All major US and most European equity indices closed higher, while all major APAC markets were lower. US government bonds closed mixed and benchmark European bonds were higher on the day. European iTraxx closed almost flat on the day alongside CDX-NAIG, while CDX-NAHY was tighter. Copper, gold, and natural gas closed higher, while the US dollar, oil, and silver were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Russell 2000 +1.7%, Nasdaq +1.2%, S&P 500 +0.8%, and DJIA +0.7%.

- 10yr US govt bonds closed +1bp/1.26% yield and 30yr bonds -1bp/1.87% yield.

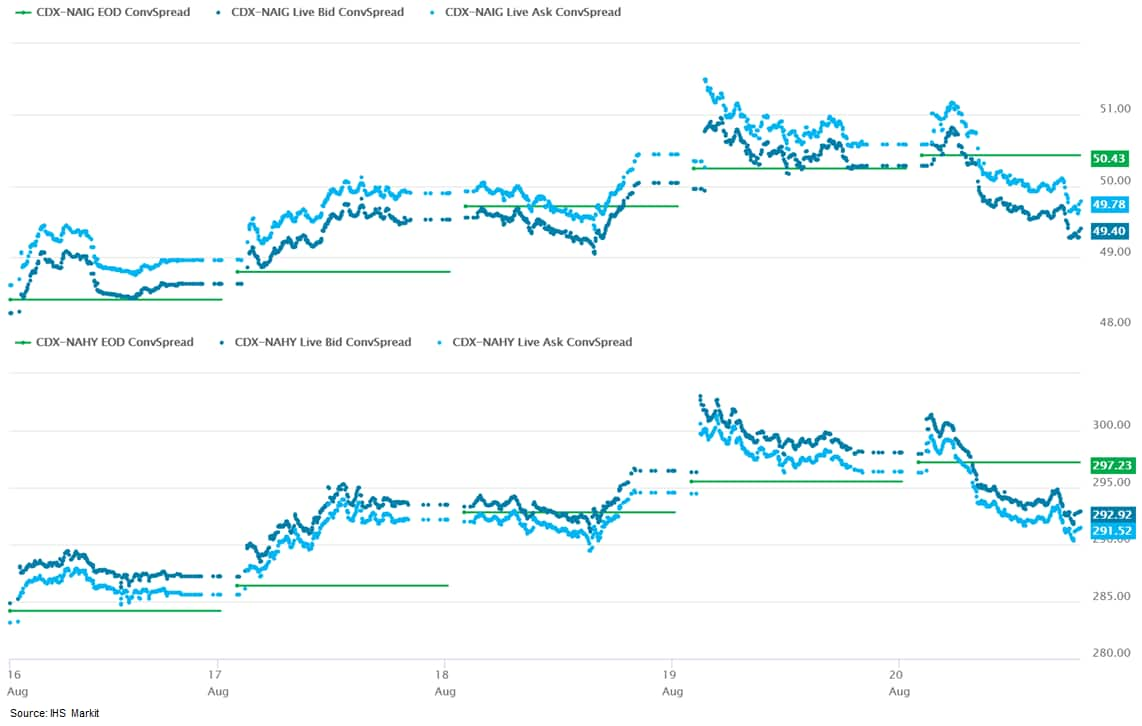

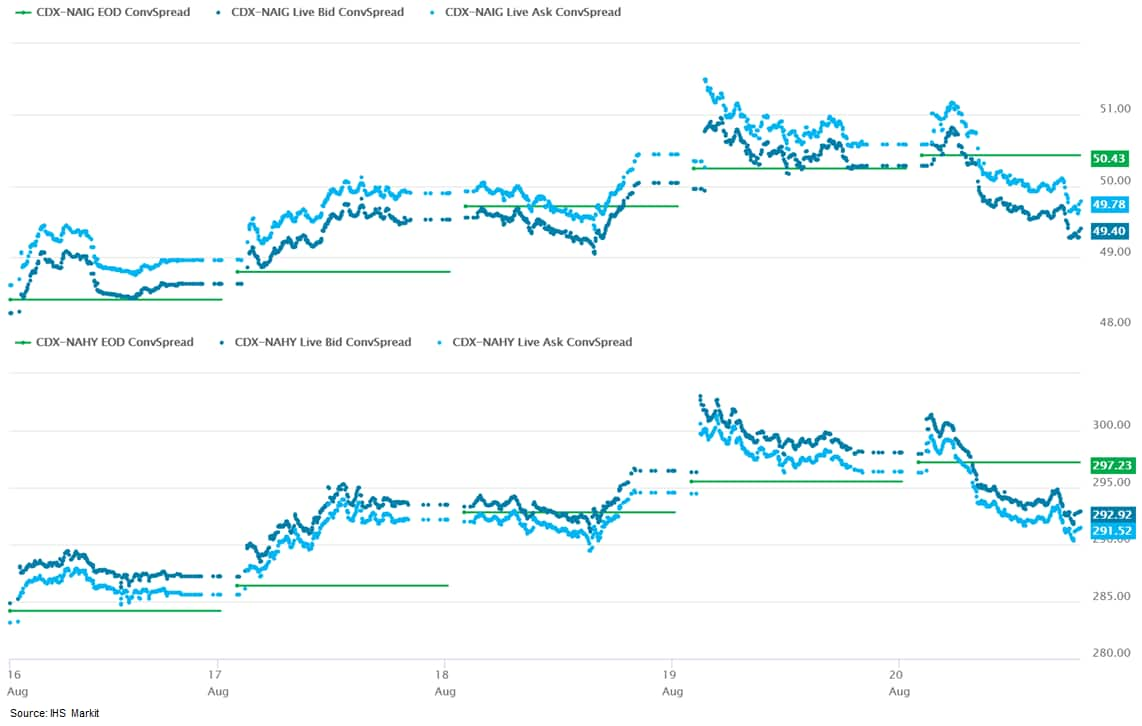

- CDX-NAIG closed flat/50bps and CDX-NAHY -5bps/292bps, which is +1bp and +8bps week-over-week, respectively.

- DXY US dollar index closed -0.1%/93.5.

- Gold closed +0.1%/$1,784 per troy oz, silver -0.5%/$23.11 per troy oz, and copper +2.4%/$4.14 per pound.

- Crude oil closed -2.1%/$62.14 per barrel and natural gas closed +0.5%/$3.85 per mmbtu. Crude oil closed lower for seventh consecutive day, which is the longest losing streak since October 2019.

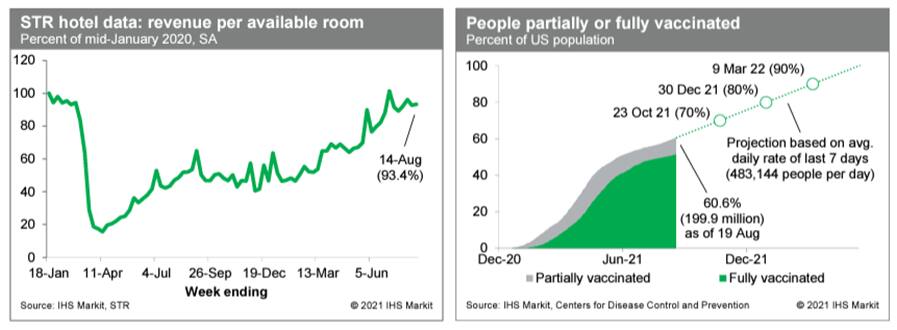

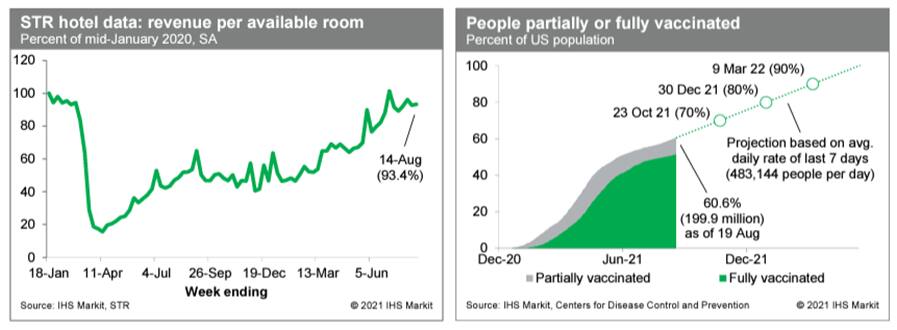

- Revenue per available room at US hotels last week was 93.4% of the January 2020 level (our estimate based on weekly data from STR). This is close to averages over recent weeks and consistent with the airport passenger traffic data from TSA, which is suggesting that travel activity has stalled just short of a full recovery. Meanwhile, averaged over the last seven days, about 483,000 people per day received a first (or only) dose of a COVID-19 vaccination, up somewhat from the prior week's rate of about 472,000 per day. As of yesterday, 199.9 million US residents, or about 60.6% of the population, were at least partially vaccinated against COVID-19. The pace of vaccinations has risen in recent weeks, likely in response to the rapid spread of the Delta variant. At the current rate, the US would achieve widespread vaccination (70-80%) by late this year. (IHS Markit Economists Ben Herzon and Joel Prakken)

- The US nut processor John B. Sanfilippo & Son, listed on the New York stock exchange, reported net sales of $206.7 million from April-June 2021, 1.2% more y/y, bringing FY2020-21 (July-June) annual net sales to $858.4 million, 2.4% less y/y. (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- The fall in net sales was led by a 7.6% decrease in the weighted average selling price per pound for nuts due to a fall in commodity acquisition costs for all major tree nuts.

- Sales volume in the consumer distribution channel increased 2.5%, which was led by increased sales of private brand trail and two snack mixes from new distribution at existing customers.

- Sales volume in the consumer distribution channel accounted for 73.2% of total sales volume in April-June 2021. The increase in food-service sales volume was attributable primarily to the lifting of indoor dining restrictions in restaurants. Sales volume increased 19.1% in the contract packaging distribution channel primarily due to the impact of increased foot traffic in convenience stores on a major customer's business in this channel.

- Fiscal 2021 net sales declined 2.5% to $858.5 million from $880.1 million for fiscal 2020, while sales volume increased 1.6%.

- The decline in food-service sales volume was due to nationwide restrictions on indoor dining at restaurants and a decline in air travel due to Covid-19.

- General Motors (GM) has expanded its partnership with AT&T to develop a fifth-generation cellular network architecture to support connected vehicles with faster data speeds, according to a company statement. Network enhancements will include improved roadway-centric coverage, faster music and video downloads, faster and more secure over-the-air software updates, faster navigation, mapping, and voice services. Under this partnership, GM and AT&T will be rolling out 5G connectivity in select Chevy, Cadillac, and GMC vehicles from model year 2024. This will also bring benefits for GM's current model year 2019 and newer vehicles, which are equipped with 4G LTE. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- LiDAR startup Ouster is conducting advanced talks to acquire rival Sense Photonics, Bloomberg reported. According to the report, the value of the acquisition deal could not be determined immediately. Ouster recently went public after merging with Colonnade Acquisition Corporation, a special purpose acquisition company. Ouster is engaged in the development of 3D sensing solutions and LiDAR sensors for autonomous vehicles (AVs), robotics, and drones. The company has raised USD142 million to date. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The US Department of Health and Human Services (HHS) has announced that the administration of President Joe Biden and Vice President Kamala Harris will invest more than USD19 million to strengthen telehealth services in rural and under-served communities, and to expand the quality and innovation of telehealth across the country. The USD19-million investment will be distributed to 36 award recipients via HHS's Health Resources and Services Administration (HRSA). The investments will be made under four separate telehealth programs (IHS Markit Life Sciences' Milena Izmirlieva):

- Telehealth Technology-Enabled Learning Program (TTELP): Approximately USD4.28 million is being awarded to nine health organizations to build sustainable tele-mentoring programs and networks in rural and medically under-served communities.

- Telehealth Resource Centers (TRCs): USD4.55 million is being awarded to 12 regional and two national TRCs. The role of TRCs is to provide information, assistance, and education on telehealth to organizations and individuals who are actively providing or want to provide telehealth services to patients.

- Evidence-Based Direct to Consumer Telehealth Network Program (EB TNP): Approximately USD3.85 million is being awarded to 11 organizations to help health networks increase access to telehealth services and to assess the effectiveness of telehealth care for patients, providers, and payers.

- Telehealth Centers of Excellence (COE) program: USD6.5 million is being awarded to two organizations to assess telehealth strategies and services to improve healthcare in rural medically under-served areas that have high chronic disease prevalence and high poverty rates.

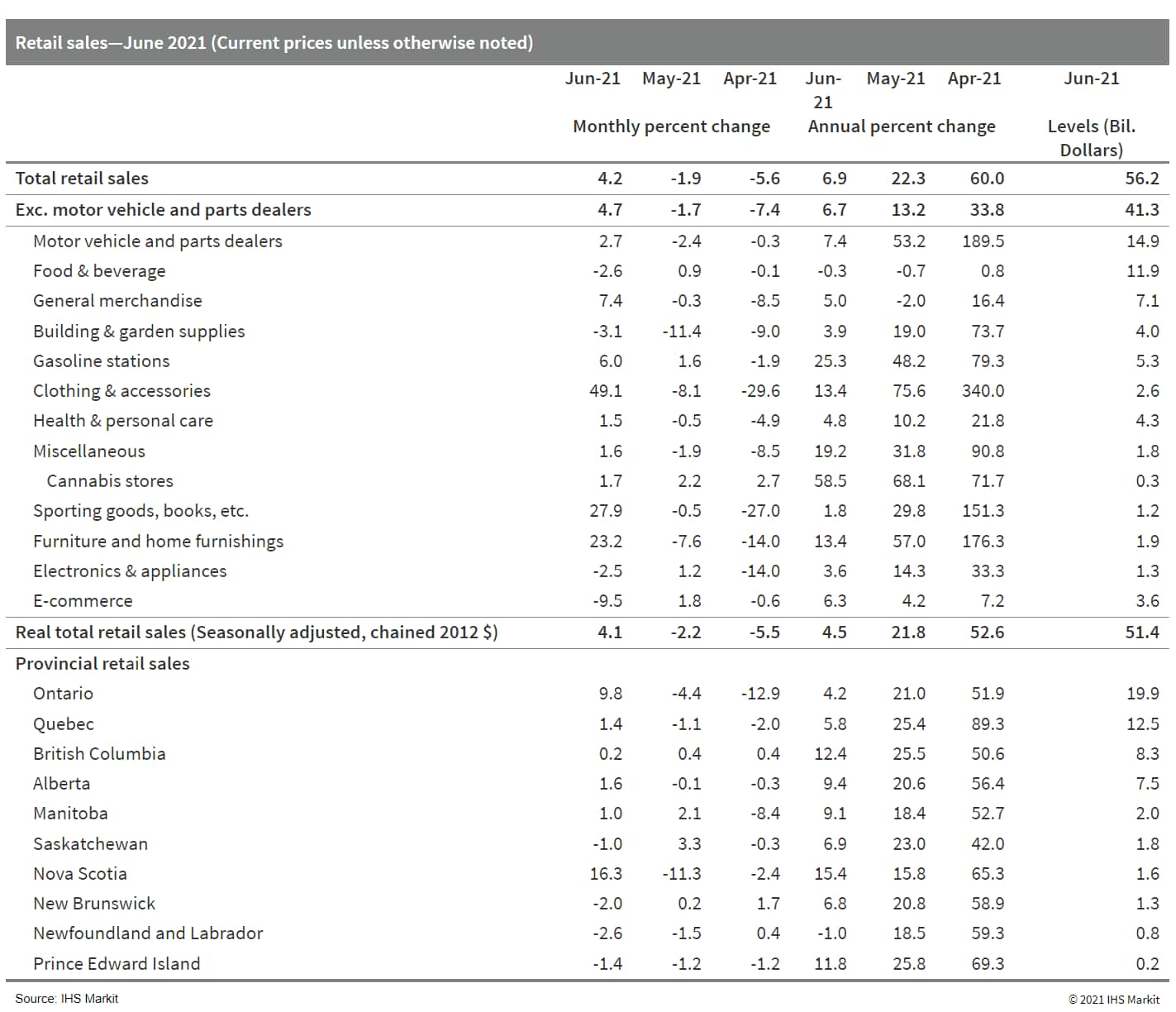

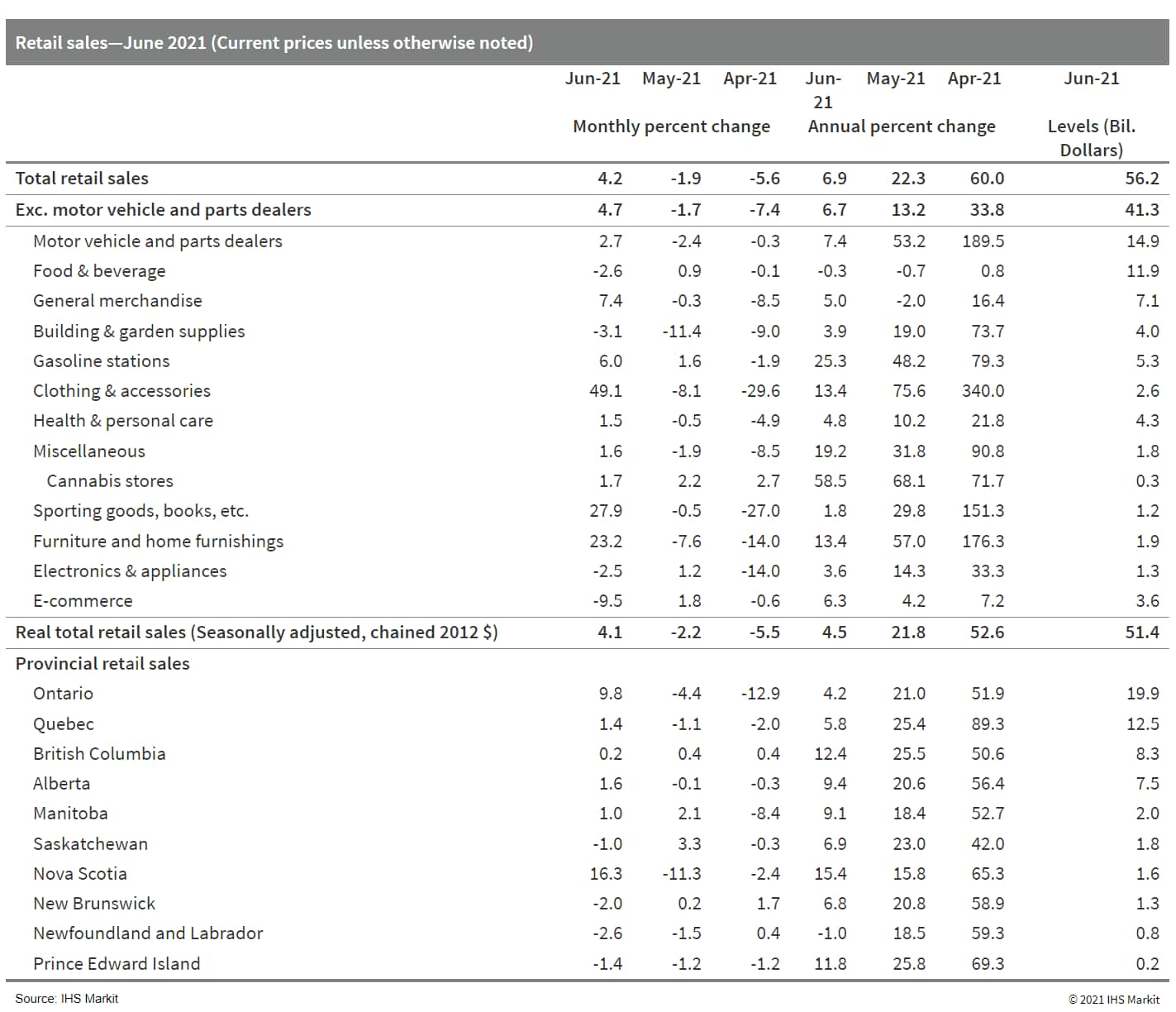

- Under the easing of public health restrictions, Canada's nominal retail sales rebounded 4.2% month on month (m/m) to $56.2 billion in June. May was upwardly revised, by 0.2 percentage point to a decline of 1.9% m/m. (IHS Markit Economist Evan Andrade)

- Core sales, which excludes sales at gasoline stations and of motor vehicles and parts, rose a further 4.6% m/m.

- Price growth was modest as retail volumes were up a similar 4.1% m/m.

- While the preliminary estimate for July calls for sales growth of 1.7%, this was based on significantly fewer survey responses than usual.

- Retail growth was broad, with 8 of 11 retailer categories expanding sales in June. The largest contribution came from the 49.1% m/m rise in clothing and accessories stores. This has been the most volatile category over the past three quarters, due to restrictions. With the sharp improvement, this category is now equal to the sales made in October 2020—the last month before second-wave regional restrictions were implemented.

- The National Statistics Office of Colombia (DANE) reports that GDP contracted 2.4% in the second quarter as compared with the previous one (quarter on quarter, q/q), with commerce, construction, and manufacturing driving the decline. GDP had jumped 2.9% q/q in Q1 and, at the time, was half a percentage short of its pre-pandemic level. (IHS Markit Economist Rafael Amiel)

- In late April, a government proposal to raise taxes triggered street protests, roadblocks, and riots, which led President Duque to quickly withdraw the tax bill. Despite this, the protests persisted through May and started waning in June because of the increase in COVID-19 cases and to a lesser extent because the government started talking to the protesters.

- The monthly index of economic activity (MIEA) dropped 5.4% in May as compared with April (month on month, m/m), which was slightly lower than March already.

- From an expenditure approach, the decline in GDP was driven by plunging investment and net exports, as imports increased sizably while exports decline. Oil production declined in Colombia in the second quarter, hurting exports; other exports were also limited by vandalism and blockades.

- The Central Bank of Brazil (Banco Central do Brasil: BCB) on 19 August approved a regulation allowing financial institutions to deposit funds additional to their reserve requirements in their central banks. According to the BCB, the tool will begin to be implemented at the end of the current month if the tests carried out 25 August are satisfactory. This policy tool is very similar to the interest of excess reserves (IOER) implemented in several advanced economies and, according to the BCB, it will be a more flexible and cheaper tool than repo operations to control banks' liquidity. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

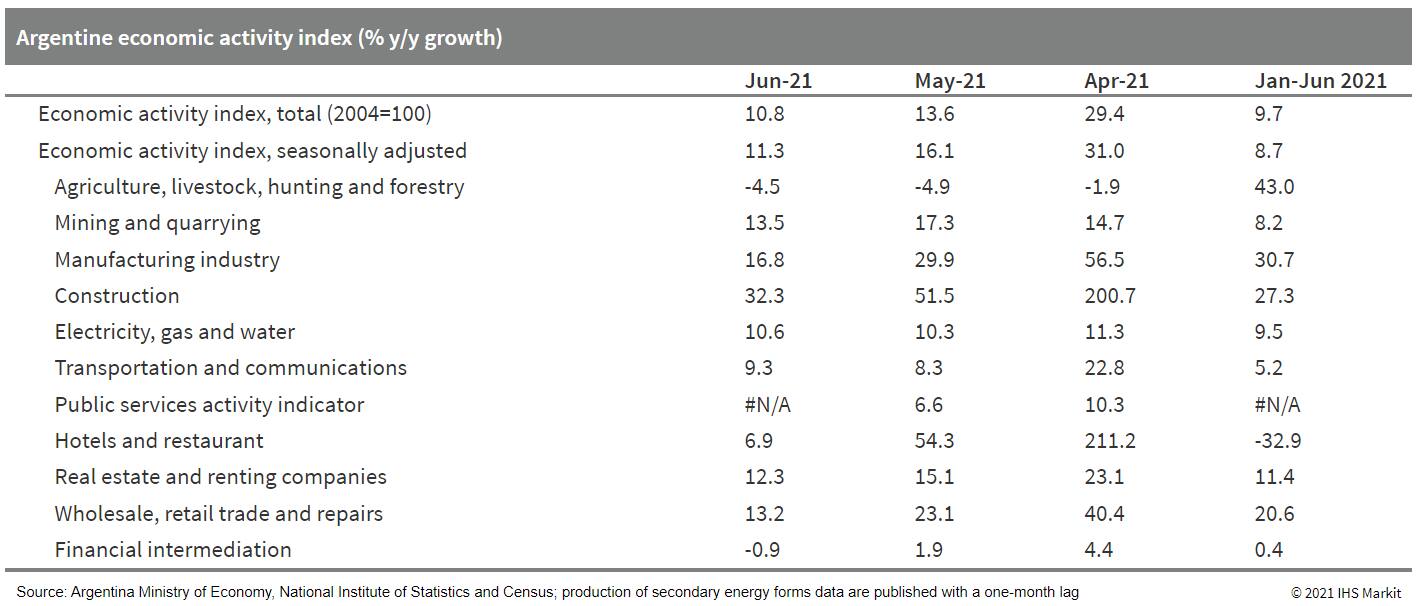

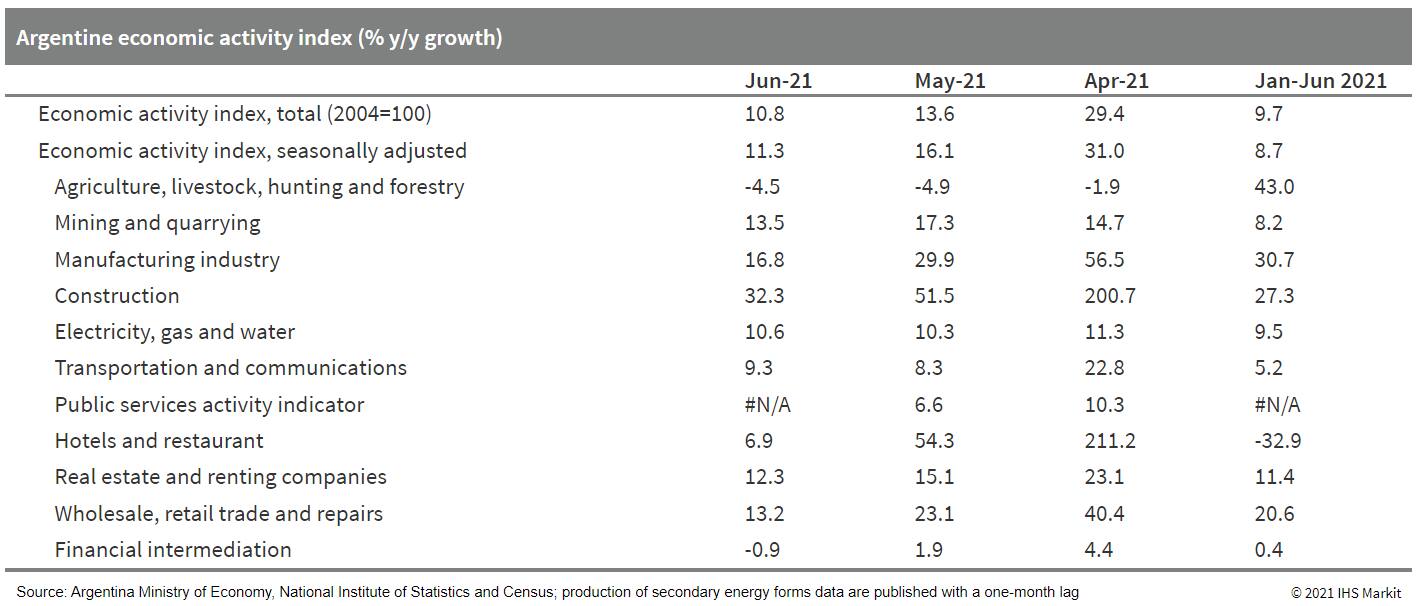

- Argentina's economic activity advanced by 2.5% month on month (m/m) in seasonally adjusted terms, after four months of declines. The outlook beyond 2021 remains complicated, macroeconomic imbalances have worsened during the pandemic and policy uncertainty reduces incentives to invest. (IHS Markit Economist Paula Diosquez-Rice)

- The economic activity index increased by 10.8% year on year (y/y) in June 2021, while the seasonally adjusted data showed a 2.5% m/m increase during the month; the monthly rise in June comes after four consecutive months of decline. Most of the categories in the composite index show an annual rise in June.

- Construction, manufacturing, and mining posted the highest annual expansion rates; the hospitality and restaurants sector rose 6.9% y/y, although the comparison base was extremely depressed. On the other hand, the primary sector and the financial intermediation services sectors posted an annual decline in June.

- Argentine construction costs increased almost 67% y/y in July 2021; the rise was driven by an 82% y/y increase in the cost of materials, a 55% y/y rise in labour costs, and a 63% y/y rise in general costs. The producer price index rose over 65% y/y in July; the biggest increases were in lumber and non-furniture wood products, and in non-machinery metal products.

Europe/Middle East/Africa

- Most major European equity indices closed higher except for Italy flat; UK +0.4%, France +0.3%, Germany +0.3%, Italy flat, and Spain +0.2%.

- 10yr European govt bonds closed higher; Italy -3bps, UK -2bps, and France/Germany/Spain -1bp.

- iTraxx-Europe closed flat/47bps and iTraxx-Xover -1bp/237bps, which is +1bp and +5bps week-over-week, respectively.

- Brent crude closed -1.9%/$65.18 per barrel.

- European cattle prices are continuing to track upwards, with no end in sight to the supply shortfall which has seen prices rise over the past 12 months to their highest levels since 2015. Prices have been over the past week in all categories other than steers. Processors are reported to be growing concerned about the pressures which high livestock prices are putting on their profit margins, but market analysts report that there is no scope in current market dynamics for any significant discounts on current prices. There has been little shift as yet in the general pandemic pattern of lively demand for beef at retail level and less demand for beef consumed in the restaurant and foodservice sectors. This in turn is tending to favor consumption of fresh domestically produced beef over imported frozen beef - although import volumes are starting to catch up after a slow start to the year. In the first five months of 2021, total EU beef imports were lagging 5.9% behind the same period last year, with increased imports from Uruguay unable to offset reductions in imports from both Brazil and Argentina. (IHS Markit Food and Agricultural Commodities' Chris Horseman)

- In the week ending 15 August, meanwhile, the Commission's overall benchmark price for A/C/Z R3 cattle was EUR386.64 per 100kg, up by 0.2% on the previous week. With one solitary exception, the price has now risen in each of the last 15 weeks.

- The price for young bulls aged 12-24 months (A-R3) rose by 0.3% week-on-week, to EUR389.8 per 100kg, while the price for male cattle in the 8-12 month age category (Z-R3) jumped by 1.1%, to EUR383.2 per 100kg.

- Steer (C-R3) prices fell by 0.4%, to EUR419.0 per 100kg, while heifers (E-R3) rose by just 0.1% to EUR402.9 per 100kg.

- Cull cows (D-03) gained 0.8%, to EUR327.4 per 100kg.

- Over 600 local residents close to Tesla's new facility in Grüenheide, Brandenburg (Germany), are said to have filed objections to the site, reports Deutsche Presse-Agentur (DPA). Frauke Zelt, spokesperson of Brandenburg's Environment Ministry, told the news service that 619 objections had been submitted hours before the deadline for objections closed last night (19 August). These included 201 new objections to this location following the automaker's announcement of its plans to manufacture battery cells at the site. (IHS Markit AutoIntelligence's Ian Fletcher)

- Unipetrol (Prague, Czech Republic), a refining and petrochemicals subsidiary of PKN Orlen (Plock, Poland), says it will invest more than 30.0 billion Czech coruna ($1.4 billion) over the next decade in projects to decarbonize the company's operations and advance core developments in petchems, plastics recycling, biofuels, and hydrogen. (IHS Markit Chemical Advisory)

- Unipetrol says it expects worldwide demand for petchem products to keep rising, with the Orlen Unipetrol group seeing "significant development potential." The company will leverage this potential utilizing production from its new 270,000-metric tons/year high-density polyethylene (HDPE) unit, called PE3, at Litvínov, Czech Republic, construction of which was completed in April last year, it says. PE3 replaced the company's ageing PE1 unit, and operations at the 200,000-metric tons/day PE2 unit will continue. Unipetrol spent CzK9.6 billion on the PE3 project.

- The company says it is also introducing a new product, dicyclopentadiene (DCPD), to its portfolio, with a previously announced new 26,000-metric tons/year production unit expected to start operations by the end of 2022. Unipetrol is investing approximately CzK831 million in the DCPD facility, which will produce DCPD for potential application in products including polymeric materials, resins, adhesives, dyes, packaging, and optical fibers. The plant's 26,000-metric tons/year capacity would account for approximately 25% of total current DCPD capacity in Europe, according to the company. It expects DCPD demand to grow 20% by 2030.

- Unipetrol says that with these and other petchem-oriented projects, it plans to boost its total petchems production from 900,000 metric tons/year to 1.2 million metric tons/year (MMt/y) by the end of the decade. The recycling of plastic waste is planned to account for up to 15% of the company's total polymer production by 2030, it says. In May, the company commissioned a pyrolytic test unit for the chemical recycling of waste plastic at Litvínov to "explore the possibilities of chemical plastic recycling and its potential implementation in standard production in the next three years," it said at the time.

- In its traditional oil and gas refining segment, Unipetrol expects the volume of fossil-based products sold to decline from 5 MMt/y to 4.4 MMt/y by 2030. Volumes of advanced biofuels produced will rise to 200,000 metric tons/year, it says. "These fuels will be produced according to circular-economy principles by processing plastic waste or organic waste," the company says.

- Unipetrol will continue decarbonizing its energy sources, mainly through the replacement of coal-fired heating plants with steam-and-gas facilities and solar sources, it says.

- Unipetrol is also planning to develop its activities related to hydrogen as an energy carrier to be used in the company's production processes, as well as in the energy sector and in transportation. Besides producing hydrogen traditionally from oil, it says it will use water electrolysis and membrane electrolysis from chemical processes using renewable energy.

- According to Statistics Norway (SSB), growth returned in the second quarter of 2021, with real GDP expanding by 1.1% quarter on quarter (q/q), after a 0.6% q/q drop in the first quarter. (IHS Markit Economist Raj Badiani)

- SSB also confirms that the end of the national drinking ban at bars and restaurants, and the reopening of restaurants in Oslo and Viken provided a significant boost to spending on hospitality services throughout the second quarter. Nevertheless, spending on services in June remained at around 10% when compared with its pre-COVID-19-virus level.

- Fixed investment expanded by 2.8% q/q in the second quarter, offsetting the 2.9% q/q fall in the first. In annual terms, it shrunk by 2.5% y/y in the first half of this year after a 3.8% drop in 2020

- Total exports grew by 3.9% q/q during the second quarter, with the sales of crude oil and natural gas being the strongest performers, up by 8.9% q/q, while traditional goods edged up by 0.5% q/q.

- Imports of goods and services grew by 3.9% q/q for the second quarter of 2021 because of stronger demand for fuel, automobiles, and machinery in May.

- The economy in unadjusted terms contracted by 0.8% in 2020, highlighting its resilience to the COVID-19-virus shock. On a seasonally adjusted basis, Norwegian real GDP shrunk by 1.3% in 2020, compared with a 6.7% drop in eurozone GDP.

- Odfjell Oceanwind has received a NOK10 million (USD1.1 million) grant from Norway's fund for climate change, Enova, to fund part of its engineering and planning activities for its mobile offshore wind unit (MOWU) concept. The project aims to connect the first MOWU to oil and gas installations in the North Sea by 2024. The floating MOWU will be fitted with Siemens Gamesa's 11 MW offshore wind turbines and Odfjell Oceanwind's WindGrid hybrid system for integrating the MOWUs into the host platform's power system. The technology will allow the gas turbines on the host platform to cut-off during periods of wind power production, this enabling up to 70% reduction of CO2 emissions on the oil and gas platform. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- According to Vanguard News, liquidity in the interbank money market plunged by 2,183% in the week ending 16 August, leading to an increase in bank borrowing from the Central Bank of Nigeria (CBN) by 2,500%. Furthermore, 86% or NGN420 billion (USD.102 billion) of banks' borrowing from the CBN were repurchase agreements (repo), while the remaining 14% or NGN69 billion was carried out through the Standing Lending Facility (SLF) of the CBN. In addition, the interest rate on overnight lending rose by 3.6 percentage points to 17.25% from 13.7% on Monday. (IHS Markit Banking Risk's Thea Fourie and Ronel Oberholzer)

- The external liquidity shortage in the Nigerian economy has persisted despite a stronger global oil price and stringent capital controls. Foreign reserve holdings fell by a further USD1.7 billion during the first half of 2021, reflecting a widening trade deficit combined with less foreign direct investment and portfolio inflows during the first quarter of 2021. OPEC+ oil production cuts combined with less demand from India hampered Nigeria's export performance.

- Bank-specific factors could also be contributing to the shortage of liquidity, including higher provisioning costs and uncertainty surrounding the resilience of smaller banks that have persistently been accessing central bank funding lines since 2017. However, a lack of up-to-date data releases from the CBN on most banking-sector indicators hinders our ability to confirm this.

- The non-performing loan (NPL) ratio was at 6.1% in March 2021. However, we believe that the reported NPL ratio understates the weakness of asset quality given loan restructurings in multiple sectors, particularly in the oil and gas sector, to which the banking sector remains heavily exposed. We expect the NPL ratio to rise further in 2021 on weak economic growth and exposure to corporate lenders who sought relief for 40% of loans through CBN forbearance measures in 2020.

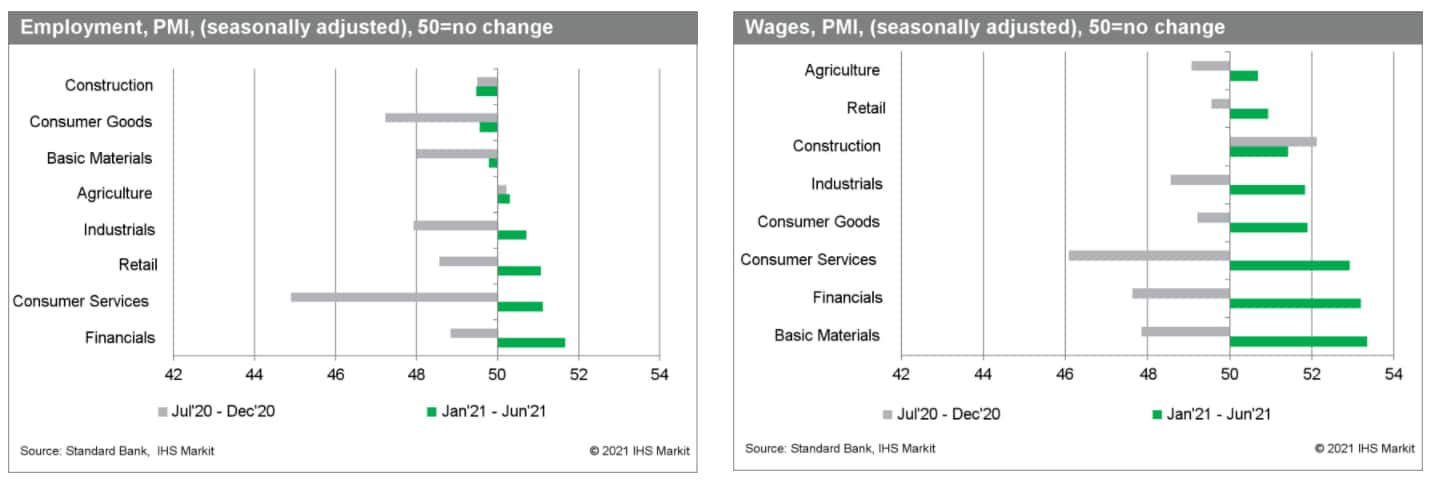

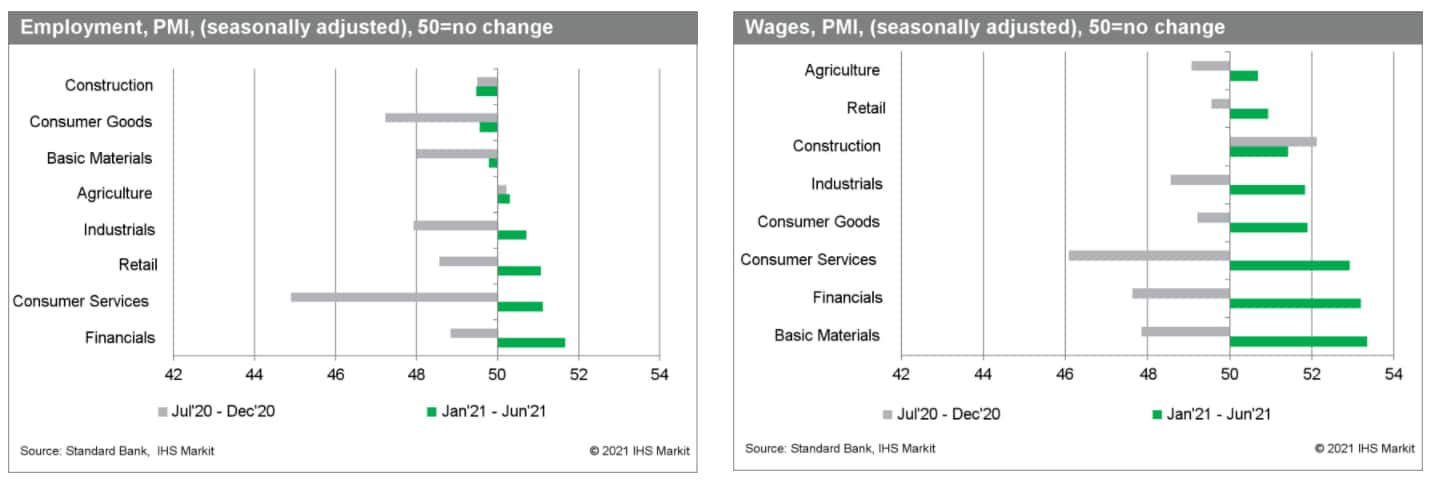

- Employment in almost all sectors of the economy picked up during January-June 2021 in the sub-Saharan African (SSA) region, latest statistics in the Standard Bank and IHS Markit purchasing managers' indices (PMIs) show. Using monthly PMI survey information, IHS Markit compiled an aggregate weighted employment PMI for SSA. A similar PMI for wages was compiled. Countries included in the analysis were Ghana, Kenya, Mozambique, Nigeria, South Africa, Uganda, and Zambia. (IHS Markit Economist Thea Fourie)

- The aggregate SSA employment PMI shows that the recovery was the strongest in the financial sector (banks, real estate, and insurance), followed by the consumer services sector (media, retail, and hotels and restaurants). Of this group, retail employment showed the biggest gains. Employment conditions in the basic metals (chemicals and resources), consumer goods (automotive, household products, beverages, and food), and construction sectors were less favorable, with the aggregate SSA employment PMI reading for these sectors remaining below the 50-neutral level during the first half of 2021.

- However, the jobs created in the sub-Saharan Africa region were not enough to bring overall unemployment down to pre-COVID-19 pandemic levels. Initial indicators show that Nigeria's unemployment rate remained at 33.3% in the fourth quarter of 2020, from 27.1% in the second quarter of 2020. South Africa's unemployment rate shot up to 32.6% in the second quarter of 2021, from 27.6% in the second quarter of 2019. Angola's unemployment rate averaged 30.5% in the first quarter of 2021, from 29.0% in the third quarter of 2019. Of the smaller economies, Rwanda's unemployment rate also increased, to average 17.0% in the first quarter of 2021, from 15.0% in the second quarter of 2019.

- More detailed unemployment data in South Africa show that the poorest in society - namely informal sector workers - have been severely impacted. Informal sector employment fell by 14.3% year on year (y/y) during the second quarter of 2021, compared with a 6.3% y/y fall in formal sector employment.

Asia-Pacific

- All major APAC equity markets closed lower for the second consecutive day; Australia -0.1%, India -0.5%, Japan -1.0%, Mainland China -1.1%, South Korea -1.2%, and Hong Kong -1.8%.

- China will step up monitoring of projects supported by local government special-purpose bonds (SPBs) and organize regular checks on the use of bond funds, according to the Vice Minister of the Ministry of Finance (MOF) at the 18 August National People's Congress Standing Committee meeting. (IHS Markit Economist Yating Xu)

- According to the vice minister, fund allocation will be suspended for SPB projects that deviate from their performance targets. Moreover, the provincial government will be allowed to adjust the use of funds in a timely way for projects that cannot be implemented owing to insufficient preparation.

- The move to tighten oversight of SPB projects is in line with the government's escalating efforts to control local governments' debt in recent months. The State Council in its annual report in early June called for better oversight of local budgets and spending and tighter monitoring of debt. In early July, the MOF ordered that the allocation of SPB quotas be linked to performance targets for the projects the bonds fund. The Banking and Insurance Regulatory Commission also released a notice requiring further tightening of local government financing vehicles loans related to hidden debt.

- FAW Group is stepping up efforts in constructing the second phase of its intelligent-connected vehicle (ICV) pilot project in Changchun, China. The project, which will take two years for completion, will be supported by the Jilin provincial government, Changchun municipal government, and local authority of the Changchun Automobile Economic and Technological Development Zone. It will involve constructing 52.7 km of smart roads, an automated operation center, a data center, and a factory dedicated to scenarios research. FAW Group said it plans to deploy about 100 units of its Hongqing-branded ICVs for the yet-to-be-completed pilot zone, Gasgoo reported. For the first phase of the Changchun-based ICV pilot project, FAW Group has constructed 10.5 km of smart roads, deployed four Hongqi E-HS3 Level 4 intelligent cars, built a cloud-based autonomous platform, and started pilot operation of smart mobility services. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Autonomous truck startup FABU.ai has raised CNY100 million (USD15 million) in a Series B+ funding round from Cowin Capital and DYEE Capital. The company plans to use the infused capital to expand the deployment of its car-road-cloud integrated solution into more scenarios such as port transportation and city shuttle service, Gasgoo reported. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- BW Ideol has revealed that it has joined two commercial-scale floating wind projects in Taiwan and Italy. The company signed a design and engineering services contract in July for the Taiwan project, followed by a Heads of Terms in August for the project in Italy. The company has declined to disclose further details. The company, a floating wind technology, engineering, and EPCI contractor, is listed on the Oslo stock exchange. The company is targeting a project portfolio of 10 GW by 2030, of which 1.5 GW will be in operational. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- Taiwan's Ministry of Economic Affairs has announced the latest allocation plan for 15 GW of capacity to be installed in a 10-year period from 2026 to 2035. Of the allocation planned, 9 GW will be added from 2026 until 2031, with a further 6 GW to be connected to the grid from 2032 to 2035. Auctions for the wind farms will be conducted starting in June 2022 for wind farms targeted for commercial operations in 2026 to 2027. This will be followed by auctions in 2023 for wind farms entering operations in 2028/29, and auctions in 2024 for wind farms entering operations in 2030/2031. As for the remaining 6 GW to be installed after 2031, auctions will be announced at a later date, taking into consideration results from the first auctions and technological developments. Potential developers will first need to pass a performance ability review before being allowed to participate in the auctions. To qualify for the auctions, three other requirements to be fulfilled are the feasibility approval for grid connection for Taipower, preliminary approval for the Environmental Impact Assessment (EIA), and agreement to the site. (IHS Markit Upstream Costs and Technology's Melvin Leong)

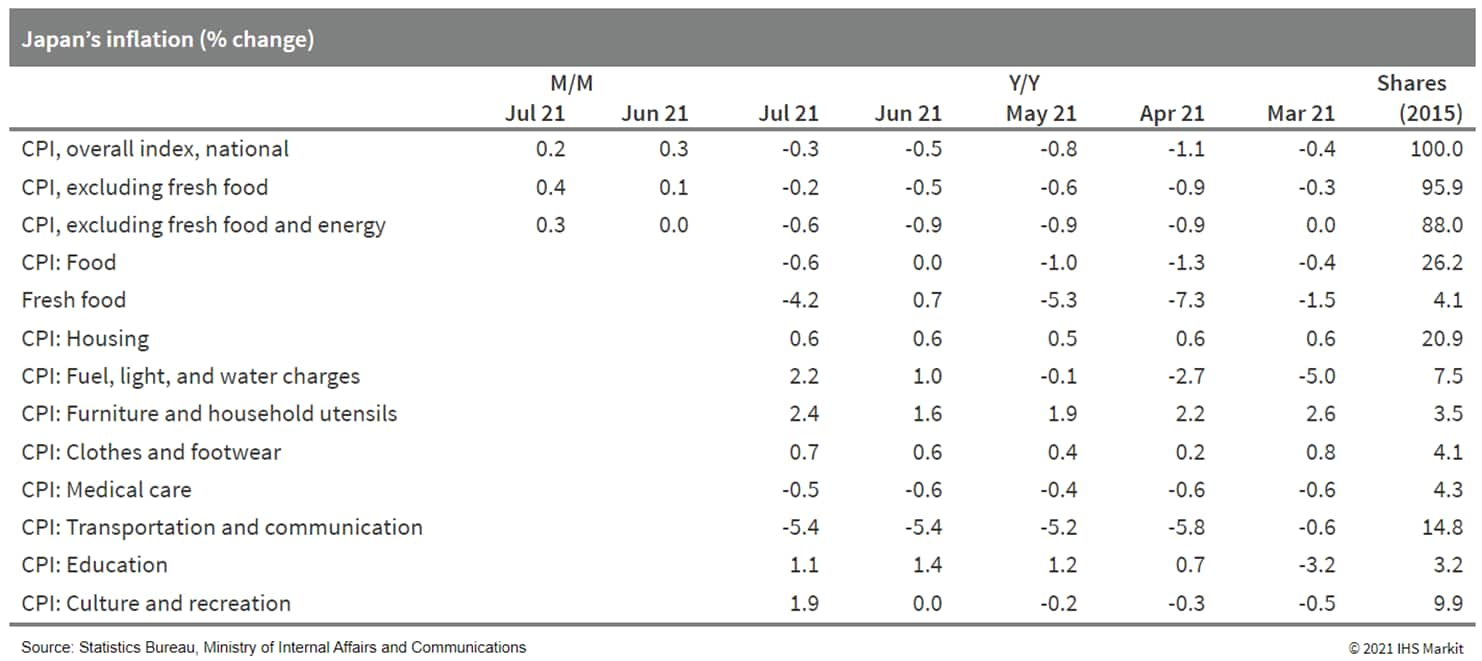

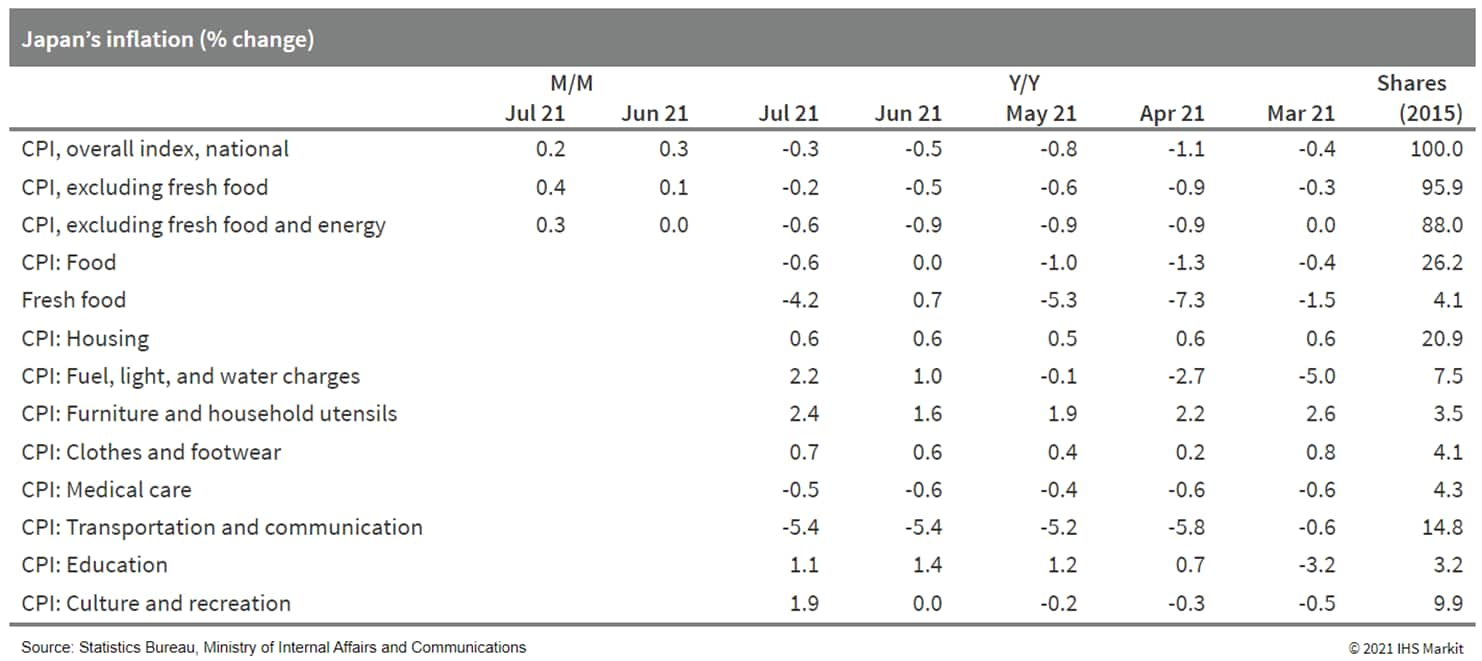

- Japan's CPI in July rose by 0.2% month on month (m/m) on a seasonally adjusted basis, but fell by 0.3% year on year (y/y). The CPI, excluding fresh food, and the CPI, excluding food and energy (the core-core CPI), rose by 0.4% m/m and 0.3% m/m, respectively, but the y/y figures fell by 0.2% y/y and 0.6% y/y. (IHS Markit Economist Harumi Taguchi)

- The major reason behind the weakness was a 25.7% y/y drop for communication. The index reference period of the CPI was revised from 2015 to 2020, and the weighting for mobile-phone charges rose from 2.3% to 2.7%. Accordingly, the negative effect from low mobile-phone charges introduced by major carriers in April widened, which lowered the annual change of the CPI for June by 0.4 percentage point from the 2015 base. The weakness was partially offset by rises in prices for energy, non-fresh food (reflecting higher import prices), accommodations (increased mobility), and furniture and household utensils (extended stay-home lifestyle).

- Higher import prices and the resumption of economic activity will gradually lift the CPI, but it is likely to remain weak over the short term. Lower mobile-phone charges have probably not affected consumers' price expectations, given that prices of items purchased frequently rose only modestly by 0.4% y/y, while prices of household durables and other infrequently purchased items increased by 0.7% y/y. However, weak demand will make it difficult for companies to transfer costs to output prices despite a continued rise in the corporate goods prices index (5.6% y/y in July). The extension and expansion of the state of emergency will also weigh on prices of non-essential goods and services.

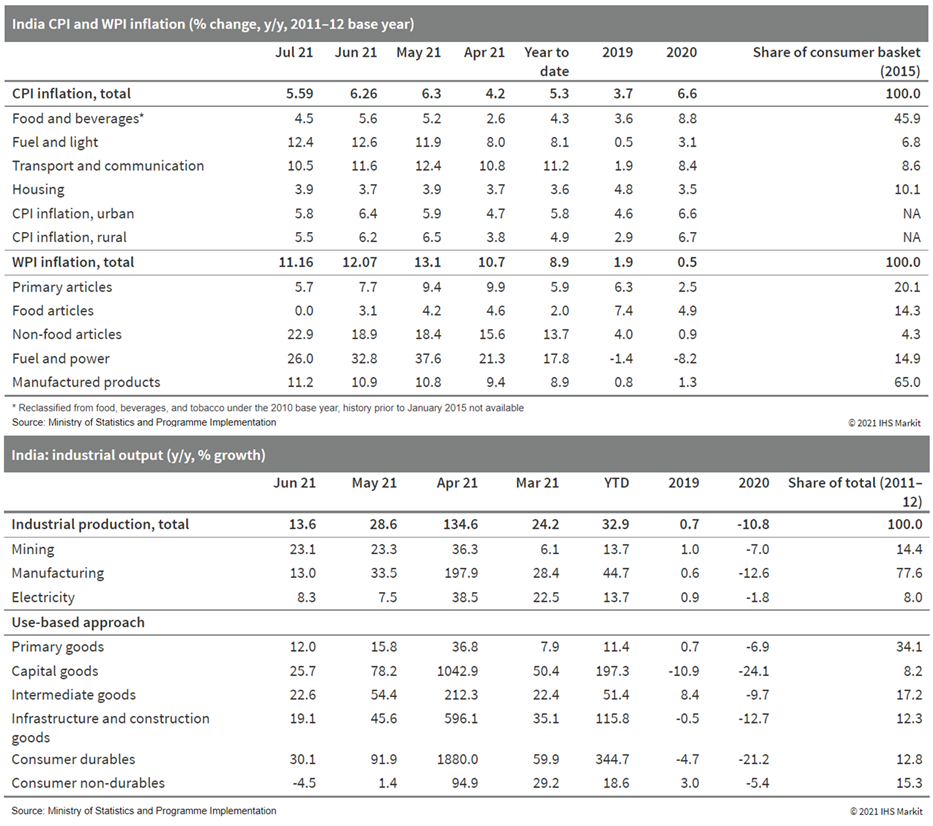

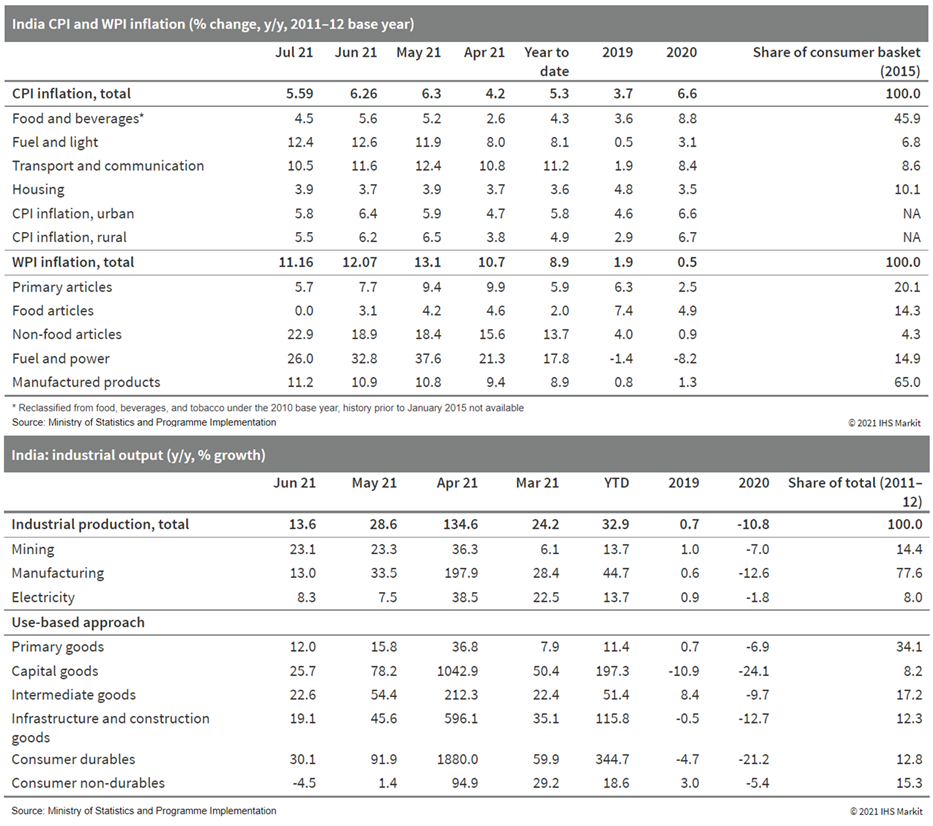

- India's retail inflation, as measured by the consumer price index (CPI), stood at 5.6% y/y in July - easing from 6.3% y/y in June - helped by the reduced pressure on food and fuel prices, as well as easing supply chain disruptions as states continued to ease restrictions in response to declining daily COVID-19 infections. (IHS Markit Economist Hanna Luchnikava-Schorsch)

- Food inflation averaged 4.5% y/y, down from 5.6% y/y in June, with some categories - including cereals, produce, and sugar - experiencing deflation. Fuel inflation has also eased, with both the fuel and light as well as transport and communication categories falling from their peaks in June and May respectively.

- In a separate statistical release, the base normalization led to a slowing annual growth in the index of industrial production to 13.6% y/y in June from 28.6% y/y in May. However, on a sequential monthly basis, industrial output grew 5.7% following two months of contraction caused by the second wave of the COVID-19 virus pandemic and state lockdowns.

- As per a report by ET Auto citing Union Minister Piyush Goyal, the Indian government intends to become self-reliant by setting up the semiconductor industry in India. He said, "There is a worldwide shortage of semiconductors and the government is very much focused on bringing the semiconductor industry to India... the government is committed to supporting both these sectors." He added, "The government is committed to supporting establishing the semiconductor industry in the country which will also help in reducing foreign exchange outflows." (IHS Markit AutoIntelligence's Tarun Thakur)

- GoTo Group, an internet firm created through a merger deal between ride-hailing company Gojek and e-commerce provider PT Tokopedia, is reportedly in discussions to launch a pre-initial public offering (IPO) funding round worth as much as USD2 billion. GoTo has delayed its listing plans to early 2022 as the Financial Services Authority (OJK) of the Southeast Asian country considers new listing guidelines for tech firms to offer dual-class shares with different voting rights, Reuters reported. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Posted 20 August 2021 by Ana Moreno, Director, Product Development, IHS Markit and

Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.