All major equity indices closed higher across the globe today. US government bonds closed lower and Europe was mixed. European iTraxx and CDX-NA credit indices closed modestly tighter across IG and high yield. Copper closed lower, while the US dollar, silver, gold, and oil were all higher on the day.

Americas

- All major US equity indices closed higher; Nasdaq +2.6%, Russell 2000 +2.5%, S&P 500 +1.6%, and DJIA +0.8%.

- 10yr US govt bonds closed +2bps/1.08% yield and 30yr bonds +3bps/1.86% yield.

- CDX-NAIG closed -1bp/55bps and CDX-NAHY -7bps/312bps.

- Silver closed +9.3%/$29.42 per ounce, which is the highest close since Feb 2013.

- DXY US dollar index closed +0.4%/90.98.

- Gold closed +0.7%/$1,864 per ounce and copper -0.3%/$3.55 per pound.

- Crude oil closed +2.6%/$53.55 per barrel.

- Bullish investors are rightfully looking at what is likely to be the largest sequential expansion in global demand in the history of oil markets, taking place over the next eight quarters. This will add 5-7 MMb/d of demand to current consumption levels. After crude led the first wave of buying since last November, speculative traders are positioning themselves to take advantage of improving product demand which is expected to arrive in 2Q2021. To get it right, the bout of macroeconomic expansion at the end of 2020 will have to continue and be accompanied by an effective vaccine rollout. Demand that is still somewhat weaker than hoped for does not derail our recovery outlook, and expectations around the rebalancing of oil markets this year. With these early 2021 disappointments, gasoline stands out as a natural winner if the global recovery goes according to expectation, as it remains more beaten up year on year than diesel, and the jet fuel component of middle distillates demand is still expected to lag into 2023. Futures markets already look ahead to April when year-on-year demand comparisons with 2020's lockdowns will be off the charts. In the US, these contracts will also start pricing in more expensive summer grade gasoline, and look beyond the yearly seasonal low in US gasoline consumption in February. (IHS Markit Energy Advisory's Roger Diwan, Karim Fawaz, Ian Stewart, Edward Moe, and Sean Karst)

- In a press release, Surge Energy US Holdings Company announced the signing of an agreement to acquire Grenadier Energy Partners II LLC's Midland Basin assets for a total consideration of $420 million. The transaction is expected to close in late first quarter of 2021. Grenadier Energy's assets are located in Howard County, Texas. The transaction will add around 18,010 net leasehold acres and 9,000 boe/d (75% oil) of current production to its portfolio, Surge Energy said. The assets also include an operated inventory of approximately 120 drilling locations. Surge said the acquisition is consistent with its strategy to build a long-term sustainable oil and gas company. Surge Energy US Holdings is an independent oil and natural gas company focused on the development, exploitation, production and acquisition of oil and natural gas reserves in the Midland Basin of West Texas. The company is based in Houston, Texas. Grenadier Energy is an upstream oil and gas company headquartered in The Woodlands, Texas. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- More Americans have received at least one dose of a COVID-19 vaccine than have tested positive for the virus, an early but hopeful milestone in the race to end the pandemic. As of Monday afternoon, 26.5 million Americans had received one or both doses of the current vaccines, according to data compiled by the Bloomberg Vaccine Tracker. Since the first U.S. patient tested positive outside of Seattle a year ago, 26.3 million people in the country have tested positive for the disease, and 443,000 have died, according to data from Johns Hopkins University. (Bloomberg)

- Eli Lilly (US) has revealed that its coronavirus disease 2019 (COVID-19) monoclonal antibody (mAb) treatment bamlanivimab generated USD871 million in sales last year, all recorded in the fourth quarter of 2020. The boost has increased its fourth-quarter revenues by 22% year on year (y/y), compared with 7% y/y growth for the quarter when excluding all bamlanivimab revenue. The company has delivered 950,000 doses of bamlanivimab to the United States, and will start delivering the next batch by 31 March after the US government agreed to purchase another 500,000 doses. Regarding expectations in 2021, Lilly forecasts COVID-19-related sales at USD1-2 billion. Lilly is one of several drug manufacturers, including Regeneron (US), that have developed mAbs as a promising treatment option to treat mild-to-moderate COVID-19 patients. (IHS Markit Life Sciences' Margaret Labban)

- A group of Senate Republicans outlined their roughly $618 billion coronavirus-relief offer Monday, including a round of $1,000 direct checks for many adults, as Democrats began a process that would allow them to pass President Biden's $1.9 trillion plan along party lines. The proposal omits measures favored by many Democrats, such as aid for state and local governments and a plan to raise the federal minimum wage to $15 an hour. (WSJ)

- US monthly GDP was essentially flat in December following a 1.2% decline in November that was revised lower by 0.4 percentage point. The flat reading in December reflected declines in personal consumption expenditures and inventory investment that were essentially offset by increases in nonresidential fixed investment, residential fixed investment, net exports, and the portion of monthly GDP not covered by the monthly source data. The level of GDP in December was 1.7% below the fourth-quarter average at an annual rate. Implicit in our latest tracking forecast of 3.1% annualized growth in the first quarter is a jump in GDP in January that reverses the weakness over the prior two months. (US Macroeconomics Team)

- The seasonally adjusted IHS Markit final U.S. Manufacturing Purchasing Managers' Index (PMI) posted 59.2 in January, up from 57.1 in December and broadly in line with the earlier released 'flash' figure of 59.1. The latest data signaled a substantial improvement in operating conditions among manufacturers, and the most marked since data collection began in May 2007. (IHS Markit Economist Chris Williamson)

- Output increased steeply at the start of 2021, as the rate of growth quickened to the fastest since August 2014. The rise in production was often attributed by panelists to stronger client demand and a sharper increase in new orders.

- Growth in foreign client demand also accelerated, as new export orders rose at the fastest pace since September 2014.

- At the same time, supplier delays persisted. Excluding December's record low, vendor performance deteriorated to the greatest extent since data collection began in May 2007. Supply chain disruption reportedly stemmed from raw material and transportation shortages, notably trucking. As a result, input costs rose markedly and at the second steepest pace since April 2018.

- Total US construction spending rose 1.0% in December, in line with the consensus expectation, but below ours. Previous months were revised higher. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Core construction spending rose 1.1% in December following upward revisions to previous months. While robust, the December increase was less than we had assumed.

- Total construction spending continues to be bolstered by strength in the private residential sector, and in particular single-family housing.

- After reaching a trough in May, total construction spending rose at an average monthly rate through December of 1.2% per month. This raised total construction spending well beyond its pre-pandemic peak.

- Roughly 80% of the increase in total construction spending over this period was accounted for by private single-family structures. Historically low mortgage rates are fueling demand in the housing market, and surging house prices are keeping builders interested and engaged.

- Private nonresidential construction spending, on the other hand, has been trending lower for about one year, and the trend continued in December, with private nonresidential construction spending down 1.7% for the month and 9.8% for the year.

- The weakness in private nonresidential construction spending is widespread, with particular weakness in manufacturing and power.

- State-and-local construction spending rose 0.4% in December but remains well below a peak reached last March. Tight state-and-local budgets will weigh on this sector for some time.

- Luminar Technologies, in collaboration with Volvo Cars, has released a curated LiDAR dataset, called Cirrus, to help advance research into autonomous vehicle (AV) software algorithms. Cirrus contains data from Volvo Cars' test fleet deployed with Luminar's LiDAR sensors, which can detect objects ahead of the car out to 250 meters away. The dataset is open to industry developers and researchers with an aim to improve vehicle safety at highway speeds and in complex environments. Duke University's Pratt School of Engineering has also contributed to the project. Christoph Schroeder, vice-president of software at Luminar, said, "Luminar and Volvo Cars are aligned in the belief that sharing knowledge and research will contribute to safer roads for everyone. Our dataset uses non-uniform gaussian scanning patterns, giving developers extremely high-quality information to help build more advanced autonomous capabilities". The dataset is released as part of the new Volvo Cars Innovation Portal, which offers variety of resources and tools for free, enabling external developers to create new innovative services. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Gentex has reported record quarterly net sales of USD529.9 million in the fourth quarter of 2020; however, the supplier's full-year sales declined on production interruptions because of the COVID-19 pandemic. Gentex's financial results for the fourth quarter show net sales were up 19% from USD443.8 million in the corresponding quarter of 2019. The automotive components supplier reports that the fourth quarter was its best ever, after seeing the same achievement in the third quarter as well. The achievements are being driven by sales of its Full Display Mirror, which increased 42% year on year (y/y) to 1.053 million shipments in the fourth quarter, even as global vehicle production declined. Gentex's sales of exterior auto-dimming mirrors also increased in the fourth quarter, by 16% y/y. The supplier's total sales of auto-dimming mirrors increased 14% in the fourth quarter, although they were down 11% in the full-year 2020. In the full year, Gentex's net sales declined 9% to USD1.68 billion. The company's results in 2020 were impacted by the automotive industry's production suspensions in various regions globally in the first half of the year because of the COVID-19 pandemic. Although Gentex did not provide full-year guidance for 2020 because of the impact of the COVID-19 pandemic, the company has provided guidance for 2021. In 2021, Gentex forecasts it will achieve full-year revenue of between USD1.94 billion and USD2.02 billion; its gross margin will remain in the 39% to 40% range; and its capital expenditure will be up to USD95 million. Similar to other suppliers and automakers, in 2020, Gentex drew down on its line of credit as a precautionary step amid the COVID-19 pandemic and, in the second quarter, used USD75 million of a USD150-million credit line. In the third quarter, the supplier paid USD50 million of that amount back. In the fourth quarter, Gentex repaid the remaining USD25 million and the company reports that it does not have any short- or long-term debt. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Ford plans to idle two shifts at its Chicago Assembly Plant in the United States for one week to cope with a shortage of semiconductors, reports Automotive News. According to the report, the two shifts are to be cut for one week. The plant produces the Ford Explorer and Lincoln Aviator mid-size utility vehicles, and the Explorer is the best-selling vehicle in its segment. According to IHS Markit sources, the days' supply of the Explorer dipped to 56 days at the end of December 2020, which was lower than in November (68 days). With a low days' supply, lost production may potentially impact on sales more quickly. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Nissan's plant in Canton, Mississippi, United States, has been impacted by the microchip shortage affecting the auto industry, according to media reports. At the plant, Nissan has cut production of certain models on specific days over the issue, rather than closing the full assembly site. An Automotive News report quotes a Nissan spokesperson as saying, "Nissan is adjusting production capacity within our North American manufacturing operations due to the global semiconductor shortage. We continue to work closely with our supplier partners to monitor the situation and assess the longer-term impact on our operations." The Canton complex produces cars, trucks, and utility vehicles. The report says that overtime production of the Altima sedan was cut during part of January, while production of the Titan and Frontier pick-up trucks was idled for two days in January and is scheduled to be idled on 8 February. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Brazilian exports to the EU (including the UK) fell 14% in 2020, mirroring a similar drop of 13% of EU imports. (IHS Markit Food and Agricultural Commodities' Julian Gale)

- After an extraordinarily challenging year, trade flows picked up in the second half of 2020, with fruit, coffee, and oil and gas playing a pivotal role in this recovery.

- In its inaugural Brazil/EU Trade Monitor report, the Brazilian Trade & Investment Promotion Agency (Apex-Brasil) noted this was particularly the case for Brazilian fruits, with a total value of almost (USD82.3 million) exported in December. This was positive growth year-on-year amid strong demand in Europe for fruits such as mangos and melons, and a weak real making prices of these Brazilian goods attractive.

- In total, Brazil and the EU traded USD59.9 billion in goods during the year, 13.5% less than in 2019.

- In 2020, Brazil's exports to the EU fell 14% or by USD5.02 billion, while imports from the EU fell 13.1% or by USD4.35 billion when compared with 2019. In total, Brazil exported USD30.8 billion to the EU, while importing USD28.9 billion.

- When comparing 2020 with 2019, some of the biggest increases were noted in oil and fuels of USD 960.8 million, soybeans and its products of USD719 million and coffee of USD262.3 million.

- In the first half of the year, COVID-19 was quick to disrupt global trade flows with significant impacts felt on goods traded between Brazil and the EU (including the UK).

- Decreasing trade flows have been noted across many key Brazilian export categories, including agribusiness products such as fruits and beef. This has primarily been a result of the implementation of lockdowns across Europe which forced the closure of the European hospitality industry and trade fairs. Despite this, there is cause for optimism. Trade flows started to recover in the second half of 2020 and some sectors, notably Brazilian coffee, grew by 12%.

Europe/Middle East/Africa

- European equity markets closed higher; Germany +1.4%, Italy/France +1.2%, UK +0.9%, and Spain +0.5%.

- 10yr European govt bonds closed mixed; Italy -2bps, Spain/UK -1bp, Germany flat, and France +1bp.

- iTraxx-Europe closed -1bp/52bps and iTraxx-Xover -2bps/267bps.

- Brent crude closed +2.4%/$56.35 per barrel.

- The UK's competition regulator will examine Uber's proposed deal to acquire Autocab, which sells booking and dispatch software to private vehicle hire firms, reports TechCrunch. In August 2020, Uber agreed to acquire Autocab with an intention to expand its reach in the UK, as it will allow riders to connect to local drivers in areas where it does not currently operate. Competition and Markets Authority (CMA) will inspect whether the deal would cause a "substantial lessening of competition." The CMA has opened an invitation for public comment on the acquisition, before deciding whether to continue with its investigation on or before 26 March 2021. Autocab has built the iGo platform, which operates a global trip marketplace for taxis and private-hire vehicles, as a rival to Uber and Lyft. Uber's plan to acquire Autocab is an attempt at improving the company's business after being hit hard by the COVID-19 virus pandemic. Uber, in partnership with CarTrawler, also launched a car rental service in the UK. Last year, Uber was granted a license to operate in London (UK) for another year and a half after winning its appeal against a previous decision by the city's transport authority. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- According to Germany's Federal Statistical Office (FSO) data, real retail sales excluding cars plummeted by 9.6% month on month (m/m, seasonally and calendar adjusted) in December 2020, which is twice as much as the net gains during July-November. The real adjusted year-on-year (y/y) rate thus came down from November's 9.2% to 0.0% in December. Unadjusted retail sales benefitted from an additional shopping day (in contrast with a missing day in November), therefore this only weakened from 5.0% to 1.5% (and from 6.0% to 2.6% in nominal terms). (IHS Markit Economist Timo Klein)

- Data for the full year 2020 show that real retail sales (shopping-day adjusted) nonetheless posted a strong 3.6% in 2020, up from 3.2% in 2019, and similarly 4.8% versus 3.8% in nominal terms. Sales growth in both years was well above the long-term averages since 1995 of 0.7% (real) and 1.4% (nominal).

- The plunge in December 2020 was largely due to the implementation of a strict lockdown in mid-month that included the closure of all non-essential shops and services. In the interim period between the end of the first lockdown in March-April and mid-December, above-trend retail sales had been attributable to three factors: the temporary VAT cut (July-December 2020), catch-up effects due to the enforced inability to make purchases during March-April, and substitution effects with respect to income that cannot be used for services, which - for public health reasons - were either not available at all or available only with restricted capacity, e.g., restaurants. Furthermore, with a greater share than usual spent indoors, people wanted to improve their living conditions at home and turn to DIY and household equipment.

- Major categories of the price-adjusted y/y data for December 2020 (total 1.5% y/y without shopping-day adjustment; see table below) understandably show a much stronger performance in food sales (6.3%) than non-food sales (-1.5%). Among the latter, 'internet and mail orders' remained very strong at 31.0% y/y, and only one other category, pharmaceutical/cosmetic goods, posted an increase (0.7%). Declines were spearheaded by clothing/shoes at -39.6% y/y, followed by sales at general department stores (-26.8%), sales in 'specialty stores such as for toys, books, bicycles' (-11.6%), and 'furniture/household goods/DIY' (-4.8%).

- The magnitude of the December 2020 retail sales weakness underlines that these data cannot be taken at face value to gauge underlying consumer demand as long as brick-and-mortar stores are closed (apart from shops for daily essentials). One can expect, as in May 2020, a major catching-up spike once retail restrictions are loosened, probably in March. Furthermore, as long as many services in the recreation and entertainment sector remain underutilized - which will last until at least mid-2021, hinging on vaccination progress - consumers will spend an above-average share of their income on retail goods, compared with long-term trends.

- The latest hard and survey data suggest Italian service providers are under increasing pressure to shed labor to make job cuts. Italy has put in place tighter restrictions to tackle the current spike in COVID-19 infections from November 2020, affecting the hospitality, leisure, transport, and retail sectors. Not surprisingly, the government has extended its employment support schemes for another 21 weeks from 1 January. (IHS Markit Economist Raj Badiani)

- Total employment in Italy fell by 0.4% month on month (m/m), or 110,000 to 22.839 million in December 2020, the largest drop since April 2020. Therefore, cumulative job losses in March-December 2020 stood at 425,000, or 1.8% lower when compared with February 2020, the pre-pandemic level.

- The unemployment rate rose to 9.0% in December from a six-month low of 8.8% in November. The number of unemployed people decreased by 34,000 to 2.257 million in December.

- The rise in the unemployment rate in December was moderated by the inactivity rate rising for a second straight month, with an increasing number of people neither working nor looking for work with the government tightening its COVID-19 virus containment measures in late 2020.

- Specifically, the labor force shrank by 0.3% m/m to 25.097 million in December, with the inactivity rate increasing to 36.1% from 35.9% in November and 35.7% in October.

- The employment losses have been less severe than expected during the pandemic, with the country's short-time work or temporary lay-off schemes helping to shore up employment levels. In addition, demand for labor probably enjoyed some support from a stronger-than-expected economic rebound during the third quarter, with the national statistical office reporting that GDP increased by 15.9% quarter on quarter (q/q).

- Saipem has been granted a EUR 460 million (USD 555 million) contract by Eoliennes Offshore du Calvados SAS (EODC) to supply the foundations for the Courseulles-sur-Mer wind farm located offshore France. The contract covers the design, construction and installation of 64 foundations, including large steel monopiles with transition pieces. Fabrication will take place in Europe and installation will be carried out by derrick vessel Saipem 3000. The contract remains subject to EODC taking a final investment decision on the project. The Courseulles-sur-Mer wind farm is located in water depths ranging from 22 to 31 m, about 16 km off the coast of Normandy, France. The 450 MW wind farm is targeted to be commissioned in 2024. EODC is consortium formed by EDF Renewables, EIH S.à r.l, a subsidiary of Enbridge, and wpd Offshore France. (IHS Markit Upstream Costs and Technology's Sophie Dear)

- Assuming no revisions of data for the first three quarters of 2020, the full-year estimate implies that Poland's unadjusted GDP declined by about 2.9% year on year (y/y) during the fourth quarter, slightly worse than the 2.7% decline reported for the first three quarters of 2020. In seasonally adjusted terms, GDP fell by approximately 1.2% quarter on quarter (q/q), far below the 9.2% drop in the second quarter. (IHS Markit Economist Sharon Fisher)

- Detailed GDP estimates signal that fixed investment and household demand were the main factors pulling down the country's GDP during the fourth quarter of 2020. While private consumption fell at the same pace in 2020 as during the first three quarters of the year, the decline in fixed investment accelerated to 8.4% during the year as a whole, from 7.1% in January-September.

- Based on the latest data, IHS Markit assumes that the fourth-quarter-2020 decline was mitigated by rising inventories and public consumption. Net exports were not included in the preliminary data but appear to have had a negative impact.

- Data by sector indicate that trade and construction had a negative impact on Poland's GDP performance in 2020, while value added from industry fell only slightly (down by 0.2%).

- Our January forecast had put Polish GDP down by 3.3% in 2020 as a whole, but we were already planning to upgrade the figure based on the better-than-expected December 2020 output data.

- IHS Markit remains conservative about the GDP growth outlook for 2021, and its current forecast stands at 3.0%, well below the consensus figure of 4.1%. Our comparative pessimism stems from the continued COVID-19 restrictions in place into early 2021, both in Poland and abroad.

- SK Innovation will build a third battery cell plant in Hungary where its two other battery cell plants are located. According to an Electrive.com report, the South Korean cell manufacturer will set up its third Hungarian plant Iváncsa, 50 km southwest of Budapest. The new plant will have the capacity to produce 30 GWh of batteries annually, which the company claims is sufficient to cater for 430,000 battery electric vehicles (BEVs) annually. By the time the third plant is completed, SK Innovation will have invested EUR1.9 billion in its Hungarian battery production cluster. The third battery plant will be considerably larger than the other two, which are located in Komaron, near the Slovakian border. These plants will service demand from the neighboring VW Slovakia plant. One plant with a production capacity of 7.5 GWh is already in operation there, and the second facility, with planned capacity of 9.8 GWh is still under construction and is due to be completed some time this year, with large-scale battery deliveries starting from the second plant in 2022. In a recent statement, SK Innovation said that it intends to increase its global production capacity to at least 125 GWh per year by 2025 and to invest more in European production. The company says it expects battery demand in European markets to increase from 41 GWh to 256 GWh by 2025. (IHS Markit AutoIntelligence's Tim Urquhart)

- Leading, customs-based trade data from the Turkish Statistical Institute (TurkStat) showed that Turkey posted a merchandise-trade deficit of USD49.915 billion for 2020 as a whole; 7.4% of projected GDP. The gap was reported to have been only USD29.512 billion, 3.9% of GDP, in 2019 according to comparable customs-based data. (IHS Markit Economist Andrew Birch)

- A surge of exports in December 2020 pushed the merchandise deficit that month below its year-earlier level, but the improvement was a drop in the ocean compared to the sharp year-on-year (y/y) worsening throughout the first 11 months of the year. A sharp tightening of monetary policy in November failed to immediately slow imports, which continued to grow by double digits in December.

- The global pandemic hit the automotive sector particularly hard, sending total exports down by nearly 18% in 2020. The value of transported oil and gas also plunged in 2020, down by 44%, although it comprised a much lower share of total Turkish exports. Heavy machinery also suffered, with iron and steel exports falling by 12% and machinery exports contracting by more than 5%.

- TurkStat also reported that in 2020, total tourism revenues fell by 65.1%, including a 50% y/y drop in the fourth quarter. Foreign tourism revenues, specifically, plunged even faster, by 68.3%. Foreign tourism revenues accounted for more than 75% of total tourism revenues in 2020.

- The combined sharp widening of the merchandise-trade deficit and the loss of foreign tourism revenues ensure that Turkey's 2020 current account will register a deep deficit - IHS Markit estimates 5.4% of GDP - after posting a modest, 0.9%-of-GDP surplus in 2019. With foreign capital inflows also evaporating in 2020, Turkey's short-term external financing has been perilous, resulting in a sharp jump in the country's external debts.

- In 2021, the merchandise-trade deficit should begin to narrow, though will remain large for the year as a whole. Export gains will be modest throughout the first part of the year. Growth expectations for the EU, Turkey's largest export partner, is being downgraded because of the second wave of the coronavirus disease 2019 (COVID-19) virus and a faltering start to the roll-out of vaccinations. With lockdowns once again imposed, demand will be slow to recover.

- On the other hand, sustained strong import demand will soon begin to fade, a reaction to the sharp tightening of monetary policy since November. In the first half of 2021, although export gains will remain modest, at least import growth will decelerate sharply, allowing for the narrowing of the trade gap.

- In a press release, BP plc announced the signing of an agreement to sell a 20% interest in Block 61 (Oman) for a total consideration of $2.45 billion in cash plus contingent payments of up to $140 million. The transaction is expected to close in 2021. (IHS Markit Upstream Companies and Transactions' Karan Bhagani)

- Under the deal, BP will receive $2.45 billion at the closing of the transaction and an additional contingent payment of up to $140 million payable on pre-agreed future conditions. Following the closing of the transaction, BP will remain the operator of the block with a 40% interest.

- Block 61 is situated in central Oman. It is estimated to hold 10.5 Tcf of gas resources. The block was developed in two phases - Khazzan (phase 1) began production in September 2017, followed by Ghazeer (phase 2) in October 2020. Total combined plateau production from the Khazzan and Ghazeer fields is expected to be approximately 1.5 Bcf/d of gas and 65,000 b/d of associated condensate. The gas produced from the fields is distributed for domestic consumption via Oman's national gas grid and is supplying as feedstock to the Oman LNG.

- In October 2020, BP announced the early startup of the Ghazeer gas field, located in Block 61, Sultanate of Oman. The field was initially expected to come into production in 2021. BP and partners took only thirty-three months to start production from the Ghazeer field after its development sanctioned in April 2018.

- BP said the transaction is an important step towards its global divestment target of $25 billion by 2025.

- PTTEP said the acquisition fits well with its strategy to increase gas portfolio to minimize the impact from oil price fluctuation and to venture into LNG value chain strategy.

- Significant debt vulnerabilities exacerbated by the impact of the COVID-19 pandemic and low global oil prices have seen the Chadian government officially request a restructuring of its external debt under the G20 Common Framework, making it the first country to do so under this arrangement. Chad has also reached a staff-level agreement with the International Monetary Fund (IMF) on a four-year program under the Extended Credit Facility (ECF) and Extended Fund Facility (EFF). (IHS Markit Economist Archbold Macheka)

- According to the IMF, the G20's Common Framework, which includes mainland China, India, and Turkey, aims to address unsustainable sovereign debt and ensure broad participation of creditors with fair burden sharing. Only countries with debt levels deemed unsustainable will qualify for possible debt reduction or rescheduling. This debt initiative will be in addition to the extension of the temporary external-debt freeze, which will end on 30 June 2021.

- The G20 will require full debt transparency to make the initiative successful. Private creditors are urged to participate, but it remains on a voluntary basis. However, countries will be recommended to seek the same treatment terms from private-sector creditors as under the extended G20 Debt Service Suspension Initiative (DSSI) framework.

- At the end of 2019, the IMF estimated Chad's public and publicly guaranteed debt at USD2.8 billion (25.6% of GDP). The bulk of the debt (more than 40%) is owed to Glencore and other commercial lenders. Obligations to the Paris Club of official bilateral creditors accounted for a little more than 4% of the total debt stock, while China held 8.6%.

- Meanwhile, IMF staff have concluded policy discussions with Chad on a new medium-term program that could be funded to the tune of USD560 million under the ECF and EFF funding. The IMF states that "reforms to strengthen governance, enhance transparency, and improve the business climate will be central elements of the program and are essential to promoting economic growth and efficient use of public resources".

- Chad received a total of USD183.59 million under the IMF's Rapid Credit Facility (RCF) to address the elevated external financing needs induced by the COVID-19 pandemic. The country also benefited from the G20's DSSI in June 2020, by the waiving of USD61 million debt repayments until June 2021.

Asia-Pacific

- APAC equity markets closed higher; India +5.0%, South Korea +2.7%, Hong Kong +2.2%, Japan +1.6%, Australia +0.8%, and Mainland China +0.6%.

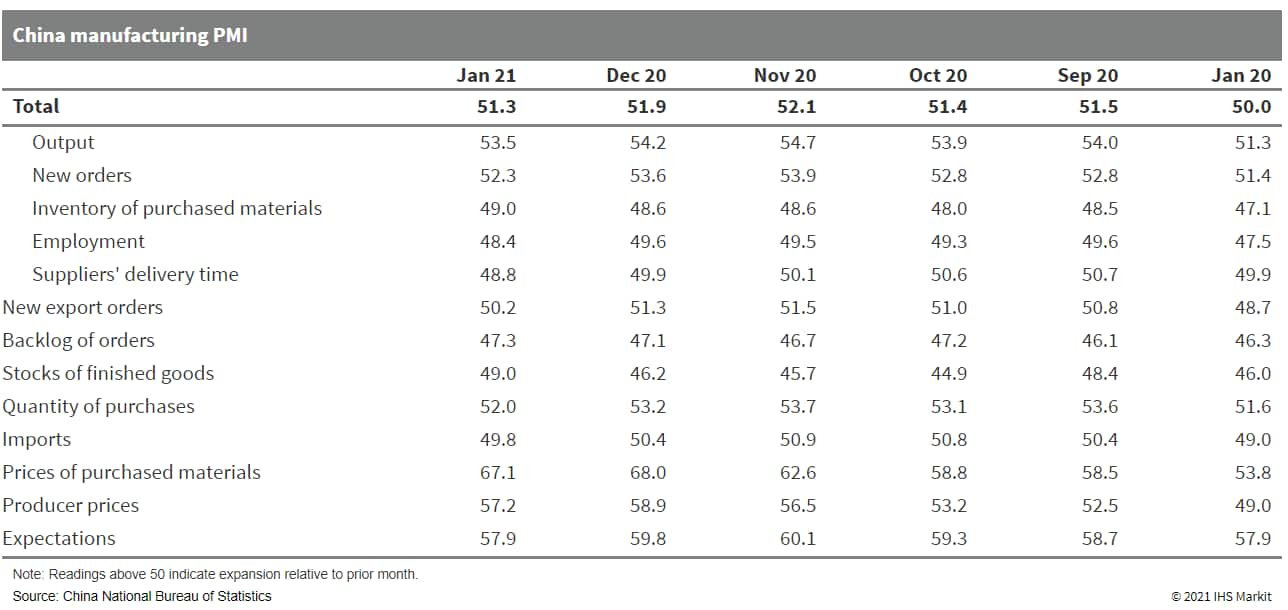

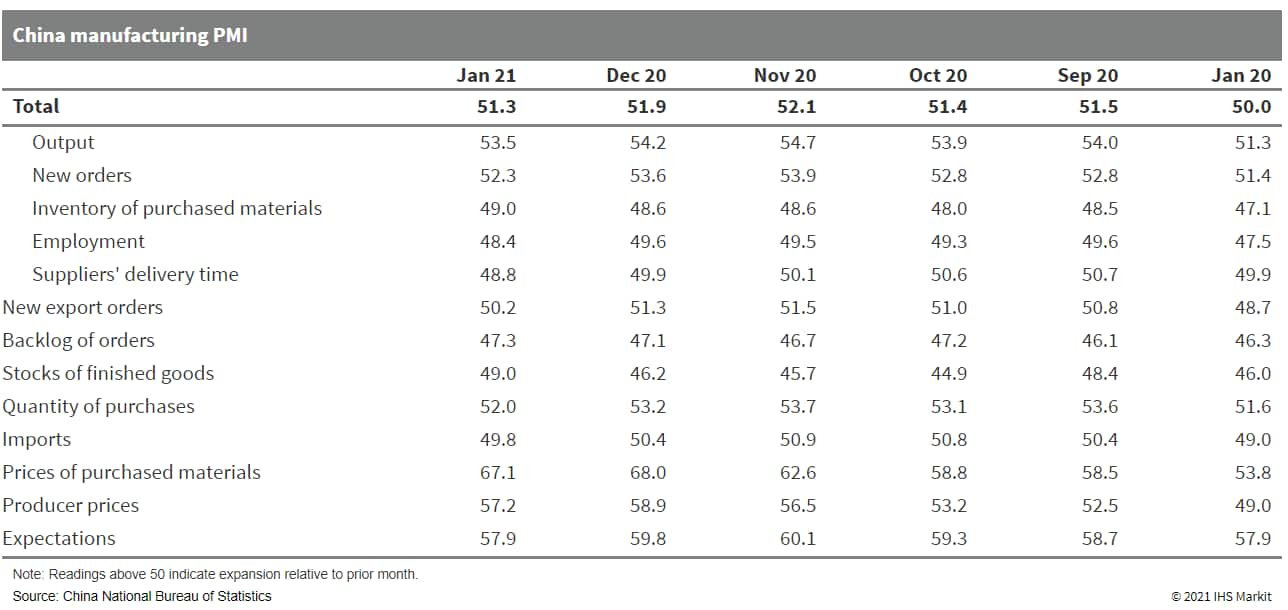

- China's official manufacturing Purchasing Managers' Index (PMI) came in at 51.3 in January 2021, still in expansion territory (for the 11th straight month), but a decline from 51.9 in December 2020. The decline, the largest recorded in 10 years, partially reflects the seasonal weakness in industrial production and demand around the Spring Festival holiday, which usually falls in January or February. (IHS Markit Economist Yating Xu)

- Moderation was registered across supply and demand sub-indexes, except the inventory and backlog of orders segments. The output, new orders, and new export orders sub-indexes all fell, and the imports PMI declined to contraction territory, reflecting slower expansion in production and demand. The input and output price indexes continued to decline from high levels as commodity prices fell.

- The employment sub-index fell again after two consecutive months of increase, and expectations fell to a six-month low. Inventory of purchased materials and finished goods improved on lower prices and demand recovery moderation.

- By sector, the food production, non-ferrous metals smelting and processing, computer, and telecommunications sectors continued to lead the headline manufacturing PMI growth, while the textile and chemicals indexes fell to contraction owing to deterioration in both production and demand.

- By scale of firm, the headline decline was entirely driven by slower expansion in large and medium-sized firms, while small firms registered slower contraction.

- China's non-manufacturing Business Activity Index fell by 3.3 points to sit at 52.4 in January 2021, with deceleration noted in both services and construction. The construction Businesses Activity Index was down by 0.7 percentage point, largely reflecting seasonality. It is worth noting that a sharp decline has been posted in the expectation index for construction activities for the next three months.

- The services PMI dropped by 3.7 points to 51.1, which is below the year-ago figure. The resurgence of COVID-19 cases since December 2020 constrained private consumption as the hotel, catering, transportation, and entertainment sectors reported significant contraction. The number of railway passengers in the first three days of the Spring Festival season shrank by 70% year on year .

- The composite output PMI, covering both manufacturing and non-manufacturing sectors, came in at 52.8, down 2.3 points from the previous month's reading and below the year-ago level of 53.0.

- Owing to disruptions due to the pandemic and ensuing containment measures, China's economic growth in the first two months of 2021 is likely to be muted. Appeals and incentives from the government to reduce traveling and continue production during the upcoming Spring Festival to reduce population mobility will significantly dampen the recovery of consumption and services during the holiday season, particularly in sectors like the transportation, hotel, tourism, and restaurant sectors.

- Hundreds of refrigerated fish containers are stuck at China's major northern port Dalian while some frozen food are diverted to South Korea, according to Bloomberg. The slow process of testing cold chain food has affected the container unloading, thus, availability of empty ones in the shipping market. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- The shortage of plug points and dwindling space at the port have prompted shipping liners to cancel new reefer bookings into Dalian, and the congestion is now spreading to other refrigerated items like fruits. It also means frozen containers are being diverted to other ports in China, leading to bottlenecks in Shanghai and Qingdao too, Bloomberg reports.

- Cargoes of perishable food could be at risk or entirely lost if they can not be re-routed to another port. IHS Markit reported (11 February 2020) similar congestion problem occurring at the beginning of the strict lockdown in China which severely disrupted the world's cargo flow.

- Maersk has halted the reefer bookings for Dalian port from 15 January.

- CMA CGM, the French shipping giant, has levied a congestion surcharge on reefer cargo from all departure ports (except the US, Brazil, Colombia, Uruguay and Argentina) to Dalian Port starting from 11 January 11, 2021 (loading date); the standard is USD1,250/box. For cargo from the US, Brazil, Colombia, Uruguay and Argentina to Dalian Port, this fee will be levied from 11 February, 2021 (the date of loading).

- Dalian Port Co Ltd has introduced (28 January 2021) a preferential policy to support reefer containers by a range of fee reduction. For example, imported refrigerated containers will receive a 20% discount on the use of the refrigerated container warehouse from the 4th day onwards.

- According to figures released by the Japan Automobile Manufacturers Association (JAMA), Japanese vehicle production declined by 2.78% year on year (y/y) to 782, 237 units during November 2020. (IHS Markit AutoIntelligence's Nitin Budhiraja)

- The figure includes passenger vehicles, trucks, and buses. Output in the passenger car category reached 675,833 units during the month, down by 2.1% y/y. Within the passenger car category, production of standard cars with an engine displacement of more than 2.0 liters was down by 0.4% y/y to 443,602 units during the month, while output of small vehicles was down by 14.55% y/y to 107,241 units.

- Production of mini-vehicles, categorized as vehicles equipped with engines smaller than 660cc, was up by 4.72% y/y to 124,990 units.

- The truck segment declined by 1.2% y/y to 101,074 units, while production of buses during November declined by 55.37% y/y to 5,330 units.

- In January-November, Japanese vehicle production declined 18.34% y/y to 7.316 million units.

- Output in the passenger car category reached 6.307 million units during the period, down by 18.16% y/y, while truck production declined by 17.1% y/y to 944,483 units and bus output by 43.08% y/y to 64,297 units.

- The production decline during November can be mainly attributed to lower Daihatsu production which was down by 17.9% y/y to 70,791 units, with the unexpected two-week shutdown of two Daihatsu plants because of component shortages.

- Production is expected to experience a boost in the next few months, once the process of vaccination for the pandemic reaches a considerable population.

- LG Chem has reported a growth of 9.9% year on year (y/y) in its sales revenues to KRW30 trillion (USD26.7 billion) during the full year 2020, according to a company press release. Operating profit also experienced a huge jump of around 185.1% y/y to KRW2.35 billion. LG Chem's Energy Solution division, which includes the electric vehicle (EV) battery business, grew by 47.9% y/y to KRW12.3 trillion, and its operating profit touched KRW388 billion, compared with an operating loss of KRW454 billion in 2019. "In 2020, despite the crisis brought on by the coronavirus pandemic, revenue rose by 10% compared to the previous year, thus breaking the KRW30-trillion mark for the first time-ever, and EBITDA was also recorded at the highest ever at KRW4.6 trillion, thus creating meaningful results in terms of revenue growth and increased profits. This year, the capacities and resources of our company will be focused on the four major business fields of battery materials, sustainable solutions, e-Mobility materials, and global new drug development, as well as in new growth engines as part of our efforts to build a company that can take another leap forward," said LG Chem chief financial officer and vice-president Dong-Seok Cha. This is the first time that LG Chem has crossed the KRW30-trillion sales mark in a year. For the full year 2021, the company expects a revenue of KRW37.3 trillion, which is a 24.1% y/y growth. The company's Energy Solution business expects growth of the EV market to continue and the energy storage system (ESS) market to expand, centering on large power grids, according to the eco-friendly vehicle policy directions of leading countries around the world, and thus anticipates revenue to grow by more than 50%. This is expected to be fueled by new EV model releases, and with increased overseas orders for ESSs. "There are also plans in place to reinforce preparations for the future through e-Platform businesses, development of next-generation batteries, and constructing cooperative relation," said the company. (IHS Markit AutoIntelligence's Jamal Amir)

- Hyundai has created the second ZER01NE fund worth KRW74.5 billion (USD66.5 million) to invest in startups that offer future mobility technologies, reports The Korea Herald. Major backers of the fund include Hyundai, Kia and Hyundai Motor Securities, among other group affiliates, as well as state policy bank Korea Development Bank (KDB) and commercial lender Shinhan Bank. The goal is to foster growth by investing in startups that can contribute to the eco-friendly mobility ecosystem, as well as companies with futuristic mobility technologies with regards to urban air mobility and purpose-built vehicles. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Despite the reduction in fixed costs through self-rescue plans such as the reduction in welfare and labor costs, SsangYong's net loss deepened during 2020, mainly owing to sluggish demand for its vehicles in both domestic and overseas markets, caused by a contraction in consumer spending and production disruptions owing to the COVID-19 virus pandemic. The automaker also suspended production operations for a few days in December 2020 because its suppliers refused to deliver parts. SsangYong's Indian parent, M&M, has said that it is in talks with an investor for the sale of its majority stake in SsangYong to reorganise its investments amid the pandemic. M&M expects to sign a non-binding agreement soon to sell a controlling stake in SsangYong and conclude the deal by 28 February. (IHS Markit AutoIntelligence's Jamal Amir)

- India's central bank is under pressure to step in to keep yields in check after the government surprised bond markets with a bigger-than-expected borrowing plan. India will borrow a gross 12 trillion rupees ($164 billion) via bonds in the fiscal year beginning April, Finance Minister Nirmala Sitharaman said Monday, higher than the 10.6 trillion rupees estimated in a Bloomberg survey. Bonds sold off on the announcement, with the benchmark 10-year yield rising 16 basis points to 6.06% while the 5.15% 2025 bond yield rose 27 basis points. (Bloomberg)

- Tata Motors has released its financial results for the third quarter of its fiscal year (FY) 2020/21, posting its first profit after three quarters as sales rebounded in key markets, including at its luxury unit Jaguar Land Rover (JLR). For the three months ending December, it said in a filing to the Bombay Stock Exchange (BSE) that it had recorded a growth of 5.6% year on year (y/y) to INR756.5 billion (USD10.3 billion) in its consolidated sales revenues while its consolidated net profit grew 68% y/y to INR29.4 billion, up from INR17.5 billion recorded a year ago. In the first three quarters of the FY, consolidated revenues declined by 18.8% y/y to INR1,611.6 billion and net loss totaled INR58.1 billion, compared with a net loss of INR21.1 billion in 2019. During the quarter, JLR reflected a strong sequential recovery in retail sales across markets except the UK, where the third quarter remained seasonally lower. The company recorded a 6.7% EBIT margin and strong positive free cash flows of GBP0.6 billion, reflecting the recovery in sales, favorable mix and Charge+ delivery. Charge+ delivered GBP0.4 billion of savings in the third quarter and GBP2.2 billion in the year to date (YTD) of the current FY. Tata Motors' standalone business posted a strong improvement in passenger vehicle sales and sequential recovery in CVs. CV profitability improved sequentially due to better product mix (higher MHC&V and ILCVs) and ongoing cost savings. Tata generated strong positive free cash flows led by the cost-saving initiatives, which yielded INR26 billion in the quarter and INR51 billion in the YTD. (IHS Markit AutoIntelligence's Isha Sharma)

- After nearly two months without new cases of community transmission, Vietnam on 1 February reported 240 new cases of COVID-19 first detected in two northern provinces in proximity to Hanoi. (IHS Markit Economist Jola Pasku)

- This is the largest outbreak since the pandemic began in January 2020, erupting just before the Tet lunar new year holiday, while also clouding the congress of the ruling Communist party.

- Although the origins of the outbreak are still unknown, health officials have detected the UK and Brazilian COVID-19 virus variants, prompting a race to trace contacts and isolate patients ahead of the biggest holiday season of the year.

- In response to the new outbreak, the government has suspended inter- and intra-provincial transportation to the affected areas, closed schools, and locked down the city of Chi Linh in Hai Duong province for 21 days. Suspected cases in Ho Chi Minh City have raised alarm for a wider regional spread, prompting additional lockdown measures in the southern city of Vietnam.

- Vietnam's health minister considers the current outbreak to be more complicated and serious than previous outbreaks. According to state media, the authorities are preparing for a potential caseload of up to 30,000 new cases.

- Although Vietnam's economy proved resilient amid the pandemic, its short-term growth outlook will be clouded by the severity of the recent outbreak. The government has so far refrained from imposing a strict national lockdown, and has reverted to localized virus containment measures instead.

Posted 01 February 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.