Major European and APAC equity indices closed mixed, while most US indices were lower. US and benchmark European government bonds closed sharply lower. CDX-NAIG and iTraxx-Europe closed flat, while CDX-NAHY and iTraxx-Xover were modestly wider on the day. The US dollar and oil closed higher, while natural gas, copper, gold, and silver were lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for DJIA +0.1%; S&P 500 -0.3%, Russell 2000 -0.5%, and Nasdaq -1.3%.

- 10yr US govt bonds closed +8bps/1.63% yield and 30yr bonds +6bps/1.97% yield.

- CDX-NAIG closed flat/52bps and CDX-NAHY +4bps/305bps.

- DXY US dollar index closed +0.5%/96.55.

- Gold closed -2.4%/$1,806 per troy oz, silver -2.0%/$24.30 per troy oz, and copper -0.2%/$4.40 per pound.

- Crude oil closed +1.1%/$76.75 per barrel and natural gas closed -5.5%/$4.86 per mmbtu.

- President Biden said he would nominate Federal Reserve Chairman Jerome Powell to a second term leading the central bank, opting for continuity in U.S. economic policy despite pushback from some Democrats who wanted someone tougher on bank regulations and climate change. Mr. Biden said he would also nominate Fed governor Lael Brainard as vice chairwoman of the central bank's board of governors. Prominent liberals like Sen. Elizabeth Warren (D., Mass.) had warned the president against picking Mr. Powell, and progressive groups mounted a last-ditch campaign to pressure the president to tap Ms. Brainard for the top job. (WSJ)

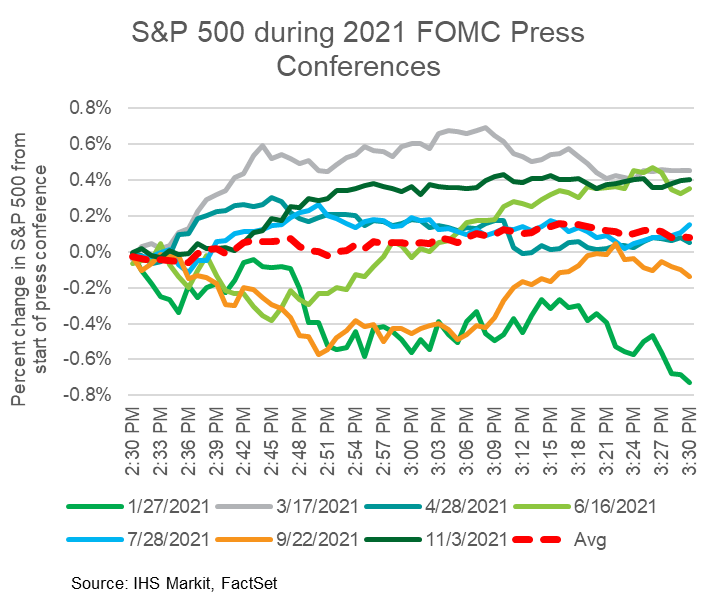

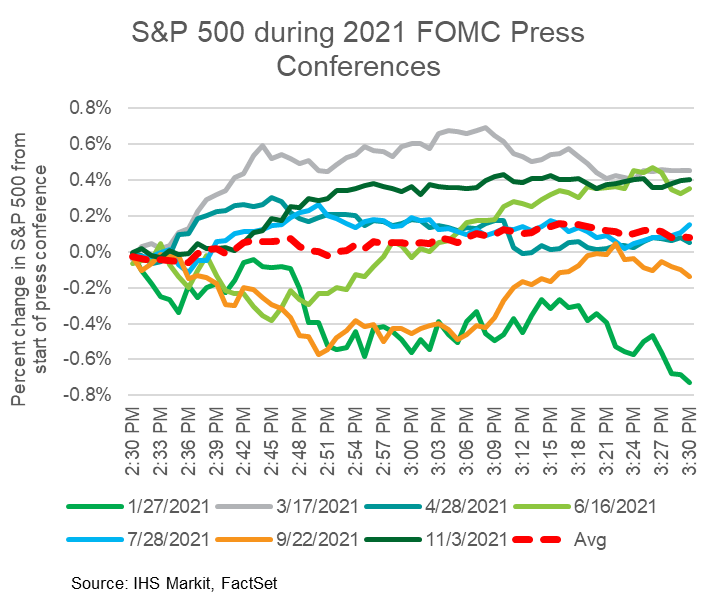

- The below chart shows the S&P 500's performance during every 2021 FOMC meeting press conference led by Fed Chairman Powell, with the baseline set at the 2:30pm ET start of each instance. To Chairman Powell's credit, the S&P 500 ended higher than it started during the press conference for all but the January and September meetings.

- The latest U.S. COVID-19 wave is taking its toll on some states' intensive-care units, with several parts of the country seeing outbreaks that are as bad as ever. In 15 states, patients with confirmed or suspected Covid are taking up more ICU beds than a year earlier, according to Department of Health and Human Services data. Colorado, Minnesota and Michigan have 41%, 37% and 34% of ICU beds occupied by COVID-19 patients, respectively, the data show. (Bloomberg)

- In early November, the US Environmental Protection Agency (EPA) issued a proposal to modify existing regulations of methane emissions from oil and gas operations. The new guidelines would set more stringent requirements in order to limit venting and fugitive emissions, although the proposal in its current form does not prohibit routine flaring. The proposed requirements are expected to be finalized before the end of 2022 and are likely to become a key tool in President Joe Biden's administration's efforts to rein in methane emissions in the hydrocarbon industry over the medium term. The EPA's new regulations were developed in line with Biden's January 2021 climate-oriented executive orders and are likely to establish a comprehensive framework to limit greenhouse gas (GHG) emissions in the oil and gas sector, replacing the current patchwork of requirements and standards. The proposal would expand methane reduction requirements for new, modified, and reconstructed oil and gas sources, including previously unregulated intermittent vent pneumatic controllers, associated gas, and liquids unloading facilities. Operators would be instructed to implement monitoring programs to identify and repair methane leaks associated with new and existing well sites and compressor stations as well as minimize fugitive emissions. Monitoring frequency would depend on the equipment, baseline emissions, and location (Alaska or the rest of the US). (IHS Markit E&P Terms and Above-Ground Risk's Aliaksandr Chyzh)

- Dominion Energy on November 22 released a new Sustainability and Corporate Responsibility Report, which outlines progress in areas like clean energy development. "We aspire to be the most sustainable energy company in the country," said Dominion Energy Chair, President, and CEO Robert Blue. "We're hitting the right milestones on the way to that goal: developing clean, renewable energy and storage; building a more diverse workforce and supply chain; improving safety; and investing in our communities to make sure no one is left behind." In terms of clean energy, the report highlights the company's work to (IHS Markit PointLogic's Barry Cassell):

- Develop the largest offshore wind project on this side of the Atlantic Ocean through its Virginia Electric and Power d/b/a Dominion Energy Virginia utility subsidiary.

- Own one of the largest solar portfolios among investor-owned utilities in the US.

- Invest in energy storage, hydrogen and other clean-energy technologies.

- Upgrade the grid to support renewable energy and improve reliability even further.

- Develop the largest renewable natural gas initiative in the country.

- US existing home sales increased 0.8% to a 6.34-million-unit annual rate in October; sales were up in the Midwest and South, unchanged in the West, and down in the Northeast. (IHS Markit Economist Patrick Newport)

- Year-to-date (YTD) sales remain solid: 13% and 11% higher than in 2019 and 2020.

- Home price growth is slowing. The median price of a single-family home was up 13.1% from a year earlier, down from May's peak of 23.6%; the average price has dropped to the single digits—8.2%, down from May's 16.9% high-point.

- Moreover, the South is the only region still seeing double-digit year-on-year home price growth. Median and average price growth in the Northeast have slowed to 6.4% and 3.9%. (Note: The consumer price index [CPI] was up 6.2% from a year earlier in October, so homeowners in the Northeast, on average, are now seeing the real value of their homes drop.)

- Inventory (data go back to September 1999) moved down by 10,000 to 1.25 million units—not far from February's all-time low of 1.03 million.

- The months' supply was 2.4 months, unchanged from September. Over 2011-19, the months' supply averaged 4.7 months.

- Properties took 18 days to sell in October, up from 17 days in September and down from 21 days in October 2020; 82% of homes sold in October were on the market less than a month.

- Bottom line: Entering the home stretch, sales remain solid and are on pace to reach a 15-year high this year; inventories remain lean; average home price growth has slowed into the single digits.

- US consumer advocates urged FDA to move up the timetable on its Closer to Zero Action Plan that sets standards for toxic metals in baby foods while industry reminded regulators to stay guided by the science at last week's first public meeting on the plan. (IHS Markit Food and Agricultural Policy's Joan Murphy)

- FDA has developed a plan to lower the levels of toxic chemicals in children's food over time while taking account that these elements are found in air, water and soil, said Janet Woodcock, FDA acting commissioner, who kicked off the November 18 meeting.

- Testing has shown there are no immediate health concerns for children, she said. While the agency eyes new standards for lead, arsenic, cadmium and mercury, FDA also does not want to limit the variety of nutritious foods critical for growing children, Woodcock said.

- After a congressional report raised alarm about levels of toxic elements in baby foods, FDA announced a three-stage Closer to Zero Action Plan in April, with the aim of completing Phase 1 in April 2022 by proposing draft action levels for lead in foods consumed by babies and young children. Under Phase 2 of the plan, the agency is aiming to set interim reference levels for cadmium and mercury, propose draft action levels for arsenic and finalize action levels for lead by April 2024. By Phase 3, FDA hopes to propose draft action levels for cadmium in baby and toddler foods and evaluate the feasibility of attaining even lower levels of lead in foods.

- Previous efforts to set standards have successfully lowered these elements in foods, FDA officials said. For example, after FDA signaled a move to set standards for inorganic arsenic in infant rice cereal, levels decreased 29% from 2012 to 2018 even before the agency proposed the new guidance, said Susan Mayne, FDA's chief of the Center for Food Safety and Applied Nutrition (CFSAN). Between 2016 and 2020, the agency saw further reductions as the agency proposed the action levels.

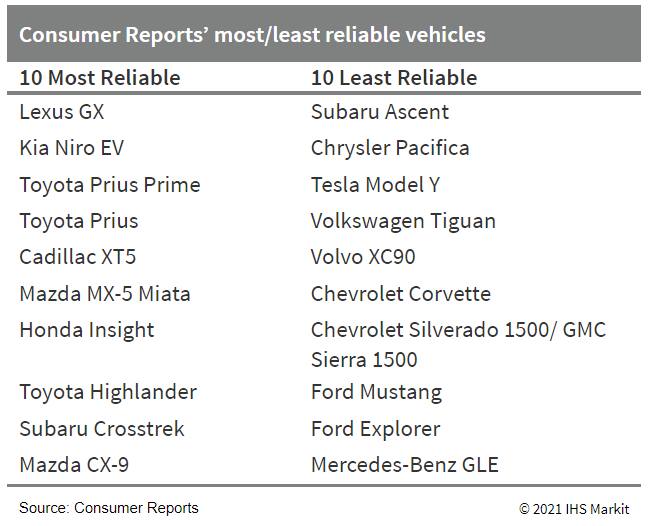

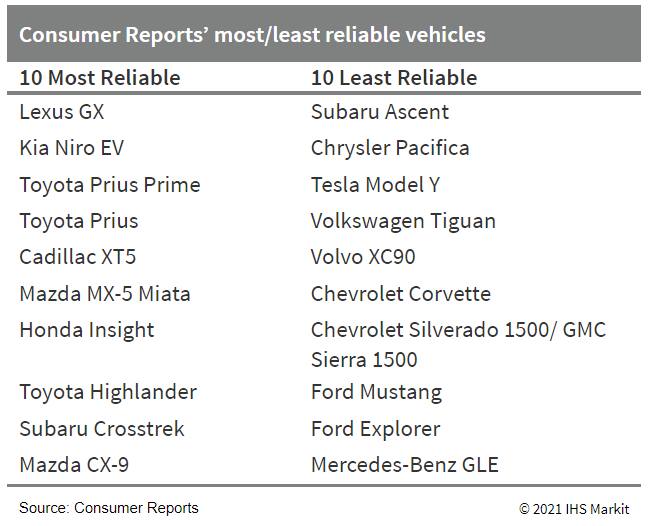

- Consumer Reports evaluates new cars, as well as non-automotive products, to advise consumers of their reliability. Buyers of new cars reference the publication's ratings in the shopping process and automakers take note of the independent-source feedback. The 2021 results show hybrid and plug-in models as being among the most reliable, while high-end electric utility vehicles' scores are affected by issues with complex electronics. The Consumer Reports reliability surveys are closely watched by the industry as some consumers consult the resource when shopping for a new car. A strong placement in the rankings can provide third-party legitimization of an automaker's internal claims of quality. Automakers often incorporate the feedback into future model development. However, the scores are not an indicator of sales performance or customer satisfaction. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ford CEO Jim Farley has confirmed that the automaker has scrapped plans to work with electric vehicle (EV) maker Rivian to produce an EV for Ford Motor Company, reports Automotive News. Farley reportedly said, "Right now, we have growing confidence in our ability to win in the electric space. When you compare today with when we originally made that investment, so much has changed: about our ability, about the brand's direction in both cases, and now it's more certain to us what we have to do. We want to invest in Rivian - we love their future as a company - but at this point we're going to develop our own vehicles." In addition, Farley reportedly commented on the market valuations of Tesla and Rivian being higher than those of traditional automakers, and acknowledged "mixed emotions". As discussion of a potential shared product between Rivian and Ford had not increased following the cancellation of a Lincoln program with Rivian, the latest statements do not come as a particular surprise. The report does not discuss Ford's relationship with Volkswagen (VW), but at this time, there is no particular reason to believe that is on weak ground. For Ford, vehicles on VW's MQB platform are well-suited for the European market, in terms of size and cost, while the company has the larger platforms and is developing more for the US market. Ford and VW had intended their relationship to be in the European market only. That plan may change, but at the moment, there is no reason to believe the change in the Rivian relationship suggests that the VW partnership is being rethought. (IHS Markit AutoIntelligence's Stephanie Brinley)

- General Motors (GM) has said that it will lift its recommended restrictions on Bolt charging, as those who do not have replacement battery modules yet can get a software update; separately, GM says it will be able to install the heated seat function into vehicles shipped without it, once supply of semiconductors improves. According to an Automotive News report, the software adjustment became available for owners of the 2019 model-year vehicle who have not had modules replaced on 19 November, with owners of 2017-18 and 2020-22 model year vehicles due to be able to get the software update in the next 30 days. Owners are required to go to dealers to have the fix applied. The new software reduces the fire risk by automatically setting the vehicle's maximum state of charge to 80%, according to the report. Owners can safely charge indoors overnight, park indoors after charging and operate the vehicle below 70 miles of range while they wait for new battery modules. For owners of vehicles to get the software in the next month, they are asked to continue with the restrictions. GM also noted that production of the Bolt will continue to be idled through the rest of 2021, as the company prioritizes battery module supply for fulfilling the recall. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- Major European equity indices closed mixed; Spain +0.8%, UK +0.4%, Italy +0.2%, France -0.1%, and Germany -0.3%.

- 10yr European govt bonds closed sharply lower; Spain +2bps, Germany +4bps, France/UK +5bps, and Italy +8bps.

- iTraxx-Europe closed flat/50bps and iTraxx-Xover +1bp/253bps.

- Brent crude closed +1.0%/$79.70 per barrel.

- The UK's Office for National Statistics (ONS) has reported that the volume of retail sales rose for the first time since April by 0.8% month on month (m/m) in October. Therefore, retail sales volumes were 5.8% higher than their pre-COVID-19 February 2020 levels. (IHS Markit Economist Raj Badiani)

- Underlying developments were less encouraging. Specifically, retail sales volumes fell by 0.9% in the three months to October compared with the three months to July.

- The only main retail sector to enjoy an improvement in October was non-food stores, with sales increasing by 4.2% m/m in volume terms. It appears that many consumers begun their Christmas shopping earlier than normal, fearful of shortages nearer the holiday season and rising prices. Specifically, the ONS reported that strong sales occurred in toy, clothing, and sports equipment stores.

- Food store sales in volume terms fell by 0.3% m/m in October but they remained 3.4% above pre-COVID-19 levels in February 2020.

- Automotive fuel sales volumes fell by 6.4% m/m in October as they normalized after strong growth in September, while soaring gasoline prices appeared to discourage some car journeys. Overall, automotive fuel sales in October were 5.0% below their pre-COVID-19 levels (February 2020).

- The proportion of retail sales online fell to 27.3% in October, its lowest share since March 2020. It stood at 19.7% in February 2020 prior to the COVID-19 virus outbreak.

- The European Food Safety Authority (EFSA) published a positive opinion on the feed additive Bovaer and it confirmed that the supplement can effectively reduce methane emissions from dairy cows. EFSA's green light could see the product approved for sale on the EU market in 2022. (IHS Markit Food and Agricultural Policy's Pieter Devuyst)

- A feed additive that aims to reduce methane emissions from cattle could soon be allowed on the European market after it received a positive assessment from the EU's food safety authority.

- On 19 November, the European Food Safety Authority (EFSA) published a scientific opinion on 3-nitrooxypropanol, which is branded as Bovaer, and found that it is safe to use for dairy cows and for consumers drinking their milk. It also confirmed that the feed additive has the potential to effectively reduce enteric methane produced by dairy cows.

- The Dutch company DSM produces Bovaer and claims the feed additive can reduce methane emissions by 20% to 35% in dairy cows and up to 90% in beef cows without affecting production. The company has said the product is the result of "a decade of scientific research" and expressed hope that the European Commission will soon approve the feed additive for sale on the EU market.

- DSM has already received market approval for Bovaer from regulatory authorities in Brazil and Chile in September. Since then, it has also signed a development agreement with Brazil's JBS, the world's largest meat processing company, which will use the feed supplement to reduce the climate footprint of its beef production.

- An investor in Hella has raised its shareholding in the company after Faurecia took a majority stake in the business. Reuters reports that Paul Singer, who owns investment fund Elliot Investment Management, has increased his stake in the German supplier to 10.75% according to filings. It added that this consists of voting rights attached to shares and instruments. It was previously reported that Singer's US-based Elliot Investment Management had acquired a 6.6% stake in Hella early last week after Faurecia offered to buy out minority shareholders in Hella on top of the 60% stake that it acquired from the Hueck family. At the end of this squeeze-out offer, Faurecia's stake in Hella reached 79.5%. The latest filing shows that Singer/Elliot now holds around half of the outstanding shares in Hella. There has been some suggestion in earlier reports that it could use the scale of its stake to push for a price of well over the EUR60 per share that Faurecia has previously paid for the shares in Hella if it wanted to secure a delisting. Indeed, the scale of Singer/Elliot's stake would also mean it would be impossible for Faurecia to reach an over 90% stake threshold to force this without reaching terms with Singer/Elliot. However, Faurecia has previously said that it is not planning to make another offer to delist Hella as its current position allows it to implement the synergies that it is aiming for without taking this step. (IHS Markit AutoIntelligence's Ian Fletcher)

- Porsche has announced that it has acquired a majority stake in Croatian electric bike (e-bike) manufacturer Greyp. According to a statement, the automaker has chosen to exercise a right of first refusal following a takeover offer from a third party. Under the terms of the agreement, as well as Porsche becoming a majority shareholder, Mate Rimac, the founder of Rimac Automobili, and other Greyp founders will retain minority stakes. The takeover is expected to be finalized before the end of the year. (IHS Markit AutoIntelligence's Ian Fletcher)

- France's unemployment rate stood at 8.1% during the third quarter of 2021. This is slightly up from 8.0% during the second quarter of the year. (IHS Markit Economist Diego Iscaro)

- The unemployment rate, as measured by the ILO methodology, has ranged between 8.0% and 8.1% since the third quarter of 2020. The third quarter's unemployment rate matches its level during the fourth quarter of 2019, just before the pandemic.

- The employment rate (i.e., the ratio of the employed to the working-age population) rose by 0.5 percentage point to 67.5%, its highest level since the data started to be collected in 1975.

- The higher employment rate's impact on the unemployment rate was offset by an increase in the labor force due to a higher participation rate (up from 72.9% to 73.5%). The participation rate had fallen in 2020 due to COVID-19-related restrictions, but it now stands well above its pre-pandemic level.

- Underemployment has also fallen sharply during the third quarter. Underemployment, which includes workers on furlough, increased markedly during lockdown periods, but the underemployment rate fell sharply during the third quarter.

- Geospatial intelligence solutions provider Bayanat, a G42-owned company, plans to begin driverless ride-sharing service trials this month in Abu Dhabi, UAE. The first phase will involve five autonomous vehicles (AVs) operating on Abu Dhabi's Yas Island, transporting passengers between nine stops, including hotels, restaurants, shopping malls, and offices. The cars will have a safety officer on board to support the operations and intervene in case of an emergency. The second phase will include more AVs deployed in multiple locations across the city. G42 expects to launch a ride-hailing app when the program is open to the public, and plans to sell the hardware technology so it can be installed on other vehicles as well, reports Bloomberg. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Inflation risk in the South African economy has increased, prompting the South African Reserve Bank (SARB) to raise its policy rate by 25 basis points to 3.75% during the November Monetary Policy Committee (MPC) meeting. (IHS Markit Economist Thea Fourie)

- Global supply chain disruptions amid strong global demand left the price for intermediate goods, raw materials and food combined with oil prices sharply up in recent months. Subsequently, the SARB has raised its inflation forecast for the fourth quarter of 2021 to 5.3% from 5.0% previously, with overall headline inflation during 2021 now expected to average 4.5% from 4.4% previously.

- The SARB's inflation outlooks for 2022 and 2023 have also been slightly revised upward to 4.3% (from 4.2% previously) and 4.6% (from 4.5% previously) respectively. The medium-term inflation outlook assumes low service inflation, a modest increase in until labour costs and relatively stable exchange rate. Furthermore, "a gradual rise in the repo rate will be sufficient to keep inflation expectations well anchored and moderate the future path of interest rates", the SARB states.

- The SARB estimates show that South Africa's negative output gap will close in late 2023. For 2021, the SARB expects GDP to average 5.2%, after which growth is expected to slow to 1.7% in 2022 and 1.8% in 2023 - in line with South Africa's potential growth. Energy supply constraints combined with the negative impact of the social unrests in July 2021 will have a lasting impact on investment decisions and job creation while the high export prices witnessed during 2020-21 is expected to fade during 2022.

Asia-Pacific

- Major APAC equity indices closed mixed; South Korea +1.4%, Mainland China +0.6%, Japan +0.1%, Hong Kong -0.4%, Australia -0.6%, and India -2.0%.

- Baidu has partnered with reinsurance company Swiss Re to help advance the autonomous vehicle (AV) industry, reports Reuters. Swiss Re will offer its risk management expertise and insurance products for Baidu's AV business. Swiss Re said, "This partnership will advance risk management research and insurance protection for autonomous vehicles, representing an important step forward in building a comprehensive ecosystem of mobility services". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Pony.ai has partnered with Guangzhou Automobile Group (GAC)'s Ontime ride-hailing app to jointly accelerate the commercial deployment of autonomous vehicle (AV) technologies in China. This partnership will allow Pony.ai to integrate its robotaxis into Ontime's platform. In addition, Pony.ai has opened its research and development (R&D) center in Shenzhen (China), its fifth R&D site globally. James Peng, co-founder and CEO of Pony.ai, said, "The Greater Bay Area offers tremendous opportunity and with this office, Pony.ai links the twin cities of Guangzhou and Shenzhen, strengthening road testing and commercialization of our two core businesses - autonomous driving passenger cars and trucks - to accelerate the deployment of autonomous driving software and hardware systems." Pony.ai claims to be the first company to test fully AVs on public roads in both the United States and China. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Honda is considering setting up an electric vehicle (EV) battery factory in Thailand, reports Bangkok Post. The automaker is conducting a feasibility study into the idea, which would reduce battery imports from Japan, but it declined to elaborate. "We are aware the global car market is moving towards EVs, so we will continue to invest in technologies in order to catch the trend," said Honda Automobile (Thailand) president and chief executive Noriyuki Takakura. In Thailand, Honda will focus on hybrid vehicles and battery electric vehicles (BEVs). However, demand for BEVs will take time to grow. "Honda will increase the number of HEVs [hybrid vehicles] to become a market leader," said Takakura. Honda's plans are in line with the Thai government's aim to boost the alternative-powertrain vehicle sector, one of the country's target industries. By 2030, the government aims for EVs to account for 30% of domestic vehicle production. The government began promoting the alternative-powertrain vehicle industry in 2017 by launching incentives for automakers, component suppliers, and other companies. (IHS Markit AutoIntelligence's Jamal Amir)

- Samkang M&T will invest USD447 million (KRW531.0 billion) to construct a new production facility to support the growing offshore wind (OFW) power market. Samkang M&T intends to fund this investment either through capital increase or issuance of convertible bonds. Investment amount includes the new factory construction cost, production facility construction cost and purchase of equipment. The new OFW substructure new plant will be located at the Goseong Shipbuilding & Marine Industry Special Zone. Construction is expected to commence in January 2022 with expected completion by June 2024. (IHS Markit Upstream Costs and Technology's Jessica Goh)

- Delhi Transport Minister Kailash Gahlot has announced on Twitter that diesel vehicles older than 10 years can run in the National Capital Region (NCR) on the condition that they are retrofitted to run on electric power, reports Autocar India. According to the source, this initiative will allow 10-year-old diesel vehicles to bypass the National Green Tribunal's (NGT)'s ban on diesel vehicles. Delhi's transport department will empanel electric vehicle (EV) kit manufacturers before allowing conversions. Furthermore, EV kit manufacturers will also have to get individual certification for each model's EV kit. EV kit makers have requested a universal retrofitting certification (in line with CNG kit certifications) and not for each model as that will require investment of more time and money. The Transport Minister also allowed entry of electric light commercial vehicles (eLCVs; inclusive of L5N and N1 categories) to enter as well as park on NCR roads during no-entry hours. The transport department of the Delhi government has also mandated the use of chromium-based hologram colour-coded fuel stickers on vehicles where blue stickers are for gasoline (petrol) and CNG vehicles and orange for diesel vehicles. There is speculation if retrofitting EV kits will be allowed or not on gasoline models that are older than 15 years and are banned for use on Delhi roads. The use of retrofitted kits is likely to affect new vehicle sales in a negative way and discourages vehicle owners to discard old vehicles. (IHS Markit AutoIntelligence's Tarun Thakur)

- Australian Vulcan Energy Resources Ltd has signed a second lithium supply deal with Renault, reports Reuters. Under the terms of the deal, Vulcan will supply 26,000-32,000 metric tons of battery-grade lithium chemicals to Renault over a six-year period starting in 2026. The multi-year lithium supply deal will support Renault Group's recently announced plans to have 90% of Renault models to be fully electric by 2030. The two parties had in August signed a five-year lithium supply deal for supply between 6,000-17,000 tons of lithium. (IHS Markit AutoIntelligence's Nitin Budhiraja)

Posted 22 November 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.