All major US and most European equity indices closed lower, while APAC markets were mixed. US and benchmark European government bonds closed sharply higher. European iTraxx closed slightly tighter across IG and high yield, CDX-NAIG was flat, and CDX-NAHY was slightly wider on the day. The US dollar, gold, and silver closed higher, while copper, oil, and natural gas were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower; DJIA -0.9%, S&P 500 -0.9%, Nasdaq -1.4%, and Russell 2000 -1.4%.

- 10yr US govt bonds closed -7bps/1.42% yield and 30yr bonds -8bps/1.80% yield.

- CDX-NAIG closed flat/53bps and CDX-NAHY +3bps/308bps.

- DXY US dollar index closed +0.2%/96.32.

- Gold closed +0.2%/$1,788 per troy oz, silver +0.6%/$22.33 per troy oz, and copper -0.1%/$4.28 per pound.

- Crude oil closed -0.5%/$71.29 per barrel and natural gas closed -3.3%/$3.79 per mmbtu.

- In a new guidance issued to US embassies on 10 December, the Biden administration has outlined a policy that "rules out" US government discussion or support of new unabated or partially abated coal generation projects worldwide also restricts engagement on some natural gas projects, and this has raised concern in the LNG export industry. The guidance takes effect immediately. (IHS Markit PointLogic's Kevin Adler)

- The message to the embassies describes the document as an interim guidance that builds on Biden's Executive Order 14008 on 27 January 2021 that "promotes ending international financing of carbon-intensive fossil-fuel based energy" and "intensifying international collaborations to drive innovation and deployment of clean energy technologies."

- "The Interim Guidance seems, on initial review, to be what we have been expecting since it was first announced right after the Inauguration—a tightening of the rules on fossil fuel engagement abroad with some limited exceptions," said Fred Hutchison, president of LNG Allies, in an email. "However, as is true with any broad guidance document, it is tough to judge how this will affect foreign LNG and natural gas infrastructure development until specific projects are brought forward for US government support."

- The LNG industry has benefited from government support such as loan guarantees for LNG import terminals and funding of feasibility studies in other countries to assess the use of natural gas to meet energy and environmental needs.

- The guidance covers any engagement in which US government expenditure is more than $250,000.

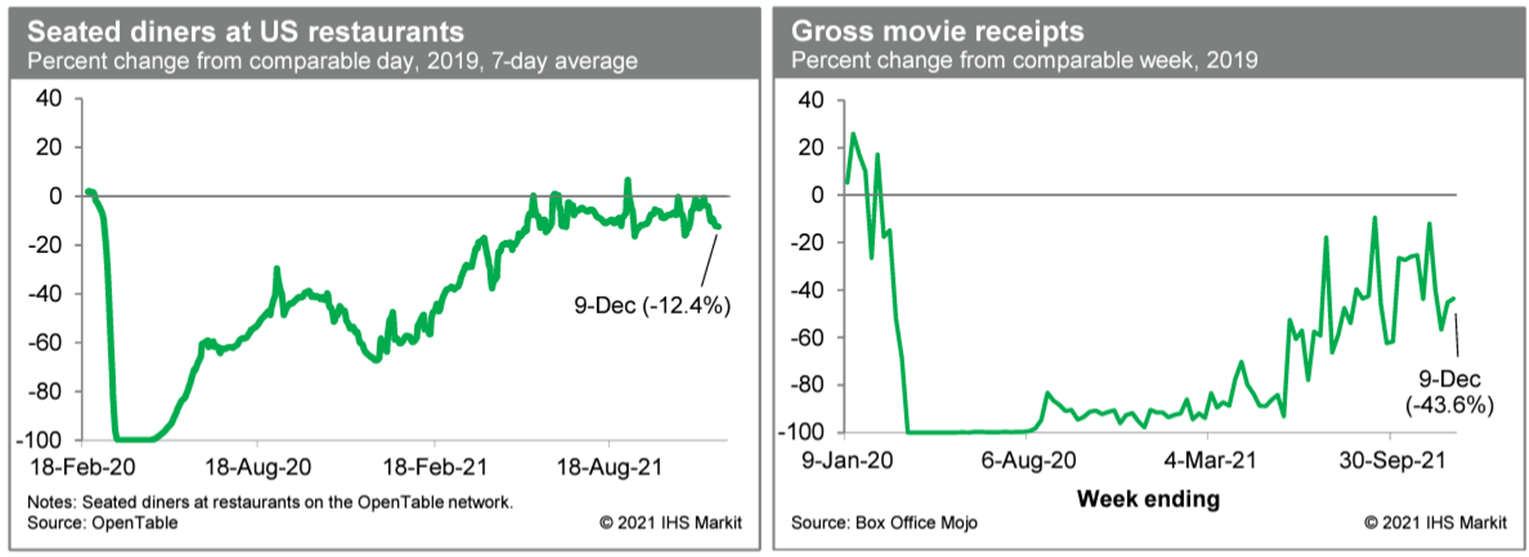

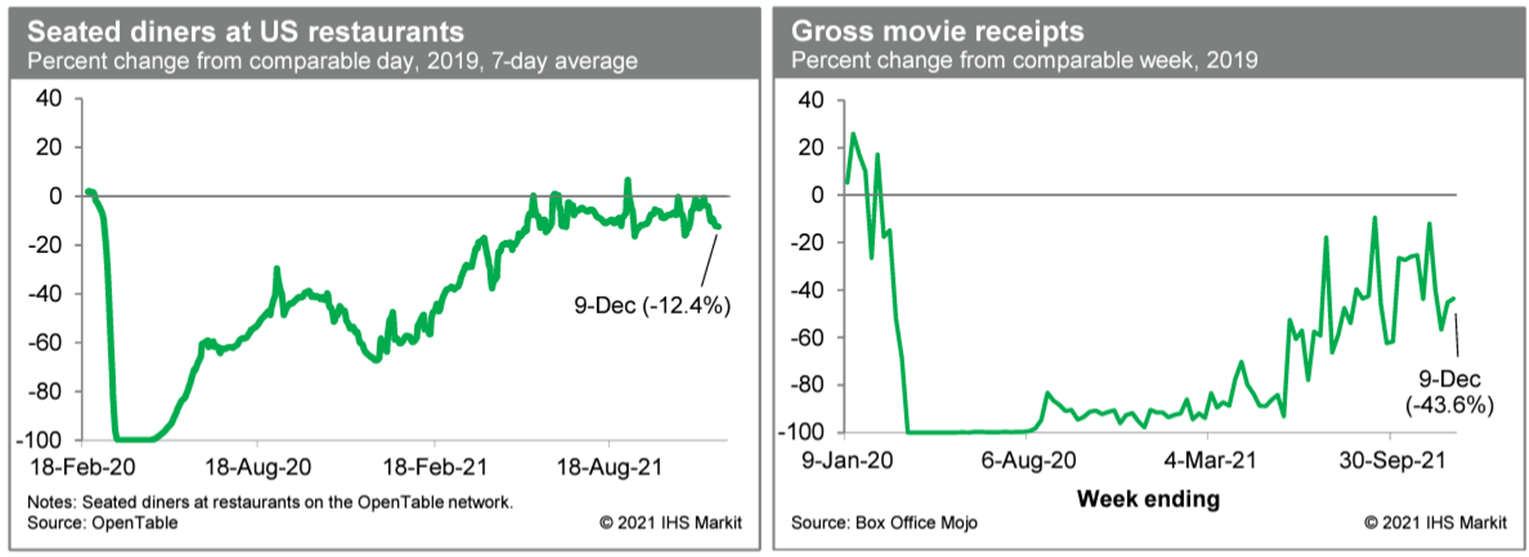

- Averaged over the seven days ending last Thursday, the count of US seated diners on the OpenTable platform was 12.4% below the comparable period in 2019. This is at the lower end of a recent range. Meanwhile, box-office revenues last week were 43.6% below the comparable week in 2019. The last three weekly readings have been materially below late summer averages, perhaps indicating some pullback on the part of would-be moviegoers. (IHS Markit Economists Ben Herzon and Joel Prakken)

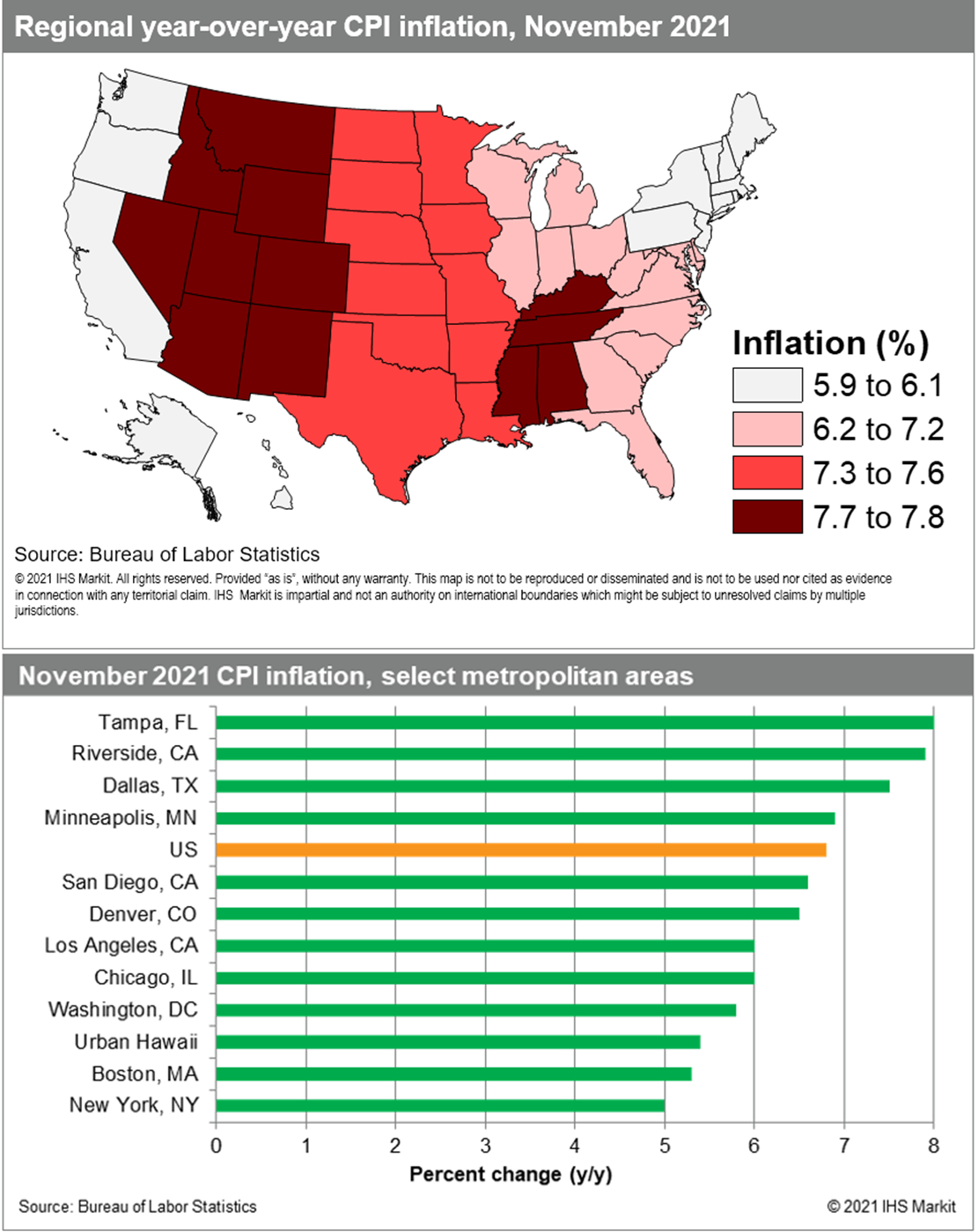

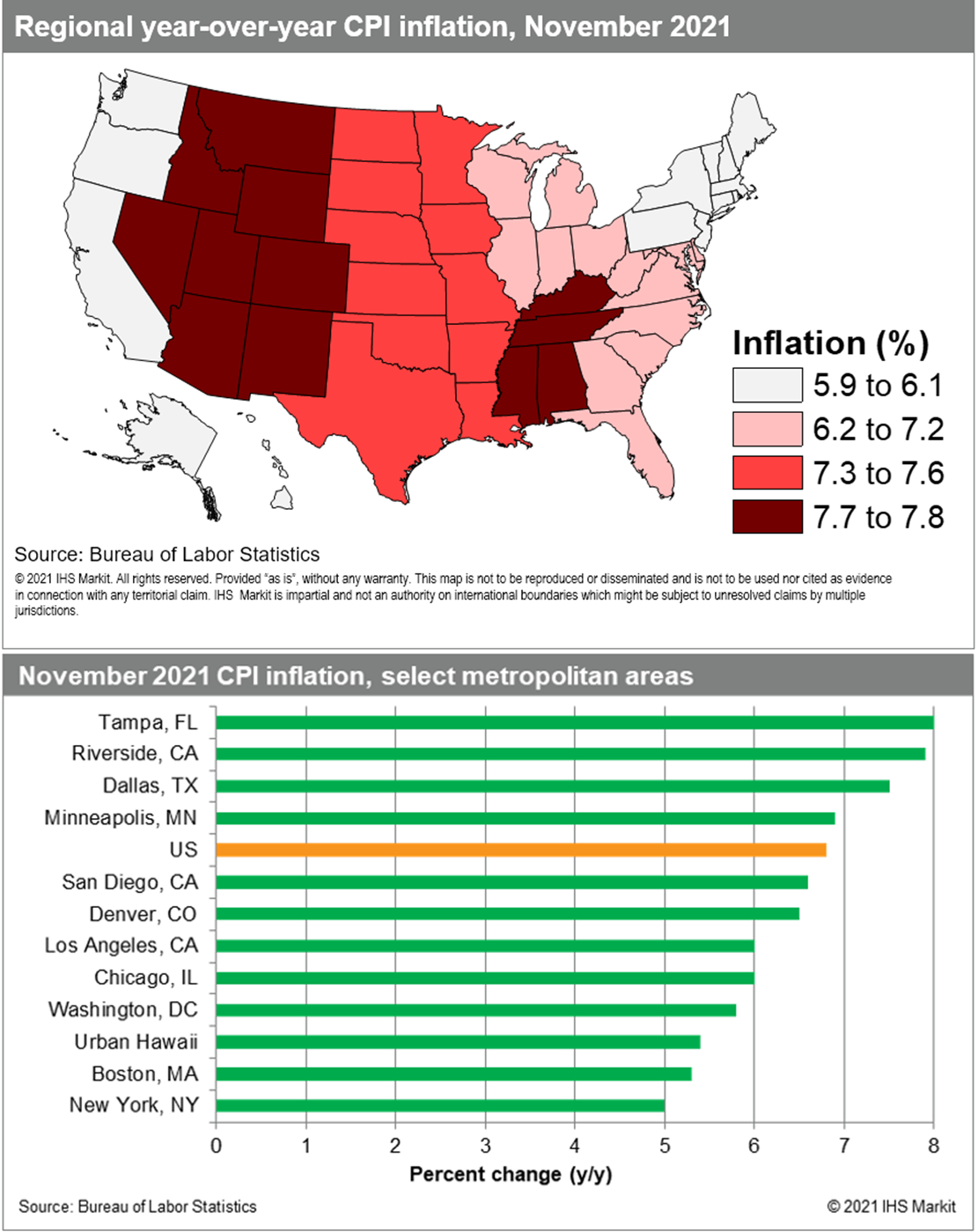

- The overall US Consumer Price Index (CPI) rose 6.8% year over year (y/y) in November, the fastest pace since 1982. As they have in recent months, supply chain disruptions and sharp increases in food and energy prices continued to drive up consumer prices nationwide. Excluding food and energy (which saw prices rise 6.1% and 33.3% y/y, respectively), the core CPI rose 4.9% y/y in November, with a 19.2% increase in transportation costs (excluding gasoline) and a 3.8% rise in shelter prices driving topline growth. (IHS Markit Economist Francis Hagarty)

- Regionally, prices rose most rapidly in the Plains and South. The East South Central region experienced the greatest surge, 7.8% y/y in November, with the Mountain and West North Central regions not far behind at 7.7% and 7.6%, respectively. The states in these regions are less densely populated than other parts of the country, and consequently their residents are among the most car-dependent for transportation given longer commuting distances and fewer public transit options. Because of this outsized car reliance compared with the rest of the country, transportation costs have above-average weights in the respective CPI baskets of these regions, meaning the 58% y/y surge in gas prices in November, and 18.4% jump in vehicle prices, also had an outsized impact.

- The Northeast and Pacific states saw lower CPI inflation than the nation overall in November. The consumer indices in these regions are less influenced by the steep rise in transportation costs and more heavily weighted toward services, which saw prices grow a more modest 3.8% y/y in November. Shelter costs increased less steeply than average in these areas as well, growing 3.1% in the Northeast and 2.3% y/y in the Pacific compared with the 3.8% increase seen nationally.

- Among the metropolitan areas with consumer prices indices measured by the Bureau of Labor Statistics (BLS), recent CPI inflation has been highest in fast-growing cities with competitive housing markets, with Tampa, Riverside, and Dallas seeing exceptional price level increases of at least 7.5% y/y in November. Among the 12 metropolitan areas reported by the BLS in November, these three cities also saw the largest rise in housing prices compared with year-earlier levels. While November data is not available for Atlanta and Phoenix, they had experienced similar above-average CPI inflation through October, driven by sizable increases in housing costs.

- Lower battery costs will drive consumers to buy more electric vehicles (EVs) and allow US automakers to meet President Joe Biden's goal of 50% light vehicle sales electric by 2030, according to a General Motors (GM) official. (IHS Markit Net-Zero Business Daily's Amena Saiyid)

- A battery is the single most expensive component of an EV, making up at least 30% of a vehicle's retail price.

- "From an automaker perspective, I would say battery costs, battery costs, battery costs," said Michael Maten, senior strategist for GM on EV and energy policy, when asked about the key obstacle to greater EV adoption.

- "Right now, battery costs are the significant barrier, but they are coming down. But they need to come down much further," Maten emphasized, as he spoke about the state of EVs in the US during an online panel discussion held 8 December.

- The discussion, which was jointly held by the nonpartisan, nonprofit Our Energy Policy and law firm Schiff Hardin, was spurred by Biden's goal to make half of all new passenger cars and light-duty vehicles sold in 2030 zero-emissions vehicles, including battery electric, plug-in hybrid electric, or fuel cell EVs.

- Transportation was responsible for 1,875.73 million mt of GHG emissions in 2019, 29% of the US total, with light vehicles (passenger cars and light trucks including sports-utility vehicles) contributing 59% of that total.

- The transition to battery-powered EVs offers the greatest opportunity for US automakers to reduce their emissions. The US Bureau of Statistics said new light vehicle sales totaling 14.47 million units in 2020 accounted for 98% of total vehicle sales in 2020, according to Statista.

- General Motors (GM) is said to be considering investments into electric vehicle (EV) and battery manufacturing in the US state of Michigan, according to media reports from Crain's Detroit Business and the Wall Street Journal (WSJ), supplemented by Automotive News. All report that GM and its battery partner LG Energy Solution are considering a new battery cell plant near GM's Lansing Delta Township Assembly plant, in Michigan, and with a potential USD2.5-billion price tag and 1,200 jobs. The battery cell plant would be through the GM and LG Chem Ultium Cells joint venture (JV), with the investment split 50/50 between the two partners. In addition, the WSJ has reported that GM is planning a USD2-billion upgrade to its Orion, Michigan, EV assembly plant. The report suggests that the plant would be revamped from building the current Bolt EV and the Bolt electric utility vehicle (EUV) to a next-generation electric pick-up on the Ultium platform. The information on the battery cell plant reflects an Ultium Cell JV tax exemption document filed with the City of Lansing, Michigan; the document reportedly outlines a four-year construction timeline to be completed by 31 December 2025. Related to the potential Lansing battery plant investment, Automotive News quoted president and CEO of the Lansing Economic Area Partnership Bob Trezise as saying that GM has "not made any decisions at all…there are no guarantees. These are just proposals that are part of a fiercely competitive process". A GM spokesperson was quoted as saying, "GM is developing business cases for potential future investments in Michigan...We are not going to speculate or disclose additional details of the projects under consideration beyond any information included in public filings. These projects are not approved and securing all available incentives will be critical for any business case to continue moving forward." (IHS Markit AutoIntelligence's Stephanie Brinley)

- Media reports suggest that Rivian may announce the site selection for its second electric vehicle (EV) assembly and battery plant this week, and that the US state of Georgia is tipped to be the location. Bloomberg sources have said that Georgia has been selected "provisionally" and that no agreement has been signed, and the outlet suggests that Rivian will make an announcement on 16 December. Rivian has declined to comment. It is not clear if Georgia will ultimately be selected; earlier reports have indicated that Rivian was looking at Texas and Arizona as well. For now, IHS Markit light-vehicle production forecast reflects the expectation that Texas would be selected, although future forecast rounds would be updated as necessary. This is also not the first report suggesting that Georgia is in the running. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Brazilian digital bank Nubank raised USD2.6 billion in its initial public offering (IPO) in the New York Stock Exchange (NYSE) on 8 December. Based on the result, Nubank would be valued by stockholders at over USD41.5 billion, making it Latin America's listed institution with the largest market capitalization. According to the bank's founder, the proceeds will be used to expand growth in the bank's branches in Mexico and Colombia. (IHS Markit Banking Risk's Alejandro Duran-Carrete)

- It is positive news for the Brazilian sector since it will increase competition and is likely to incentivize traditional banks to improve their digitalization strategy. However, the financial technology (fintech) sector is still at an early stage of development in Latin America and will face several challenges, especially from a regulatory and profitability standpoint, before representing a structural change to the region's banking sectors.

- Nubank has been rapidly growing in Brazil, benefiting from the large digitalization of financial customers in the country as well as from Brazil's rigid and expensive traditional banking sector.

- However, the bank has been struggling to generate substantial revenues - a relatively common feature in the fintech sphere - given its lack of credit penetration, focused almost only on credit cards. This has resulted in the bank mostly allocating its assets into securities (44.8% of its total assets as of end-2020), mostly Treasury notes, or interbank lending (18.5% of its total assets as of end-2020), which have generated low revenues. As a result, Nubank has been unable to become profitable since its creation in 2013.

- Additionally, traditional banks are likely to deter the entrance of new competitors through the acquisition of rising fintech banks or through the push for a tighter regulatory framework, as in the case of Argentina (see Argentina: 23 July 2021: Increasing tensions between banks and fintech to contain diversification within Argentine banking sector). These moves would result in either a segregated and small fintech sector or a banking sector similar to what IHS Markit has observed in the region, but with some digital services for operational improvement.

Europe/Middle East/Africa

- Most major European equity indices closed lower except for Germany flat; Spain -0.5%, Italy -0.6%, France -0.7%, and UK -0.8%.

- 10yr European govt bonds closed higher; Germany/Italy/Spain/UK -4bps and France -3bps.

- iTraxx-Europe closed -1bp/52bps and iTraxx-Xover -2bps/258bps.

- Brent crude closed -1.0%/$74.39 per barrel.

- According to the results of a real-world analysis carried out by the UK Health Security Agency, a booster dose of Pfizer/BioNTech's Comirnaty (tozinameran) provides a significant boost in protection against the Omicron variant for people who have received two doses of Comirnaty or two doses of the AstraZeneca / Oxford University (both UK) COVID-19 vaccine Vaxzevria. The analysis involved 581 people confirmed as having been infected with the Omicron variant. The analysis found that protection against symptomatic Omicron infection increased to 70% with a Comirnaty booster in people who had initially received two doses of Vaxzevria, while the Comirnaty booster increased protection to 75% for people who had received two doses of Comirnaty previously. This compares with protection of around 90% against the Delta variant, after a booster vaccination. Results of another study carried out in Israel add weight to the evidence for booster vaccinations to protect against the Omicron variant. The study, carried out by the Sheba Medical Centre and the Central Virology Laboratory of the Ministry of Health, involved an investigation of the serum of healthcare workers, divided into two groups. One group had received two doses of Comirnaty, the second dose having been administered five to six months previously, while the other group had received booster doses one month ago. The investigation found that while the former group had almost no ability to neutralize the Omicron variant, the boosted group showed a significant increase in neutralizing ability (around a hundred times more than the non-boosted group). This was still estimated to be four times lower than the neutralization ability shown against the Delta variant, however. (Life Sciences by GlobalData's Brendan Melck)

- Vauxhall is planning to launch a variant of its battery electric Vivaro-e light commercial vehicle (LCV) that features a hydrogen fuel cell range extender in the UK during the next couple of years. Vauxhall managing director Paul Willcox has been quoted by Autocar as stating, "We're already in contact with UK fleet operators that want to go the extra mile on sustainability, and we look forward to bringing Vivaro-e Hydrogen to the UK soon." In a separate statement, the brand added that it "expects right-hand drive vehicles to arrive from early 2023". Separately, The Telegraph Online reports that UK telecoms provider BT is in talks with Vauxhall with regards increasing the availability of the Vivaro-e to expand its fleet of electric LCVs. Willcox told the newspaper, "BT Openreach has already ordered 270 all-electric Vauxhall Vivaro-e from us and we are in discussion with them for supply of further electric vans. We support the work of the electric vehicle fleet accelerator group in buying British-built electric vans and are keen to work with both them and the UK government on how we can bring the electric Vivaro-e production to our Luton [UK] plant." The announcement regarding plans to bring the hydrogen fuel cell range extender Vivaro to the UK coincides with Vauxhall's sister brand Opel completing production of the first Vivaro-e Hydrogen which will be supplied as a field service van to domestic appliance manufacturer Miele in Germany. This variant is planned to be offered as an alternative to the Vivaro-e in providing zero-emissions in use, but offering a long driving range and faster refueling. (IHS Markit AutoIntelligence's Ian Fletcher)

- The use of robotics in food and beverage manufacturing is increasing. This is the observation of ING Bank in its article 'Robots extend reach in the food industry', based largely on research by the International Federation of Robotics (IFR). The IFR forecasts that new robot installations across all industries will increase by 6% per year in the coming three years. (IHS Markit Food and Agricultural Commodities' Julian Gale)

- Food manufacturing is expected to contribute to this growth. It is likely that not only the number but also the diversity of robots in food processing plants will become greater.

- The total global operational stock of robots grew by 8,600 in 2020, according to the latest data from the IFR. As a result of the continuous growth, robot stock has almost doubled since 2014. Most of the newly installed robots among food manufacturers in 2020 was destined for the EU (27%), China (26%) and the US (22%). While robots are becoming more common in food manufacturing, their presence is limited to a minority of businesses with, for example, only one in 10 food producers in the EU currently making use of robots.

- In 2020, food manufacturers in the US employed on average 89 robots per 10,000 employees, compared with 75 in the EU-27 in 2020. However, within the EU there are considerable differences between countries with robots being much more common in countries such as the Netherlands, Denmark, Sweden and Italy.

- The rise of robotics in the food industry is not limited to the industrial robots in food manufacturing. According to IFR data, more than 7,000 agricultural robots were sold in 2020, an increase of 3% compared with 2019. Within agriculture, milking robots are the biggest category but only a fraction of all cows in the world are milked this way. Moreover, there is a lot of activity around robots that can harvest fruit or vegetables.

- Volkswagen's (VW) software unit Cariad and automotive supplier Bosch are reportedly nearing a deal to collaborate on automotive software. According to a report by Reuters, VW is planning to invest a triple-digit-million euro amount as part of the deal. To create new revenue streams in the future, carmakers are increasingly focusing on software-related services for vehicles. VW has been in pursuit of a digital model for several years, laying the groundwork through a number of initiatives. Recently, it launched the ACCELERATE strategy to transform itself into a software-driven mobility provider. VW has bundled all its software efforts into one unit, Cariad, which will power passenger vehicles that will be "Level 4 ready" by 2025. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Netherlands-based contract vehicle manufacturer VDL Nedcar is said to be in the running for European production of Rivian products. De Gelderlander has reported that this unit has been linked with a possible sale to the startup automaker and investment in the site. The Ministry of Economic Affairs is also being linked to discussions with the startup automaker about production in the Netherlands. However, while the previous minister of economic affairs, Eric Wiebes, said that the government would help VDL Nedcar find a replacement for the BMW X1 that it will lose in 2023, the ministry would not be drawn on whether it would be Rivian. Indeed, a spokesperson for the current Minister of Economic Affairs Stef Blok said, "We would of course like to see Rivian come to the Netherlands. The government is committed to this, as it is to attracting other foreign investments in our country. We cannot comment on the nature and content of these contacts because of their confidentiality." (IHS Markit AutoIntelligence's Ian Fletcher)

- Volvo Cars has announced that it has been hit by a cyberattack that has stolen some of its research and development (R&D) data. In a statement released on 10 December, the automaker said it "has become aware that one of its file repositories has been illegally accessed by a third party. Investigations so far confirm that a limited amount of the company's R&D property has been stolen during the intrusion. Volvo Cars has earlier today concluded, based on information available, that there may be an impact on the company's operation." The automaker added that on detection of the cyberattack, it "immediately implemented security countermeasures." It is now "conducting its own investigation and working with third-party specialist to investigate the property theft." (IHS Markit AutoIntelligence's Ian Fletcher)

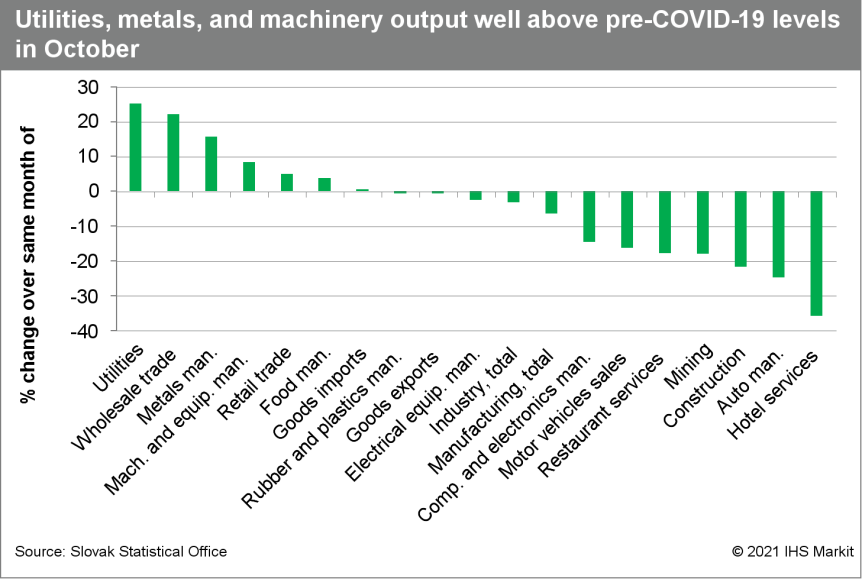

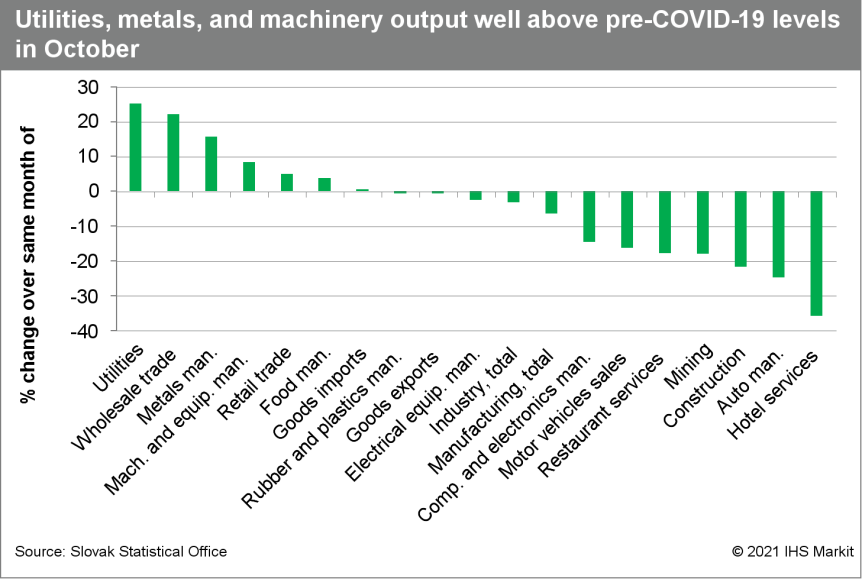

- Slovak working-day-adjusted industrial output fell 0.6% year on year (y/y) in October, improving over September's decline of 4.8% y/y. In seasonally adjusted terms, output jumped 3.0% month on month (m/m). (IHS Markit Economist Sharon Fisher)

- Manufacturing and mining continued to have a negative impact on overall industrial output, although the drop in manufacturing was considerably less steep in October than in September. Utilities production increased rapidly in October, which marked the third straight month of double-digit growth.

- Within manufacturing, supply-chain bottlenecks meant that transport equipment continued to have a strongly negative impact on overall growth, but the decline (at 20.9% y/y) was milder than in August and September. On the other hand, machinery and equipment and metals recorded double-digit gains.

- By industrial groupings, output of capital goods and consumer durables fell 8.9% and 7.0% y/y, respectively. In contrast, production of energy, non-durables, and intermediate goods increased.

- The improving manufacturing results were reflected in Slovakia's foreign trade performance, as goods exports fell 2.3% y/y in October, after a 4.8% y/y decline in September. Growth in goods imports decelerated to 4.9% y/y - the weakest figure since February - signalling that the negative impact of net exports could be less dramatic in the fourth quarter than in the previous period.

Asia-Pacific

- Major APAC equity indices closed mixed; Japan +0.7%, Mainland China +0.4%, Australia +0.4%, Hong Kong -0.2%, South Korea -0.3%, and India -0.9%.

- China's Shaoxing City locked down its Shangyu District unexpectedly on Dec. 10 to conduct large-scale COVID-19 tests, sources told OPIS over the weekend. Shangyu District was locked down last Friday, after Shaoxing City declared its highest level of emergency Covid response on Thursday, said sources from nearby Ningbo and Hangzhou cities. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- There are no known polyester or upstream plants in Shangyu District.

- Shaoxing City is home to Reignwood, a 3.2 million mt/yr purified terephthalic acid (PTA) producer. The company's main 1.4 million mt/yr unit shut on March 6 this year for maintenance, but never restarted. It also has three lines with 600,000 mt/yr each, but these have idled for years.

- Polyester plants based in Shaoxing City include Guxiandao, Hengming, Jiabao, Jinxin, Juxing, Luyu, Guxiandao, Rongsheng, Tiansheng and Yongsheng. These account for around 7% of China's total 62 million mt/yr production.

- Keqiao and Binhai Districts in Shaoxing host crucial downstream printing and dyeing mills. These have not been locked down, but are impacted by the city-wide emergency measures and could suffer logistical problems.

- BAIC has increased its stake in Daimler to 9.98%, according to a company statement. The statement said that BAIC has actually held the stake since 2019. Daimler owns a 9.55% stake in BAIC's Hong Kong SAR-listed unit BAIC Motor, as well as a stake of 2.46% in the Shanghai-listed BAIC BluePark. According to an agreement between both parties, BAIC has confirmed that it will not raise its stake in Daimler any further. Commenting on the stake increase, Daimler CEO Ola Källenius said, "We welcome all long-term strategic shareholders who support our strategy. During our partnership with BAIC, China has emerged as the largest global market for Mercedes-Benz and as a key driver of the shift towards electric mobility and digitalization. BAIC's shareholding is a reflection of their commitment to our joint successful manufacturing and development alliance in the world's biggest car market." The Chinese state-owned BAIC has been Daimler's main partner in China since 2003 and operates Mercedes-Benz factories in Beijing through Beijing Benz Automotive. (IHS Markit AutoIntelligence's Tim Urquhart)

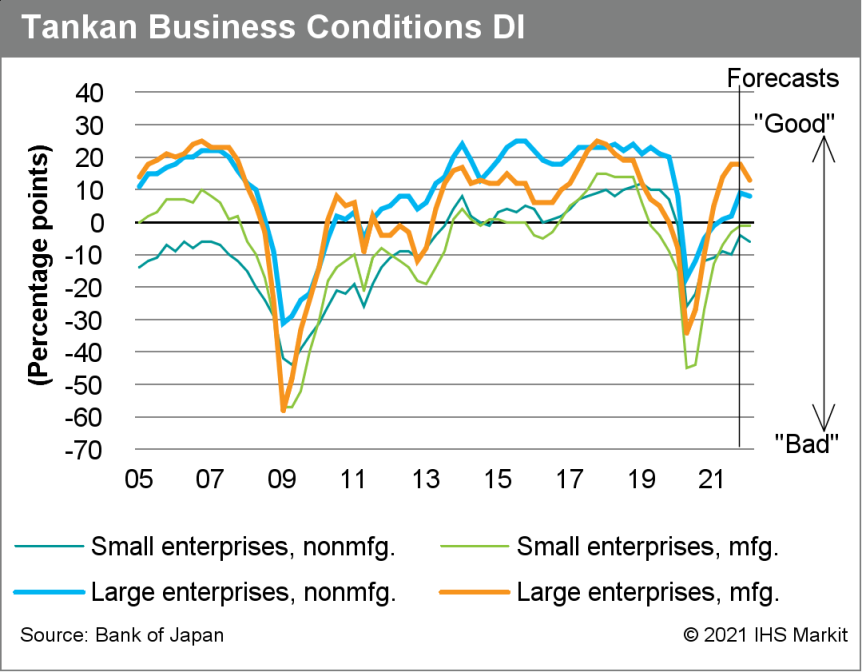

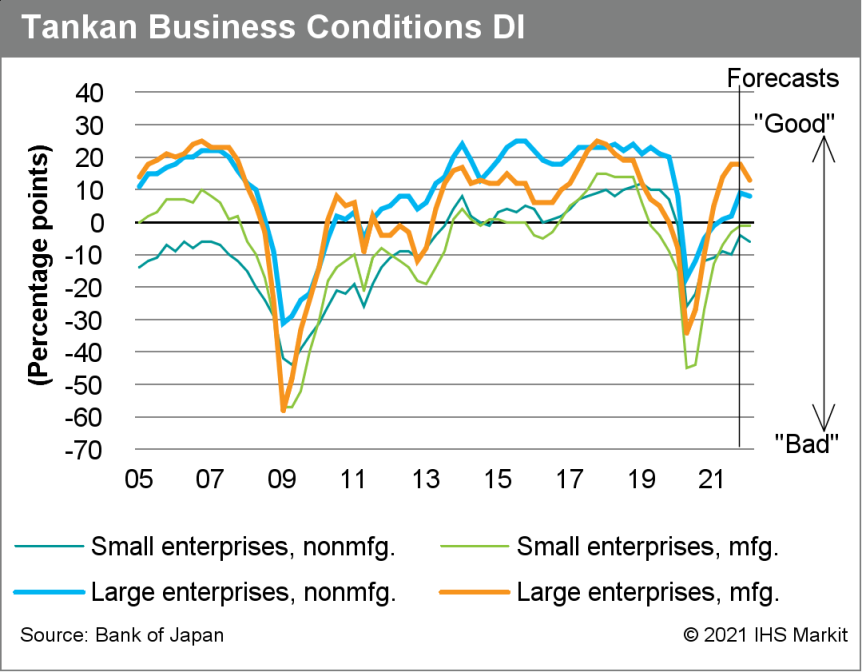

- The diffusion index (DI) of current business conditions for large non-manufacturing groupings in the Bank of Japan's December Tankan Survey has risen by 7 points to 9. Although this was the highest level in eight quarters, it remains below the pre-COVID-19-virus pandemic level. The improvement was driven by softer declines in the DIs of personal services (up by 36 points to -9) and accommodation/eating and drinking services (up by 24 points to -50), reflecting easing containment measures to counter COVID-19 Delta variant cases. The high level of the DIs for information services (34) and communication (29) suggests the continued expansion of businesses related to digitalization. (IHS Markit Economist Harumi Taguchi)

- The DI of current business conditions for large manufacturing groupings held at the September level at 18. Although the DIs for supply and demand conditions suggest that domestic and external demand have improved from September, the DIs for changes in output and input prices indicate higher input costs relative to increases in output prices weighed on business conditions for manufacturers. The conditions for both small manufacturing and non-manufacturing groupings improved (up 2 points to -1 and up 6 points to -4, respectively), but remain in negative territory, pointing to a lagging recovery for small enterprises.

- Despite the improvement in current conditions, outlooks for the coming three months remain sluggish. The DIs for future business conditions for large manufacturing and non-manufacturing fell by 5 points and 1 point, respectively, with expectations of softer domestic and external demand. Although manufacturers expect input price increases to ease slightly, they believe that it will be difficult to increase output prices. The DI for future business conditions for small manufacturing held at the current level while the DI for small non-manufacturing fell by 2 points from the current level. Small enterprises also expect softer domestic and external demand over the next three months, although they anticipate higher output prices relative to large enterprises.

- Fixed investment plans (including software, research and development, excluding land) for all enterprises were revised down by 0.8 percentage point to an 8.5% y/y rise in FY2021/22. Planned investment in machinery and equipment was unchanged from the previous survey at a 7.9% rise, but investment plans for software and research and development were revised down by 0.7 percentage point to 13.5% and by 0.3 percentage point to 5.4% y/y, respectively.

- Japan's private machinery orders (excluding volatiles) - a leading indicator for capital expenditure (capex) - rose by 3.8% month on month (m/m) in October following two consecutive months of decline. Orders from non-manufacturing rose by 16.5% m/m, which offset a 15.4% m/m drop in orders from manufacturing. (IHS Markit Economist Harumi Taguchi)

- Orders from the public sector increased solidly, by 46.4% m/m, following a 23.8% m/m drop in the previous month. Orders from overseas also rebounded, with a 17.2% m/m rise after two consecutive months of decline.

- The solid increase in orders from non-manufacturing largely reflected surges in orders from transport and postal services (up 170.1% m/m) and retail services (up 117.2% m/m), and rebounds in orders from agriculture, forestry and fishing, and finance and insurance. The weakness in orders from manufacturing was due largely to declines after surges in orders from chemical and chemical products, and non-ferrous metals.

- Tesla has received the homologation certification for three more models, reports The Hindu Business Line. The total count of the approved Tesla models by India's vehicle testing and certification agencies in the country is seven. Homologation as a process includes certifying a particular vehicle as roadworthy in a country after it meets all the specified criteria. In August, Tesla Inc. received approval to make or import four models in India by the Ministry of Road Transport and Highways. The four Tesla models have been certified as roadworthy. (IHS Markit AutoIntelligence's Tarun Thakur)

- Olectra Greentech plans to set up a manufacturing plant for electric buses in Hyderabad. According to a report by ET Auto, the company will invest over INR6 billion (USD79 million) in the facility, which will have capacity of 10,000 units and will be spread over 150 acres. The facility will also manufacture electric three-wheelers and trucks. Olectra Greentech, previously called Goldstone Infratech, entered the EV segment in 2016 by forming a joint venture (JV) with BYD Auto Industry Co Ltd. The report added that the company currently has won orders for nearly 2,000 electric buses worth INR3-3.5 billion, which it plans to supply in the over a year. The company will look to enter the electric truck market as well in partnership with a truck-maker and is already in talks with BYD to collaborate on electric passenger cars. (IHS Markit AutoIntelligence's Isha Sharma)

- Vietnam's Vingroup, the owner of automaker VinFast, has announced the construction start of its first battery cell plant; the project itself was announced in October. In a statement emailed to IHS Markit, Vingroup said that construction of its VinES Battery Manufacturing Factory has officially begun. The plant will provide lithium-ion batteries for VinFast electric vehicles (EVs), with phase one including a casting shop, a welding shop, and a packaging (battery pack) shop designed to produce 100,000 battery packs per year. Phase two, Vingroup said, will expand production to include battery cells and upgrade capacity to 1 million battery packs per year. Vingroup said that the plant uses European- and American-standard technologies with a workflow automation rate of 80%. It notes that it has a three-pillar approach to batteries, including sourcing from top battery manufacturers, collaborating with partners to produce the "world's best" batteries, and conducting in-house research and development (R&D) for battery production. (IHS Markit AutoIntelligence's Stephanie Brinley)

Posted 13 December 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.