All major US and European equity indices closed lower, while APAC markets were mixed. US and benchmark European government bonds closed higher. European iTraxx and CDX-NA closed wider across IG and high yield. The US dollar, oil, natural gas, silver, and copper closed lower, while gold was flat on the day. The tone of tomorrow afternoon's FOMC statement and press conference could drive heightened volatility going into the close of US markets.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -0.2%, S&P 500 -0.5%, Russell 2000 -1.1%, and Nasdaq -1.2%.

- 10yr US govt bonds closed -5bps/1.25% yield and 30yr bonds -5bps/1.90% yield.

- CDX-NAIG closed +1bp/50bps and CDX-NAHY +6bps/289bps.

- DXY US dollar index closed -0.2%/92.43.

- Gold closed flat/$1,800 per troy oz, silver -2.6%/$24.65 per troy oz, and copper -0.9%/$4.55 per pound.

- Crude oil closed -0.4%/$71.65 per barrel and natural gas closed -3.4%/$3.94 per mmbtu.

- Rig activity tracked expectations in second quarter 2021 (implying spending, production, and cash flows are following course, keeping 2021 flat), leading the industry to consider how the US supply system will behave in 2022. IHS Markit forecasts lower-48 onshore capex of $87 billion, with pre-interest cash flows of $159 billion, supporting entry-to-exit growth of 760,000 b/d. The Permian Basin plays account for 600,000 b/d of growth, where capex will rise to $38 billion (up from $27 billion this year). Rig counts reflect Permian dominance, with nearly half of the 200 rig additions between fourth quarters 2021 and 2022 going to the Permian. (IHS Markit Energy Advisory's Raoul LeBlanc, Reed Olmstead, Narmadha Navaneethan, Imre Kugler, and Prescott Roach)

- Operators transformed the business model from production growth to a returns-driven model in relatively short order. This year is a landmark year, as assuming a market-typical multiple four times EBITDA, the entire lower-48 onshore industry will (finally) generate a cash yield per share that is competitive with other mature industries. In the coming years, returning 60-75% of the free cash flow bounty to shareholders should yield roughly 4-5% per share, equivalent to nearly $120 billion between 2022 and 2025. The yield-per-share of 4-5% in 2021 and beyond, up from -5% in 2015 and roughly 0% in 2019-20, brings independent E&Ps in line with the broader S&P 500 earnings yield of 4-7% from 2010 to 2020, a key factor in attracting investors.

- While operators are still declaring discipline to investors, production growth "cheating" from private operators is on the horizon. Public companies, currently producing roughly 7.5 MMb/d, are forecast to grow volumes 3-4% in 2022. The 3.5 MMb/d of privately operated production is likely to grow 10%. Granted, these two groups have vastly different objectives—the privates could spoil the party by igniting supply growth and causing concern about US growth. Private behavior and performance differs from independents in a few ways that push private rig productivity 20-50% lower than independents.

- US growth is speeding up, but as long as operators keep increases less than 1 MMb/d entry-to-exit, markets likely won't be spooked. Private operators could push the limits, particularly if aided by renegade public companies. At an average realized price of $65/bbl WTI, supply could grow by 1 MMb/d while operators returned 30% to investors, causing a worrisome scenario. A mid $60/bbl WTI price will surely keep public operator growth constrained, but a $75 price will not.

- US manufacturers' orders for durable goods rose 0.8% in June, continuing along a rising trend, but falling short of expectations. Shipments of durable goods rose 1.0%, and inventories of durable goods rose 0.9%. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- The civilian aircraft sector figured prominently in much of this report. Shipments of civilian aircraft posted a solid gain in June and were partially responsible for raising our estimate of second-quarter GDP growth. Underlying this strength was that Boeing delivered 45 aircraft in June, about three-quarters of which were their 737 MAX model. This was the highest count of deliveries since March 2019, just before MAX deliveries were suspended.

- Where the aircraft sector did not figure prominently was in orders. Orders for aircraft at Boeing surged to 219 aircraft in June (from 73 in May; a 200% increase), while orders for civilian aircraft in this morning's report rose "only" 21.7%. This is too large a discrepancy to be accounted for by seasonal variation. IHS Markit analysts will be looking into this.

- The US Conference Board Consumer Confidence Index rose in July by a marginal 0.2 point (0.2%) to 129.1, an unexpected increase that followed an 8.9-point surge in June and left the index above its 2019 average. (IHS Markit Economists David Deull and James Bohnaker)

- The index of views on the present situation accounted for July's modest increase, rising by 0.7 point to 160.3. The expectations index edged down 0.1 point to 108.4.

- The strength of the jobs market has been a key driver of consumer confidence. In July, the labor index (the percentage of respondents viewing jobs as currently plentiful minus the percentage viewing jobs as hard to get) rose a further 0.2 percentage point to 44.4%, the second-highest monthly reading in the more than 50-year record.

- The net percentage of respondents expecting higher incomes in the next six months edged up 0.4 point to 12.0%, still three percentage points below the average recorded during the half-year preceding the pandemic.

- Purchasing plans rose in July. The share of respondents planning to buy homes in the next six months edged up 0.2 point to 7.0%; the share planning to buy autos rose 1.6 points to 13.1%; and the share planning to buy major appliances rebounded 7.0 points to 56.8%. Purchasing plans for autos were the highest in 19 months, and for appliances, they were a 43-month high.

- The elevated level of the Consumer Confidence Index remained in stark contrast with the University of Michigan Consumer Sentiment Index, which in its preliminary July reading fell to a five-month low.

- Survey respondents reported a 6.6% expected year-ahead inflation rate in July, 0.1 percentage point lower than in June. This measure surged during the initial months of the COVID-19 pandemic, reaching 6.6% in June 2020, but has not much exceeded this level in the intervening months. In contrast, the University of Michigan survey's measure of one-year inflation expectations in early July far exceeded its 2020 range.

- The US homeowner vacancy rate—the proportion of residential inventory vacant and for sale—remained at a record-low 0.9% in the second quarter. The rental vacancy rate—the proportion of rental inventory vacant and for rent—rose to 6.2%, from 5.7% a year earlier. (IHS Markit Economist Patrick Newport)

- The homeownership rate dropped 2.5 percentage points in the second quarter from a year earlier to 65.4%.

- Estimated housing inventory increased to 141.7954 million, up 1.222 million from a year earlier.

- Data-collecting procedures and response rates were nearly back to normal in the second quarter, improving the accuracy of the estimates. Some of the published numbers in this update, nonetheless, are head-scratchers: the median asking rent was 19% and 22% above its 2020 and 2019 second-quarter readings, respectively, while the median asking price for a "vacant for sale unit" (i.e., an existing home sale) was up 19% in the second quarter from the first quarter More reliable sources indicate that rents are not rising much while home prices are likely to grow about 5% in the second quarter from the first quarter.

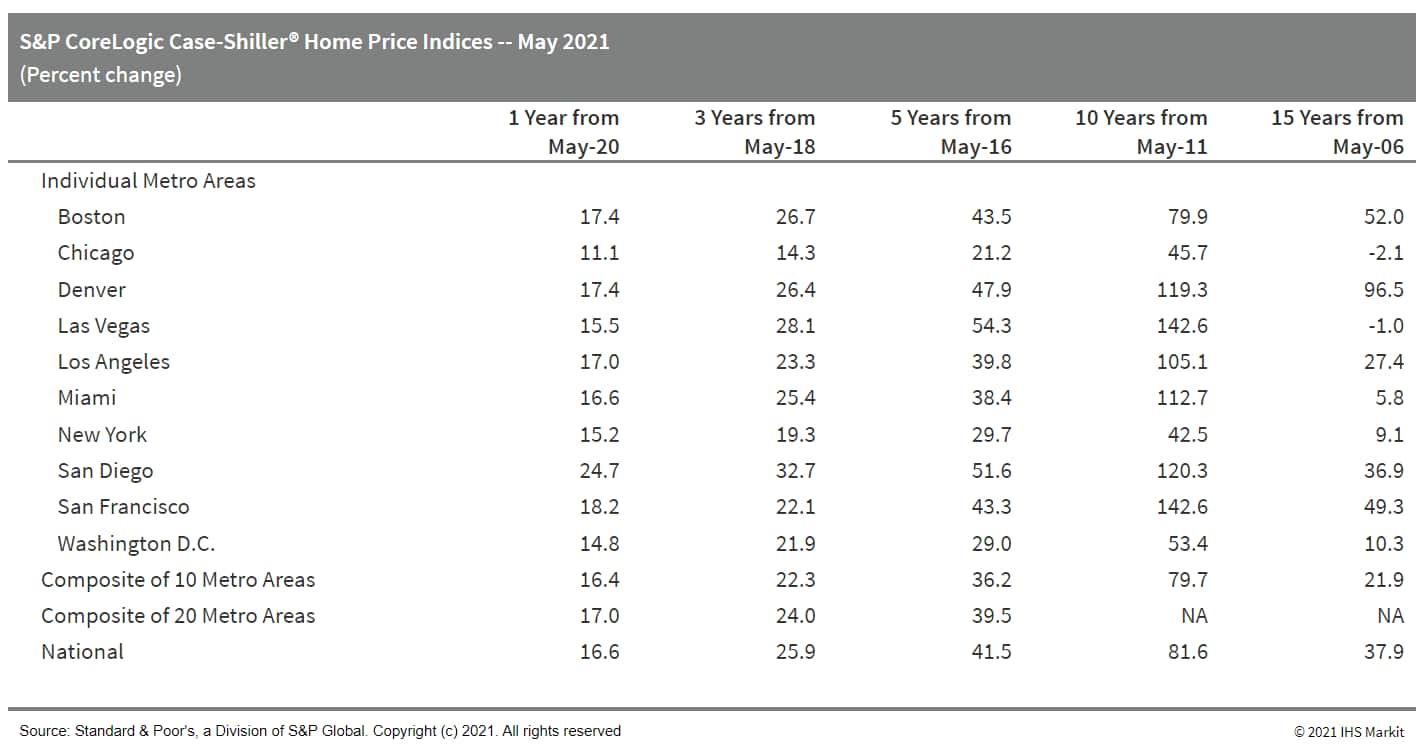

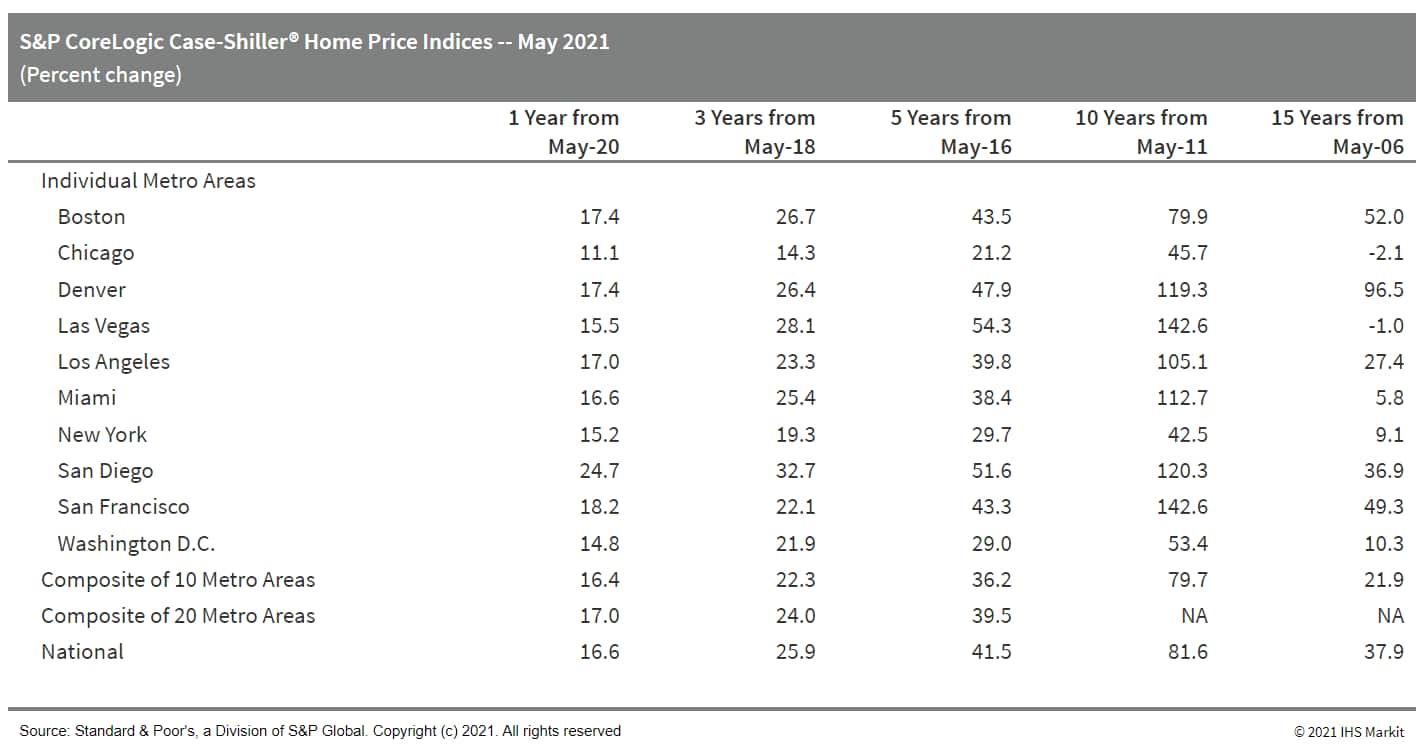

- The S&P CoreLogic Case-Shiller indexes set new record for home price growth again in May, as Monthly home price growth ticked up again during the month. The 10-city composite index was up 1.7% month over month (m/m) while the 20-city composite was up 1.8%. (IHS Markit Economist Troy Walters)

- Monthly gains were again positive in all 20 cities, ranging from 0.8% in Cleveland to 3.5% in Phoenix.

- The 10-city and 20-city composite indices again set new records for annual growth in May. They were up 16.4% and 17.0% year over year (y/y), respectively, the fastest pace since June 2005 and August 2004, respectively.

- All 20 cities covered in the report experienced home price appreciation in the double digits in May. Increases ranged from 11.1% y/y in Chicago to 25.9% in Phoenix.

- The national index was up 16.6% y/y in May, the fastest pace on record.

- Tesla's financial performance in 2021 continues to benefit from increased production capacity compared with a year earlier, as the company has not sated demand for its products, and Tesla returned an eighth consecutive quarterly profit in the second quarter. In addition, Tesla began production of the updated Model S in the second quarter. Tesla reported a surge in GAAP net income in the second quarter, exceeding the figure in the first quarter and exceeding USD1.0 billion for the first time. In 2021, comparisons of quarterly results against the prior quarter will continue to show improvements on the increased production this year. In addition, some headwinds Tesla faced in the first quarter eased in second quarter, as the updated Model S is now in production. However, the semiconductor shortage continues to dampen Tesla's results and CEO Elon Musk suggested the situation could become worse yet. Although Tesla's profitability continues to be assisted by the sale of regulatory credits, the company's results in the second quarter showed strong profits from vehicle sales, including an 11% overall operating margin and improved automotive gross margin. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Hyundai has announced that it will deploy demonstration versions of its XCIENT Fuel Cell hydrogen fuel-cell electric heavy-duty truck in the US, participating in two publicly funded California projects. By early 2023, Hyundai will deploy 30 XCIENT Class 8 trucks in northern California, as part of a NorCal ZERO project (the project's full name is Zero-Emission Regional Truck Operations with Fuel Cell Electric Trucks). That project is through a consortium led by the Center for Transportation and the Environment (CTE); Hyundai notes it has been awarded USD22 million in grants from the state-level California Air Resources Board (CARB) and the California Energy Commission (CEC) as well as an additional USD7 million from the local-level Alameda County Transportation Commission and the Bay Area Quality Management District to support the project. The truck is a 6x4 axle configuration; fleet operator Glovis America will operate the vehicles. For this project, the consortium also plans to build a high-capacity hydrogen refueling station in Oakland, California. That station is planned to be able to support as many as 50 trucks with an average fill of 30 kg. The second project is in southern California, where Hyundai was awarded a USD500,000 grant from the South Coast Air Quality Management District (South Coast AQMD). This is a 12-month program that will deploy two trucks, also Class 8 trucks. Hyundai says it will begin operating those trucks in August 2021, with an unnamed fleet partner. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Lordstown Motors has disclosed that a hedge fund has committed to buy up to USD400 million of the company's shares over a three-year period, potentially providing funding at a critical time for the US electric vehicle (EV) maker. According to an 8-K report filing with the US Securities and Exchange Commission (SEC), Lordstown "entered into an equity purchase agreement" with YA II PN (YA). The filing says that YA has committed to purchase up to USD400 million of Lordstown's Class A common stock "at our direction from time to time". The agreement also prohibits Lordstown from directing YA to purchase an amount of stock which would result in YA owning more than 4.99% of the then-outstanding Class A common stock. YA has agreed to purchase the stock at the price Lordstown asks, at a point in time dictated by Lordstown. YA can receive up to 35 million shares of Lordstown stock, with the agreement fully executed, dependent on the approval of Lordstown's shareholders. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous mobility solutions provider Beep has opened its headquarters in Lake Nona (Florida, US). The 10,000-square-foot facility will have the Beep Command Center, a centralized command center that will actively monitor all autonomous projects and an innovation lab. Joe Moye, CEO of Beep, said, "Since our launch in 2019, we knew we needed a premier facility that would allow us to continue testing and delivering next-generation autonomous mobility to communities and planned developments around the country, as well as serve as a technology development hub as we continue to move the autonomous industry forward through real world learnings and proprietary technology development". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Sherwin-Williams (SW) today reported second-quarter net income up 8.8% year on year (YOY), to $648.6 million, on net sales up 16.9%, to $5.38 billion. Adjusted earnings rose 11.8% YOY, to $2.65/share, slightly short of analysts' consensus estimate of $2.67/share, as reported by Refinitiv (New York, New York). Higher product sales volumes across most of the company drove the increases. (IHS Markit Chemical Advisory)

- Americas group sales grew 22.5% YOY, to $3.09 billion, while segment profit was up 21.2%, to $727.3 million. Higher architectural paint sales to the professional market, especially for residential repaint, drove the increases. Selling prices also increased. This was partly offset by lower DIY sales and increasing raw material costs.

- Performance coatings group sales increased 41.3% YOY, to $1.55 billion, while segment profit rose 49.5%, to $144.8 million. Higher volumes in all end markets and higher selling prices were partly offset by increasing raw material costs.

- Consumer brands group sales declined 25.3% YOY, to $731.5 million, while segment profit was down 44.6%, to $144.1 million. Lower volumes to retail customers, driven by declines in DIY paint demand, and a divestiture were partly offset by higher selling prices.

Europe/Middle East/Africa

- All major European equity indices markets closed lower; UK -0.4%, Germany -0.6%, France -0.7%, Italy -0.8%, and Spain -0.9%.

- 10yr European govt bonds closed higher; Germany -3bps and France/Italy/Spain/UK -1bp.

- iTraxx-Europe closed +1bp/47bps and iTraxx-Xover +3bps/238bps.

- Brent crude closed -0.2%/$73.52 per barrel.

- Floventis Energy, a newly established joint venture between SBM Offshore and Cierco, has been granted seabed rights for an offshore wind project in the Celtic Sea subject to a Habitats Regulations Assessment (HRA). SBM Offshore said that the Crown Estate has confirmed its intention to move forward with the lease process for two 100MW floating wind test and demonstration sites in the UK Celtic Sea to Llyr Floating Wind. The formal award for the Llyr project is subject to a HRA assessment, and further environmental assessments and surveys in line with the regulatory consent processes. Floventis Energy is a joint venture with Cierco which will aim to secure seabed rights and relevant permits before developing floating offshore wind projects. Cierco is a US-based offshore wind project development company established in 2001. (IHS Markit Upstream Costs and Technology's Kelvin Sam)

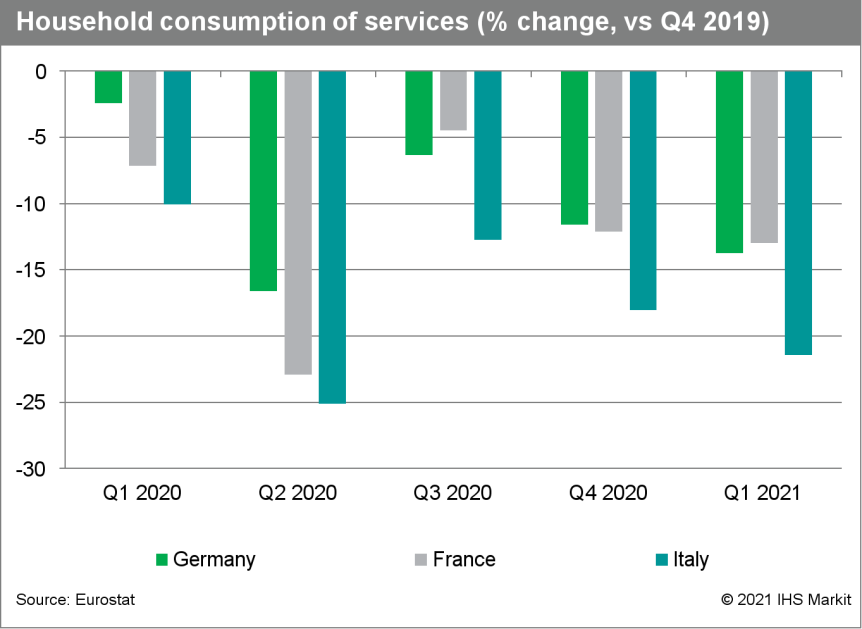

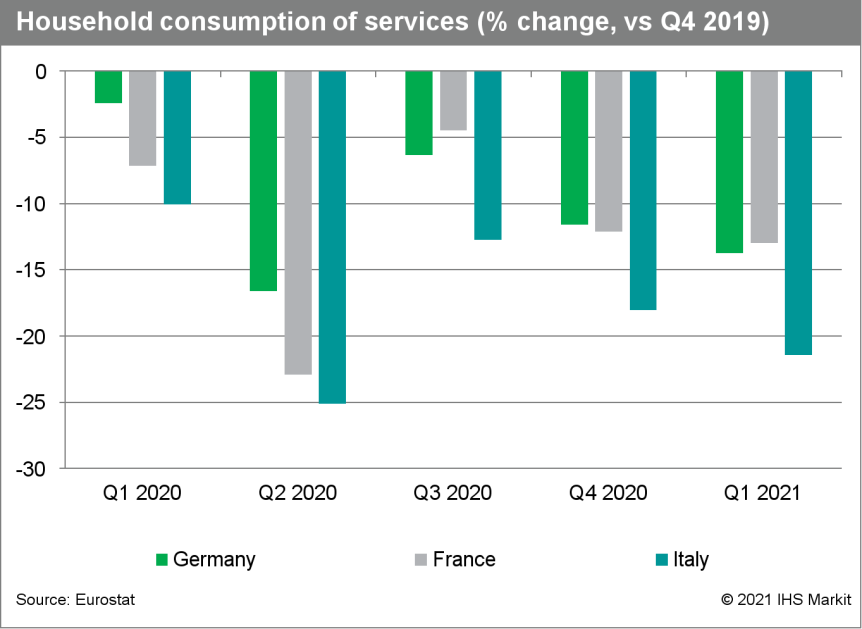

- Supply bottlenecks have taken the wind out of the eurozone's industrial sector's sails, but a strong rebound in household consumption, of services in particular, is expected to drive the forecast spurt in eurozone growth from the second quarter onwards. (IHS Markit Economist Ken Wattret)

- The latest "hard" activity data for the eurozone, for the month of May, have disappointed in some areas, primarily reflecting disruptions to global supply chains. Industrial production contracted by 1.0% month on month (m/m), for example, while export values declined by 1.5% m/m, only the second m/m fall since April 2020.

- Some of the latest sentiment surveys, for July, have also started to falter, albeit after a phenomenally strong run over the past several months, with supply-chain issues and worries over new COVID-19 variants prominent.

- Still, not all the economic news for the eurozone has been downbeat. May's retail sales were very strong (discussed below), while the services PMI for July reached its strongest level in a decade and a half.

- Some perspective is also essential. Even after May's decline, the level of eurozone industrial production was just 1.4% below its pre-pandemic level, compared with a peak output loss of almost 30% during the initial wave of COVID-19. Despite May's fall, eurozone exports were just 2% below their pre-pandemic level.

- In contrast, based on the latest data available, for the first quarter, private consumption in the eurozone was still a whopping 9.5% below its level in the fourth quarter of 2019.

- Furthermore, as the chart below illustrates, in the three largest member states of the eurozone the net declines in household consumption of services over the same period have been far larger still: Germany (-13.8%), France (-13.0%), and Italy (-21.4%).

- EU approval periods for 39 agrochemical active ingredients are to be extended by one year because of slow re-assessment procedures. All but one of the ais have already had previous extensions for the same reason. The exception is the fungicide/bactericide, 8-hydroxyquinoline, whose original ten-year approval is due to expire at the end of the year. The proposed extensions from the European Commission were voted through by EU member states in July. (IHS Markit Crop Science's Jackie Bird)

- A new approval expiry date of October 31st 2022 will apply to: the herbicides, chlorotoluron, clomazone, flufenacet, MCPA, MCPB and prosulfocarb; the plant growth regulator (PGR), daminozide; the fungicides, fludioxonil and indoxacarb; the insecticide, deltamethrin; the insecticide/acaricide, cypermethrin; and the nematicide, fosthiazate.

- A new date of November 30th 2022 will apply to: the herbicides, propaquizafop, quizalofop-P-ethyl, quizalofop-P-tefuryl and tritosulfuron; and the PGR, chlormequat.

- The date of December 31st 2022 will apply to: the herbicides, amidosulfuron, bifenox, dicamba, diflufenican, dimethachlor, fenoxaprop-P, fenpropidin, lenacil, nicosulfuron, picloram, tri-allate and triflusulfuron; the insecticides/acaricides, clofentezine, etofenprox, paraffin oil and paraffin oils; the fungicides, difenoconazole, penconazole, 2-phenylphenol (including its salts such as the sodium salt) and tetraconazole; the fungicide/acaricide, sulfur; and the fungicide/bactericide, 8-hydroxyquinoline.

- For 12 of the ais, more time is also needed to carry out an assessment relating to endocrine disrupting properties, based on criteria that were updated in 2012. These ais are: amidosulfuron, clofentezine, clomazone, daminozide, fenoxaprop-P, fludioxonil, flufenacet, 8-hydroxyquinoline, lenacil, 2-phenylphenol, triflusulfuron and tritosulfuron.

- GoTo Group, an internet firm created through a merger deal between ride-hailing company Gojek and e-commerce provider PT Tokopedia, is reportedly in discussions with investors to raise as much as USD2 billion in funding. GoTo has begun the process of raising USD1 billion to USD2 billion at a valuation of between USD25 billion and USD30 billion, reports Bloomberg. In a separate statement, it has selected Google Cloud as its primary technology partner for its next phase of growth across Southeast Asia. Google Cloud services will support GoTo's continued expansion across areas such as cloud infrastructure, cloud artificial intelligence (AI), and machine learning (ML), as well as the productivity and collaboration capabilities offered by Google Workspace. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Following its second review of Egypt's USD5.2-billion standby facility, the International Monetary Fund (IMF) sees Egypt's foreign direct investment (FDI) growing in the next four years. Egypt could draw in USD8.6 billion of FDI in FY2021/22 (which started in July), up sharply from USD5.4 billion in FY2020/21. The IMF projects that FDI will rise to USD11.7 billion in FY2022/23 and inching up further to USD16.5 billion in FY2024/25. (IHS Markit Economist Yasmine Ghozzi)

- Despite such a positive projection, Egypt continues to have a high trade deficit, which has widened over the past year as the COVID-19 pandemic hit key sources of hard currency. The trade deficit increased 9% year on year (y/y) to USD30.6 billion during the first nine months of FY2020/21, according to the latest data by the Central Bank of Egypt (CBE). For FDI to reach the IMF's projections, the hope is on the non-oil foreign direct investment to pick up, and local industry as well as local manufacturing to take over, which will have a substitution for imports.

- The review also sees a rebound in tourism to USD8 billion in FY2021/22 up from an estimated USD4.4 billion in FY2020/21. This will further increase to USD15 billion in FY2022/23 and USD25.1 billion in FY2024/25. IHS Markit's expectation is in line with the review that tourism receipts are expected to remain subdued in FY2020/21. Egypt's slow vaccine rollout is likely to keep foreign visitors away. Egypt was recently added to the UK's red list, making the cost of travel to Egypt very high for British Red Sea holidaymakers as they will be required to quarantine at their own expense for 10 days upon returning home. This is likely to discourage many UK nationals from visiting what has traditionally been a popular holiday destination. Full resumption of Russian flights to Egypt next month could generate about USD3 billion in tourism revenues but it is not expected to materialise until 2022.

- The picture is not great for the overall trade balance, as the IMF sees it falling deeper into deficit over the next four years. Exports will increase only marginally from USD29.4 billion during the current fiscal year to USD32.1 billion in FY2024/25 and will be outpaced by import growth, which will surge from USD65.9 billion this year to USD83.8 billion by FY2024/25.

Asia-Pacific

- Major APAC equity indices closed mixed; Australia/Japan +0.5%, South Korea +0.2%, India -0.5%, Mainland China -2.5%, and Hong Kong -4.2%.

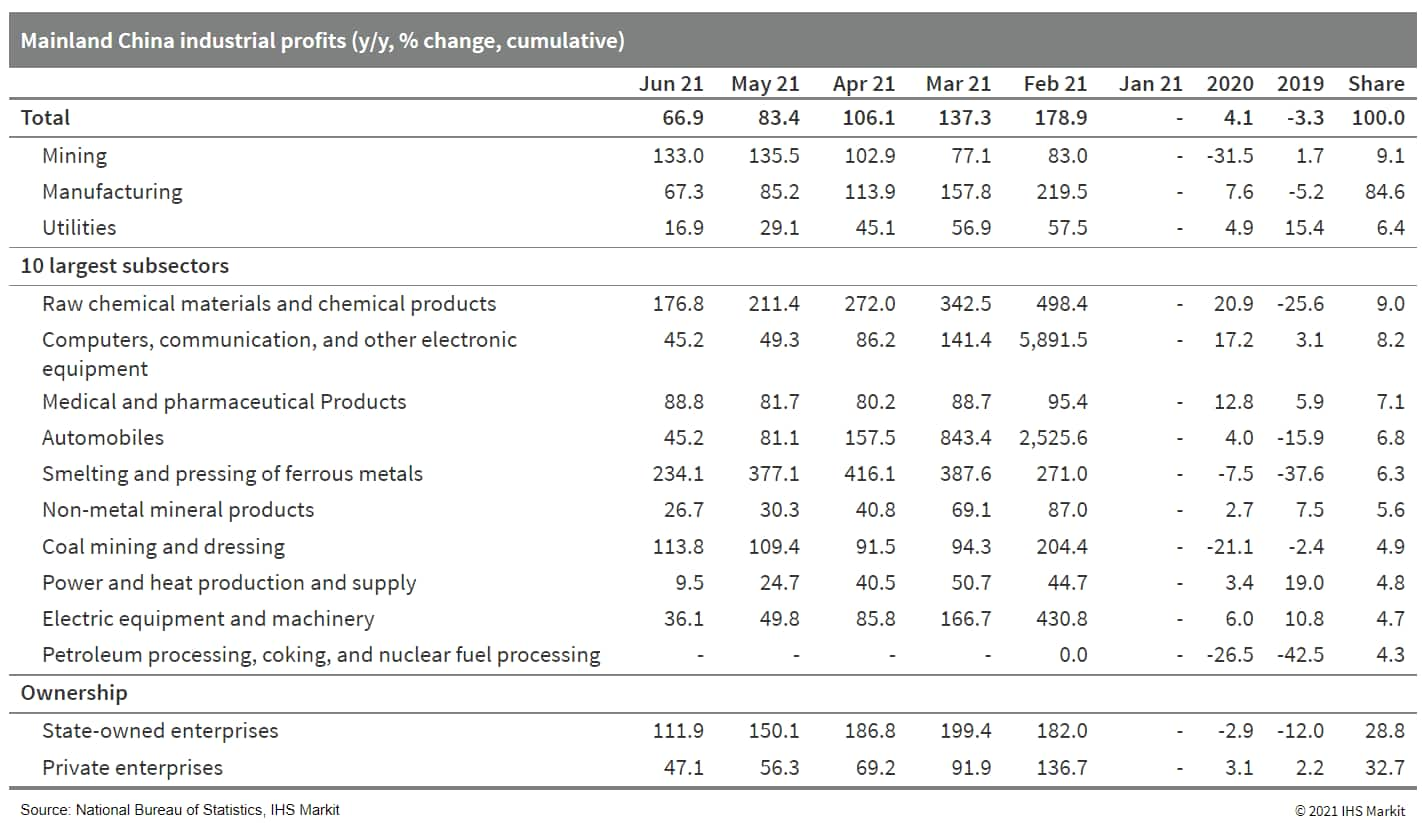

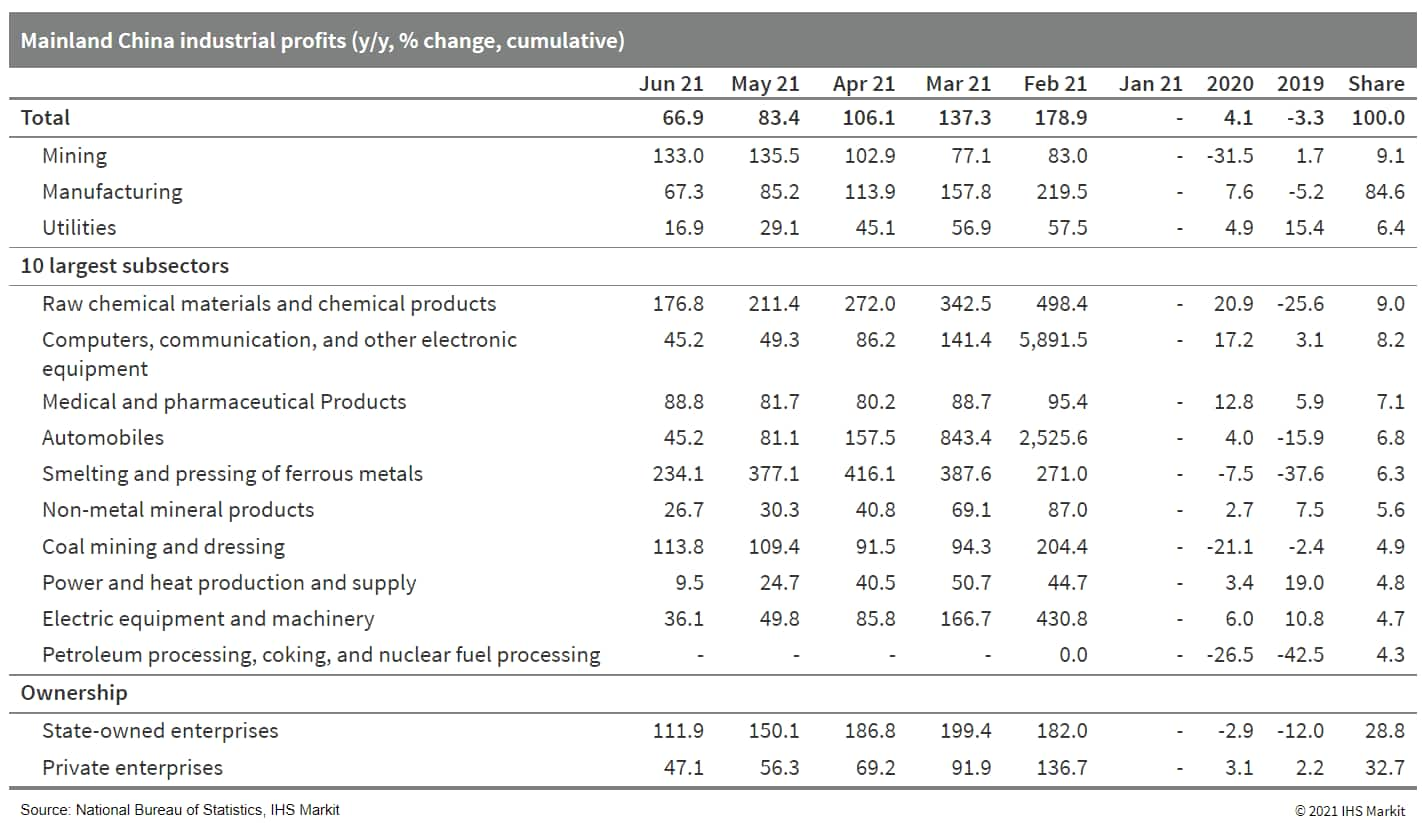

- Mainland China's industrial profits expanded by 66.9% year on year (y/y) in the first half of 2021, down by 16.5 percentage points from the first five months as the low-base effect continues to fade. On a two-year (2020-21) average basis, industrial profits increased by 20.6% y/y, 1.1 percentage point lower than the May reading. For June alone, industrial profits grew 20.0% y/y compared with 36.4% y/y in May, according to the National Bureau of Statistics (NBS). (IHS Markit Economist Lei Yi)

- The cumulative profitability ratio remained elevated at 7.11% through June thanks to operating revenue persistently outpacing operating costs growth in the first half of the year, coming in at 27.9% y/y and 26.4% y/y, respectively. Compared with the first half of 2020, the profitability ratio increased by 1.66 percentage points, led by the gains in mining sector.

- Industrial profits for up to 29 out of the total 41 industrial sectors (70.7%) exceeded the pre-pandemic (i.e., comparable 2019) level through June. The upstream mining and raw material manufacturing sectors continued to benefit from the global commodity rally, reporting two-year average growth of 16.5% y/y and 35.8% y/y, respectively, in the first half of the year. High-tech and equipment manufacturing profits strength held steady, registering a two-year average growth rate of 36.2% y/y and 18.3% y/y, respectively, through June. Industrial profits of consumer goods manufacturing further recovered, with sectors like textiles and furniture narrowing their profits contraction on a two-year average basis.

- By the end of June, the average liability-to-asset ratio of industrial enterprises reached 56.5%, up 0.2 percentage point from the previous month but down by 0.4 percentage point year on year. Inventory of finished goods was up by 11.3% through June, an uptick of 1.1 percentage points from the end of May.

- Chinese electric vehicle (EV) startup Xpeng Motors has formed a Hainan-based technology subsidiary that will focus on development of AI-based application software, the brokerage of secondhand vehicles, and the sale of new automobiles and charging piles, reports Gasgoo. Called the Xiaopeng Motors Technology Co., the new company involves a registered capital of CNY20 million (USD3.1 million) and is fully controlled by Xpeng. Xpeng, also known as Xiaopeng Motors, is among a group of EV startups established in China due to growing demand for new energy vehicles (NEVs). It established a new mobility service subsidiary, Chuxiong Xiaopeng Smart Mobility Technology Co, in the city of Chuxiong (China) in April last year. The subsidiary has registered capital of CNY2 million and has been established through the EV maker's Guangzhou-based smart travel technology branch. The new company will work on building a smart mobility ecosystem that includes ride-hailing services, car leasing services, sales of new and used cars, and research of automobile manufacturing technologies. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Guizhou province, located in southwest China, is planning to set up 38,000 charging piles for electric vehicles (EVs) by 2023, reports China Daily. As per the plan, 4,500 EV charging piles will be set up this year, 5,000 piles next year, and 5,500 piles in 2023. These piles will be located at tourist attractions, transport hubs, and expressway service areas. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Japan's JFE Engineering Corporation will build the country's first offshore wind monopile facility in Kasaoka City, Okayama. The foundation factory is expected to start production in April 2024. The facility will be located on the premises of JFE Steel West Japan Works and will obtain steel plates from JFE Steel. The facility will start off producing monopiles and steel pipes for transition pieces and may produce jackets in the future. The monopiles produced will be shipped directly to offshore construction sites from the facility, whilst the transition pieces will be transported by sea to JFE Engineering Tsu Manufacturing in Mie Prefecture, for the outfitting of secondary steel and subsequent transportation offshore to construction sites. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Shin-Etsu Chemical reports a 38% increase in net profit for the fiscal first quarter ended 30 June, to ¥95.7 billion ($867.3 million), compared with ¥69.3 billion in the prior-year period. Operating income increased 41.7% year on year (YOY) to ¥128.8 billion, on sales up 20.8% YOY to ¥434.2 billion. (IHS Markit Chemical Advisory)

- Operating income at Shin-Etsu's infrastructure materials business more than doubled to ¥44.1 billion, compared with ¥19.5 billion in the year-earlier quarter, on sales of ¥157.1 billion, up 38% YOY.

- The company says that sales prices for polyvinyl chloride (PVC) grew, supported by strong global demand. It projects demand for PVC resin to grow owing to housing shortages in major countries and investments in infrastructure. Enhanced production at Shintech, the company's US-based PVC business, will also contribute to higher earnings in the second half of the fiscal year, it says.

- Shin-Etsu's electronics materials business recorded a 9.4% YOY increase in operating income to ¥56.7 billion, on sales that rose 11.5% YOY to ¥161.1 billion. Products including semiconductor silicon, photoresists, and photomask blanks continued to be shipped at high levels for semiconductor device applications. Demand for rare-earth magnets has been strong in all applications, including automobiles, factory automation, and hard disk drives, it says.

- In the company's functional materials segment, operating income rose by 39.4% YOY to ¥22.7 billion, with sales growing 18.3% YOY to ¥91.6 billion. Demand for personal care applications increased, it says. Inventory adjustments for automobile applications have ended and shipments were favorable, while healthcare applications remain firm, it adds.

- Shin-Etsu's processing and specialized services business reported operating income that was 76% higher YOY at ¥5.3 billion, on sales of ¥24.3 billion, up 2.9% YOY. Shipments of semiconductor wafers containers were strong, both for transporting use and for manufacturing process, it says.

- Indian news media reported the chairperson of Dr Reddy's Laboratories as predicting that the country's pharmaceutical sector could potentially more than triple in value within the next 10 years. K Satish Reddy is quoted as forecasting that by 2030 the value of domestic sales in India plus exports could climb from an estimated USD42 billion in 2021 to between USD120 billion and USD130 billion. This continues to assume that roughly half the value of the sector will be accounted for by domestic sales and half by the export-orientated pharmaceutical sector. The predictions are also considered to be dependent on a successful outcome of the government's Atmanirbhar Bharat program, a broad macroeconomic package designed to ensure India's self-reliance and global competitiveness. (IHS Markit Life Sciences' Eóin Ryan)

- Indonesian media conglomerate Emtek Group (Elang Mahkota Teknologi) is investing USD375 million in ride-hailing and payment firm Grab's Indonesian unit, reports Reuters. According to the report, the deal intends to reform the digital payments industry while also allowing Grab to boost its stake in e-wallet OVO. Grab, which recently went public via a special-purpose acquisition company (SPAC) merger deal, is focusing on expanding its range of services, from transport to food delivery and payments. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Posted 27 July 2021 by Ana Moreno, Director, Product Development, IHS Markit and

Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.