US equity indices closed higher led by technology, while European and APAC markets were mixed. US and benchmark European government bonds closed higher. European iTraxx and CDX-NA closed almost unchanged across IG and high yield. The US dollar, gold, and silver closed higher, copper flat, and oil and gas were lower on the day.

Americas

- US equity markets closed higher led by Nasdaq +1.1%, with the S&P 500 +0.7%, DJIA +0.5%, and Russell 2000 +0.3% all closing at new all-time highs.

- 10yr US govt bonds closed -2bps/1.61% yield and 30yr bonds -2bps/2.36% yield.

- CDX-NAIG closed -1bp/52bps and CDX-NAHY -1bp/297bps.

- DXY US dollar index closed +0.2%/91.83.

- Gold closed +0.5%/$1,729 per troy oz, silver +1.5%/$26.29 per troy oz, and copper flat/$4.14 per pound.

- Crude oil closed -0.3%/$65.39 per barrel and natural gas closed -4.5%/$2.52 per mmbtu.

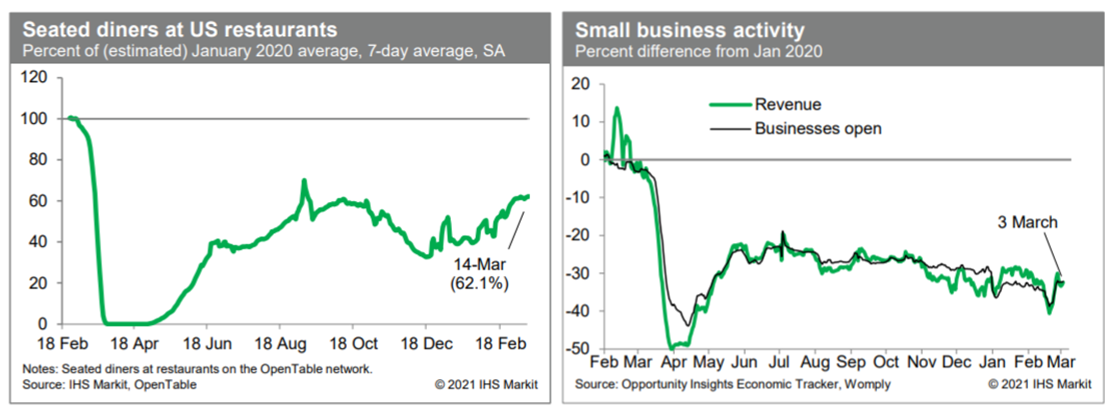

- Averaged over the last seven days, the count of US seated diners on the OpenTable platform was about 62% of the (estimated) January 2020 level. This continues a firming trend since last December, as the spread of the virus is slowing, mandated restrictions on indoor dining are easing, and weather conditions are becoming more amenable to outdoor dining. Still, recovery in the restaurant industry has a long way to go. Meanwhile, small business activity (revenues and the count of small businesses open) improved in early March, according to the Opportunity Insights Economic Tracker, but remains weak. The small business sector has yet to show signs of material improvement so far in the recovery. (IHS Markit Economists Ben Herzon and Joel Prakken)

- Industry experts at the Future Food-Tech 2021 conference last week predicted a bright future for fermentation - the newest and still emerging branch of the growing space of alternative proteins. (IHS Markit Food and Agricultural Policy's Margarita Raycheva)

- While the novel sector is still expanding and battling to resolve hurdles on the way to mass production, fermented alternative proteins are well-positioned for growth, especially following a significant boost in funding and consumer interest in 2020.

- Just like producers of plant-based foods and cell-based meats, companies using fermentation to derive alternative proteins and ingredients have benefitted from the COVID-19 crisis in 2020.

- By placing a greater focus on health and making consumers more selective in their food choices, the pandemic has only accelerated consumer interest in better-for-you products that are also more sustainable, said Valerio Nannini, general manager for alternative protein solutions at Novozymes, a Swiss biotechnology company.

- Investment research firm Hindenburg Research has issued a report on electric vehicle (EV) startup Lordstown Motors calling it a "mirage". Hindenburg Research is the same firm that issued a report on EV maker Nikola which ultimately led to that company's CEO departing, and led to a deal between General Motors (GM) and Nikola being sharply scaled back. The latest Hindenburg report claims that Lordstown CEO Steve Burns inflated non-binding pre-orders and letters of intent as sales. In an interview with the Wall Street Journal , Burns said that Hindenburg's report contains half-truths and lies. Hindenburg claims that Lordstown Motors paid consultants to generate the pre-orders, among other allegations. Speaking of the pre-orders in November 2020, Burns told broadcaster CNBC, "Most of them are signed by the CEOs of these large firms. They're very serious orders." The Journal reports that Burns confirmed that the company did pay consultants to generate pre-orders that were understood to be non-binding as a way to assess market demand, but the executive denies misrepresenting the company's order book. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous vehicle (AV) LiDAR startup Aeva has completed its previously announced merger with InterPrivate Acquisition Corp, a special-purpose acquisition company. The combined company will be renamed "Aeva Technologies" and will start trading on the New York Stock Exchange (NYSE) on 15 March, under the ticker symbols "AEVA" and "AEVAW". Separately, Ouster, a digital LiDAR sensor provider, has finalized its previously announced business combination with Colonnade Acquisition Corp, a SPAC. Ouster started trading its common stock on the NYSE on 12 March, under the symbol "OUST". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- The widespread decrease in Canada's regional housing starts in February was led by Quebec. Following the 79.8% surge in the previous month, Quebec's housing starts moderated to 79,251 units and remained higher than Ontario's starts of 78,470 units. (IHS Markit Economist Chul-Woo Hong)

- Housing starts declined 13.5% month over month (m/m) to 245,922 units (annualized) in February.

- Urban single starts went down 9.3% m/m and multifamily starts fell 15.8% m/m. Rural starts decreased for the third consecutive month, down 5.0% m/m.

- British Columbia bucked the national trend with the only increase in housing starts.

- Robust homebuilding activities in the first quarter support our view of strong business residential construction investment growth in 2021.

- Canadian Tire has partnered with startup NuPort Robotics to launch a two-year project to test automated truck technology, according to a company statement. This project is backed by the Ontario government, which will invest USD1 million through Ontario's Autonomous Vehicle Innovation Network (AVIN) and a USD1-million investment each from Canadian Tire and NuPort Robotics. NuPort Robotics will deploy its artificial intelligence (AI) technology in two conventional semi-tractor trailers. These trailers will also have high-tech sensors and controls, a touchscreen navigation system, and other advanced features such as obstacle and collision avoidance. The project is aimed to design a "transportation solution for the middle mile, the short-haul shuttle runs that semi-tractor trailers make between distribution centers, warehouses and terminals each day". (IHS Markit Automotive Mobility's Surabhi Rajpal)

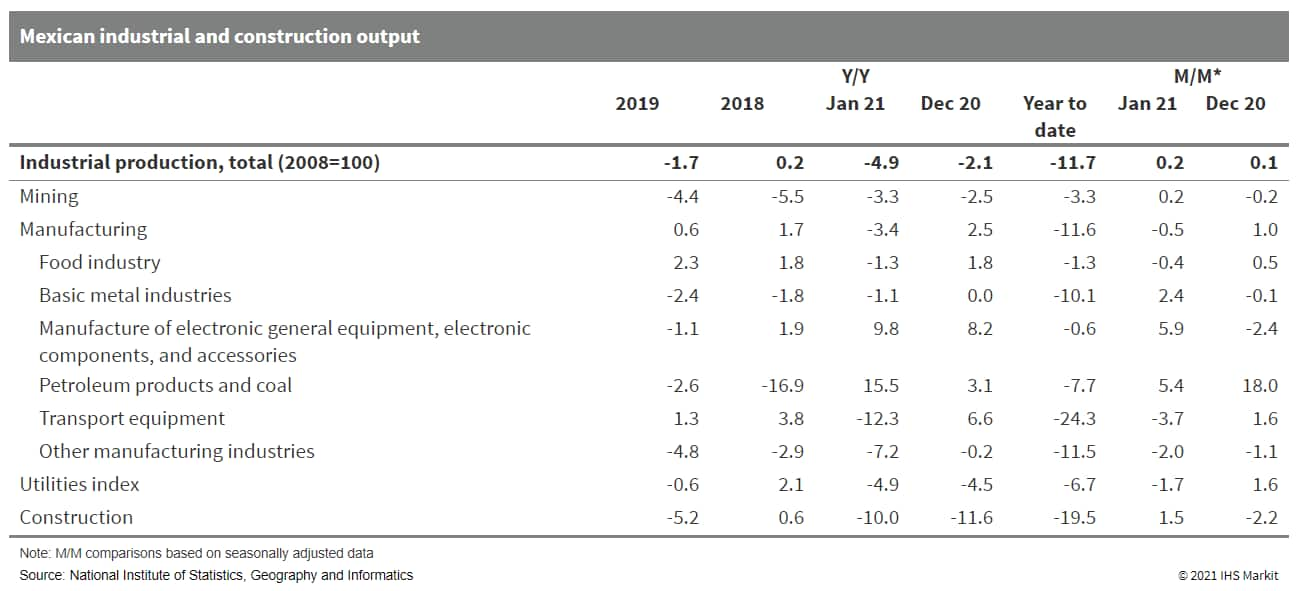

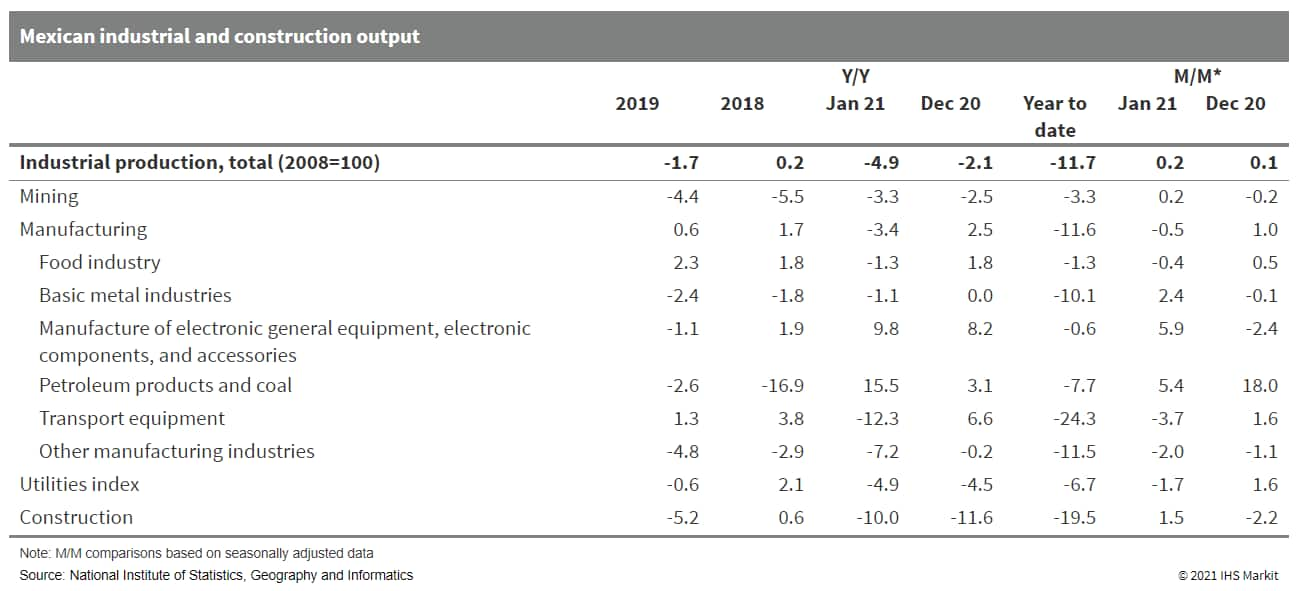

- The National Statistics Office of Mexico (INEGI) reported that the country's industrial production expanded by 0.2% in January compared with December month on month (m/m); this is based on seasonally adjusted data. (IHS Markit Economist Rafael Amiel)

- Based on raw data and comparing with January 2020 year on year (y/y), production declined by 4.9%, showing that the return to pre-coronavirus disease 2019 (COVID-19)-virus pandemic levels still requires a sizeable expansion.

- The table below shows that growth was driven by construction and, to a lesser extent, mining drove the monthly expansion in January. However, y/y comparisons show that manufacturing is the sub-sector that has recovered the most.

- According to the Central Bank of Paraguay (Banco Central del Paraguay: BCP), economic activity dropped by 6.4% in seasonally adjusted monthly terms in January, by far the sharpest downturn since the -14.2% month-on-month collapse in April 2020, induced by the lockdown. In annual terms, the MIEA declined by 5.6% in January. (IHS Markit Economist Jeremy Smith)

- The BCP continues to observe weakness in services, agricultural, and hydroelectric output, although manufacturing went from a strong point to a drag on growth. At the same time, the central bank noted strength in the construction and livestock sectors.

- The monthly index of business sales fell by 2.4% year on year in January but continued to outperform the MIEA. Sales slowed in all commercial categories compared with December, particularly in the construction materials category, perhaps suggesting that recent strength in the construction sector may be waning.

- On a positive note, in February the consumer confidence index registered its first reading above the neutral level of 50 points since the COVID-19-virus pandemic began.

- On 15 March, the Brazilian Congress passed a constitutional amendment that allows new emergency financial aid to buffer the impact of the COVID-19 pandemic; such aid had ceased on 31 December 2020. The amendment passed despite a 2017 constitutional mandate that imposes a cap on the federal budget. In practice, the measure exempts the additional expenditure, totaling USD 7.7 billion, from the cap demanding additional government borrowing. This puts public debt at USD1.17 trillion, or 89.7% of the GDP, according to the Central Bank. (IHS Markit Country Risk's Carlos Caicedo)

- The approval of additional aid indicates Economy Minister Paulo Guedes' plan to contain growing fiscal deficit is unlikely to count on Congressional support. The measure goes against Guedes' proposed measures to cut public expenditure to narrow Brazil's fiscal deficit, which ended 2020 at 15% of GDP.

- President Jair Bolsonaro is likely support further expenditure, ignoring the austerity agenda, to boost his declining popularity.

- As the 2022 elections draws closer, Bolsonaro will probably be less willing to support the market reforms long promoted by Guedes. The two pillars of Guedes's fiscal agenda are the tax and administrative reforms he outlined in January 2019, when he was appointed minister. The reforms, which seek to reduce the large civil service payroll, and introduce new taxes, have made no progress since they were proposed.

- The President's recent interference in the running of state-run companies also indicates that the chances of privatisation before the 2022 election are negligible.

Europe/Middle East/Africa

- Most European equity markets closed lower except for Italy +0.1%; Spain -0.1%, UK/France -0.2%, and Germany -0.3%.

- 10yr European govt bonds closed higher; France/Italy/Spain -4bps, Germany -3bps, and UK -2bps.

- iTraxx-Europe closed flat/47bps and iTraxx-Xover +2bps/244bps.

- Brent crude closed -0.5%/$68.88 per barrel.

- A major survey of consumer attitudes to battery electric vehicles (BEVs) in the UK has found that 65% of respondents said there is no public charging station near to their residence. The survey was conducted by the Daily Express newspaper and it carried some interesting data points in terms of how quickly BEV take-up by consumers will accelerate. The Green Britain Needs You poll found an even split between readers, with 43% wanting to go electric and 44% against. (IHS Markit AutoIntelligence's Tim Urquhart)

- Four silver-containing biocides would present "unacceptable" risks for human health if used in activated carbon water filters, according to European Chemical Agency (ECHA) biocide experts. ECHA's Biocidal Products Committee (BPC) concluded that silver zinc zeolite, silver zeolite, silver copper zeolite and silver sodium hydrogen zirconium phosphate should not be approved as active ingredients for product-type 4 biocides used in food and feed areas. (IHS Markit Food and Agricultural Policy's Sara Lewis)

- According to all measures, on an annual basis, Sweden's headline consumer price inflation dipped in February. The consumer price index (CPI), which is the national definition, came in at 1.4% year on year (y/y), down from 1.6% in January. According to the EU-harmonised measure (HICP), inflation came in at 1.8% y/y, down from 1.9% y/y in January (IHS Markit Economist Daniel Kral)

- South Africa's real seasonally adjusted manufacturing output increased by 0.5% m/m during January, the South African statistical service, StatsSA, reported. Real seasonally adjusted manufacturing production remains below the levels prior to the COVID-19 pandemic, with output contracting by 0.8% year on year (y/y) during the month. (IHS Markit Economist Thea Fourie)

- Sectors that showed the strongest gains in output levels during January included motor vehicles, parts and accessories and other transport equipment (up 12.8% m/m); glass and non-metallic mineral products (up 6.2% m/m); textiles, clothing, leather and footwear (up 3.8% m/m); and petroleum, chemical products, rubber and plastic products (up 2.2% m/m).

- Output in the food and beverages sector, followed by the radio, television and communication apparatus and professional equipment and furniture and other manufacturing sectors, recorded m/m contractions during January.

- South Africa's manufacturing production fell by 11.0% during 2020, reflecting the impact of the COVID-19 pandemic's local and global supply-chain disruptions combined with COVID-19-related government restrictions.

Asia-Pacific

- APAC equity markets closed mixed; Hong Kong +0.3%, Japan +0.2%, Australia +0.1%, South Korea -0.3%, India -0.8%, and Mainland China -1.0%.

- China's industrial production, services production, investment, and retail sales surged at the beginning of 2021, partly owing to the COVID-19 pandemic-induced low-base effect. However, economic recovery momentum will moderate as the low-base effect diminishes. (IHS Markit Economist Yating Xu)

- Value-added industrial output in the first two months of 2021 rose 35.1% year on year. Compared with the pre-pandemic level, industrial value-added output grew 16.9% relative to the same period 2019 and the average growth achieved in 2020 and 2021, at 8.1%, is significantly above the three-year pre-pandemic average of 6.3%. However, month-on-month growth declined to 0.69% from 0.78% in December 2020, continuing the downward trend that has endured since fourth quarter 2020.

- The services production index increased 31.1% y/y during the first two months of 2021, up 14.1% compared with the same period in 2019 and up by 6.8% in terms of two-year average growth. By sector, the real estate and information sectors were two main drivers of the headline acceleration, having expanded 51.4% and 26.1% year on year, respectively, and the two-year average growth reached 11.8% and 14.1%, respectively.

- Fixed-asset investment (FAI) expanded 35% y/y in the first two months of 2021, with the two-year average growth at 1.7% y/y. Compared with the 2019 level, FAI 3.5%. The average month-on-month growth in January and February was 2.4%, edging up from 2.3% in December 2020.

- Nominal retail sales increased 33.8% y/y in the first two months of 2021, up 6.4% from the same period of 2019 and up 3.2% on a two-year average basis compared with the 4.6% y/y growth registered in December 2020. Auto sales rose 77.6% y/y and 11.9% compared with the same period 2019, thus remaining the main driver of the headline retail sales growth.

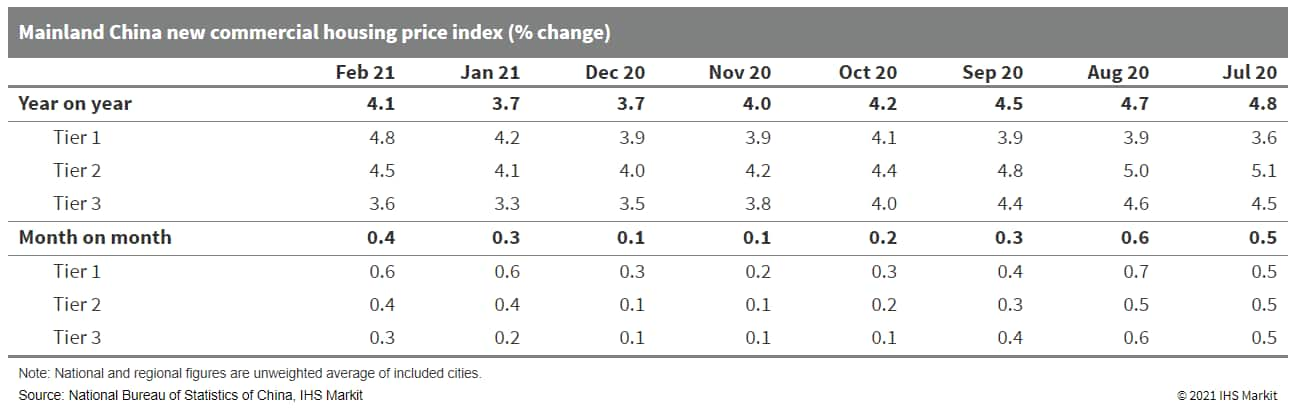

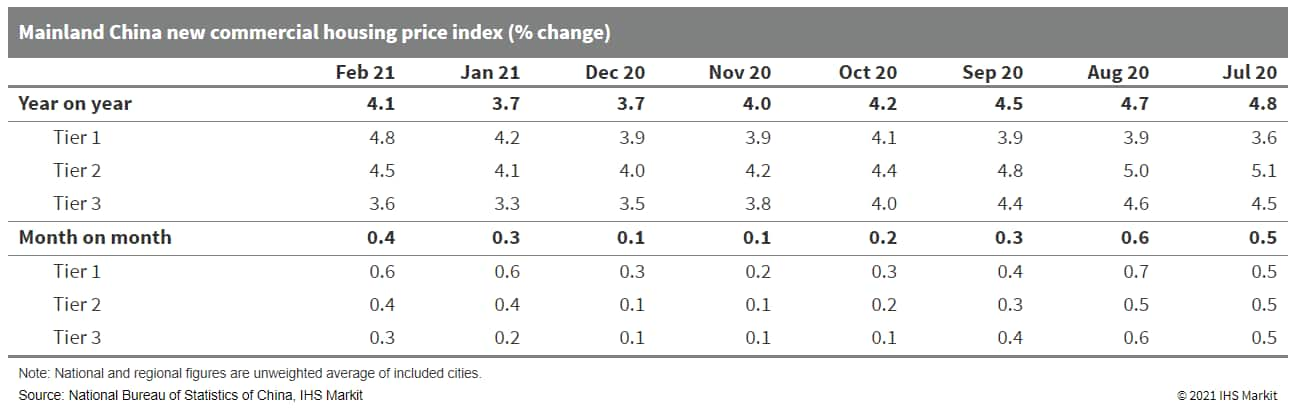

- Mainland China's new home price inflation averaged 0.36% month on month (m/m) in February, up by 0.08 percentage point from January, according to the survey by National Bureau of Statistics covering 70 major cities. The month-on-month uptick in national new home price inflation in February was largely driven by tier-3 cities, for which average new home price inflation rose month-on-month by 0.12 percentage point. (IHS Markit Economist Lei Yi)

- RoboSense has announced the launch of China's first automotive-grade solid-state LiDAR production line, according to a company statement. LiDAR sensors are necessary for autonomous vehicle (AV) operation as they measure distance via pulses of laser light and generate 3D maps of the world around them. The company also plans to begin mass production and delivery of its RS-LiDAR-M1 for contract projects in the second quarter of this year. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Japan's private machinery orders (excluding volatiles), a leading indicator for capital expenditure (capex), fell by 4.5% month on month (m/m) in January. (IHS Markit Economist Harumi Taguchi)

- The first decline following three consecutive months of increases reflected a 4.2% m/m decrease in orders from manufacturing and an 8.9% drop in orders from non-manufacturing (excluding volatiles).

- While orders from governments dropped by 27.9% m/m in January following a 15.6% m/m surge in the previous month, orders from overseas rose for the fourth straight month with a 6.4% m/m increase.

- The decline in orders from manufacturing largely reflected decreases in orders from electrical machinery, other transport equipment, and other miscellaneous manufacturing groups and a continued fall in orders from chemical and chemical products.

- Takeda (Japan) plans to exercise its option to acquire T-cell targeted immunotherapies-focused company Maverick Therapeutics (US), Takeda said in a statement. Under the agreement, Takeda will acquire the US company's T-cell engager COBRA platform as well as a portfolio of treatment candidates - including lead development candidate TAK-186 (MVC-101), which is currently in Phase I/II development for the treatment of EGFR-expressing solid tumors, and TAK-280 (MVC-280), which is scheduled to start clinical development for the treatment of patients with B7H3-expressing solid tumors in the second half of Takeda's fiscal year (FY) 2021. The companies expect the acquisition to complete in the first quarter of FY 2021. (IHS Markit Life Sciences' Sophie Cairns)

- Panasonic's outgoing CEO Kazuhiro Tsuga has expressed the need for the company to reduce its heavy dependence on Tesla's battery business and to develop batteries more compatible with electric vehicle (EV) models of other automakers, according to Financial Times. Tsuga said, "At some point, we need to graduate from our one-legged approach of relying solely on Tesla." Panasonic is the primary battery supplier for Tesla and has multi-year supplier agreement with the automaker for the latter's Nevada Gigafactory. Recently, Panasonic announced plans to add a 14th production line at the Tesla Gigafactory in Nevada to increase the plant's capacity by about 10%. The two companies are continuing to work together on automotive batteries, despite Panasonic pulling out of work with Tesla on solar cells in the United States. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- South Korean OEMs Hyundai, Kia, General Motors (GM) Korea, Renault Samsung, and SsangYong have announced a 37.9% year-on-year (y/y) surge in their combined domestic output to 260,958 units during February, reports Yonhap News Agency, citing data released by the South Korean Ministry of Trade, Industry, and Energy. Vehicle exports by the South Korean OEMs also jumped during the month by around 31.6% y/y to 161,886 units, while the total value of their overseas shipments increased by 47.0% y/y to USD3.5 billion. The surge in the South Korean OEMs' vehicle production and exports in February came on the back of strong demand in the domestic market, a recovery in their overseas markets, and a low base of comparison. (IHS Markit AutoIntelligence's Jamal Amir)

- Live Mint reported that, according to unnamed sources, India's Ministry of Finance is looking to inject INR145 billion (USD2 billion) into several banks that are currently under prompt corrective action (PCA). According to the website, this likely means that the Indian Overseas Bank, Central Bank of India, and UCO Bank will benefit from the capital injection and that the amount will allow them to come out of PCA. (IHS Markit Banking Risk's Angus Lam)

- According to the budget this year, the government has earmarked INR200 billion into state-owned banks.

- The proposed INR145 billion is around 75% of the total earmarked amount of capital injection for financial year 2021/22. This supports our previous estimation that weaker banks will be supported but stronger banks will have to rely on financial markets for funding.

- The amount to be injected is sooner and larger than IHS Markit had expected, but this is likely to be necessary to ensure that the privatization candidates are attractive to investors by improving their financial indicators. This further supports the view that the government is keen to privatize more banks after changing the bank nationalization act.

Posted 15 March 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.