All major US equity indices closed higher, while European and APAC markets were mixed. US government bonds closed higher, while benchmark European government bonds closed lower. European iTraxx and CDX-NA closed slightly tighter across IG and high yield. Natural gas and copper closed higher, while the US dollar, oil, gold, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed higher, with the Nasdaq +0.8% closing at a new all-time high; S&P 500 +0.5%, Russell 2000 +0.4%, and DJIA +0.2%.

- 10yr US govt bonds closed -3bps/1.47% yield and 30yr bonds -3bps/2.09% yield.

- CDX-NAIG closed -1bp/49bps and CDX-NAHY -3bps/277bps.

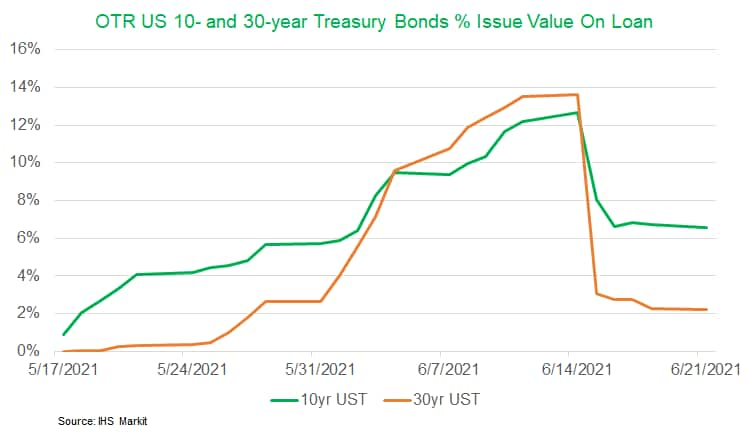

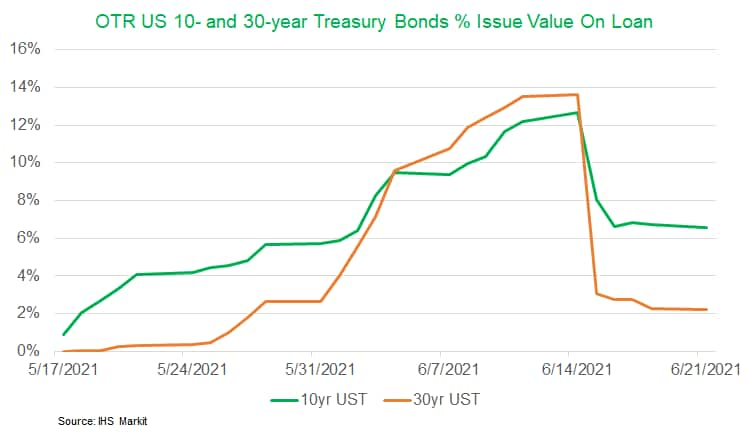

- The below chart of IHS Markit's securities lending data indicates that the percentage of issue value on loan for the on-the-run 10- and 30-year US Treasury bonds had been gradually increasing since settlement, with levels for the OTR 30-year bond peaking at 13.6% on 14 June and then declining sharply to 3.1% the next day which is likely one of the drivers of the significant rally in US Treasury rates post-FOMC meeting. (IHS Markit Fixed Income Research's Chris Fenske)

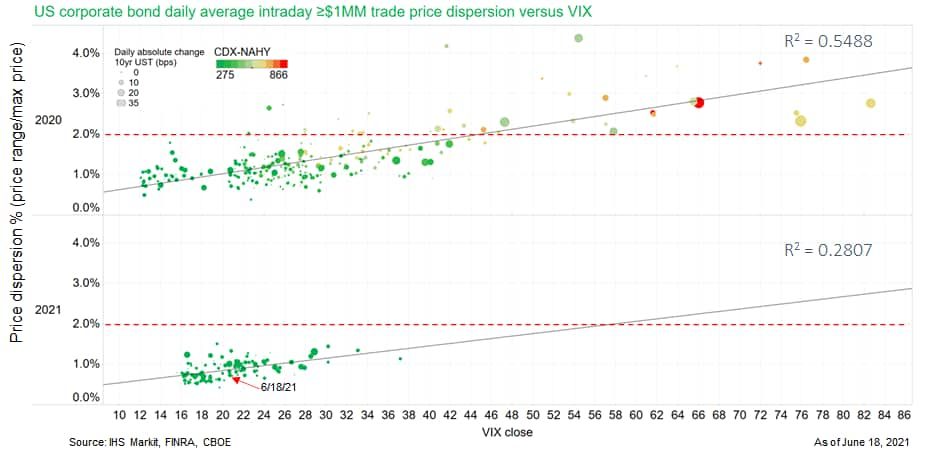

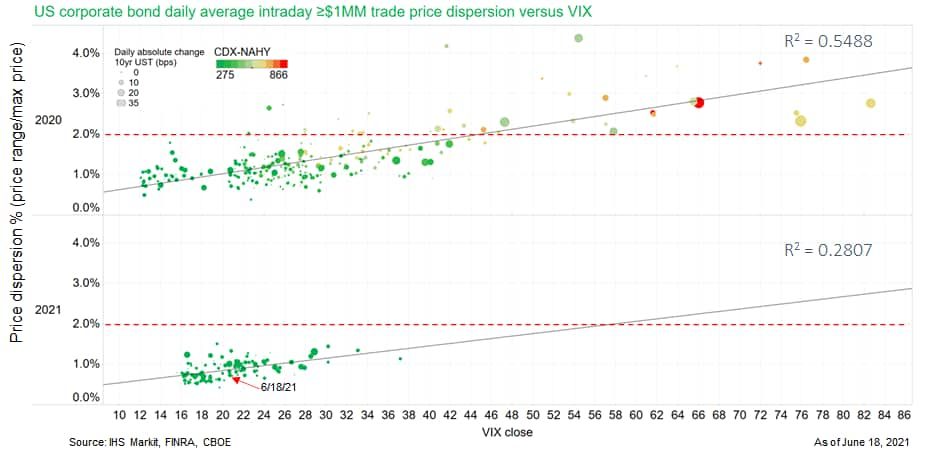

- As shared during today's IHS Markit's webinar 'Dynamic Tolerance Data - Improving the Efficiency of the Daily Pricing Process', the below graph shows the 2020/2021 average price dispersion of ≥$1MM US corporate bond trade prices versus the VIX equity volatility index, with the color scale representing CDX-NAHY spreads and the size of the markers indicating the absolute daily change in 10yr UST yields. The data indicates that the average price dispersion was >2% every time the VIX closed above 46 in 2020, with the subdued VIX levels in 2021 translating into lower price dispersion in the US corporate bond market. (IHS Markit Fixed Income Research's Chris Fenske)

- DXY US dollar index closed -0.2%/91.76.

- Gold closed -0.3%/$1,777 per troy oz, silver -0.6%/$25.86 per troy oz, and copper +1.1%/$4.23 per pound.

- Crude oil closed -0.4%/$72.85 per barrel and natural gas closed +2.1%/$3.26 per mmbtu.

- US existing home sales dropped 0.9% to a 5.80-million-unit annual rate, falling for the fourth straight month in May. For the second straight month, sales were up in the Midwest and down in the other three regions. (IHS Markit Economist Patrick Newport)

- Year-to-date sales remain solid: 24% and 13% higher than in 2020 and 2019, respectively.

- Total inventory (data go back to May 1999) moved up from 1.15 million units to 1.23 million units; inventory of single-family homes (data go back to June 1982) climbed from 980,000 to 1,050,000 units. These are not seasonal increases. Our estimate of single-family home inventory increased from 950,000 to 976,000.

- Lean inventories have led to an unprecedented surge in home prices. Nationally, the median price of a single-family home was up 24.4% from a year earlier in May, while the average price was up 17.5%. All four regions are seeing double-digit increases in both median and average prices.

- Properties took 17 days to sell in May, unchanged from April and down from 26 in May 2020. Indeed, 89% of homes sold in May were on the market less than a month.

- The share of homes bought by individual investors or second-home buyers remained at 17% in May, up from 14% in May 2020; the share bought all-cash was 23%, up from 25% in April and 17% in May 2020.

- Live cattle futures were on the rise this week as all but spot June touched new life-of-contract highs by midweek. A sharp sell-off followed on Thursday but prices were able to settle in higher than last week by Friday's close. Since the beginning of June, spreads have been extremely active. The June/August spread has now narrowed in by over $3.00 to levels near $0.50. The nearby and deferred spreads also have been active and, in general, narrowed sharply from record wide levels in early June. From Friday to Wednesday, open interest declined in August (the most active contract) by over 4,000 contracts while open interest in October increased by 6,000 contracts. The loss in open interest in August coincided with this week's breakout rally and indicated short covering. (IHS Markit Food and Agricultural Commodities' Roger Bernard)

- Amazon has placed an order for 1,000 autonomous systems from technology startup Plus, reports Bloomberg. Plus mentioned in its regulatory filing that Amazon has the right to purchase preferred shares of the startup via a warrant at a price of USD0.46647 per share. That equates to about a 20% stake based on Plus's shares outstanding before its proposed merger with special purpose acquisition company (SPAC) Hennessy Capital Investment Corp. V. Plus, which focuses on developing Level 4 autonomous technology, plans to begin mass production of PlusDrive this year, with Chinese commercial vehicle maker FAW. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Westlake Chemical (Houston, Texas) has agreed to buy Boral Industries' North American building products businesses for $2.15 billion in a deal that will nearly double Westlake's building products business. Westlake expects the transaction to close in the second half of 2021. It will be earnings accretive in the first full year of combined operations, says Westlake, which estimates cost synergies of about $35 million annually. (IHS Markit Chemical Advisory)

- BNA has leading positions in concrete & clay roofing, decorative stone, and plastic shutters; as well as strong positions in stone coated metal roofing, Texas windows, and premium siding. Westlake has leading positions in vinyl trim and molding, composite roofing, PVC pipe and fittings, and vinyl siding.

- Westlake officials also say the deal increases the portion of earnings attributable to businesses that trade at premium valuation multiples relative to chemical companies. Building products accounted for 28% of Westlake's 2020 revenue of about $7.5 billion. The acquisition will increase the segment's share to about 37% of $8.6 billion, says the company. The US polyvinyl chloride (PVC) segment will fall from 18% of revenue to 16%; the olefins segment, from 21% to 18%; and the chlor-alkali and European PVC segment, from 34% to 30%.

- Panama's government has agreed with its banking sector to extend the period during which clients can ask for forbearance from the end of June to the end of September 2021. As a result, some clients may enjoy grace periods extending until end-2021. As with prior forbearance arrangements, the measure only applies to those clients that can prove their current inability to service their loans. The measure represents the third extension of forbearance in Panama during the COVID-19 pandemic. (IHS Markit Banking Risk's Alejandro Duran-Carrete and Brian Lawson)

- The measure is likely to imply further delay to a potentially rapid increase in non-performing loans (NPLs) within the banking sector - giving banks more time to increase their loan-loss reserves.

- The large scale of existing forbearance is an adverse indicator of the sector's underlying asset quality. According to the Superintendence of Banks of Panama, as of March 2021, 36.1% of credit outstanding had been refinanced and/or granted a grace period. In addition, 39.2% of household loans had enjoyed relief, suggesting this segment is suffering the most severe credit deterioration.

- A Brazilian web site has reported that Stellantis will add hybrids and electric vehicles (EVs) at its Betim (Brazil) plant as soon as 2024 for the hybrids. The report indicates that Stellantis will add hybrid production based on the Firefly engine, as well as eventually EVs in Brazil. The report suggests the first 4xe product could start production between 2024 and 2025, with full battery electric production in about five years at Minas Gerais. The report also notes that Stellantis is considering closing the Peugeot-based engine production. The engines are currently produced at the former Peugeot plant in Porto Real, although output could be consolidated at Betim. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Argentina has reached a deal to avoid another damaging default by delaying the bulk of a $2.4 billion payment due to a group of wealthy countries by the end of July, economy minister Martín Guzmán said on Tuesday. Argentina now has until the end of March to reach an agreement with the so-called Paris Club of 22 countries, which includes the US, Germany, Japan and France. Guzmán said Argentina would pay just $430 million in two instalments before then, the first by July 31, when the 60-day grace period for the $2.4 billion payment originally due on May 30 ends. The agreement would effectively save the country $2 billion over the next eight months, Guzmán said. (FT)

Europe/Middle East/Africa

- Major European equity indices closed mixed; UK +0.4%, Germany +0.2%, France +0.1%, Spain 0%, and Italy -0.3%.

- 10yr European govt bonds closed lower; Italy +2bps and Germany/France/UK/Spain +1bp.

- iTraxx-Europe closed -1bp/47bps and iTraxx-Xover -3bps/234bps.

- Brent crude closed -0.1%/$74.81 per barrel.

- The BMW Group will look to cut vehicle manufacturing costs by 25% by 2025 in comparison to those of 2019, according to a Handelsblatt report. The major cost-cutting program was announced in an interview with the newspaper by Milan Nedeljkovic, BMW's board member in charge of production. Production costs have become relatively difficult to lower in recent years after massive improvements in the last two decades, thanks to just-in-time production techniques, inspired in the automotive arena by Toyota and its Toyota Production System (TPS). However, the increasing use of the latest Industry 4.0 digital production technology will create new opportunities, as will the switch to manufacturing full battery electric vehicles (BEVs) which in terms of pure manufacturing are less complex than traditional internal combustion engine (ICE) vehicles to produce. (IHS Markit AutoIntelligence's Tim Urquhart)

- Sanofi (France) and Translate Bio (US) have initiated an early-stage clinical trial to evaluate the potential application of mRNA technology to develop seasonal influenza vaccine candidates. The partnership is based on positive preclinical safety and immunogenicity data for mRNA influenza vaccines, according to statements issued by Sanofi and Translate Bio. Interim data from the Phase I trial are anticipated by no later than the end of 2021. Positive clinical outcomes from the trial of a monovalent flu vaccine candidate, coding for the hemagglutinin protein of the A/H3N2 strain of the influenza virus, is expected to pave the way for a full-scale mRNA-based influenza vaccine development program between Sanofi and Translate Bio. Two formulations of the vaccine candidate will initially be studied - MRT5400 and MRT5401. According to company statements, MRT5400 and MRT5401 differ in the lipid nanoparticle (LNP) that contains the mRNA. (IHS Markit Life Sciences' Eóin Ryan)

- Siemens Gamesa and Siemens Energy have entered a non-binding memorandum of understanding with Odfjell Oceanwind to develop mobile offshore wind units (MOWU's) with the intention to supply power for micro-grids. Odfjell Oceanwind has stated that MOWUs could provide power to oil and gas installations that require power for a limited period, typically prior to the closure of the field, and cut emissions by up to 70 percent. Odfjell Oceanwind's WindGrid™ intends to utilize Siemens Energy 's BlueVault™ energy storage solution ― which includes batteries, AC PowerGrids, transformers, switchboards, and power control system ― and Siemens Gamesa's SG 14-222 DD or SG 11.0-200 DD offshore wind turbines, with 14MW or 11MW capacities respectively, for their harsh environment semisubmersible MOWUs. The first MOWU is expected to be ready by 2024. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

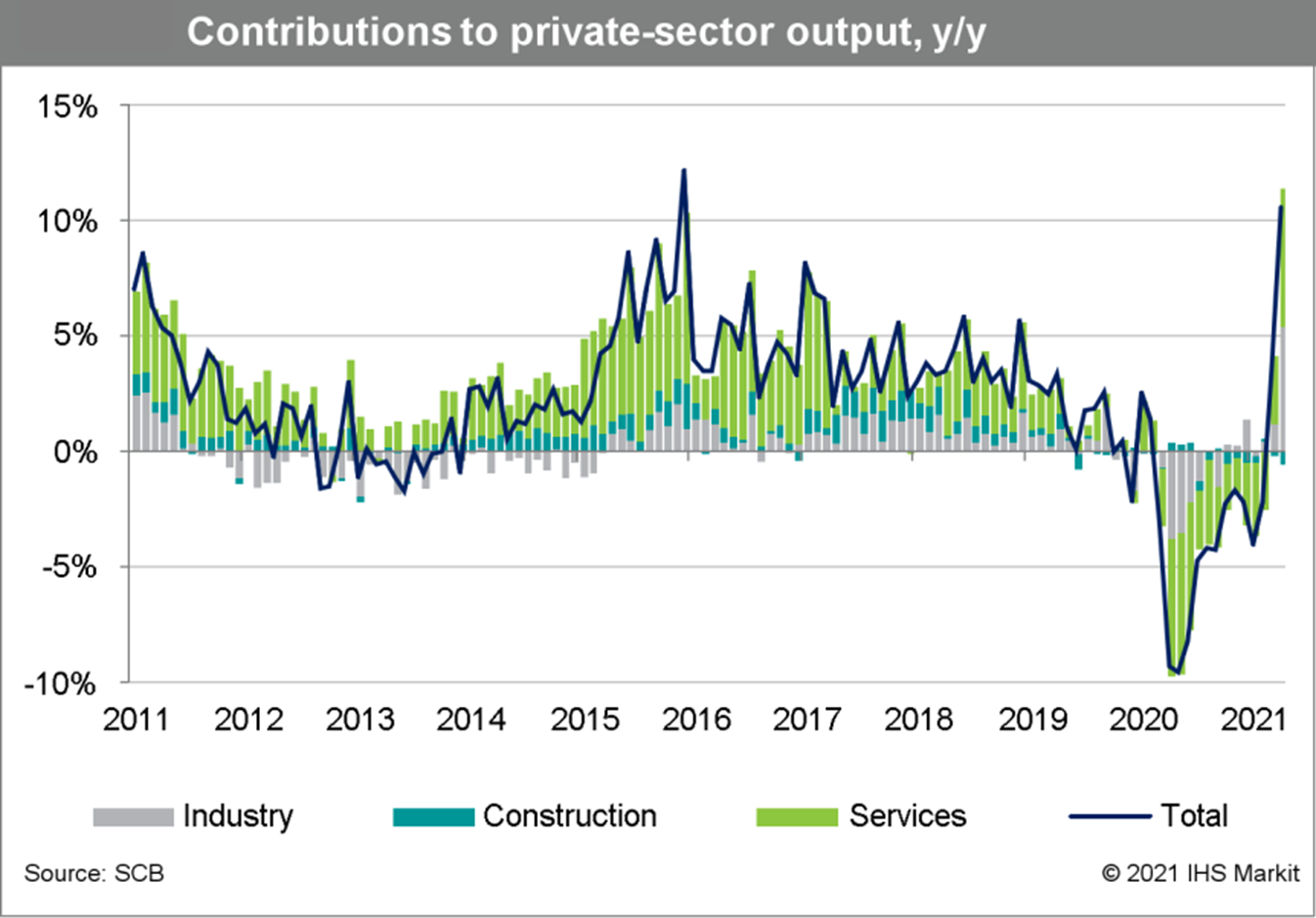

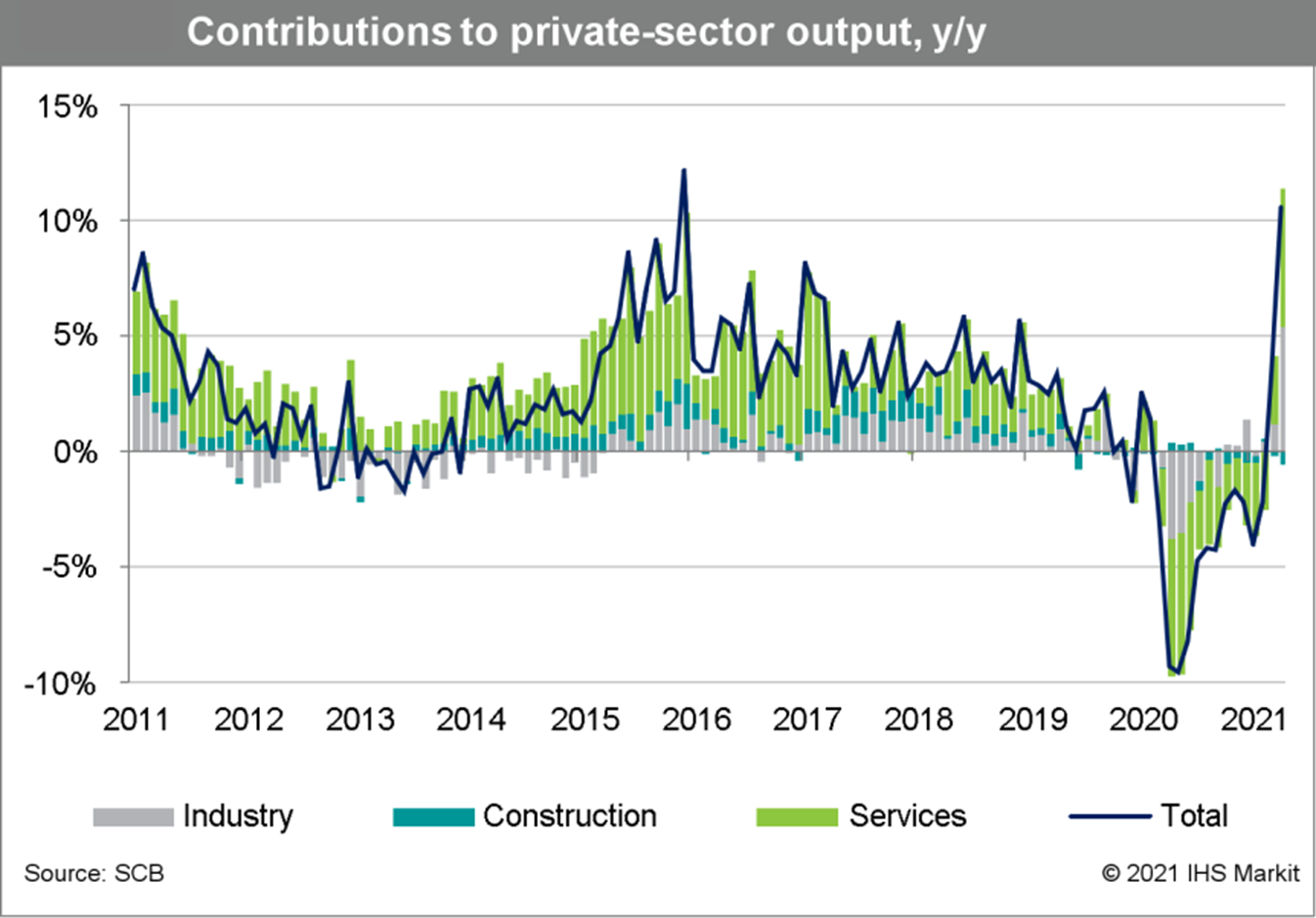

- Swedish private-sector output indicators testify to an expected acceleration of annual growth, while the contraction from March suggests moderating impact on household consumption from the retightening of lockdown measures. (IHS Markit Economist Venla Sipilä)

- According to the monthly production value index (PVI) published by Statistics Sweden (SCB), Swedish calendar-adjusted private-sector output in April increased by 10.7% year on year (y/y), after rising by 3.3% y/y in March and contracting y/y every month since March 2020.

- A fourfold surge in motor vehicle output lifted annual industrial growth to over 26% y/y, whereas production in the chemical and pharmaceutical industry contracted, as did construction activity.

- Meanwhile, services supply rose by 9.2% y/y in April, with domestic trade contributing 1.8 percentage points to private-sector output growth. Conversely, real estate activity contracted y/y and acted as a minor drag on output growth. A related data release from the SCB shows that working-day-adjusted household consumption in April increased by 7.5% y/y, while it fell by 5.1% in seasonally and working-day adjusted terms in March.

- Volvo Car Group has announced that it plans to establish an electric vehicle (EV) battery development and manufacture joint venture (JV) with Northvolt that will be used in the next generation of Volvo and Polestar models. According to a statement, in the first stage of the 50:50 JV, Volvo and Northvolt plan to set up a research and development (R&D) center in Sweden that will begin operations in 2022. This is "intended to build on the battery expertise within both companies and develop next-generation, state-of-the-art battery cells and vehicle integration technologies, specifically developed for use in Volvo and Polestar cars". There seems to be an air of inevitability over the announcement that the iconic Swedish passenger car brand is in talks with the Swedish startup, as it seeks to secure enough battery supply capacity to undertake its transition away from the internal combustion engine (ICE) technology. Volvo announced that it is accelerating its vehicle electrification strategy and setting a goal to become a battery electric vehicle (BEV)-only automaker from 2030. (IHS Markit AutoIntelligence's Ian Fletcher)

- Chart Industries booked an order for helium liquefaction at a large-scale helium plant for an unnamed independent oil and gas producer in Russia. Chart 's supply scope will include equipment, commissioning, and start-up. The award reflects the combination of Cryo Technologies (which Chart bought in February 2021) and Chart capabilities. The contract will utilize Cryo Technologies' liquefaction engineering expertise and Chart's knowhow in precooling, brazed aluminum heat exchangers and cold box fabrication. Cryo Technologies had earlier provided the customer's first helium plant (pre-acquisition). The project equipment delivery is expected to be completed by end of 2022, with completion of commissioning and startup a year later. (IHS Markit Upstream Costs and Technology's Amey Khanzode)

- The central bank of the eight-nation West African Economic and Monetary Union (known by its French acronym of UEMOA) has maintained its minimum rate for open-market operations at 2.0%, the marginal lending rate also remains unchanged at 4.0%, as does the reserve requirement ratio for banks in the monetary union, unchanged at 3.0%. The bank's monetary policy committee (MPC) meeting took place on 9 June 2021, with Benin, Burkina Faso, Côte d'Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo comprising the West African CFA franc zone. (IHS Markit Economist Anton Casteleijn)

- The economic recovery in the UEMOA region gained further momentum in the first quarter of 2021, with a 3.2% increase in real GDP driven by all sectors and supported mainly by renewed domestic demand strength. The price index of non-energy raw materials exported by countries in the UEMOA region increased by 5.1% in the first quarter of 2021, compared with an increase of 2.7% in the previous quarter.

- Due to a significant increase in grants received from donor countries, the budget deficit for all UEMOA member states was 2.9% of GDP in the first quarter of 2021, compared with the 4.5% of GDP recorded in the first quarter of 2020. The West African bloc's level of foreign-exchange reserves provided 6.7 months of import cover at the end of March 2021, compared with 5.9 months at the end of December 2020, while the average rate on bank loans fell 16 basis points to 6.42% in the first quarter of 2021.

- Nigeria's headline inflation rate slowed to 17.9% year on year (y/y) in May, from 18.1% y/y in the previous month. This leaves Nigeria's headline inflation at 17.6% for the first five months of 2021, compared with 12.3% for the same period last year. (IHS Markit Economist Thea Fourie)

- The month-on-month (m/m) rise in the headline inflation rate slowed for the second consecutive month, falling to 1.0%, well below the 1.5% m/m recorded over January-March 2021 and 1.6% m/m over October-December 2020.

- A slowdown in food price inflation to 22.2% y/y in May, from 22.7% in the previous month, was primarily responsible for the moderation in Nigeria's overall inflation rate. 'Core' inflation, which excludes food and energy prices, rose to 13.7% y/y in May, from 13.3% in the previous month. Sub-categories which showed the biggest gain in inflation during May included clothing and footwear (up to 13.5% y/y from 13.2% y/y in April), furnishing, household equipment and maintenance (up to 12.9% y/y from 12.5% y/y in April), and restaurants and hotels (up to 11.7% y/y from 11.5% y/y in April).

- COVID-19 infections surged to a record in South Africa's industrial hub of Gauteng, prompting warnings about hospital capacity and calls for tighter restrictions. One in four South Africans lives in the province where Johannesburg, the country's biggest city, and the capital Pretoria are located. On Tuesday, 67% of South Africa's new coronavirus cases were in Gauteng, according to the National Institute of Communicable Diseases, while the number of regional hospitalizations has jumped by almost a third in the past week to more than 5,200. (Bloomberg)

Asia-Pacific

- APAC equity markets closed mixed; Japan +3.1%, Australia +1.5%, Mainland China +0.8%, South Korea +0.7%, India flat, and Hong Kong -0.6%.

- COVID-19 containment-related restrictions at Shenzhen's Yantian Port at the end of May have added to global shipping disruptions, the shipping backlogs at the port pose headwinds for June goods exports from Guangdong, as the port is the largest container terminal in Guangdong; exports from the province accounted for 24.3% of total Chinese merchandise exports in 2020 (IHS Markit Economist Lei Yi)

- Handling capacity of Shenzhen's Yantian Port is expected to return to normal levels by the end of June, according to the local government on 21 June. The detection of COVID-19 cases among dockworkers from 21 May led to the implementation of a series of pandemic control measures, including suspension of acceptance of heavy export containers from 10 pm, 25 May, to 30 May. This resulted in a sharp decline in port operating capacity, which fell to 30% of the average level.

- The restriction was only lifted starting from 31 May, with the introduction of an appointment-based system for port entrance to avoid further congestion. So far, handling capacity at Yantian Port has recovered to 70% of normal levels.

- Electric vehicle (EV) manufacturer BYD along with Sapphire group, a Pakistan-based textile company, agreed to manufacture EVs in Pakistan, reports Energy update news. Federal Minister for Energy, Hammad Azhar said in a tweet, "BYD, the largest global electric bus manufacturer along with Sapphire group have joined hands to develop market development and manufacturing of electric vehicles in Pak." Meanwhile, Chinese company RNL Technologies China revealed its plans to start manufacturing EV chargers in Pakistan. RNL Technologies has signed a memorandum of understanding (MoU) with Dynamic Engineering and Automation (DEA), an Engineering Service Company in Pakistan for the task. (IHS Markit AutoIntelligence's Tarun Thakur)

- Borgward will file for bankruptcy next month due to falling sales, despite heavy investments made by Beiqi Foton to revive the brand, according to Gasgoo. Beiqi Foton acquired the defunct German brand in 2014 and a formal announcement of the brand's return was made in February 2015. In March 2016, Beiqi Foton received approval from the National Development and Reform Commission (NDRC) to set up an assembly plant in China to produce vehicles under the Borgward brand. In June 2018, Beiqi Foton announced plans to invest CNY4.4 billion (USD680 million) in Borgward Group, however, the brand has been underperforming and its sales have been falling consistently, despite the company marketing it as a German brand. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Changan Mazda, the 50:50 joint-venture (JV) between Changan Automobile and Mazda, is planning to sell up to a 5% stake to an eligible investor to bring in new investment and raise its registered capital by USD5.84 million, reports Gasgoo. According to the report, the funds generated would be used by the JV to improve its management quality, perfect its industrial deployment, and enhance its competitiveness. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Hyundai Motor Group has announced the completion of its planned acquisition of robotics company Boston Dynamics, purchasing a controlling interest from SoftBank on 21 June. In a company statement, Hyundai indicated the deal is valued Boston Dynamics at USD1.1 billion, but no financial details of the transaction between Hyundai and SoftBank were disclosed. Hyundai Motor Group now holds 80% of Boston Dynamics, while SoftBank retains 20% through one of its affiliates. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Hyundai Motor Group and Grab have announced an expansion of their strategic collaboration on electric mobility. The partnership's next phase will focus on accelerating electric vehicle (EV) adoption throughout Southeast Asia. The Group, including its affiliates Hyundai and Kia, as well as Grab, will continue to develop new pilots and initiatives such as EV leasing, battery-as-a-service, and car-as-a-service. These are aimed at lowering the barriers to EV adoption for Grab's drivers and delivery partners, such as lowering total cost of ownership and reducing range anxiety. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Posted 22 June 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.