All major European equity indices closed lower, while APAC and US markets were mixed. US and benchmark European government bonds closed sharply lower. CDX-NA closed wider across IG and high yield, while iTraxx-Europe closed almost flat and iTraxx-Xover was wider on the day. Natural gas, gold, and silver closed higher, the US dollar was flat, and oil and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed mixed, with the Nasdaq +1.0% and S&P 500 +0.2% closing at new all-time highs; DJIA -0.4% and Russell 2000 -0.5%.

- 10yr US govt bonds closed -5bps/1.48% yield and 30yr bonds -5bps/2.10% yield.

- CDX-NAIG closed +1bps/48bps and CDX-NAHY +3bps/273bps.

- DXY US dollar index closed flat/91.89.

- Gold closed +0.2%/$1,781 per troy oz, silver +0.5%/$26.22 per troy oz, and copper -0.3%/$4.28 per pound.

- Crude oil closed -1.5%/$72.91 per barrel and natural gas closed +2.1%/$3.59 per mmbtu.

- OPEC and OPEC+ are set to meet later this week, with the trajectory of supply management beyond July hanging in the balance. Saudi Arabia's clear intent to lag the demand recovery has yielded much of what was hoped for, with Brent prices oscillating in the mid-high $70s and physical markets tightening, especially in highly visible markets like the US. But as always in oil markets, there is no such thing as a goldilocks price range, and the bullish momentum that has vaulted the oil market to these levels shows no signs of relenting. We expect that in the face of growing pressures and given the visible tightening and recovering demand, the OPEC+ group is likely to continue to unwind production cuts in August and September along the same rate as the recent collective increases (~500,000 b/d per month). Playing with fire: without additional production in August and September, physical crude markets risk getting much tighter. In our base case forecast, July, August, and September carry the deepest global oil deficit of the year at an average 1.5 MMb/d. Part of the leading from behind strategy was to avoid reversing price momentum, and part was to keep some flexibility around the eventual timing of the return of Iranian barrels, if and when they were to re-enter the markets as negotiations to revive the JCPOA gathered steam. (IHS Markit Energy Advisory's Roger Diwan, Karim Fawaz, Ian Stewart, Edward Moe, and Sean Karst)

- The biggest US banks on Monday announced plans to pay investors an extra $2bn of dividends next quarter after the Federal Reserve last week loosened restrictions on payouts to shareholders that were imposed during the COVID-19 pandemic. The move underscores the confidence of the large US lenders, which think they can return more capital to shareholders and still remain comfortably above the levels mandated by the Fed. The Fed this past Thursday released the results of its "stress tests" for banks, which prompted the US central bank to further ease restrictions on dividends and buybacks. (FT)

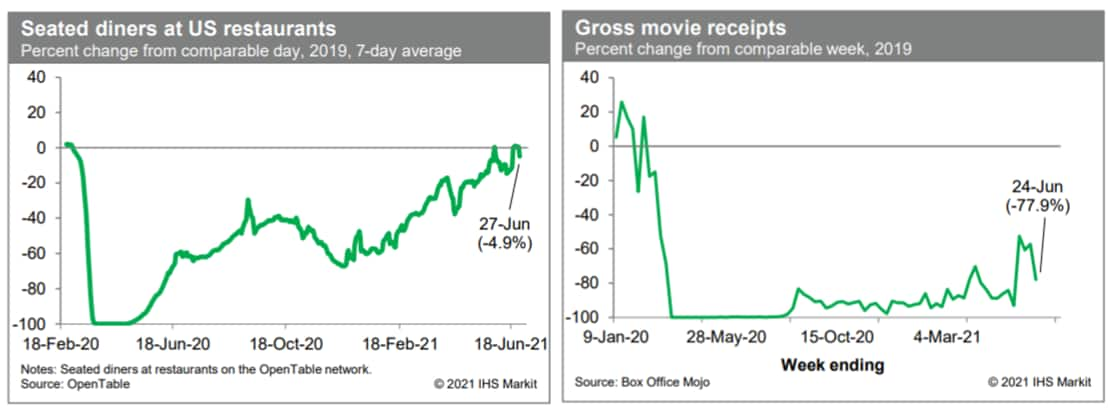

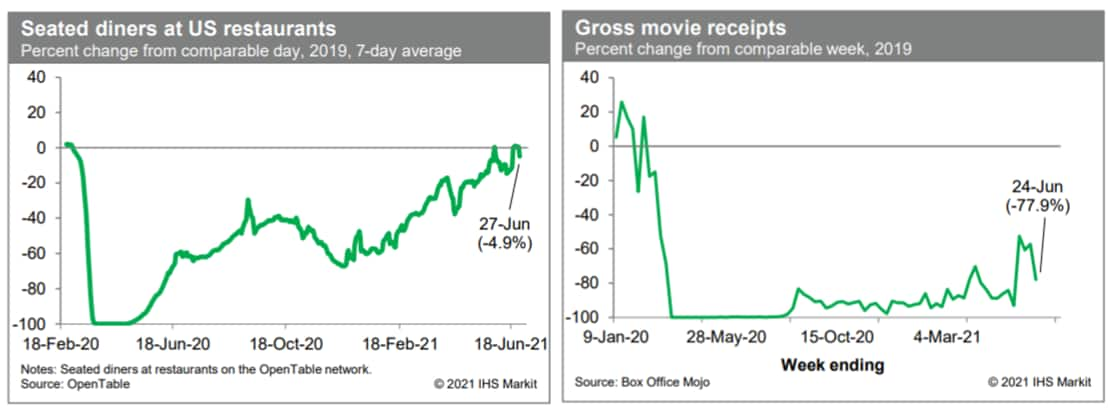

- Averaged over the last week, the count of seated diners on the OpenTable platform has been about 4.9% below the comparable period in 2019. Within the last month or so, this average has touched zero (relative to 2019) twice. For all intents and purposes, restaurant activity appears to have nearly fully recovered. Meanwhile, box office revenues last week were 77.9% below the comparable week in 2019, a sharp decline from the prior three weeks, when revenues were down roughly 60%. The recovery in movie-theater activity—an indoor and socially dense activity that has been disrupted by streaming services—has a long way to go. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Autonomous vehicle (AV) startup Pony.ai has appointed Lawrence Steyn, vice-chairman of investment banking at JPMorgan Chase & Co, as chief financial officer (CFO). Pony.ai said Steyn's hiring will help the company with "commercial growth and global deployment". This comes as the company is considering going public in the US to fund its goal of commercializing driverless ride-hailing services, reports Reuters. James Peng, chief executive of Pony.ai, said, "For autonomous driving, it's a big opportunity. But at the same time, it's a long term, big opportunity. So it requires a long lead way for spending. That means all the autonomous driving companies need to raise enough funding to support their operations". Pony.ai claims to be the first company to test AVs on public roads in both the United States and China. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The California Public Utilities Commission (CPUC) on 24 June approved what it called "an historic decision" to order the state's utilities to procure 11,500 MW from a combination of energy efficiency programs and clean renewable sources to come online between the years 2023 and 2026. As of the end of 2020, the state had about 80,000 MW of installed power capacity, with natural gas-fired power the largest component at nearly 40,000 MW, according to the California Energy Commission (CEC). Solar photovoltaic and large hydropower each accounted for about 12,500 MW of capacity, and wind power was at about 6,000 MW. (IHS Markit Climate and Sustainability News' Kevin Adler)

- US beekeepers suffered near record colony losses last year and many continue to struggle to keep their businesses afloat, according to annual survey of beekeepers funded by USDA. Preliminary analysis of the survey by the non-profit Bee Informed Partnership (BIP) found beekeepers lost 45.5% of their managed honey bee colonies from April 2020 to April 2021, the second-highest loss rate since the nationwide survey began in 2006 and far above the 23% loss rate beekeepers consider economically sustainable. The reported losses are 6.1 percentage points higher than the average loss rate of 39.4% over the last decade. Conducted by BIP along with researchers at the University of Maryland and Auburn University, the survey includes information from 3,347 beekeepers who manage more than 192,000 colonies across the country. The participants collectively manage some 7% of the nation's estimated 2.71 million managed colonies. The annual report is considered a critical indicator of bee health and the state of commercial beekeeping and its findings add to ongoing concern about the state of the nation's pollinators, an issue that remains a headache for farmers, food manufacturers, pesticide companies, EPA and state agriculture officials. (IHS Markit Food and Agricultural Policy's JR Pegg)

- The Central Bank of the Argentine Republic (Banco Central de la República Argentina: BCRA) on 25 June issued a communiqué extending the ban over banks' dividend payments until end-2021. The original restrictions on dividend payments were imposed in March 2020 with an original deadline in June 2020, however the deadline has been rolled over three times since then. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- Given that the sector is very well capitalized - as shown by its Tier 1 ratio at 23.4% in March 2021 - and that the economy is starting to recover, the extension of the deadline appears to be related to capital controls, rather than to boost the solvency ratios of banks.

- Foreign-owned banks' profitability ratios stood well above the sector with the return on assets (ROA) at 3.0% and the return on equity (ROE) at 18.6%, both as of end-2020. Also, their capital ratios stood largely above the sector's average. Therefore, a limitation to distribute dividend payments suggests that the BCRA is rather focusing on reducing the demand of foreign currency and consequently limiting the depreciation of the peso and protecting its reserves.

Europe/Middle East/Africa

- All major European equity indices closed lower; Germany -0.3%, UK -0.9%, France -1.0%, Italy -1.1%, and Spain -2.0%.

- 10yr European govt bonds closed sharply higher; UK -6bps, Germany/Italy -4bps, and France/Spain -3bps.

- iTraxx-Europe closed flat/46bps and iTraxx-Xover +5bps/230bps.

- Brent crude closed -1.6%/$74.14 per barrel.

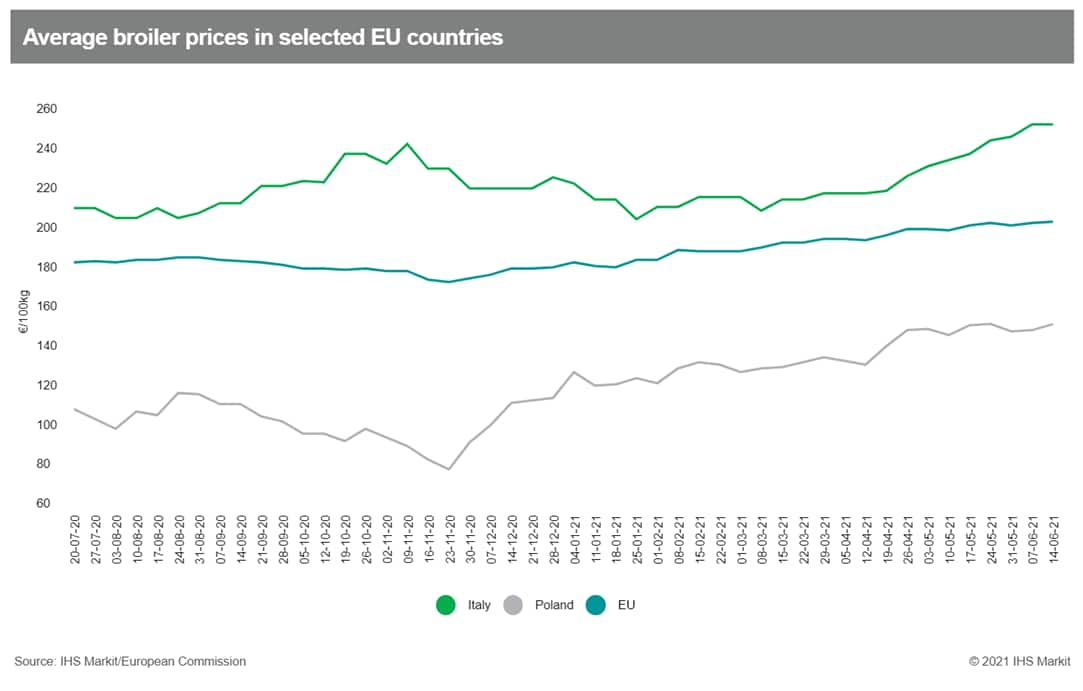

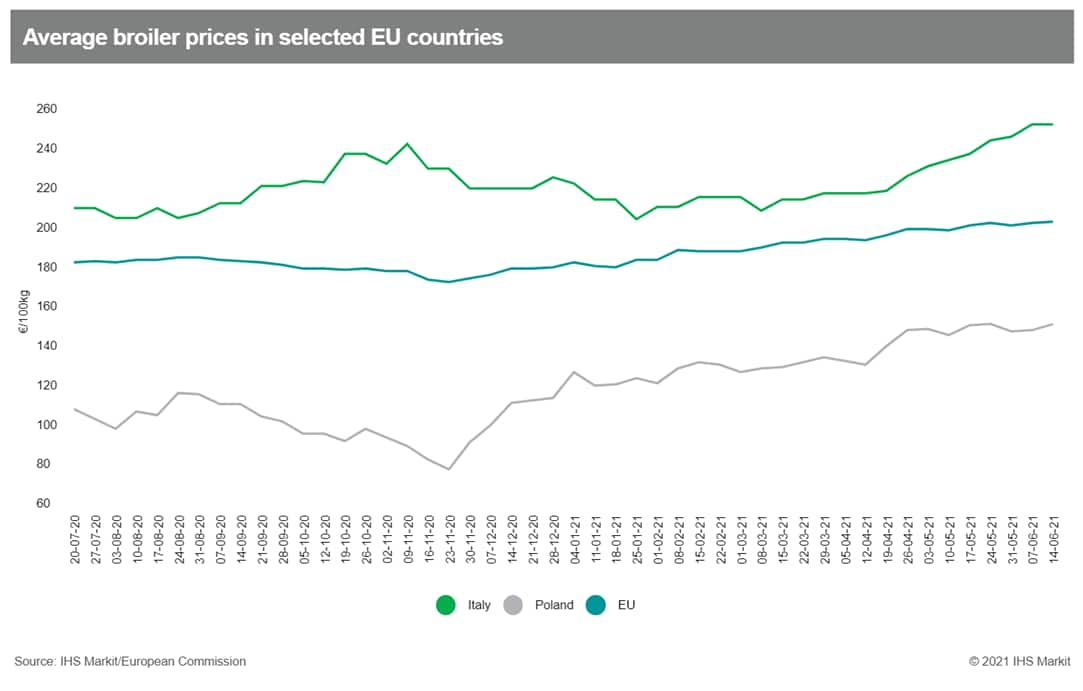

- EU broiler prices have continued to nudge upwards over the past week, as low levels of supply have encountered growing demand for grilling pieces in particular. The latest weekly increase in the EU average broiler price was only marginal, but it did establish another multi-year high of EUR205.34 per 100kg, for the week ending 20 June. This is now some 14% above the price level recorded this time last year. These high prices are being set in spite of a significant dip in EU poultrymeat exports so far this year. Exports from the EU27 to all destinations including the UK in the first four months of 2021 totalled 634,346 tonnes carcase weight, down by 15% on volume terms on the same period last year. (IHS Markit Food and Agricultural Commodities' Chris Horseman)

- In Germany, the Federal Statistical Office (FSO) has reported that real monthly earnings in the whole economy (including employees in the public sector and bonus payments, and assuming for analytical purposes that the employment structure of the previous year has remained constant) relapsed from 0.4% year on year (y/y) in the fourth quarter of 2020 to -2.0% y/y in the first quarter, returning to negative territory (IHS Markit Economist Timo Klein)

- Nominal wage growth only deteriorated from 0.2% y/y to -0.7% y/y owing to the concurrent spike of consumer price inflation from -0.2% to 1.3%. Nevertheless, -0.7% is well below its long-term average of 2.1% and matches the series low prior to the pandemic, which was in the second quarter of 2009 as a consequence of the global financial crisis.

- As in the three previous quarters, the number of hours worked remains an important determining factor for monthly earnings. As the number of people forced to enter short-time work schemes rebounded during November 2020-February 2021, the decline in hours worked deepened from -2.3% y/y to -3.0% y/y. This matters because government subsidies for short-time work are not classified as earnings as reported in these statistics (employees who were furloughed, i.e., effectively put on 0% short-time, were ignored altogether).

- The first-quarter breakdown for different types of employment shows that nominal wage growth (total: -0.7% y/y) suffered the least among full-time employees, followed by part-time workers (-1.0%) and the holders of so-called mini-jobs (-1.8%). The underperformance of the latter group reflects the reimposition of tight lockdown restrictions during this period, as this affected activities in the recreation, entertainment, and catering sectors in particular.

- The breakdown by skill level (which excludes the mini-job segment) reveals major differences, unlike the relatively even picture in the previous quarter. Leading employees did best at 1.4% y/y, followed by skilled employees with special qualifications (0.2%). The three other groups suffered substantial wage declines compared with the first quarter of 2020 - employees with average skills posted -1.6% y/y, unskilled workers -2.0% y/y, and semi-skilled workers even -2.7% y/y.

- MAN Truck & Bus, a subsidiary of Volkswagen (VW) Truck & Bus, in partnership with German logistics company Hamburger Hafen und Logistik AG (HHLA) has tested automated trucks in the container terminal of Altenwender at the port of Hamburg (Germany). The tests were conducted in late May involving trucks with electronic automation systems, operating in regular traffic. Forwarding company Spedition Weets carried 40-foot containers from Weets Logistic Center in Soltau to Hamburg on behalf of VW Group Logistics. To make way for a trained MAN safety driver, the Weets driver shifted to the passenger seat at the check gate of the terminal's entrance. The truck accelerated autonomously to reach block storage and manoeuvred backwards into the correct parking position. After handling the container, the return trip to the check gate was also autonomous. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Renault Group has announced three deals that will support its electrified vehicle plans. According to a statement released this morning, the company has signed two agreements that will lead to the development and manufacture of batteries for electrified vehicles in France. The first announcement relates to a strategic partnership that has been signed with Chinese battery manufacturer Envision AESC to set up a large-scale 'gigafactory' facility in Douai (France), which will be close to its Renault ElectriCity battery electric vehicle (BEV) hub. The site will initially have the capacity to manufacture 9 GWh of batteries in 2024, but this is planned to expand to 24 GWh by 2030. Around EUR2 billion will be invested to support this investment, which will "produce latest technology, cost-competitive, low-carbon and safe batteries for electric models," which it added will include the production of the R5 subcompact. (IHS Markit AutoIntelligence's Ian Fletcher)

- A consortium of GE Renewable energy, LM Wind Power, and TNO are cooperating on Project TIADE (Turbine Improvements for Additional Energy) to improve wind turbine blade designs and efficiency. The research, which began in 2020, will explore the use of innovative blade add-ons on a full-scale 130-meter diameter turbine installed in Wieringermeer, Netherlands. The outer 12 meters of the blade will be replaced with various add-ons, such as spoilers, serrations, vortex generators, and 'turbulators', and will be assessed with advanced measurement techniques. GE expects that from 2023 onwards, the technology can be applied to new wind turbines or partly retrofitted to existing ones, helping to lower the levelized cost of energy. The TIADE project is a 46-month long program partially funded by the 'Topsector Energiesubsidie' of the Dutch Ministry of Economic Affairs. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- Edete Precision Technologies for Agriculture has just launched a technology to pollinate trees which use wind pollination such as pistachios and dates, after developing insect-pollination solution. Effective natural wind pollination depends on several factors: bloom of male and female plants, temperature, day length and water and soil quality. The mechanical pollinators, called 2Be, do not depend on flowering synchronisation, thanks to the ability to produce and preserve pollen years in advance and disperse pollen at the appropriate flowering times. Edete collects the flowers mechanically, separates the pollen from the anthers and other flower parts, and produces pure pollen. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- According to statements made by the African Centres for Disease Control and Prevention (Africa CDC) on 24 June, the total number of COVID-19 vaccines procured by African nations so far amounts to 61.4 million, with 48.6 million of these having been administered, among a total population of 1.1 billion. According to the Africa CDC, 1.12% of the African population have been fully vaccinated. The countries that have procured and administered the highest number of vaccines, in comparative terms, are Algeria, Egypt, Morocco, Nigeria, and South Africa. South African news website News24 reported the comments of Strive Masiyiwa, special envoy of the African Union on COVID-19 vaccines, as stating that the shortage of COVID-19 vaccine doses was the result of "deliberate actions by the world's richest nations". Masiyiwa pointed to the fact that although only 1.1% of the African population had been fully vaccinated, this figure stood at 45% in the United States, 47% in the United Kingdom, and 29% in the European Union. (IHS Markit Life Sciences' Brendan Melck)

- Central banks' financing of wide fiscal deficits in the sub-Saharan African (SSA) region continued in the early months of 2021. This trend underlines the region's shallow capital markets and could become inflationary if maintained unabated. (IHS Markit Economist Thea Fourie)

- Central banks' financing of wide government deficits in the SSA region gained momentum during 2020 as the COVID-19 pandemic weakened government income and pushed up healthcare-related state spending. The region's relatively low level of development which manifests in tax administration gaps and ultimately weak revenue-generation capabilities, combined with mostly shallow domestic capital markets, contributed to the policy shift.

- Even the central bank of one of the more-advanced economies in SSA, the South African Reserve Bank (SARB), stepped in briefly to provide much-needed liquidity to the domestic market through purchases of South African government bonds (SAGB) in the primary and secondary markets. Since then, the SARB has wound down its bond-buying programme due to COVID-19 pandemic-related liquidity pressures and has resumed normal monetary operations.

- Central bank support to finance the fiscal budget occurs despite the significant external emergency financing provided to countries in SSA under the IMF's Rapid Credit Facility (RCF) and Rapid Financing Instrument (RFI) programmes in 2020-21. The support from the IMF was supplemented by the G20's Debt Service Suspension Initiative (DSSI). In April 2020, Nigeria secured a USD3.4-billion RFI facility and Ghana secured a USD1.0-billion RCF from the IMF. In March 2021, Ghana issued a USD3-billion Eurobond and it has already received budget approval for a further USD1 billion this fiscal year. Kenya secured a USD739-million RCF from the IMF in May 2020, followed by a USD770-million Extended Credit Facility (ECF) and USD1.77-billion Extended Fund Facility (EFF) in April 2021. In June 2021, Kenya issued a USD1-billion Eurobond, while its central bank financing continues unabated.

Asia-Pacific

- APAC equity markets closed mixed; Australia/South Korea/Mainland China flat, Japan/Hong Kong -0.1%, and India -0.4%.

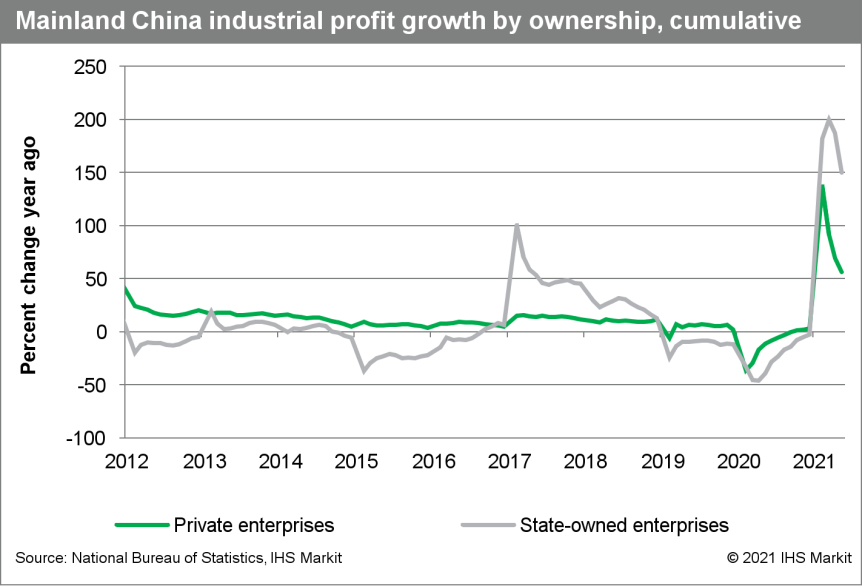

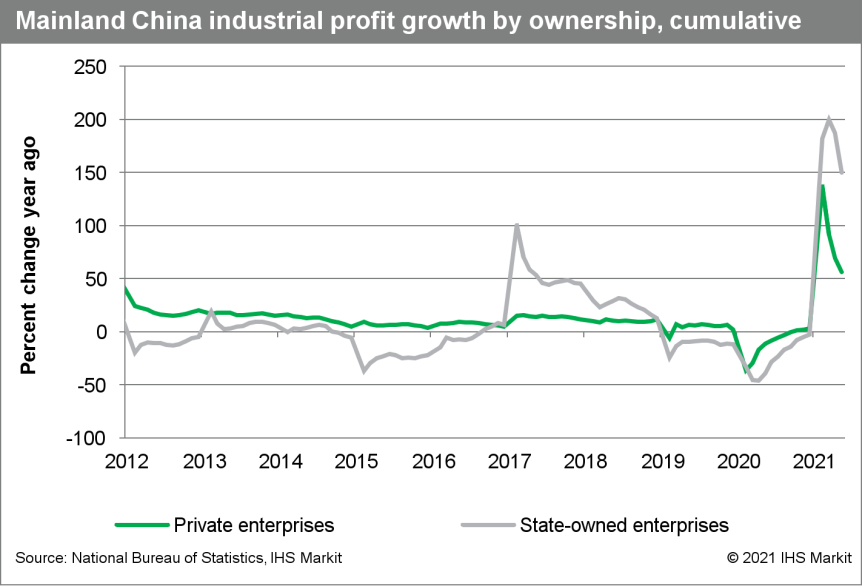

- Rising profitability continues to support mainland China's industrial profits recovery through May whilst sectoral imbalance remains significant (IHS Markit Economist Lei Yi)

- Mainland China's industrial profits expanded by 83.4% year on year (y/y) through May, down by 22.7 percentage points from April on a rising baseline. On a two-year (2020-21) average basis, industrial profits rose by 21.7% y/y cumulatively in the first five months of 2021, 0.6 percentage point lower compared with the April reading. For May alone, industrial profits grew 36.4% y/y, or by 20.2% on a two-year average basis (compared with 22.6% in April), according to the National Bureau of Statistics (NBS).

- With operating revenue growth persistently outpacing costs growth so far in 2021, standing at 30.5% y/y and 28.6% y/y, respectively, through May, the year-to-date profitability ratio further edged up to 7.11%, up 2.05 percentage points y/y. The profitability ratio for May alone came in at 8.02%, up by 0.95 percentage point y/y.

- Sectoral imbalance in industrial profit recovery remained significant in May, as the upstream mining and raw material manufacturing sectors continued to benefit from the global commodity rally, while downstream sectors saw rising cost pressures. Partially owing to the dominant role of state-owned enterprises (SOEs) in the mining sector, industrial profit growth of SOEs took the lead across ownership categories. Meanwhile, private enterprises' profit growth lagged behind the headline industrial profit growth, with consumer-facing sectors like clothing and furniture still reporting profits below pre-pandemic levels.

- By the end of May, the average liability-to-asset ratio of industrial enterprises reached 56.3%, unchanged from the previous month, but marking a larger year-on-year decline of 0.6 percentage point. Inventory of finished goods was up by 10.2% y/y through May, an increase of 2.0 percentage points compared with the end of April.

- Tesla is recalling more than 285,000 vehicles in China over a safety issue related to the vehicles' cruise control, according to a plan filed with China's State Administration for Market Regulation, reports CNN. The recall includes 35,665 imported Model 3 and 249,855 locally made Model 3 and Model Y vehicles. The cruise control system in these models may get activated when drivers try to shift gears or accidentally touch the gear selector, resulting in undesired acceleration. The company plans to update the software of the system either remotely or in-person to resolve the issue. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- SsangYong has opened an auction for its majority stake, reports the Yonhap News Agency. In a public notice of sale, EY Han Young, the accounting firm in charge of the sale process, said it will accept letters of intent from potential buyers until the end of July and conduct preliminary reviews on them in August. Court-appointed administrator Chung Yong-won said last month that the company aims to select a preferred bidder in late September and enter price negotiations in October, but it remains unclear whether the automaker will be able to find a new investor within the timeframe, due to its heavy debt load and weak sales. The US-based automotive distribution company HAAH Automotive Holdings had expressed interest in the preliminary process, but did not submit an official bid. Other potential bidders include local electric bus maker Edison Motors, electric vehicle (EV) maker K Pop Motors, and a local private equity fund, highlights the report. Meanwhile, EY Han Young last week submitted an interim report to the bankruptcy court that estimated the present value of SsangYong's liquidation at around KRW1 trillion (USD886.2 million), which is greater than the value of continuance at KRW600 billion, according to industry sources. (IHS Markit AutoIntelligence's Jamal Amir)

- Panasonic has sold 100% of its shares in electric vehicle (EV) maker Tesla for USD3.6 billion, media reports state. According to several media reports, Panasonic stated that the share sale would not affect its supply of batteries to Tesla and the two companies maintain a good relationship. Panasonic reportedly sold the shares during its last financial year, which ended in March 2021, and says it notified Tesla at the time, but did not provide further information at the time of the sale. The Wall Street Journal reports that Panasonic purchased 1.4 million shares in Tesla for USD30 million in 2010, and that the company's annual securities report valued the stake at about USD730 million as of March 2020. The news source reports that a Panasonic spokesperson said that the company plans to use the proceeds of the share sale to fund investments. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The South Korean government has approved 53 projects with a budget of KRW85 billion (USD75.3 million) this year, in line with efforts to develop fully automated vehicles by 2027, reports the Yonhap News Agency. Around 373 organizations and 3,500 experts are expected to join the research projects, according to the South Korean Ministry of Trade, Industry and Energy. The government said that the budget will be spent on developing automotive parts for autonomous vehicles, along with artificial intelligence software. (IHS Markit AutoIntelligence's Jamal Amir)

- Ashok Leyland plans to establish a new plant in India to scale up its electric vehicle (EV) business, reports the Times of India. The new plant is to be set up by the automaker's United Kingdom-based subsidiary, Switch, following which Ashok Leyland's entire EV business will move to Switch. The subsidiary is also to develop EV-specific platforms for electric light commercial vehicles and buses. Ashok Leyland's current EV products, including electric buses already delivered to a few cities such as Patna and Ahmedabad, are also to come under Switch's aegis. (IHS Markit AutoIntelligence's Tarun Thakur)

Posted 28 June 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.