APAC and European equity markets closed mixed, while most major US indices were lower on the day. US and most benchmark European government bonds closed lower. European iTraxx and CDX-NA closed slightly wider across IG and high yield. The US dollar closed lower, and oil, natural gas, gold, silver, and copper were higher on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our newly launched Experts by IHS Markit platform.

Americas

- Most major US equity indices closed lower except for Russell 2000 +0.1%; DJIA -0.2%, S&P 500 -0.3%, and Nasdaq -0.4%.

- 10yr US govt bonds closed +2bps/1.65% yield and 30yr bonds closed +2bp/2.37% yield.

- CDX-NAIG closed +1bps/52bps and CDX-NAHY +5bps/293bps.

- DXY US dollar index closed -0.2%/90.16.

- Gold closed +1.6%/$1,868 per troy oz, silver +3.3%/$28.27 per troy oz, and copper +1.2%/$4.71 per pound.

- Crude oil closed +1.4%/$66.27 per barrel and natural gas closed +5.0%/$3.11 per mmbtu.

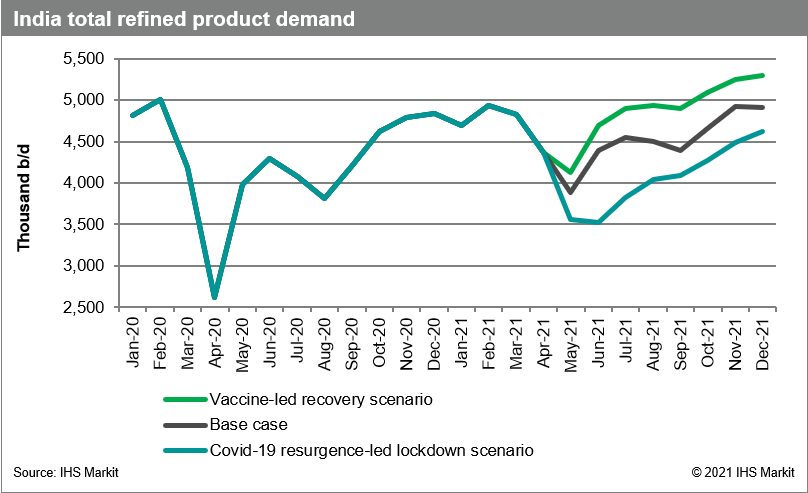

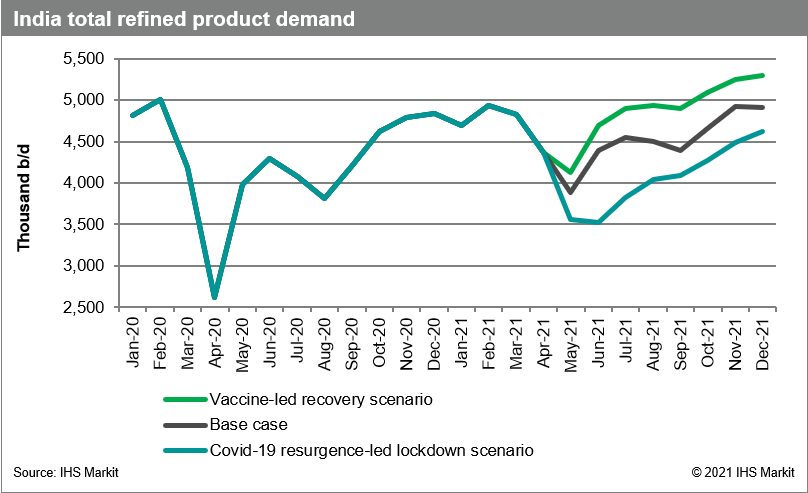

- A rapid resurgence of COVID-19 cases and tightening localized containment measures pose a material threat to India's economic and fuel demand recovery. While we maintain our expectation for a robust global liquids demand recovery this year, a severely disrupted Indian oil product demand recovery would materially threaten the magnitude of that global recovery, loosening global balances. Given the size and complexity of the crisis in India, we have developed three scenarios covering distinct pathways and estimated the oil demand impact in each scenario. These scenarios include a base case, an extended lockdown case, and a vaccine-led recovery case. (IHS Markit Energy Advisory's Roger Diwan, Saurabh Dimri, and Gaurav Gosain)

- In the base case, the country's economic recovery is interrupted but not short-circuited. Current vaccine shortages are resolved by June 2021 as additional vaccines are granted emergency approval and localized lockdowns remain in place for an additional 6-8 weeks. In this scenario, total refined product demand expands by 320,000 b/d year on year in 2021, averaging some 3% below average 2019 demand.

- In the extended lockdown case, current vaccine shortages remain unresolved until the end of 3Q2021 and approval of additional vaccines is likewise delayed. Localized lockdowns are extended for an additional 4-5 months, weighing heavily on the country's economic recovery pathway. In this scenario, total refined product demand remains flat on the year, and comes in at around 10% below average 2019 demand.

- In the vaccine-led recovery case, the government's vaccination campaign accelerates and vaccine shortages are resolved by the end of May. India continues to use localized lockdowns but for a shorter period of 2-3 weeks. As a result, business activity normalizes in short order and the economic recovery picks up by end-2Q2021. As the economy recovers, the fiscal pressure on the government eases, improving its ability to introduce stimulus measures. In this scenario, total refined product demand expands by nearly 570,000 b/d year on year in 2021, averaging some 2% above average 2019 demand.

- Annual worldwide renewable generation capacity additions are set to stabilize around 270-280 GW in 2021 and 2022, data released recently by the International Energy Agency (IEA) show. About 275 GW of renewables were installed in 2020, it said, a 45% increase compared with 2019 and the fastest rate of increase in two decades. That "new normal," as the intergovernmental organization calls it, far surpasses the IEA's expectations of a year earlier, with Europe and the US compensating for a slowdown in Chinese capacity installations after 2020 saw record newbuild there. Renewable generation additions are expected to account for 90% of total global power capacity increases in both 2021 and 2022, according to IEA forecasts. (IHS Markit Climate and Sustainability News' Keiron Greenhalgh)

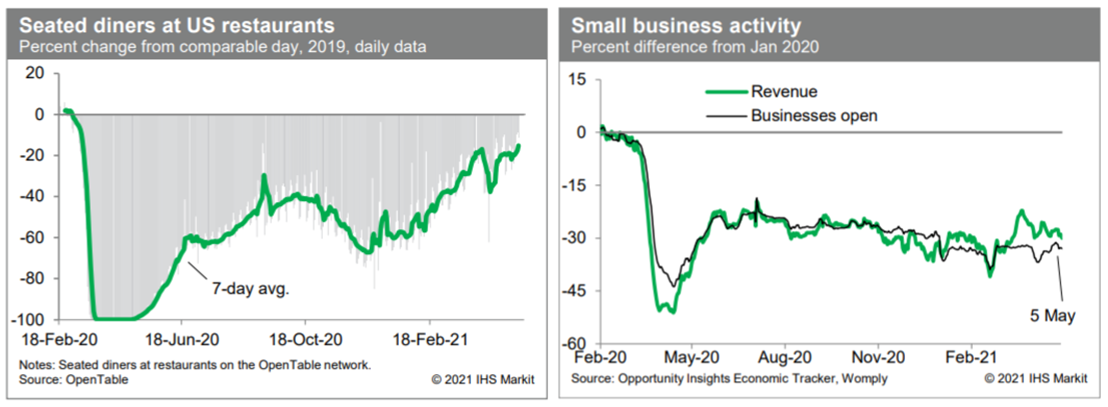

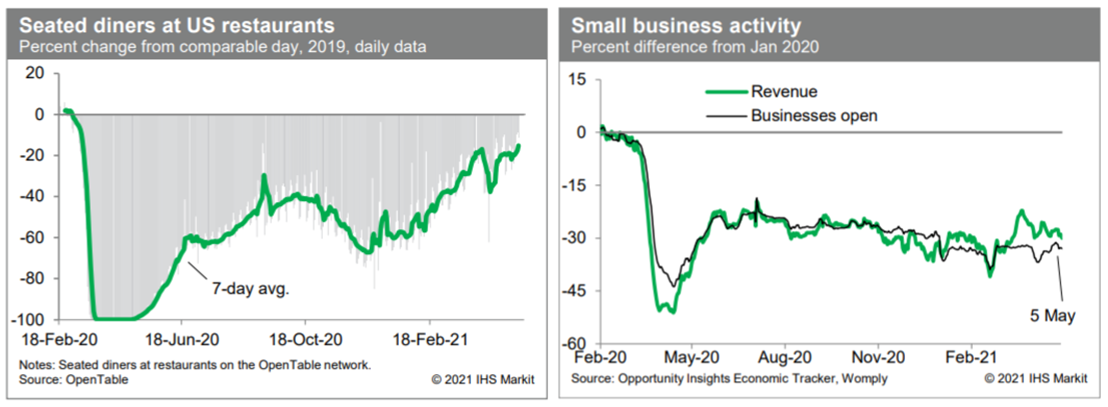

- The count of seated diners on the OpenTable platform has been firming in recent days, as persons, businesses, and local authorities respond to new guidance from the Centers for Disease Control (CDC) on masking and distancing. We expect to see continued improvement in restaurant activity in coming days and weeks. However, small-business activity (revenues and the number open) remained depressed through early May, according to the Opportunity Insights Economic Tracker. These data suggest that the small-business sector has yet to participate in the broad recovery. (IHS Markit Economists Ben Herzon and Joel Prakken)

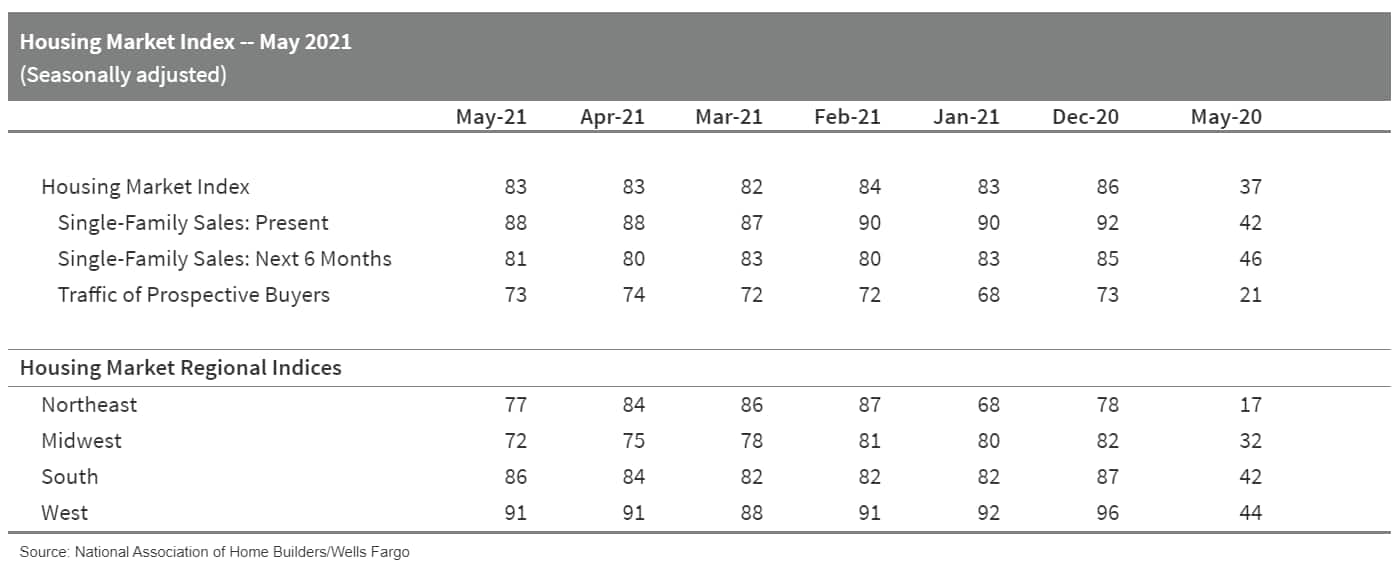

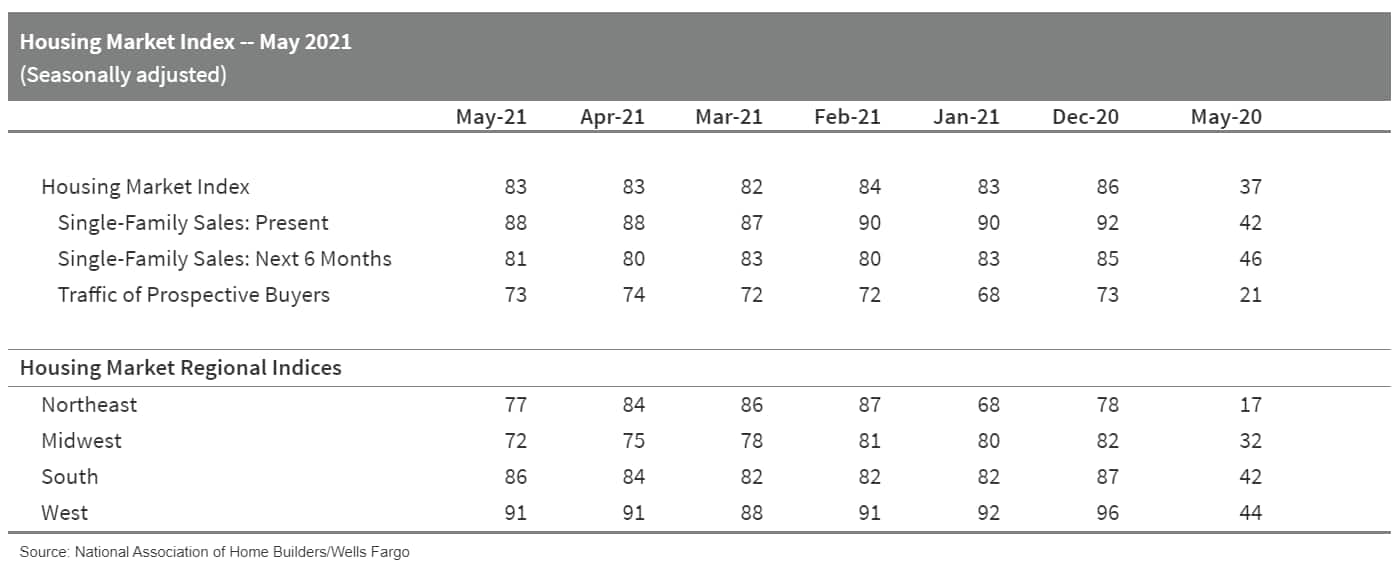

- The US headline housing market index remained at a solid 83 in May. A reading above 50 indicates that more builders view conditions as good rather than poor. (IHS Markit Economist Patrick Newport)

- The current sales conditions index was also unchanged, remaining at 88; the index measuring sales prospects over the next six months inched up a point to 81; the traffic of prospective buyers' index lost one point to 73.

- By region, the West was unchanged at 91, the South rose by two to 86, the Midwest slipped three points for the third straight month to a still respectable 72, and the Northeast moved down seven points to 77.

- Builders remain optimistic, just not as optimistic as in last November when the headline index hit a record high 90. Demand for homes remains strong, but builders are being squeezed by rising costs and breakdowns in supply chains.

- According to the press release, "first-time and first-generation home buyers are particularly at risk for losing a purchase due to cost hikes associated with increasingly scarce material availability."

- Canadian housing starts decreased 19.8% month over month (m/m) to 268,631 units (annualized) in April. (IHS Markit Economist Chul-Woo Hong)

- Urban single starts edged down 0.1% m/m while multifamily starts plunged 22.8% m/m. Rural starts plummeted 46.6% m/m.

- Regionally, the drop was led by British Columbia (down 46.1% m/m), Quebec (18.1% m/m), and Ontario (17.7% m/m).

- Despite the decrease, April's housing starts level remained at a firm level, closely in line with our forecast.

- Urban single starts inched down as widespread regional gains were cancelled by large declines in Quebec, British Columbia, and Nova Scotia. Alberta's single starts continued a 10-month winning streak, up 5.7% m/m in April. Single starts in Saskatchewan, New Brunswick, and Manitoba also surged.

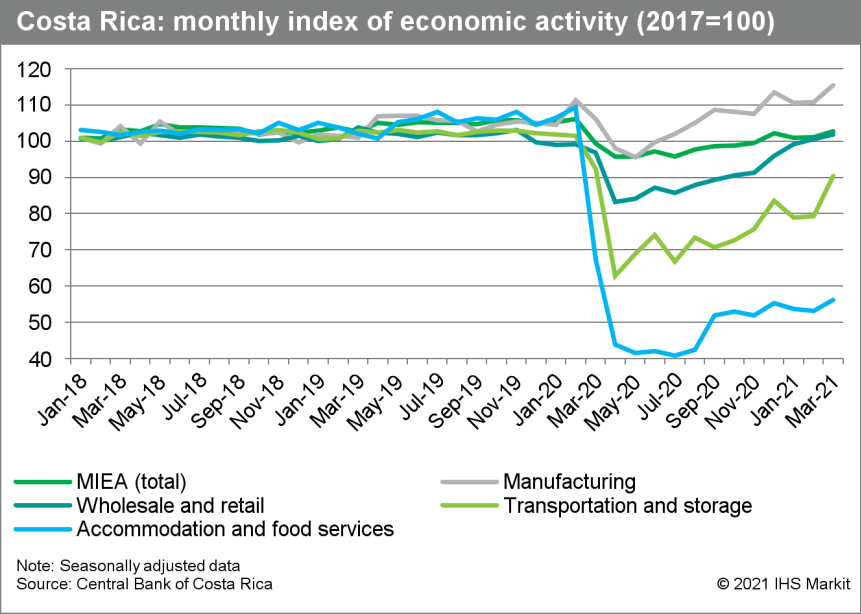

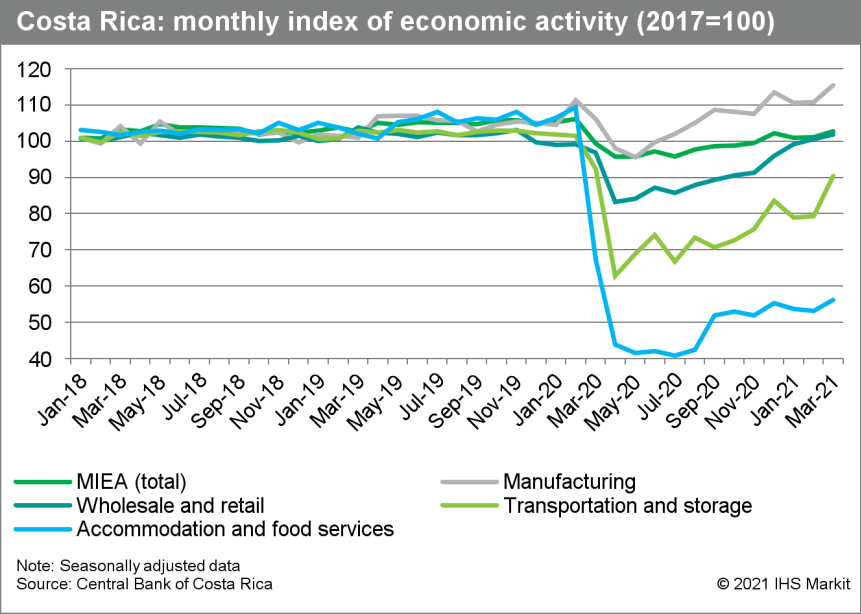

- Strength in manufacturing and a positive US outlook support continued progress towards Costa Rica's recovery, but the important tourism sector remains highly depressed. Precarious public finances and a resurgence of COVID-19 infections are the most serious downside risks. (IHS Markit Economist Jeremy Smith)

- The MIEA grew by 1.7% on a seasonally adjusted monthly basis, the best result since December 2020, leaving economic activity 3.2% below the historical peak in February 2020.

- The manufacturing sector led the way in March, growing 3.6% month on month (m/m) and exceeding February 2020 levels by 3.8%. Manufacturing is supported by strong US demand for Costa Rican medical devices, powering total exports to an 11% year-on-year (y/y) increase in the first quarter.

- Sectors closely tied to tourism remain in a deep slump. The impact is acutely felt in accommodation and food services along with transportation and storage, which together account for most of the decline relative to pre-pandemic levels.

- International arrivals approached 90,000 in March, a significant improvement from the first two months of the year yet still 73.4% below the 2019 level.

Europe/Middle East/Africa

- European equity markets closed mixed; Italy +0.4%, Spain +0.1%, Germany -0.1%, UK -0.2%, and France -0.3%.

- Most 10yr European govt bonds closed lower except for UK flat; Italy +4bps and Spain/France/Germany +2bps.

- iTraxx-Europe closed +1bp/51bps and iTraxx-Xover +2bps/254bps.

- Brent crude closed +1.1%/$69.46 per barrel.

- UK scientists have warned the British public to be very cautious as some restrictions on social gatherings and indoor dining and use of other indoor venues are being lifted today (17 May), the BBC reported. The warnings come from different quarters, including Joint Committee on Vaccination and Immunisation (JCVI) member Professor Adam Finn and Health Secretary Matt Hancock, who suggested that outdoor gatherings are still safer than indoors. The warnings come amid growing concerns about the spread of the Indian variant B1.617.2 in the UK. The latest Public Health England (PHE) data indicate that Indian variant cases increased to 1,313 in the week ending on 14 May, up from 520 in the previous seven-day period. Hancock told the BBC that the majority of the 18 people who are in hospital with COVID-19 complications and have the Indian variant had not been vaccinated; however, five of them had had one jab and one person had had both jabs before falling ill. Amid reports that the Indian variant could be 40-60% more contagious than the UK variant, Hancock conceded in a Sky News interview that the Indian variant is likely to become the dominant strain in the UK. (IHS Markit Life Sciences' Janet Beal and Milena Izmirlieva)

- Bank of England Governor Andrew Bailey reported on 12 May that during the period of financial dislocation at the start of the COVID-19 virus pandemic, there had been a "dash for cash" by holders of money market funds, which had threatened financial stability. He noted that over 12-20 March 2020, investors withdrew GBP25 billion from such funds, some 10% of total holdings. Highlighting that US money market funds had faced similarly heavy outflows, he claimed the rapid withdrawals had been an important driver in the Bank of England's reactivation of its asset repurchase program and provision of emergency liquidity facilities. He described this as "an unwelcome reminder" that post 2008-09 financial reforms "did not finish the job", leaving "a dangerous gap" in "our exposure to the risk of financial instability". Bailey clearly indicated that further regulation is likely, both in the UK and globally, stating that regulators "must finish the task this time". He specified that the Financial Stability Board (FSB) will consult shortly on regulatory change to address the problem that money market funds present themselves to investors as "cash-like", offering instant redemption, but hold a large proportion of illiquid assets. (IHS Markit Economist Brian Lawson)

- Sports car manufacturer Caterham Cars is planning to develop a battery electric variant of its Seven as part of plans for the business. CEO Graham Macdonald told Autocar in an interview that the vehicle, which is intended to arrive in 2023, would be developed so that it "rides and handles like a Caterham". With this in mind, the company will focus on keeping the weight as low as possible, although suspension geometry and other aspects of the chassis will be recalibrated to mitigate the weight of the batteries. It is also expected to forgo certain associated systems, such as regenerative braking. Macdonald expects the minimalist approach to the design to be maintained, with acceleration on a par with the top specification 620R variant. To help bring the vehicle to production, Caterham is looking to partner with another company to secure batteries and motors; Macdonald stated, "I think we would enter into some sort of partnership whereby we can purchase batteries and get them made to fit our dimensions, rather than buy a square skateboard that has a body-in-white on top. That loses the Caterham." (IHS Markit AutoIntelligence's Ian Fletcher)

- Ireland's consumer prices, measured by the EU's harmonized index, rose by 1.1% year on year (y/y) in April. Prices had stagnated, on a y/y basis, in March and had declined for most of 2020. (IHS Markit Economist Diego Iscaro)

- April's inflation rate was the strongest since February 2020, when prices also increased by 1.1% y/y.

- Inflation was boosted by higher health and energy costs, which rose by 4.7% y/y and 4.0% y/y, respectively. On the other hand, prices of clothing/footwear (-3.6% y/y), household durables (-1.0% y/y), and food/non-alcoholic beverages (-0.8% y/y) contributed to a decline in April.

- Core inflation (i.e., excluding energy and unprocessed food) stood at 0.6% in April, slightly below a reading of 0.8% for the eurozone.

- Following its policy meeting in March, the ECB announced a "significantly higher" pace of asset purchases under its Pandemic Emergency Purchase Programme (PEPP) over the subsequent quarter (see first chart below), based on a joint assessment of financing conditions and the inflation outlook. (IHS Markit Economist Ken Wattret)

- The marked pick-up in bond yields prior to the policy meeting had led to concern about a premature tightening of financing conditions in the eurozone, which the ECB wanted to push back against, while the sharp acceleration in inflation early in 2021 was seen as largely being due to "transitory factors" and energy price effects.

- The ECB's communication following its subsequent policy meeting in April followed broadly similar lines. Net asset purchases under the PEPP would continue to be conducted at a significantly higher pace than during the first months of the year, while the pick-up in inflation was judged to be due primarily to "temporary and idiosyncratic" factors, which would "fade out" early in 2022.

- However, the subsequent release of the account of April's policy meeting has shed more light on the discussions over the economic and policy outlook, with upside risks to growth and inflation now being cited by some members of the Governing Council.

- The European Union (EU) said it is postponing tariff hikes on US goods scheduled to take effect June 1 as both sides agreed to talks aimed at resolving the underlying dispute over steel and aluminum overcapacity and lifting duties previously imposed in the matter. EU retaliatory duties imposed in response to US Section 232 tariffs on steel and aluminum imports put in place during the Trump administration were imposed in mid-2018 and targeted just over $3 billion in US goods including whiskey, orange juice and boats. On June 1, the EU planned to up duties on many of those goods from 25% to 50% and add several new products to the list of targeted imports—amounting to around $4 billion in additional duties. Now, the EU has agreed to hold off on the expansion and increase for at least six months. (IHS Markit Food and Agricultural Policy's Richard Morrison)

- Germany announced it will further restrict pollution from sources like energy and fuel after a court found its regulations shifted emissions reduction burdens to future generations, violating their rights. On 29 April, the Constitutional Court in Germany published a decision saying that Germany's government lacks a plan for emissions reductions after 2031, and ordered it to enact related provisions by 31 December 2022. The court sided with the case made by five youths living on German islands at risk of becoming uninhabitable due to sea level rise, as well as three from heat-stricken family farms. It based its decision on the protection for the civil liberties afforded to future generations under Article 20a of Germany's constitution, the Basic Law. The petitioners found fault with the emissions levels laid out in Germany's 2019 Federal Climate Act (Bundesklimaschutzgesetz) that sets out sector emissions goals to help meet Germany's Paris Agreement target of 55% emissions cuts between 1990 and 2030. That target is higher than the EU's target of 40% for all member states, but the EU is currently working on raising its target to the 55% level. After the court released its findings, Germany's government moved "unexpectedly" quickly to update laws, E3G policy advisor Rebekka Popp said in a statement. (IHS Markit Climate and Sustainability News' Cristina Brooks)

- French oil company Total is to present a climate-based proposal giving shareholders an opportunity on 28 May to express their views on the company's strategy towards energy transition. The pending shareholders' discussion comes at a sensitive time, after core lenders to Total recently rejected funding the USD3.5-billion East African Crude Oil Pipeline (EACOP) project, in which Total is the majority stakeholder with a 72% stake, amid widespread criticism of the scheme for both its carbon-intensive content and specific risks of damage to key nature reserve sites. Despite the banks' adverse stance, the project continues to have strong political backing from the host governments, and the Ugandan government on 1 May published a letter sent to President Yoweri Museveni by French President Emmanuel Macron, who stated his support for the project. (IHS Markit Country Risk's Jordan Anderson, William Farmer, Bibianna Norek, and Alisa Strobel)

- Core banks have rejected lending for the EACOP, challenging execution of the project. Core bank lenders to Total, including France-based BNP Paribas, Société Générale, and Crédit Agricole, have refused to finance the EACOP project on environmental and human rights grounds, reducing the likelihood of the project going ahead and increasing the risk of lengthy delays.

- Chinese policy banks are most likely to provide an alternative source of financing for the EACOP project. Total has previously received financing from Export-Import Bank of China and China Development Bank for a project in Russia, which Western banks did not fund because of sanctions. China is Uganda's largest creditor, and Tanzania signed a USD1.3-billion loan agreement with Chinese policy banks in January to build a section of its standard gauge railway.

- Italian anti-trust watchdog, the Competition and Market Authority (AGCM), has fined Google for preventing an application designed to find and book electric vehicle (EV) charging points from working on its Android Auto in-car operating system, reports Reuters. The regulator said that Enel's JuicePass had been prevented by Google for two years, unfairly curtailing its use and favoring Google Maps. As well as fining Google EUR102 million for abuse of a dominant position, the company, it also asked Google to make JuicePass available on Android Auto. The JuicePass application not only allows drivers to find and book charging points, but also uses maps to do so. It is already offered on rival Apple's equivalent CarPlay system, which would allow for the use of the application while in the car, albeit with some changes to functionality. (IHS Markit AutoIntelligence's Ian Fletcher)

- Stellantis and Hon Hai Precision Industry, known as Foxconn, are to announce a strategic partnership later this week. According to a statement, a presentation will take place tomorrow (18 May) at 11:45 am CEST together with Foxconn's subsidiary, FIH Mobile. The companies said that Stellantis CEO Carlos Tavares, chairman of Foxxcon Young Liu, Stellantis chief software officer Yves Bonnefont, and CEO of FIH Calvin Chih will take part in the presentation. Foxconn is best known for contract manufacturing high technology consumer goods, such as Apple's iPhone. Its FIH Mobile business provides a range of services including industrial design, although according to its website this is primarily focused on mobile devices and their accessories. (IHS Markit AutoIntelligence's Ian Fletcher)

- Poland has announced plans to upgrade its port infrastructure, under its National Reconstruction Plan, to support its fledgling offshore wind industry. The ports of Leba and Ustka will act as support and maintenance hubs, while the port of Gdynia will act as the main installation facility. Works are expected to start in 2021 and end sometime in 2026, and will cost the Polish government EUR437 million. The government hopes to encourage the formation of a local industry with the establishment of ports near the planned offshore wind farms. (IHS Markit Upstream Costs and Technology's Melvin Leong)

Asia-Pacific

- APAC equity markets closed mixed; India +1.7%, Mainland China +0.8%, Hong Kong +0.6%, Australia +0.1%, South Korea -0.6%, and Japan -0.9%.

- Shanghai has announced plans to begin its first hydrogen energy testing base in Anting Town, Jiading District at the end of July this year with construction expected to be completed by the end of next year, according to Gasgoo. The testing center will support tests to check performance of vehicles, fuel cell vehicle (FCV) engines, and fuel cell stacks along with providing testing environment for hydrogen supply, air supply, and cooling system. There will also be a hydrogen fueling station set up at the location to provide hydrogen fuel to labs and vehicles to be tested. The move is in line with the June 2019 announcement that Shanghai aims to establish a complete hydrogen energy and FCV industrial chain in its northwestern Jiading district, a new effort by the city to greatly develop the fuel cell industry. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- Baidu has launched Apollo Air, a vehicle-to-everything (V2X) technology platform that allows Level 4 autonomous vehicles (AVs) to communicate with roadside sensors using ultra-fast 5G cellular networks, according to a company statement. Apollo Air is built as a part of Baidu's partnership with the Institute for AI Industry Research (AIR) at Tsinghua University to provide reliable safety redundancy for autonomous operations. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Autonomous vehicle (AV) startup Pony.ai has expanded its robotaxi fleet in Beijing (China). The company has added 30 AVs into its fleet, which can be hailed through a smartphone application for robotaxi service around the 150-square-km Yizhuang region. Pony.ai said the new vehicles are built on a standard production line with Toyota and that each of them is equipped with 15 sensors. James Peng, co-founder and CEO of Pony.ai, said that it also plans to explore partnership with other carmakers, reports China Daily. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- GE Renewable Energy and Toshiba Energy Systems and Solutions Corporation have entered into a strategic partnership agreement to localize critical manufacturing processes of GE's Haliade-X offshore wind turbine, and to support its commercialization in Japan. Financial terms of the deal were not disclosed, however as part of the agreement, GE will provide the Haliade-X technology, nacelle parts, and components for assembly. Toshiba will develop a local supply chain to assemble, warehouse, transport, and provide preventive maintenance services for the Haliade-X nacelles. Toshiba will also lead critical sales and commercial activities to help GE's offshore wind technology to become more competitive in Japan. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- South Korean chicken meat imports rose sharply in the first four months of 2021 as domestic production capacity was hit by outbreaks of highly pathogenic avian flu. Total import volumes reached 60,592 tons of chicken meat in the January-April period - an increase of 13% y/y. This almost matches the record volume imported in the same period in 2019. (IHS Markit Food and Agricultural Commodities' Max Green)

- Brazil and Thailand strengthened their dominance as suppliers of poultry meat - together providing more than 93% of total import volumes.

- South Korean imports from Brazil reached 43,861 tons in the period - an increase of 24% y/y. Imports from Thailand were up 12.5% y/y at 12,744 tons.

- In contrast, imports from the US fell below 1,000 tons - down 22% y/y. The US, which six years ago was the leading supplier of chicken meat to the Korean market, now accounts for less than 2% of total import volumes.

- Indonesia's ride-hailing and payments giant Gojek has merged with local e-commerce company Tokopedia to form GoTo Group. The new company will be led by Gojek's Andre Soelistyo as group CEO and Tokopedia's Patrick Cao will serve as group president. GoTo Group will combine e-commerce, on-demand, and financial services from Gojek and Tokopedia. The companies together have over 11 million merchant partners as of December 2020 and more than 100 million monthly active users. Gojek and Tokopedia first began working together in 2015 to accelerate e-commerce deliveries using Gojek's drivers. The companies started conducting discussions on a potential merger in 2018, but the deal did not materialize. Negotiations between the companies gained attention in November 2020 after months-long merger talks between Gojek and rival Grab reached an impasse. Common investors of Gojek and PT Tokopedia include Temasek Holdings, Sequoia Capital, and Google. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Australia's Deputy Prime Minister Michael McCormack said on 13 May that Australia is seeking "patience" in its relationship with mainland China, but is also aiming for "broadening its trade interests" and to "diversify their markets" to other countries. The remarks follow a 6 May decision by China's National Development and Reform Commission (NDRC), under the State Council, to "indefinitely suspend all activities" under the China-Australia Strategic Economic Dialogue (CASED), which was initially introduced in June 2014 and involved annual talks between the NDRC and Australia's treasurer and trade minister, although no exchanges have taken place since 2017. (IHS Markit Country Risk's Hannah Cotillon and David Li)

- CASED's suspension indicates that China is considering limiting Australia's long-term role as a main economic partner, particularly in commodities trade. CASED's main role is to advocate for closer economic engagement and to provide a platform for bureaucratic-level engagements. Its suspension by China is almost certainly a reciprocal response to the cancellation on 21 April of two Belt and Road Initiative (BRI) agreements in Victoria state under Australia's Foreign Relations Act, which was passed in December 2020.

- The cancellation of BRI agreements in Victoria reflects the Australian federal government's unwillingness to reverse core policies affecting Chinese interests in Australia. Recent targeted measures affecting Australian exports to China have not resulted in a softening of Australia's policies towards Beijing.

- Termination of the Darwin port lease would be likely to result in reciprocal measures from China affecting key Australian exports. Defense Minister Peter Dutton confirmed on 3 May that the 2015 lease of the commercial port of Darwin in the Northern Territory to China's Landbridge Group is under review by the Department of Defense.

Posted 17 May 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.