All major US equity indices closed higher, while European and APAC markets were mixed. US government bonds closed sharply lower and benchmark European bonds closed mixed. CDX-NA closed almost flat across IG and high yield, iTraxx-Europe was also close to unchanged, and iTraxx-Xover was slightly wider on the day. The US dollar, natural gas, and Brent closed higher, while WTI, gold, silver, and copper closed lower.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Nasdaq +0.8%, S&P 500 +0.4%, and Russell 2000/DJIA +0.2%.

- 10yr US govt bonds closed +6bps/1.64% yield and 30yr bonds +7bps/2.03% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY flat/294bps.

- DXY US dollar index closed +0.5%/95.92.

- Gold closed -0.7%/$1,854 per troy oz, silver -0.6%/$24.94 per troy oz, and copper -1.1%/$4.35 per pound.

- Crude oil closed -0.1%/$80.76 per barrel and natural gas closed +3.3%/$5.27 per mmbtu.

- New York Governor Kathy Hochul urged people who live in areas with high transmission rates to get the booster, as cases rise across the state. People should start avoiding large indoor gatherings, Hochul said at a briefing, adding that the state could implement harsher restrictions if cases continue to increase. "The warning is going out loud and clear today," she said. Five regions in the state have infection rates of more than 50 cases per 100,000 residents, up from one region a week ago, she said. The seven-day average positivity rate topped 8% in Western New York and the Finger Lakes. Hospitalizations have topped 2,000 statewide and are increasing. (Bloomberg)

- Municipal bond buyside participation has paired well with last week's double digit weekly calendar which supplied $10.9 billion, offering accounts greater par size after a large presence from the state of California accounting for nearly $3 billion in volume. Investor demand was front and center after the District of Columbia (Aaa/AA+/AA+/-) priced $653 million general obligation bonds across 02/2024-02/2046 with buyside activity suppressing yields and driving bumps of 2-18bps across the curve with the greatest interest noted in the 2046 maturity falling +22bps off the interpolated MAC, yielding allotted investors 1.70%. The Dallas Area Rapid Transit (Aa2/AA+/-/AAA) also experienced robust investor demand after selling $576 million senior lien sales tax revenue refunding bonds with maturities spanning 12/2022-12/2048 and bumps of 10-15bps evenly distributed across the scale with the 2031 maturity falling +45bps off the 10YR UST following strong order flow. This week's calendar is slated to climb to $14.2 billion spanning across 352 new issues with the State of Mississippi (Aa2/AA/AA/-) leading the negotiated calendar offering S1.12 billion of general obligation bonds spanning across three series with maturities ranging from 10/2022-10/2041. The California Health Facilities Financing Authority (Aa3/AA-/AA-) will also tap into the negotiated market to sell $1.05 billion revenue bonds with funds designated for the Cedars-Sinai Health system, selling on Wednesday 11/17 and senior managed by Barclays. This week's competitive calendar will span across 187 new issues for a total of $3.33 billion with King County, Washington (Aaa/AAA/AAA) leading the auction schedule paired with the Public Utilities Commission of the City and County of San Francisco, CA selling a combined $650 million across four tranches with three carrying a green bond designation. (IHS Markit Global Market Group's Matthew Gerstenfeld)

- Total US retail trade and food services sales increased 1.7% in October. Core retail sales growth was stronger than expected, resulting in an upward revision of 0.5 percentage point to our estimate for personal consumption expenditures (PCE) in the fourth quarter, from 4.5% to 5.0%. (IHS Markit Economists James Bohnaker and William Magee)

- Gasoline station sales surged 3.9% and were up 47% over 12 months. Gasoline consumption in the US has made a full recovery to pre-COVID-19 levels, and elevated pump prices are supporting nominal gasoline sales. Regular gas prices averaged $3.29/gallon in October, the highest monthly level since 2014.

- Sales at motor vehicle and parts dealers increased 1.8% in October, but the level of sales remained 10.5% lower than its April peak. Auto sales will not soon approach early-2021 levels as semiconductor chip shortages and high retail prices are expected to persist well into next year.

- Retail sales growth was highlighted by standouts including nonstore sales (up 4.0%), electronics and appliance stores (up 3.8%), and building materials stores (up 2.8%). Consumers remain settled into pandemic-era buying patterns, suggesting only a gradual rebalancing of spending toward services. Sales at food services and drinking places were unchanged (0.0%) as consumers remained somewhat cautious about dining out amid a declining yet elevated number of COVID-19 cases in October.

- The strength in retail sales in October reflects earlier-than-usual holiday shopping as it has been widely publicized that supply chain disruptions may result in product shortages and longer delivery times between Black Friday and Christmas. High prices for some goods and services are weighing on confidence, but consumer buying power remains solidly based.

- Total US industrial production (IP) rose 1.6% in October, reflecting increases in manufacturing (1.2%), utilities IP (1.2%), and mining (4.1%). Recovery from the effects of Hurricane Ida, which forced plant closures for petrochemicals, plastic resins, and petroleum refining and disrupted oil and gas extraction, was responsible for half of the gain in IP. (IHS Markit Economists Ben Herzon and Akshat Goel)

- Manufacturing IP rose 1.2% in October as the production of both durable and nondurable goods recorded gains. The output for durable goods was propelled higher by a large gain in vehicle output, even as the production of machinery (down 1.3%) was dragged down by a strike at John Deere involving more than 10,000 workers across 14 plants.

- Output of motor vehicles and parts, which has been a drag on factory output in the last couple of months, rose 11.0% in October. Manufacturing output excluding motor vehicles and parts rose only 0.6%. Vehicle assemblies rose 1.4 million units to 9.1 million in October, after falling to a 16-month low in September.

- Plants for petrochemicals, plastic resins, and petroleum refining that were forced off-line in late August owing to Hurricane Ida resumed normal operations in October. As a result, large increases were reported in output of chemicals (1.9%) and petroleum and coal products (5.0%).

- The output of utilities rose 1.2% in October while mining activity jumped 4.1%. Mining was helped by a surge in oil and gas extraction (5.1%) as more offshore facilities in the Gulf of Mexico were restarted after being shut in August because of Hurricane Ida.

- According to the National Association of Home Builders (NAHB), strong buyer demand and low inventories pushed the Housing Market Index higher, despite affordability challenges stemming from rising material prices and shortages. The headline Housing Market Index increased 3 points to 83 in November, the third straight monthly improvement. A reading above 50 indicates that more builders view conditions as good rather than poor. A 3-point gain should be interpreted as a modest boost in confidence. (IHS Markit Economist Patrick Newport)

- The current sales conditions index rose 3 points to 89; the index measuring sales prospects over the next six months was unchanged; the traffic of prospective buyers' index rose 3 points to 68.

- By region and three-month averages, the Midwest and South gained 4 points to 72 and 84, the West moved up 1 point to 84, and the Northeast dropped 2 points to 70.

- The rise in construction costs has been stunning. The price deflator for single-family new construction increased at a 17% annual rate in the third quarter, its highest reading in 42 years. Lumber prices have plummeted from stratospheric highs, while labor costs, as measured by the employment cost index for the construction industry, are growing about 3.0%—lower than the national average for private-sector industry of 4.1%. But other costs have skyrocketed, as evidenced by the producer price index for inputs to single-family residential construction less capital investment, labor, and imports, which increased 14% from a year earlier in October.

- Electric vehicle (EV) maker Rivian is considering a site near Atlanta, Georgia, for its second US plant, according to a media report. The Atlanta Journal-Constitution newspaper reports that an Atlanta site is a potential location for the plant, stating the company's negotiations for the land are at a late stage and it would build a facility to manufacture both vehicles and batteries. In a statement, a Rivian spokesperson is reported as saying, "Rivian is in discussions with multiple locations as part of a competitive process for siting a second manufacturing facility. This may include Rivian being involved in certain public-facing processes at potential locations. Involvement in these processes does not indicate a final decision." The Atlanta Journal-Constitution reports that the negotiations have not been finalized on the purchase of land for the plant and Rivian is considering purchasing between 2,000 and 10,000 acres. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Freeport LNG said it has signed a letter of intent with Talos Energy to jointly develop a carbon capture and sequestration project adjacent to Freeport's LNG pretreatment facility. The companies said they signed an agreement for injections up to 30 years, but did not say how much annual injections would be, nor the capacity of the planned facility. They said initial injections could begin in late 2024. (IHS Markit PointLogic's Kevin Adler)

- Freeport already is the only US facility that uses electricity to drive all of its processing, said Michael Smith, chairman and CEO. As a result, it has reduced CO2 emissions by 90% compared to a comparably sized gas-fired operation. "Embarking on carbon capture and sequestration will only further reduce the carbon intensity of our facilities," he said.

- The facility operates three liquefaction trains at up to 15 million metric tons/annum, and the company has received FERC certificates for a fourth train, but has not yet reached a final investment decision.

- Freeport has a geological site that would be ideal for sequestration, and the companies said it is less than a half-mile from the liquefaction plants.

- The companies said that in addition to Freeport's CO2, they have identified another 15 million metric tons/year of CO2 that is produced by manufacturing processes within 25 miles of the planned facility, "which offers potential for expansion in the future."

- On November 16, the Financial Oversight and Management Board for Puerto Rico announced that it has approved a proposed $265.5 million diesel fuel contract between the government-owned Puerto Rico Electric Power Authority (PREPA) and Novum Energy Trading Inc. (IHS Markit PointLogic's Barry Cassell)

- This contract covers fuel supply for PREPA's San Juan, Palo Seco, Aguirre, Mayagüez and Cambalache power plants, plus PREPA's gas turbines. The contract includes payment for fuel at market prices and a fee for logistics and delivery, known as a price adder. The price adder negotiated under PREPA's enhanced procurement process is about 19% lower than the $9.63 adder of the current supplier, Puma Energy Caribe LLC, which has been PREPA's sole provider of diesel fuel since 2014.

- "The proposed contract is the result of a competitive procurement process that led to more favorable terms and will produce measurable savings compared to PREPA's existing diesel fuel supply contract," said the Oversight Board's Executive Director Natalie Jaresko. "The proposals received show there is market appetite to supply PREPA with diesel fuel in a transparent bidding process. PREPA should take advantage of this renewed interest and continually look for new opportunities to achieve the best possible terms for Puerto Rico's consumers."

- The contract with Novum is a one-year agreement expected to become effective on November 21, 2021. It is extendable for an additional 1-year term, under the same terms and conditions, if both parties agree.

- With the Biden administration casting an eye on market concentration in the food industry, a consumer group has released a new report taking a swipe at the rise of supermarket supercenters and the consolidation of food industry sales that can spell problems for the consumer. (IHS Markit Food and Agricultural Policy's Joan Murphy)

- In the new report, The Economic Cost of Food Monopolies: The Grocery Cartels, Food & Water Watch (FWW) looked at the market share of dominant companies across 55 grocery categories and calculated the top four companies in each food category.

- Four companies took in an estimated two-thirds of all grocery sales in 2019, the year before the pandemic hit, with Walmart taking 34.8%, Kroger at 13.9%, Costco at 12.2% and Albertson's Companies at 8.1%. All four combined gobbled up 69% of grocery sales, while the number of grocery stores nationwide declined from 1993 to 2019 by some 30%, the report said.

- One reason is the rise of the supercenters and warehouse chains, and report said the next trend of increasingly popular online shopping may be cornered by companies like Walmart and Instacart that can crowd out smaller players.

- FWW looked at a list of common food items, such as fresh vegetable side dishes, milk, beer, pasta, and breakfast cereals, and found more than 60% of the grocery categories in the study are "tight oligopolies/monopolies," leaving only eight as highly competitive.

- Canada's housing starts fell for a fifth consecutive month, which is unusual for a typically volatile indicator. For a historical comparison, the few times there has been a losing streak of this length, or greater, have been during recessionary periods. However, total starts are still above the historical average, including starts in 2016 and 2017—the previous hot housing market. The six-month moving average declined by 6,397 to 264,264 units. (IHS Markit Economist Evan Andrade)

- Housing starts dropped 5.3% month over month (m/m) to 236,554 units (annualized), the lowest level in 2021.

- Total urban starts fell 3.7% m/m as the 5.3% decrease in urban multiple starts fully offset the 1.0% rebound in urban single starts. Rural starts plunged 19.3% m/m.

- The decrease was concentrated in Ontario while starts in Alberta and the Atlantic provinces solidly jumped.

- The number of starts in September was revised down modestly to 249,922 units.

Europe/Middle East/Africa

- Major European equity indices closed mixed; Germany +0.6%, France +0.3%, Italy -0.2%, UK -0.3%, and Spain -0.6%.

- 10yr European govt bonds closed mixed; Germany/Italy -2bps, France flat, and Spain/UK +3bps.

- iTraxx-Europe closed flat/49bps and iTraxx-Xover -2bps/247bps.

- Brent crude closed +0.5%/$82.43 per barrel.

- The number of payrolled UK employees posted another substantial monthly increase, rising by 160,000 month on month (m/m) to 29.3 million in October. In addition, it now stands around 235,000 or 0.8% higher than its COVID-19 virus pandemic levels (February 2020). (IHS Markit Economist Raj Badiani)

- Three of the sectors benefiting from the end of COVID-19 restrictions reported a further rise in payrolled employees between September and October, namely accommodation and food service activities by 33,514 m/m, arts and entertainment by 13,108 m/m, and wholesale and retail by 14,565 m/m. In addition, the number of workers in administrative and support services increased by 54,351 m/m.

- The rise in payrolled employees was better than expected after 1.1 million workers still on furlough when the scheme ended on 30 September.

- The Office for National Statistics (ONS) reported that total UK employment (all aged 16 plus) increased by 247,000, or 0.8%, to 32.523 million in the three months to September, compared with the three months to June.

- In annual terms, the number of employed people in the three months to September was 173,000, or 0.5%, higher compared with a year earlier.

- Average annual weekly earnings (total pay including bonuses) growth slowed to a still elevated 5.8% year on year (y/y) in the three months to September. Regular pay (which excludes bonus payments) growth eased to 4.9% y/y in the three months to September after accelerating over the past 12 months.

- Total pay in real terms slowed for the third straight month when rising by 3.1% y/y in the three months to September, which was the 13th successive gain.

- Projections for UK employment levels were upbeat again in October as firms look to ease labor shortages seen across vast areas of the economy. That said, the overall level of hiring expectations slipped from a 12-year survey-record high in June, while firms also signaled that a mismatch of skills was likely to present recruitment challenges over the coming year. (IHS Markit Economist David Owen)

- Latest data from the Accenture/IHS Markit UK Business Outlook survey - a tri-annual survey based on a panel of around 1,300 companies in the manufacturing and services sectors - showed a robust level of confidence among UK businesses regarding hiring over the coming 12 months.

- Barring the record high seen in the previous survey in June (+41%), the net balance of companies expecting an increase in staffing (+32%) was the highest since June 2015. This was also the second-strongest out of the countries monitored by the Business Outlook survey, with Ireland the only nation to report higher expectations for employment growth in October.

- Some 40% of firms lacked confidence that they would be able to find skilled workers for vital roles within their organization. October data showed that only 35% of survey respondents were confident that they could recruit skilled staff during the year ahead, with most of these firms replying they were 'Slightly Confident' (28%) instead of 'Very Confident' (7%).

- With 40% of UK companies reporting that they were 'Not Confident' of finding the staff they required, the survey suggests that a changing business landscape has led to a mismatch of skills across many sectors, likely linked to the pandemic and Brexit.

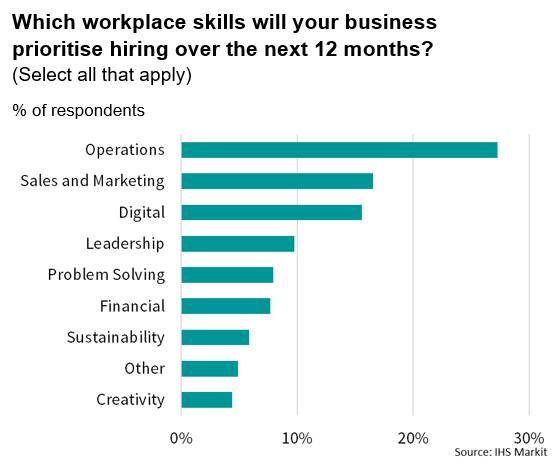

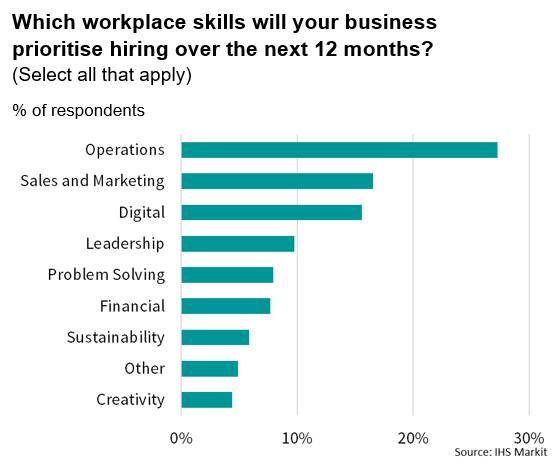

- Surveyed companies were also asked to pinpoint workplace skills that they would prioritize hiring over the coming year. Top of the list was Operations (27%), reflecting efforts among firms to redesign their supply chains and build resilience to global supply disruption.

- TVR has announced that it has signed a joint venture (JV) agreement with a lithium mining company, reports Autocar. The sports car manufacturer said that its relationship with Ensorcia Metals Corporation will not only help fund production of the internal combustion engine (ICE) Griffith, but also "ensure the supply chain for TVR's future battery requirements". Ensorcia chairperson Daniel Layton said that the TVR deal is the result of "a tight synergy and alignment" between the two companies and that the electric models will be "among the most exciting EVs in the market". Les Edgar, the chairperson of TVR, also said that the automaker is working on future electrified models and that the deal "is a hugely important element in ensuring that TVR will become a sustainable, net-zero business." The news of this tie-up and the potential for EVs to join TVR's range comes despite the brand's rebirth having faltered. Although the Griffith was first revealed in 2017, it has struggled to bring it to production due to its planned site in the Ebbw Vale requiring a great deal of work. (IHS Markit AutoIntelligence's Ian Fletcher)

- In line with our expectations, real GDP growth rates rebounded strongly in the eurozone in the second and third quarters. This was primarily owing to the positive impact of looser COVID-19 restrictions on hitherto weak private consumption. (IHS Markit Economist Ken Wattret)

- In our baseline forecast, however, we have been expecting a marked slowdown in economic growth to become apparent from late in the third quarter, reflecting supply-chain disruptions, soaring energy prices, and deteriorating COVID-19-related developments.

- Retail sales volumes contracted by 0.3% m/m in September, the second decline in three months. Some of the recent weakness is likely to reflect substitution effects away from spending on goods towards services, as economies reopened from COVID-19 restrictions. Sales volumes in September were almost 4% above their pre-pandemic level.

- Still, looking forward, with energy prices having soared and COVID-19 trends deteriorating rapidly, the prospects for consumer-driven growth look much less favorable over the coming quarters.

- Eurozone industrial production, meanwhile, contracted by 0.2% m/m in September. This followed an unusually large 1.7% m/m decline in August. Production over the third quarter as a whole declined by 0.2% q/q, the first contraction in five quarters.

- Eurozone production was 1.6% below its pre-pandemic level in September, with weakness concentrated in production of capital goods (5.6% below its pre-pandemic level), a poor augury for business investment. Production of non-durable consumer goods continued to outperform (4.5% above its pre-pandemic level).

- Eurozone trade figures for September also disappointed. On a seasonally adjusted basis, the monthly trade surplus fell to EUR6.1 billion, the lowest since April 2020. This was less than half its July level and roughly a quarter of the peak in the surplus prior to the COVID-19 virus shock.

- Exports (in value terms) declined by 0.4% m/m in September, the first fall in four months. Exports were 1.2% above their pre-pandemic level in February 2020, compared with a net 12.2% increase in imports over the same period. Eurozone imports rose by 1.5% m/m in September, the eighth consecutive increase.

- The European Commission has authorized the dried and frozen migratory locust (Locusta migratoria) products range from Dutch producer Fair Insects as the second insect approved under the 2015 novel foods regulation (2283/2015), following Agronutris' dried yellow mealworm (Tenebrio molitor larva) and more approvals are in the regulatory pipeline. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- The Commission adopted the regulation authorizing frozen, dried and powder forms of the migratory locust (Locusta migratoria) on 12 November with publication in the EU's Official Journal (OJ) three days later. Fair Insects will now be able to sell its locust products as a snack or a food ingredient, in a wide range of food products from 5 December.

- As for the first insect product approved, the Agronutris dried yellow mealworm products, approval is proprietary meaning that Fair Insects benefits exclusively from the marketing authorization for five years until 5 December 2026. In its positive opinion on the application, the European Food Safety Authority (EFSA) said that it could not have reached the conclusions confirming the safety of the locust products without the proprietary data that Fair Insects provided.

- Other companies can still apply for authorization for their migratory locust products, but would need to provide their own studies to back up the application or Fair Insects could grant them a license. Fair Insects is a Protix company so could well share the authorization within the larger group.

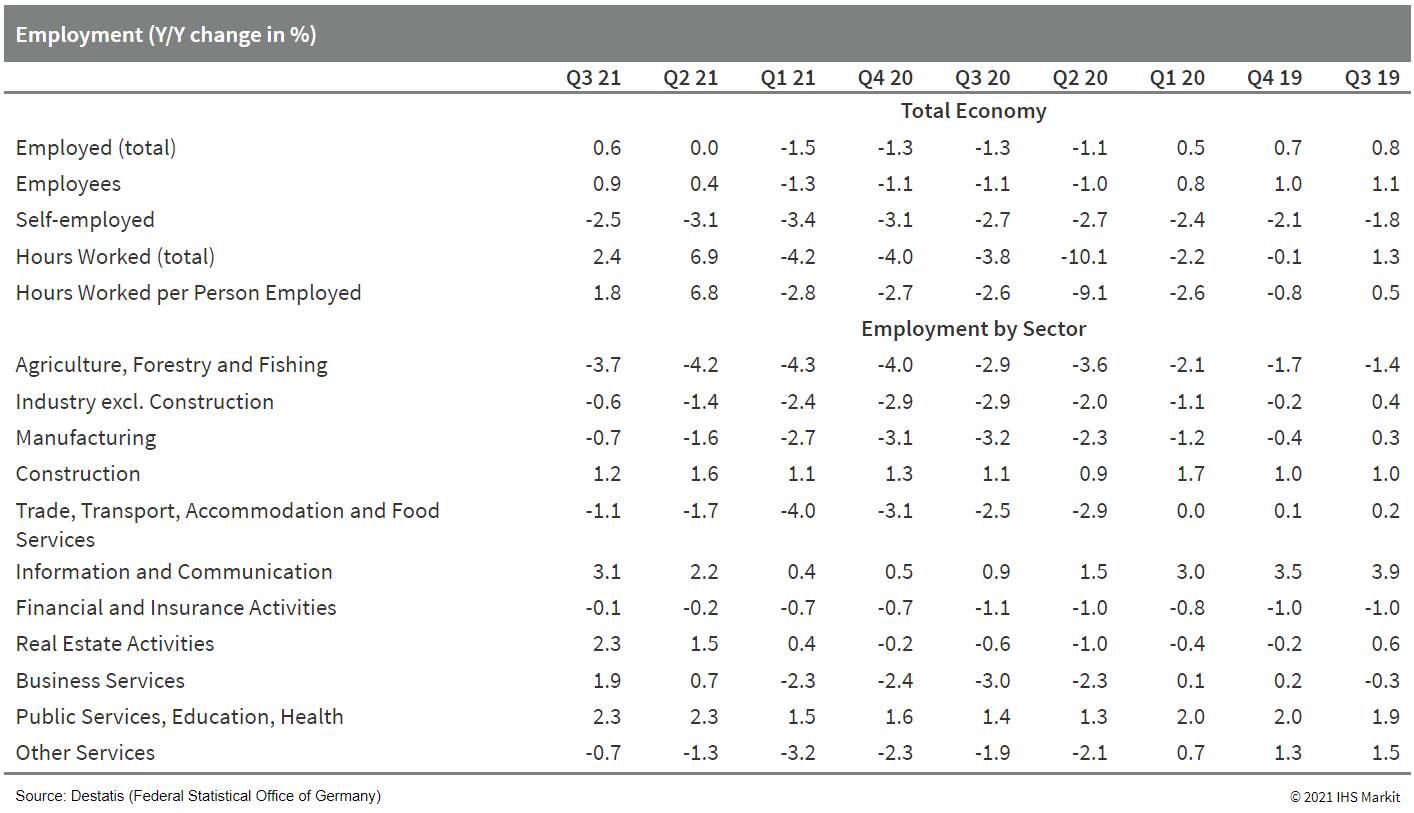

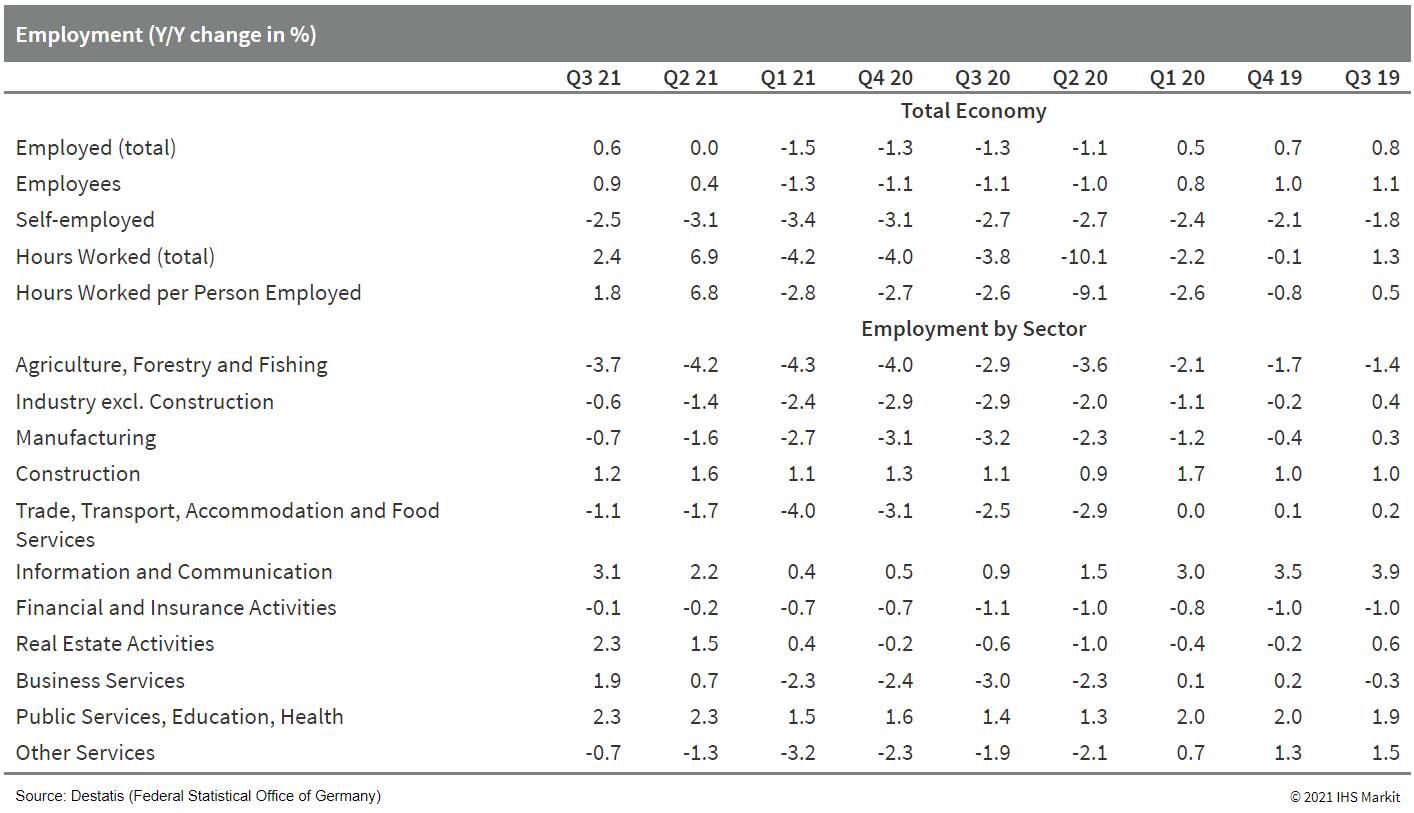

- Federal Statistical Office (FSO) data show that total German employment increased by more than 0.3 million to 45.061 million in the third quarter, exceeding the usual seasonal increase. In conjunction with base effects, the year-on-year (y/y) change improved further from 0.0% in the second quarter to 0.6%. This compares with the cyclical trough in the first quarter of -1.5% y/y and an average annual gain of 1.0% in 2010-19. The third-quarter level remains about 0.8% below the level of end-2019 before the pandemic broke out. (IHS Markit Economist Timo Klein)

- In seasonally adjusted terms, employment increased by 169,000 or 0.38% quarter on quarter (q/q) in the third quarter. This almost doubles the growth pace of the previous quarter and also exceeds the average quarterly gain of 0.26% q/q during the past decade (2010-19). However, separate monthly data show that employment growth has slowed down progressively during July-September following an interim peak in June.

- The breakdown by major sector reveals that still only about one-half employ more people now than they did a year ago. Apart from construction, this pertains exclusively to the services sector, led by the information and communications sector and followed by public services/education/health and real estate activities. In contrast, the secular employment decline in agriculture persists, and the manufacturing sector has curtailed its annual employment losses but still employs less people than in late 2019 just prior to the pandemic.

- As expected, the ongoing economic rebound during the third quarter has depressed short-time work requirements markedly. Short-time work numbers had declined from February's interim peak of 3.4 million (having reached an absolute high of 6.0 million in April 2020) to 0.8 million in August. Progress may have stalled subsequently (September data not available yet) owing to mounting supply-chain disruptions.

- The third-quarter average of hours worked will have increased even more sharply than employment during the latest quarter, even if base effects have dampened the former's y/y increase from 6.9% in the second quarter to 2.4% in the third quarter. Hours worked per employee similarly had moderated from 6.8% y/y in the second quarter to 1.8% y/y in the third quarter. In any case, Germany's short-time work scheme once again has proven its usefulness in preventing unnecessary unemployment and the loss of skilled workers.

- Tesla is looking to set new standards of production efficiency at its new car manufacturing plant in Grünheide (Germany), according to a Bloomberg report. Tesla CEO Elon Musk is targeting a production time per vehicle of 10 hours, which would set a new standard in European car manufacturing and this has already got rivals such as Volkswagen (VW) looking to improve their own levels of efficiency. VW CEO Herbert Diess has long admired Tesla for its methods and innovative approach to car building and has cited the new Tesla plant as a prime example of what his company needs to do to remain competitive as the industry speeds up electrification. Musk has been compared to Henry Ford in terms of the scale of innovation he wants Tesla to employ in order to improve car manufacturing efficiencies. Ford was famously the first to employ production line techniques for car making with the Model T, which modern car plants still use to this day, albeit with many improvements being made along the way, not least the use of robotic automation. While the technology that Tesla will use at its German facility is impressive and cutting-edge, it comes with some risk, as Musk himself acknowledges. He posted on Twitter last year when discussing the plant, "Lots of new technology will happen in Berlin, which means significant production risk." However, while that may be the case to an extent, a lot of the technology is already in use and has been proven at Tesla's plants in Shanghai and the company's original plant in Fremont (California, US). Tesla has already experienced some issues with its giant press machines; one of the machines at Fremont was involved in a minor fire, although this is also perhaps not that surprising given the fact they handle molten aluminum at temperatures of up to 850 degrees Celsius. The most difficult part of the manufacturing process is using these giant aluminum presses, as the alloy must enter the press at high speed so the temperature across the batch remains even. This is so the whole piece cools at the same rate and ensures the integrity of the structural piece being formed. (IHS Markit AutoIntelligence's Tim Urquhart)

- Spain's BBVA announced on Monday (15 November) that it had opened a tender to purchase the 50.15% of Turkey's Garanti Bank shares that it does not currently own. The EUR2.25-billion (USD2.57-billion) deal, which represents a 34% premium compared with the average price of Garanti Bank's shares over the past six months, is "very attractive", according to BBVA's executive chair Carlos Torres Vila, as reported by the Financial Times. Torres noted that the deal represents "3.6 times earnings in Turkey", a "very, very attractive price", compared with the 20 times earnings BBVA was able to sell its US unit for earlier this year. BBVA hopes to conclude the offer in the first quarter of 2022. (IHS Markit Banking Risk's Alyssa Grzelak)

- Although BBVA currently holds a 49.9% stake in Garanti, no other shareholder holds a 5% stake or greater; BBVA has controlled Garanti's board since 2015, and IHS Markit had already placed a high likelihood on BBVA providing capital support for Garanti Bank in the event of a future crisis. Therefore, the announcement of BBVA's intention to purchase the outstanding shares does not change our expectation of external support, although its eventual takeover of the remaining shares would speed up the deployment of capital if needed in a future dislocation and is thus a positive development for Garanti, in our view.

- Although Garanti's financial performance has outperformed its peers in some ways in recent years, its market share has slipped as its growth has not kept pace with the rapid expansion exhibited by state-owned banks Ziraat, Vakifbank, and Halkbank. Garanti's market share slipped from over 12% of sector assets in 2009 to just over 8% at the end of 2020, falling back from being the third-largest bank in the country to the fifth largest.

- Relative to peers in Turkey, Garanti posts slightly above average capital buffers, higher profitability, and similar non-performing loans (NPLs). Stage II loans are much higher than other top-five banks however, which could be partly due to better reporting and more conservative models, bringing the bank's troubled loan ratio to 18.8% of total loans, second only to YapiKredi's 19.9% of troubled loan ratio among the largest banks.

Asia-Pacific

- Major APAC equity indices closed mixed; Hong Kong +1.3%, Japan +0.1%, South Korea -0.1%, Mainland China -0.3%, and India/Australia -0.7%.

- Volvo Cars has signed a deal with navigation map service provider NavInfo for vehicle-to-everything (V2X) communication service in China, reports Gasgoo. NavInfo will provide compliance services for V2X platforms on all Volvo cars in the country for the next three years. The deal's price is dependent on the correlating vehicle sales of Volvo Cars during the contracting period. NavInfo is a navigation map service provider to global automakers including SAIC, BMW, Volkswagen Group, General Motors, Volvo, Toyota, and Nissan. In 2019, Beijing's municipal authority issued a temporary license plate for the testing of autonomous vehicles (AVs) to NavInfo. NavInfo reported that during the first half of 2021, its automotive traffic condition information service had covered over 300 cities in China and supported over 95% of the domestic highway information. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Chinese automaker Chongqing Changan Automobile (Changan) introduced its premium electric vehicle (EV) brand AVATR and unveiled the AVATR 11, the first model from AVATR, yesterday (15 November). According to Changan, the official launch of this new model is scheduled in the second quarter of 2022. Consequently, detailed specifications of the new model are to be announced at a later date. However, the automaker did share some key performance metrics of the AVATR 11. The model, a mid-size sport utility vehicle (SUV), is designed by Nader Faghihzadeh, a former BMW designer. Nader was involved in the design of several BMW models, including the BMW 6 Series Gran Coupe and the M6 Gran Coupe. This helps to explain the AVATR 11's coupé-like styling, although its high-ground clearance gives the model the stance of a typical SUV. The company says the new model will have a range of 700 kilometers and will be able to accelerate from 0 to 100 km per hour in less than 4 seconds. The model will be based on a 200-kW, high-voltage architecture to enable fast charging and it will have 400TOPS computing power, says Changan. The automaker has lagged behind its counterparts, such as GAC Motor and Geely Auto, in fleshing out its EV strategy. GAC's AION brand has already rolled out four models in the market and ZEEKR, the EV brand launched by Geely, has just begun deliveries of its first model. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Taiwanese city Hsinchu has deployed driverless vehicles to deliver goods in mixed traffic, reports Taiwan News. The vehicles travelled on a 1.9-km route connecting two warehouses of HCT Logistics, a leading delivery service provider in Taiwan. The vehicles operated on a system developed by the Industrial Technology Research Institute (ITRI), which would help HCT Logistics experience a 20% reduction in time to process 450,000 items monthly at its distribution center in Hsinchu. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Grab said that it was experiencing a disruption to its ride-hailing services in Singapore, Indonesia and Malaysia. Customers and drivers complained about having difficulty using Grab app's ride-hailing functions, reports Reuters. Grab said, "We are experiencing some technical difficulties with the app and our engineers are working to recover the issue". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The National Economic and Social Development Council's latest official data showed that Thailand's real GDP fell by 0.3% year on year (y/y) during July-September. Economic activities retreated from 7.6% y/y growth in the second quarter, although the slump is exaggerated by an artificially strong second-quarter figure. (IHS Markit Economist Jola Pasku)

- Consumption spending took a significant toll during the third quarter with the emergence of the Delta virus strain in late July and the stringent lockdown measures that followed. Private consumption fell by 3.2% y/y during the third quarter, down from 4.8% y/y in the second quarter, as COVID-19 containment measures curtailed spending across the board. Spending on discretionary goods and services took the biggest hit as reflected in a 16% y/y contraction recorded during this period.

- Government consumption spending picked up the pace in the third quarter (up 2.5% y/y) and provided marginal support to overall growth in line with the boost in social transfer spending and rising compensation of employees.

- Fixed investment spending fell by 0.4% y/y in the third quarter, reversing a 7.6% y/y expansion in the second quarter. Private investment expanded by 2.6% y/y, although not nearly enough to offset a 6.0% y/y drop recorded in public investment. Investment in construction and machinery equipment was held back on the back of depressed demand and supply-chain disruption.

Posted 16 November 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.