All major European equity indices closed higher, US was mixed, and most APAC markets closed lower. US and most benchmark European government bonds closed higher. European iTraxx and CDX-NA closed almost flat on the day. The US dollar closed higher, while oil, natural gas, gold, copper, and silver all closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- US equity indices closed mixed; DJIA +0.3%, S&P 500 +0.2%, Russell 2000 -0.2%, and Nasdaq -0.2%.

- 10yr US govt bonds closed -2bps/1.52% yield and 30yr bonds -3bps/2.06% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY -1bp/297bps.

- DXY US dollar index closed +0.6%/94.34, which is the highest close since October 2020.

- Gold closed -0.8%/$1,723 per troy oz, silver -4.4%/$21.49 per troy oz, and copper -1.1%/$4.20 per pound.

- Crude oil closed -0.6%/$74.83 per barrel and natural gas closed -6.9%/$5.48 per mmbtu.

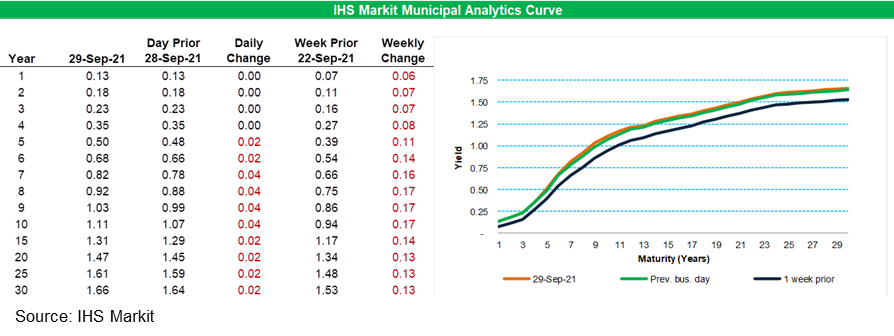

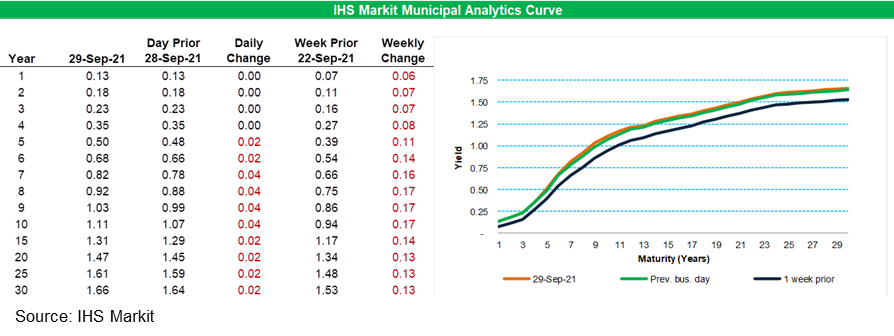

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC) sold off 2-4bps today for 5-year and longer paper, with that same part of the curve 11-17bps weaker week-over-week.

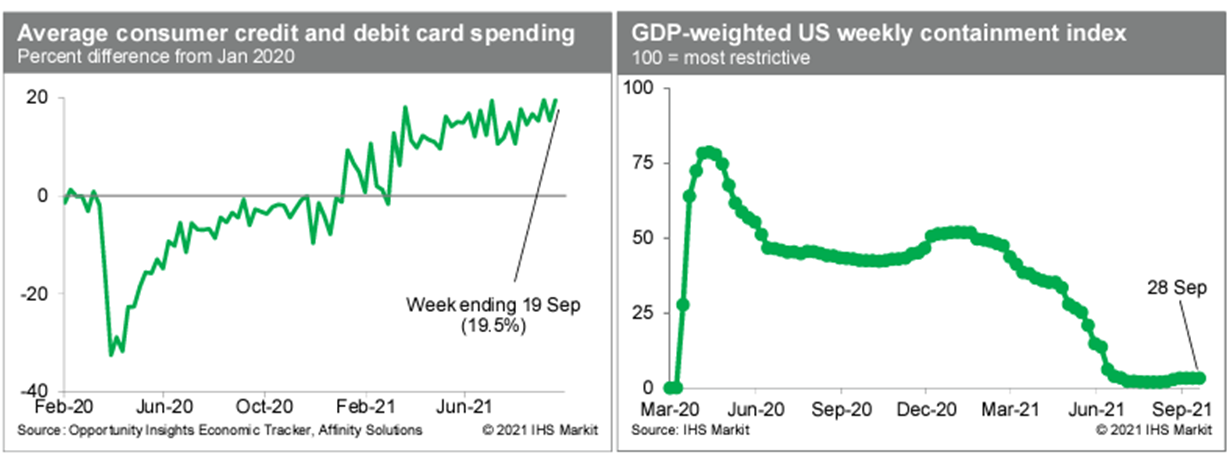

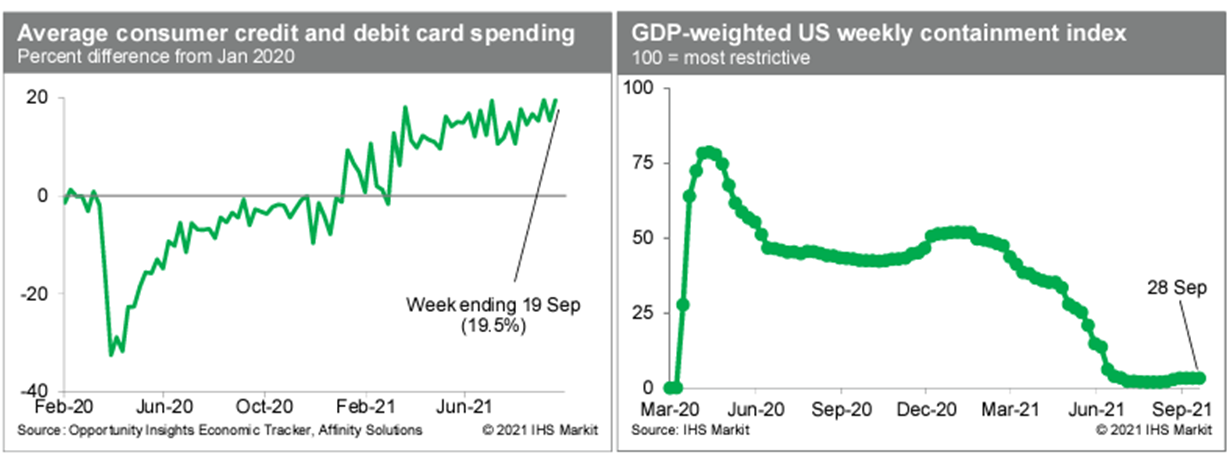

- Average consumer credit- and debit-card spending during the week ending 19 September was 19.5% above the January 2020 level, according to the Opportunity Insights Economic Tracker. The trend in this series has been firming over the last month or so, suggesting that growth of spending may be picking up again following a Delta-induced pause. Conservative assumptions for spending over the final two weeks of September would imply prorated monthly growth of 1.3% in September, suggesting some modest upside risk to our current assumption of a 0.1% decline in retail and food services sales in September. Meanwhile, the IHS Markit GDP-weighted US weekly containment index was unchanged this week at a value of 3.3, suggesting virtually no mandated restraint on social and economic activity at the national level. (IHS Markit Economist Ben Herzon and Joel Prakken)

- The US Pending Home Sales Index (PHSI) jumped a surprising 8.1% in August to a seven-month high. The regional gains were also (unexpectedly) strong, ranging from 4.6% in the Northeast to 10.4% in the Midwest. (IHS Markit Economist Patrick Newport)

- According to Lawrence Yun, the National Association of Realtors' chief economist, "Rising inventory and moderating price conditions are bringing buyers back to the market. Affordability, however, remains challenging as home price gains are roughly three times wage growth."

- The Mortgage Bankers Association (MBA)'s Purchase Index (four-week moving average), which had been sliding since January but turned six weeks ago, growing 10% since then, is also pointing to stronger near-term sales.

- The August jump in the PHSI suggests that listings have picked up in the past month. Strong demand for houses this year has mostly led to higher home prices—not higher sales—because listings were hovering near all-time lows.

- The PHSI leads existing home sales by a month or two. The latest two PHSI readings point to a modest pickup in existing home sales in September and October.

- General Motors' (GM) BrightDrop brand has announced that it has begun assembly of the EV600, its first electric light commercial vehicle, for delivery to Federal Express. In addition, the company has announced that its second van is to be the EV410, and telecom giant Verizon is its first customer. The EV410 will be a mid-size van designed for shorter and more-frequent trips than the larger EV600. GM says the EV410 is well-suited for Verizon's telecom maintenance fleet, but also for activities such as grocery deliveries. Production of the EV410 is due to begin in 2023, at the same Canadian plant where the company is to build the EV600, beginning in November 2022. GM is ensuring it expands its electric vehicle (EV) offerings across vehicle segments and classes, including the commercial vehicle arena. GM has just released pictures of the EV410 and the company has indicated that the BrightDrop van family will include multiple vehicle sizes, as is common for commercial vans. The confirmation of the brand's second body style and new customer shows the business continues to build momentum, although the 2023 production start for the EV410 also reflects a recognition that it will take years for the company to fully realize its growth plans. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Goodyear's venture capital fund, Goodyear Ventures, has participated in autonomous trucking startup Gatik's recently announced Series B funding round, according to a company statement. This investment is a part of their multi-year collaboration that aims to develop advanced mobility solutions for the autonomous B2B short-haul logistics industry. Gatik's medium-duty fleet will use Goodyear tires, equipped with its tire intelligence technology SightLine. It is expected to help reduce fuel and maintenance costs while increase operational efficiencies. (IHS Markit Automotive Mobility's Surabhi Rajpal)

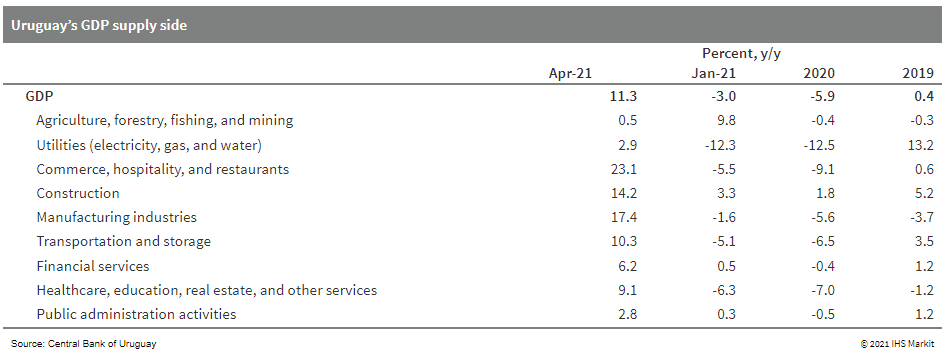

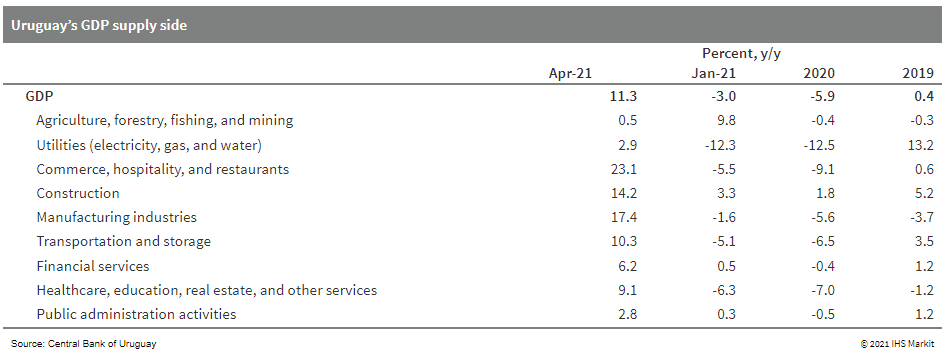

- Uruguay's real GDP grew by 11.3% year on year (y/y) in the second quarter of 2021 following a 3.0% y/y decrease in the previous quarter, according to the Central Bank of Uruguay (Banco Central del Uruguay: BCU). As a result, the economy expanded by 3.8% y/y during the first half of 2021, in part because of the low comparison base in the first half of 2020. When correcting for seasonality, GDP during the second quarter rose by 0.9% quarter on quarter (q/q) after declining by 0.6% q/q in the previous quarter. (IHS Markit Economist Paula Diosquez-Rice)

- The sector that recorded the most significant rise was the commerce, hospitality, and restaurants, up by over 23% y/y, followed by the manufacturing sector and the construction sector. External demand was one of the main driving factors of activity in the meat-processing sector, thus raising the manufacturing sector's value added in the second quarter.

- The transport, storage, and communications sector also recorded a strong expansion. Other sectors posted more moderate annual expansions, namely the primary sector, the utilities sector, and healthcare, education, and social services.

- On the demand side, real exports of goods and services increased by 23.7% y/y. There were expansions in private-sector consumption, which rose by 8.1% y/y, despite the country's COVID-19-virus-related social distancing measures, and in public-sector consumption, which increased by 17.2% y/y as a result of increased activity in the public sector's healthcare services and education.

Europe/Middle East/Africa

- All major European equity indices closed higher; Spain +1.3%, UK +1.1%, France +0.8%, Germany +0.8%, and Italy +0.6%.

- Most 10yr European govt bonds closed higher except for UK flat; Italy -3bps, France -2bps, Germany/Spain -1bp, and UK flat.

- iTraxx-Europe closed flat/50bps and iTraxx-Xover -1bp/248bps.

- Brent crude closed -0.3%/$78.09 per barrel.

- The dire shortage of road freight drivers in the UK is causing major problems across the UK dried fruit and nut trade and agricultural commodity trade flows in general. "It is absolutely horrendous," Marcus Welch, managing director of Ozgur Foods UK, told IHS Markit. "We have done everything that we possibly can within our power in terms of organizing shipments earlier, trying to get goods in to ensure that we can cover orders. Shipping is challenging in one respect, but at this end now, we were trying to deliver in eight containers today to two different warehouses and six of them have failed because there were no drivers to deliver them." Simon Heather, director at Chelmer Foods, commented: "It is extremely difficult both on drivers and availability of equipment, containers and whole logistics world. Our haulers are struggling, as are everyone's haulers, whether that is to move containers or palletized goods. The pallet networks are oversubscribed, understaffed. Everything there is proving very difficult." The crisis has been attributed to the combined effects of Brexit and Covid-19. Heather said large numbers of drivers have left the industry in recent years due to the introduction of new CPC training requirements. He acknowledged that Brexit is another factor. (IHS Markit Food and Agricultural Commodities' Julian Gale)

- UK-based electric truck manufacturer Tevva has revealed a new medium commercial vehicle (MCV). According to a company statement, the vehicle is designed to have a gross vehicle weight (GVW) of 7.5 tons and to have the ability to carry up to 16 euro pallets at a payload of more than two tons. The company has not released any details about the powertrain or battery size, but it has said that the vehicle will offer a range of 250 km as a pure battery electric model, and that technology is being tested that will allow it to be fully charged in just one hour. It has also said that the range can be increased to 500 km with the installation of its "patented range extender technology (REX), which has now been upgraded to use hydrogen fuel cells". As for total cost of ownership (TCO), an important metric for running a vehicle as part of a business, the company says that the model can achieve parity at the level when 3,000 km are driven or 500 liters of diesel are consumed on a monthly basis. Tevva has confirmed that the vehicle will be built at a brand-new facility at London Thames Freeport (United Kingdom). (IHS Markit AutoIntelligence's Ian Fletcher)

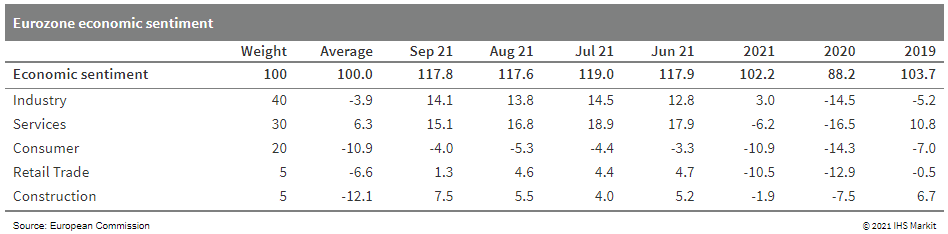

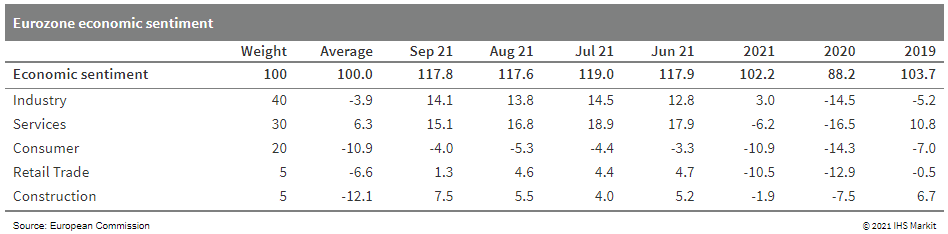

- September's economic sentiment indicator (ESI) for the eurozone showed an unexpected improvement, albeit a modest one, edging up from 117.6 to 117.8. This was almost one point above the market consensus expectation (of 116.9, according to Reuters' survey). (IHS Markit Economist Ken Wattret)

- The ESI remains consistent with eurozone GDP growth running well above its potential rate. September's index is more than 17 points above its long-run average and 13 points above its pre-pandemic level in February 2020.

- The breakdown of September's data by sub-sector shows a mixed picture. Industry, consumer, and construction sentiment improved, while services and retail sentiment weakened. All the sub-indices remained well above their long-run averages.

- Covestro held its annual investor conference on Tuesday and announced that it would relaunch a project to build a world-scale methylene di-para-phenylene isocyanate (MDI) facility. The company also said it would invest about €1 billion ($1.17 billion) in circular-economy projects. Covestro says it is laying the groundwork for sustainable growth and that its previously announced Sustainable Future strategy will continue to focus on the circular economy and on structurally increasing demand for sustainable solutions. (IHS Markit Chemical Advisory)

- Covestro temporarily suspended the MDI project at the beginning of 2020. The plant was originally due to be built at Baytown, Texas, at a cost of €1.5 billion and have a capacity of 500,000 metric tons/year. The company says it is now exploring plans to build the plant in the US or China. A final decision is expected to be taken after the current project stage, and commissioning of the plant is planned for 2026.

- Resuming the project partly reflects expected worldwide demand growth for MDI and toluene diisocyanate (TDI) of 6%/year through 2025, Covestro says. "For MDI in particular, demand is meeting an already high utilization of industry-wide capacities," it says.

- The new plant will use Covestro's AdiP technology, which is already used to make MDI at the company's Brunsbüttel, Germany, site. The technology can reduce steam by up to 40% and electricity by 25% per ton of product, cutting CO2 emissions by up to 35%, the company says.

- The company says its overall capex in 2021 will be about €800 million and rise substantially in subsequent years, on average at or slightly above the level of depreciation and amortization. The relaunched MDI project will significantly increase capex, particularly in 2024-26, it says. Meanwhile, to meet growth in demand for TDI, Covestro says it will expand its production capacities for that product at Dormagen, Germany, as early as 2023 through debottlenecking.

- Covestro says it will also invest about €300 million to build additional capacities in its coatings and adhesives business by 2025 to enable further growth. The company adds that it is expanding worldwide compounding capacities for its "highly differentiated" polycarbonate (PC).

- The Swedish National Institute of Economic Research revealed that Sweden's economic confidence weakened in September. The economic tendency indicator fell for the second consecutive month to 119.9 in September from 120.6 in August. The index, however, is still at a higher level than its long-term average. (IHS Markit Economist Marie-Louise Deshaires)

- Apart from a mild drop in December 2020, confidence increased each month since its low of 60.6 in April 2020. This upward trend was interrupted for the first time in August 2021 when the index fell for the first time in eight months.

- The fall in September was driven by weaker manufacturing confidence. The manufacturing industry's confidence indicator fell to 126.6 in September, from 128.5 in the previous month. Nevertheless, the index remains at an unusually high level driven by relatively small stocks and a large order backlog.

- Turkish-based bus manufacturer Karsan has introduced its new electric bus model family, the e-ATA series, reports Newsbase Daily News. Karsan CEO Okan Bash said, "Around 35% of buses sold in 2024 and at least 50% by 2030 will be all-electric. In order to support this transformation [from diesel], big cities such as Paris, London and Hamburg now require zero-emission vehicles in new bus purchases. Karsan … predicted this transformation and made all its plans accordingly five years ago. When we look at the European city bus market, we see that 83% of the market consists of 12 and 18-metre large buses. There is interest from municipalities such as Istanbul, Ankara, Eskisehir, Izmir, Mersin and Kocaeli [in Turkey]. We will even do a road show soon." (IHS Markit AutoIntelligence's Tarun Thakur)

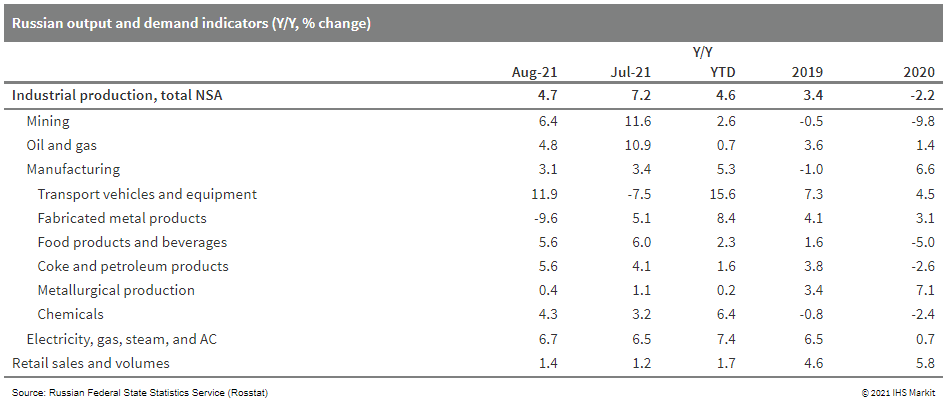

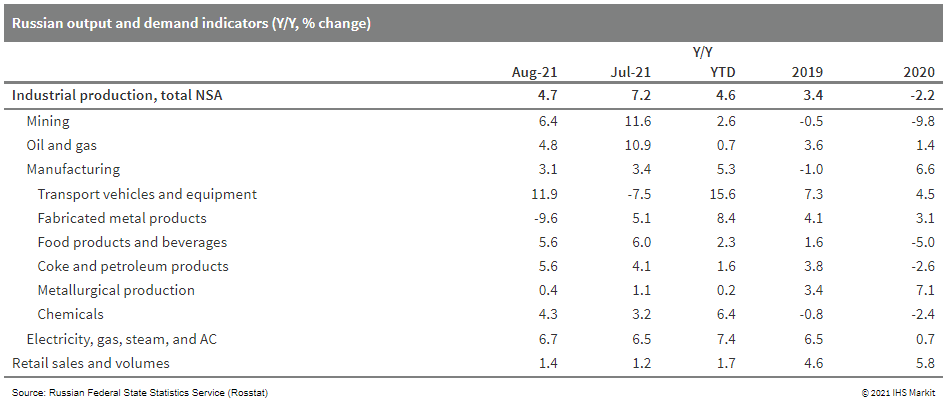

- Russia's detailed industrial production data showed a notable deceleration in the sector's growth rate in August because of a slowdown in the mining sector's expansion. The industrial production index increased by 4.7% year on year (y/y) in August, marking the weakest expansion rate since March. In cumulative terms, the sector grew at a slightly slower pace, at 4.5% y/y. On a seasonally adjusted basis, the index fell by 0.8% compared with the previous month, according to Russia's Federal Service for State Statistics (Rosstat). (IHS Markit Economist Lilit Gevorgyan)

- The breakdown of the index suggests that the key drag came from the mining sector. This sub-index increased by 6.4% y/y in August, easing from year-on-year gains of 11.6% in July, 13.4% in June, and 12.1% in May.

- In monthly comparison, the extractive sector rose by a meagre 0.1% in August, compared with 1.4% in July, which followed a 1.5% month-on-month (m/m) drop in June. In monthly terms, August results were disappointing, as oil and gas extraction fell by 0.3% in August after a 2.1% expansion in July.

- The monthly activity pattern has been volatile during prior months as well. Oil and gas extraction fell by 3.9% m/m in June after growing by 2.8% m/m in May.

- In light of the surge in natural gas prices in Europe, and considering Russia's important role as a key supplier, it is noteworthy that the all-important oil and gas extraction slowed to 4.8% y/y in August from 11% y/y in July, 12.8% y/y in June and 11.7% y/y in May.

- A closer look at the latest monthly data suggests that in annual comparison, the natural gas production significantly slowed in August, growing only in single digits after sharp rises during prior months. The changes in the statistical base have injected volatility in the annual growth rates.

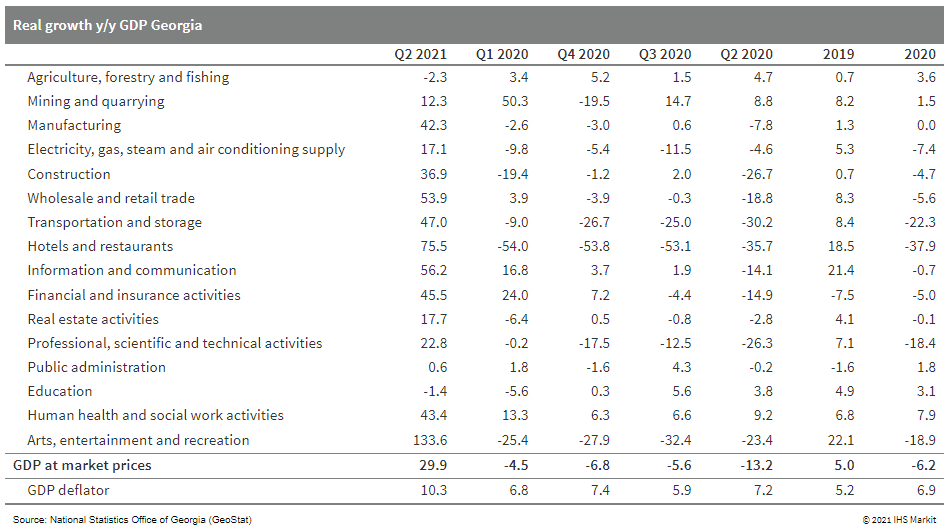

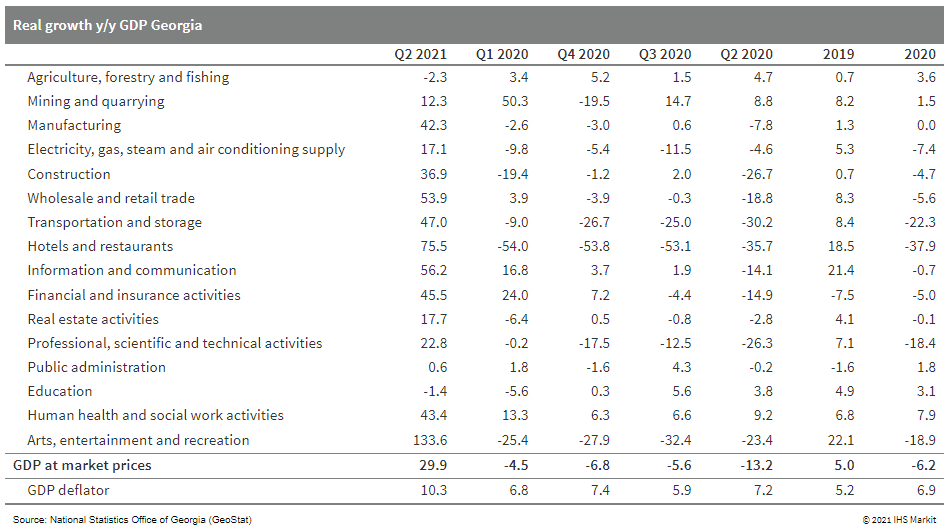

- Helped partly by base effects but also by surprisingly strong economic vigor, Georgian GDP in the second quarter expanded by nearly 30% year on year (y/y), aided particularly by manufacturing, domestic trade, and the emerging return of tourism activity. Risks with the vaccine program rollout, uncertainties related to external demand as well as the potential of political instability are among key risks clouding the generally improved near-term growth outlook. (IHS Markit Economist Venla Sipilä)

- The Georgian economy took a substantive step toward recovery during the second quarter, with the latest national accounts data from the National Statistics Office of Georgia (GeoStat) showing a surge of 29.9% y/y in GDP, following contraction of 4.5% y/y in the first quarter. This comes after the economy contracted by 6.2% in 2020.

- Manufacturing expansion significantly accelerated, reaching over 40% y/y, following contractions over the past two quarters and flat output in 2020 as a whole. Consequently, the share of manufacturing of GDP increased to 11.6%, while it still remained clearly behind domestic trade.

- Construction sector activity increased by nearly 37% y/y, following contraction of around one-fifth y/y in the first quarter.

- Conversely, the agricultural sector slid into contraction for the first time since the last quarter of 2019, with production falling by 2.3% y/y. Nevertheless, its GDP increased to 7.8% from 6.6% from the first quarter, while remaining below 8.4% in 2020.

Asia-Pacific

- Most APAC equity markets closed lower, except for Hong Kong +0.7%; India -0.4%, Australia -1.1%, South Korea -1.2%, Mainland China -1.8%, and Japan -2.1%.

- Alibaba's digital mapping service, AutoNavi, has rolled out a taxi ride-hailing platform in Beijing, China. To achieve this, AutoNavi has partnered with Beijing's Taxicab and Livery Association, making more than 100 of the city's small and medium-sized taxi companies available through a single online interface. The service, called Beijing Taxi, is accessible through AutoNavi's Amap app and its mini-programs on Alipay and WeChat, reports The South China Morning Post. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- BASF's integrated steam cracker and derivatives complex currently under construction at Zhanjiang, Guangdong Province, southern China, will generate an estimated €4.0-5.0 billion ($4.7-5.8 billion) in annual sales by 2030, according to BASF chairman Martin Brudermüller. (IHS Markit Chemical Advisory)

- The chemicals mega site on Donghai Island is also expected to achieve EBITDA of €1.0-1.2 billion by the end of the decade, with forecast capital expenditure (capex) on the project put at €8.0-10.0 billion, said Brudermüller at a virtual investor update by the company.

- BASF also outlined growth expectations for its worldwide battery materials business, saying it expects to generate more than €1.5 billion in sales by 2023 and more than €7.0 billion by 2030 as electric vehicle (EV) production grows.

- BASF expects to realize capex of about €2.0 billion/year on average in its growth projects, namely Zhanjiang and in the battery materials business, during 2021-25, and will average annual capex of about €2.6 billion to maintain and grow its existing businesses, according to Brudermüller. BASF will provide a new five-year capex plan at the end of February 2022 for the period 2022-26, he said.

- Zhanjiang will ultimately become BASF's third-largest production site, behind Ludwigshafen, Germany, and Antwerp, Belgium, Brudermüller said.

- The Zhanjiang site's initial development phase, focused on producing performance materials for the automotive and consumer industries, features plants under construction that will supply engineering plastics and thermoplastic polyurethanes "that are in high demand in Guangdong," he said. The first of these is expected to start operations by mid-2022, with the others to follow by 2023. Construction began officially in November 2019.

- The "heart" of the site will be the cracker, which together with several other associated downstream plants will be built during phase 1, with these expected to start up in 2025, Brudermüller said. The cracker and downstream plants in phase 1 will supply the C2, C3, and C4 value chains, according to an accompanying presentation. Further product lines will start up as of 2028 during the site's second development phase. "These will mostly consist of downstream plants that will be backward integrated into the streams of the steam cracker, achieving Verbund synergies," he added.

- Key factors in reducing emissions at Zhanjiang include the company having secured 100% renewable power, about 10 megawatts (MW), for the production plants in the site's initial development phase, and another will be replacing steam with electricity, such as in powering the turbines for the cracker's compressors.

- Toyota's Woven Planet announced yesterday (28 September) that it had bought US software company Renovo Motors, with Toyota noting that the acquisition will advance Woven Planet's efforts at programmable vehicles. Financial terms of the deal have not been disclosed. According to a statement from Woven Planet, the acquisition adds depth to its open vehicle development platform Arene. The company says that the move will bolster its team with top-tier engineers with deep expertise in building a complete software-defined vehicle infrastructure stack; provide a platform and software proven to work across multiple automaker platforms (which supports Woven Planet's desire to establish a hardware-agnostic operating system); and bring an established technology ecosystem of industry partners. Woven Planet hopes to sell its new automotive operating system, Arene, to other companies; it is being developed as an open software platform for what Woven Planet calls "programmable cars". Woven Planet expects to bring Arene to market by 2025; it is currently operating in proof-of-concept vehicles and pre-production cars. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Japan Inc. is picking up its pace in developing offshore wind power projects to help meet the country's decarbonization targets for the decades to come. The Ministry of Economy, Trade and Industry (METI) unveiled a series of measures aimed at streamlining and accelerating site selection processes after proposing in July to target a higher renewable proportion in Japan's power mix by 2030. (IHS Markit Net-Zero Business Daily's Max Lin)

- Among them are the Guidelines for Designation of Offshore Renewable Energy Power Facility Promotion Zones, which pave the way for the Japanese government to secure grid connections prior to auctions. The connections would be transferred to auction winners based on the policy design.

- The positive policy signals came after Tokyo vowed to develop 10 GW of offshore wind power by 2030 and 30-45 GW by 2040 last year. Now, an increasing number of domestic and foreign firms are showing an appetite for a Japanese offshore wind sector that could attract tens of billions of dollars in investments in the coming years.

- On 12 August, Mainstream Renewable Power and Norway's Aker Offshore Wind said they were the frontrunner to acquire an initial 50% stake via a joint bid for Progression Energy's 800-MW Japanese floating offshore wind project. The project has yet to reach the Final Investment Decision.

- PowerX announced in the same month that it would design and build an automated power transfer vessel to carry electricity from offshore wind farms to shore. Designed to have 100 grid batteries with a total storage capacity of 200 MWh, the 2,200-dwt ship is due to be launched in 2025.

- SsangYong and its lead manager, the EY Hanyoung accounting firm, plan to select a preferred bidder and a secondary preferred bidder by mid-October, reports the Yonhap News Agency. "We are planning to announce the selection of a preferred bidder for SsangYong around [12 October] after thoroughly reviewing the [four] bidders' funding plans to acquire SsangYong," said an unnamed EY Hanyoung official. As reported earlier, South Korean electric bus manufacturer Edison Motors, electric vehicle (EV) and battery manufacturer EL B&T, and US-based EV startup Indi EV have submitted final bids for a controlling stake in SsangYong. Once the preferred bidder is selected, SsangYong and EY Hanyoung plan to conduct a two-week due diligence process on the bidders in October and sign a deal in November. It is estimated that up to KRW1 trillion (USD843 million) is needed to take over SsangYong. (IHS Markit AutoIntelligence's Jamal Amir)

- Vietnamese automaker VinFast has agreed a partnership with US-based Cerence, according to which the latter will provide voice-controlled artificial intelligence (AI) solutions for its smart electric vehicles (EVs), reports the Yonhap News Agency. Under the partnership, Cerence will supply VinFast with some core technologies, such as automatic speech recognition, natural language understanding (NLU), text-to-speech, and natural language generation (NLG), as well as enhancing voice signals to give the virtual assistant the ability to communicate like a human. The virtual assistant will be able to understand users' commands and questions in six languages, including English, German, French, Spanish, and Dutch, highlights the report. The automaker is also working with VinBigData JSC to develop ViVi, a multi-regional Vietnamese-language assistant. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 29 September 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.