Most major US equity indices closed higher, Europe lower, and APAC was mixed. US government bonds closed modestly higher for the first time this year, while benchmark European bonds closed sharply lower. European iTraxx closed wider across IG/high yield and CDX-NA was close to flat on the day. The US dollar and gold closed lower, while silver, copper, gold, wheat, and oil were higher.

Americas

- US equity markets closed mixed; Russell 2000 +1.8%, Nasdaq +0.3%, DJIA +0.2%, and S&P 500 flat.

- 10yr US govt bonds closed -2bps/1.13% yield and 30yr bonds -1bp/1.88% yield, which is the first rally for both bonds since 31 December.

- CDX-NAIG closed flat/52bps and CDX-NAHY +2bps/302bps.

- DXY US dollar index closed -0.4%/90.09.

- Gold closed -0.4%/$1,844 per ounce, silver +0.6%/$25.44 per ounce, and copper +1.4%/$3.61 per pound.

- Crude oil closed +1.8%/$53.21 per barrel.

- The chart below highlights that the average dollar price for high yield E&P debt is at its best level since late 2018.

- The below chart shows the best performing sectors each month in 2020 for BB USD corporate bonds within the IHS Markit iBoxx High Yield Corporate Bond Index. The data indicates that energy subsectors were the best performers in the rating category for half the months of the year. Note that only sectors with 10 or more bonds each month were included in the analysis.

- Wheat futures rallied sharply on Tuesday on bullish surprises in key USDA reports accompanied by strength in corn and soybean futures. Chicago March wheat finished up 30 1/4 cents at $6.65 while Kansas City gained 28 1/2 cents at $6.22 1/2 and Minneapolis rose 14 3/4 cents at $6.20 3/4. US wheat prices were firm before the report release, underpinned by the prospects of an export tax increase in Russia. US wheat prices built on those gains after the release of the USDA reports. USDA's Grain Stocks report showed US all-wheat ending stocks on December 1 at 1,674 million bushels versus the IHS Markit forecast of 1,711 million bushels and the average trade estimate at 1,695 million bushels. In the January WASDE report, USDA forecast 2020/21 wheat ending stocks at 836 million bushels versus the IHS Markit forecast of 884 million bushels and the average trade estimate at 859 million bushels. In its Winter Wheat and Canola Seeding report, USDA sees 2021 US winter wheat seedings at 31.99 million acres versus the IHS Markit estimate of 31.92 million acres and the average trade estimate of 31.53 million acres. In the tender market, Egypt's GASC passed on offers citing low participation amid uncertainty surrounding the potential increase in Russia's wheat export tax. South Korea bought 50,000 tons of US milling wheat. Japan was in the market for 116,700 tons of food wheat in a regular tender. Commodity funds were net buyers of 25,000 contracts of Chicago wheat. Wheat prices closed today at the highest level since May 2014 (IHS Markit Food and Agricultural Commodities' Adriel Cheng)

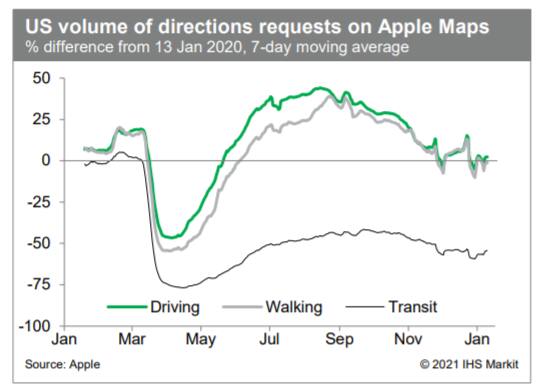

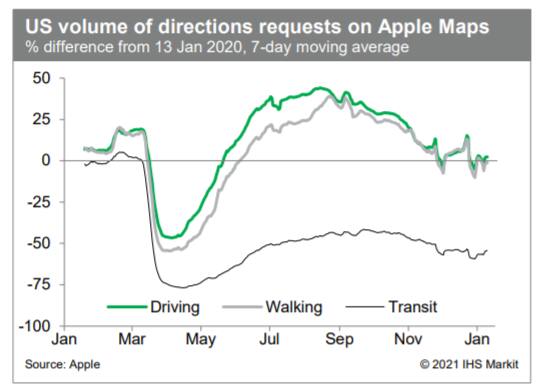

- The Weekly Economic Index, from researchers affiliated with the New York Fed, stood at -1.5 last week, a reading that, if sustained over the balance of the first quarter, would suggest a 1.5% decline in real GDP over the four quarters ending in the first quarter. This is somewhat weaker than but nevertheless broadly consistent with the 0.9% decline implicit in our latest tracking for fourth- and first-quarter GDP growth. Meanwhile, the volume of requests for driving direction on Apple Maps in recent days has been somewhat above that of 13 January 2020. This could suggest that, at least temporarily, internal mobility is slightly higher than normal levels. A bump in internal mobility would be consistent with other travel-related indicators, such as passenger throughput at US airports and revenues at US hotels, that strengthened around the holidays. (IHS Markit Economists Ben Herzon and Joel Prakken)

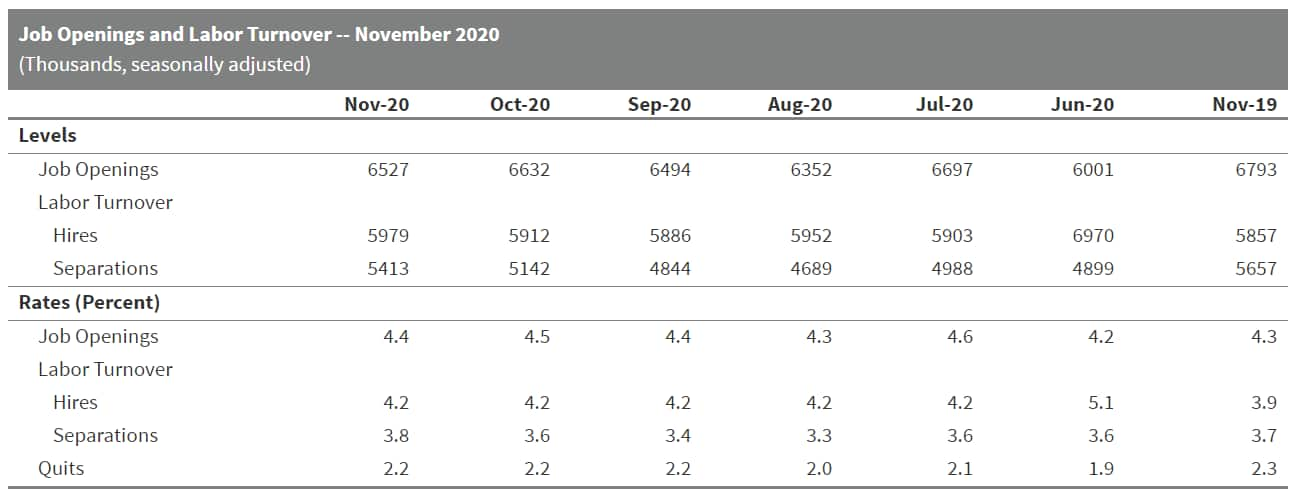

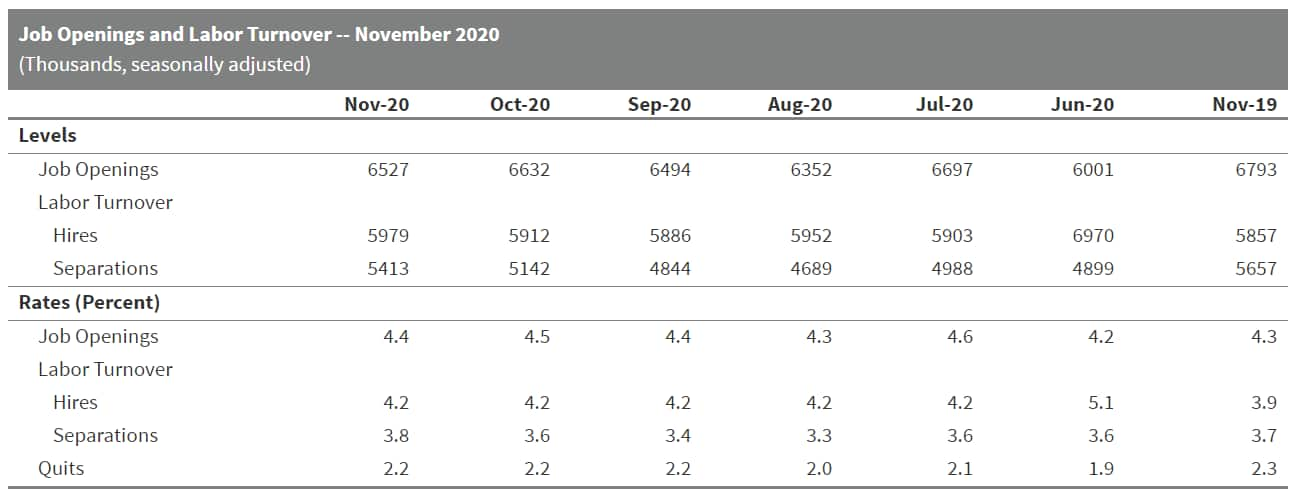

- The November JOLTS report suggests that the labor market recovery is continuing to slow, with US employment still short of the pre-pandemic peak. (IHS Markit Economist Akshat Goel)

- The number of hires edged up to 6.0 million and the number of job openings edged down to 6.5 million in November.

- In a worrying trend, job separations rose for the third successive week to a seven-month high of 5.4 million in November. There were 2.0 million layoffs and discharges in November, an increase of 295,000 from a month ago.

- The quits rate, a valuable indicator of the general health of the labor market, was unchanged at 2.2%, just shy of the two-year pre-pandemic average of 2.3%.

- Over the 12 months ending in November, there was a net employment loss of 5.2 million.

- There were 1.6 workers competing for every job opening in November. In the two years prior to the pandemic, the number of job openings exceeded the number of unemployed in every report.

- Electric vehicle (EV) startups Lucid Motors and Faraday Future are both in talks with special-purpose acquisition companies (SPACs) to go public, according to media reports. Bloomberg reports that deal-maker Michael Klein is working with Lucid Motors on a potential SPAC deal and he has two SPACs looking for agreements, and SPAC Churchill Capital Corp IV is considering a deal with Lucid. A separate Bloomberg report states that Faraday Future is in talks with Property Solutions Acquisition Corp, another SPAC, for the startup to go public. Bloomberg reports that Property Solutions Acquisition Corp is looking to raise more than USD400 million to support a transaction with Faraday. The deals are still in the discussion stages, and Bloomberg reports that the negotiations could fail or the terms could change. Moving companies from private to public entities was a theme in 2020, with companies including Canoo, Arrival, Nikola, Fisker, Lightning eMotors, and Electric Last Mile among the vehicle makers either announcing or executing such plans last year. The auto industry suppliers taking this route included LiDAR startups Aeva, Ouster, Innoviz, and Luminar. At the time of writing, it is not clear how close Lucid and Faraday are to moving forward on deals to go public. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Electric vehicle (EV) manufacturer Tesla has recently made a less-expensive, lower-range version of the Model Y sport utility vehicle (SUV) available for order in the United States. The new version is rear-wheel drive and has a lower-range battery, which the company calls standard range. The new trim level of the Model Y has an Environmental Protection Agency-estimated range of 244 miles. The new version has a base price of USD41,990, a price point that is USD8,000 lower than the long-range, all-wheel-drive Model Y. In addition, buyers of the Tesla Standard Range and Long Range Model Y have the option of choosing a seven-seat configuration, which is not available on the Model Y Performance model. The option of the extra seats costs USD3,000. The move by Tesla creates a version of the Model Y that costs less than the price of the new Ford Mustang Mach-E, although the Mach-E is also available with the US federal tax credit, while the Tesla is not. Tesla has also indicated that eventually it intends to expand its line-up to include a model priced lower than the Model 3, with recent reports stating that the model could be built in China as soon as 2022. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous truck startup Kodiak Robotics has completed "disengage-free" deliveries on I-45 highway between Dallas and Houston, according to a blog posted on the Medium website. Disengage-free means the startup's autonomous vehicle (AV) system operated without intervention from a human safety driver. Kodiak conducted commercial shipments in December 2020 and completed two round trips in a row, covering around 800 miles, on the highway without human involvement. Andreas Wendel, vice-president of engineering at Kodiak, wrote, "We've never been big on publicizing incremental achievements, but this milestone in Kodiak's history is worth sharing". (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Fluor (Irving, Texas) has announced an organizational revamp that "better aligns its business with identified growth markets and company strategy" after conducting a strategic review, it says. The company is initiating plans to sell its subsidiary Stork (Utrecht, Netherlands) as part of the revamp, it says. Starting in the first quarter of 2021, Fluor will conduct its operations in three business segments—Energy Solutions, Urban Solutions, and Mission Solutions. The energy solutions business will focus on energy transition, chemicals, and traditional oil and gas opportunities, according to Fluor. "As a result of our strategic review, we have determined that maintenance services no longer fits within Fluor's core service portfolio. Therefore, the company is initiating plans to sell Stork," it says. Fluor acquired Stork in 2015 for $755 million. Stork is a provider of maintenance, modification, and asset integrity services for large industrial facilities in the chemicals, petrochemicals, oil and gas, industrial, and power markets. Fluor's urban solutions business will pursue opportunities in mining, metals, advanced technologies, manufacturing, life sciences, and infrastructure, while the mission solutions business will be focused primarily on delivering solutions to federal agencies across the US government and to select international opportunities. Fluor has also established two functional organizations for project execution and corporate development and sustainability. Further information on the revamp will be given at a strategy day scheduled to be held by Fluor on 28 January. (IHS Markit Chemical Advisory)

- Mexico's National Minimum Wage Commission (Comisión Nacional de Salarios Mínimos or CONASAMI) said on 10 January that the 1 January 2021 minimum wage increase of 15%, from USD6.1 to USD7.0 per day (and to USD10.7 in the Northern Free Zone), will not increase inflation and will incentivize economic growth. It follows the current government's previous 20% (2020) and 16% (2019) national minimum wage increases. Modifications to Mexico's pension system also took effect on 1 January, aimed to increase pension amounts and access. They include an increase in employer contributions from 5.2% to 13.9% over eight years (for a 15% total contribution), fewer required weeks of contributions by employees, and a lower cap on fees chargeable by the country's 10 private pension funds (Administradores de Fondos para el Retiro: AFORE), from 0.92% to 0.54%. The minimum wage and pension increases are positive in terms of bringing both closer in line with Mexico's regional neighbors. However, their introduction at the same time, while a bill to ban outsourcing practices is also under discussion, represents a significant increase in costs for employers. They also coincide with companies facing severely reduced liquidity because of the COVID-19-virus crisis and a lack of federal government financial support. Private-sector associations, namely the Employers' Confederation of the Mexican Republic (Confederación Patronal de la República Mexicana: COPARMEX) and the Business Coordinating Council (Consejo Coordinador Empresarial: CCE), estimated in December 2020 that the 15% minimum wage increase will lead to 700,000 companies going bankrupt in the first quarter of 2021, although union leader José Luis Carazo has argued that it will strengthen working conditions and domestic consumption. The immediate impact of the higher pension contribution for employers will be less severe due to its gradual imposition. (IHS Markit Country Risk's Emily Crowley and Johanna Marris)

Europe/Middle East/Africa

- European equity markets closed lower; UK -0.7%, Italy -0.3%, France -0.2%, and Germany/Spain -0.1%.

- 10yr European govt bonds closed sharply lower; Italy +10bps, Spain +5bps, UK +4bps, and France/Germany +3bps.

- iTraxx-Europe closed +1bp/50bps and iTraxx-Xover +9bps/262bps.

- Brent crude closed +1.7%/$56.58 per barrel.

- China's BYD and the UK's ADL have extended their partnership. According to a statement, the pair will begin the design and assembly of chassis for the BYD ADL partnership's electric single- and double-decker buses for the UK market. It added that this will ensure completed vehicles are built in the UK. This is planned to begin at ADL's facilities in the second half of 2021, with support from a BYD team on the ground. At present, the chassis for the BYD ADL Enviro200EV single-decker and BYD ADL Enviro400EV double-decker buses were fully built up elsewhere by BYD before being delivered to ADL's facilities in the UK to have their bodywork fitted. Although there has been no confirmation of why this change has taken place, it could well be because volumes have reached a critical mass to make this feasible. Indeed, since 2015, around 500 battery electric buses have either been delivered or are on order. This is likely to rise in future as there is pressure to reduce city center emissions, despite fewer passenger numbers in the country due to the COVID-19 virus pandemic. (IHS Markit AutoIntelligence's Ian Fletcher)

- The closure of non-essential shops across Italy contributed to an acute drop in retail sales during November. Specifically, retail sales in volume terms declined by 7.4% month on month (m/m) during the month and were 8.4% lower than a year earlier. (IHS Markit Economist Raj Badiani)

- The average volume of retail sales in October and November was 0.3% lower when compared to the third quarter of 2020.

- The largest year-on-year (y/y) drops in November occurred for furniture and textile items and household furnishings (12.4%), clothing (37.7%), sporting equipment, games, and toys (22.9%) and shoes, leather goods, and travel items (45.8%).

- On the flipside, spending on computers and telecoms equipment rose by 28.7% y/y during November.

- In addition, online sales strongly increased in November 2020, with sales up by 50.2% compared with the same period a year ago.

- Retail spending during December appeared to have conflicting pulls. The stricter COVID-19 restrictions put in place in November loosened prior to Christmas, resulting in crowds of shoppers flocking to many city centers.

- However, this triggered a new spike in new COVID-19 infections, with the government deciding to place the whole of Italy in the red zone measures during Christmas and effective until 6 January, implying the closure of non-essential shops.

- Household consumption appeared to be under renewed pressure during the fourth quarter of 2020, led by lower spending on non-food goods, leisure and travel. In addition, we now anticipate Italy suffered renewed GDP losses during the same quarter.

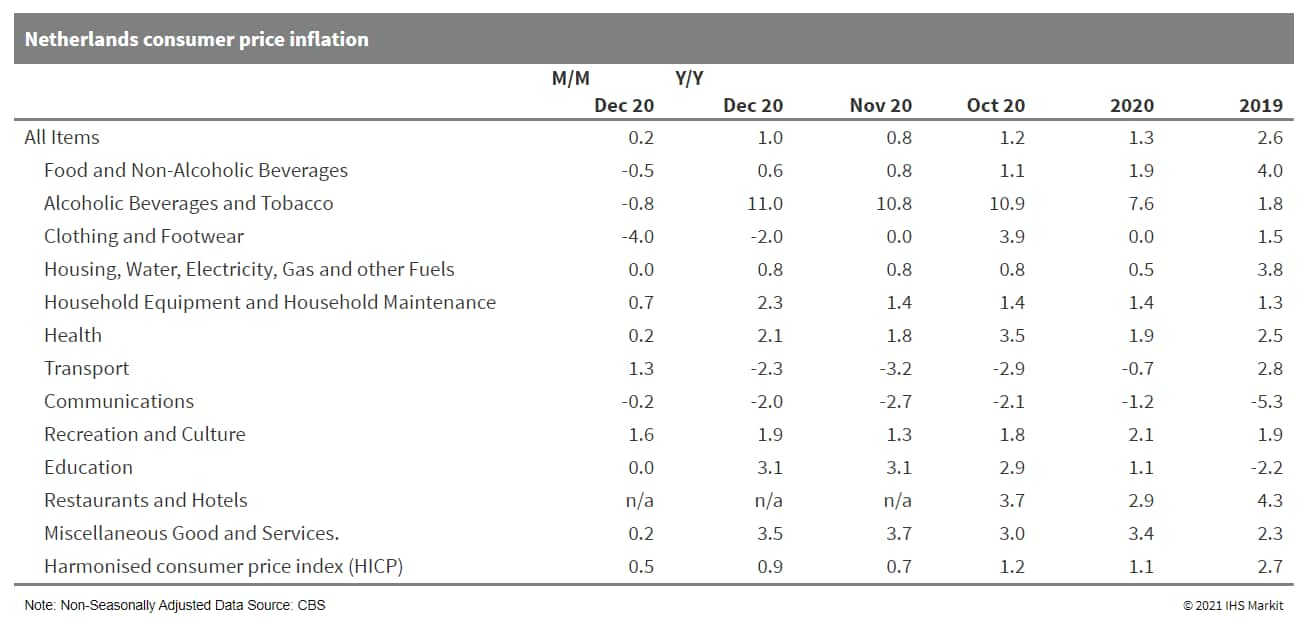

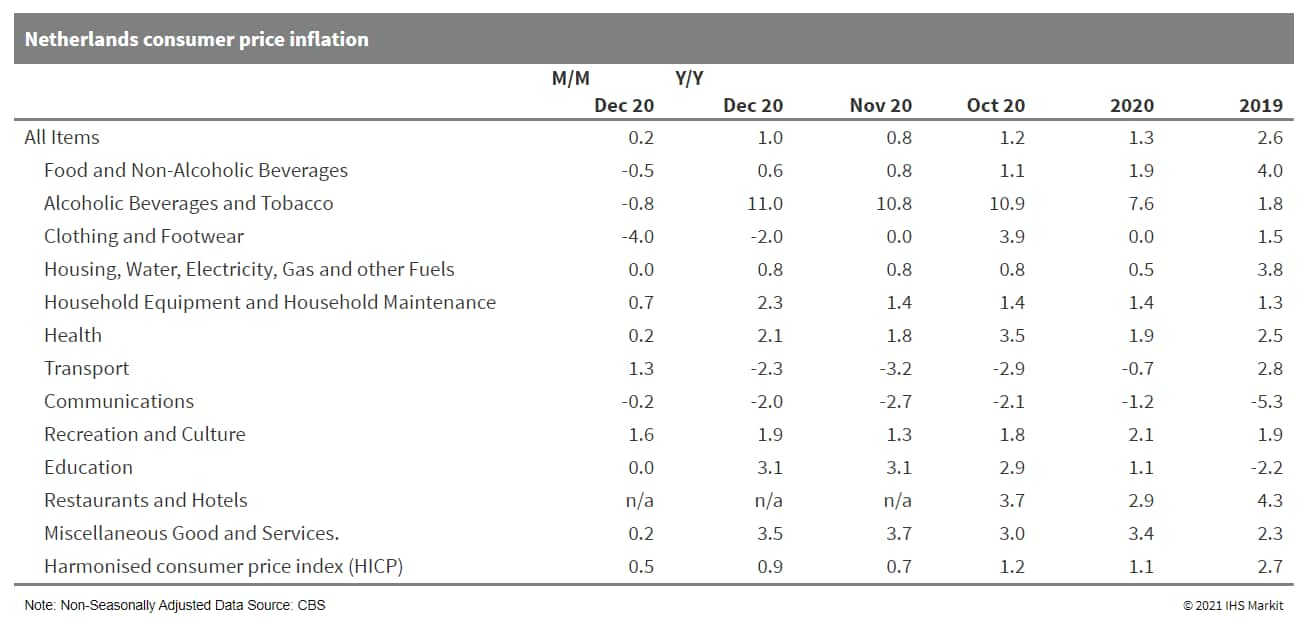

- Statistics Netherlands (Centraal Bureau voor de Statistiek: CBS) reports that Dutch consumer prices increased by 1.0% year on year (y/y) and 0.2% month on month (m/m) in December 2020, according to the national consumer price index (CPI) measure, and grew by 0.9% y/y and 0.5% m/m according to the EU-harmonized measure. (IHS Markit Economist Daniel Kral)

- For the whole of 2020, Dutch CPI inflation dropped to 1.3%, down from 2.6% in 2019. HICP inflation dropped to 1.1%, down from 2.7% in 2019, while core inflation remained at 1.9% in 2020, the same as in 2019, due to elevated levels in the first half of 2020. Headline inflation rate is the fourth highest in the eurozone, after Slovakia (2.0%), Austria (1.4%), and Lithuania (1.2%).

- Among the subcomponents, the largest annual increase in 2020 came from alcoholic beverages and tobacco by 7.6%, due to an increase in tobacco taxes. The largest moderation in price increases compared to 2019 was recorded in housing, water, electricity, gas and other fuels, which grew by just 0.5%.

- Wages covered by collective labor agreements rose by 3.0% in 2020 and thus, after subtracting inflation, 1.7% in real terms. The CBS notes that this is the largest increase in real terms since 1986 and presents an important boost to household incomes.

- CBS notes that prices covering roughly 5% of the consumption basket, such as for airlines or events, had to be estimated in 2020, owing to an insufficient number of recorded transactions.

- The recent extension of COVID-19 virus-related restrictions is likely to continue the difficulty in measuring inflation in the most affected sectors in the short term. The Netherlands is expected to remain in its toughest lockdown yet throughout at least January.

- The relatively subdued headline inflation, weighed down by limited increases in food and fuel, combined with the largest pay rises since 2008 will support real incomes, which can be released once restrictions are lifted. Household spending has been affected particularly severely during the COVID-19-induced recession and the broader recovery will depend on a strong rebound in this component.

- The frozen food giant Nomad Food, the group behind brands such as Igloo and Findus, has entered into exclusive negotiations to acquire Fortenova Group's Frozen Food Business Group (FFBG), which includes Ledo, Frikom and other leading frozen brands. FFBG has a wide frozen food portfolio of iconic local brands popular in Croatia, Serbia, Bosnia and Herzegovina and other countries in south-eastern Europe. It is the market leader in those regions, where it operates across several categories including fish, fruits, vegetables, ready meal, pastry and ice cream. The acquisition of FFBG would extend Nomad's portfolio into new and developing European markets while also creating a beachhead for potential future consolidation within central and eastern Europe. These discussions are preliminary and there can be no assurance that a transaction will be completed. The company does not intend to provide further updates unless there is a definitive outcome to the discussions. Other groups showed some interest toward Fortenova's frozen food brands, such as the Norwegian food processor Orkla as well as Czech-Slovak consortium of Emma Capital and J&T Private Equity Group. (IHS Markit Food and Agricultural Commodities' Cristina Nanni)

- The CEO of the Aurus car company, which is developing a new limousine and ultra-premium sport utility vehicle (SUV), has said the SUV will go into production in the second quarter of 2022, according to an Esmerk Russia News report. Adil Shirinov said the company is preparing to begin production of its long-awaited Senat limousine in the next few weeks, and the SUV is scheduled for start of production (SoP) a year later. The Komendant SUV will come with the same hybrid powertrain as the Senat, namely a 4.4-litre gasoline (petrol) V8 and a single electric motor. A nine-speed automatic transmission works with all four wheels with up to 600 PS and 880 Nm of torque. It is a bold gamble by the company, which has backing from the Russian government, to create a homegrown ultra-premium car brand from scratch which will evoke the famous ZIL limousines used by successive Russian premiers in the Communist era. The cars will be built at the Ford Sollers plant in Yelabuga and the output of all the Aurus models may reach 5,000 units per year, if the plant operates on a single-shift basis, according to other comments by Shirinov. (IHS Markit AutoIntelligence's Tim Urquhart)

- The National Bank of Ethiopia (NBE) has disclosed the draft of a 10-year financial-sector reform roadmap, following an International Monetary Policy (IMF) review of Ethiopia's financial soundness. The central bank's roadmap suggests an increased emphasis on increasing the role of the financial sector in total economic development; however, the proposed changes are expected to be rolled out gradually. (IHS Markit Economist Alisa Strobel)

- NBE governor Yinager Dessie mentioned at Ethiopia's CEO forum on 18 December 2020 that the central bank disclosed the draft of a 10-year financial-sector roadmap, according to media reports. The roadmap is to be tabled for discussion in the near future before implementation. The governor reportedly said that Ethiopia's reform momentum should particularly focus on the financial sector because it is the backbone for the development of other sectors.

- The IMF's statistics department provided technical assistance on financial soundness indicators (FSI) to the NBE during 15 June to 10 July 2020. A report on the findings was published on 18 December 2020 suggesting that source data reported by the banks was broadly adequate for FSI compilation for deposit-takers in terms of quality.

- Ethiopia is currently under IMF Extended Credit Facility and Extended Financing Funding (ECF/EFF) arrangements, including proposed financial-sector reforms. Improved FSIs are expected to facilitate better monitoring of financial stability by the NBE and help guide economic policies in the context of the ECF/EFF arrangements. In response to the coronavirus disease 2019 (COVID-19) pandemic, the NBE issued temporary measures to ease the pandemic's impact on the local economy and its social consequences.

- IHS Markit previously stated that, although it will take some time before foreign banks are allowed to fully operate in Ethiopia, the country's banking sector will not be closed all the time. Prime Minister Abiy Ahmed explicitly pointed out the government's position back in September 2020, which was that the government would not open the financial sector to foreign firms until local private banks come together in joint ventures and build competitiveness. This suggested fears that foreign firms with vast expertise and experience could overwhelm the country's financial sector, which, he said, was in its infancy.

- However, the apparent move towards greater openness follows a recent financial-sector expansion that potentially increased the sector's attractiveness to foreign investors. The NBE's Proclamation No. 592/2008 currently prohibits foreign banks from operating in the country; it also prohibits foreign nationals and/or organizations from opening banks or owning shares in local banks.

- Therefore, while we maintain our view that immediate changes will be made to allow greater foreign ownership in the financial sector, such changes are likely to be made very gradually. An important constraint to change is the fact that the Ethiopian banking sector is dominated by the state-owned Commercial Bank of Ethiopia (CBE), accounting for around 60% of the sector's assets and 70% of the sector's deposits.

Asia-Pacific

- APAC equity markets closed mixed; Mainland China +2.2%, Hong Kong +1.3%, India +0.5%, Japan +0.1%, Australia -0.3%, and South Korea -0.7%.

- Increases in the trade surplus and primary income lifted Japan's current-account surplus in November. However, the resurgence of COVID-19 could weigh on the surplus. (IHS Markit Economist Harumi Taguchi)

- Japan's current-account surplus rose by 18.0% in November from the previous month to JPY2.3 trillion (USD22.4 billion) on a seasonally adjusted basis and by 29.0% year on year (y/y) to JPY1.9 trillion on a non-seasonally adjusted basis. The seasonally adjusted current account recorded the largest surplus in nine months. The solid y/y rise was due to increases in the trade surplus (up JPY636 billion from a deficit of JPY20 billion) and the primary balance (up 17.8% y/y to JPY1.7 trillion).

- The increase in the trade surplus reflected a softer decline in exports (down 3.4% y/y) than imports (down 13.6% y/y). While the wider y/y drop in exports largely reflected decreases in exports to Asia and the US following rises in the previous month, the continued weakness for imports was due largely to lower prices, particularly for resources and mineral fuels. The increase in the primary balance was thanks largely to increased revenue from portfolio investment, reflecting improved share prices.

- The continued increase in the surplus of the trade and services balance signals that net exports are likely to contribute to real GDP growth in the fourth quarter of 2020. Although IHS Markit maintained its view that Japan's current-account surplus will continue over the short term, the November results were better than expected.

- Automakers globally are facing up to semiconductor shortages. Reuters reported late last week that affected companies have included Honda - its spokesperson has said that it has begun "seeing some impact in the parts supply". It cited the Nikkei as stating that it will shrink production by around 4,000 units per month, which would mainly affect the Fit, built at its Suzuka (Japan) facility. Separately, its Chinese partner GAC has said its joint venture (JV) with Honda had received warnings over the supply of components for certain models, without giving details. Nissan has said it will cut production of the Note hybrid built at its Oppama (Japan) facility, without giving any details of the scale. However, the Nikkei has reported separately that output will be slashed in January from 15,000 units to 5,000 units. In North America, Ford is pulling forward a week of downtime at its Louisville (Kentucky, US) facility which builds the Ford Escape and Lincoln Corsair. A spokesperson told Reuters, "We are working closely with suppliers to address potential production constraints tied to the global semiconductor shortage." Restrictions on the supply of any component related to the manufacture of vehicles is typically detrimental to production volumes. However, in this instance a perfect storm of challenges specifically related to semiconductors has emerged, which is testing the automotive industry, particularly given the expansion of electrified powertrains, infotainment systems and sophisticated automated driver assistance systems (ADAS). Having started to emerge towards the end of last year, it is set to come to a head in during the first quarter of 2021. IHS Markit's initial analysis suggests that global light-vehicle production over this three-month period will fall by around 485,000 units. A large proportion of this will be lost in China, which is set to lose over 245,000 units, with this focused on joint ventures (JVs). Around 100,000 units are set to be lost in Europe, and this is expected to be mainly by the Volkswagen (VW) Group as has already been noted above. In North America and Japan, we see the lack of semiconductors as having an impact of around 37,500 units each, while in the rest of Asia it will suffer a decrease of around 61,800 units. (IHS Markit AutoIntelligence's Ian Fletcher)

- American Axle & Manufacturing (AAM) and Inovance Automotive have announced a new technology development agreement aimed at accelerating the development of next-generation 3-in-1 electric drive systems for the global market. A joint press release by the US-based global driveline systems company and the China-based electric propulsion components and systems supplier indicates that they will continue the launch of a current-generation 3-in-1 drive units, first with a 135 kW model, to support a Chinese OEM in the first quarter of 2021. The next-generation 3-in-1 systems will integrate the inverter, the electric motor, and the gearbox; the partnership aims to increase power density, efficiency, and cost effectiveness. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Hyundai reportedly plans to build a hydrogen fuel-cell system plant in Guangzhou (China) this year, reports the Yonhap News Agency. The automaker has received the South Korean government's approval for the investment plan. The South Korean Ministry of Trade, Industry and Energy reviewed the impact of hydrogen fuel-cell systems' exports as hydrogen technologies are regarded as one of the country's core technologies. It approved the plan as it judged building a hydrogen fuel-cell systems plant will pave the way for the country's auto parts suppliers to increase their exports to the world's biggest automobile market. "Hyundai Motor is in talks with a Chinese company to form a joint company for the construction of the plant. Hyundai is expected to announce the plant as early as this month," said an unnamed person familiar with the matter. Hyundai did not confirm the investment plan. Hydrogen fuel-cell technology is one of the key technologies Hyundai is planning to focus on in the coming years. Last month, the automaker announced the launch of its new brand, HTWO, dedicated for hydrogen fuel-cell systems. This new brand is expected to help facilitate Hyundai's global fuel-cell business and grow the hydrogen ecosystem. With the HTWO brand, Hyundai will be increasing its efforts for the development of a next-generation hydrogen fuel-cell system that can be applied to various forms of mobility such as automobiles, vessels, urban air mobility, and trains. (IHS Markit AutoIntelligence's Jamal Amir)

- Tata Motors is looking to launch a range of affordable electric vehicle (EV) models with a long battery range in India over the next few years. According to a report by The Times of India, the company plans to price its EV models at "not more than 15-20% premium" compared with conventional gasoline (petrol)- and diesel-powered cars while offering a battery range of over 200 km on a single charge. Tata Motors is working closely with other Tata Group companies including Tata Power, Tata Chemicals, Tata AutoComp, and Tata Capital to create an ecosystem that serves the EV segment. The initiatives are in line with the company's plans to launch four new EVs in India by 2022, including two sport utility vehicles (SUVs), a sedan, and a hatchback. (IHS Markit AutoIntelligence's Isha Sharma)

Posted 12 January 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.