Most major US and European equity indices closed higher, while APAC was mixed. US and European government bonds closed sharply higher. European iTraxx and CDX-NA both closed tighter across IG and high yield. Oil closed lower, while the US dollar, gold, silver, and copper were all higher on the day.

Americas

- US equity markets closed mixed; Russell 2000 -0.8%, DJIA flat, S&P 500 +0.2%, and Nasdaq +0.4%.

- 10yr US govt bonds closed -4bps/1.09% yield and 30yr bonds -6bps/1.82% yield.

- CDX-NAIG closed -2bps/50bps and CDX-NAHY -5bps/296bps.

- DXY US dollar index closed +0.3%/90.36.

- Gold closed +0.6%/$1,855 per ounce, silver +0.5%/$25.57 per ounce, and copper +0.3%/$3.62 per pound.

- Crude oil closed -0.6%/$52.91 per barrel.

- The number of hospitalized COVID-19 patients was roughly flat in the U.S. this week, and likely will begin declining for the first time since September. The numbers are now dropping compared with a week earlier in both the Northeast and Midwest, according to the Covid Tracking Project. In the West, they were up 0.8%, the least since Oct. 1 on a percentage basis. The South has the most alarming momentum, with an increase of 4.2% from seven days earlier. (Bloomberg)

- The US Consumer Price Index (CPI) rose 0.4% in December following a 0.2% increase in November. The price index for gasoline rose 8.4%, contributing to a 4.0% increase in the CPI for energy and accounting for more than one-half of the rise in the overall CPI. The food index rose 0.4% while the core CPI, which excludes the direct effects of movements in food and energy prices, rose 0.1%. (IHS Markit Economists Ken Matheny and Juan Turcios)

- Twelve-month inflation rates show that inflation remains muted despite a partial rebound from last spring. The overall CPI rose 1.4% over the 12 months through December, up from 1.2% as of November. The core CPI rose 1.6% over the 12 months through December, equal to November's reading. The 12-month change in the core CPI fell from 2.4% in February 2020 to 1.2% as of May and June and has recovered only partially over the past six months.

- Rent inflation remains low after subsiding since last winter. In December, both rent of primary residence and owner-equivalent rent of residences rose just 0.1%. Their 12-month changes were 2.3% and 2.2%, respectively, down 1.5 and 1.1 percentage points from 12-month readings as of February 2020. The CPIs for rent represent about 32% of the overall CPI and 40% of the core CPI.

- The price index for used cars and trucks fell 1.2% in December. It declined 2.5% over the final three months of the year, partially reversing a 15.1% increase from July to September. Also rising in December were price indices for apparel (1.4%) and new vehicles (0.4%).

- The price index for gasoline jumped 8.4% in December. Since May, the price of gasoline has risen 30.1%, reversing a little more than one-half of the sharp decline that occurred over the first five months of the year.

- Archer, a startup looking to build electric vertical takeoff and landing (VTOL) vehicles, has announced a deal with Fiat Chrysler Automobiles (FCA) for access to its supply chain and engineering experience. Archer claims to be developing the world's first electric VTOL and aims to become an industry leader in the new segment. According to the statement, Archer will manufacture high-volume, composite eVTOL aircraft and aims to start production in 2023. FCA has already collaborated on the cockpit design, Archer notes, as well as other design elements. According to the statement, FCA and Archer will work together to decrease cost of production. Where and when Archer expects to produce the vehicle is not clear, although FCA is not expected to be involved in the manufacturing. Archer envisions a vehicle which can carry about two dozen passengers in dense urban areas for short distances. According to Automotive News, Archer says it plans its first vehicle will be able to travel as far as 60 miles at 150 miles per hour. Doug Ostermann, FCA's head of global business development, said in the statement, "Electrification within the transportation sector whether on roads or in the air is the future and with any new and rapidly developing technology, scale is important. Our partnership with Archer has mutual benefits and will enable innovative, environmentally friendly transportation solutions to be brought to market at an accelerated pace." The vehicle is due to be unveiled in early 2021, and Archer expects the deal with FCA to enable the lower cost of manufacturing and enable Archer to meet its goal for affordably priced aircraft. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The CEO of Lordstown Motors has said the company has more than 100,000 non-binding production reservations for its upcoming Endurance pick-up, according to web site Trucking Info.com. The company says the average order size has been for nearly 600 vehicles per fleet. CEO Steve Burns is quoted as saying, "Receiving 100,000 pre-orders from commercial fleets for a truck like the Endurance is unprecedented in automotive history. Adding in the interest we have from federal, state, municipal and military fleets on top of that, I think you can see why we feel that we are about to revolutionize the pickup truck industry." The report notes that Lordstown has begun beta production and is on track for saleable production in September 2021, which also suggests a delay from deliveries once expected in January 2021. Lordstown became a publicly traded company in November 2020, after revealing its truck midway through the year. The company has previously confirmed range of 250 miles and ability to tow 7,500 pounds, with a starting price around USD45,000. The Endurance, unlike GMC's Hummer electric vehicle (EV) due later in 2021, Rivian's upcoming pick-up and Ford's F-150 EV due in 2022, which are all aimed at personal use more heavily than work (although Ford is also prioritizing work capability), is aiming at fleet work trucks. (IHS Markit AutoIntelligence's Stephanie Brinley)

- IFF is aiming for 4-5% annual currency-neutral sales growth through 2023, driven by top positions in a number of end markets and a strong R&D pipeline, the company said in an investor presentation yesterday. IFF announced new growth and synergy targets in conjunction with its $26.2-billion merger with DuPont Nutrition & Biosciences (N&B), which is slated to close on 1 February. (IHS Markit Chemical Advisory)

- The combined company will have about $11.1 billion in annual revenue, and generate about $1.4 billion/year in free cash flow, both the highest figures among its peer set, according to IFF. The next-largest peer company—unidentified in the investor presentation—generates about $7.1 billion/year in revenue. IFF says the combined company will have the top position in many end markets with in its four segments: flavor and fragrance; pharma; health and bioscience; and food and beverage.

- IFF is also aiming for 26% EBTITDA margins, $400 million in revenue synergies, and $300 million in cost synergies by the end of the third year after the DuPont N&B deal closes. The company expects to realize $20 million in cost synergies and $45 million in revenue synergies by the end of this year, and plans to reduce net debt to 3 times (x) EBITDA by end of 2023.

- Divestitures will be a part of the strategy for meeting the debt reduction target. "We are evaluating some of the smaller non-core operations in our existing business portfolio," IFF president and CFO Rostam Jilla said during an investor call yesterday. "Upon the completion of the N&B transaction, we also intend to evaluate possible non-core divestiture candidates from that business portfolio." Proceeds from divestitures "will be used primarily to achieve the leverage reduction commitments," Jilla adds.

- The company, post-close, will well-positioned to capitalize on major trends, including sustainability and traceability, clean labels, and increasing consumer interest in healthy foods, according to chairman and CEO Andreas Fibig. "We have seen acceleration and evolution of consumer trends through the pandemic with long-term impacts," Fibig says. "Customers across end markets expect more from their value chain partners and the new IFF is well-positioned to deliver."

- Electric vehicle (EV) manufacturer BYD has announced that it has won cumulative orders to supply 1,002 units of electric buses to Bogotá (Colombia), according to company sources. According to the automaker, this is the largest order for electric buses outside China to date. BYD aims to partner with local bus manufacturers Superpolo and Busscar for bus body parts. The buses will be delivered during 2021 and the first half of 2022. They will be deployed for operation on 34 bus routes across five regions of Bogotá. Stella Li, president of BYD Motors, said, "This more than 1,000 buses order marks a fresh start, which will effectively promote the rapid development of green transportation in Latin America and the coming era of global bus electrification." She added, "In the move towards electrification globally, BYD will continue to make great contributions moving forward." BYD's operations in Colombia, which will include assembly of bus body parts, will enable job creation and improve the environment. In June 2020, BYD authorized Motores y Máquinas S.A. (Motorysa), an auto distribution company, to distribute its EVs in Colombia. (IHS Markit AutoIntelligence's Tarun Thakur)

- The Central Bank of Chile (Banco Central de Chile: BCC) published on 12 January its credit conditions survey covering the final quarter of 2020. From a supply side, the main results highlight a loosening in household credit standards in most institutions, with 25% of banks stating that the conditions are less restrictive now than in the previous quarter. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- The supply of credit to the corporate sector is perceived to be more restrictive than a quarter before; nevertheless, it is at its lowest level of restrictiveness since the final quarter of 2019. From a demand side, banks experienced an increase in credit appetite from households. However, large, medium-sized, and small corporations were all perceived by banks to have reduced their demand for credit in the second half of 2020.

- Credit conditions have tightened since the final quarter of 2019 when in October of that year protests and riots began. The COVID-19-virus pandemic has increased restrictions on lending standards, reaching its tightening peak in June 2020. The loosening of these restrictions means that banks expect a recovery in this segment of borrowers and are experiencing fewer risks in this type of credit.

- As a result, it is likely that there will be a jump in the growth of household credit, which is at record-low growth levels. This segment of credit increased by 1.9% year on year in September 2020, when last reported. This is the lowest figure in our records, covering the past 12 years of credit by borrower.

- Corporate credit is likely to end 2020 with slightly lower figures than those observed during the year. This segment had a rapid surge in 2020, aided mostly by the credit guarantee scheme introduced in April that year. It may be revived over the first half of 2021 if a second version of the credit guarantee program is introduced.

- Shipping company Hapag-Lloyd will implement its Asia Express service (AN1 service) to reduce the transit time from Valparaiso to Hong Kong during the Chilean fruit seasons. The service, with 24/7 support from the sale team, will begin working on week 3 with the Corcovado ship departing from Valparaiso on January 20, 2021 and will run until week 13. The seasonal express service quickly connects Valparaiso and Hong Kong as it has a transit time of 22 days. It has a connection to Shanghai via Hong Kong in 27 days and an extensive network of feeders that ensures flexible and express delivery of cargo to other destinations in Asia via Hong Kong. Starting in October, Chilean cherry exports to Asia peak in January. Cherries are very popular winter fruits in China, especially during the Lunar New Year festive season. 2021's Lunar New Year is 12 February. In November 2019 - November 2020, over USD1.0 billion fob worth of Chilean cherries were sent to mainland China. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- According to the Central Bank of Paraguay (Banco Central del Paraguay: BCP), in November 2020 the monthly index of economic activity (MIEA) declined in seasonally adjusted month-on-month (m/m) terms for only the second time since April. Nonetheless, the MIEA and the index of business sales have continued to make year-on-year (y/y) improvements. (IHS Markit Economist Jeremy Smith)

- The MIEA fell by 1.4% m/m in November, the first such decrease since August and only the second since recovery began in May, although this left economic activity just 0.7% below 2019 levels in cumulative annual terms. As in recent months, drag from various service industries and hydroelectric output outweighed strength in construction, manufacturing, livestock, government services, and telecommunications.

- Meanwhile, the monthly index of business sales rose by 0.2% y/y in November after shrinking at an average of 1.2% y/y over the previous three months. Nonetheless, all commercial categories aside from construction materials and mobile phone services remain in contraction, with many worsening from the previous month.

- Consumer confidence jumped back to the neutral level of 50 in November, the highest since March, after hovering in the low- to mid-40s from May to October. Confidence in the current economic situation registered at 28, extremely low in historical terms but a notable improvement from recent months.

- The consumer price index rose by 2.2% y/y in November and December; Paraguay thus concluded 2020 with its average annual inflation of 1.8%, which falls outside the BCP's target range of 4% +/- 2%. Monetary policy remains highly accommodative, with the policy interest rate at 0.75%, and the tone and guidance of BCP monetary policy communiqués have changed little in recent months.

- Coronavirus disease 2019 (COVID-19) cases spiked in November and remain elevated, prompting a halt to the economy reopening and new regulations around the holiday season. Paraguay had successfully warded off the initial surge, but is now proving to be more vulnerable as COVID-19 cases rise again across South America.

- According to a report by Automotive Business, Ford's shutdown announced on 11 January will result in 5,000 employees being laid off and costs of USD4.1 billion. According to the automaker, it has about 6,171 employees in Brazil, and the closure of the plants will affect around 5,000 employees (including employees in Argentina and at the Camaçari plant, Taubaté engine plant, and Belo Horizonte plant in Brazil). Earlier this week, Ford announced that it would end production in Brazil in 2021. However, it will continue to operate sales and services in the country and in the wider South America region, using vehicles from its global network. Ford will continue production in Argentina and completely knocked down (CKD) production in Uruguay, and these operations will supply the region with the all-new Ranger, as they do today. In Brazil, Ford will maintain its South American headquarters in São Paulo, its product development center in Bahia, and its proving grounds in Tatui, São Paulo. Initially, the move will cost Ford USD4.1 billion. Ford's revenue has been declining in the region on the back of lower volumes and weaker currencies. Ford's decision to exit manufacturing in Brazil carries some risk as the country's taxation system is friendlier to automakers that invest in the region. (IHS Markit AutoIntelligence's Tarun Thakur)

Europe/Middle East/Africa

- Most European equity markets closed higher except for UK -0.1%; Italy +0.4%, France/Spain +0.2%, and Germany +0.1%.

- 10yr European govt bonds closed sharply higher; Italy -8bps, France -6bps, and Spain/UK/Germany -5bps.

- iTraxx-Europe closed -1bp/49bps and iTraxx-Xover -10bps/252bps.

- The fall in Italy's industrial production between October and November was expected in the face of stricter COVID-19 related measures. Specifically, industrial production declined by 1.4% month on month (m/m) in November after a 1.4% m/m gain in October. (IHS Markit Economist Raj Badiani)

- Falling output in November was across all the main categories. The main falls on a m/m basis arose from consumer durables (6.5%) and investment goods (0.6%).

- Therefore, the average output in October and November was 0.5% lower than in the third quarter of 2020.

- Meanwhile, on a working-day-adjusted basis, the picture was bleaker, with industrial output falling by 4.2% year on year (y/y) in November. This implies that production contracted by 12.1% y/y in the first 11 months of this year, compared with a 1.0% drop in 2019.

- Some of the largest y/y falls in November occurred in manufacture of textiles, wearing apparel, leather and accessories (26.7%), coke and refined petroleum products (18.3%) and machinery and equipment (6.8%).

- Despite not being affected directly by the tighter COVID-19 restrictions during November, industrial activity appeared to endure some residual damage.

- The Italian government adopted a three-tier system in early November 2020, which entailed red (high-risk), orange (medium-risk) and yellow (low-risk) zones. The most restrictive measures apply in the red zone, and include the closure of bars, pubs, restaurants, and most shops. In addition, people can only leave their homes for essential trips, namely for work and health reasons, or taking children to school. Six regions reside in the red zones, and they are Tuscany, Campania, Calabria, Lombardy, Piedmont, and Val d'Aosta.

- Falling industrial output in November supports our narrative of renewed GDP losses in the final quarter of 2020, with tighter regional lockdowns targeting yet again the hospitality, transport, and the retail sectors.

- The latest survey data suggest manufacturing activity regained marginal momentum in December. The IHS Markit Italy Manufacturing Purchasing Managers' output index improved from 51.8 in November to 52.0 in December, which is above 50.0 to signify expansion for the seventh straight month. This was due to order books returning growth, albeit marginally. However, firms reported that COVID-19 measures continued to affect supply chains, with delays being the most severe since last May.

- We expect industrial activity remained under pressure in December for two reasons.

- First, a new spike in new COVID-19 infections forced the government to place the whole of Italy under the toughest restrictions during Christmas and effective until 6 January, implying the closure of non-essential shops.

- Stricter COVID-19 restrictions across Europe during December probably affected the demand for Italian exports of goods. Italy is vulnerable to any regional trade disruptions with its open economy, highlighted by exports accounting for 32% of its GDP.

- Volvo Cars has announced that it has agreed a new EUR1.3-billion revolving credit facility. According to a statement, this is an evolution of an existing undrawn revolving credit facility signed in 2017. However, its interest rate is now linked to the automaker's progress in reducing carbon emissions. It has been coordinated by financial institutions Citi, HSBC, Nordea, and SEB and is backed by 21 participating banks. It has a three-year term with two one-year extension options and is intended to serve as a back-up facility for general corporate purposes. Separately, the company has said that it is working with its home town Gothenburg (Sweden) to support its climate neutrality. In a statement, it said that new emission-free urban zones in the city under the Gothenburg Green City Zone initiative will be used as testbeds for future sustainable technologies. Volvo said that this will enable it to accelerate "the development of technologies and services in the areas of electrification, shared mobility, autonomous driving, connectivity and safety". It noted that as part of its test program, Volvo plans to run "robotaxis" operated by its mobility provider M. Other potential examples include fully electric mobility hubs and a complete, easy-to-use charging network for electric cars. The initiative is expected to start in early 2021 and will gradually be scaled up. The two initiatives are broadly related to Volvo's push to reduce emissions. The new revolving facility follows the recent successful issuance of its first EUR500 million Green Bond in the wake of it establishing a 'Green Finance Framework', which would allow the company to fund its low-emission and electrification strategy. This would provide transparency for this type of investment given that it specifies how these projects are identified, selected and managed. These initiatives will give it a financial incentive to maintain the momentum of its push towards ending the sale of internal combustion engine (ICE) vehicles and becoming carbon-neutral by 2040. (IHS Markit AutoIntelligence's Ian Fletcher)

- Norway's parliament has approved the 2021 budget, which includes over NOK10.5 billion (USD1.23 billion) for offshore carbon transportation and storage projects, the development of hydrogen infrastructure, and mapping of seabed minerals. The minority coalition government led by the Conservative Party (Høyre) subsequently allocated NOK10.4 billion of that sum to the Northern Lights facility, the transport and storage component of the full-scale carbon capture and storage (CCS) Longship project. The state funding commitment provides certainty to upstream investors that seek to mitigate the net environmental impact of their offshore operations and signals broad political support of the oil and gas industry's efforts to contribute to Norway's climate goals. The government's decision to finance two-thirds of the NOK14.3-billion Northern Lights project reinforces its commitment to the development of the offshore CCS industry in collaboration with upstream players and confirms the state's leading role in advancing clean-energy initiatives on the Norwegian Continental Shelf (NCS). The remaining portion of the project cost (NOK3.9 billion) will be covered by the project partners - Equinor, Total, and Royal Dutch Shell. Parliament has also approved the funding of carbon capture facilities at the Norcem cement plant in Brevik and Fortum waste-treatment plant in Oslo, for which the government will provide around 75% of the total funding. The construction of the carbon capture plant in Brevik is starting in January with the view to commission the facility in the first half of 2024, while the implementation of the Fortum project is contingent on additional financing from private sources and potentially the European Union's Innovation Fund. (IHS Markit E&P Terms and Above-Ground Risk's Aliaksandr Chyzh)

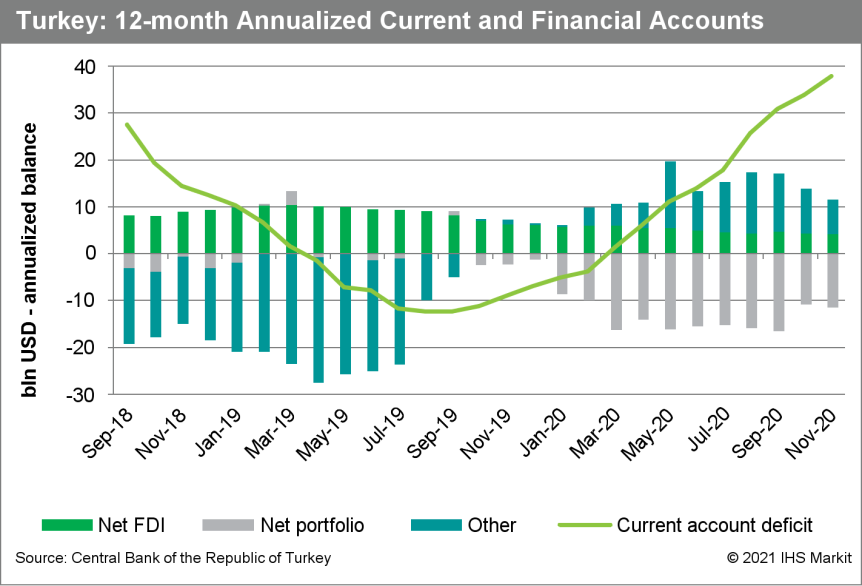

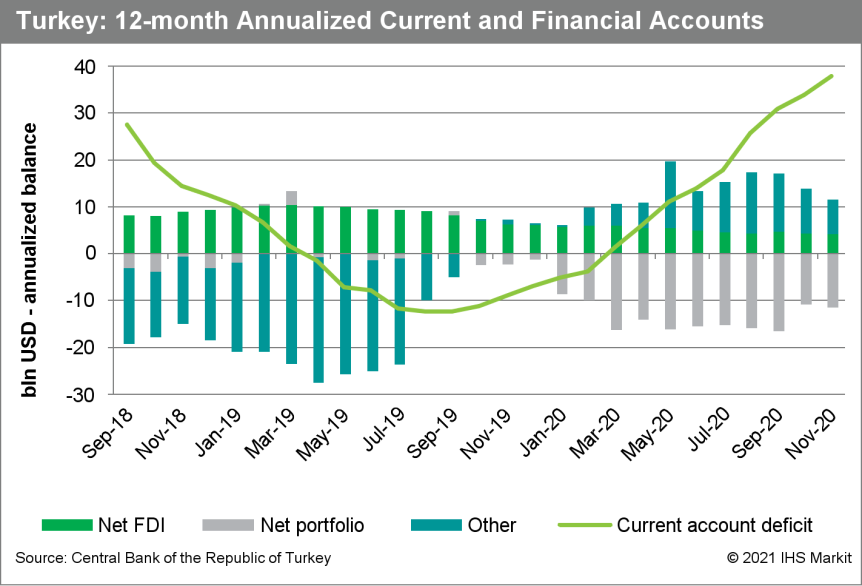

- Turkey attracted a net inflow of portfolio investment in November 2020, contributing to the lira rally from its early-month low-point. Soaring gold imports sent the current-account deficit surging, though. Tighter monetary policy in 2021 will reduce import demand, moderating the gap and maintaining net inflows of portfolio investment. (IHS Markit Economist Andrew Birch)

- For the second consecutive month, in November, portfolio investments flowed inward on a net basis to Turkey. In October, a public debt offering drew in USD2.5 billion. In November, equity securities drew the gross inflows, reflected by a rise in the Istanbul Bourse's main index over the month.

- Despite the net inflows in October-November, for the first 11 months of 2020 as a whole, Turkey suffered a severe loss of capital. In January-November 2020, net portfolio investment outflow topped USD10.6 billion, on track to be the largest year of net outflows since 2015.

- While a return of net portfolio investments is a positive development for Turkish external financing, the current-account deficit continued to soar in November, maintaining high pressure on the country's ability to meet external obligations. In November, surging demand for gold sent imports soaring, up 15.9% year on year (y/y).

- In 2020, IHS Markit estimates that Turkey's current-account deficit will have reached 5.6% of GDP, a drastic turnaround from the 1.1%-of-GDP surplus registered the previous year. Sustained expansionary economic policies kept import growth strong long after exports faltered in the face of collapsed demand from the European Union and other key trade partners.

- The combination of the current-account deficit and the net outflow of portfolio investment put tremendous upward pressure on the country's external debt and took a heavy toll on the lira, which was the second-worst performing major emerging market currency over the course of 2020 - bested only by the Brazilian real - losing 25% of its value against the dollar.

- The pivot to much more restrictive economic policies under the new central bank governor that began in November is likely to substantially limit import demand in both December and early 2021. The continued intensification of the current-account deficit should abate. However, sustained weakness of export demand will limit the improvement we expect. For the year as a whole, we anticipate that the current-account deficit will narrow to only around 4% of GDP.

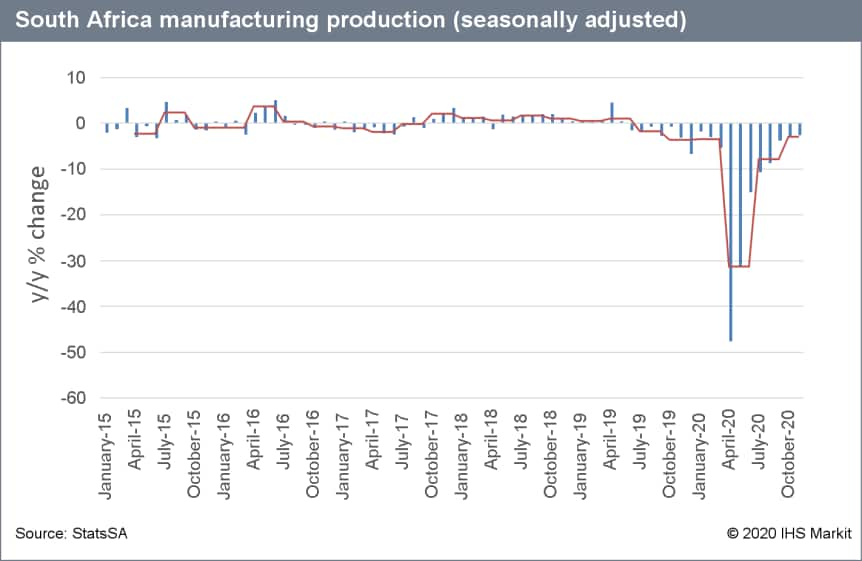

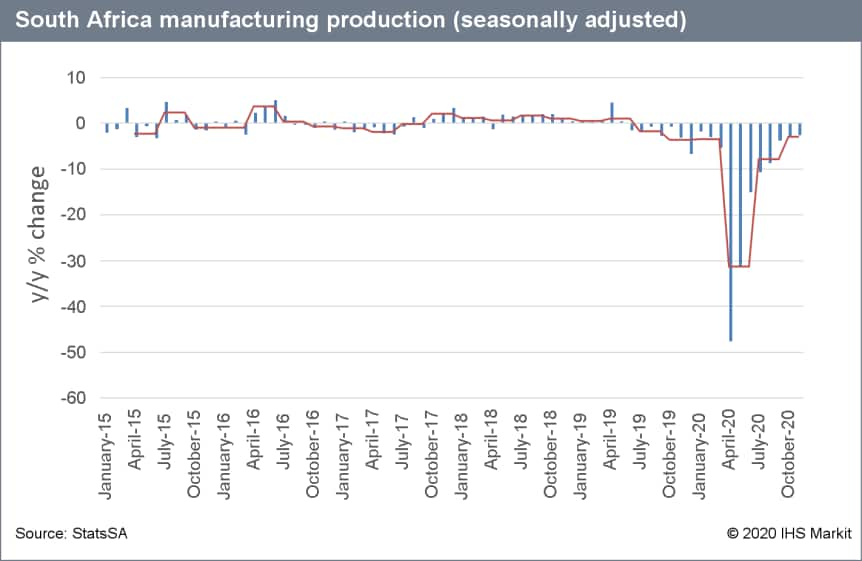

- South Africa's real seasonally adjusted manufacturing production slowed by 1.3% month on month (m/m) and 2.6% year on year (y/y) during November 2020, latest numbers of the Statistics South Africa (StatsSA) shows. This leaves overall manufacturing production down by 12.1% y/y for January-November 2020. (IHS Markit Economist Thea Fourie)

- The slowdown in manufacturing production was broad based. Sectors that recorded negative monthly changes during November included food and beverages (down 1.3%), petroleum, chemical products, rubber and plastic products (down 3.5%), motor vehicles, parts and accessories and other transport equipment (down 4.5%), furniture and other manufacturing (down 3.7%), glass and non-metallic mineral products (down 0.5%) and electrical machinery (down 2.7%).

- The radio, television and communication apparatus and professional equipment sub-sector recorded the strongest monthly gain and output increased by 5.3% m/m.

- IHS Markit has been of the view that manufacturing production could have lost some of its upward momentum during the fourth quarter of 2020. The opening up of the economy during the third quarter of 2020 following harsh COVID-19 virus-related lockdown measures introduced in the previous quarter lifted real seasonal adjusted manufacturing growth by 33.3% quarter on quarter (q/q) during the third quarter of 2020. A strong boost in manufacturing production during October will however balance some of the softer manufacturing production numbers expected over the November-December period.

- Sluggish domestic demand and a fall in production of key exporting goods such as motor vehicles, parts and accessories underline the sluggish manufacturing output during the fourth quarter of 2020. These drivers are likely to spill over to the first quarter of 2021. COVID-19 related lockdown measures introduced in some of South Africa's major exporting partners in the European Union over the December-January period combined with more stringent COVID-19-related local lockdown measures introduced before Christmas until 15 February underline this expectation.

- Togo has announced pineapple production of 30,150 tons in 2019, which represents an increase of nearly 12% from the 27,000 tons recorded in 2017, according to the latest government statistics. The sector, which employs more than 3,200 producers, generated over XOF6.0 billion (USD11.1 million) per year over the 2017-19 period. Togo processes some of the fruit into organic pineapple juice. In 2019, production was about 1.0 million liters (about 1,050 tons) of single-strength juice, 20% of which is organic and is mostly exported to Europe. Europe accounts for 60% of Togo's fresh and processed pineapple exports. Driven mostly by the growth of the pineapple industry and a rising demand for organic products, the number of businesses processing and exporting the fruit in Togo has risen from 30 to 50 in the 2017-19 period. Pineapple (the Cayenne and Brazza varieties) is mainly grown in the coastal and plateau regions (south and central regions). Besides juice production, it is also dried and used to make jam. IHS Markit's short-term sovereign risk assessment of Togo comments: "Our short-term sovereign credit risk rating is supported by Togo's membership of the West African Economic and Monetary Union and success in progressing on structural reforms in revenue administration and public financial management. "Progress has been made on collection of tax arrears and steps towards program-based budgeting. However, our rating remains constrained by the imbalance between exports and imports and high exposure and vulnerability to externalities, as the export base remains narrowly focused. With a weak financial system, Togo remains highly dependent on external assistance to meet its liquidity needs." Togo's real GDP growth is estimated at 1% in 2020 and forecast to be over 4% this year. (IHS Markit Food and Agricultural Commodities' Neil Murray)

Asia-Pacific

- APAC equity markets closed mixed; Japan +1.0%, South Korea +0.7%, Australia +0.1%, India -0.1%, Hong Kong -0.3%, and Mainland China -0.3%.

- China is considering allowing autonomous vehicle (AV) testing on highways, reports China Daily. The Ministry of Industry and Information Technology (MIIT) has published this proposal as a draft national guideline on its official website for public opinion. The draft guideline mentions that "provincial and municipal governments can select representative roads and regions, including highways, in their administrative areas" to test AVs. The draft regulation also allows unmanned vehicles to apply for road tests for professional use. The proposal is an update of a guideline released in 2018. Currently, in China there is no national regulation that allows AV testing on highways. This creates a barrier for tech companies towards the commercialization of AVs, especially autonomous trucks. The draft regulation also states that tech companies are eager to test their AVs in a wide range of scenarios, including expressways. Currently, Germany, the United Kingdom, South Korea, and Singapore have allowed AV testing on highways. China is pushing to commercialize autonomous smart vehicles, which is a key part of the country's 'Made in China 2025' plan. Recently, the country released the 'Technology Roadmap for Intelligent-Connected Vehicles 2.0', which expects vehicles with partial autonomous functions to account for 50% of new vehicle sales by 2025. Under this plan, new vehicles with Level 2 or Level 3 automation will represent 70% of new vehicle sales by 2030. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Automotive Research & Testing Center (ARTC) has developed Taiwan's first autonomous electric minibus, the WinBus, in collaboration with more than 20 industry groups. The WinBus has received a license for a one-year experimental "sandbox" operation in central Taiwan. Initially, the bus will undergo a two-month trial to collect technical and operational data, with the aim of beginning free shuttle services for the general public in June. The WinBus has Level 4 autonomous capabilities and is deployed with sensors such as camera, LiDAR, and radar. The autonomous minibus will travel along a 12.3-km fixed route under different scenarios, encountering pedestrians, traffic lights, and tricky junctions. ARTC president Jerry Wang said, "Under the sponsorship from [the] Department of Industrial Technology (DoIT) under MOEA [Ministry of Economic Affairs], ARTC has completed the construction of the WinBus and will continue to tie up with local partners for creating new and innovative business models that are crucial in future's self-driving vehicle industry development in Taiwan." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Seajacks Japan LLC, a wholly-owned subsidiary of Seajacks International, won a second contract with Kajima Corporation for wind turbine installation work at Akita Offshore Wind Corporation's 139 MW Akita Port and Noshiro Port wind farms located off Akita Prefecture, Japan. The work scope includes transportation and installation of 33 MHI Vestas V117-4.2 MW wind turbines. Wind turbine installation is expected to commence in 2022. Seajacks will deploy wind farm installation jackup Seajacks Zaratan for the scope, following foundation installation work which is to be completed in an earlier campaign from April to October. The projects will consist of 13 units of 4.2 MW wind turbines at Akita Port wind farm, 20 units of 4.2 MW wind turbines at Noshiro Port wind farm, and an onshore substation. The new contract represents a strengthening expansion for Seajacks into the emerging Asia-Pacific (outside of mainland China) wind market. The company secured its first contract for the Akita and Nasiro Port projects in March 2020, and has pocketed three installation contracts in the Taiwan offshore wind market since 2018. (IHS Markit Upstream Costs and Technology's Genevieve Wheeler Melvin)

- US-based electric vehicle manufacturer Tesla has incorporated a new subsidiary in India, called Tesla India Motors and Energy Private Limited. According to a report by the Times of India, the company was registered on 8 January in Bangalore. The company has three directors: Vaibhav Taneja, Tesla's chief accounting officer; Venkatrangam Sreeram; a Bengaluru-based startup entrepreneur; and David Feinstein, global senior director at Tesla. It is unclear whether the new company will undertake manufacturing, sales, or research and development (R&D). This latest development marks Tesla's first concrete move towards an Indian market entry. Tesla CEO Elon Musk indicated last month on Twitter that the automaker could enter the Indian market this year. According to previous reports by local media, customers will be able to order a Tesla car beginning from this month, with deliveries expected in June. It was also reported that Tesla's first product in the market would be the Model 3. According to IHS Markit light-vehicle data, the automaker could launch the Model X in the country first, with sales expected to reach 79 units this year. This will be followed by the Model 3 and Model Y in 2022. (IHS Markit AutoIntelligence's Isha Sharma)

- The Thai government has announced a stimulus package worth THB210 billion (USD7 billion) to counter the COVID-19-induced blow on the domestic economy. (IHS Markit Economist Jola Pasku)

- The latest proposal came in response to the biggest wave of COVID-19 infections domestically since the pandemic began in 2020. The authorities confirmed a daily record of 754 new infections last week that were spread across several provinces, including Bangkok. The new surge in infections prompted localized containment measures, but the government has so far refrained from imposing a strict national lockdown.

- The stimulus package that is up for approval on 19 January includes fiscal measures and loan programs. A monthly cash stipend program starting in February will distribute THB3,500 per month to about 30 million people working in the informal and farming sectors. State-funded programs to boost domestic spending and tourism may also be extended after current virus curbs are lifted.

- The government has also directed state-owned banks to boost liquidity to businesses and farmers affected by the new wave of infections. Sizeable loans ranging from THB5 billion to THB20 billion will be extended to farmers, exporters, importers, and small businesspeople.

- The price of electricity and water will be reduced for two months, and the land and building taxes will be cut by 90% for another year to ease the burden on the population.

- The latest stimulus package will soften the shock from the new wave of infections, but is likely to fall short from expediting Thailand's economic recovery in the short term. The short-term outlook for Thailand's economy remains grim, and a full recovery in 2021 is highly unlikely at this point. Thailand's economic recovery will probably depend on how rapidly the country can inoculate its population and when the tourism industry can return to pre-COVID-19-crisis trends.

- Despite being a production hub for AstraZeneca (UK), Thailand has yet to secure sufficient COVID-19 vaccine doses for its citizens. The country has so far secured about 26 million doses from those that will be produced domestically, which are set to be delivered in June 2021.

- The Bank of Thailand released a Thai-language press statement on 12 January extending the loan moratorium for retail borrowers by six months to the end of June 2021, from the original deadline of 31 December 2020. Additionally, the notice specified that debt restructuring, such as turning unsecured loans into term loans; working capital disbursements; and delaying repayment of micro, small, and medium-sized enterprise (MSME) loans as part of the soft loan package will continue. (IHS Markit Banking Risk's Angus Lam)

- The Bangkok Post has released further detail, stating that unsecured personal loans, including credit card loans, can be transformed into a term loan or rescheduled into a 48-month loan, with interest rates capped at 12% for credit cards and 22% for personal loans. At the same time, financial institutions are allowed to lower the monthly repayment of "car-title" loans by 30% and cap the interest rate at 22%.

- Other neighboring countries, such as Malaysia, have also extended their loan moratorium for some sectors of the economy, such as low-income households, instead of a blanket loan moratorium.

- The loan moratorium for households follows previous announcements allowing banks to convert unsecured loans into secured loans and term loans, which was reiterated in this latest announcement. IHS Markit expects that this will have an impact on banks' profitability, but will lower capital pressure from higher non-performing loans.

- Our main concern is in line with our previous assessments regarding extending the MSME loan moratorium and that this will continue to delay the rise of NPLs and hide credit risk in the meantime. Overall, considering that the loan moratorium for MSMEs and retail customers will expire in June, depending on economic recovery and progress, further extension is unlikely.

Posted 13 January 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.