All major US equity indices closed higher, while most APAC markets were lower, and Europe was mixed. US government bonds closed sharply lower, while benchmark European bonds closed mixed. CDX-NA closed slightly tighter across IG and high yield, while European iTraxx was close to flat on the day. Natural gas closed higher, while the US dollar, oil, silver, gold, and copper all closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; DJIA +0.3%, S&P 500 +0.7%, Nasdaq +1.0%, and Russell 2000 +1.8%.

- 10yr US govt bonds closed +4bps/1.60% yield and 30yr bonds +7bps/2.03% yield.

- CDX-NAIG closed CDX-NAIG closed -1bp/258bps and CDX-NAHY -4bps/297bps.

- DXY US dollar index closed -0.2%/93.86, selling off on the FOMC statement at 2:00pm ET then rallying at the beginning of the press conference at 2:30pm ET only to sell-off sharply minutes afterwards.

- Gold closed -1.4%/$1,764 per troy oz, silver -1.2%/$23.23 per troy oz, and copper -1.0%/$4.32 per pound.

- Crude oil closed -3.6%/$80.86 per barrel and natural gas closed +2.5%/$5.78 per mmbtu.

- The Federal Open Market Committee (FOMC) concluded its scheduled two-day policy meeting this afternoon. The statement released at the conclusion of the meeting was consistent with our expectations. First, the Committee announced that it would begin later this month to reduce the pace of its securities purchases in monthly increments of $15 billion, relative to the current pace of $120 billion per month. This would put them on track to decline to zero by the end of June 2022. Second, policymakers expressed less conviction that the surge of inflation largely reflects transitory factors, a hint that if inflation does not soon moderate, monetary policy could be tightened earlier than currently anticipated. (IHS Markit Economists Ken Matheny and Lawrence Nelson)

- Global manufacturing growth continues to be stymied by supplier delays and stalling export trade, according to the J.P.Morgan Global Manufacturing PMI. However, fears of rising inflation and continued supply chain disruptions were not able to trick markets in October, a month historically associated with stock market crashes, as investors in the US, developed Europe and Japan were treated to a strong finish to the month. Furthermore, an overview of factor performance for the month unmasked a tendency towards high momentum shares, though with some variation across regions and capitalization ranges. (IHS Markit Research Signals)

- US: Deep Value measures such as Forward 12-M EPS-to-Enterprise Value were especially favored among small caps, a theme that did not carry over to large caps

- Developed Europe: High momentum stocks measured by Industry-adjusted 12-month Relative Price Strength were strong performers

- Developed Pacific: High quality firms outperformed in markets outside Japan, as captured by Inventory Turnover Ratio

- Emerging markets: Investors rewarded Deep Value stocks, as gauged by TTM EBITDA-to-Enterprise Value, while short-term price reversal measures such as 5-day Industry Relative Return underperformed

- Finding clean energy and infrastructure projects to deploy trillions in private capital is the challenge that financiers face and governments must resolve, Black Rock CEO Larry Fink said 3 November. The financial community is committed to bringing that capital forward, but the "key is finding the jobs, and finding the ability to deploy that capital and there lies the fundamental issue today," said Fink, who heads the world's largest investment fund, which has $9.5 billion of assets under management. (IHS Markit Net-Zero Business Daily's Amena Saiyid)

- Speaking on a climate finance panel at the UN COP26 meeting, Fink was commenting on the $130 trillion in private capital commitments that the Glasgow Financial Alliance for Net-Zero (GFANZ) said it has secured to help economies transition to net zero.

- GFANZ is a network of more than 450 banks, insurers, and asset managers across 45 countries that was formed in April by former Bank of England Governor Mark Carney and US Special Presidential Envoy for Climate John Kerry to bring all net-zero financial initiatives, including the Net Zero Asset Managers Initiative, under one umbrella.

- With the $130 trillion in private commitments, Carney said: "We now have the essential plumbing in place to move climate change from the fringes to the forefront of climate finance so that every financial decision takes climate change into account."

- Fink cautioned Carney and other financial leaders that there is currently no system in place to rapidly deploy private capital to the emerging world without "three, four, five, six years of waiting for regulation and having it passed."

- Republican Glenn Youngkin won the Virginia governor's race on 2 November, while the New Jersey gubernatorial contest remained too close to call 12 hours after the polls closed. The first major US elections following the presidency 2020 election of President Joe Biden suggested that Democrats will probably struggle to retain their congressional majorities in the 2022 midterm elections. (IHS Markit Country Risk's John Raines)

- The Virginia and New Jersey results indicate that the electoral coalition that secured Democrats control of the White House and both chambers of Congress in 2020 has deteriorated. In 2020, Biden won Virginia by 10 points and New Jersey by 16 points, but the results in both states imply that the Democrats have lost significant support among independents and suburban voters, most probably because of the ongoing coronavirus disease 2019 (COVID-19) pandemic and inflation concerns. Before Youngkin's victory, Democrats had won 13 straight statewide elections in Virginia.

- Youngkin's victory provides a template for Republican candidates in close contests to navigate divided sentiments around former president Donald Trump in the 2022 midterm elections. Youngkin campaigned by using cultural issues that Trump had sought to address, such as the teaching of critical race theory in schools, to fuel enthusiasm among Republican voters, while distancing himself directly from association with the former president by refusing to campaign personally with him and avoiding claims of 2020 voting fraud.

- The Virginia race also has legislative implications for Biden's social agenda. McAuliffe's attempts to project an image of a competent, pragmatic Democratic Party faltered against a congressional backdrop of Democratic infighting over the fate of the USD550-billion bipartisan infrastructure bill and a USD1.75-trillion social spending package, the Build Back Better Act.

- US manufacturers' orders rose 0.2% in September, while shipments rose 0.6% and inventories rose 0.8%. The reading on orders was somewhat stronger than the consensus estimate of a slight decline. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Orders and shipments of core capital goods (nondefense capital goods excluding aircraft) were little revised from the advance estimates, as were total inventories. As a result, we left our forecast of fourth-quarter GDP growth unrevised at 4.9%.

- Supply constraints continue to restrain real expansion in manufacturing, even as demand remains elevated. The result has been surging prices.

- Year to date (through September), the producer price index (PPI) for the net output of the manufacturing sector rose 13.0%.

- This has more than accounted for growth of nominal orders (10.2%) and nominal shipments (7.6%) over this period.

- That is, after adjusting for price change, both real orders and shipments within manufacturing are down for the year following the completion of a full recovery last fall.

- Supply constraints, broadly, are expected to continue into next year.

- If the spread of COVID-19 continues to slow, we believe that demand for goods will soften as spending on services returns to pre-pandemic norms.

- This will help to ease pressures on supply chains and allow for robust expansion in the manufacturing sector, as businesses catch up with demand and rebuild inventories.

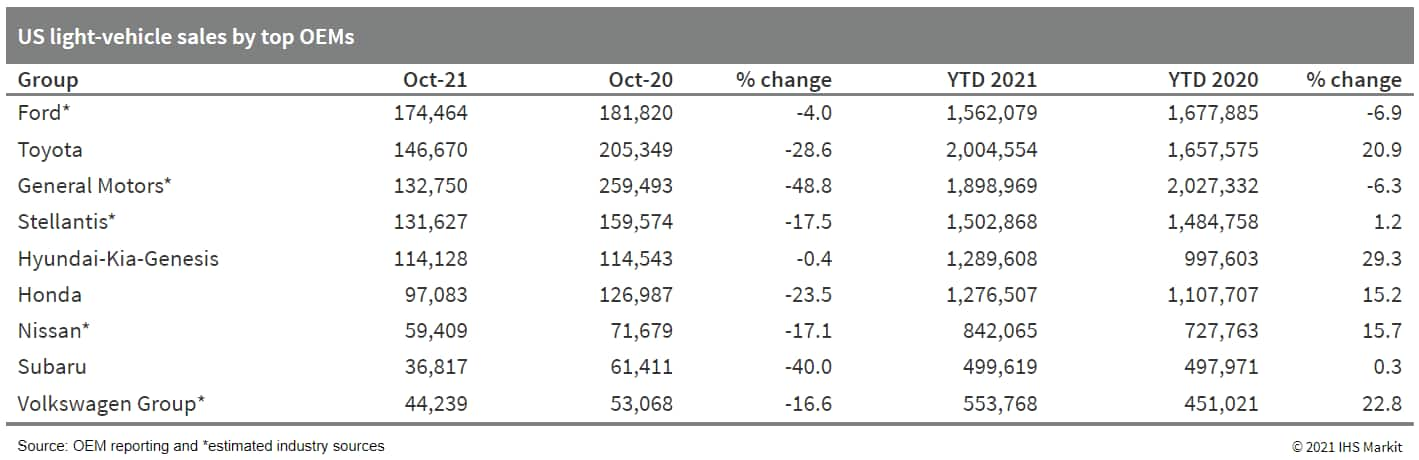

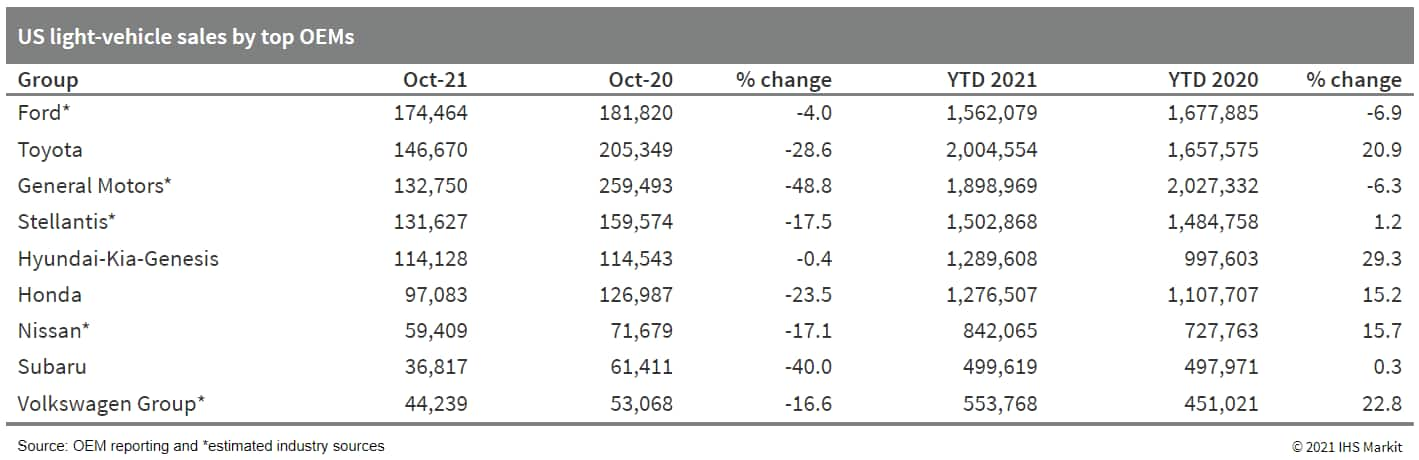

- The lack of inventory pushed US light-vehicle sales down by 22.5% y/y in October; YTD sales were up by 9.2%. October's 1.0 million units were similar to the volume in September. Although the pace of sales is projected to have increased mildly from September, auto demand levels in the US continue to be subdued by new vehicle inventory constraints. IHS Markit forecast as published in October stands at 15.1 million units, but the softer-than-expected October sales point to potential that full-year sales could possibly be somewhere between 14.9-15.1 million units. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric autonomous vehicle (AV) company Local Motors has entered into a strategic customer agreement with a provider of digital LiDAR sensors, Ouster, according to a company statement. The agreement includes a binding commitment for the delivery of more than 1,000 OS digital LiDAR sensors through to 2023 and a non-binding forecast of more than 20,000 sensors through to 2025. These sensors will be deployed in Local Motors' next-generation 3D-printed autonomous shuttles. Local Motors has developed the Olli autonomous shuttle, which is designed to provide last-mile transportation in low-speed environments, including campuses, hospitals, military bases, and universities. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Autonomous delivery vehicle startup Nuro has raised USD600 million in its latest funding round, at a valuation of USD8.6 billion, reports Reuters. The funding round was led by Tiger Global Management, in participation with Toyota Motor Corporation's Woven Capital, SoftBank Group Corporation's Vision Fund 1, Google, and Kroger Co., among others. In addition, Nuro has signed a five-year strategic partnership with Google Cloud to support autonomous vehicle (AV) simulation and data management. Google Cloud will assist Nuro in optimizing its deliveries to retailers and other businesses, with the aim of transforming local commerce together. Nuro has been testing its autonomous system on the R1 vehicle and its updated version of the R2 via partnerships with retail companies such as Walmart, Kroger, and CVS Pharmacy, as well as via partnerships for parcel deliveries with FedEx and food deliveries with Domino's Pizza. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- On November 2, Interstate Power and Light (IPL) applied with the Iowa Utilities Board for approval of advance ratemaking principles that would allow it to add new solar generation and energy storage resources. (IHS Markit PointLogic's Barry Cassell)

- "IPL is proposing Advance Ratemaking Principles, included as Attachment A to this Application, that would allow IPL to benefit its customers and the state of Iowa with a unique opportunity to add 475 MW of solar generation and battery energy storage to IPL's generating portfolio in 2023 and 2024," the utility wrote. "These renewable resource additions will help meet the capacity needs of IPL's customers and support the reliability of IPL's generating fleet, all while boosting economic development, continuing IPL's transition to cleaner sources of energy and capacity, and further solidifying Iowa's status as a national leader in renewable energy."

- It added: "IPL's need for 475 MW of solar and energy storage is demonstrated primarily by IPL's Iowa Clean Energy Blueprint, a resource planning evaluation consistent with the settlement between IPL, the Office of Consumer Advocate, and intervenors in IPL's last electric rate case proceeding in Docket No. RPU-2019-0001. The Iowa Clean Energy Blueprint demonstrates the potential for customers to avoid significant costs through a combination of coal generation retirement, continued energy efficiency, and the addition of utility-scale and distributed solar generation and energy storage.

- "The Iowa Clean Energy Blueprint identifies the need for 400 MW of nameplate capacity, which can be most cost-effectively met with additions of solar generation to IPL's fleet. Supplemental analysis performed since the Iowa Clean Energy Blueprint was completed shows that the addition of 75 MW of energy storage, paired with a portion of the 400 MW of solar generation, would also be cost-effective and would support the reliability of IPL's fleet.

Europe/Middle East/Africa

- Major European equity indices closed mixed; Italy +0.7%, France +0.3%, Germany flat, UK -0.4%, and Spain -0.8%.

- 10yr European govt bonds closed mixed; Italy -4bps, Germany/France -1bp, Spain flat, and UK +4bps.

- iTraxx-Europe closed flat/51bps and iTraxx-Xover -2bps/258bps.

- Brent crude closed -3.2%/$81.99 per barrel.

- According to the first estimate from the National Institute of Statistics (Istituto Nazionale di Statistica: ISTAT), Italian real GDP grew by 2.6% quarter on quarter (q/q) in the third quarter. (IHS Markit Economist Raj Badiani)

- This followed growth of 2.7% q/q and 0.3% q/q in the second and first quarters.

- The third-quarter GDP developments were better than expected, with IHS Markit estimating that the economy grew by 1.9% q/q during the period.

- In annual terms, GDP increased by 6.3% year on year (y/y) in the first three quarters of this year, after an 8.9% drop in the full year 2020 to remain.

- At the end of the third quarter, real GDP stood 1.4% below its pre-COVID-19 level at end-2019.

- Despite the better-than-expected real GDP outturn in the third quarter, we still expect the recovery to slow during the next few quarters, tempered by supply bottlenecks and soaring energy prices.

- According to our October forecast, real GDP growth is likely to slow to 0.7% q/q in the fourth quarter of this year and 0.4% q/q in the first quarter of 2022.

- Ferrari has announced its financial results for the third quarter of 2021 which have shown a stronger year-on-year (y/y) performance. During the three months ending 30 September, the automaker's net revenues increased by 18.6% y/y to EUR1,053 million. EBITDA has grown by 12.4% y/y to EUR371 million, although its EBITDA margin has dipped from 37.2% to 35.2%. EBIT also increased by 21.6% y/y to EUR270 million, with the EBIT margin growing from 25% to 25.7%. Net profit ended the quarter at EUR207 million, an improvement of 21.1% y/y. The performance this quarter has contributed to the year-to-date (YTD) performance, which has been largely dominated by the improvement on a low base during the second quarter due to COVID-19 virus measures implemented in 2020. For the nine-month period, Ferrari's net revenues have grown by 29.6% y/y to EUR3,099 million, EBITDA has increased by 47% y/y to EUR1133 million and a margin of 36.6%, and EBIT has leapt by 74.2% y/y to EUR810 million, and a margin of 26.2%. Net profit has jumped 78.9% y/y to EUR619 million. The growth this quarter is partly as a result of the normalization of the automaker's operations in the wake of the COVID-19 virus which had a huge impact on its 2020 performance. As the company resumed operations from stoppages in 2020, it chose to focus on supplying vehicles in nearer markets rather than more distant destinations, which would take longer for transactions to be completed. (IHS Markit AutoIntelligence's Ian Fletcher)

- Coca-Cola HBC, a strategic bottling partner of The Coca-Cola Company, announced that juice volumes increased 14.0% y/y in the third quarter, outperforming the company's overall volume growth of 13.1% y/y in Q3. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- "Juice volume was up 14.0%, with growth in all three segments [established, developing, and emerging markets], while ready-to-drink tea volume grew by 6.5%," said Coca-Cola HBC.

- The company's overall volumes grew fastest in the emerging markets segment (+21.3% y/y), followed by an increase of 8.0% y/y in established markets and a drop of 1.9% y/y in developing markets.

- Emerging markets' volume increased by 21.3%, with continued strong performance from Nigeria, Russia, Ukraine and others. "Sparkling volumes were up low 20s, while adult sparkling and energy [drinks] performed very well in the quarter, both increasing high double digits. Stills volumes were up mid-teens with strong performance from water led by Russia, and juice led by Nigeria," said the company.

- Nigerian performance gained momentum in Q3, with volume up mid-30s despite the double-digit comparator. Sparkling grew by high 30s with very strong performance from Coke Zero. Stills grew by low-double digits with a high-double digit increase in the juice segment.

- Equinor has revealed its plans to deploy a new floating semisubmersible foundation if it secures a seabed lease for its 1 GW bid in the ongoing ScotWind auction. The floater, named Wind Semi, has several key design features that the company says will make its design cost-competitive. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Firstly, the structure has been designed to allow fabrication and assembly based on local supply chain capabilities. It has a flat plate design without bracings, heave plates, and complicated nodes, thus reducing the risk of fatigue cracking. The structure can be built in blocks that can either be built locally or shipped in from overseas locations.

- Secondly, the floater has a simple design with a passive ballast system. This will reduce the risk of system failure and the amount of maintenance needed.

- Lastly, the design has a shallow draught of less than 10 meters, allowing it to be assembled portside at most industrialized ports in the region.

- Should Equinor secure a seabed lease at eh ScotWind auction, the Wind Semi design will be deployed in the full-scale 1 GW floating wind project, dwarfing the size of the company's current largest floating wind project, the 88 MW Hywind Tampen.

- Angola's council of ministers approved the proposal for the upcoming scheduled KWZ18.8-billion state budget 2022 on 28 October that foresees real GDP reaching 2.4% next year. (IHS Markit Economist Alisa Strobel)

- The budget still needs to be submitted to and approved by the National Assembly. The reference price for the barrel of oil has also been adjusted to USD59 per barrel, up from USD39 per barrel in 2021.

- Social sector spending is set to increase by 24.7% from the previous year and revenue intakes should also be supported by non-oil growth, which is estimated to reach 3.1% in 2022. Meanwhile annual headline inflation is expected to fall to 18%.

- The much more conservative benchmark oil price of USD39 per barrel in 2021 helped the government to reach fiscal targets so far. Non-oil government revenue has recorded an increase of 30% as of the second quarter of 2021. Angola's fiscal policy has already delivered substantial consolidation since 2020. Non-oil revenue continued to increase thanks to value-added tax (VAT) and income tax collections through 2020 and data available for 2021.

Asia-Pacific

- Major APAC equity indices closed lower except for Australia +0.9%; Mainland China -0.2%, Hong Kong -0.3%, India -0.4%, and South Korea -1.3%.

- Geely Auto Group has launched its global powertrain brand "Leishen Power", and a new modular intelligent hybrid powertrain platform, Leishen Hi-X. According to a company statement, the Leishen hybrid platform features ultra-high 43.32% thermal efficiency engine, three-speed Dedicated Hybrid Transmission (DHT), 40% lower fuel consumption NEDC rating, and full powertrain FOTA (Firmware Over the Air) update capabilities. The modular platform can be used for A-C-segment models and in HEV/PHEV/REEV configurations for brands within Geely Auto Group. The 40% lower fuel consumption NEDC rating would mean a substantial reduction in emissions and a shorter time to achieve the clean air targets set up by the Chinese authorities. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Sing Da Marine Structure (SDMS) has produced Taiwan's first offshore wind jacket foundation. The jacket will be used in Ørsted's 900 MW Changhua 1 & 2a offshore wind farm. Ørsted has stated that the jacket, weighing more than 1,200 tons with a height of around 60 to 80 meters, is entirely made in Taiwan and has passed all inspections. The company has stationed double the usual manpower at site to support SDMS in becoming a qualified offshore wind supplier. Ørsted has also stated that it had sent its experts to coach SDMS's sub-suppliers in welding, and conducted more than 30 workshops to effect knowledge transfer on jacket foundations, including fabrication procedures, systematic quality assessment, control processes to meet global QHSE standards, management of large-scale projects, and preparation of documentation. The Greater Changhua 1 & 2a wind farm will require 111 jackets for its Siemens Gamesa 8 MW wind turbines. Offshore construction is ongoing and will extend to 2022, when the projects is expected to be fully operational. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- South Korea-based autonomous transportation-as-a-service (TaaS) startup 42dot has raised KRW104 billion (USD88.5 million) in a Series A round of funding. This brings the total amount of funds raised by the startup to USD130.1 million, reports TechCrunch. 42dot secured investment from new investors such as Shinhan Financial Group, Lotte Rental, Lotte Ventures, STIC Ventures, We Ventures, and DA Value Investment, among others. Returning backers also joined this round. The startup plans to use the infused capital to advance its artificial intelligence (AI)-based technology, establish joint ventures, and hire staff. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ola reported EBITDA of INR898.2 million (USD12 million) for the fiscal year that ended in March 2021, compared with a loss of USD81.6 million a year ago. This is the company's first-ever operating profit, driven by cost cuts and workforce reduction, reports Livemint. Ola reportedly plans to conduct a USD1-billion initial public offering (IPO) in the next few months. The company, which operates in over 100 cities in India, has expanded to several international markets, including Australia, New Zealand, and the UK, in a bid to improve its valuation. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Reserve Bank of Australia (RBA) left the official cash rate target unchanged at 0.10% and there were no adjustments to the bank's government bond-buying program, but the monetary policy board decided to halt the yield-targeting program for three-year Australian Government Securities (AGS). Although the policy-anchoring yield target was dropped, Governor Philip Lowe continued to insist that interest rate hikes are not imminent. (IHS Markit Economist Bree Neff)

- The yield-targeting program commenced in March 2020 as a way to anchor monetary policy expectations to a longer-term horizon (three years) and to contain funding costs through the pandemic. The target had been extended to the April 2024 dated bond as the pandemic persisted and because the RBA still viewed three years as an appropriate timeframe to keep the policy rate on hold and gradually unwind other stimulus measures.

- As conditions have shifted - a lower-than-expected unemployment rate, higher inflation, and a potentially sharp rebound in activity post-lockdown - defending the AGS target at 0.10% over the past week has become far more difficult. The RBA had not defended the target since late February, but it was forced to intervene on 21 October and was expected to defend again last week after the higher-than-expected inflation reading, but it did not. This accelerated bets that the RBA would drop the yield-targeting program.

- The RBA's policy statements this month also highlighted revisions to the bank's core forecasts, which will be released in full at the end of this week. The bank's baseline forecast anticipates real GDP growth of 3% for 2021 (a downgrade from August), 5.5% in 2022 (an upgrade), and 2.5% for the subsequent two years. The adjustments to the GDP outlook stem from expectations of a fast rebound in activity following the Delta variant-induced lockdowns as vaccination rates have picked up quickly, allowing containment measures to be unwound.

Posted 03 November 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.