APAC equity markets closed mixed, while all major US and European equity indices closed lower. US government bonds closed sharply higher for a second consecutive day and benchmark European government bonds closed mixed. European iTraxx and CDX-NA closed wider across IG and high yield. The US dollar, oil, and silver closed higher, while gold, copper, and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Major US equity indices closed lower; Nasdaq -0.9%, S&P 500 -1.3%, DJIA -1.6%, and Russell 2000 -2.2%.

- Stocks fell for a fourth day, wrapping up the worst week for the S&P 500 since February and worst for Dow Jones Industrial Average since January, as the Federal Reserve's surprise hawkishness upended the reflation trade that has dominated markets this year. (Bloomberg)

- 10yr US govt bonds closed -7bps/1.44% yield and 30yr bonds -8bps/2.02% yield. The 2s10s basis is the tightest since 12 February at +118bps.

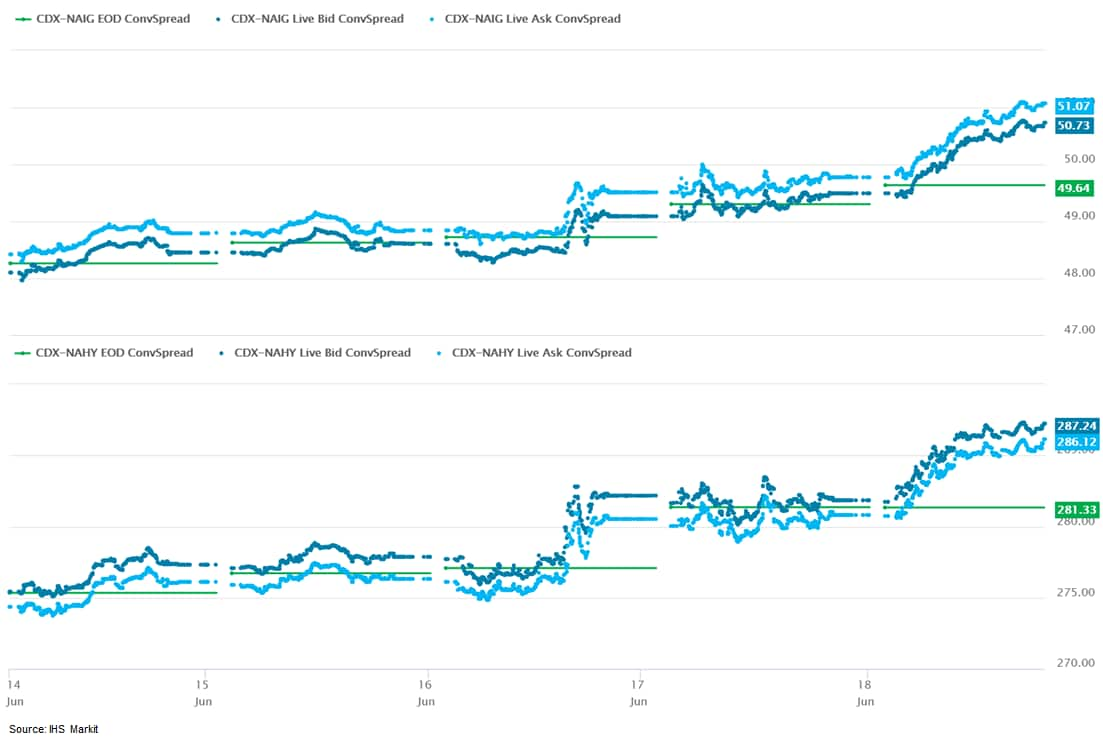

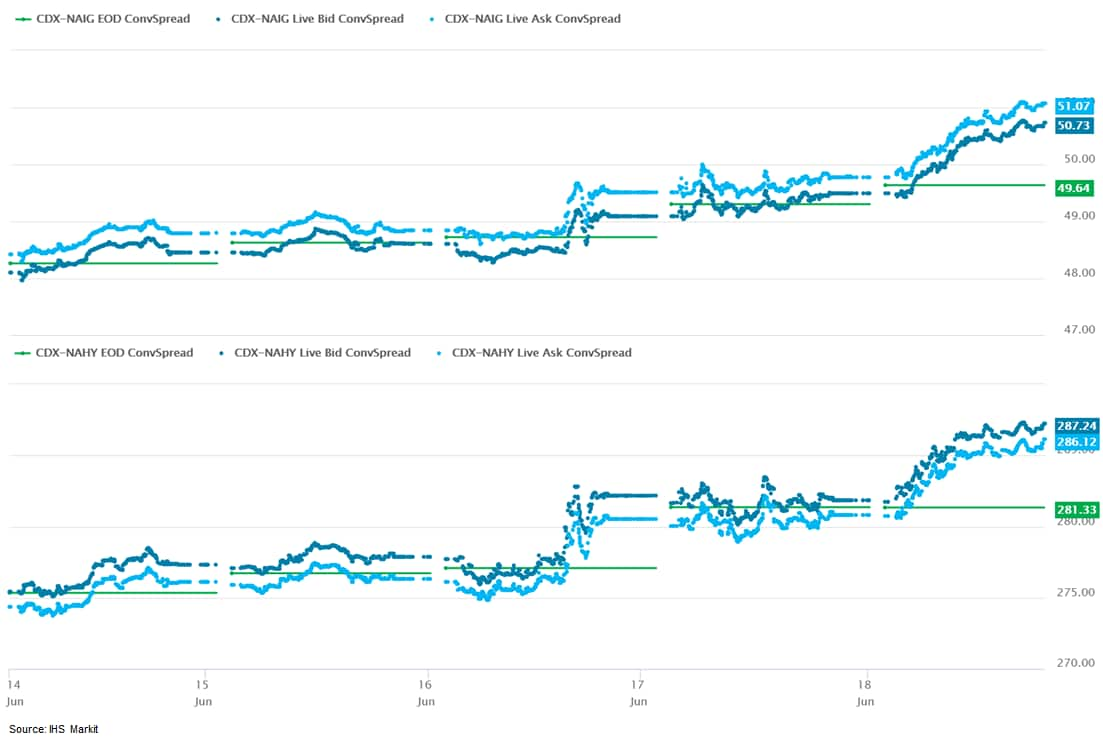

- CDX-NAIG closed +1bp/51bps and CDX-NAHY +6bps/287bps, which is +3bps and +12bps week-over-week, respectively.

- DXY US dollar index closed +0.4%/92.23.

- Gold closed -0.3%/$1,769 per troy oz, silver +0.4%/$25.97 per troy oz, and copper -0.5%/$4.16 per pound. Today's post-close price as of 4:55pm ET left copper 13.4% below the multiyear high close of $4.76 per pound set on 11 May.

- Crude oil closed +0.8%/$71.64 per barrel and natural gas closed -1.2%/$3.22 per mmbtu.

- President Joe Biden urged unvaccinated Americans to get inoculated, warning that a highly transmissible variant of the virus could cause more deaths. The delta variant first found in India and now spread widely in the U.K. is expected to become the dominant strain in the U.S., said Rochelle Walensky, director of the Centers for Disease Control and Prevention. (Bloomberg)

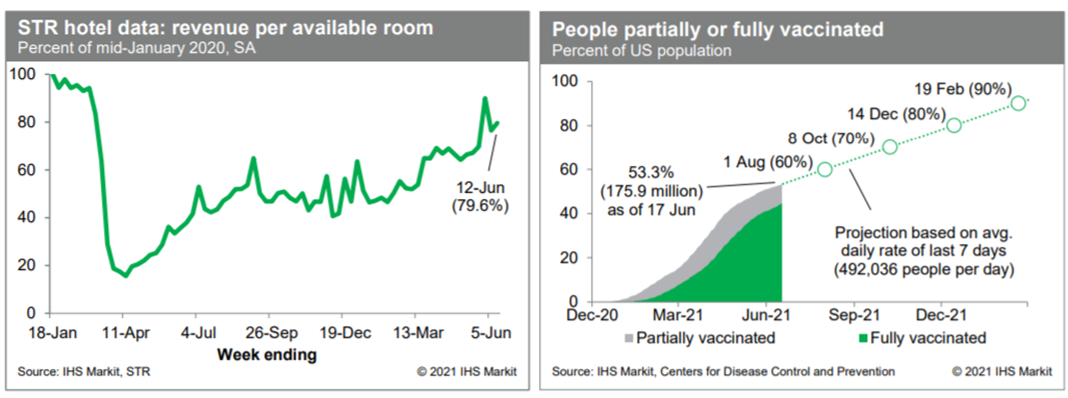

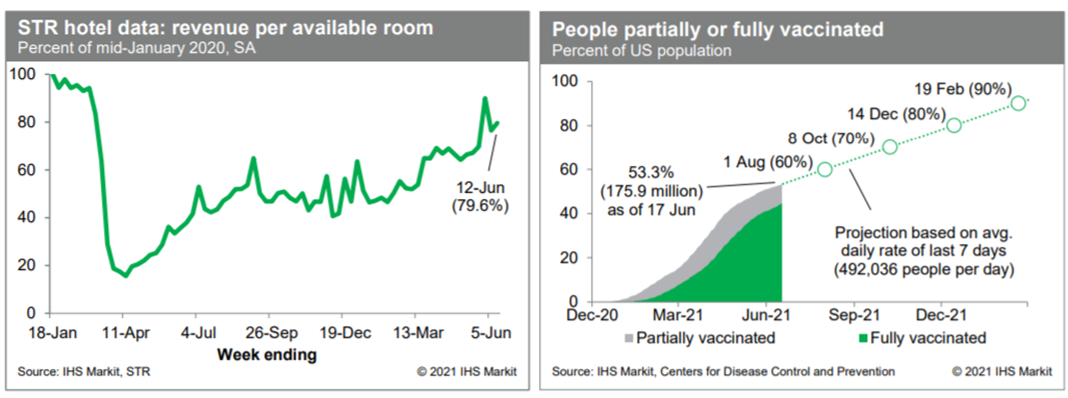

- US hotel revenues last week, after seasonal adjustment, were 79.6% of the mid-January 2020 level, according to our estimate based on weekly data from STR. The timing of the Memorial Day weekend has led to some volatility in this series in recent weeks, but the trend is clearly firming, as activity in the travel sector continues to recover. Meanwhile, averaged over the last seven days, about 492,000 people per day received a first (or only) dose of a COVID-19 vaccination, up from an average daily rate of about 476,000 per day over the prior week. As of yesterday, 175.9 million US residents, or about 53% of the population, were at least partially vaccinated against COVID-19. At the current rate, the US would achieve widespread vaccination (70-80%) by this fall. (IHS Markit Economists Ben Herzon and Joel Prakken)

- A legislative proposal that would allow the deployment of thousands of autonomous vehicles (AVs) has again been rejected by the US Senate Commerce Committee, after unions and attorneys campaigned against it. After failing to attach measures lifting regulations on AVs to a USD78-billion surface transportation bill last month, Republican Senator John Thune tried again this month to attach them to a bill on China technology policy. Thune proposed giving the US National Highway Traffic Safety Administration (NHTSA) the authority to grant exemptions for tens of thousands of AVs per manufacturer from safety standards written with human drivers in mind. The senator claimed that AVs might help in preventing deaths caused by human error, to which Maria Cantwell, the Democrat who chairs the Commerce Committee, responded by citing recent crashes involving driver assistance systems. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Autonomous truck startup Kodiak Robotics has received an undisclosed amount of investment funding from tire-maker Bridgestone Americas, according to a company statement. The deal is also a strategic partnership, under which Kodiak's Level 4 autonomous trucks will be integrated with Bridgestone's smart-sensing tire technologies and fleet solutions. Kodiak Robotics focuses on developing autonomous technology for long-haul trucking. In August 2019, Kodiak received USD40 million in funding and began its first commercial deliveries in Texas (United States). (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Despite the ongoing semiconductor shortage, Ford believes that its second-quarter adjusted earnings before interest and taxes (EBIT) will be stronger than expected, without providing specifics. The second-quarter results will be released on 28 July. CEO Jim Farley delivered the news during a Deutsche Bank automotive conference. The better-than-expected performance is a result of lower-than-expected costs and favorable market factors, according to a company statement ahead of the event. Another factor is that Ford Credit is seeing higher vehicle auction values. Although Ford expects adjusted EBIT to beat expectations, suggesting earnings rather than the loss the company had previously indicated, the company also notes that net income will be down substantially compared with the second quarter of 2020; in that quarter, Ford benefited from a USD3.5-billion gain on its Argo AI investment. In addition, Ford has confirmed that it has received more than 190,000 reservations (which include USD100 refundable deposits) for the all-new Bronco and that it has converted 125,000 of these into orders. (IHS Markit AutoIntelligence's Stephanie Brinley)

- In an effort to support its Ford Pro commercial electric vehicle (EV) ambitions, Ford has agreed to acquire Electriphi, a commercial charging and fleet management company. According to a Ford statement, the deal is expected to be finalized in June, and financial terms are not being disclosed. Ford says that the acquisition will "accelerate electric vehicle fleet adoption by offering commercial customers depot charging management together with vehicles like [the] F-150 Lightning Pro and E-Transit van". (IHS Markit AutoIntelligence's Stephanie Brinley)

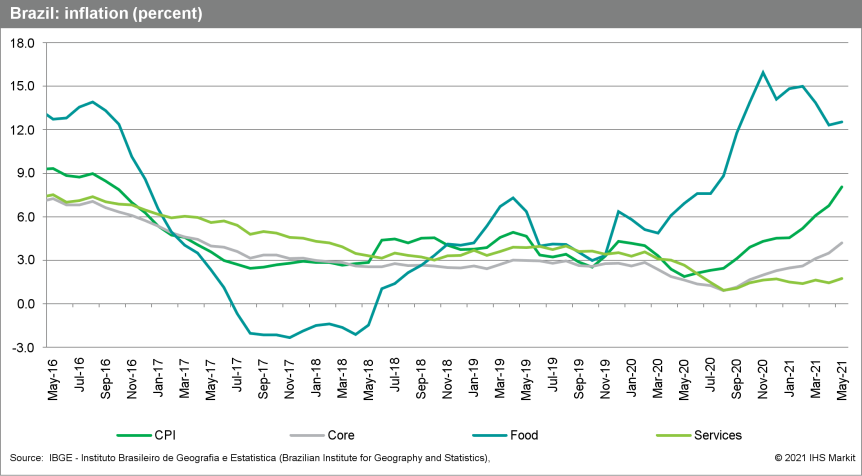

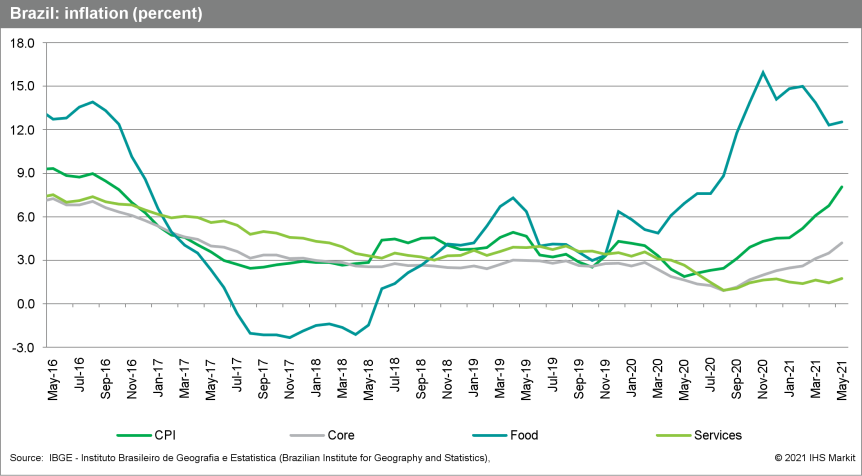

- On 16 June, the Central Bank of Brazil (Banco Central do Brasil: BCB) increased the policy rate from 3.50% to 4.25% and announced a similar move in its next meeting scheduled for 4 August. (IHS Markit Economist Rafael Amiel)

- Driven by steep increases in prices of food and energy items, the 12-month inflation rate amounted to 8.1% as of the end of May, its highest value since October 2016. In May alone, inflation amounted to 0.83%, the highest value for the month of May since 1996. Inflation has been above the 0.8% mark in six out of the past eight months.

- A major factor driving May's inflation was the hike in electricity tariffs (up 5.4% compared with April); Brazil is suffering from a severe drought and hydroelectric power reservoirs are reaching very low water levels. This had prompted authorities to issue increased electricity tariffs as the plants require greater use of thermoelectric plants, which makes electricity more expensive.

- Another factor that is driving the overall CPI inflation higher is the fast increase in food prices; the drought explains, in part, this trend. Prices in the food and beverages category increased by 0.4% in May, very much the same expansion as April. The cost of dining out rose by 1.0% as the restaurant sector progressively reopened.

Europe/Middle East/Africa

- European equity indices closed sharply lower; France -1.5%, Germany/Spain -1.8%, and UK/Italy -1.9%.

- 10yr European govt bonds closed mixed; UK -3bps, France -1bp, Spain +2bps, and Germany +4bps.

- iTraxx-Europe closed +1bp/48bps and iTraxx-Xover +6bps/240bps, which is +1bp and +9bps week-over-week, respectively.

- Brent crude closed +0.6%/$73.51 per barrel.

- The European Commission is to set EU limits on the amount of opium alkaloids - morphine and codeine - allowed in poppy seeds sold to consumers as well as bakery products containing them. Seeds from the opium poppy (Papaver somniferum L.) are used in bakery products, on top of dishes, in fillings of cakes and in desserts and to produce edible oil. While the opium poppy plant contains narcotic alkaloids such as morphine and codeine, the seeds usually do not or only at very low levels. However, poppy seeds can become contaminated with alkaloids as a result of insect damage, or through contamination during harvesting, when dust particles stick to the seeds. National food safety officials are to discuss, then probably vote on, a Commission implementing regulation to the EU's 2006 contaminants regulation in a 21 June meeting of the Standing Committee on Plants, Animals, Food and Feed (PAFF) Section Novel Food and Toxicological Safety of the Food Chain. The implementing regulation would set a 20 milligrams per kilogram (mg/kg) limit on the sum of morphine and codeine in whole, ground, milled poppy seeds placed on the market for the final consumer. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- Daimler will accelerate its battery electric vehicle (BEV) rollout program by launching a number of vehicles one year earlier than planned, according to a Manager Magazin report. The report states that the models planned by Daimler's Mercedes-Benz Passenger Cars brand for the mid-part of the decade will be brought forward a year. According to the report, Daimler CEO Ola Källenius is looking to announce the changes before the summer break this year and hold a capital markets day to tell shareholders of the plan. (IHS Markit AutoIntelligence's Tim Urquhart)

- VDL Nedcar and Canoo have announced an agreement for the former to produce the latter's vehicles in the Netherlands, while Canoo has also announced that it has selected a site in the US state of Oklahoma for its first owned manufacturing facility. According to a joint statement from VDL Nedcar and Canoo, the agreement between these companies secures production through to at least 2028, with a target for 1,000 vehicles to be produced in the fourth quarter of 2022 and 15,000 in 2023. The contract automaker does not have a permit for construction of a new plant yet and said "temporary accommodation" may be made at its Born plant to build the initial vehicles (Born currently produces certain Mini and BMW models, although this is scheduled to end in 2023). Canoo also issued a statement regarding US production. It noted that by "parallel pathing" owned and contract manufacturing, it will meet its target for production in the fourth quarter of 2022. The Oklahoma site will be a 400-acre campus in the Tulsa area on the 9,000-acre MidAmerica Industrial Park. (IHS Markit AutoIntelligence's Stephanie Brinley)

- At its regularly scheduled, rate-setting meeting on 17 June, the Central Bank of the Republic of Turkey (Türkiye Cumhuriyet Merkez Bankası: TCMB) held the one-week repo rate (the main policy rate) steady at 19.0%. It was the third consecutive month at which the rate remained at that level following the 200-basis-point rate hike in March. (IHS Markit Economist Andrew Birch)

- In its press release alongside the meeting, the TCMB once again stated that the policy interest rate would remain above the prevailing inflation rate until inflation showed signs of a permanent deceleration towards the bank's 5% medium-term target. Inflation cooled slightly from April to May, but remained elevated, at 16.6% that month.

- Following the decision, the Turkish currency was trading at TRY1:USD8.63, retreating from a brief rally at the end of the previous week amid hopes that the upcoming summit between President Recep Tayyip Erdoǧan and US President Joe Biden would be fruitful. However, the lira did not dip below its early-June historical low point.

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong +0.9%, Australia/South Korea +0.1%, Mainland China/India flat, and Japan -0.2%.

- China's market regulator, the State Administration for Market Regulation (SAMR), has reportedly begun an anti-trust probe into Didi Chuxing (DiDi). The SAMR is looking into whether DiDi used any unfair competitive practices to push out smaller competitors. It is also investigating whether DiDi's core ride-hailing business's pricing method is transparent enough, reports Reuters. DiDi declined to comment on the report. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese new-energy vehicle (NEV) sales are anticipated to increase by more than 40% each year for the next five years, reports Reuters, citing a statement from the executive vice-chairman of the China Association of Automobile Manufacturers (CAAM), Fu Bingfeng. According to the estimate, NEV sales, including battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), and fuel-cell vehicles (FCVs), will reach 1.9 million units in 2021 and 2.7 million units in 2022. According to a high-ranking government industrial policy adviser, the country may extend tax exemptions on NEV purchases beyond 2022. (IHS Markit AutoIntelligence's Nitin Budhiraja)

Posted 18 June 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.