Most major US equity indices closed higher, while European and APAC markets closed mixed. US government bonds closed higher, while benchmark European bonds closed mixed. CDX-NA closed almost flat across IG and high yield, iTraxx-Europe was also unchanged, and iTraxx-Xover closed modestly wider. The US dollar, natural gas, copper, and silver closed higher, gold was flat, and oil was lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed higher except for the DJIA closing flat; Nasdaq +0.4%, S&P 500 +0.2%, and Russell 2000 +0.2%.

- 10yr US govt bonds closed -4bps/1.64% yield and 30yr bonds -7bps/1.96% yield.

- CDX-NAIG closed flat/53bps and CDX-NAHY +1bp/307bps.

- DXY US dollar index closed +0.4%/96.88, which is the highest close since July 2020.

- Gold closed flat/$1,784 per troy oz, silver +0.3%/$23.50 per troy oz, and copper +0.8%/$4.46 per pound.

- Crude oil closed -0.1%/$78.39 per barrel and natural gas closed +1.6%/$5.11 per mmbtu.

- Federal Reserve officials expressed greater concern at their meeting earlier this month about how long inflation would stay elevated and discussed whether they should prepare to raise interest rates in the first half of next year to cool off the economy. But some officials signaled concern that inflation pressures were broadening and that they might want to wrap up the asset-purchase program sooner in case they feel greater urgency to raise interest rates, according to minutes of the meeting released Wednesday afternoon. (WSJ)

- US personal income increased 0.5% in October while real disposable personal income (DPI) decreased 0.3% amid higher consumer prices. Wage and salary income increased a solid 0.8% in October and was up 12.9% over a 24-month period; this suggests a full recovery to the pre-pandemic trend. Also supporting personal income in October were dividend and interest income, which rose 1.2% and 0.6%, respectively. (IHS Markit Economists James Bohnaker and William Magee)

- Ongoing advance payments of the Child Tax Credit authorized under the American Rescue Plan raised personal income by $220 billion (annual rate), roughly the same amount as in the previous three months. Fewer unemployment insurance payments under pandemic-era programs—which expired in early September—acted as a drag on income.

- Real personal consumption expenditures (PCE) increased 0.7% in October as PCE for durable goods rose 2.0% thanks primarily to a partial rebound in spending on motor vehicles and parts. Real PCE for services increased 0.5%, but pandemic-sensitive categories such as food services and accommodations experienced declines in October.

- The PCE price index increased 0.6% in October and its 12-month change was 5.0%. Excluding food and energy, for which prices rose strongly, the core PCE price index rose 0.4% during October and 4.1% over 12 months.

- The pandemic and inflation remain headwinds for household spending, but personal income growth rooted in rising compensation is expected to support faster expansion in PCE over the fourth quarter.

- The US University of Michigan Consumer Sentiment Index sank 4.3 points from its October level to 67.4 in the final November reading—its lowest level in a decade. The decline was driven by worsening views on both the present situation and the future. The present situation index fell 4.1 points to 73.6 and the expectations index declined 4.4 points to 63.5. (IHS Markit Economists James Bohnaker and William Magee)

- Households in the bottom half of the income distribution were exclusively responsible for the decline in sentiment. The index of sentiment for households earning below $100,000 per year declined 7.6 points, while that for households earning over $100,000 per year edged up 0.9 point.

- Elevated inflation remains the foremost drag on sentiment. According to the report, one in four consumers cited inflationary erosions of their living standards in November, more than double the proportion from six months earlier. The 12-month change in the consumer price index (CPI) in October was the fastest since 1990 at 6.2%, with highly visible consumer prices, such as those for gasoline and food, rising at even sharper rates. The median expected one-year inflation rate in the University of Michigan survey ticked higher by 0.1 point to 4.9% to reach its highest level since 2008. Inflation expectations over the 5-10-year horizon were a moderate 3.0%.

- The indexes of buying conditions for large household durable goods, automobiles, and homes were all starkly lower, as rising prices for those items remained the chief reason for poor buying sentiment.

- The recent trend in consumer sentiment underscores the downside risks related to a prolonged period of above-trend inflation. However, inflation risks are balanced by our expectation for strong job and wage growth in the coming months, and the fact that healthy consumer balance sheets and excess savings will continue to support solid growth of consumer spending. Recent data on credit- and debit-card spending suggest that consumers are spending confidently as we enter the peak holiday shopping season.

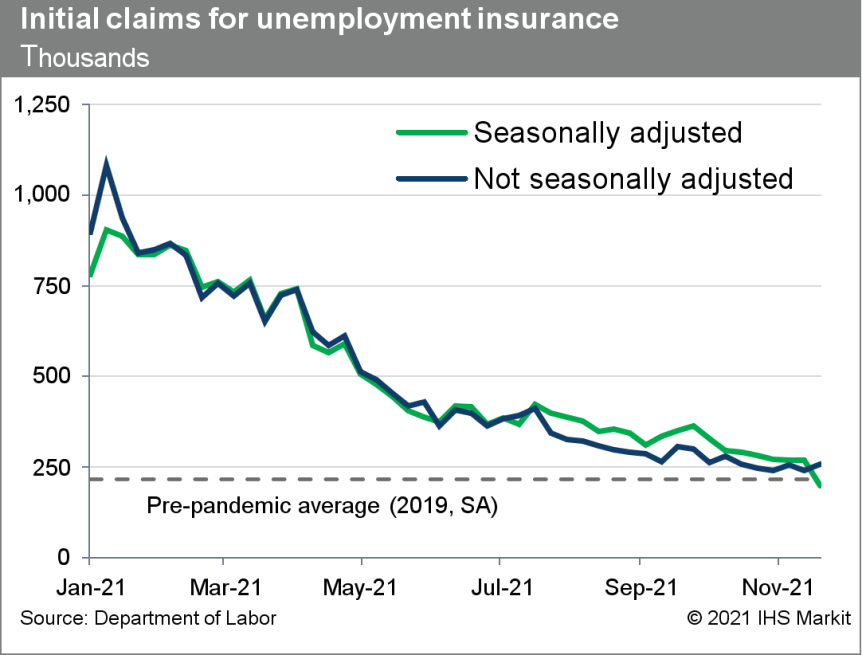

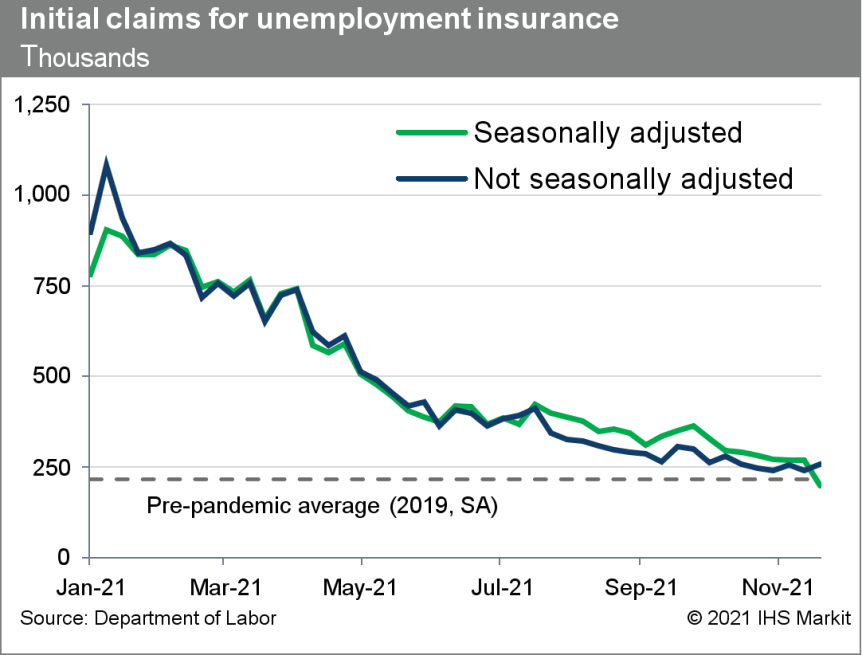

- US seasonally adjusted initial claims for unemployment insurance decreased by 71,000 to 199,000 in the week ended 20 November, plunging to its lowest level since 15 November 1969. Given the tight labor market, employers are holding onto their existing employees—indeed, the layoffs and discharges rate is at a record low. Nevertheless, due to the difficulty of seasonal adjustment during the pandemic, we caution against reading too much into this week's decline. (IHS Markit Economist Akshat Goel)

- The not seasonally adjusted (NSA) tally of initial claims rose by 18,187 to 258,622. The fall in adjusted claims to a multi-decade low is in part explained by seasonal adjustment, which expected a much larger increase of 88,572 in the level of unadjusted claims.

- Seasonally adjusted continuing claims (in regular state programs) fell by 60,000 to 2,049,000 in the week ended 13 November, hitting its lowest since 14 March 2020. The insured unemployment rate edged down 0.1 percentage point to 1.5%.

- In the week ended 6 November, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 121,418 to 151,556.

- In the week ended 6 November, continuing claims for Pandemic Unemployment Assistance (PUA) fell by 456,310 to 334,750. The number of claims under PUA and PEUC should continue to decline in coming weeks as states work through retroactive claims.

- In the week ended 6 November, the unadjusted total of continuing claims for benefits in all programs fell by 752,390 to 2,432,281. Claims under all programs have declined sharply since the expiration of pandemic-related benefits—there were 11,250,306 claimants in the week ended 4 September.

- US new home sales edged up 0.4% (plus or minus 21.1%; not statistically significant) in October to a 745,000-unit seasonally adjusted annual rate. The three-month average, which peaked at 973,000 in September 2020, has dropped to a 727,000 rate, although it has stabilized. (IHS Markit Economist Patrick Newport)

- Sales for July through September were collectively revised down by a whopping 75,000 units. Note: About one-fourth of new home sales are imputed; these consist of homes sold before a permit is issued and account for the lion's share of data revisions.

- Median and average new home prices soared 17.5% and 21.1%, respectively, from a year earlier. From 2016 to just before the pandemic struck in early 2020, new home prices hardly budged.

- Meanwhile, builders' costs also soared. The Census's construction cost index for homes under construction, which also came out today (24 November), was up 14.7% in October.

- Inventory—the number of homes for sale at the end of the month—increased by 11,000 in October to 389,000. Only 38,000 of homes classified as inventory were completed; inventory units still in the planning stage were 106,000.

- The Census Bureau also released the state housing permits estimates for October today. These show that five southern states—Texas, Florida, North Carolina, South Carolina, and Georgia—have largely powered the surge in new home construction since the pandemic struck. Collectively, comparing 2021 with 2019, these states accounted for half of the year-to-date increase in permits through October, even though they accounted for 23% of the housing stock in April 2020.

- While new home sales were weaker than we had expected through October, the average selling price was stronger than expected. On balance, this raised our estimates of brokers' commissions and residential investment in Q4. Bottom line: Fourth-quarter GDP growth is forecast to be up 0.1 percentage point to 6.9%.

- US manufacturers' orders for durable goods declined 0.5% in October, while shipments rose 1.5% and inventories rose 0.6%. (IHS Markit Economist Ben Herzon and Lawrence Nelson)

- Orders for durable goods remain well above pre-pandemic levels, but that almost entirely reflects higher prices for manufactured durable goods. We estimate that prices for manufacturing durable goods rose 11.0% from December 2020 through October 2021.

- Core orders were revised higher for September and rose 0.6% in October, in contrast to our assumption for a small decline. Meanwhile, core shipments were revised lower for September and rose 0.3% in October, a smaller increase than we had assumed. Aircraft shipments were also weaker than anticipated, with a 6.5% decline in October.

- The unexpected weakness in core shipments reflects the difficulty on the part of manufacturers to keep up with orders amid ongoing supply-chain constraints. Indeed, unfilled orders of core capital goods have surged in recent months.

- The unexpected weakness in core shipments implied a downward revision to our forecast of fourth-quarter equipment spending.

- In collaboration with Microsoft and Ballard Power Systems, Caterpillar has embarked on a three-year project to demonstrate a power system incorporating large-format hydrogen fuel cells to produce reliable and sustainable 1.5 MW backup power for Microsoft data centers. The project is supported and partially funded by the US Department of Energy (DOE) under the H2@Scale initiative and backed by the National Renewable Energy Laboratory (NREL). Caterpillar is providing the overall system integration, power electronics and controls that form the central structure of the power solution which will be fueled by low-carbon-intensity hydrogen. Microsoft is hosting the demonstration project at a company data center in Quincy, Washington, while Ballard is supplying an advanced hydrogen fuel cell module. The NREL is performing analyses on safety, techno-economics and greenhouse gas (GHG) impacts. Caterpillar has been working with the DOE on research, development and demonstration projects for more than 20 years. (IHS Markit Upstream Costs and Technology's Kamila Langklep)

- Electric vehicle (EV) manufacturer Tesla is rolling out its Full Self-Driving Beta (FSD Beta) update 10.5, Electrek reported on 22 November. FSD Beta is an early version of Tesla's self-driving software that allows a vehicle to drive autonomously to a destination entered into the navigation system, but the automaker insists that the driver must be ready to take control at all times. The updates include improved vulnerable road user (VRU) crossing velocity error by 20% from improved quality in auto-labelling; improved static world predictions by up to 13% using a new static world auto-labeler; improved cone and sign detections; improved cut-in detection network by 5.5% to help reduce false slowdowns; enabled 'emergency collision avoidance maneuvering' in shadow mode; enabled behavior to lane change away from merges; improved merge object detection recall by using multi-modal object prediction at intersections; improved lane changes by allowing a larger deceleration limit in short-deadline situations; improved lateral control for creeping forward to obtain more visibility; improved modelling of road boundaries on high curvature roads; and improved logic to stay on-route and avoid unnecessary detours/rerouting. (IHS Markit AutoIntelligence's Jamal Amir)

- Tritium Holdings Pty Ltd, a leading provider of electric vehicle (EV) fast-charging networks, has partnered with US-based EVCS to expand EV charging solutions in California, Oregon, and Washington states, according to a press release by Tritium. EVCS, one of the leading EV charging network operators in the United States, has entered into a contract to purchase over 400 Tritium fast chargers to add to its current more than 100 Tritium chargers, it said. The company added that EVCS is in the process of expanding its network by the end of 2022. Notably, EVCS has over 600 DC fast chargers in its network of over 1,500 chargers. EVCS CEO Gustavo Occhiuzzo said, "Expanding EVCS' fast charging network in California, Oregon, and Washington is an important part of reducing range anxiety for EV drivers on the West Coast. Tritium provides best-in-class fast charging hardware, which will allow us to grow our unlimited charging subscription model at a much faster rate." The company said EVCS' order of more than 500 Tritium fast chargers, ranging from 50 kW to 175 kW, are expected to account for nearly half of its fast-charging network, once fully deployed. It aims to provide EV owners in the US with the option to pay through its mobile app, Apple Pay, Google Pay, credit card, or by becoming monthly subscribers with unlimited charging for a small monthly fee. (IHS Markit AutoIntelligence's Jamal Amir)

- The Central Reserve Bank of Peru (Banco Central de Reserva del Perú: BCRP) reports 11.4% year on year (y/y) real GDP growth in the third quarter of 2021. This result is largely explained by the extremely low comparison base from the comparable quarter of 2020, during which economic activity was strictly curtailed. (IHS Markit Economist Jeremy Smith)

- Real GDP grew at a robust 3.0% pace compared with the second quarter in seasonally adjusted terms, lifting output by 1.1% above the pre-pandemic peak reached in the fourth quarter of 2019. This followed back-to-back contractions in the first half.

- The monthly index of economic activity, a close proxy for output, was 2.0% above the January 2020 level as of September 2021. Ultra-loose fiscal and monetary policy continued to be highly supportive of growth in the third quarter.

- Second-quarter private consumption improved to 2.8% above the same period of 2019. Curfews, capacity limits, and other restrictions on economic activity were gradually relaxed in the third quarter as COVID-19 infections fell and the vaccination rate improved substantially. A new round of stimulus payments of USD350 to around 13.5 million Peruvian households gave a further boost.

- These factors enabled a greater recovery in consumer spending on retail and other services that had previously lagged considerably. Retail sales and overall service-sector activity are each 1.3% above comparable 2019 levels.

- Net exports continued to be a drag on growth. Inbound tourism remains highly depressed at 15% of 2019 levels as of September, leaving exports 11.9% below 2019, while recovering consumer demand and strong industrial activity caused an increase in import volumes.

- Peru's Financial Superintendence of Banking and Insurance (Superintendencia de Banca, Seguros y AFP: SBS) on 22 November published its financial stability report for the second half of 2021; the report is different from the one published by the Central Bank of Peru (Banco Central de Reserva del Perú: BCRP). (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- The document details the current condition of the financial system, highlighting that the improvement in the Peruvian economy has been favorable, aiding the recovery of the banking sector, particularly from a credit growth and profitability perspective. Nevertheless, credit risks - both measured by deteriorated loans and resilience of the corporate portfolio - have been increasing, likely leading to a decline in asset quality.

- IHS Markit agrees with the SBS regarding the persistence of credit risks in the sector. In our view, it is the main concerning factor for Peruvian banks given that the sector excels in other areas such as provisioning and capitalization and has appropriate levels of liquidity, although it has some signals of tightness, such as a high loan-to-deposit ratio.

- The SBS reports that loans that are past due by more than 15 days were at 4% of total loans in September, particularly contributed by the small and medium-sized enterprise (SME) segment, at 7.6%. We assessed that the significant refinancing of loans during mid-2020 was likely to lead to higher credit risks. If we focus on the high-risk trench of the credit portfolio, which includes the refinanced credits, the past-due portfolio is at 6.1%, with the SME segment at 10.0%. Additionally, 15.1% of the 2020 refinanced loans (equivalent to 2% of total loans) are past due by six months, likely leading to a rise in the non-performing loan (NPL) ratio.

- In our current forecast, we expect the NPL ratio to end 2021 at 3.2% and 2022 at 3.1%, well above its 10-year historical average of 2.2%.

- Toyota has announced plans to increase the annual production capacity of its plant in Zárate, Argentina, by 27,000 units from 2022, as well as to create 500 direct jobs, reports NF News Center. Daniel Herrero, president of Toyota Argentina, made the announcement yesterday (23 November) at a meeting with Argentinian President Alberto Fernández. Herrero said, "The company will increase from 140,000 to 167,000 units the production capacity in 2022, which implies the incorporation of 500 new jobs at the Zárate plant, plus 1,000 in the value chain." He added, "Japan has high expectations about Argentina, is optimistic in terms of its future, and the demand for pick-ups throughout the Latin American market is growing." (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- European equity indices closed mixed; Italy +0.6%, UK +0.3%, France flat, Spain -0.3%, and Germany -0.4%.

- 10yr European govt bonds closed mixed; Germany -1bp, UK flat, France +2bps, and Italy/Spain +3bps.

- iTraxx-Europe closed flat/52bps and iTraxx-Xover +3bps/263bps.

- Brent crude closed -0.3%/$81.05 per barrel.

- World wine production has been dragged down by shortfalls in the EU, with consumption also thought to be lower but more data is required. It worth noting there were production gains of 30% in both Australia and Chile. (IHS Markit Food and Agricultural Commodities' Julian Gale)

- The sharp drop in EU wine production means that global 2021 output hit an almost record low of around 250 million hectoliters.

- All three big countries, Italy, France and Spain, saw substantial declines. France dropped from second place to third place in the ranking.

- Italy's 2021 wine output is estimated at down 9% y/y to 44.5 million hectoliters.

- Spain is at -14% to 35 million hectoliters and France -27% to 34.2 million hectoliters.

- In 2020 these three European countries together made 136.5 million hectoliters. Their cumulative 2021 volume is only 113.7 million hectoliters, a decrease of 22.8 million hectoliters or -17% collectively.

- These three countries made 78% of all wine in the EU. They also account for almost 50% of the global wine production.

- The International Organization of Vine and Wine (OIV) estimates that the total global production of wine in 2021 will range between 247-253 million hectoliters. This number is very close to the harvest in 2017 of 247 million hectoliters, which was the smallest volume in more than 20 years.

- The headline German Ifo index, which reflects business confidence in industry, services, trade, and construction combined, has declined anew from 97.7 to 96.5 in November. This is now just marginally above the pre-pandemic level in February 2020 (96.3) and slightly below the long-term average of 97.1. The Ifo institute blames both supply bottlenecks and the fourth wave of the COVID-19 pandemic for the ongoing drop in confidence. (IHS Markit Economist Timo Klein)

- Business expectations have dipped for the fifth consecutive month in November, but at only half the pace of the previous month. The decline from 95.4 to 94.2 dampens expectations to their lowest level since January, which is a fair amount below their long-term average (97.6). The service sector stands out as the main depressing force for expectations in November. Manufacturing sector expectations have improved for the first time since March, mainly owing to a brightening outlook in the automotive industry. This indicates that supply chain issues, although remaining a problem, have lost some of their depressing momentum. In contrast, the construction sector outlook has worsened for the first time since April.

- Meanwhile, the assessment of current conditions has worsened to the same degree as expectations in November, slipping from 100.2 (revised up from 100.1) to 99.0. This is the lowest level since May and is almost equal to the pre-pandemic reading of 99.1 in February 2020. Nevertheless, it remains clearly above the long-term average of 96.7. With respect to the current situation, confidence in construction and trade has improved slightly, whereas sentiment has worsened in the manufacturing and service sectors. The latter is evidently related to the renewed tightening of administrative restrictions - especially for the unvaccinated - in an effort to break the momentum of the fourth wave of the pandemic.

- The workforce at Tesla's new German facility is taking steps to organize and set up a works council, reports Reuters. The IG Metall union has said that seven employees have taken the first steps towards setting up this body and are planning to choose an election committee on 29 November. However, the union added that as only one-sixth of the 12,000 staff planned for the facility have been hired so far, the election of works council will not take place soon. Birgit Dietze, IG Metall's district leader in the Berlin, Brandenburg, and Saxony areas, added, "A works council ensures that the interests of the workforce have a voice and a weight. This is in line with the democratic work culture in Germany." Tesla's workforce has not typically been aligned with a union in other countries where the automaker builds its vehicles. Indeed, the automaker has faced complaints from the United Auto Workers (UAW) union in the United States over the steps that it has taken to prevent unionization at its Fremont, California (US), facility. (IHS Markit AutoIntelligence's Ian Fletcher)

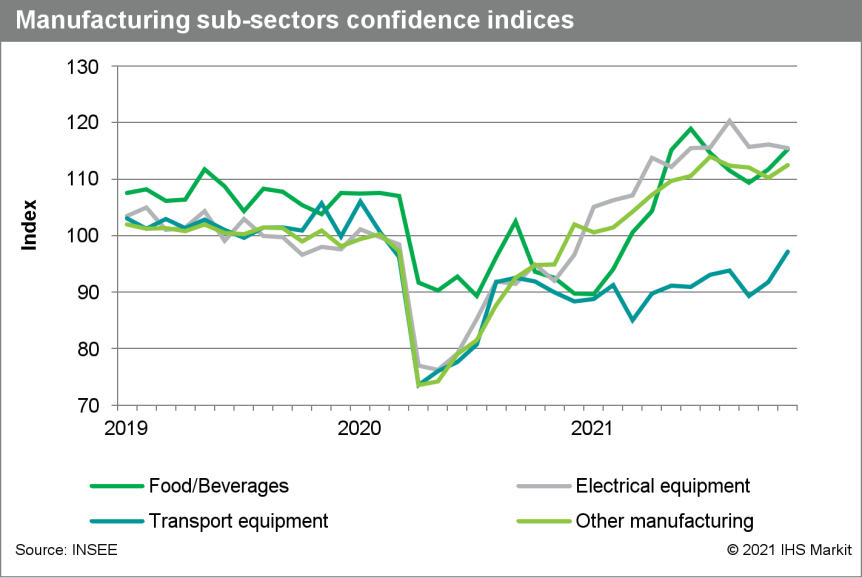

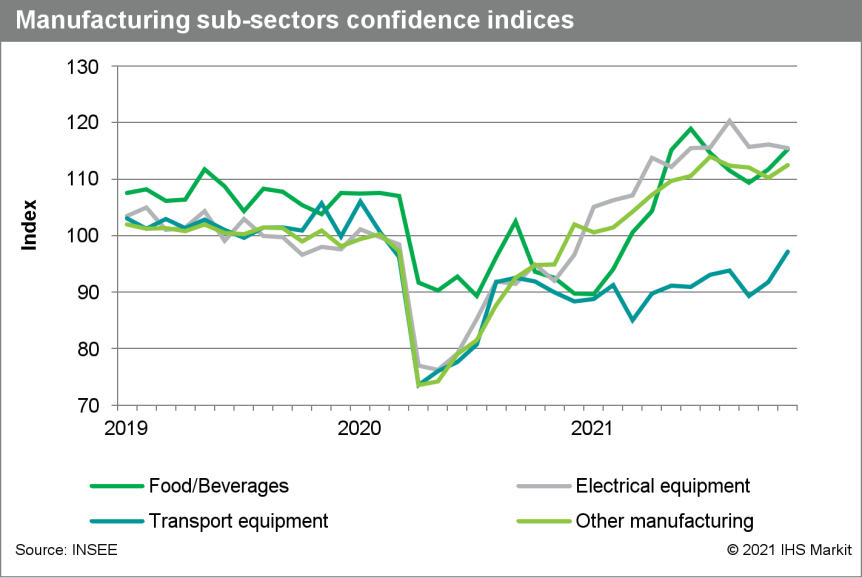

- France's business sentiment index stands at 114 in November, up from 112 in October (revised from 113). The index has now improved for the second successive month, and it is well above its long-term average of 100. (IHS Markit Economist Diego Iscaro)

- Sentiment has increased in all the sectors included in the survey. However, the highlight of November's release is the improvement in the confidence index in the manufacturing sector, which has risen for the first time in three months.

- Manufacturers have reported improved order books, particularly from abroad. Moreover, the index measuring personal production expectations has risen in November, despite a less upbeat assessment of the economic outlook.

- The increase in confidence is particularly strong in transport equipment (excluding vehicles, which has actually declined in November). However, confidence among transport equipment manufacturers remains well below its pre-pandemic levels.

- Confidence in the service sector has continued to trend upwards, reaching a level not seen in almost 21 years. Although the index measuring expected demand has declined modestly, this is more than offset by a more upbeat view on expected activity and employment.

- Confidence in the wholesale and retail sectors has continued to increase in November, while the confidence index in the construction sector has risen to a level not seen since 2008.

- Greece's Prime Minister, Kyriakos Mitsotakis, has announced a series of measures to protect household incomes from rising inflation. The measures include pay-outs to low-income pensioners, recipients of disability allowances, and health workers. (IHS Markit Economist Diego Iscaro)

- The pay-outs will be disbursed over the next six months. The total cost of these measures is estimated to be EUR338.5 million (USD380 million, around 0.2% of GDP).

- This support comes on top of a previously announced electricity bill subsidy and the heating benefit. In total, the measures introduced to protect households from higher prices are around EUR680 million (0.4% of GDP).

- The new measures were not included on the 2022 budget tabled last week, which projects a primary (i.e., excluding interest payments) deficit of 1.2% of GDP next year.

- Yandex has said that its new generation of vehicles will deploy sensors developed in-house, reports Bloomberg. The new cars from the Yandex Self-Driving Group will have a software-defined LiDAR system as the main sensor, which has a range of 500 meters and can operate in frigid weather. The company said that about 70 cars in Russia, the United States, and Israel will be equipped with this sensor. LiDAR sensors are necessary for autonomous vehicles (AVs) as they measure distance via pulses of laser light and generate 3D maps of the world around them. Yandex's move to in-house LiDAR sensors will help the company to bring down the unit cost of LiDAR sensors through economies of scale. Yandex said that previously its vehicles were equipped with sensors manufactured by Velodyne, and it would continue to use those for near-field detection. (IHS Markit Automotive Mobility's Surabhi Rajpal)

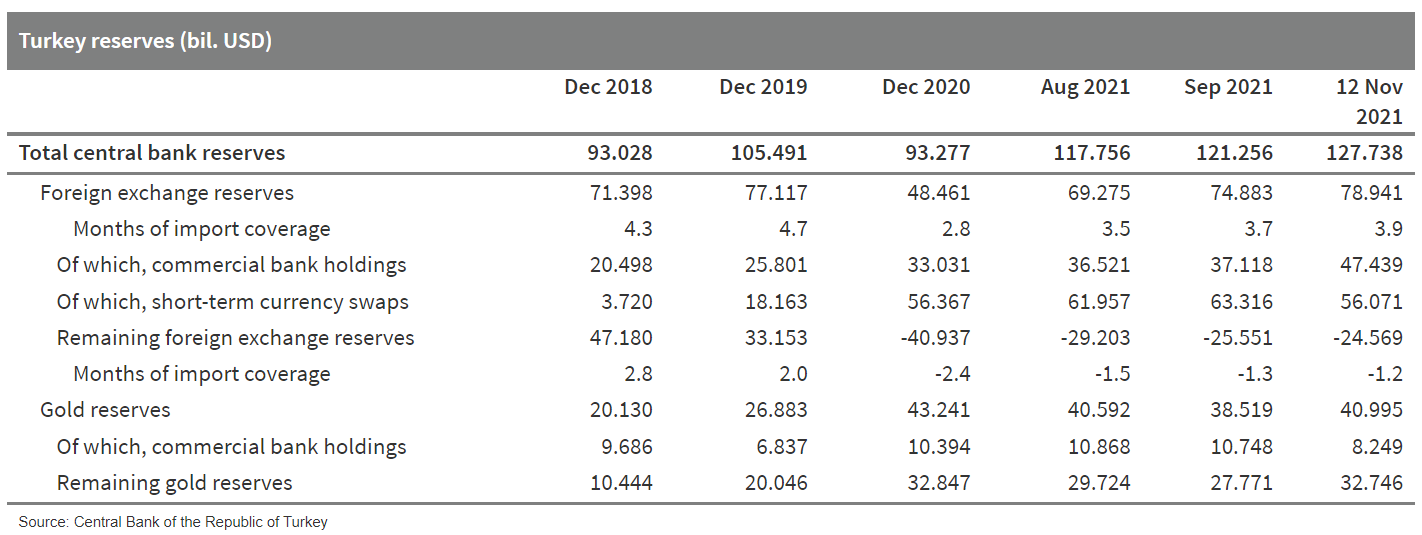

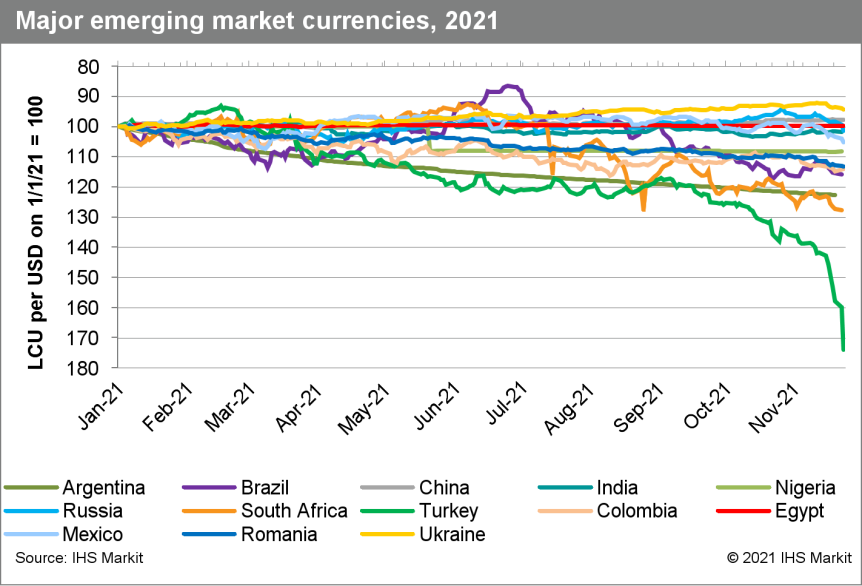

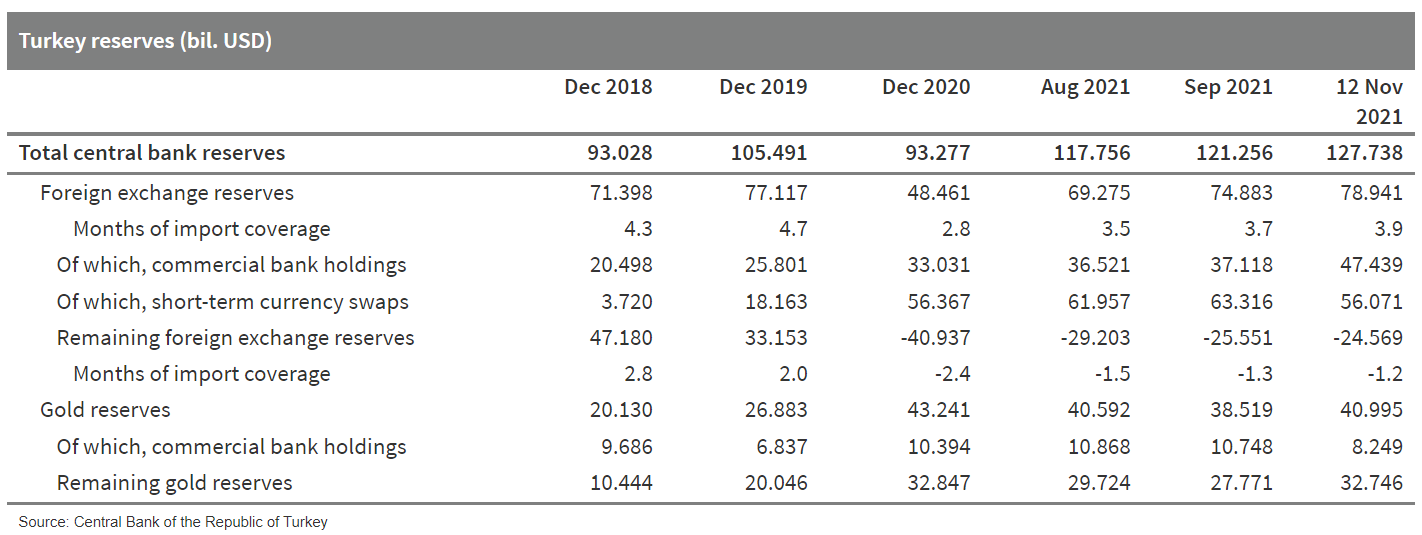

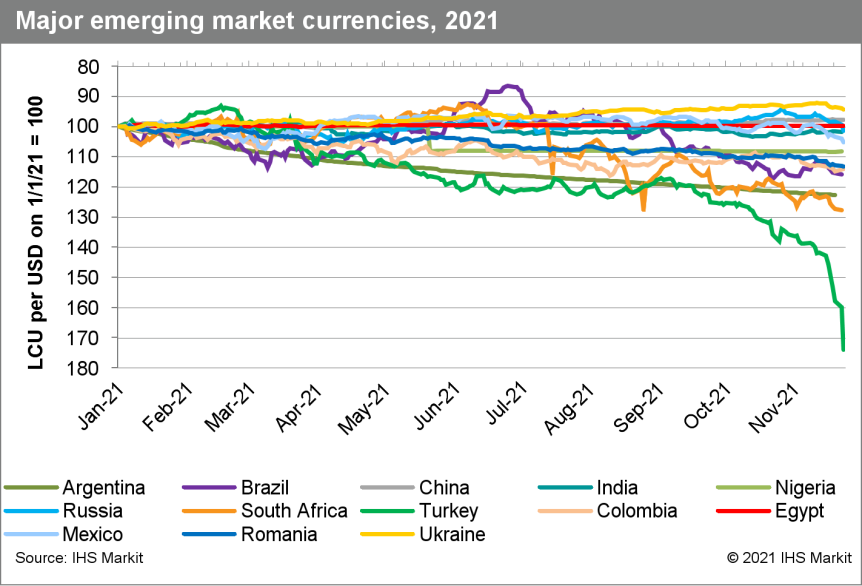

- The Turkish lira continued to plunge on 23 November as President Recep Tayyip Erdoǧan expanded his anti-interest rate rhetoric. Severe lira losses are aggravating inflation and beginning to disrupt real economic activity, as purchase/sale contracts are unable to be efficiently negotiated against the plunging lira. Lira losses in 2021 have surpassed those from 2018, with further depreciation likely given that Erdoǧan is giving no indication of agreeing to a rate rise as happened three years ago and the central bank's net foreign exchange reserve position is now more precarious. (IHS Markit Economist Andrew Birch)

- The lira continued to plunge on 23 November, with President Erdoǧan once again further enflaming the depreciation with his statements. That day, Erdoǧan pledged to keep interest rates below the prevailing rate of inflation until economic growth in Turkey.

- By doubling down on his previous days' rhetoric of continued monetary policy in the face of high inflation and sharp lira depreciation, the exchange rate reportedly tumbled to as low as TRY13.46/USD1.00 during the day, although it ended the day officially trading at TRY12.17/USD1.00. Even with a late day rally, the lira nonetheless depreciated by 8.8% over the course of the single day and was down by over 25% in less than two weeks.

- The severe lira losses are not only aggravating inflationary pressures, but are beginning to disrupt real production and retail trade activity. According to several various news reports, wholesalers are beginning to refuse to sell their goods to retailers because they cannot properly set prices. They fear that if they sell to retailers at one price, they would need to pay substantially more to replace their inventory.

- Sell contracts between wholesalers and their sources and between wholesalers and retail outlets are now being drawn up in foreign currency terms because of the unpredictability of the lira. The lira losses are putting retailers in a particular predicament, as they must now purchase goods in foreign currency but, by and large, must sell in lira, leading to a sharp squeeze on profits. In one headline-grabbing move, Apple has frozen its retail operation in Turkey because of an inability to properly set prices.

- Foxconn Interconnect Technology (FIT), a subsidiary of Foxconn, has invested USD10 million in connected vehicle technology developer Autotalks, according to a company statement. This investment is a strategic collaboration between the two companies that will allow them to accelerate vehicle-to-everything (V2X) penetration across automotive and micro-mobility segments. FIT will leverage Autotalks' automotive V2X technology and its recently launched ZooZ micro-mobility platform. The companies will jointly begin activities in the micro-mobility segment later this year, and in the automotive segment at the beginning of next year. Thomas Fann, special assistant to the chairman at FIT, said, "Over the last couple of years, we have been strategically expanding into the automotive segment, with special focus on electric vehicles, connectivity, mobility and safety and technologies. We see Autotalks as the provider of the world's most trusted V2X solution, with the highest performance, security and reliability. This is why we decided to enter into [a] strategic collaboration agreement with Autotalks and invest USD10 million in this company." V2X is designed to allow vehicles to communicate directly with other vehicles, pedestrians, devices, and roadside infrastructure, and assists Advanced Driver Assistance Systems (ADAS) operations. Autotalks is an Israeli-based company founded in 2008 that specializes in developing chipsets for vehicle communication in automated vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- At its Exhibit Zero Arabia event being held at Dubai World Trade Center, General Motors (GM) announced its plans to launch 13 new electric vehicles (EVs) in the Middle Eastern market by 2025, reports Zawya. According to the source, this will start with the launch of EVs like the Chevrolet Bolt, GMC Hummer and Cadillac Lyriq. Luay Al Shurafa, President and Managing Director of General Motors Africa and the Middle East said, "I am proud to make this announcement that will change the industry in our region and marks a new era in electrified mobility. We are building a multi-brand, multi-segment EV strategy because we want everybody in." He added, "The Middle East is one of GM's most important international markets and a region of the world known for early adoption of technology. The future is now, and GM's plans align with ambitious and visionary regional government goals to reach net zero, while illustrating GM's commitment to a more sustainable and brighter future. It also establishes our place as more than an automaker - we are an innovator changing the world." GM also announced the launch of OnStar connected vehicle services in the UAE on 2 December. (IHS Markit AutoIntelligence's Tarun Thakur)

- Ride-hailing firm Bolt has signed a deal to enable its drivers in Nigeria to take part in a lease-to-own plan, reports Bloomberg. Under this plan, up to 10,000 energy-efficient vehicles will be financed. The agreement with Metro Africa Xpress, also known as MAX, will allow Bolt drivers to make down payments of as low as 5% depending on their credit score, and pay the balance over five years. Bolt has 75 million customers in 45 countries and is primarily active in Eastern European and African cities. It sees Africa as one of its main targets for expansion and is a dominant ride-hailing firm in Nigeria, with about 35,000 drivers. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Asia-Pacific

- Major APAC equity indices closed mixed; Hong Kong +0.1%, Mainland China +0.1%, South Korea -0.1%, Australia -0.2%, India -0.6%, and Japan -1.6%.

- Mitsubishi Corporation has said that it is conducting talks with the municipal government of Kamakura city in Japan about transforming the region into a smart city, according to a company statement. Mitsubishi Corporation with Kamakura General, Macnica, and Mitsubishi Electric Corporation have initiated a pilot project that combines autonomous vehicle (AV) technologies and healthcare services in Shonan iPark. The project will involve AVs travelling to and from healthcare facilities to perform examinations, check patients' vital statistics and take their medical histories using digital technologies. The Kanagawa Prefecture's publicly funded initiative to support companies engaged in robotics technology trials, as well as funding from the cities of Kamakura and Fujisawa, will provide financial assistance for this pilot project. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Nitin Gadkari, India's Union Minister of Road Transport and Highways, has proposed a benefit worth INR100,000-150,000 (USD1,340-2,010) for every individual who scraps an old vehicle, reports The Times of India. According to the news source, the Indian transport minister has approached the finance minister with a proposal to request that the GST Council grant incentives to individuals to move to cleaner vehicles. According to the report, Transport Minister Gadkari said, "I have requested that whoever comes with a scrappage certificate should be offered a minimum (discount) of INR100,000-150,000 in benefits. This is a request and is not mandatory." The transport minister said that the vehicle scrappage policy of the central government would eventually lead to an increase in new vehicle sales of 12-15% for auto companies, as well as help them access inexpensive raw materials recovered from scrapped cars. (IHS Markit AutoIntelligence's Tarun Thakur)

Posted 24 November 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.