European equity markets closed higher, APAC was mixed, and the US was lower. US government bonds closed lower and benchmark European bonds were mixed. European iTraxx was almost unchanged on the day, while CDX-NA was sharply wider across IG and high yield. The US dollar, gold, and silver closed higher, and copper, oil, and natural gas lower.

Americas

- US equity indices closed lower today; DJIA -0.5%, S&P 500 -1.5%, Russell 2000 -2.9%, and Nasdaq -3.0%.

- 10yr US govt bonds closed +6bps/1.71% yield and 30yr bonds +3bps/2.46% yield but were +11bps and +9bps at the lowest points of the day, respectively. 10yr yields are now at the highest level since January 2020 and the spread between 2s10 is the widest since 2015.

- CDX-NAIG closed +2bps/53bps and CDX-NAHY +14bps/308bps.

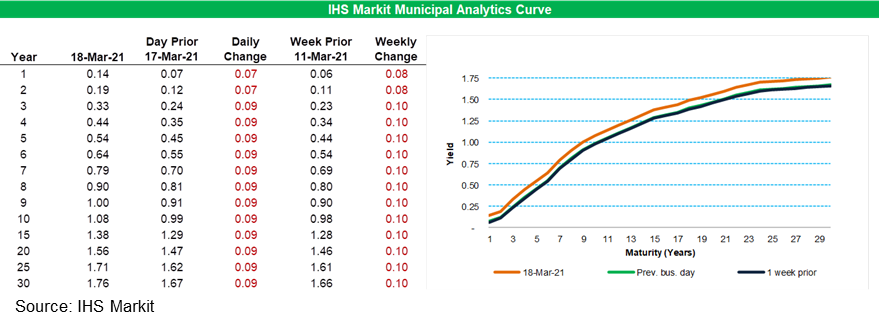

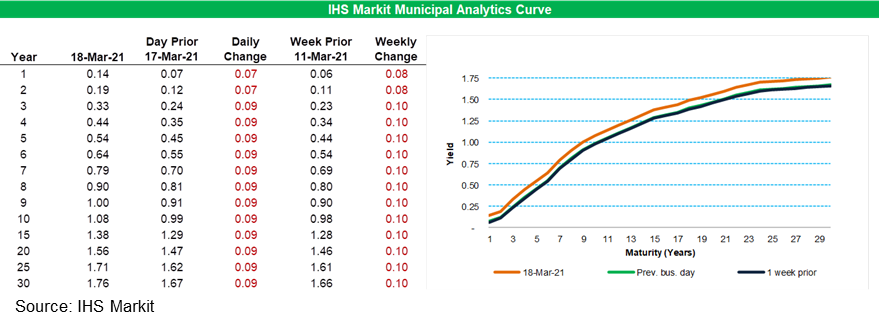

- IHS Markit's AAA Tax-Exempt Municipal Analytics Curve (MAC) yields increased closed +9bps for 3yr and longer paper today.

- DXY US dollar index closed +0.5%/91.86, recovering a large portion of the losses from yesterday's post-FOMC meeting sell-off.

- Gold closed +0.3%/$1,733 per troy oz, silver +1.1%/$26.35 per troy oz, and copper -0.3%/$4.11 per pound.

- Crude oil closed -7.1%/$60.06 per barrel and natural gas closed -1.9%/$2.51 per mmbtu.

- A battery recycling industry aimed at recovering key cathode components—primarily cobalt, lithium and nickel—from end-of-life batteries and reinjecting those materials back into the supply chain is rapidly forming on the horizon. A wide array of companies, from cathode producers and cell manufacturers to raw material providers, automakers, traditional recyclers and startups, have their sights set on capitalizing on the coming tsunami of spent lithium-ion batteries. (IHS Markit EnergyView Climate & Cleantech's Peter Gardett, George Hilton, and Sean Karst)

- The existing base of lithium-ion battery recycling capacity is overwhelmingly concentrated in China and comes from just a handful of large facilities.

- Battery manufacturers CATL, through its subsidiary Brunp, and Camel Group, and cathode materials producer GEM own and operate three of these facilities, all of which feed recovered raw materials back into their respective supply chains.

- However, a number of companies, including Northvolt, Li-Cycle and Volkswagen, have made headlines of late around plans to build out recycling facilities in Europe and North America.

- IHS Markit expects recycled materials to make up a rapidly increasing share of the battery material supply chain beyond 2030. We estimate that recycled cobalt, lithium, and nickel could account for up to 76%, 57% and 55%, respectively, of global lithium-ion battery demand for those raw materials by 2040.

- US seasonally adjusted (SA) initial claims for unemployment insurance rose by 45,000 to 770,000 in the week ended 13 March. The not seasonally adjusted (NSA) tally of initial claims rose by 24,318 to 746,496. The president signed the American Rescue Plan (ARP) Act last week, which provides enhanced benefits of up to $300 per week through 6 September 2021 and exempts the first $10,400 of benefits from 2020 income taxes. (IHS Markit Economist Akshat Goel)

- Seasonally adjusted continuing claims (in regular state programs), which lag initial claims by a week, fell by 18,000 to 4,124,000 in the week ended 6 March. The insured unemployment rate edged up 0.1 percentage point to 3.0%.

- There were 282,394 unadjusted initial claims for Pandemic Unemployment Assistance (PUA) in the week ended 13 March. In the week ended 27 February, continuing claims for PUA fell by 772,583 to 7,615,386.

- In the week ended 27 February, continuing claims for Pandemic Emergency Unemployment Compensation (PEUC) fell by 640,732 to 4,815,348. Eligible recipients can receive up to 79 weeks of unemployment benefits between the regular state programs and PEUC.

- The Department of Labor provides the total number of claims for benefits under all its programs with a two-week lag. In the week ended 27 February, the unadjusted total fell by 1,902,005 to 18,216,463.

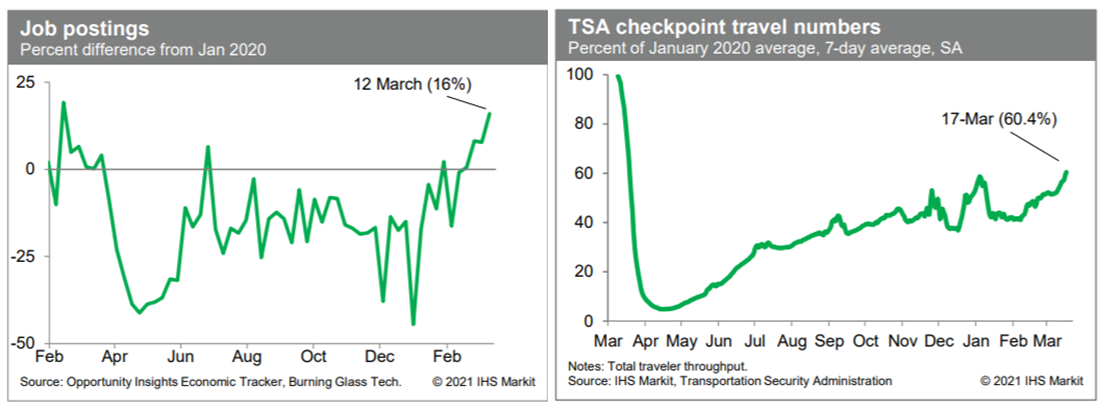

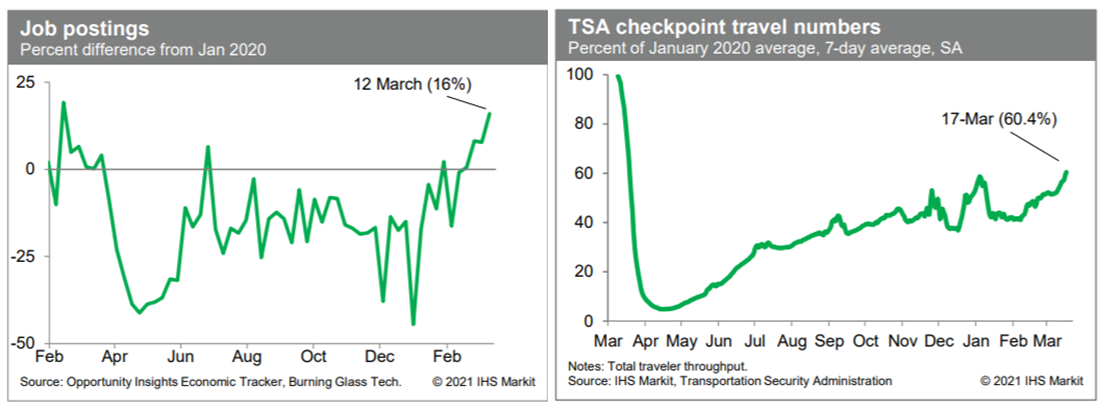

- Job postings last week, from the Opportunity Insights Economic Tracker, were 16% above the January 2020 level. This was the highest reading so far in the recovery and does not appear to be "noise," as it extends a run of several weekly increases. This is a clear indication that labor demand is turning up and will likely translate to solid job growth in the near future. Meanwhile, passenger throughput at US airports (from TSA) has been firming in recent weeks. Averaged over the week ending yesterday, passenger throughput (seasonally adjusted) was 60.4% of the January 2020 average, the highest reading so far in the recovery. A declining rate of spread of COVID-19 infections and the ongoing vaccination campaign are providing a boost to the travel industry. (IHS Markit Economists Ben Herzon and Joel Prakken)

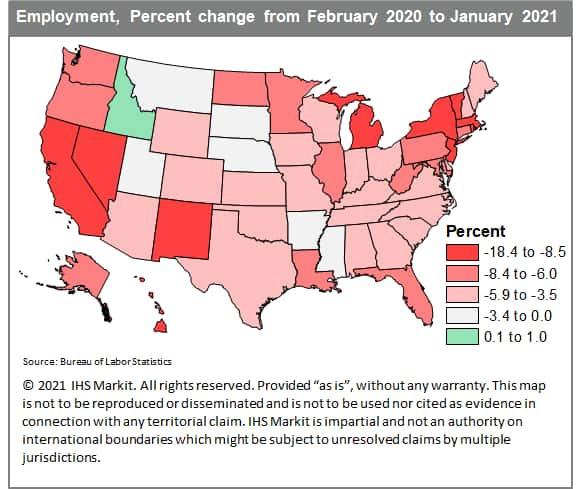

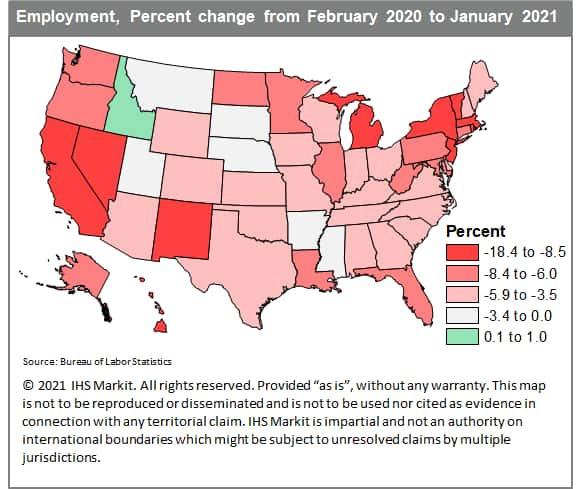

- Total nonfarm payroll employment increased in 36 states in January 2021, gaining a net 339,200 jobs from the previous month on a seasonally adjusted basis, according to the most recent report from the US Bureau of Labor Statistics (BLS). This was up from the loss of 170,900 jobs in December 2020—the first month of payroll contraction since April 2020, when the pandemic's economic impacts were at their worst. (IHS Markit US Regional Economics)

- Not all states rebounded in January; indeed, 14 of them lost jobs. The largest losses were in California and South Carolina. California was still plagued by high COVID-19 case numbers by the time the survey was collected, and it still had significant business restrictions in place. As a result, the state extended its losses in leisure and hospitality, but we expect it to rebound next month given its quickly improving case numbers. South Carolina, on the other hand, had similar losses in food and accommodation services as California, but was also pushed into negative territory by job losses in construction.

- A look at the percentage change of total jobs from February 2020 to January 2021 shows which state economies have fared the best or worst since the beginning of the pandemic. States in the Northeast, specifically New York, New Jersey, Massachusetts, Vermont, Rhode Island, and New Hampshire, suffered the biggest early employment impacts from the coronavirus outbreak and efforts to contain it.

- After Singapore became the first country to approve a cell-cultured meat product, experts at the Future Food-Tech conference suggested the US could be next in line to stand up a regulatory process, which would open the door for other countries to follow the US lead. GFI reported on results from two reports it commissioned - a life cycle assessment and techno-economic assessment - that used industry data to model how cultivated meat may be produced by 2030, along with the projected costs of a commercial-scale facility. (IHS Markit Food and Agricultural Policy's Joan Murphy)

- The good news, according to one of the studies conducted by research firm CE Delft, is that meat cultivated directly from cells may cause up to 92% less global warming and 93% less air pollution and use up to 95% less water and 78% less water.

- According to the data, cultivated meat may be able to compete with traditional meats on costs in the future - with one study showing production costs as low as $2.57 per pound in biomass by 2030, Byrne said. This is not referring to the supermarket price for the new product, he added.

- Cargill is "bullish" on cell-based meats because there is a big market opportunity and the sustainability agenda is part of that, he said. However, there are major challenges for the technology to scale-up and lingering questions where all the capital will come from to float cell-based products.

- Commercial electric vehicle (EV) startup Electric Last Mile Solutions (ELMS) has received 45,000 orders for its upcoming van, which the company plans to produce at a former Hummer plant in Indiana, United States, reports Bloomberg. According to the report, the company states that production of the van is scheduled to begin in the third quarter of 2021. The announcement from Electric Last Mile Solutions did not provide a breakdown of the 45,000 orders by customer. In addition, it is not clear if these orders include down payments or contracts that suggest a more-definite intention to make a purchase, rather than expressions of interest. That question has become an issue for some other startup EVs, raised in part by short-seller investors with an interest in seeing stock prices fall, and the situation highlights the challenges companies face in getting to the market. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Canadian commuter electric vehicle (EV) producer ElectraMeccanica has announced the selection of the US state of Arizona for a new assembly facility. In a statement, the company announced it has chosen the city of Mesa, Arizona, for its US-based assembly facility and engineering technical centre. The selection of the location comes after a year-long search process, which had reduced the list of candidate sites from seven to two, and finally to Mesa. The company plans to produce the Solo EV at the facility, which is expected to have a production capacity of 20,000 units per year and create 500 jobs when it is fully operational. (IHS Markit AutoIntelligence's Stephanie Brinley)

Europe/Middle East/Africa

- European equity markets closed higher; Germany +1.2%, Italy/Spain/UK +0.3%, and France +0.1%.

- 10yr European govt bonds closed mixed; Italy -1bp, Spain flat, France +2bps, Germany +3bps, and UK +4bps.

- iTraxx-Europe closed -1bp/47bps and iTraxx-Xover -1bp/307bps.

- Commercial electric vehicle (EV) startup Arrival has announced plans to build a microfactory in the US state of North Carolina. The facility will be Arrival's second microfactory in the United States. The company says that initially the new facility will produce zero-emission vans for delivery company UPS. The second factory is to be in Charlotte, North Carolina, and the company expects to begin production at the plant in the third quarter of 2022. Arrival states that its microfactories have lower capital expenditure requirements, have a smaller footprint than conventional factories, and can create significant economies per unit of production. Arrival is to invest USD41.2 million in the new facility, which is to have a production capacity of 10,000 units per year. (IHS Markit AutoIntelligence's Stephanie Brinley)

- TechnipFMC has announced it has entered into an agreement with Magnora to jointly pursue floating offshore wind project development opportunities under the name Magnora Offshore Wind. Magnora holds a strategic position within the renewable energy sector as an owner in offshore wind, onshore wind, and solar development projects and is a key enabler in solar energy technologies. When combined with TechnipFMC's EPCI experience projects and its initiative to integrate wind and wave energy with offshore green hydrogen storage, Magnora Offshore Wind could add value to the growing offshore wind market. (IHS Markit Upstream Costs and Technology's Helge Qvam)

- Following eight consecutive increases, eurozone exports fell by 2.8% month on month (m/m) in January. Compared with their pre-pandemic level in February 2020, exports were down by 6.2%. (IHS Markit Economist Ken Wattret)

- January's trade figures were heavily influenced by the end of the UK's transition period, with eurozone exports to the UK plunging by almost 32% m/m. In contrast, eurozone exports to other non-EU countries increased by just under 5% m/m.

- Eurozone imports from the UK were even weaker still, plunging by over 57% m/m. Eurozone imports overall fell by 1.3% m/m in January, the second successive decline, with COVID-19 containment measures introduced from late 2020 hitting domestic demand.

- The relative weakness of exports caused the eurozone's monthly trade surplus to narrow in January, to EUR24.2 billion, although this followed a record high in December 2020.

- Haldor Topsoe says it has signed a memorandum of understanding (MOU) with institutional investor Aquamarine Investment Partners aimed at building a green hydrogen and ammonia facility in Germany, to be operational by 2024. No potential investment figure has been given. (IHS Markit Chemical Advisory)

- The proposed facility will include a 100-megawatt (MW) electrolysis unit that will use Haldor Topsoe's proprietary solid oxide electrolyzer cells (SOEC) electrolysis technology to produce renewable hydrogen to be converted into green ammonia, it says.

- Aquamarine plans to develop the large-scale green ammonia facility in multiple stages, with the first stage to use the SOEC process to produce green hydrogen for processing into 300 metric tons/day of green ammonia. The ammonia could be used as a green marine fuel or as fertilizer, says Haldor.

- Aquamarine is seeking relevant permits for the project, located in northern Germany close to existing offshore wind farms, where the product can be sold to the marine shipping industry, according to Haldor. The plant's commissioning date in 2024 is subject to a final investment decision, it adds.

- The Renault Group has announced an alliance with recycling and resource management specialist Veolia and science company Solvay on battery material recycling. According to a company press statement, Veolia and Solvay created an alliance in this field in September 2020, which Renault plans to join and help expand. The alliance will benefit from Solvay's expertise in the chemical extraction of battery metals and Veolia's 10 years of experience in lithium-ion battery dismantling and recycling via a hydrometallurgical process. This will ensure the safe and cost-effective recycling of battery electric vehicle (BEV) batteries. (IHS Markit AutoIntelligence's Tim Urquhart)

- Autofleet, a provider of a vehicle-as-a-service (VAAS) platform for vehicle fleet optimization, was chosen by Keolis, a transport operator, to provide the VAAS platform for an ongoing autonomous electric vehicle (EV) project in Gothenburg (Sweden), according to company sources. Autofleet provides a VAAS platform for vehicle fleet optimization by using machine-learning algorithms for demand prediction, and has partnered with Avis Budget Group, Zipcar, Keolis, and Suzuki. Keolis is a public transport operator and has conducted various autonomous shuttle deployments. Since 2016, the company has deployed autonomous shuttles in Australia, Belgium, Canada, France, Sweden, the United Kingdom, and the United States and transported 200,000 passengers covering 100,000 km. (IHS Markit Automotive Mobility's Tarun Thakur)

- South Africa's seasonally adjusted real retail trade sales fell by 1.6% month on month (m/m) during January, pulling the year-on-year (y/y) rate down to a contraction of 4.7%. Non-seasonally adjusted real retail sales dropped by 3.5% y/y during January, the South African statistical service, StatsSA, reported. (IHS Markit Economist Thea Fourie)

- Categories that showed the largest contribution to the 3.5% y/y contraction in non-seasonally adjusted real retail trade sales during January included food, beverages and tobacco in specialized stores (contributing 2.6% percentage points to the y/y contraction); general dealers (contributing 2.5 percentage points); and all other retailers (contributing 2.1% percentage points).

- Categories that showed a significant positive contribution included pharmaceuticals and medical goods, and cosmetics and toiletries, followed by textiles, clothing, footwear and leather goods; household furniture, appliances and equipment; and hardware, paint, and glass.

- Cameroon's GDP grew by 1.0% year on year (y/y) in real terms during the third quarter of 2020, after suffering a modest contraction of 1.0% y/y in the second quarter. The growth rebound in the third quarter was spurred by strong investment, which expanded by 18.5% y/y owing to the public investment component, which grew by 25.6% y/y. Private investment also remained resilient, registering growth of 8.8% y/y. (IHS Markit Economist Archbold Macheka)

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong +1.3%, Japan +1.0%, South Korea +0.6%, Mainland China +0.5%, Australia -0.7%, and India -1.2%.

- BYD is hiring engineers for its first overseas battery plant in Europe, reports Reuters. "The planning of the factory is to prepare for supply to European automotive customers and to prepare for the further expansion of BYD's overseas business," a BYD representative told Reuters, without providing details about the location or manufacturing capacity. According to Reuters, BYD has already begun to plan for its first battery plant in Europe. BYD is currently the second largest electric vehicle (EV) battery manufacturer in China, although by sales volumes it is lagging well behind market leader Contemporary Amperex Technology Limited (CATL) as the latter has a much wider customer base in the EV battery sector. (IHS Markit AutoIntelligence's Abby Chun Tu)

- The government of Hong Kong SAR has announced the first "Hong Kong Roadmap on the Popularisation of Electric Vehicles", which sets out long-term policy objectives and plans for the city to attain zero pipeline emissions before 2050. According to Hong Kong Government News, Secretary for the Environment KS Wong introduced the key measures under the roadmap, which cover six aspects to promote the adoption of electric vehicles (EVs) and their supporting facilities, at a press conference on 17 March. As announced in the 2021-22 budget last month, new registrations of internal combustion engine (ICE) vehicles, including hybrid vehicles, will cease in 2035 or earlier. The government will also take the lead by setting electric cars as the standard for its small and medium-sized private cars when procuring new vehicles or replacing old ones, as well as encouraging public organizations to adopt green procurement policies that favor EVs. Additionally, it also plans to launch electric commercial vehicles in the city's public transport and business sector. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Japan's trade balance recorded a surplus of JPY217 billion (USD2.0 billion) but declined by 80.5% from a year earlier on a non-seasonally adjusted basis in February. The seasonally adjusted balance was a deficit of JPY38.7 billion, the first deficit in eight months. Although the non-seasonal balance turned to surplus, the weakness reflected an 11.8% year-on-year (y/y) surge in imports, while exports slipped to a 4.5% y/y drop. (IHS Markit Economist Harumi Taguchi)

- The major factor behind the weakness in exports was the Lunar New Year holiday in Japan's Asian trade partners, as exports to Asia dropped by 0.8% y/y after a 19.4% y/y rise in January.

- The sluggishness also reflected continued declines in exports to the United States and the European Union in line with the negative effect of lockdowns and constrained automotive production caused by supply-chain issues because of semiconductor shortages and the 13 February earthquake.

- A 12.9% y/y drop in automotive exports contributed to the first decline in exports in three months.

- Hyundai has signed a new five-year global business co-operation agreement with Royal Dutch Shell plc, the international energy company known as Shell, for co-operation in future mobility solutions, according to a company press release. The agreement, which runs through to 2026, marks the fourth extension of the partnership, but this time with a new focus on clean energy and carbon reduction in proactive response to market changes. Under the extended partnership, the two companies plan to establish a new type of service channels specialized for mobility service providers, primarily in Asia. They will also discuss co-operation schemes for the energy supply business, such as electric vehicle (EV) and fuel-cell electric vehicle (FCEV) charging services. (IHS Markit AutoIntelligence's Jamal Amir)

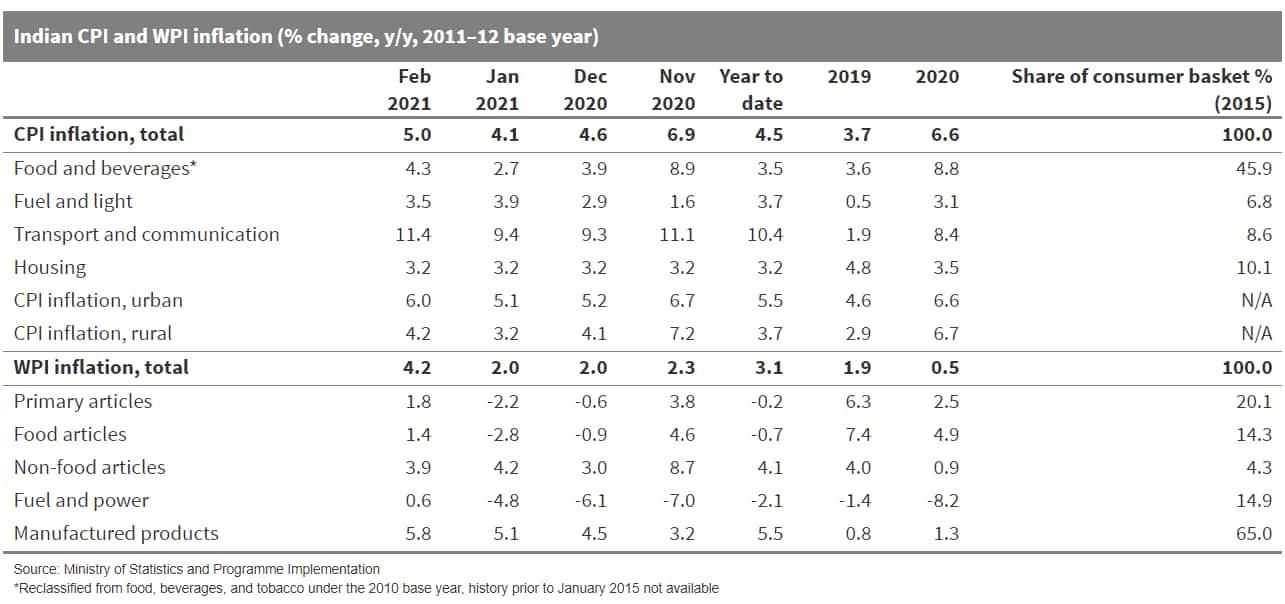

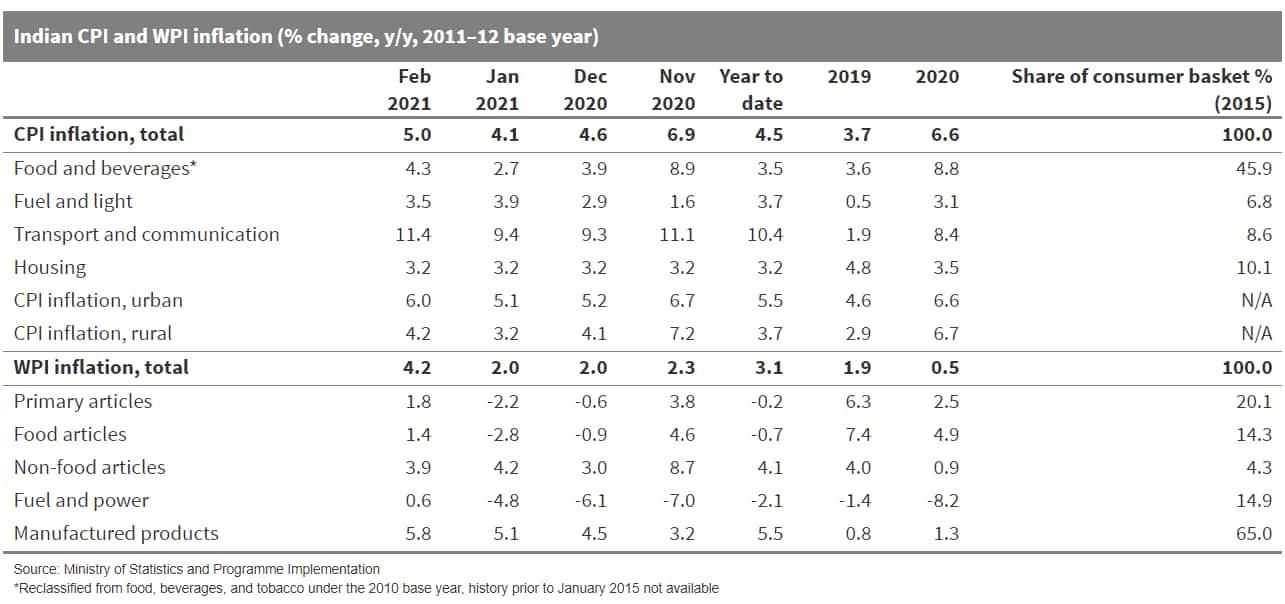

- India's consumer price index (CPI) inflation accelerated to a three-month high of 5.0% year on year (y/y) in February, up sharply from 4.1% y/y in January, according to data released by the Ministry of Statistics and Programme Implementation. (IHS Markit Economist Hanna Luchnikava-Schorsch)

- A fading of the favorable base effects for food items led to a jump in food prices, with food and beverages inflation accelerating to 4.3% y/y from 2.7% y/y recorded in January. Food accounts for nearly 45% of the overall consumer price basket, making food prices a key driver of headline CPI inflation.

- In addition, the uptick in global commodity prices contributed to a jump of two percentage points to 11.4% y/y in the transport and communications category, compared with the January reading.

- Wholesale price index (WPI) inflation accelerated to a 27-month high of 4.2% y/y in February, with all categories showing a strong acceleration in prices. Manufactured products inflation stood at 5.8% y/y, up from 5.1% y/y in January.

- Separately, industrial output contracted by 1.6% y/y in January after posting modest growth in the previous month, government data show. In our forecast, we expected the index of industrial production to fall in annual terms in January, but the contraction was stronger than anticipated. While power output continued to grow, both manufacturing and the mining industry shrank, by 2.0% y/y and 3.7% y/y, respectively. Eighteen of the 23 sub-sectors in manufacturing showed a contraction in January.

Posted 18 March 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.