Equity markets closed mixed across major US, European, and APAC indices. US and benchmark European government bonds closed lower. European iTraxx and CDX-NA closed flat across IG and high yield. The US dollar, oil, and natural gas closed higher, while gold, silver, and copper were lower.

Americas

- Most major US equity indices closed lower today, except for the DJIA +0.3% which also closed at a new all-time high. S&P 500 -0.1%, Nasdaq -0.6%, and Russell 2000 -2.8%.

- 10yr US govt bonds closed +3bps/1.72% yield and 30yr bonds +2bps/2.41% yield.

- CDX-NAIG closed flat/56bps and the new OTR CDX-NAHY 36.1 closed at 315bps.

- DXY US dollar index closed +0.2%/92.94.

- Gold closed -1.2%/$1,712 per troy oz, silver -1.4%/$24.77 per troy oz, and copper -0.8%/$4.04 per pound.

- Crude oil closed +1.0%/$61.56 per barrel and natural gas closed +1.3%/$2.65 per mmbtu.

- Bankruptcy filings by US consumers under chapter 7 were down 22% last year compared with 2019, while individual filings under chapter 13 fell 46%, according to Epiq data. After holding above 50,000 filings a month in 2019 and in the first quarter of 2020, bankruptcy filings have remained below 40,000 a month since last March when the pandemic hit. By contrast, commercial bankruptcy filings rose 29%, with more than 7,100 businesses seeking chapter 11 protection last year, according to Epiq. (WSJ)

- The head of the Centers for Disease Control and Prevention pleaded with Americans to wear masks and stick with COVID-19 mitigation measures, warning of "impending doom" as cases, hospitalizations and deaths begin to rise again. The seven-day average for new daily Covid-19 cases is now almost at 60,000, up 10% from the prior week. Hospitalizations are also up, to about 4,800 a day from 4,600 a week earlier. Deaths, a lagging indicator, have also started to rise again, she said. (Bloomberg)

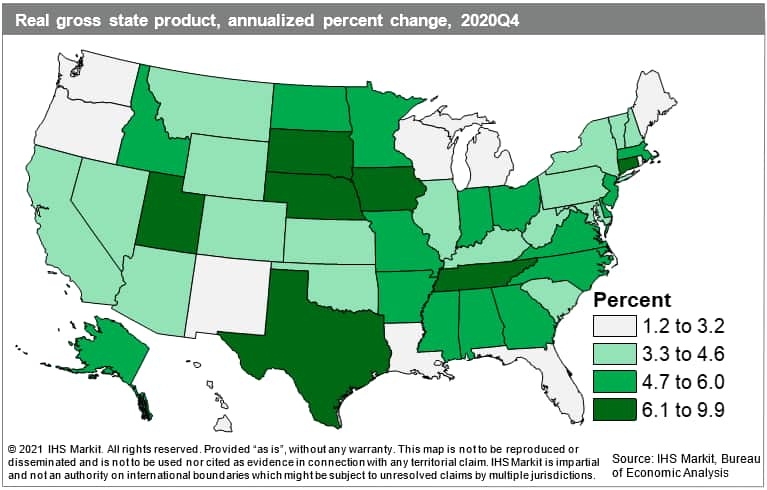

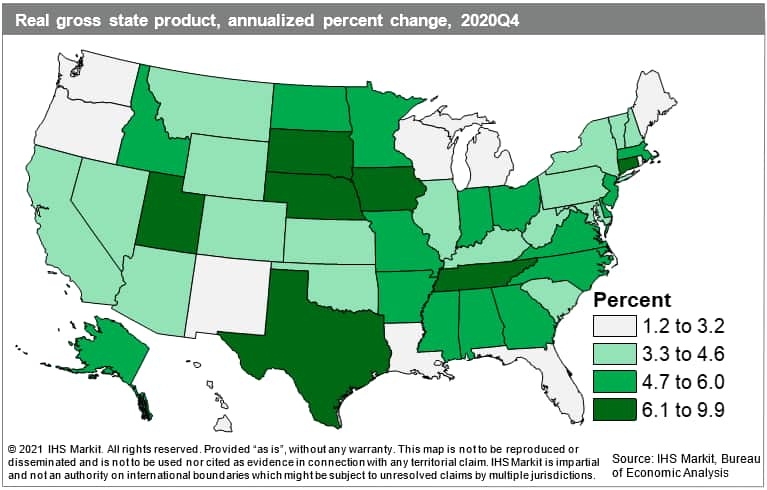

- Ongoing recoveries from the COVID-19 pandemic brought real gross state product (GSP) gains to all US states in the fourth quarter of 2020, but reimposed containment measures and restrictions on business activity meant slower growth in some states according to the latest data from the Bureau of Economic Analysis (BEA). (IHS Markit Economist James Kelly)

- Strong and steady increases in finance and insurance output supported expansions in every state, but accommodation and food services faltered, dipping 7.1% as new waves of COVID-19 hospitalizations depressed hospitality business activity.

- Moderate rises in business services and healthcare output helped to blunt the weakness in leisure and hospitality.

- Declines in accommodation and food services output struck many regions that reinstituted restrictions on businesses in the face of a fall and winter surge in COVID-19 cases. States in the Pacific Northwest, Great Lakes, and the Northeast all recorded slower gains in the fourth quarter because of stumbles in leisure and hospitality.

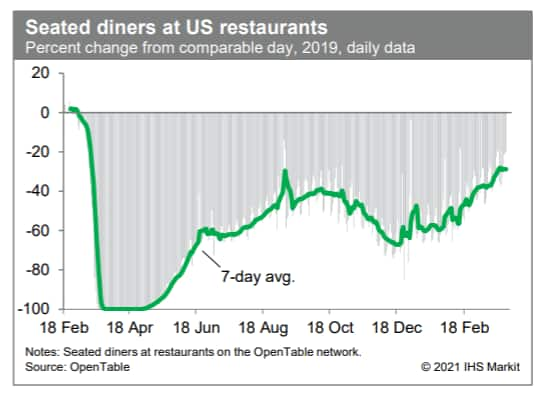

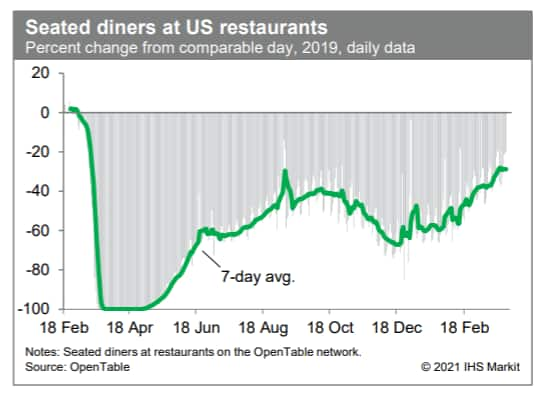

- Averaged over the week ending yesterday, the count of seated diners on the OpenTable platform was down about 29% from the comparable period in 2019. The trend in dining out has been improving in recent weeks, as restrictions on indoor dining are easing and opportunities for outdoor dining are improving with the weather. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Jeep is to create an electric vehicle (EV) charging network branded Jeep 4xe and is to work with Electrify America to deploy EV charging stations at off-road trailheads in the United States, according to a company statement. Over the next 12 months, Jeep plans to install Level 2 charging stations for EVs at Jeep Badge of Honor off-road trailheads in the US. The first locations due to receive the charging stations are Moab, Rubicon Trail, and Big Bear off-road trailheads. The Jeep 4xe Charging Network is to be operated by Electrify America and is to be accessible by other brands. However, Jeep 4xe plug-in hybrid vehicle owners will receive free charging. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- European equity markets closed mixed; Germany/France +0.5%, Italy +0.1%, and UK/Spain -0.1%.

- 10yr European govt bonds closed lower; France/Germany/Italy/Spain/UK +3bps.

- iTraxx-Europe closed +1bp/54bps and iTraxx-Xover flat/264bps.

- Brent crude closed +0.8%/$64.92 per barrel.

- Greece's non-seasonally adjusted unemployment rate stood at 16.2% during the last quarter of 2020. This is down from 16.8% during the same period of 2019. (IHS Markit Economist Diego Iscaro)

- The unemployment rate averaged 16.3% in 2020, 1 percentage points below its level in 2019. While employment fell by 0.9% last year, the labor force declined by a stronger 2.1% as a large number of potential jobseekers exited the labor market while many sectors of the economy were closed during lockdown periods.

- Among the largest economic sectors, employment fell particularly sharply in accommodation/food services (-11.9% y/y), agriculture (-11.3% y/y) and manufacturing (-4.9% y/y). On the other hand, employment in professional/technical activities (+15.3% y/y) and public administration/defense (+12.8% y/y) grew during the fourth quarter.

- A growing number of consumers see plant-based alternatives to meat and dairy as the sustainability savior for the agri-food sector's environmental struggles, but despite a surge in sales it remains unclear whether these products will grow beyond a niche market or become the disruptive force some hope they can be. (IHS Markit Food and Agricultural Policy's Steve Gillman)

- In Europe, sales of plant-based alternatives represent about 0.7% of the market for meat and 2.5% for dairy. Still, the strong demand for these animal-free products has sparked a wave of new companies trying to capture a slice of its potential future value - the global market for meat alternatives alone could be worth $35 billion by 2027.

- The European Commission expects EU meat consumption per capita to decline only by 1.1 kg by 2030, reaching 67.6kg. By the same time, EU plant protein consumption could increase 50%, but that would still see plant proteins in diets at just around 6.7kg per capita. This estimate suggests that people's diets will remain relatively similar over the next decade, but plant-based alternatives would still gain a strong enough market share to keep growing.

- The US is currently leading the way in bringing together these different elements for a commercial and scalable plant-based product. Californian based Impossible Foods has raised $1.3 billion of investment and its ongoing success in the market saw them recently increase production by 600% and cut their prices by 20% for 17,000 US grocery stores.

- Beyond Meat, another Californian-based company, has a market value of around $8.6 billion and continues to expand its production capacity in the US while also increasing manufacturing capabilities in Europe.

- Arrival has announced that it has completed its successful listing on the Nasdaq Global Select Market. According to the company, this follows the completion of it combining with CIIG Merger Corp. The company added that the process generated USD660 million in gross proceeds, which will be used to ramp up the delivery of its battery electric vehicles (BEVs) and expand its global production footprint which will be underpinned by a global network of "Microfactories". (IHS Markit AutoIntelligence's Ian Fletcher)

Asia-Pacific

- APAC equity markets closed mixed; Japan +0.7%, Mainland China +0.5%, Hong Kong flat, South Korea -0.2%, and Australia -0.4%.

- Losses at Archegos Capital Management, run by former Tiger Asia manager Bill Hwang, have triggered the liquidation in excess of $30 billion in value. Banks were continuing to sell blocks of stocks linked to Archegos Monday, traders said. Archegos took big, concentrated positions in companies and held some positions in a mix of stock and equity swaps. (WSJ)

- The China Banking and Insurance Regulatory Commission (CBIRC), Ministry of Housing and Urban-Rural Development, and the People's Bank of China (PBoC), China's central bank, released a joint notice titled "Preventing working capital loans from entering real estate sector" on the CBIRC website on 26 March. (IHS Markit Banking Risk's Angus Lam)

- The notice is based on the National People's Congress's "home for living not for flipping" message, and has outlined several conditions. These include ensuring that shell companies will not be given working capital loans, additional scrutiny of companies' records that had only held real estate properties for less than a year, identify companies' repayment ability and source of income, and identify the reasonableness of requesting a working capital loan shortly after a property transaction.

- The notice continues to push banks to ensure that loans are provided to micro, small, and medium-sized enterprises (MSMEs). Overall, local branches of the CBIRC will need to finish inspecting banks' adherence to the above-mentioned by 31 May.

- Chinese electric vehicle (EV) startup NIO is halting production temporarily at its Hefei plant in Anhui province, China, due to a semiconductor shortage. The company expects the production suspension to last for five working days, starting from 29 March. Because of the disruption, NIO now expects to deliver 19,500 vehicles in the first three months of the year, compared with the previously announced forecast of 20,000 to 20,500 vehicles. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The US French fry multinational Lamb Weston has announced the construction of a new potato processing facility in China's Inner Mongolia in order to capitalize on the anticipated market growth opportunity. The USD250 million French fry processing facility in Ulanqab, Inner Mongolia has the capacity to produce more than 250 million pounds (113,400 tons) of potato products per year. The facility is expected to add to the company's existing in-country production from its facility in Shangdu, Inner Mongolia. The new facility is expected to be completed in the company's first half of fiscal year 2024. (IHS Markit Food and Agricultural Commodities' Jana Sutenko)

- Honda has confirmed that it has signed agreements to sell its production facilities in the United Kingdom and Turkey. According to a statement, the company said that it has entered into a contract with Panattoni for the sale of its Swindon (UK) vehicle manufacturing facility. Honda added that, following the end of production at the plant on 30 July, the automaker will decommission the site, which it plans to hand over early in 2022, once necessary consents have been obtained. Honda first announced in February 2019 that it planned to end production at these two sites, as part of a restructuring of its global manufacturing footprint and following years weak sales performances in Europe. (IHS Markit AutoIntelligence's Ian Fletcher)

- Hyundai has announced that it will start production of electric vehicles (EVs) at its new Indonesian plant from March 2022, reports Tempo.co, citing Hyundai Motor vice-president and chief operating officer for the Asia-Pacific region Lee Kang Hyun. Hyundai has spent USD1.55 billion to build a factory in Kota Deltamas, an integrated industrial, commercial, and residential district east of the capital city Jakarta. However, Hyun noted that this plant will not only exclusively produce EVs but also traditional internal combustion engines (ICE). (IHS Markit AutoIntelligence's Jamal Amir)

- MG Motor India has collaborated with Indian Institute of Technology (IIT) Delhi's Centre for Automotive Research and Tribology (CART) for research on electric and autonomous vehicles, according to a company press release. The partnership, which has been formed through Foundation for Innovation and Technology Transfer (FITT), IIT Delhi, aims to further strengthen MG's focus on connected, autonomous, shared, and electric (CASE) mobility with the help of related research for the deployment of electric and autonomous vehicles in India. The automaker already has the first electric sport utility vehicle (SUV), the MG ZS EV, and the first autonomous Level 1 premium SUV, the Gloster, in its line-up and aims to use the research to develop its future autonomous vehicles. (IHS Markit AutoIntelligence's Jamal Amir)

- Bharat Forge has acquired a newly formed company within Kalyani Group named Kalyani Powertrain Private Limited (KPPL), according to a Bombay Stock Exchange (BSE) filing by Bharat Forge. KPPL has been formed with an aim to develop electric powertrain transmission systems for the automotive sector. It has not commenced its business yet. (IHS Markit AutoIntelligence's Jamal Amir)

Posted 29 March 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.