All major European and US equity indices closed higher, while APAC markets were mixed. US government bonds closed higher, while most benchmark European bonds closed lower. CDX-NA and European iTraxx closed tighter across IG and high yield. The US dollar closed lower, while oil, natural gas, copper, silver, and gold closed higher. Markets will be focusing on tomorrow morning's 8:30am ET US CPI release for any signs that US consumer prices are stabilizing.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed higher; Nasdaq +1.4%, Russell 2000 +1.1%, S&P 500 +0.9%, and DJIA +0.5%.

- 10yr US govt bonds closed -3bps/1.74% yield and 30yr bonds -3bps/2.07% yield.

- CDX-NAIG closed -1bp/52bps and CDX-NAHY -7bps/300bp.

- DXY US dollar index closed -0.4%/95.62.

- Gold closed +1.1%/$1,819 per troy oz, silver +1.6%/$22.81 per troy oz, and copper +1.8%/$4.43 per pound.

- Crude oil closed +3.8%/$81.22 per barrel and natural gas closed +3.5%/$3.97 per mmbtu.

- U.S. hospitals are caring for the highest number of patients with COVID-19 reported during the pandemic, according to federal government data, as the Omicron variant worsens pressures on the already strained facilities. The U.S. seven-day average reached 140,576 people hospitalized with confirmed and suspected COVID-19 cases on Tuesday, more than the previous high recorded during the surge last winter, according to a Wall Street Journal analysis of U.S. Department of Health and Human Services data. (WSJ)

- Lithium-ion (Li-ion) battery prices have increased by 10-20% in the later months of 2021, predominantly for lithium iron phosphate (LFP) technology, which is the favored technology for grid energy storage systems. Surging raw materials prices, automotive industry demand for LFP batteries, and tight, geographically concentrated LFP supply are all drivers of higher prices. (IHS Markit EnergyView Climate & Cleantech's Peter Gardett and Sam Wilkinson)

- The latest IHS Markit forecasts for battery energy storage capex suggest that average battery module prices in 2022 will be 5% higher than in 2021, contributing to a 3% increase in total battery energy storage system costs. Compared with the previous IHS Markit forecast, these battery prices are 16% and 22% higher, respectively. Prices may decline modestly in 2023, contingent upon scaled-up LFP manufacturing capacity and energy storage system integrators securing supply agreements with LFP suppliers.

- Higher prices alone are not expected to severely impact the near-term outlook for energy storage installations. With electricity and fuel prices all trending upward and displaying unprecedented levels of volatility, battery energy storage remains competitive with the alternative technologies that can help provide the flexibility required to enable high renewable penetrations in the power system.

- The bigger threat to industry growth is the ability of system integrators to procure the required volumes of batteries, meaning that strategic partnerships with multiple vendors will become increasingly important for system integrators to mitigate against supply disruption.

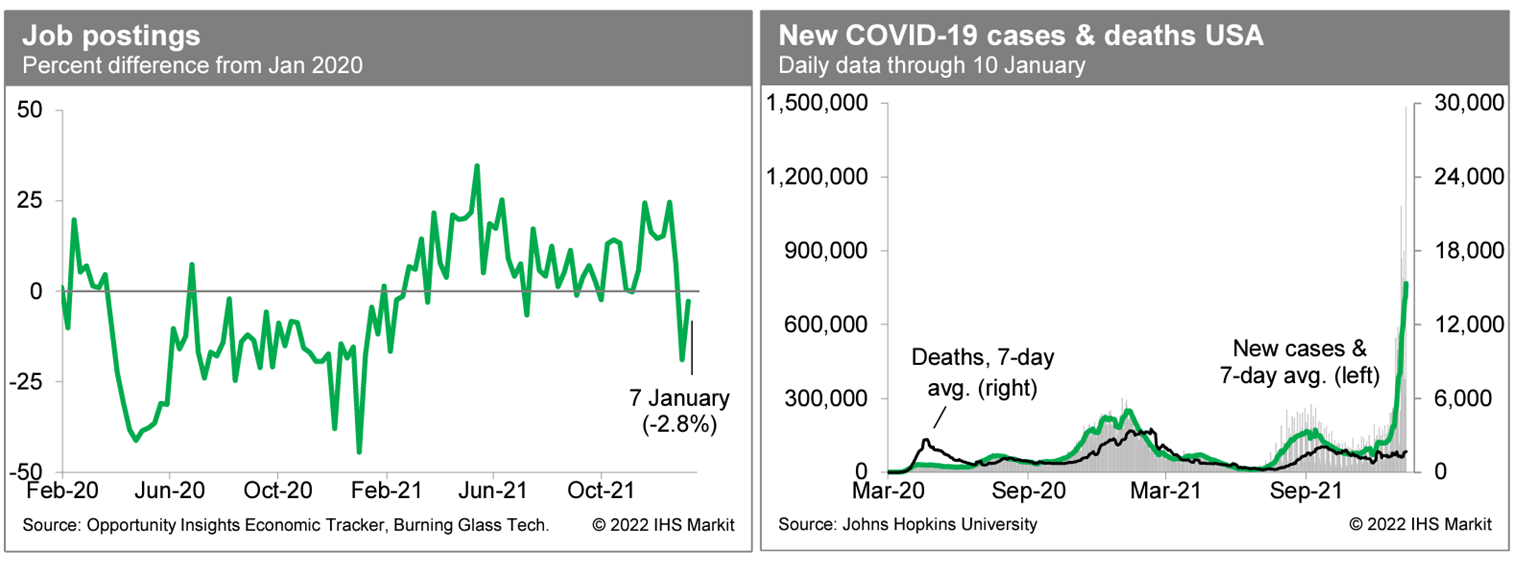

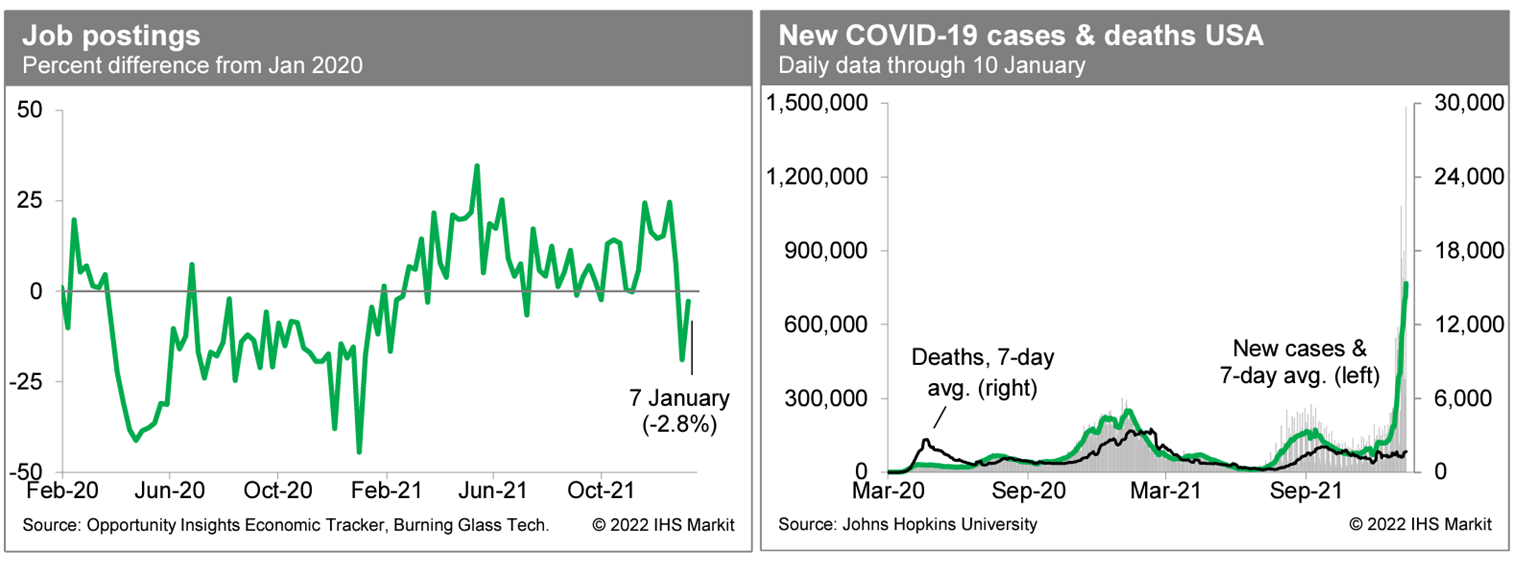

- US job postings rose last week to 2.8% below the January 2020 level, according to the Opportunity Insights Economic Tracker. This and the prior week's reading are significantly below the prior trend. The weakness could simply be a temporary lull following the holidays but could also signal a more fundamental slowing in labor demand. The next few weekly readings will help to clarify which is more likely the case. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Vietnamese automaker VinFast has partnered with Applus+ IDIADA, a leading global firm with complete vehicle testing and engineering capabilities in the US, Europe, and Asia, for electric vehicle (EV) safety testing, according to a company statement. It will conduct safety tests to examine the performance of VinFast EVs in accordance with global regulatory and consumer requirements. "We are very pleased to deserve the trust of VinFast as their technical partner for vehicle safety in this ambitious and challenging project," said Carlos Garcia, director of Applus+ IDIADA North America. (IHS Markit AutoIntelligence's Jamal Amir)

- Peer-to-peer car-sharing startup Turo has released its filing to become a publicly listed company in the United States, reports Bloomberg. The company confidentially filed for an initial public offering (IPO) with the US Securities Exchange Commission (SEC) in August last year. In its public filing, Turo listed the size of the offering as USD100 million, a placeholder that will alter when terms of the share sale are finalized. The company also revealed in its filing that its revenue more than tripled to reach USD330 million for the nine months ended 30 September 2021, compared with USD108 million for the same period a year earlier. Turo reported a net loss of USD129 million for that period in 2021, compared with a loss of USD52 million for the first nine months of 2020. Turo, which competes with Getaround, allows private vehicle owners to rent out their cars through its platform. The company's service is currently available in more than 5,500 cities in Canada, Germany, the United Kingdom, and the US. It has over 450,000 vehicles listed, with more than 850 unique makes and models on its platform, and has a community of 14 million members globally. Turo's largest investors include IAC/InterActiveCorp, August Capital, Canaan Partners, G Squared, Shasta Ventures, and GV and their affiliates. Turo's IPO will be led by Morgan Stanley and JPMorgan Chase & Co with plans for listing its shares on the New York Stock Exchange under the symbol TURO. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Bus maker GILLIG has partnered with RR.AI to jointly develop automated vehicle technology for commuter buses in the United States, according to a company statement. The companies will jointly develop Level 4 autonomous technology for buses, which would allow a vehicle to drive itself under certain circumstances. Safety features such as automatic emergency braking, precision docking, bus yard automation, blind spot detection, and pedestrian avoidance will be developed and tested by the two companies. Derek Maunus, GILLIG president and CEO, said, "We see this partnership as a great fit for both our companies. The GILLIG team is passionate about delivering transformative products and solutions that make transportation safe, efficient and help eliminate roadway congestion. RR.AI is equally committed to those important goals. We're excited to work with such a technology leader to bring advanced vehicle automation technologies to cities across America." (IHS Markit Automotive Mobility's Surabhi Rajpal)

- On January 7, three Community Choice Aggregators (CCAs) - Central Coast Community Energy, Silicon Valley Clean Energy and Sonoma Clean Power - announced that they have partnered to jointly issue a Request for Proposals (RFP) for new clean energy resources. The RFP seeks proposals from qualified and experienced individuals or firms to develop non-polluting energy sources to meet the state's new Mid-Term Reliability procurement mandate in addition to each CCA's Renewable Portfolio Standard (RPS), greenhouse gas emission reductions and reliability requirements. The RFP is at: sonomacleanpower.org/request-for-proposals. Proposals are due by 5 p.m. PT on January 31. The CPUC ordered all load serving entities in the state, including CCAs, to purchase 11,500 MW of new, clean resources to come online by 2026. The decision requires the three CCAs to procure a combined total of more than 600 MW of additional Net Qualifying Capacity (NQC) to come online before June 1, 2026. NQC refers to the ability of a power plant to meet the reliability needs of the grid, particularly during peak, evening hours. Eligible resources for this RFP include (IHS Markit PointLogic's Barry Cassell):

- Non-fossil fuel sources such as solar, wind, renewable plus storage hybrids, and demand response.

- Zero-emitting resources available during peak evening hours, such as energy storage.

- Firm-generation resources that are not weather dependent, such as geothermal.

- Long-duration energy storage that is able to discharge over at least an eight-hour period.

Europe/Middle East/Africa

- All major European equity markets closed higher; Germany +1.1%, France +1.0%, Italy +0.7%, and UK/Spain +0.6%.

- Most 10yr European govt bonds closed lower except UK -2bps; Germany/France +1bp and Italy/Spain +2bps.

- iTraxx-Europe closed -1bp/51bps and iTraxx-Xover -5bps/252bps.

- Brent crude closed +3.5%/$83.72 per barrel.

- Toyota plans to use its Burnaston facility in the United Kingdom to carry out comprehensive refreshing of former customers' vehicles to extend their lifecycle. In an interview with Autocar, Agustín Martín, president and managing director of Toyota GB, said, "We need to stretch the way we look at life for both the vehicle and the customer." He added, "I think we're very familiar with the usual two- to three-year cycles that are extremely popular in the UK, but we need to go beyond that two- to three-year cycle and say, 'Okay, what happens in that second cycle and in the third cycle?'" In this new initiative, which comes under the automaker's mobility sub-brand Kinto, Toyota plans to take vehicles back after their first use cycle - similar to the end of a lease - and refurbish them "to the best standard", leading to a vehicle as close to new as possible, it says. Martín added that this process should allow the vehicle to go through three cycles. Beyond that, the senior executive said that Toyota would recycle the vehicles. Martín reportedly said the questions that still need answering include, "How do we recycle it? How do we reuse different parts that are essential and maybe can be used for other services? How do we then rebuild the batteries, reuse them and recycle them? How do we use part of the material for the brand-new vehicle that's going to be used in the factory?" The report indicates this new initiative may achieve several benefits. Martín suggests that the rejuvenation process could extend the automaker's relationship with customers "at least to 10 years". This likely means 10 years through the life of a car, whereas currently, after the initial ownership period and perhaps some further continued servicing at a dealer after being sold as a used car, the vehicle will likely slip out of the franchised network well before this point. The rejuvenation process is likely to bring with it a warranty similar to one with a new car and, therefore, provide peace of mind for a second or third owner; however, it is likely to require dealer servicing or check-ups to maintain its validity. Furthermore, by maintaining the relationship with the car and owners through its lifecycle, this will enable the company at the end of it potentially to recycle the vehicle in a way that avoids waste and can support new vehicle production with the least environmental impact. (IHS Markit AutoIntelligence's Ian Fletcher)

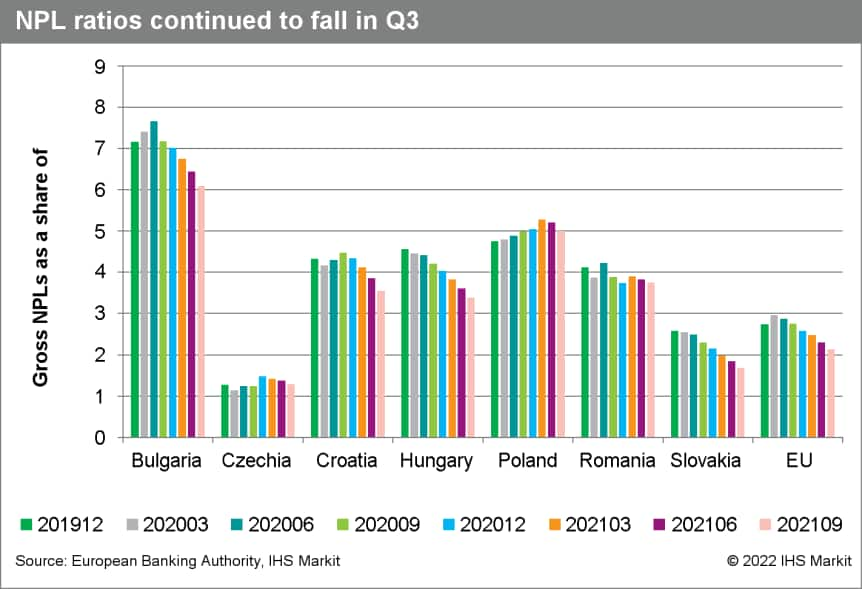

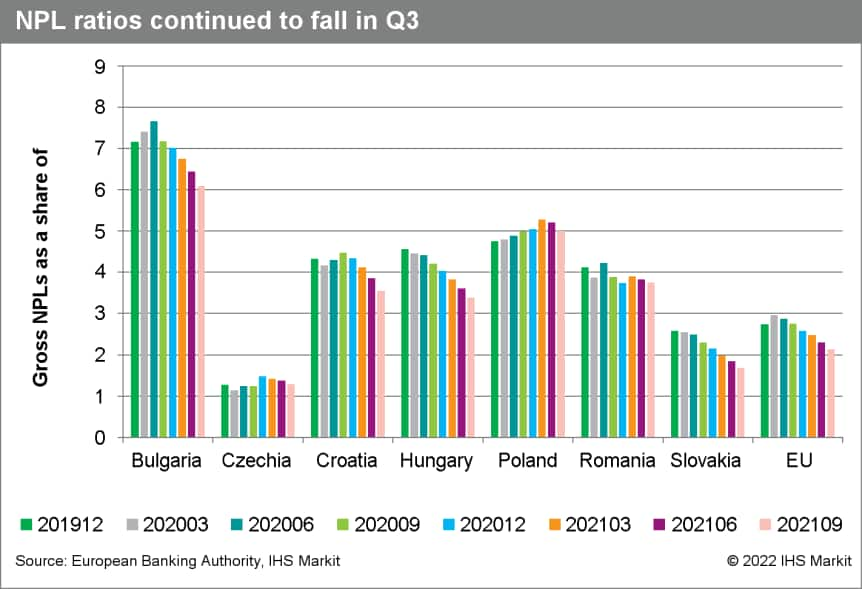

- The European Banking Authority published its latest quarterly risk dashboard on 10 January 2022. The report indicates stable impairment and profitability, but the sector continues to face potential asset quality deterioration from loans previously subject to forbearance measures, along with growing threats from securities revaluation and operational risks, notably those relating to cyber threats and climate risk. This risk dashboard is based on a sample of 161 European banks (unconsolidated banks, including 30 subsidiaries). (IHS Markit Banking Risk's Brian Lawson and Natasha McSwiggan)

- The stock of non-performing loans (NPLs) of the overall sample has fallen by 5%, permitting the NPL ratio to reach 2.1%. Alongside this, NPL ratios for loans to commercial real estate and small and medium-sized enterprises (SMEs) fell to 5.4% and 5.3%, respectively, compared with 5.9% and 5.7%, respectively, in the second quarter of 2020.

- The share of non-expired and expired EBA-compliant loan moratoria to total loans fell in the third quarter of 2021 in the European Union. Nevertheless, this share remains relatively high in Hungary, Poland, and Croatia at 15.2%, 10.3%, and 9%, respectively. However, the stock of loans benefitting from support is higher than the calculated figures given that the data only reflect EBA-compliant moratoria.

- The average common equity tier-1 capital ratio (on a fully weighted basis) has fallen by 0.1 % to 15.4%, reflecting a small decline in capital and a parallel increase of over 1% in assets. The capital ratio and the tier-1 capital ratio stood at 19.5% and 17%, respectively, a minimal decrease over the quarter. The return on equity for the sample was stable, at 7.7%, a marked improvement compared with the 2.5% return recorded in the third quarter of 2020, with an unchanged net interest margin of 1.24%.

- According to the EBA, increased profitability in the quarter was supported by low impairment, but the net interest margin (NIM) remains at historically low levels. The pre-tax return on assets ratio was 0.49% in the third quarter of 2021, largely unchanged for the third consecutive quarter. Banks aim to increase income from fees and commissions and reduce operating expenses in the coming months.

- Coverage ratios remain low, with only 16.3% of the sample reporting over 55% coverage: 32.5% of banks had below 40% coverage, versus 38.1% in the preceding quarter.

- Market risk remains high. The report highlights "price corrections and further increased volatility" with the valuation of securities holdings facing downside risk from high inflation and central bank tightening. This risk is already affecting the price of debt securities holdings, exemplified by an increase of around 0.7 percentage points in the yield on 10-year German Bunds from their 2020 low to just under zero, threatening a move to positive yields for the first time since May 2019.

- The German general election of November 2021 saw the end of a political epoch with Angela Merkel stepping down after 16 years as Western Europe's longest-serving leader. The results of the election were tight and inconclusive, and required the formation of a coalition government, a not unusual situation in German politics. The new coalition of three parties forms a centrist government - the centre-left Social Democratic Party (Sozialdemokratische Partei Deutschlands: SPD), the Green Party (Die Grünen), and the liberal Free Democratic Party (Freie Demokratische Partei: FDP) - with a four-year plan for the coalition agreed at the end of November last year, and the SPD's Olaf Scholz was confirmed as the new Chancellor on 8 December. The new government has a clear focus on Germany's transition to a greener economy and the fight against climate change, which will require legislative changes and subsidized incentives in a broad array of areas. This will include advancing energy policies that phase out carbon-intensive industries. The SPD, the Greens, and the FDP announced that 80% of Germany's power supply should come from renewable sources by 2030. At the same time, the new administration also stated that 15 million electric vehicles (EVs) are envisaged to be on German roads by that date. Following the initial broad brushstroke policy, extra details has emerged that could have implications for the accelerated greening of the German automotive market. This is a high-stakes game for the German government and automotive industry, which employs 880,000 people across Germany and that it is a huge net positive for the German economy as well as being a symbol of national pride. Therefore, it is vital that the correct balance is struck between accelerating the pace of electrification and protecting the stability of, and employment within the industry. Continental, for example, has previously warned that too rapid a transition to an all-electric future will hit jobs, while Bosch has 15,000 workers in Germany alone allocated to the production of diesel engine components. That is the pragmatic approach the OEMs and suppliers would like to see, but with the Green Party's influence, there may not be such a staged transition. It would appear that the new government will look to encourage the sale of pure BEVs over PHEVs. (IHS Markit AutoIntelligence's Tim Urquhart)

- Russia's Prodo Group, owned by Roman Abramovich, has pulled out of the egg sector by selling its Chikskaya production facility to Chelyabinskaya Ptitsefabrika. (IHS Markit Food and Agricultural Commodities' Max Green)

- In a statement, Chelyabinskaya said it had acquired a 100% stake in Chikskaya, a business based in Russia's Novosibirsk region. The acquisition, which closed on 29 December, will strengthen Chelyabinskaya's position as one of Russia's largest egg producers.

- Chelyabinskaya produces table eggs, along with liquid and powdered eggs and chicken meat products. Prior to the latest acquisition, the company produced more than 720 million eggs per year and 1,500 tons of poultrymeat. The newly acquired facility has the capacity to produce around 300 million eggs per year, which will lift the company's annual production capacity beyond one billion.

- Prodo is better known for its meat production activities, which include sausages, semi-finished meat products and meat delicacies. The company has four poultry factories and three meat processing enterprises located in the Central, Siberian, Ural and Volga federal districts. Its brands include Klinsky, Omsky Bacon, Troekurovo, Rococo, UMKK, Yasnaya Gorka.

- Russia currently produces almost 45 billion eggs per year but as in other parts of the world, producers have recently seen profitability eroded by the high cost of animal feed and other inputs.

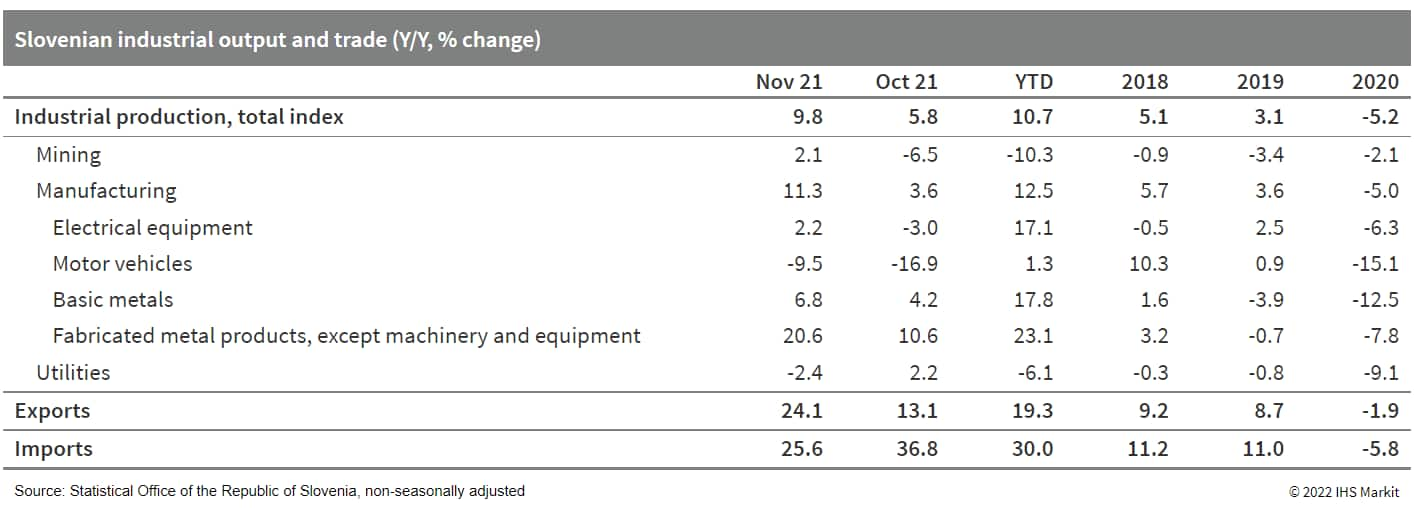

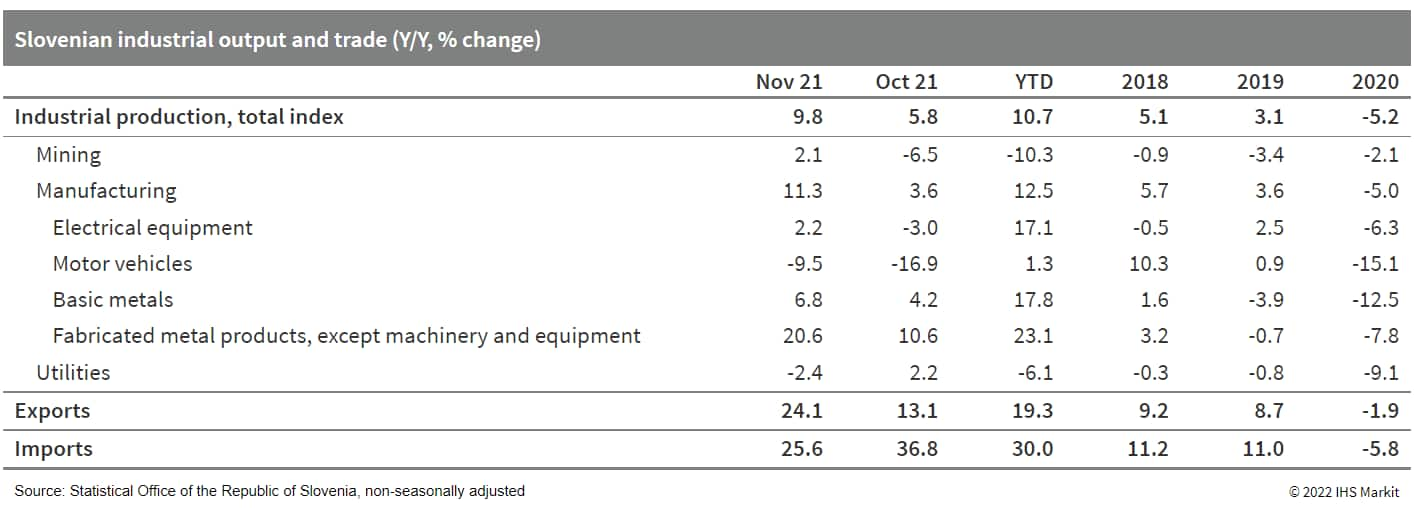

- In November 2021, Slovenian industrial production grew 2.8% month on month (m/m) in seasonally adjusted terms, according to data from the country's Statistical Office. November far exceeded industrial performance previously noted since mid-year. Industrial output increased by only 0.8% over the four prior months in total. (IHS Markit Economist Andrew Birch)

- In particular, in November, the manufacture of durable consumer goods enjoyed a recovery, with output rising by 4.7% m/m that month after having contracted in each of the previous four months.

- Continued industrial gains entering 2022 will depend upon continued strong export gains. Through the first 11 months of 2021, export growth increased by 19.3% year on year (y/y) in nominal euro terms. Total shipments were over 15% higher than they had been immediately before the pandemic, even in the face of global supply and transportation challenges on ongoing COVID-19 lockdowns.

- Botswana's economy continued to recover in the third quarter of 2021 with growth of 8.4% y/y, compared with a 4.5% y/y contraction in the third quarter of 2020, thanks largely to stronger output in the diamond industry. Although a marked slowdown from the record-breaking 37.3% y/y growth in the second quarter of 2021, third-quarter GDP's outcome seems robust enough to push full annual growth to more than IHS Markit's current 7.9% y/y estimate. (IHS Markit Economist Archbold Macheka)

- Supported by strengthening global diamond demand amid the relaxation of COVID-19 travel restrictions, which disrupted the diamond sight-holding calendar in 2020, real value added of mining and quarrying grew by 29.8% y/y. The diamond sub-sector expanded by 31.0% y/y, driven by diamond production in carats, which surged by 32.2% y/y during the quarter under review.

- The wholesale and retail trade sector's real value added also expanded by 8.2% y/y, compared with an increase of 2.7% y/y registered in the third quarter of 2020. The GDP report from Statistics Botswana did not mention the growth drivers, but we assume that the strong performance was supported by the relaxation of strict COVID-19 pandemic protocols. Historically, the wholesale value added has also been largely influenced by the performance of downstream diamond industries.

- Significant growth was also observed in the accommodation and food services sector, which expanded by 5.1% y/y, reflecting increased demand for leisure and conferencing activities as the relaxation of the restriction measures during the quarter continued. Real estate activities registered growth of 5.2% y/y, supported by improved real estate services' performance, which grew by 5.9% y/y.

- Nonetheless, water and electricity utilities value added contracted by 6.4% y/y, compared with growth of 18.6% y/y in the corresponding quarter of 2020, thanks to the electricity component, which recorded a decline of 12.6% y/y as local electricity production decreased by 4.2% y/y. The agriculture, forestry, and fishing value added fell by 4.0% y/y in the third quarter of 2021, mainly as a result of a decline of 8.7% y/y in real value added of livestock farming as fewer cattle were marketed during the quarter.

Asia-Pacific

- Major APAC equity indices closed mixed; India +0.4%, South Korea flat, Hong Kong flat, Mainland China -0.7%, Australia -0.8%, and Japan -0.9%.

- General Motors (GM) and its joint ventures (JVs) delivered 2,891,900 vehicles in China in 2021, down 0.3% year on year (y/y). Retail sales of the Buick brand contracted by 7.8% y/y to 815,900 units last year while sales of the Chevrolet brand slumped by 21.1% y/y to 229,600 units. Cadillac reported growth of only 0.5% y/y last year with sales of 231,800 units. Sales of the Baojun brand have declined by 47.6% in 2021 to 210,800 units. As a highlight in GM's sales report, the Wuling brand's sales rose 28.5% y/y in 2021 to 1,403,800 units. The budget car brand is also the highest-selling brand under GM in the Chinese market. GM's sales stayed flat last year in China thanks to strong performance of the Wuling brand. The Wuling Hongguang Mini EV has outsold an array of electric vehicles (EVs) in China to become the best-selling EV in the market last year. According to GM, its sales approached 450,000 units last year, taking GM's small EV sales to over 750,000 units. Strong market demand for the Wuling Hongguang Mini EV has boosted GM's sales, and partially offset sales declines by the group's other brands, however, the automaker is faced with mounting pressure in the standard-price and premium vehicle market as Chevrolet is clearly losing traction in the market. In the premium EV market, GM has already launched the Cadillac Lyriq. The E-segment premium model, based on GM's Ultium platform, will enable GM to take on rivals such as Tesla, NIO and Audi, in the premium EV segment. Deliveries of the Lyriq are set to begin in mid-2022 in the country. IHS Markit currently expects sales of the Lyriq to stay below 10,000 units in 2022 as the model is currently only available in China as a long-range rear-wheel drive with high selling price of CNY439,700 (USD69,006). (IHS Markit AutoIntelligence's Abby Chun Tu)

- Chinese electric vehicle (EV) startup NIO entered into an agreement with Zhejiang Commercial Group on 9 January to build battery-swapping facilities jointly. The two parties aim to establish battery-swapping stations along expressways in Zhejiang province. Under this partnership, 30 new stations are expected to come online by the end of June. NIO expanded its battery-swapping service network at an unprecedented rate during 2021 with the help of other companies. By the end of 2021, the EV startup had deployed a total of 777 battery-swapping stations in China, 605 of which were newly built in 2021. NIO and Sinopec, one of China's leading utility suppliers, have launched 101 supercharging and battery-swapping stations in China since the opening of first NIO-branded battery-swapping stations in April 2021. The new stations built under NIO's partnership with Sinopec are located inside existing petrol stations in Sinopec's network, saving costs for NIO and making such locations easy to find for EV owners. Thanks to its expanding battery-swapping network, NIO's vehicle sales grew by 109% in 2021 to a record of 91,429 units. (IHS Markit AutoIntelligence's Abby Chun Tu)

- Hanwha Total Petrochemical Co., the largest styrene producer in South Korea, has further reduced the operating rates at its styrene plants in Daesan, said a source with knowledge of the matter. It on Jan. 1 decreased the overall operating rates at its two styrene plants to 70% of capacity, after implementing a run rate cut to 80%-90% in November, the source said. (IHS Markit Chemical Market Advisory Service's Trisha Huang)

- It plans to keep running its two styrene plants, with a combined capacity of 1.05 million mt/yr, at the current reduced rate in the near term, the source added.

- Ongoing styrene capacity expansion in China has pressured margins for Northeast Asian styrene producers and prompted several to curtail output in late 2021.

- The price spread between spot CFR China styrene to key feedstock spot FOB Korea benzene shrank in December to the smallest in 2021, data compiled by OPIS show.

- Ahead of the early-2022 commissioning of three new styrene units in China with a combined capacity of 1.97 million mt/yr, the styrene/benzene price spread fell to an average of $151/mt in December, down by 32.9% from $225/mt in November, OPIS data show.

- For comparison, the styrene/benzene price spread averaged $284/mt in the first six months of 2021, the data show.

- SML Isuzu has temporarily suspended production at its commercial vehicle manufacturing plant located in Shahid Bhagat Singh Nagar district in Punjab (India) for five days until 15 January due to an increase in COVID-19 cases. According to a filing to the Bombay Stock Exchange (BSE), the company said that due to the sudden increase in COVID-19 cases, especially with the highly infectious Omicron variant, resulting in challenges in the supply chain and likely impact on the demand of school buses, and to ensure safety of its employees and optimize inventory, the company has decided to temporarily suspend production. (IHS Markit AutoIntelligence's Isha Sharma)

Posted 11 January 2022 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.