Most major US, European, and APAC equity indices closed lower. US government bonds closed slightly lower and benchmark European bonds were mixed. iTraxx-Europe and CDX-NAIG closed flat, while high yield counterparts closed slightly wider. The US dollar closed flat, oil and natural gas higher, and gold, silver, and copper were lower on the day.

Americas

- US equity indices closed mixed; DJIA +0.9%, S&P 500 flat, and Nasdaq/Russell 2000 -0.4%.

- 10yr US govt bonds closed +1bp/1.67% yield and 30yr bonds +1bp/2.34% yield.

- CDX-NAIG closed flat/51bps and CDX-NAHY +2bps/295bps.

- DXY US dollar index closed flat/92.14.

- Gold closed -0.7%/$1,733 per troy oz, silver -1.8%/$24.87 per troy oz, and copper -0.5%/$4.02 per pound.

- Crude oil closed +0.6%/$59.70 per barrel and natural gas closed +1.4%/$2.56 per mmbtu.

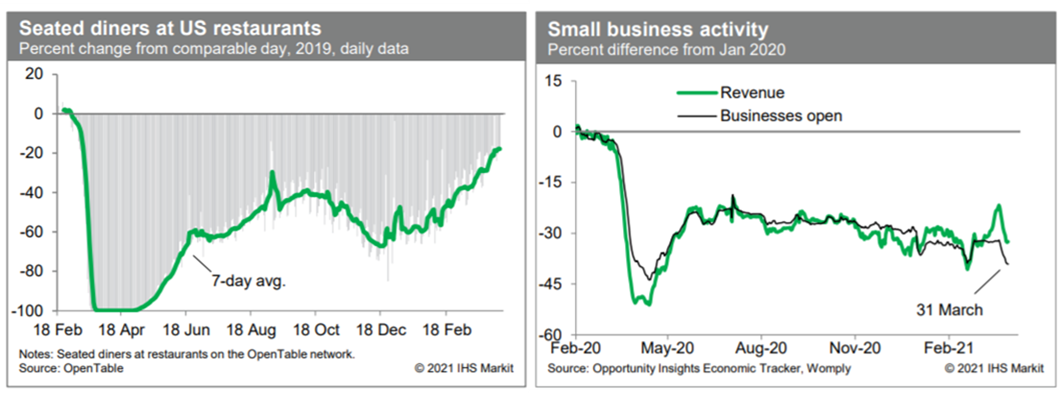

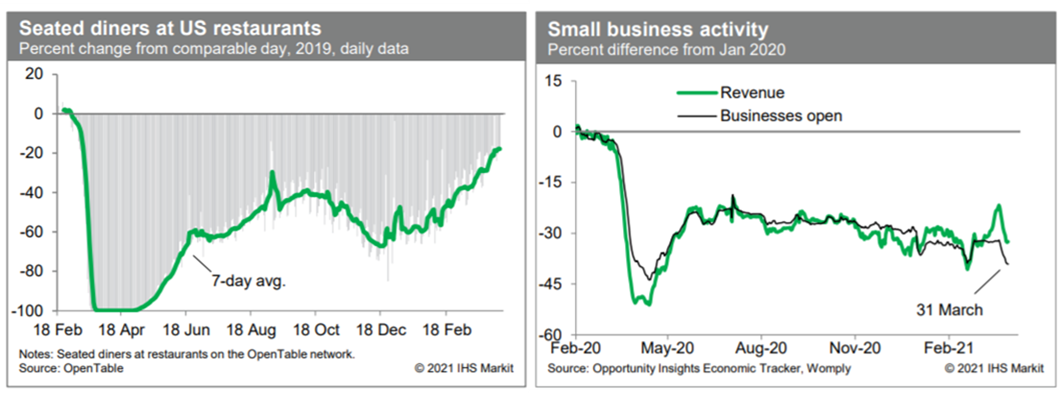

- Averaged over roughly the last week, the count of seated diners on the OpenTable platform was 18% below the comparable period in 2019. This is a vast improvement over prior weeks, reflecting relaxation of constraints on indoor dining and expansion of outdoor dining as temperature rise. Meanwhile, activity at small businesses (revenues and the number open) weakened at the end of March, according to the Opportunity Insights Economic Tracker. This seems at odds with other indicators pointing to broadly firming activity but, in any event, highlights continued struggles in the small-business sector. Finally, box-office revenues firmed again last week, according to weekly data from Box Office Mojo. While still down about 75% from the comparable week in 2019, revenues are on the rise. (IHS Markit Economists Ben Herzon and Joel Prakken)

- The US Securities and Exchange Commission (SEC) is warning financial advisers, firms, and private funds against making potentially misleading green investing claims. In a risk alert issued 9 April, the SEC said a Division of Examinations review uncovered some instances of potentially misleading statements regarding environmental, social and governance (ESG) investing processes and representations regarding adherence to global ESG standards. Despite some companies' claims to have formal processes in place, SEC staff uncovered a lack of policies and procedures related to ESG investing including those that were either not "reasonably designed" to prevent violations of law, or that were not implemented. SEC staff also found that documentation of ESG-related investment decisions was weak or unclear, and that compliance programs also did not appear to be "reasonably designed" to guard against inaccurate ESG-related disclosures and marketing materials. (IHS Markit Climate and Sustainability News' Amena Saiyid)

- Attorneys representing a California man suing paraquat manufacturers for failing to warn him that exposure to the potent herbicide may cause Parkinson's disease have asked a US judicial panel to consolidate more than a dozen similar lawsuits. The move could escalate the legal battle over the litigation, which centers on claims Syngenta, Syngenta Crop Protection and Chevron Phillips Chemical Company knew for decades that paraquat could cause Parkinson's. First registered for use in US in 1964, paraquat is used on cotton, corn, soybeans, peanuts and more than 100 other crops. US farmers annually apply an estimated 8.5 million pounds of paraquat across nearly 16 million acres of crops to control invasive weeds and plants. Cotton growers also use the herbicide as a desiccant or plant growth regulator to dry the leaves of the crop and make it easier to harvest. The herbicide has known health risks - a single sip can be fatal - and it has long been suspected of being associated with Parkinson's disease, a neurological disorder. (IHS Markit Food and Agricultural Policy's JR Pegg)

- Canadian supplier Magna has announced a new rear-view mirror with embedded driver-monitoring technology, a feature designed to detect driver distraction and focus. According to Magna's statement, the interior rear-view mirror has an integrated camera that enables the technology to alert drivers when they take their eyes off the road too long. Magna's new technology is market-ready and the company says it meets all regulations globally related to driver-distraction detection. The driver is alerted using customizable audio or visual alerts if the technology detects distraction. Magna says that, compared to other solutions that have a camera mounted on the steering column, the integration of the camera into the rear-view mirror "provides the best unobstructed view to the driver and offers the best vantage point for additional occupant monitoring features. (IHS Markit AutoIntelligence's Stephanie Brinley)

- The Central Reserve Bank of Peru (Banco Central de Reserva del Perú: BCRP) directorate opted to hold the policy interest rate constant at 0.25% at the April meeting, reiterating its intention to maintain a "strongly expansionary monetary posture" for a "prolonged period". A gradual rise in inflation continues to be largely explained by increases in food and energy prices. (IHS Markit Economist Jeremy Smith)

- Consumer price inflation averaged 2.6% year on year (y/y) in the first quarter of 2021, one-half percentage point higher than at any point in 2020 and near the upper end of the BCRP's 2% +/- 1% target range. The bank has largely shrugged off this uptick, citing its expectation that consumer price inflation will stay within the target range throughout the next two years amid a substantial output gap.

- The BCRP highlights that, excluding food and energy costs, the inflation rate was just 1.8% y/y in March 2021; this value is below the midpoint of the target range and is essentially unchanged over the past year.

- Pre-election jitters continue to weigh on the Peruvian sol in advance of the country's general election on 11 April 2021, prompting the BCRP to intervene in the foreign-exchange market throughout March to smooth volatility. Sales totalled USD1.1 billion over the course of March and reached a daily peak of USD127 million on 30 March, the same day that the sol slid to a record 3.76:1.00 rate against the dollar.

Europe/Middle East/Africa

- Major European equity indices closed lower except for Italy +0.1%; France/Germany -0.1% and UK/Spain -0.4%.

- 10yr European govt bonds closed mixed; France/Italy flat and Spain/UK/Germany +1bp.

- iTraxx-Europe closed flat/51bps and iTraxx-Xover +3bps/248bps.

- Brent crude closed +0.5%/$63.28 per barrel.

- Given extreme weakness in January, eurozone sales remain on track for a large COVID-19-driven contraction in the first quarter of 2021. (IHS Markit Economist Ken Wattret)

- Eurozone retail sales rose by 3.0% month on month (m/m) in February 2021, the strongest increase since August 2020 and twice the market consensus expectation.

- However, given the huge decline in January 2021, sales over the first two months of the quarter were still down by over 4% compared with the final quarter of 2020. This is despite the upward revision to the January 2021 figures (with the initial m/m change of -5.9% revised to -5.2%).

- As of February, retail sales were 2.8% below their pre-pandemic level a year previously.

- The outperformance of mail order and internet sales continued, unsurprisingly given widespread COVID-19-related restrictions, with sales in February 2021 almost 38% above their pre-pandemic level.

- Sembcorp Marine has awarded a contract to Heerema for the transport and installation of the HVDC offshore converter platform for RWE's Sofia offshore wind farm in the UK sector. Sembcorp Marine was awarded the EPIC contract for the HVDC electrical system works. The company will fabricate the platform which is scheduled for offshore installation in 2024. Heerema will utilize its semisubmersible heavy lift vessel Sleipnir for the job. The Sofia offshore wind farm is located 220 km off the coast of the coast of Teeside in the North Sea and will have a total capacity of 1.4 GW when complete. (IHS Markit Upstream Costs and Technology's Sophie Dear)

- BMW has said that it will only offer Level 3 autonomous capability on production vehicles when all systems are completely safe and proofed. The company already offers enhanced Level 2 capability in vehicles in China and the United States, although the driver has to constantly monitor the vehicle and the car will insist on manual control being taken back if it does not think the driver is monitoring the systems. Level 3 autonomous vehicle technology allows fully autonomous operation on roads with a central reservation at speeds of up to 37mph, but full level 3 will not be offered until the company is fully convinced it is foolproof in every situation. (IHS Markit AutoIntelligence's Tim Urquhart)

- French industrial production declined by 4.7% month on month (m/m) in February, according to seasonally adjusted figures released by the National Institute of Statistics and Economic Studies (Institut national de la statistique et des études économiques: INSEE). Production had increased by 3.2% m/m in January. (IHS Markit Economist Diego Iscaro)

- Production fell by 6.6% year on year (y/y) in February, its strongest annual decline in five months.

- Manufacturing output also dropped 4.6% m/m in February, following a rise of 3.3% m/m at the start of the year. Manufacturing production in February was 7.1% below its pre-COVID-19 virus pandemic level in February 2020.

- Production of transport equipment fell particularly sharply in February (-11.4% m/m), but production also contracted in most other sectors.

- Manufacture of coke and refined petroleum products was the exception, rising by 11.5% m/m.

- Production of food products and beverages (-2.0% m/m), machinery/equipment (-5.3% m/m), and manufactured goods classified as "other" (-4.0% m/m) all declined in February.

- Energy production, which had risen by 2.8% m/m in January, fell by 5.4% m/m in February.

- Construction activity, which is published simultaneously but is not included in the headline index, followed its 13.2% m/m increase in January with a 6.0% decline in February.

- February's figures were worse than expected and will drive a downward revision of IHS Markit's GDP estimate for the first quarter.

- Sanofi (France) announced on 10 April that it had agreed to purchase preclinical biotechnology developer Tidal Therapeutics (US) for a sum of USD160 million. The acquisition enables Sanofi to gain access to Tidal Therapeutics' mRNA-based technology platform, which has potential applications in an in vivo approach to reprogramming immune cells mainly in immuno-oncology and inflammatory diseases. Sanofi claims that the next-generation mRNA technology could bring a new wave of novel, in vivo, off-the-shelf chimeric antigen receptor T-cell (CAR-T) therapies to a "much broader patient population", and that the deal could create new "disruptive therapeutic approaches" in a range of oncology and autoimmune diseases. (IHS Markit Life Sciences' Eóin Ryan)

- Michelin is looking to accelerate its diversification program to branch out into new business sectors, such as hydrogen power systems and medical equipment, reports Reuters. According to the report, the company is looking for the diversification program to add about EUR14 billion (USD17 billion) to it revenues by 2030. In a strategy presentation on its plans, Michelin outlined how it is looking to boost annual revenue to EUR34 billion, from EUR20.5 billion in 2020. Michelin partners with Faurecia in a business called Symbio, which makes hydrogen fuel-cell systems for light vehicles, utility vehicles, and trucks. Michelin is hoping to grow Symbio's revenue from EUR200 million in 2025 to EUR1.5 billion by 2030, while it is also looking at medical equipment and 3D printing as new business avenues. (IHS Markit AutoIntelligence's Ian Fletcher)

- Spanish ride-hailing app Cabify has hired a chief financial officer (CFO) to accelerate its plan to go public, reports Reuters. Cabify is considering listing on the Madrid stock exchange and has tapped Antonio Espana for the role of CFO. Espana, former CFO of gas pipeline operator Redexis, has previously worked with security firm Prosegur, leading its initial public offering (IPO). Cabify is backed by investors that include Rakuten Inc and Inter American Development Bank. Cabify is currently valued at about USD1 billion, and operates in Spain, Portugal, and several Latin American countries, among others. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Greek consumer prices, measured by the harmonized index of consumer prices, fell by 2% year on year (y/y) in March, following a decline of 1.9% in February. (IHS Markit Economist Diego Iscaro)

- The extension of the winter sales until the end of March (they had ended in February in 2020) led to a 16.9% y/y decline in prices of clothing and footwear.

- This more than offset weaker declines in the prices of food/beverages (-0.3% y/y following -0.5% y/y in February), transport (-0.8% y/y following -4.3% y/y) and the first increase in housing costs since January 2020 (+0.1% y/y, following a decline of 1.9% y/y in February).

- Core inflation (i.e., excluding energy, food, alcohol and tobacco) stood at -2.1% in March, following a fall of 1.3% y/y in February.

- Year-end data for South Africa show that the banking sector has remained resilient despite the impact of the COVID-19-virus pandemic in 2020, with the reported capital adequacy ratio (CAR) and Tier-1 ratio of 16.5% and 13.6%, respectively, as of December 2020 comfortably above the minimum regulatory requirement of 8% and 6%, respectively. (IHS Markit Banking Risk's Ana Souto)

- Credit increased in 2020, aided by first-quarter growth and stimulus measures. Year-on-year (y/y) credit growth reached 6.8% by end-2020, compared with y/y credit growth of 4.8% in 2019.

- Impairments have begun to accumulate despite significant restructuring. The non-performing-loan (NPL) ratio rose from 2.8% in December 2017 to 3.9% at the end of 2019, and from 4% in March 2020 (when the country reported its first COVID-19 case) to 5.2% in December 2020 despite loan restructuring of about 20% of total private-sector loans.

- Profitability reduced significantly by higher provisioning. The banking sector recorded an average pre-tax return on assets (ROA) of 0.5% in December 2020, versus an average ROA of 1.2% in the same period in 2019 because of higher provisioning requirements.

- Capital buffers are likely to remain robust despite increasing impairments. In December 2020, the banking sector's CAR was 16.5% and the Tier-1 capital ratio was 13.6%, broadly unchanged from December 2019, when these ratios stood at 16.6% and 13.5%, respectively, and well above the regulatory requirements of 8% and 6% for the CAR and Tier-1 ratio.

- The sector's liquidity profile benefited from a surge in deposits. The banking sector recorded a y/y deposit growth of 10.7%, which has moderated the loan-to-deposit ratio (LDR) from 99.9% in December 2019 to 96.6% in December 2020, marginally improving the stability of banks' funding.

Asia-Pacific

- Most APAC equity markets were closed lower except for South Korea +0.1%; Australia -0.3%, Japan -0.8%, Hong Kong -0.9%, Mainland China -1.1%, and India -3.4%.

- Chinese ride-hailing firm Didi Chuxing (DiDi) has filed confidentially for an initial public offering (IPO) with the US Securities and Exchange Commission (SEC). DiDi has hired Goldman Sachs Group and Morgan Stanley as underwriters to lead its IPO, which could value the company between USD70 billion and USD100 billion. DiDi has additionally raised USD1.5 billion through a revolving loan facility ahead of its planned IPO. It is also considering dual listing in Hong Kong SAR later, reports Bloomberg. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- LG Chem and SK Innovations have reached a settlement over a trademark dispute, avoiding a decision on whether a US International Trade Commission (ITC) ban on SK Innovation's ability to import battery technology (and therefore its ability to produce in the US). On 10 February, the US ITC had issued the ban, at that time saying that SK Innovation went to "extraordinary" effort to destroy evidence in a trade-secret case lodged by LG Energy against SK Innovation in South Korea. The ITC February ruling included time for the two to come to an agreement, with the deadline of 11 April 2021. SK Innovation has agreed to pay LG Energy Solution (a wholly owned subsidiary of LG Chem) USD1.8 billion. The payments will be two lump sums in 2021 and 2022, as well as royalties over the next six years. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Mahindra & Mahindra (M&M) has announced plans to invest around INR30 billion (USD400 million) in its electric vehicle (EV) business in the next three years, reports the Times of India. The automaker has already invested INR17 billion in the EV business in India and another INR5 billion in a new research-and-development (R&D) center. In addition, it has said that it is to invest INR90 billion in auto and farm sectors in the next five years. M&M is looking for alliances and partnerships in the EV space, in addition to its planned investment, and aims to put 500,000 EVs on Indian roads by 2025. (IHS Markit AutoIntelligence's Tarun Thakur)

- Siemens has partnered with Switch Mobility Automotive Limited, signing a Memorandum of Understanding (MoU) to set up charging infrastructure for electric commercial vehicles (CVs) in India, reports News 18. Siemens Financial Services (SFS) also said that it will consider a minority investment in OHM Global Mobility Private Limited. As a part of the MoU, Switch Mobility will import its electric CVs into India, while Siemens would provide the charging infrastructure technology as well as a charging infrastructure management software solution to enable its chargers to be more energy-efficient. According to Siemens, it will additionally collaborate with Switch Mobility on new business models like eMobility-as-a-Service (eMaas), integrated depot energy management, Vehicle-to-Grid (V2G) and on-site/off-site renewable energy sources by leveraging batteries from commercial vehicles. (IHS Markit AutoIntelligence's Tarun Thakur)

- Sanofi (France) plans to invest EUR400 million (USD475 million) over five years in a vaccine manufacturing facility in Singapore in partnership with the Singapore Economic Development Board (EDB), the company said in a statement. The planned facility will include several fully digitalized modules enabling the simultaneous production of up to four vaccines, and will also enable the use of multiple vaccine manufacturing technology platforms based on different cell types. Sanofi expects construction of the plant to start in the third quarter of 2021, with the site expected to be fully operational in the first quarter of 2026. (IHS Markit Life Sciences' Sophie Cairns)

Posted 12 April 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.