flat and -1bp week-over-week, respectively.

- Brent crude closed -0.6%/$72.61 per barrel.

- Eurozone retail sales volumes declined by 2.3% month on month (m/m) in July, well below the initial market consensus expectation (of +0.1% m/m, according to Reuters' survey) prior to the release of weak member-state data. (IHS Markit Economist Ken Wattret)

- However, eurozone retail sales data are typically rather volatile from month to month, exceptionally so during the COVID-19 shock (see first chart below), and July's drop followed strong gains in the prior two months. Indeed, this is reflected in the still robust three-month-on-three-month rate of increase in sales in July (2.3%).

- The breakdown of July's data shows weakness across many member states, including an extreme plunge in Germany (-5.1% m/m) again following prior strength.

- This weakness likely reflects the impact of the opening up of the economy from COVID-19-related restrictions and a related switch away from consumption of goods towards services. The start of the summer holiday season may have exacerbated this effect.

- Stellantis's Opel brand will receive a EUR437-million grant from German authorities to establish its battery cell facility in Kaiserslautern (Germany), reports Reuters. According to a statement released by Germany's Federal Ministry of Economics and Technology, around EUR51 million of this funding will come from the state of Rheinland-Pfalz, while the remainder will come from the German government. The battery cell facility in Kaiserslautern is one of three facilities that is being backed by Stellantis through Automotive Cells Company (ACC), a joint venture between the automaker and the Saft division of French energy company Total. Around EUR2 billion is said to be invested by ACC in the Kaiserslautern facility, which will have a capacity to manufacture around 24 GWh of cells annually after it comes onstream in 2025. (IHS Markit AutoIntelligence's Ian Fletcher)

- A consortium of blue-chip German companies including Evonik and Thyssenkrupp announced plans to study the cross-sectoral coordinated development of green hydrogen infrastructure and production in the Rhine-Ruhr region. (IHS Markit Net-Zero Business Daily's Keiron Greenhalgh)

- Evonik, Thyssenkrupp, E.ON, RWE, and Vonovia teamed up with the Max Planck Institute for Chemical Energy Conversion, the RWI-Leibniz Institute for Economic Research, and the Alfried Krupp von Bohlen und Halbach-Foundation with the aim of accelerating the region's green transformation.

- Green hydrogen is produced using electrolysis of water using renewable energy, delivering zero emissions.

- The consortium said it aims to connect holistic solutions from industry, the energy sector, mobility, and housing for carbon-free hydrogen in Germany. The project will lay the groundwork for the necessary planning for infrastructure and production, it said.

- Requirements include determining cross-sectoral hydrogen demand, measuring the expansion of renewable energies or alternative hydrogen imports needed, and identifying necessary transport infrastructure.

- Exports of French wines and spirits in the first half of 2021 recovered - and even surpassed pre-pandemic 2019 levels - thanks to the easing of COVID-19 control measures, the country's federation of wine and spirit exporters (FEVS) announced in a statement on 31 August. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- Wine and spirit exports rebounded 42.8% y/y to €7.25 billion ($8.6 billion) in H1 2021. "This progression, although spectacular compared to 2020 must be put into perspective since it is only up 8.6% in value compared to 2019," said FEVS in the statement.

- As regards wine export volumes, they increased 18% y/y to 72.0 million cases, or 5% up from the pre-pandemic H1 2019. This result is even better when viewed by value. The French wine industry earned €4.95 billion from wine exports in H1 2021, which is an increase of 42% y/y and 11% more than in H1 2019.

- Almost all of the French wine-making regions and all product categories benefited from this recovery.

- The US, as the biggest external market for French wine and spirits, imported 21.0 million cases of French wines (+32% y/y) worth €2.04 billion (+54% y/y) in H1 2021. Exports to the UK, the second largest market in volume terms, increased 31% y/y to €679.8 million, corresponding to a total volume of 8.9 million cases (-8% y/y).

- Nouryon (Amsterdam, Netherlands) has filed with the US Securities and Exchange Commission (SEC) for an initial public offering (IPO) of its shares. The timing and price range for the proposed offering have not yet been determined, the company says. Nouryon is the former chemicals business of AkzoNobel, which was acquired for $10.1 billion by private equity firm The Carlyle Group and GIC (Singapore) in October 2018. Nouryon posted 2020 revenue of $4.2 billion with adjusted EBITDA of $970 million, according to a company fact sheet. It has approximately 7,900 employees with production in 18 countries. The portfolio includes cellulosics, organic peroxides, bleaching chemicals, specialty polymers, expandable microspheres, and surfactants. Key end markets include personal care, cleaning goods, paints and coatings, agriculture and food, pharmaceuticals, and building products. In July, Nouryon completed the spin-out of its base chemicals business Nobian (Amersfoort, Netherlands)—which includes salt, chlor-alkali, and chloromethanes—into a separate company that remains under the ownership of The Carlyle Group and GIC (Singapore). Nouryon repaid €1.5 billion ($1.8 billion) of debt with the proceeds of a completed external financing by Nobian, as part of the spin-out transaction. (IHS Markit Chemical Advisory)

- Sobi (Sweden) has accepted a premium share price offer valued at SEK69.4 billion (USD8.1 billion) from US private equity group Agnafit Bidco, which comprises Advent International and Aurora Investment (part of Singapore's sovereign wealth fund GIC). The takeover of the Swedish rare-disease developer is a potential signal to pharmaceutical majors that Sobi is once again a viable long-term prospect for acquisition. In the past, Sobi had been the subject of acquisition speculation from Biogen (US) and Pfizer (US), among others. (IHS Markit Life Sciences' Eóin Ryan)

- Saudi Arabia will set up a platform for the trading of carbon offsets and credits generated in the Middle East and North Africa as part of the country's efforts to fight climate change, the official Saudi Press Agency (SPA) reported 3 September. SPA said the Riyadh Voluntary Exchange Platform will be a joint venture between the Public Investment Fund, the country's sovereign wealth fund, and the Saudi Tadawul Group, which owns the Saudi Exchange. (IHS Markit Net-Zero Business Daily's Keiron Greenhalgh)

- Egypt's economy recorded growth of 7.7% in Q4 of FY2020/21, accelerating from a contraction of 1.7% during the final quarter of FY2019/20, and up from the 2.9% growth recorded in Q3 of FY2020/21, according to a statement by Minister of Planning and Economic Development Hala El Said during a Cabinet meeting on 1 September. (IHS Markit Economist Yasmine Ghozzi)

- The figure considerably exceeded the government's quarterly target of a 5.2%-5.5% growth rate, which ended on 30 June. Details are absent at this moment, and it is not clear what drove the positive surprise, but the minister highlighted that the sectors most affected by COVID-19, including hospitality, restaurants, construction, natural gas, and electricity, mainly drove the rebound.

- Egypt has had steady increases in quarterly growth figures, from 0.7% in Q1 FY2020/21, to 2% and 2.9% in the second and third quarters respectively, the minister unveiled.

Asia-Pacific

- Major APAC equity markets closed mixed; Japan +2.1%, South Korea +0.8%, Australia +0.5%, India +0.5%, Mainland China -0.4%, and Hong Kong -0.7%.

- Despite the likely weakening of services sector GDP in the third quarter, effective containment of the domestic pandemic situation should help services recovery regain momentum over the remainder of 2021. That said, fears of breakthrough infections and lingering restrictions for pandemic prevention may continue to cap offline services sector recovery. (IHS Markit Economist Lei Yi)

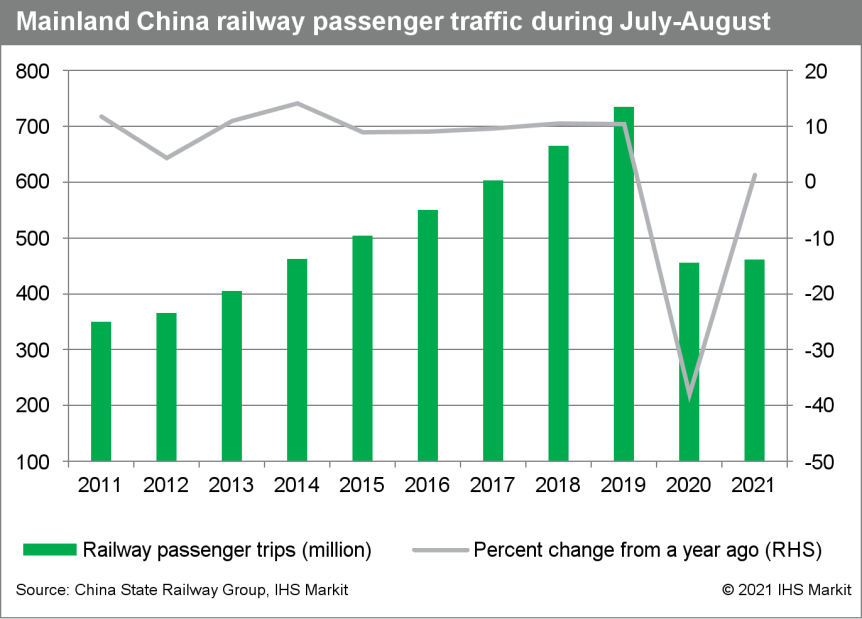

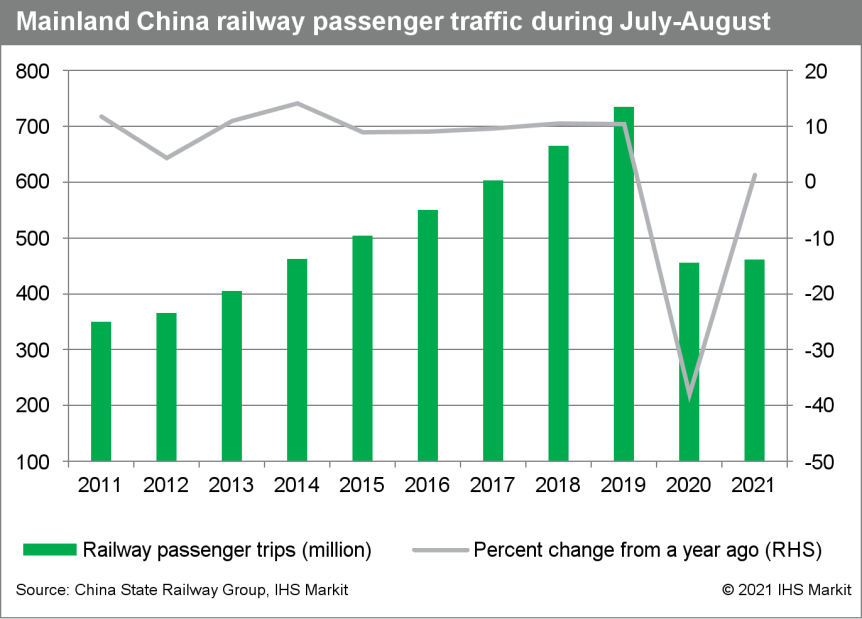

- Mainland China's railway passenger trips totaled 462 million through the July-August summer holiday, up by 1.3% year on year (y/y) from summer 2020, according to the State Railway Group. Compared with 2019, summer passenger traffic by rail in 2021 only reached 63% of the pre-pandemic level.

- The fresh regional outbreaks, which started from the end of July, notably curtailed travel activity in August. While railway passenger trips increased by 48% y/y to 306 million in July, in August only 156 million were registered, marking a decline of 37% y/y.

- Delta variant-related infection flareups and extreme summer flooding have notably weighed on services recovery, especially in August, suggesting a likely weakening of services GDP in the third quarter. The monthly railway passenger traffic growth rate trajectory is in line with the latest services PMI reading, which registered a temporary uptick in July before falling into contraction territory in August.

- Amid weakening domestic and overseas demand and the ongoing push for housing market de-risking and leverage ratio stabilization, Mainland China's near-term policy will likely be aimed at alleviating pressure on small businesses. (IHS Markit Economist Yating Xu)

- Mainland China will set up a new stock exchange in the capital city of Beijing to provide a major fund-raising platform for innovative small and medium-sized enterprises, Chinese President Xi Jinping said in his speech at the opening of the China International Fair for Trade in Services on Thursday. The timeline and details on how the Beijing New Third Board will differ from the existing New Third Board in Shenzhen have yet to be published.

- President Xi also unveiled a slew of new measures to facilitate services trade, including exploring the development of national demonstration zones to promote innovative development of services trade, building digital trade demonstration zones, and rolling out a national negative list for cross-border service trade. According to the Ministry of Commerce on 3 September, mainland China' services trade value through July increased 7.3% year on year (y/y), with the deficit in services trade down 70% year on year. Technology-intensive services accounted for over 50% of total service exports in the first seven months.

- Chinese electric vehicle (EV) startup Aiways has collaborated with Hesai Technology to promote the application of automotive-grade LiDAR sensors. To achieve this, the companies will jointly develop hardware equipment, software algorithms, and smart assistance driving systems. The collaboration will provide the EV maker with an advanced intelligent assistance driving system by deploying Hesai's hybrid solid-state LiDAR solution, reports Gasgoo. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Beset by the second wave of the COVID-19 virus pandemic and containment measures by the states, the Indian economy contracted 16.9% on a sequential quarter-on-quarter (q/q) basis during the June quarter - the first quarter of Indian fiscal year (FY) 2021. The pace of the year-on-year (y/y) expansion was pushed to 20.1% following the economy's contraction of 24.4% y/y in the first quarter of FY 2020. (IHS Markit Economist Hanna Luchnikava-Schorsch)

- Real private consumption expanded 19.3% y/y in the April-June quarter following a 26.2% y/y contraction during the same quarter in 2020. But as the second wave of the COVID-19 virus pandemic and associated state-level lockdowns severely depressed household spending and sentiment, private consumption fell 17.4% from the March quarter, while its level in real terms was 17.9% below that recorded in the December 2019 quarter - the last quarter before the pandemic began.

- Similarly, real fixed investment soared to a growth of 55.3% in annual terms following a 47% y/y contraction during the same quarter of 2020, but it fell by 23.6% from the Match quarter and was 12% below the level seen in the last pre-pandemic quarter. Both private and public investment declined, as projects were paused or suspended amid strict mobility restrictions and high level of uncertainty.

- According to the CMIE CAPEX data, the value of completed projects fell by 37.5% during the June quarter from the March quarter, while the value of stalled projects doubled.

- LG Chem (Seoul, South Korea) says it will partner with biodiesel producer Dansuk Industrial to build a hydrotreated vegetable oil (HVO) plant at its Daesan chemicals complex that will supply eco-friendly raw materials for the manufacture of products including polyvinyl chloride (PVC), acrylonitrile-butadiene-styrene (ABS), and bio-superabsorbent polymers (bio-SAP). The investment figure for the project has not been disclosed. (IHS Markit Chemical Advisory)

- LG Chem and Dansuk have signed a heads of agreement to establish the HVO joint venture (JV), with a definitive agreement scheduled for signing in the first quarter of 2022. Construction of the plant is planned to be completed by 2024, it says. The facility would be South Korea's first HVO unit, and is one of 10 planned new plants at Daesan announced by LG Chem last month.

- When the JV is established, LG Chem says it will "prepare a base for supplying raw materials used to produce bio-SAP resin, ABS synthetic resin, and PVC." The company plans to expand its ISCC Plus international certified portfolio to more than 30 products by the end of this year, it says.

- HVO is a bio-oil produced through hydrotreatment of raw materials such as waste cooking oil and palm by-products, which can be used as a vehicle and aviation biofuel, as well as a raw material for chemical products. LG Chem says global market demand for HVO is expected to grow from 6 million metric tons in 2020 to 30 million metric tons in 2025, at an average annual growth rate of more than 40%, driven largely by international renewable energy policies and mandatory use of eco-friendly jet fuel and diesel.

- Dansuk will enter the HVO business using its existing biodiesel export capability and expand its bioenergy portfolio to include products such as jet biofuel.

- LG Chem announced in August it would invest 2.6 trillion South Korean won ($2.2 billion) by 2028 building 10 plants at Daesan for the manufacture of eco-friendly chemical products.

- The Australian economy continued to expand in the second quarter, although at a slower, yet respectable 0.7% quarter on quarter (q/q), seasonally adjusted, as the domestic economy appeared to be normalizing after several quarters of robust growth. With the implementation of significant containment measures since late June not flattening the COVID-19 infection rates in Sydney, and outbreaks in other major cities resulting in lockdowns, the economy's growth streak is likely to be broken in the current quarter. (IHS Markit Economist Bree Neff)

- Australia's GDP result in the quarter to June beat market expectations because there were only sporadic and short-lived COVID-19 containment measures implemented during the quarter, and Sydney only started its virus containment measures towards the end of June.

- Additionally, between the first quarter of 2015 and the fourth quarter of 2019, average seasonally adjusted GDP growth rates were 0.6% q/q. Therefore, while the growth result in the second quarter of 2021 is slower than the previous exceptionally strong rebound from the 2020 lockdowns, it is not disappointing, and a return to more normal GDP growth rates was to be expected as capacity constraints increased.

- Domestic demand was buoyant in nearly all sectors in the second quarter, with fixed investment spending making the largest contribution to growth during the quarter, according to the Australian Bureau of Statistics (ABS). In line with the national government's focus on directing funding and assistance towards state-level shovel-ready infrastructure projects, state and local government spending on infrastructure projects was a key growth driver during the second quarter, contributing 0.3 percentage point to growth and increasing by 10.7% q/q in real (inflation-adjusted) terms.

- Commercial and residential solar photovoltaic (PV) generation could meet as much as 77% of electricity demand in four of the five most populous mainland Australian states by 2026, according to an outlook released 31 August by the Australian Energy Market Operator (AEMO). The climb in the generation share significantly surpassed prior expectations, it added. (IHS Markit Net-Zero Business Daily's Keiron Greenhalgh)

- As a result, support systems for the coming buildout of the country's solar PV generation capacity, and its nascent offshore wind infrastructure, are rapidly being created to pave the pathway Prime Minister Scott Morrison's government has chosen for cutting Australia's carbon footprint.

- Rooftop solar already accounts for the largest slice of the generation pie in the National Energy Market (NEM), AEMO said in its annual Electricity Statement of Opportunities, the 10-year outlook. It added that continued investment in residential rooftop solar PV is at times challenging AEMO's ability to provide secure and reliable electricity.

- The AEMO expects a further 8.9 GW of commercial and residential solar PV to be installed by 2025 in the mainland NEM states—Queensland, New South Wales, Victoria, and South Australia. Western Australia and the Northern Territory are not connected to the NEM.

Posted 03 September 2021 by Ana Moreno, Director, Product Development, IHS Markit and

Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.