Major APAC equity indices closed mixed, while all US and European indices were lower. US and benchmark European government bonds closed sharply higher. CDX-NA and European iTraxx closed wider across IG and high yield. The US dollar, gold, and silver closed higher, while copper, oil, and natural gas closed lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed sharply lower; DJIA -1.8%, S&P 500 -2.1%, Russell 2000 -2.5%, and Nasdaq -2.9%.

- 10yr US govt bonds closed -7bps/1.97% yield and 30yr bonds -5bps/2.30% yield.

- CDX-NAIG closed +3bps/68bps and CDX-NAHY +11bps/368bps.

- DXY US dollar index closed +0.1%/95.8.

- Gold closed +1.6%/$1,902 per troy oz, silver +1.1%/$23.88 per troy oz, and copper -0.3%/$4.52 per pound.

- Crude oil closed -2.0%/$91.76 per barrel and natural gas closed -4.9%/$4.49 per mmbtu.

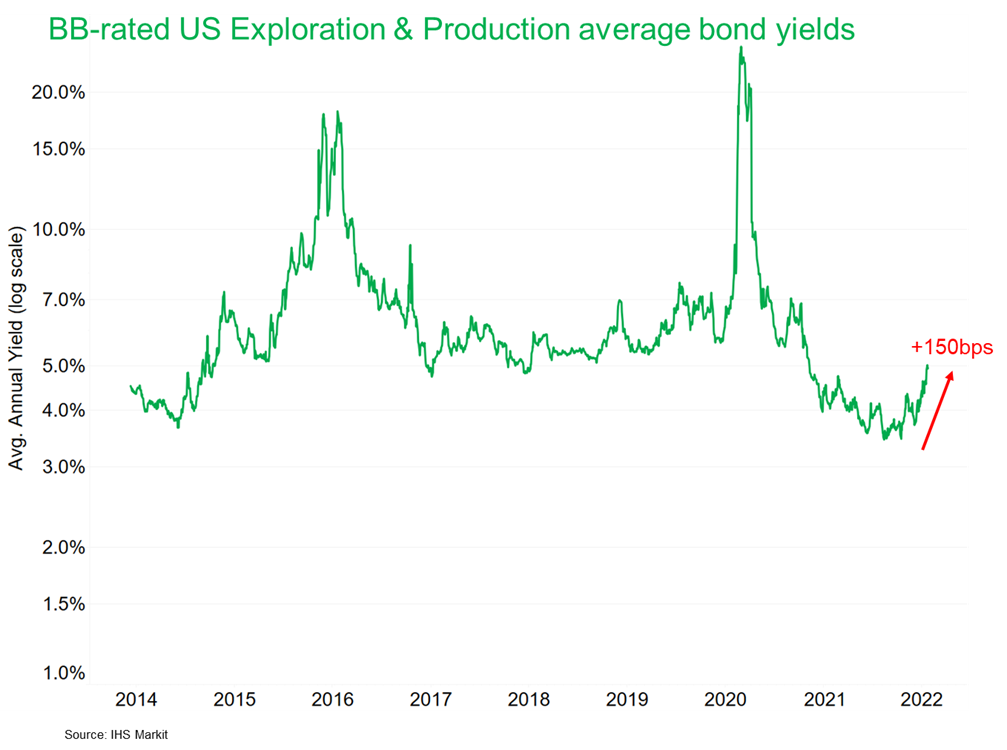

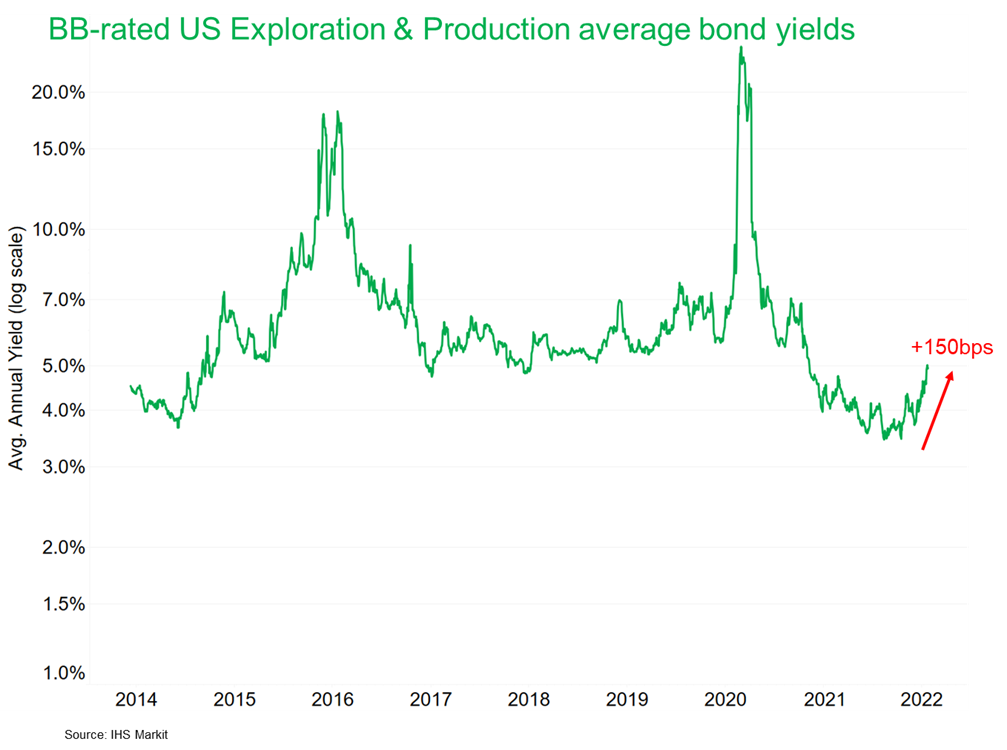

- BB-rated exploration and production company constituents in the IHS Markit iBoxx Liquid USD High Yield debt index closed at an average yield of 4.96% on 16 February, which is 150bps higher than the all-time low yield of 3.46% on 9 November 2021 when WTI closed at $84.15/barrel.

- While the offshore wind power sector is set to attract heavy investment amid decarbonization efforts across the globe, one crucial support sector is showing strain: wind turbine installation vessels (WTIV). With wind turbines getting bigger and moving away from the shorelines, many industry experts have warned of a potential vessel shortage because the existing fleet cannot meet all requirements. In its latest sector outlook published in December, IHS Markit's Costs and Energy team estimated that at least 21 new WTIVs will be delivered between this year and 2025.But the fleet available to do the required work will only grow from 38 units to 44 units in the same period, as some vessels are too small to handle forecast turbine hub heights and will be redeployed to other support sectors like geotechnical work. (IHS Markit Net-Zero Business Daily's Max Lin)

- The Global Wind Energy Council expects 235 GW of new offshore wind capacity will be added between 2021 and 2030. This will bring the total capacity to 270 GW before this decade ends.

- According to the Brussels-based industry group's forecast, new annual installations are to increase from 6.1 GW in 2020 to 23.1 GW in 2025 and, potentially, 40 GW in 2030.

- To gain economies of scale and operational efficiency, wind project developers have been shifting to larger turbines in deeper waters.

- Consultancy Rystad Energy said the average offshore turbine size globally has risen to the current level of 6.5 MW from 3 MW in 2010 (when China is excluded). Turbines larger than 8 MW are expected to account for 53% of total annual installations by 2030, compared with 3% in 2010-2021, according to Rystad.

- In the Chinese market, where developers focused on shallow-water installations and faced less cost pressure earlier, most turbines are expected to measure between 6 MW and 8 MW this decade.

- Excluding China, Rystad expects global WTIV demand to reach 79 vessels on an annual basis by 2030. Of them, 62 will need to be capable of installing turbines larger than 9 MW. This assessment does not consider non-operational days.

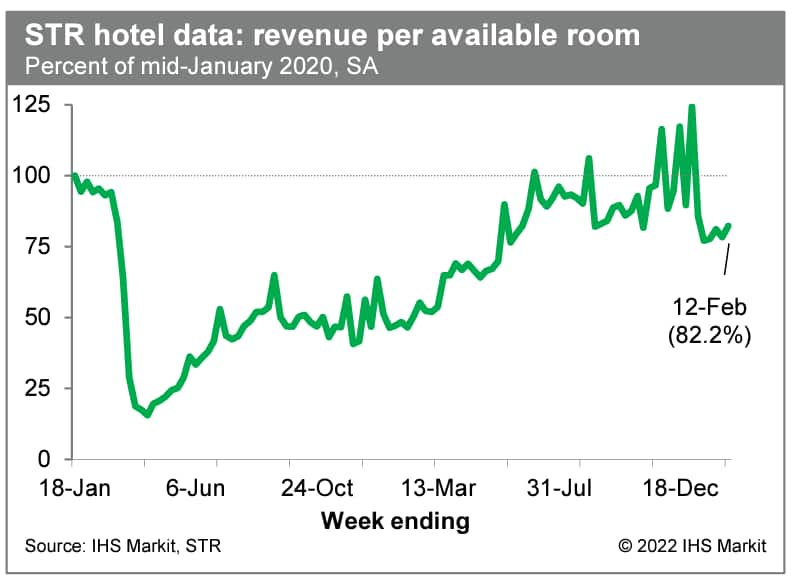

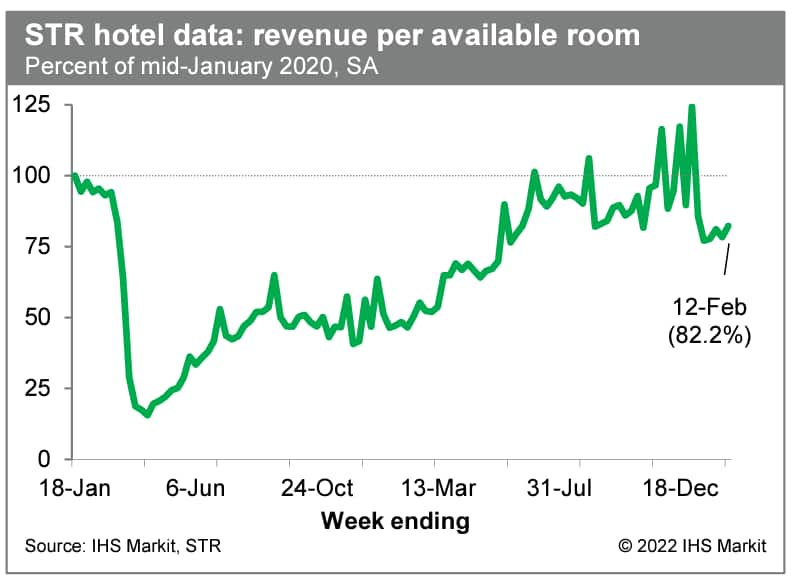

- Revenue per available room at US hotels last week, after seasonal adjustment, was 82.2% of the mid-January 2020 level (our estimate based on weekly data from STR). This remains well below averages from late last year and, along with depressed airport passenger traffic from the TSA, indicates ongoing caution on the part of would-be travelers during the Omicron wave. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- US single-family housing permits, perhaps the most important number in this report, increased for the fourth straight month, jumping 6.8% to a 1.205-million-unit rate. The three-month moving average for single-family permits is moving up in all four Census regions. Single-family permits matter a lot because they are well measured, forward-looking, and are affected less by weather than single-family housing starts. Multifamily permits dropped to a 694,000-unit annual rate—the second highest in 30 years after December's 757,000-unit 30-year high. (IHS Markit Economist Patrick Newport)

- Builders took out an annualized 1.899 million housing permits in January, the highest total since May 2006.

- Housing starts fell 4.1% (plus or minus 13.7%, not statistically significant) in January to a still-solid 1.638 million unit annual rate. Single-family starts dropped 5.6% (plus or minus 12.0%, not statistically significant) to a 1.116 million rate, and multifamily starts fell 0.8% to a still solid 522,000-unit yearly rate, only the seventh time in the past 30 years this category has crossed the 500,000-unit threshold.

- The number of homes under construction increased to a seasonally adjusted 1.543 million in January. That is the highest total since September 1973 and partly explains why builders are struggling to find labor and materials.

- This month, the Census changed the way it measures permits. The new method, the "cutoff sample," uses data from state and state and local governments "with the highest level of permit activity" and models those with "little to no permit activity." The previous "representative sample "method, sampled about half of permit issuing places monthly and collected hard data from the rest annually. The new methodology will allow the Census to publish monthly county and metropolitan housing permits estimates.

- U.S.-based multinational beverage maker The Coca-Cola Company aims to have at least 25% of all beverages sold globally in reusable packaging by 2030, the company said late last week. It aims to do this across all of its beverage brands sold in refillable or returnable glass or plastic bottles, or in refillable containers through traditional fountain or dispensers, the company said. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- The Coca-Cola Company said that accelerating reusable packaging use supports its goals of making 100% of primary consumer packaging recyclable by 2025, using 50% recycled material in its packaging by 2030, and 1:1 collection and recycling of bottles or cans for every one sold by 2030.

- Using reusable packaging promotes a circular economy, as refillable containers have high levels of collection and are low-carbon footprint beverage containers as container collection is built into the beverage delivery model, it explained.

- Citing a third-party report, the company said that converting 20% of global plastic packaging into reuse models is a $10 billion business opportunity that benefits customers and represents a crucial element in the quest to eliminate plastic waste and pollution.

- It said refillable packaging already accounts for 25% or more of sales in more than 40 markets, 50% or more of sales in over 20 markets, and 16% of its total global volume for 2020.

- Use of refillables is growing in several markets, outperforming non-refillables in Germany and parts of Latin America, where reusable bottles represented 27% of transactions in 2020, said The Coca-Cola Company.

- U.S.-based information technology company HP has acquired packaging development company Choose Packaging, in its aim to disrupt the single-use plastics market, HP said earlier this month. According to HP, Choose Packaging's technology provides an alternative to plastic bottles and can hold a variety of liquids. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- HP said Choose Packaging's invention, the only commercially available zero-plastic paper bottle, is made with naturally occurring and non-toxic materials and can become a new global standard.

- An HP executive said that the acquisition strengthens HP's business in sustainable packaging, and also supports HP's sustainability goals.

- HP believes it can disrupt the fiber-based sustainable packaging market, which it values at $10 billion. It has already introduced a 3D printing-enabled fiber molding solution, and plans to integrate Choose Packaging into its 3D printing business before scaling up its technology and business.

- It said that there are more than 150 million metric tons of single-use plastics produced each year, which HP can disrupt with its fiber-based plastic-free packaging.

- Choose Packaging already works with global companies including wine company Accolade Wines, consumer and industrial goods company Henkel, and Malibu Rum, HP added.

- Waymo has partnered with truck fleet operator CH Robinson to test automated trucks in Texas (United States). Under this partnership, Waymo Via, the company's trucking and cargo transportation service, will conduct multiple pilot schemes by deploying its test fleet for CH Robinson's customers in the Dallas-Houston transportation lane. The companies will collaborate to shape the future development and expansion of autonomous technology as a new mode of transport. Charlie Jatt, head of commercialization for trucking at Waymo Via, said, "We look forward to this collaboration with C.H. Robinson, both for their deep roots and experience in logistics and transportation, but also as a company that shares our vision of how technology and autonomous trucking can change our industry for the better. C.H. Robinson's size, scale and platform gives us access to rich and unique transportation data along with customer relationships and pilot opportunities to help bring our Waymo Via solution to the market." (IHS Markit Automotive Mobility's Surabhi Rajpal)

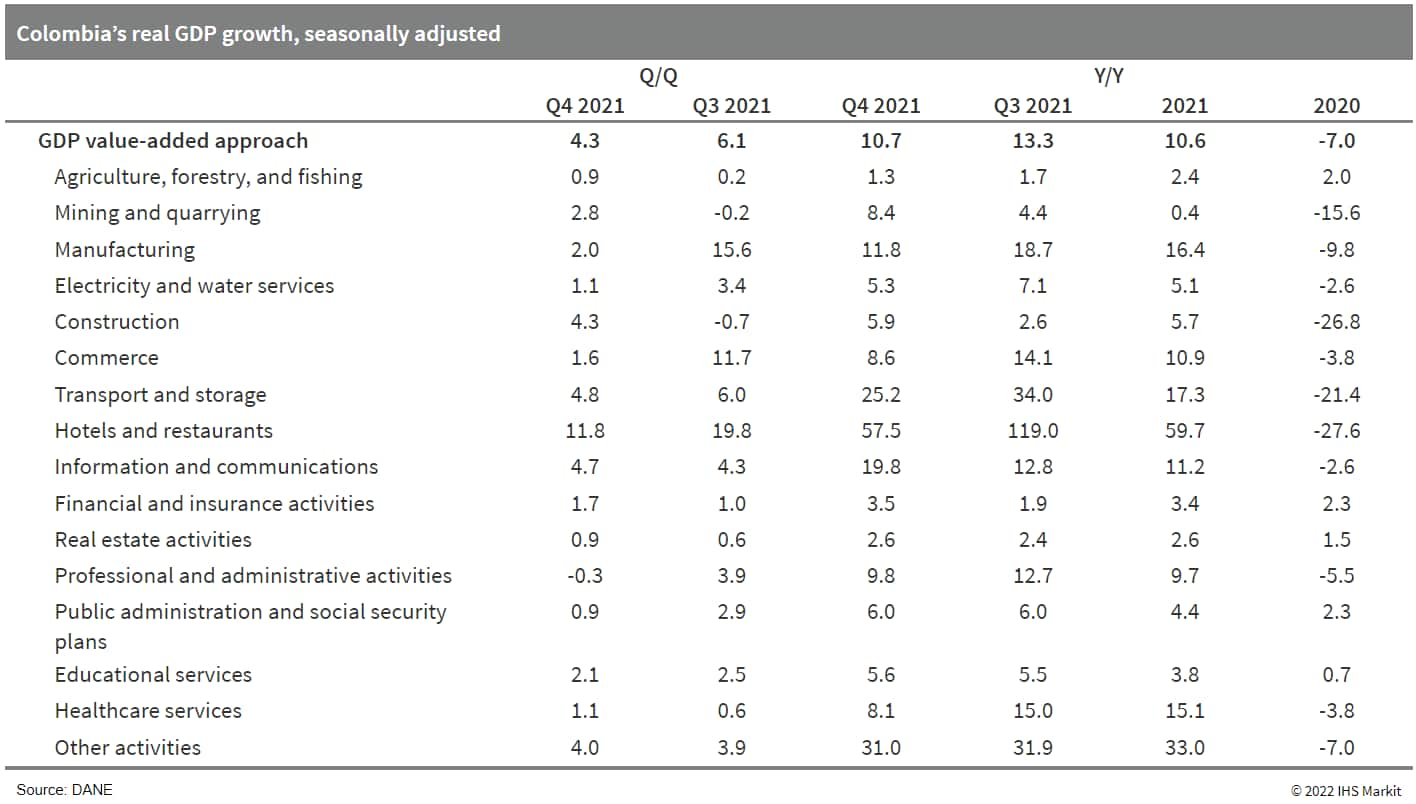

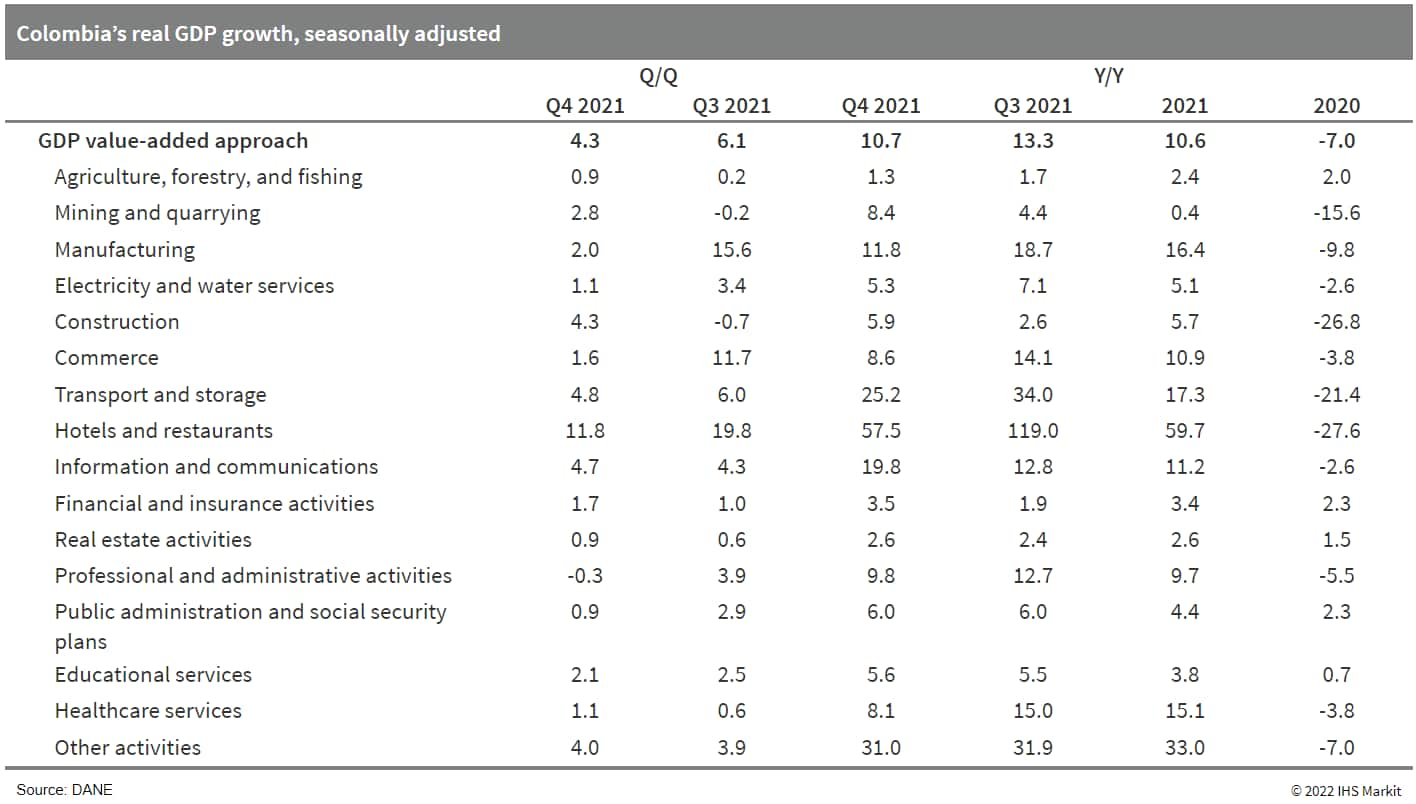

- The Colombian economy continues to recover strongly from the COVID-19 pandemic-induced slump in 2020. In the fourth quarter of 2021, the country's real GDP grew by 4.3% quarter on quarter (q/q), taking the overall annual growth rate to 10.6% for the whole year. IHS Markit assesses that the results will lead the Central Bank of Colombia (Banco de la República: Banrep) to keep tightening its key policy rate when it meets next month. (IHS Markit Economist Dariana Tani)

- According to the National Statistics Office of Colombia (Departamento Administrativo Nacional de Estadística: DANE), Colombia's real GDP grew by 4.3% q/q in the fourth quarter of 2021, bringing the economy 6.9% above its fourth-quarter 2019 level (the last pre-pandemic quarter).

- The breakdown of the quarterly expenditure data show that output was mainly driven by large gains in private consumption and net foreign trade (as the expansion of exports surpassed that of imports), while fixed investment and public consumption both grew by just 0.7% q/q.

- Peru's total employment in the fourth quarter of 2021 in Metropolitan Lima, the Peruvian capital city occupied by about one-third of the population, stood 2.6% below the same quarter of 2019, according to Peru's National Institute of Statistics and Information (Instituto Nacional de Estadística e Informática: INEI). Nationwide figures for the fourth quarter have not yet been released. (IHS Markit Economist Jeremy Smith)

- Although total employment is approaching 2019 levels, the working age population is now 2.7% larger, suggesting a larger gap compared with the trend observed before the COVID-19 pandemic in employment growth. As in many parts of the world, Peru's labor force participation rate remains persistently below the pre-COVID-19 norm, standing at 66% at end-2021 compared with 68% at end-2019.

- By sector, employment in the service sector is just 88% of the 2019 level, while the employment rates in the industrial sectors such as construction and manufacturing have grown significantly, illustrating the varied COVID-19 impact across industries. Less educated individuals have disproportionately returned to jobs, leaving a large amount of human capital outside the workforce. Employment is 17% below the 2019 level among those with university education.

Europe/Middle East/Africa

- All major European equity markets closed lower; France -0.3%, Germany -0.7%, Spain -0.8%, UK -0.9%, and Italy -1.1%.

- 10yr European govt bonds closed sharply higher; Italy/UK -6bps, Germany -5bps, and France -4bps.

- iTraxx-Europe closed +2bps/68bps and iTraxx-Xover +9bps/331bps.

- Brent crude closed -1.9%/$92.97 per barrel.

- In Ukrainian-held towns of the Donbas region Thursday, a kindergarten and a school were hit by mortar shells fired by Russian-backed forces, according to the Ukrainian army and local residents. Authorities in Russian-controlled areas said mortar attacks had also damaged several buildings there. No fatalities were reported on either side. (WSJ)

- Eurocell, a self-described Anglo-Korean battery manufacturer, is planning to build a new battery factory in Western Europe, which it says will supply production-ready batteries in 12 months. According to a press statement from the company, it is looking to build the factory in either the United Kingdom, the Netherlands, or Spain and is "actively looking at sites and the final choice is heavily dependent on gaining the right level of central government support". Eurocell is planning a GBP600-million (USD816-million) investment in two phases, with expectations for its batteries to supply European energy storage, automotive, and e-mobility applications. It plans for full capacity in 2025 - although it did not disclose what full capacity is. In the first phase of production, it will begin producing advanced battery cells at scale by early 2023 for existing customers, Eurocell said; the second phase is a bespoke facility capable of producing more than 40 million cells per year by 2025. Eurocell says that its batteries have been developed in South Korea and can last more than 10 times longer than conventional lithium-ion cells and have no 'end of life' issues. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Jaguar Land Rover (JLR) has announced that it will work with Nvidia to develop its artificial intelligence (AI)-powered autonomous vehicle and connected services, with a nearly all-encompassing use of Nvidia hardware and software sets. According to a press statement, starting in 2025, all Jaguar and Land Rover vehicles will be built on the Nvidia Drive software-defined platform. JLR says that this will enable a "wide spectrum of active safety, automated driving and parking systems as well as driver assistance systems", as well as AI inside the car. Interior elements will include driver monitoring and occupant monitoring and "advanced visualization of the vehicle's environment". Although software engineers from both companies will be involved, the full-stack solution is based on Nvidia Drive Hyperion with Drive Orin centralized AV computers; Drive AV and Drive IX software; safety, security, and networking systems; plus surround sensors. The company says that Drive Orin is the AI brain (a system-on-chip), and Drive Hyperion the central nervous system. JLR will use in-house-developed data center solutions with Nvidia DGX for training AI models and Drive Sim software built on Nvidia's Omniverse. With these developments in its collaboration with Nvidia, JLR will join other automakers in the promise of routine over-the-air updates that transform a vehicle during its lifecycle. This is JLR's next step towards the software-enabled and -defined car that many automakers are working towards, although JLR is focusing more on the partnership than developing as much as possible in-house, as some larger automakers are doing. JLR, however, is far from the only automaker working with Nvidia in one way or another. Volvo, Vinfast, Polestar, and others have announced work with Nvidia in the past year. (IHS Markit AutoIntelligence's Stephanie Brinley)

- ServCity, an autonomous mobility service research project, has started operations in London (United Kingdom). The project, which has been developed, simulated, and tested on private tracks, will now be tested on public roads near the Smart Mobility Living Lab in Greenwich. The connected and autonomous vehicle deployed for the service is based on the all-electric Nissan Leaf. This will use the roadside sensors and processing power to create a co-operative infrastructure environment. The project will benefit from funding from the UK government's Intelligent Mobility Fund, which is administered by the Centre for Connected and Autonomous Vehicles (CCAV) and delivered by the UK's innovation agency, Innovate UK. Six partners - Nissan, the Connected Places Catapult, TRL, Hitachi Europe, the University of Nottingham, and SBD Automotive - are involved in the project. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Ireland's consumer prices, measured by the EU harmonized index, rose by 5.0% year on year (y/y) in January. This is down from a rise of 5.7% y/y in December 2021. (IHS Markit Economist Diego Iscaro)

- Inflation averaged 2.4% in 2021. However, the annual average masks a sharp increase during the second half of the year, driven by energy prices and higher core inflation.

- In January, the divisions with the largest y/y increases were transport (+14.1% y/y, following +18.0% y/y in December 2021), housing/water/electricity/gas (+12.0% y/y, following +11.8% y/y in December 2021), and alcoholic beverages/tobacco (+8.4% y/y, following +2.0% y/y).

- On the other hand, the prices of clothing/footwear (-3.7% y/y) and miscellaneous goods and services (-0.8% y/y) declined during January this year.

- The consumer price index excluding energy and unprocessed food rose by 3.1% y/y in January, following an increase of 3.8% y/y in December 2021.

- Electric vehicle (EV) rental company UFODrive has raised USD19 million in a Series A funding round, according to a company statement. The funding round was co-led by Hertz and Certares, in participation with Knighthead Capital Management and existing investors. The company plans to use the infused capital to accelerate product development and to expand globally, with a focus on the US market. Hertz interim CEO Mark Fields said, "Our partnership with UFODRIVE is yet another major step in Hertz becoming an essential component of the modern mobility ecosystem. Together, we will pilot ways to make renting an EV even easier using UFODRIVE's digital platforms for both the rental experience and fleet management. For customers, this partnership will help us create the future rental car experience that is all-digital and EV-centric." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The Egyptian government has announced its agreement to form a joint venture (JV) with Landi Renzo, an Italy-based manufacturer of compressed natural gas (CNG) systems for cars, reports Newsbase. The JV aims at reducing carbon emissions in Egypt. It comprises the National Organisation for Military Production, El Maasara Company for Engineering Industries, and Landi Renzo and aims to establish and operate an industrial complex for the manufacturing and assembly of CNG systems for the automotive market in Egypt itself. This includes bi-fuel passenger vehicles, bi-fuel engines, medium and heavy commercial vehicles (MHCVs) including trucks, as well as the conversion of vehicles produced to run on fuel to run on CNG. (IHS Markit AutoIntelligence's Tarun Thakur)

- Shell BP SA Petroleum Refineries (Sapref), owner of the largest oil refinery in the South African economy, announced the indefinite suspension of its South African operations on 10 February. Sapref said rising input costs, such as for crude oil, labour, and electricity, combined with imminent changes in legislation, which will become binding in 2023, contributed to the decision. The state-owned Central Energy Fund, which manages the country's energy assets, has shown an interest in buying the 180,000-barrels-per-day refinery, although the authorities have made no final investment decision. (IHS Markit Economists Thea Fourie and Langelihle Malimela)

- The South African downstream sector, although much more vibrant than elsewhere in sub-Saharan Africa, is facing a regulatory environment that is finally catching up with world standards. In recent years, investments were made by the South African refining industry to comply with CF1 regulations of 50 parts per million (ppm), which mandate motor fuels, gasoil, and gasoline (petrol) must not have a sulphur content of more than 50 ppm. This was followed by the updated Clean Fuel 2 (CF2) regulation, initially planned to come into effect in July 2017, which lowered the mandated maximum sulphur content in motor fuels, gasoil, and gasoline to 10 ppm. The CF2 regulation was gazetted in September 2021, with a deadline for implementation of 1 September 2023.

- The scale of new investment needed to upgrade the South African refineries to adhere to the CF2 legislation is massive, estimated at USD4 billion. Given the high complexity and high maintenance cost of the Sapref refinery, there is a likelihood of reassessment of the economic viability of the refinery under the new regulation. In such a case, a decision for its closure could be taken in the medium term if an interested buyer could not be found. One of South Africa's other main refineries, the Enref refinery owned by Engen in Durban, has been shut down officially and has been converted into a fuel storage facility. Meanwhile, the future of another of the country's main refineries, the Calref refinery owned by Astron in Cape Town, remains in the balance. The Calref refinery was shut down due to fire incidents in the second half of 2020.

- The last lifeline of South Africa's refining sector is the 150,000-barrels-per-day coal-to-liquid (CTL) plant operated by Sasol, Natref. Sasol has reportedly reduced operating rates since 2020, due to low demand. The CTL plant has recorded a strong operating rate of over 90% since 2018, with a slight decline to 85% in 2020. However, despite producing ultra-low-sulphur fuels, this plant reportedly would also need some investment to fully comply with the new regulation.

- Considering the sector's low margins and stressed finances, and the regulatory changes that mandate expensive upgrades, more refinery closures cannot be ruled out. In 2022, about 60% of South Africa's oil demand is forecast to be supplied by imports, marking a substantial increase from around 25% in 2019, prior to the refinery closure.

Asia-Pacific

- Major APAC equity markets closed mixed; South Korea +0.5%, Hong Kong +0.3%, Australia +0.2%, Mainland China +0.1%, India -0.2%, and Japan -0.8%.

- Japan's private machinery orders (excluding volatiles), a leading indicator for capital expenditure (capex), rose by 3.6% month on month (m/m) in December 2021 for the third consecutive month of increase. Orders from manufacturing continued to rise, moving up 8.0% m/m in December following a 12.9% m/m increase in November and offsetting a 0.1% m/m drop in orders from non-manufacturing in December. Orders from the public sector rose by 6.7% m/m in December following a 17.4% m/m drop in the previous month. Orders from overseas fell by 3.5% m/m in December following two consecutive months of increases. (IHS Markit Economist Harumi Taguchi)

- The solid rise in orders from manufacturing was thanks largely to a 275.9% m/m surge in orders from the non-ferrous metals grouping and continued increases in orders from the chemical and chemical products and electrical machinery groupings, offsetting declines in orders from the general-purpose and production machinery grouping and some other industry groupings. The weakness in orders from non-manufacturing was due largely to decreases in orders from finance and insurance, transport and postal services, and information services, although this was partially offset by continued rises in orders from construction and telecommunications.

- The December 2021 results were better than IHS Markit expected. The continued increase suggests that the uptrend in production in line with expectations for the resuming economic activity underpins orders from manufacturing as well as fixed investment. However, a weak rise in private capital investment in the fourth quarter of 2021 despite a robust 6.5% quarter-on-quarter (q/q) increase in private machinery orders probably suggests that supply chain constraints have delayed the delivery of finished machinery.

- Japan's trade balance recorded a deficit of JPY2.2 trillion (USD19.0 billion) on a non-seasonally adjusted basis in January. The seasonally adjusted trade deficit widened by 69.7% in January from the previous month to JPY933 billion. The largest trade deficit since January 2014 (or since April 2020 on a seasonally adjusted basis) was partially due to seasonal low export volumes during the New Year holidays. Export growth weakened to 9.6% year on year (y/y) in January 2022 following a 17.5% y/y rise in the previous month. Import growth remained high at 39.6% y/y in January after a 41.1% y/y rise in the previous month. (IHS Markit Economist Harumi Taguchi)

- The softer export growth stems from weaker exports to the US (up 11.5% y/y) and Asia (up 6.3% y/y), which were partially offset by an acceleration in exports to the European Union (up 16.1% y/y). Major contributors to export growth were exports of iron and steel (up 47.0%), semiconductors (up 18.7% y/y), and mineral fuels (up 112.2% y/y). However, those increases were partially offset by declines in exports of autos and computer parts, reflecting shortages of semiconductors and auto parts.

- Although y/y growth softened slightly, a continued sharp increase in import prices for goods together with the weak yen (10.9% weaker than the year-earlier level) continued to boost imports. Imports of mineral fuels remained the major driver of imports, contributing 15.1 percentage points of total imports. Aside from mineral fuels, imports of semiconductors (up 48.6% y/y) and iron ore (up 82.1% y/y) were major contributors to the overall growth in imports.

- GE Renewable Energy and Hyundai Electric & Energy Systems have signed a Memorandum of Understanding (MoU) to form a strategic offshore wind partnership in South Korea. The MoU sets out initial plans for the construction of a nacelle assembly factory for Haliade-X turbines in South Korea, with a detailed timeline of any industrial development depending on "the volume of customers' orders and their specific projects timing". GE Renewable Energy will bring its offshore expertise and the Haliade-X wind turbine technology and Hyundai Electric will contribute local expertise and electrical equipment and help to establish a local supply chain. South Korea has a target of increasing its offshore wind capacity by up to 12GW and achieving 30 per cent of renewables in the energy production by 2030. (IHS Markit Upstream Costs and Technology's Monish Thakkar)

- Mahindra and Mahindra (M&M) has partnered with Quiklyz, a vehicle leasing and subscription platform, to lease its sport utility vehicles (SUVs) across eight cities, reports the Indian Express. The leasing service will be available in Delhi, Gurugram, Noida, Bangalore, Mumbai, Pune, Hyderabad, and Chennai. Under the partnership, the Quiklyz platform will be available on M&M's auto portal and across the latter's dealership network. The monthly rentals will start at INR21,000 (USD279.6) per month for vehicles, including insurance, maintenance, and roadside assistance with no additional down payment. Veejay Nakra, CEO of the automotive division at M&M, said, "The 'pay per use' model has been specifically designed keeping in mind the changing customer needs. Offering leasing options to customers through our sales channels will provide customers with flexibility and transparency in a simple and convenient manner." (IHS Markit AutoIntelligence's Isha Sharma)

- IHS Markit has analyzed the main banking indicators for Mongolia for the end of 2021. Our key findings indicate that credit growth in Mongolia's banking sector breached the 20% year-on-year (y/y) threshold in the fourth quarter of 2021, standing at 21.7%, likely because of base effects. Annual lending also outpaced deposit growth for the first time since 2014. Additionally, the sector's non-performing loan (NPL) ratio remains elevated, while capital positions vary greatly. (IHS Markit Banking Risk's Natasha McSwiggan)

- Mongolia's banking-sector loan book expanded by almost 22% y/y in the fourth quarter of 2021. Private-sector lending expanded in all key segments including mortgage, services, trade, and real estate and construction. The strong growth is likely reflective of a mix of factors such as higher demand for loans as a result of coronavirus disease 2019 (COVID-19) containment measure-related debt-servicing pressures that have affected corporations and households and base effects because of a year-on-year lending contraction in all the quarters of 2020.

- The NPL ratio trickled back up to 10% at end-2021. The ratio has experienced limited deterioration since the third quarter of 2021, up from 9.8%, and remains elevated. In July 2021, the Bank of Mongolia (BoM) extended COVID-19 virus loan forbearance, allowing consumer and mortgage borrowers to have their loans deferred until the end of 2021 without accrual of interest.

- Impairment is potentially higher than what NPL ratios would suggest. The state-owned policy bank, the Development Bank of Mongolia (DBM), different from the Trade and Development Bank of Mongolia (TDB), published NPL data in January 2022, with bne IntelliNews reporting that 55% of its loans were found to be risky or non-performing.

- Although data are not available at the sectoral level, unaudited individual bank data provide an insight into capital position developments in 2021. As of the end of 2021, out of the 11 commercial banks operating in the Mongolian sector, two have reported capital ratios of below requirements. For the rest of banks, ratios vary greatly, with reported tier-1 capital ratios ranging from 13% to almost 50%.

- Chinggis Khaan Bank and the National Investment Bank have reported capital ratios that are below requirements. Chinggis Khaan Bank (the sector's ninth-largest bank by assets) continues to operate below capital requirements as of the end of 2021, reporting a tier-1 capital ratio of 0.7%; down from 1% a year previously.

- Total deposits in Mongolia's banking sector expanded by 15% y/y in the fourth quarter, slowing since the start of 2021. As previously assessed, the base effects associated with the first half of 2021 are likely weighing down on the headline figure in Mongolia. For the first time since 2014, year-on-year deposit growth was outpaced by lending. Despite this, the loan-to-deposit (LDR) ratio is indicative of a low-to-moderate structural liquidity risk profile at 74.9%.

Posted 17 February 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.