All major US and European equity indices closed higher and APAC equity markets closed mixed. US government bonds closed unchanged, while benchmark European bonds closed mixed. European iTraxx and CDX-NA closed tighter across IG and high yield. The US dollar, natural gas, oil, and copper closed higher, while gold and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher, with the Nasdaq +1.0%, S&P 500 +1.0%, and DJIA +0.7% closing at new record highs; Russell 2000 +0.5%.

- 10yr US govt bonds closed flat/1.28% yield and 30yr bonds flat/1.92% yield.

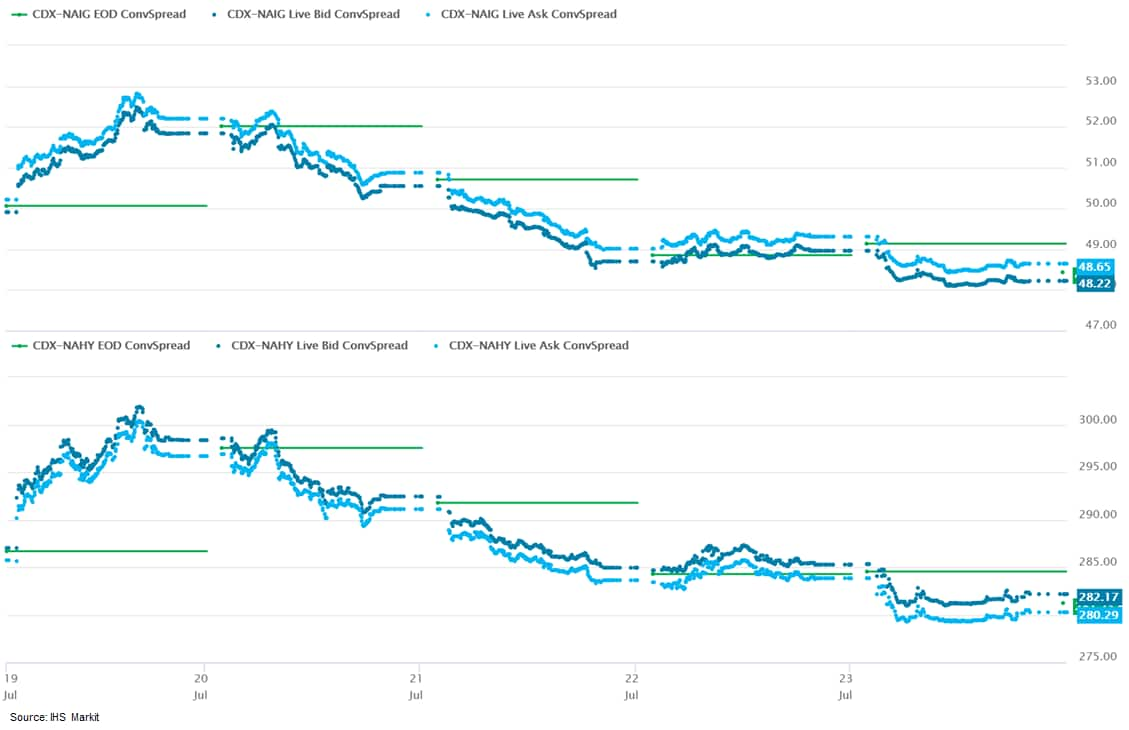

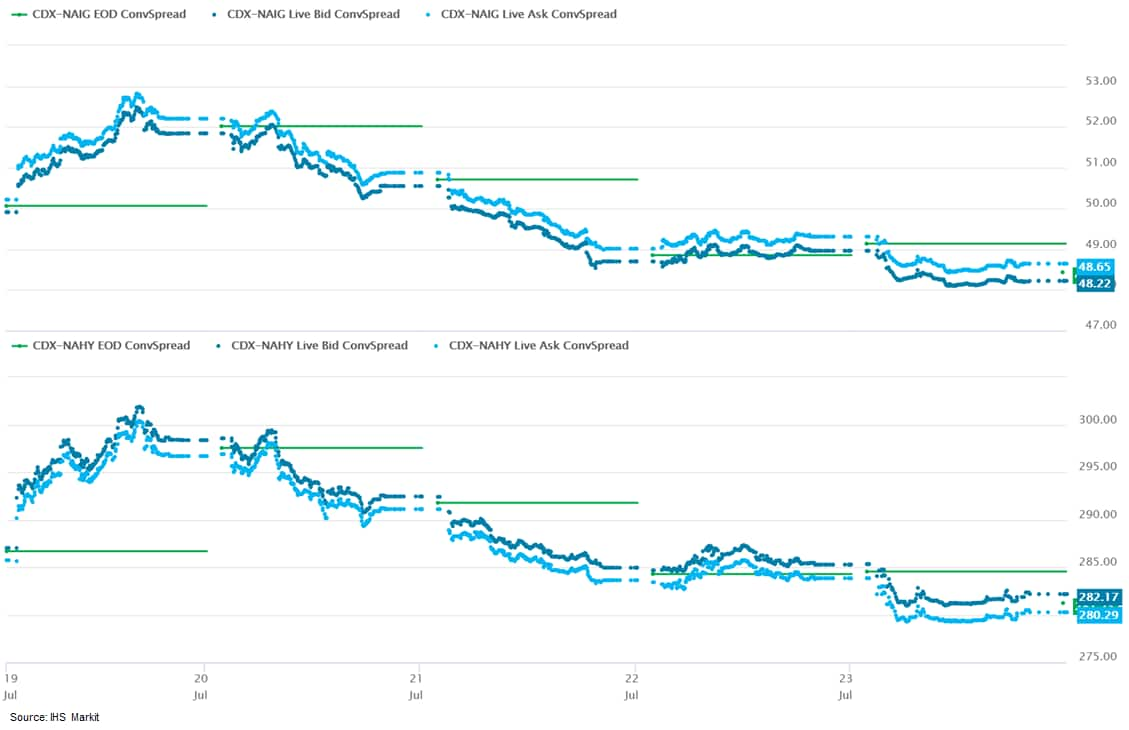

- CDX-NAIG closed -1bp/48bps and CDX-NAHY -3bps/281bps, which is -2bps and -6bps week-over-week, respectively.

- DXY US dollar index closed +0.1%/92.91.

- Gold closed -0.2%/$1,802 per troy oz, silver -0.6%/$25.23 per troy oz, and copper +1.4%/$4.40 per pound.

- Crude oil closed +0.2%/$72.07 per barrel and natural gas closed +1.4%/$4.06 per mmbtu.

- Adjusted for seasonal factors, the IHS Markit Flash U.S. Composite PMI Output Index posted 59.7 in July, down from 63.7 in June. The rate of output growth was the slowest for four months, but robust nonetheless and among the fastest recorded over the survey's 14-year history. Manufacturers registered a slight acceleration in the pace of expansion in production, but service providers recorded a further loss of growth momentum amid labor shortages. (IHS Markit Economist Chris Williamson)

- Flash U.S. Services Business Activity Index at 59.8 (64.6 in June). 5-month low.

- Flash U.S. Manufacturing PMI at 63.1 (62.1 in June). Series record high.

- Flash U.S. Manufacturing Output Index at 59.5 (58.9 in June). 2-month high.

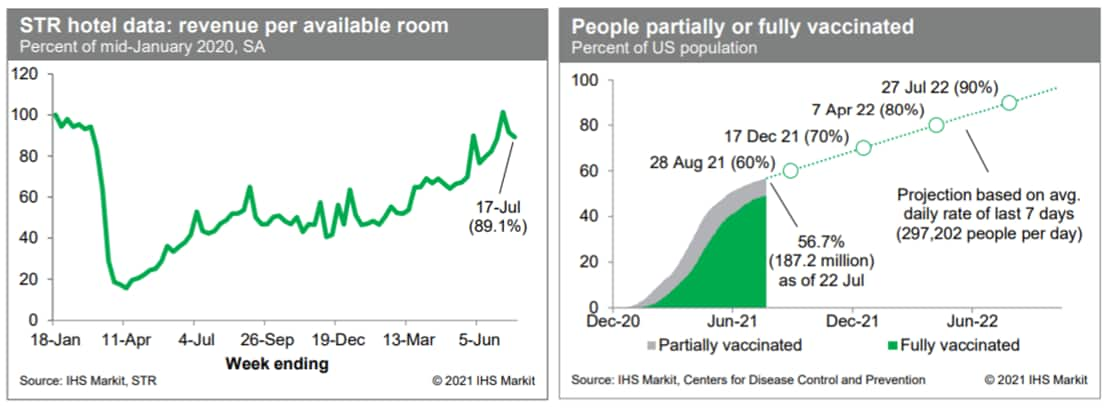

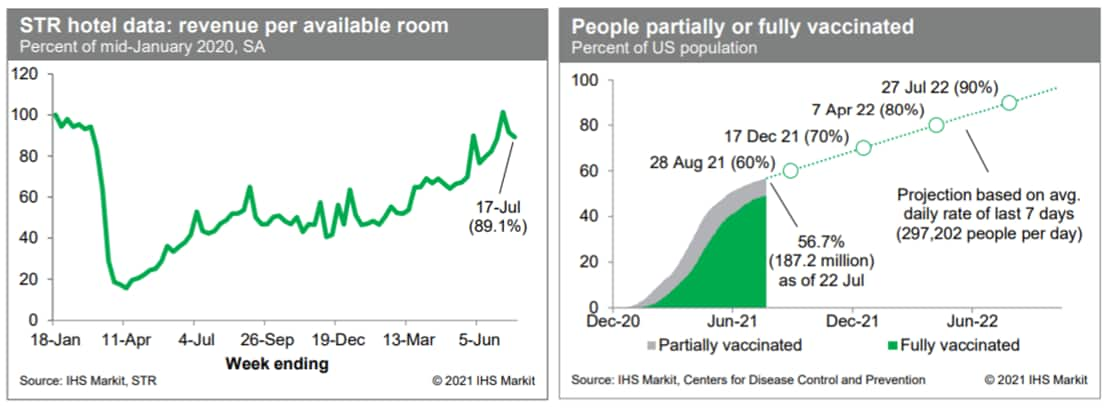

- Revenue per available room last week (seasonally adjusted) was 89.1% of the mid-January 2020 level, according to our estimate based on weekly data from STR. This is consistent with airport passenger traffic, which has staged a roughly equal recovery. Meanwhile, averaged over the last seven days, about 297,000 people per day received a first (or only) dose of a COVID-19 vaccination, up from the prior week's rate of about 271,000 per day. As of yesterday, 187.2 million US residents, or about 57% of the population, were at least partially vaccinated against COVID-19. At the current rate, the US would achieve widespread vaccination (70-80%) by early next year. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Arvinas and Pfizer (both US) have jointly announced that they have entered into a global collaboration to develop and commercialize Arvinas's investigational oestrogen receptor-targeting breast cancer therapy ARV-471, and that in a separate deal, Pfizer will make a USD350-million equity investment in Arvinas, giving it an ownership share of about 7%. Under the terms of the ARV-471 collaboration, Pfizer will make an upfront payment of USD650 million to Arvinas, and the two companies will equally share worldwide development and commercialization costs. Arvinas is also eligible to receive up to USD400 million in approval milestones and up to USD1 billion in commercial milestones, in addition to sharing worldwide profits on ARV-471. (IHS Markit Life Sciences' Milena Izmirlieva)

- Latham, New York-based Plug Power isn't content with just decarbonizing forklifts with its patented hydrogen fuel cells at big box stores like Walmart or Home Depot or mammoth data centers. The company is now eyeing the skies to demonstrate that renewable energy-sourced, green hydrogen produced at its own facilities can be used safely and cleanly in fuel cells to power the two propellers of regional airplanes. Armed with green hydrogen fuel cells from Plug Power and electric motors from MagniX, Los Angeles-based Universal Hydrogen is developing a 2-MW powertrain for retrofitting regional turboprop-powered aircraft. Compared with kerosene, a petroleum product currently used in regional turboprop planes, fuel cells are cleaner because they generate power through an electrochemical reaction rather than combustion. When powered with hydrogen, their only exhaust is water rather than CO2 and other pollutants. The goal of both Plug Power and Universal Hydrogen is to test this retrofitted engine in either a de Havilland Canada Dash 8-300 or an Embraer ATR 42 aircraft that can carry between 40-60 passengers up to about 700 miles. (IHS Markit Net-Zero Business Daily's Amena Saiyid)

- Trading of electric vehicle (EV) startup Faraday Future's shares began on the NASDAQ stock exchange on 22 July. This followed the closure Faraday's merger with special purpose acquisition company (SPAC) Property Solutions Acquisition Corp (PSAC). The newly combined company is called Faraday Future Intelligent Electric. The new company's common stock trades under the ticker 'FFIE', with warrants trading under FFIEW. Faraday expects the deal to generate gross proceeds of about USD1 billion and to fully finance the launch of the FF 91 within 12 months of the July closing of the merger, which was the plan announced in January. (IHS Markit AutoIntelligence's Stephanie Brinley)

- US electric vehicle (EV) maker Rivian has confirmed that it is looking at potential sites for a second assembly plant, according to a media report. Reuters reports on the developments, citing several unnamed sources as well as a Rivian spokesperson. The Rivian spokesperson is quoted as saying, "While it's early in an evolving process, Rivian is exploring locations for a second U.S. manufacturing facility… We look forward to working with a supportive, technology-forward community in order to create a partnership as strong as the one we have with Normal [Illinois, the location of Rivian's existing plant]." Reuters also reports that other sources have confirmed that, as part of Rivian's "Project Tera", several US states are bidding to host the new plant, the location of which the company could announce by the end of 2021. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Uber Technologies' trucking business is acquiring transportation logistics company Transplace for about USD2.25 billion. Uber Freight is buying Transplace from private equity firm TPG Capital. The deal will involve USD750 million in Uber stock, with the remainder in cash. The companies said this combination is expected to create one of the largest and most-comprehensive managed transportation and logistics networks in the world. (IHS Markit Automotive Mobility's Surabhi Rajpal)

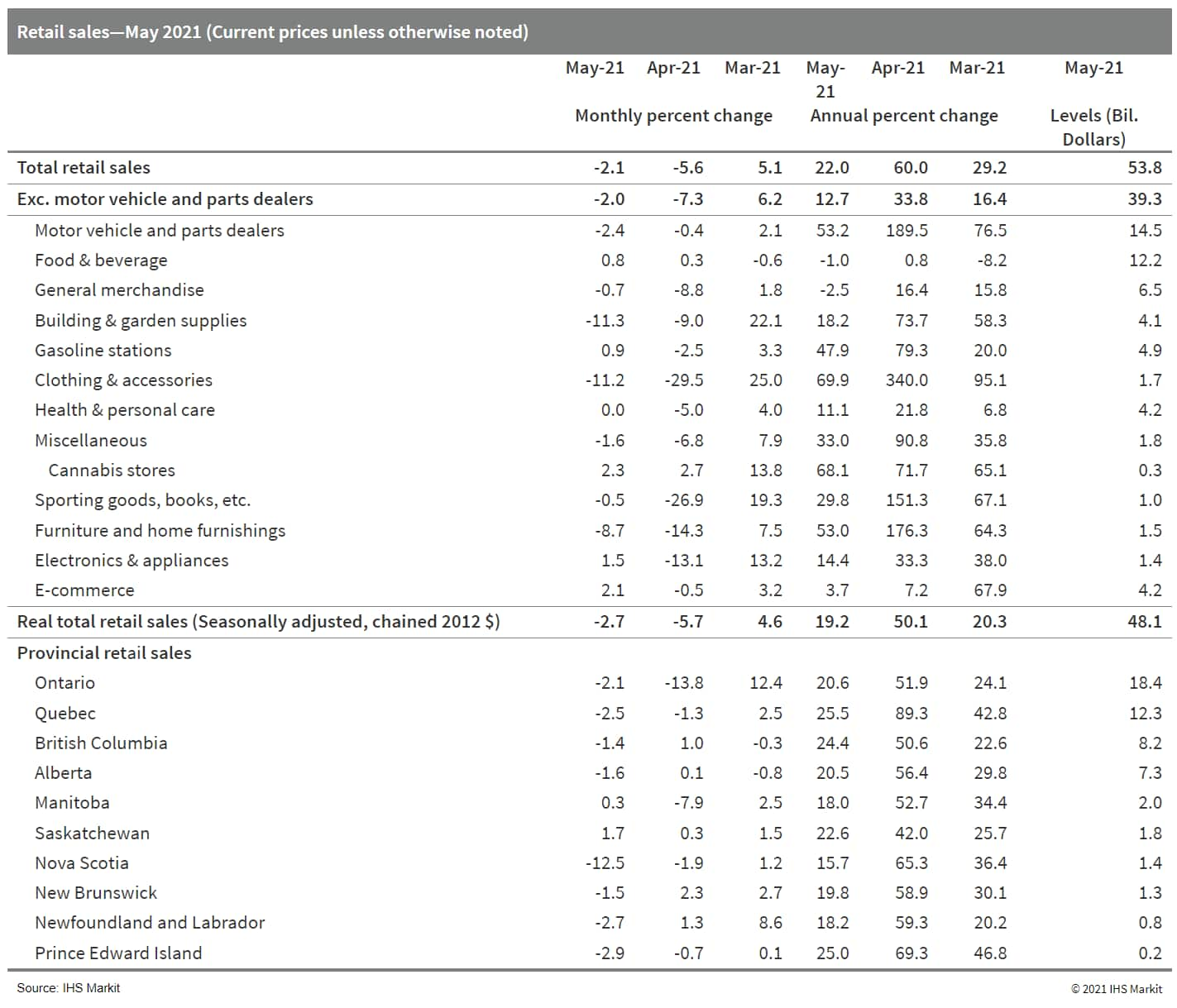

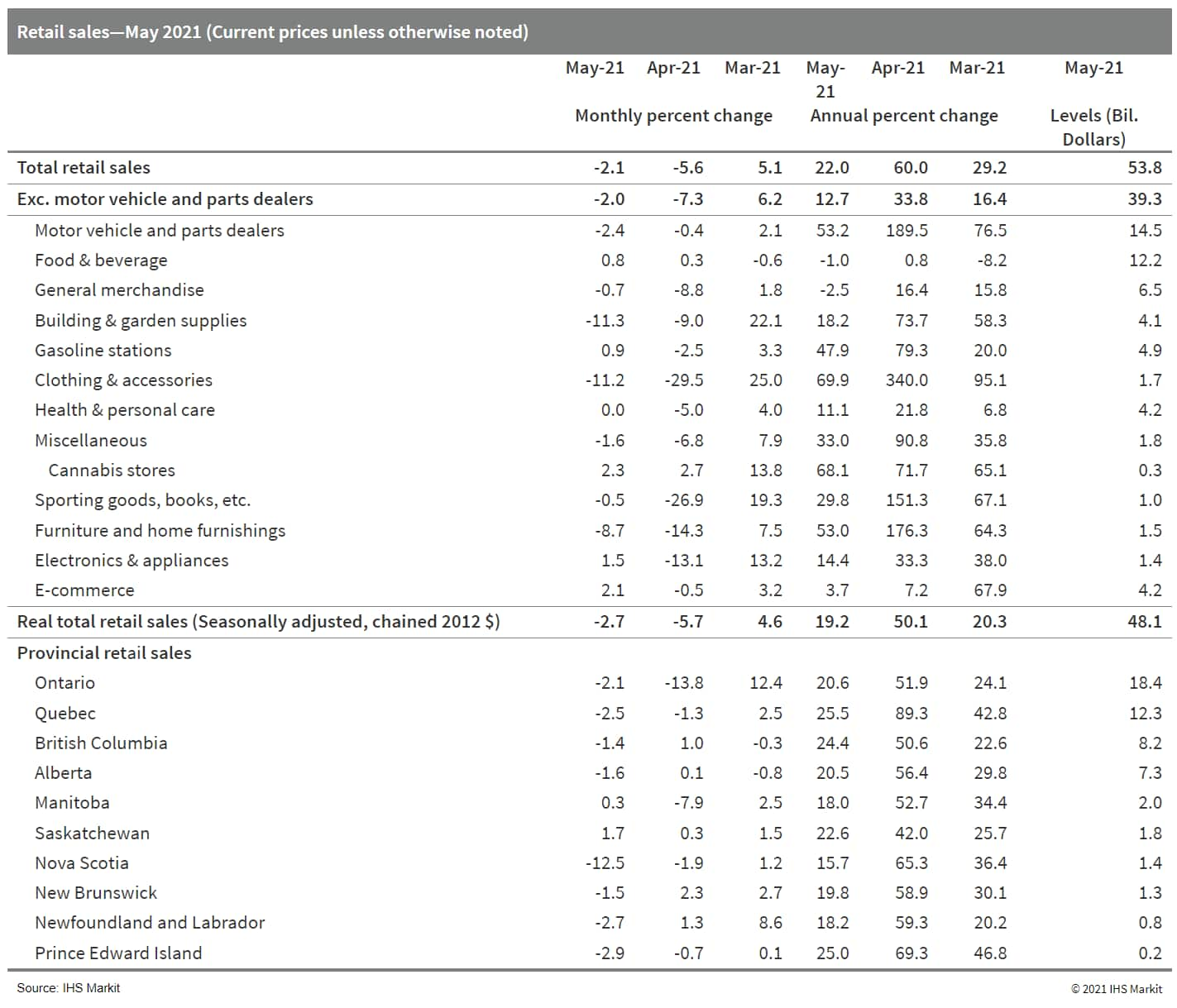

- Canada's nominal retail sales figure fell 2.1% month on month (m/m) to $53.8 billion in May as provincial public health restrictions were extended from April. (IHS Markit Economist Evan Andrade)

- Core retail sales, excluding vehicle and gasoline sales, fell a further 2.4% m/m, primarily driven by a deep 11.3% m/m sales decline within building and garden supply retailers.

- In volume terms, retail sales fell a further 2.7% m/m to $48.1 billion as prices rose over the month.

- With the lifting of regional restrictions during June, retailers are expected to recoup some of their second-quarter losses. The preliminary estimate from Statistics Canada is a 4.4% m/m increase for June sales.

- Beverage group Arca Continental, the second largest Coca-Cola bottler in Latin America, has reported a 6.7% y-o-y increase in net sales to MXN45.8 billion (USD2.27 billion) in the second quarter. The company's EBITDA rose to MXN9.4 billion (+14.1% y-o-y) in Q2. "The results exceeded our expectations ... in an environment still affected by the pandemic," said Richard Horbach, an analyst at Intercam Banco. Arca Continental sold 300.1 million unit cases, or MUC, (+2.9% y-o-y) in the cola and 103.8 MUC (+16.1% y-o-y) in the flavors category in Q2. Sales of still beverages, including teas, isotonics, energy drinks, juices, nectars, fruit beverages and dairy, rose 29.3% to 50.7 MUC in Q2. (IHS Markit Food and Agricultural Commodities' Vladimir Pekic)

- According to news portal Infobae, the Banking Association of Argentina (Asociación de Bancos de la Argentina: ABA) and the Association of Argentine Banks (Asociación de Bancos Argentinos: Adeba) have informed the Central Bank of the Argentine Republic (Banco Central de la República Argentina: BCRA) that they have limited transfers from and to virtual accounts since that type of transactions have "enabled crimes related to financial services". The Argentine Chamber of Fintech (Cámara Argentina de Fintech: CAF) has denied the charge and has claimed the decision to be against the BCRA's norms. Meanwhile, the ABA and Adeba have asked for increasing regulation in relation to financial technology (fintech) companies and improved operational processes between money-transfer systems that connect virtual accounts with banking accounts. The CAF has denied that there is a lack of interoperability between both systems. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

Europe/Middle East/Africa

- Most major European equity indices markets closed higher; France +1.4%, Italy +1.3%, Spain +1.1%, Germany +1.0%, and UK +0.9%.

- 10yr European govt bonds closed mixed; Italy -2bps, France flat, Germany +1bp, and Spain +5bps.

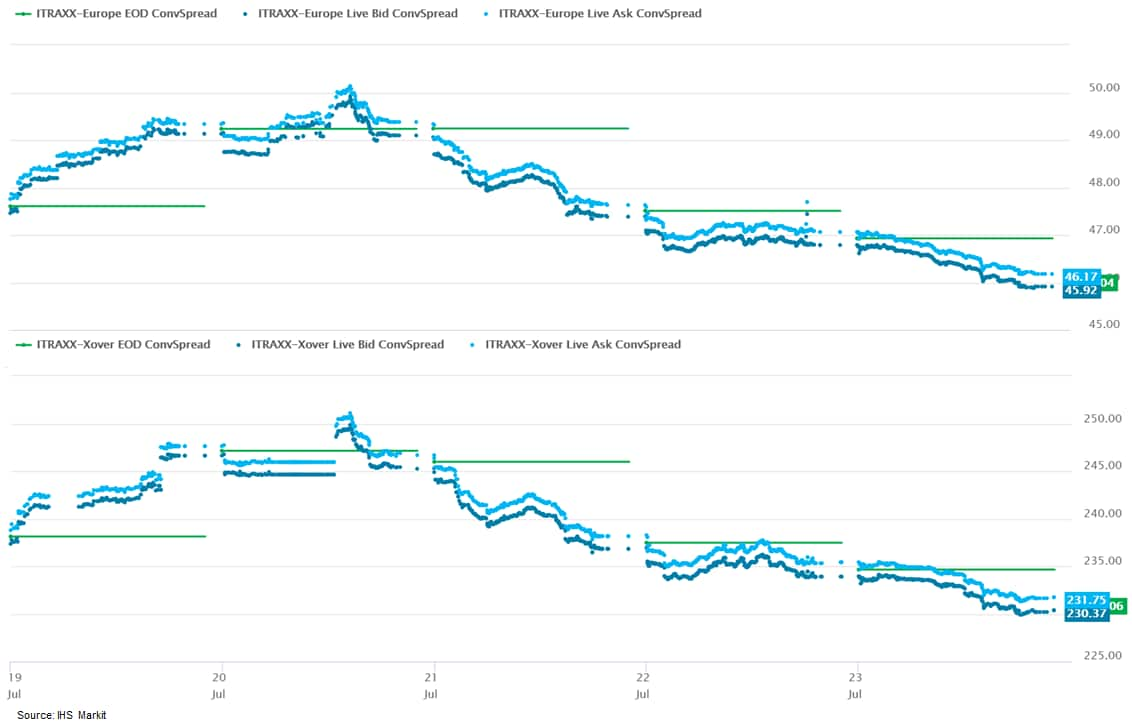

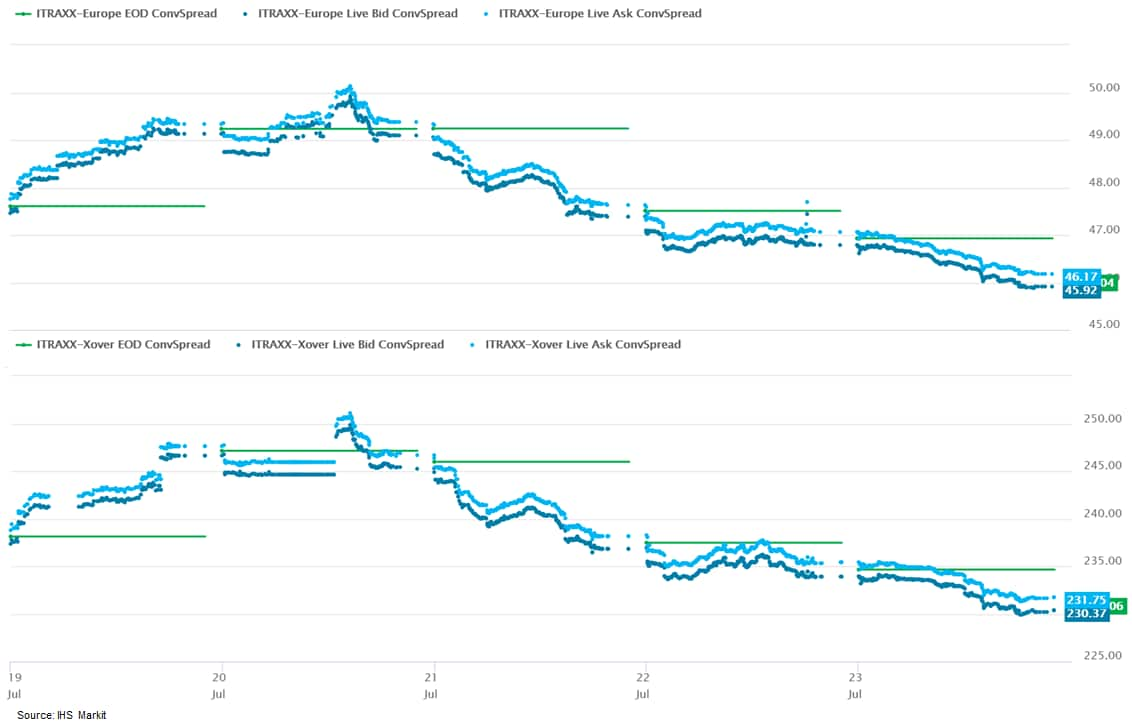

- iTraxx-Europe closed -1bp/46bps and iTraxx-Xover -4bps/231bps, which is -2bps and -7bps week-over-week, respectively.

- Brent crude closed +0.4%/$74.10 per barrel.

- July saw the UK economy's recent growth spurt hit by a rising wave of virus infections, which subdued customer demand, disrupted supply chains and caused widespread staff shortages. (IHS Markit Economist Chris Williamson)

- The IHS Markit/CIPS flash composite PMI output index, covering both services and manufacturing, fell further from its all-time high of 62.9 in May, down sharply from 62.2 in June to 57.7 in July.

- Although the PMI remains elevated by historical standards, indicating that business activity continued to grow strongly, the decline in the index means the rate of expansion slowed to the weakest since March.

- While growth was buoyed by the easing of lockdown restrictions to the lowest since the pandemic began, July also saw widespread reports of virus-related factors subduing customer demand, disrupting supply chains and causing widespread staff shortages.

- Transport, hospitality and other consumer-facing services companies were the hardest hit, though manufacturing also saw growth slow markedly during July. Business and financial services and the IT sector showed the greatest resilience.

- Furthermore, concerns over the Delta variant overshadowed any optimism associated with the passing of "freedom day", and were a key factor alongside Brexit and rising costs behind a sharp slide in business expectations for the year ahead, which slumped to the lowest since last October.

- The IHS Markit/CIPS UK manufacturing PMI's output index, which measures month-on-month changes in production volumes, fell from 61.1 to 57.1 between June and July, according to the provisional 'flash' data. With the index above 50, the survey continued to signal expansion, but the decline in the index indicated the weakest production growth since March. (IHS Markit Economist Chris Williamson)

- Analysis of the replies provided by those manufacturers reporting lower production volumes in July highlights a growing impact of COVID-19 and staff shortages, though material shortages remain the most common cause of lost output.

- Of those giving a reason for falling production, one-in-three (34%) attributed the decline to a shortage of raw materials and components, which in turn were blamed on a combination of the pandemic and Brexit-related supply disruptions. As a proportion that was down from 44% in June, though the actual number of companies reporting shortages was only marginally lower.

- The survey also showed that supply delays continued to develop at a pace rarely witnessed over almost 30 years of survey history, according to the suppliers' delivery times index - an important barometer of capacity constraints and inflationary pressures.

- An additional 14% reported that production was curbed by a lack of staff, in many cases also attributed to COVID-19, with employees either ill with the virus or unavailable to work due to isolation rules, though others simply noted difficulties filling vacancies.

- At the same time the proportion blaming lost output on COVID-19 in general jumped from 7% in June to 16% in July, with companies often citing the rise in infection numbers associated with the Delta variant.

- One-in-four (24%) meanwhile reported that lower production was caused simply by weakened demand, with 6% citing lower exports.

- The Office for National Statistics (ONS) has reported that UK retail sales improved in June following a drop in May. Improved spending during June was due to increased sales of food and drinks as households stayed indoors to watch the Euro 2020 football tournament. (IHS Markit Economist Raj Badiani)

- The volume of retail sales grew by 0.5% month on month (m/m) in June after a 1.3% m/m drop in May.

- Therefore, retail sales volumes during the month stood 9.5% above their pre-COVID-19 virus level (February 2020). Retailers have benefited from households spending less on services and foreign travel during the three national lockdowns in England.

- Sales in food stores grew by 4.2% m/m in June. The ONS reported that anecdotal evidence suggests that these increased sales were probably linked to the Euro 2020 football championship held during the month.

- Meanwhile, sales in non-food store fell by 1.7% m/m in volume terms in June. The worst performers were stores selling household goods (down by 10.9% m/m) and clothing (down by 4.8% m/m).

- Non-store retailing declined for a second straight month when falling by 3.7% m/m in June as consumers continued to drift back to physical stores. This implies that its share of overall retail spending dropped to 26.7% from 28.5% in May and a record 34.7% in March.

- Fuel sales volumes rose for the third straight month, rising by 2.3% m/m in June, because less stringent lockdown measures allowed greater mobility. Nevertheless, sales remained 2.1% lower than in February 2020.

- The volume of total retail sales in the three months to June rose by 12.2% compared with the previous three months.

- The head of one Britain's biggest poultry producers has warned that the UK will see its worst food shortages in 75 years unless fundamental issues are quickly solved by the government. (IHS Markit Food and Agricultural Commodities' Max Green)

- Ranjit Singh Boparan, founder and president at 2 Sisters Food Group, says the current challenges facing the sector are like no other he has seen in his 27 years as a food entrepreneur.

- Mr Boparan - known as the Chicken King - says Covid-19 policies, labor shortages and high feed costs have been compounded by the difficult post-Brexit trading environment.

- The entrepreneur released a hard-hitting statement today as the food industry struggles to cope with the number of workers being 'pinged' by the Covid-19 app and asked to self-isolate. Although the government has just announced plans to exempt some food industry workers from having to self-isolate, Boparan says this issue is just the tip of the iceberg.

- Eurozone business activity grew at the fastest rate for 21 years in July as the economy continued to re-open from COVID-19 restrictions. The strongest rise in service sector activity for 15 years was tempered, however, by a slowing in manufacturing output growth, linked in many cases to worsening supply lines. (IHS Markit Economist Chris Williamson)

- The headline IHS Markit Eurozone Composite PMI® rose from a 15-year high of 59.5 in June to 60.6 in July, its highest since July 2000, according to the preliminary 'flash' reading, which is based on around 85% of typical monthly replies.

- The improvement on June's performance was led by the service sector, where growth accelerated to the fastest since June 2006, marking a fourth successive month of rising output. The removal of some pandemic-related travel restrictions notably led to the largest rise in services exports since comparable data were first collected in 2014.

- While manufacturing reported a thirteenth successive month of output growth, the rate of expansion slipped to the lowest since February. In many cases, notably in Germany, output was constrained by shortages of inputs. Supplier delivery times - a key barometer of supply chain delays - continued to lengthen at one of the sharpest rates ever recorded by the eurozone PMI survey.

- The survey also highlights how the delta variant poses a major risk to the outlook. Not only have rising case numbers led to a slide in business optimism to the lowest since February, further covid waves around the world could lead to further global supply chain delays and hence ever higher prices.

- Mercedes-Benz Cars and Vans has announced a new corporate strategy that will see it invest EUR40 billion in becoming an almost completely BEV brand by 2030. The plan is based on the launch of three all-new BEV architectures in 2025, with no new ICE architectures being developed after this point. There had already been press reports about Mercedes-Benz's strategy to become a full BEV brand by 2030, so this announcement is not too much of a surprise. It shows that Mercedes-Benz is now fully committed to electrifying its entire light-vehicle range, although it is still reluctant to set an end-of-production (EoP) date for ICE vehicles. (IHS Markit AutoIntelligence's Tim Urquhart)

- The Netherlands has asked its grid operator to build a ring-shaped hydrogen pipeline to supply industrial clusters in two countries at first, and later trucks, ships, and buildings. State-owned infrastructure operator Gasunie, which runs natural gas networks and storage in the Netherlands and Germany, is set to develop a Dutch national hydrogen network, after a request by the State Secretary for Energy and Climate. Because green hydrogen is not yet a profitable sector, the pipeline would have seen only gradual investment without the move. (IHS Markit Net-Zero Business Daily's Cristina Brooks)

- Gasunie already operates the 12-km Yara-Dow hydrogen pipeline, commissioned in 2018. The pipeline in the Netherlands runs between Dow Chemical Benelux's facility in Terneuzen and Norwegian ammonia producer Yara's facility in Sluiskil. The collaboration is part of the Dutch government and Gasunie's Green Deal on Hydrogen, a green industrial growth partnership agreed in 2016.

- Gasunie says the planned national hydrogen infrastructure will be the first large-scale retrofit of natural gas pipelines, making use of existing pipelines for 85% of the backbone to save substantially on costs. The project, with an estimated price tag of €1.5 billion ($1.77 billion), is scheduled for completion in 2027.

- Canadian automotive supplier Magna International has announced that it will buy Swedish rival Veoneer Inc. to expand its advanced driver assistance systems (ADAS) business. As part of the agreement, Magna will acquire all the issued and outstanding shares of Veoneer for USD31.25 per share in cash, representing an equity value of USD3.8 billion and an enterprise value of USD3.3 billion. Magna said that the acquisition is expected to achieve about USD100 million in annual cost savings by 2024. Magna CEO Swamy Kotagiri, said, "We expect the combined entity to be an industry leader in active safety solutions, to enhance its position in complete ADAS systems, and to be well-positioned for the transition towards higher levels of autonomy. The acquisition is also consistent with our go-forward strategy to accelerate investment in high-growth areas." The deal has been unanimously approved by the boards of Magna and Veoneer. The transaction is expected to close near the end of 2021, subject to approval by Veoneer stockholders and certain regulatory approvals. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Moscow local authorities and Russia's largest bank, Sberbank, have reportedly submitted a joint proposal to the Russian government for permission to conduct a Moscow pilot trial for online trade in prescription drugs. According to a report in Interfax, the scheme would exclude narcotic or psychotropic medicines, or items containing substantial ethyl alcohol concentrations. A joint letter with details to the scheme was reportedly sent to the government last week by Moscow Mayor Sergei Sobyanin and Sberbank CEO Herman Gref, according to Interfax. This pilot scheme is reportedly intended to help reduce face-to-face visits to pharmacies during the pandemic, to help monitor the circulation of medicines, and to reduce counterfeiting. The pilot trial is proposed for implementation from 1 January 2022 to 1 January 2023. Moscow has reportedly been selected as the location in light of its leading position in digitalization in the healthcare sector, according to the source. The scheme is expected to operate by direct contact to pharmacies from customers via websites or mobile applications, and submission of a unique prescription number or QR code, including the use of the unified state health information system (EGISZ). (IHS Markit Life Sciences' Janet Beal)

- South African central bank leaves GDP growth forecast for 2021 and policy rate unchanged during July MPC meeting. The SARB left its policy rate unchanged at 3.5% at the July meeting of the central bank's monetary policy committee (MPC), a unanimous decision by all members of the MPC. Furthermore, the MPC statement said that South Africa's monetary policy would remain "highly accommodative" until the end of 2022, "keeping financial conditions supportive of credit demand as the economy recovers from the pandemic and associated lockdowns". (IHS Markit Economist Thea Fourie)

- At the July meeting of the MPC, the SARB left its GDP growth forecast for 2021 unchanged at 4.2%, after which it will trail down to 2.3% in 2022 and 2.4% in 2023. The 4.6% quarter-on-quarter annualized growth rate recorded in the first quarter of 2021 exceeded the SARB's initial GDP estimates, so the social unrest in the third quarter negated the better first-quarter growth results.

- The SARB lifted its short-term investment forecast - reflecting the restocking and rehabilitation of infrastructure destroyed during the social unrest. Meanwhile, household spending exceeded expectations due to wage and salary resilience, rising asset prices, and low interest rates during the first quarter. However, the SARB warns that recent events of social unrest could have "lasting effects on investor confidence and job creation".

- The SARB now expects headline inflation during 2021 to be marginally higher than the MPC's forecast in May, averaging 4.3% in 2021 (from 4.2% previously). Headline inflation is likely to average 4.2% in 2022 and 4.5% in 2023. Risk to the inflation outlook is tilted to the upside; higher global producer price inflation, supply shortages created by disruptions in local transport networks, food price surprises, and rising administered prices such as petrol and electricity costs contribute to the near-term inflation concerns. However, the SARB states that the output gap will remain negative while inflation expectations remain contained.

- The Quarterly Projection Model (QPM) indicates an increase of 25 basis points in the policy rate during the fourth quarter of 2021 and in each quarter of 2022, leaving the inflation-adjusted repo rate at 0.5% by the end of 2022.

Asia-Pacific

- Major APAC equity indices closed mixed; India +0.3%, South Korea +0.1%, Australia +0.1%, Mainland China -0.7%, and Hong Kong -1.5%.

- Chinese chicken meat imports fell sharply in June with all of the country's main suppliers losing out as a result. Imports for the month amounted to 86,555 tons - down 35% y/y and the lowest monthly volume since February 2020. (IHS Markit Food and Agricultural Commodities' Max Green)

- Imports from top supplier Brazil have fallen steadily since March and amounted to just 38,357 tons in June - a decrease of 26% y/y.

- Purchases from the US have also hit reverse gear after rising sharply earlier this year. According to Chinese customs data, imports of US chicken meat fell 44% y/y to 23,944 tons in June.

- Meanwhile, avian flu related restrictions meant Poland and France were unable to export any chicken meat to China in June.

- Trade overall has slowed due to a combination of sluggish demand and stricter controls at Chinese ports, which were introduced due to fears that Covid-19 might be transmittable in frozen foods.

- On top of this, domestic demand for chicken has slowed in recent weeks - partly because of increased competition from pork, prices of which have fallen in line with higher supplies.

- The flash IHS Markit Australia composite PMI output index, covering both services and manufacturing, slipped from 56.7 in June (final reading) into contraction at 45.2 in July, bringing a 10-month growth streak to an abrupt end. (IHS Markit Economist Jingyi Pan)

- Perhaps of little surprise, the reimposition of COVID-19 lockdown measures covering approximately half of Australia's population into July played a primary role in dampening business conditions in the country. The measures, introduced in response to the spread of the more infectious Delta variant, were extended to a greater number of Australian states into end-June, and it remains uncertain as to when these restrictions will eventually be lifted.

- Although both manufacturing and services output indices fell sharply, manufacturing production managed to sustain growth, albeit at the slowest pace since output growth recommenced in July 2020. Anecdotal evidence suggested that firms related to the mining and building industries were most likely to report positive demand and output conditions.

- Services business activity meanwhile plunged into contraction for the first time in 11 months and printed the lowest reading since May 2020 amid the reimposition of widespread lockdowns in the country. Demand for services and the level of outstanding work also declined from June, reflecting the toll taken on the service sector.

- Alongside the contraction of output and demand, the July survey was notable in recording an easing in its price gauges. While welcome as a leading indicator of softer inflationary pressures, a worrying aspect was a quicker rate of decline in output charges compared to input costs for firms, which points to a further strain on margins. The extent to which input price inflation exceeded output price growth was in fact the greatest since November 2019.

- At the same time, supply constraints remained a prevalent issue in July, which is evident across both panelists' comments and the severe rate at which suppliers' delivery times continued to lengthen for manufacturers. The deterioration of COVID-19 conditions was a key factor adding fuel to the fire for the supply crunch.

- Australia's Northern Territory (NT) administration has announced a new five-year strategy and implementation plan to boost sales of electric vehicles (EVs). According to a statement by the NT government, the plan includes a range of measures for implementation over the next five years, including reduced registration charges for EVs from mid-2022 and reduced stamp-duty fees for new and second-hand EV purchases by AUD1,500 (USD 1,105) over the same period. This will be applicable for vehicles with a purchase cost of AUD50,000 or less. The NT government is to offer financial support for new charging infrastructure and facilitate the installation of more EV charging stations. It will also commit to increasing the number of EVs in its own fleet. The strategy also includes plans to support training of local workers on the installation and maintenance of up to 400 EV charging stations at government buildings. (IHS Markit AutoIntelligence's Jamal Amir)

- Hyundai Mobis has introduced M.Brain, the "world's first" brainwave-based advanced driver assistance systems (ADAS), according to a company press release. M.Brain assesses the driver's condition in real-time by detecting brainwaves around the ears using earpiece sensors. The software technology that analyses and determines data from brainwaves is crucial. Hyundai Mobis is dedicated to research and development, and has even used machine learning to interpret brainwave signals. M.Brain can also be linked to a smartphone app to alert the driver when the driver is losing concentration. The accident prevention technology also provides alerts for various sensory organs, including via sight (LEDs around the driver's seat), touch (vibrating seat), hearing (headrest speaker), and so on. "Brainwave-based technology has endless possibilities for development because it can measure large amounts of data, which is why Hyundai Mobis is considered an innovative technology," said the company. (IHS Markit AutoIntelligence's Jamal Amir)

- Vietsovpetro (VSP) has secured a geotechnical survey campaign contract with La Gan Wind Power Development Corporation for 3.5 GW La Gan Offshore wind farm (OWF) in Vietnam. Under the contract, VSP will subcontract Fugro Singapore and Petrovietnam Technical Services Corporation to gather soil and rock samples deep under the seabed at the wind farm sites. The samples will be tested and analyzed in laboratories to understand the seabed conditions and develop ground models for the offshore foundation structure design and subsea cables. (IHS Markit Upstream Costs and Technology's Lopamudra De)

Posted 23 July 2021 by Ana Moreno, Director, Product Development, IHS Markit and

Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.