All major European and most APAC equity indices closed higher, while all major US indices were lower. US government bonds closed higher, while benchmark European bonds were lower. European iTraxx closed tighter on the day across IG and high yield, while CDX-NA closed modestly wider on the day. Gold closed higher, the US dollar was flat, and oil, natural gas, silver, and copper were lower on the day.

Please note that we are now including a link to the profiles of contributing authors who are available for one-on-one discussions through our Experts by IHS Markit platform.

Americas

- All major US equity indices closed lower, despite being higher the first half of the trading session until the announcement of the first identified case of the Omicron COVID-19 variant in the US triggered an immediate sell-off; S&P 500 -1.2%, DJIA -1.3%, Nasdaq -1.8%, and Russell 2000 -2.3%.

- 10yr US govt bonds closed -4bps/1.41% yield and 30yr bonds -4bps/1.76% yield.

- CDX-NAIG closed flat/58bps and CDX-NAHY +3bps/331bps.

- DXY US dollar index closed flat/96.03.

- Gold closed +0.4%/$1,784 per troy oz, silver -2.1%/$22.34 per troy oz, and copper -0.7%/$4.25 per pound.

- Crude oil closed -0.9%/$65.57 per barrel and natural gas closed -6.8%/$4.26 per mmbtu.

- Pennsylvania's natural gas production for the July-August-September 2021 was 1,884 Bcf, up by 6.8% from a year ago, said the Pennsylvania Independent Fiscal Office (IFO) in a report released on 1 December. (IHS Markit PointLogic's Kevin Adler)

- "The third quarter growth was largely driven by September production, which grew by 11.3% from September 2020. This is the strongest year-over-year growth for a month of production since July 2019," the IFO said.

- For the first nine months of the year, production is 5,599 Bcf, for a gain of 6.7% over the same period in 2020. It should be noted that the 2020 figures include Q2 2020, which was the lowest growth rate since at least 2017, due to COVID-19 precautions.

- For Q3 2021, the IFO said that Pennsylvania had 10,114 producing horizontal wells, an increase of 5.4% from the prior year. Looking ahead, however, growth might taper because there were 111 new horizontal wells spud in Q3 2021, the same as Q3 2020. "Recent growth in producing wells dropped to its lowest rate on record," the IFO said.

- Susquehanna County continued to lead production for the year, but Washington County is closing fast. For the first nine months of the year, Washington County registered a gain of 17% to 1,029 Bcf, while Susquehanna showed a decline of 2.3% to total production of 1,197 Bcf. Bradford (846 Bcf) and Greene (803 Bcf) are the two other substantial producing counties.

- As with the rest of the US, Pennsylvania's producers have benefited this year—and especially in the third quarter—from rising prices. Pennsylvania prices in Q3 were $3.54/MMBtu, an increase of 187% from the same quarter last year ($1.23/MMBtu). This growth rate far exceeds Henry Hub, which gained 120% year over year, the IFO said.

- ADP said private sector employment shot up by 534,000 jobs in November after surging by a revised 570,000 jobs in October. Economists had expected private sector employment to jump by about 525,000 jobs compared to the addition of 571,000 jobs originally reported for the previous month. (Nasdaq)

- November PMI data from IHS Markit signaled the second-weakest rise in production recorded over the past 14 months as producers reported further near-record supply delays and a slowing of new order inflows to the softest so far this year. Jobs growth also waned amid difficulties filling vacancies. (IHS Markit Economist Chris Williamson)

- Longer lead times, supplier shortages and higher energy prices meanwhile pushed the rate of cost inflation to a fresh series high. Although firms still sought to pass on greater costs to clients, the pace of increase in prices charged slowed to the softest in three months amid signs of push-back to higher prices from customers.

- The seasonally adjusted IHS Markit US Manufacturing Purchasing Managers' Index™ (PMI™) posted 58.3 in November, down fractionally from 58.4 in October and lower than the earlier release 'flash' estimate of 59.1. The latest reading was the lowest since December 2020.

- Although remaining well above the 50.0 neutral level, the PMI was boosted in particular by the further near-record lengthening of supplier lead times and increased inventory building. While normally considered positive developments associated with an expanding manufacturing economy, the lengthening of lead times reflected an ongoing supply shock and inventory building often reflected concerns over the future supply situation.

- US total construction spending rose 0.2% in October. Activity in prior months was revised higher. Although spending in October was above our prior estimate, growth of construction spending in October was below expectations. (IHS Markit Economists Ben Herzon and Lawrence Nelson)

- Core construction spending was flat in October. Prior months were revised higher. In response, we raised our estimate of third-quarter GDP growth 0.2 percentage point to 2.3% and our forecast of fourth-quarter growth 0.1 percentage point to 7.6%.

- While revisions to quarterly growth were positive, the recent momentum in construction spending is soft.

- Over the two months ending in October, total construction spending rose at only a 0.5% annual rate, down from annualized growth over the prior six months of 8.5%.

- The sudden slowing in momentum reflects a peak and early stages of slowing of private residential construction spending, as single-family housing permits peaked in January and have been trending lower since.

- Private nonresidential construction spending is up on the year. After reaching a low last December, private nonresidential construction spending has risen (through October) at a 6.4% annual rate.

- Nearly one-half of that increase has been in the manufacturing sector, as elevated demand for goods has led to expansion of manufacturing capacity. Also contributing to the gain has been spending on commercial warehouses, another reflection of elevated spending on goods.

- After trending lower through June, state and local spending has firmed.

- The US flavor and essential oil processor IFF, listed on the New York stock exchange, has reported that its sales increased by 11-12% on a currency-neutral basis to $3.07 billion (+147% y/y) in Q3 2021, bringing incomes between Q1-Q3 to $8.6 billion (+126% y/y) after completing its merger with Nutrition & Biosciences (N&B). (IHS Markit Food and Agricultural Commodities' Jose Gutierrez)

- Sales were led by nourish, scent and health & bioscience divisions.

- Nourish division sales grew by 15% y/y to $1.66 billion (combined basis) in Q3 2021; health & biosciences rose by 5% to $618 million; scent rose by 9% to $580 million.

- "While the global supply chain environment remains volatile, we are confident in our long-term value creation opportunity as we execute our strategy and drive our business forward," the chief officer of IFF, Andreas Fibig, said.

Europe/Middle East/Africa

- All major European equity indices closed higher; Germany +2.5%, France +2.4%, Italy +2.2%, Spain +1.8%, and UK +1.6%.

- 10yr European govt bonds closed lower; France/Germany/UK +1bp, Spain +4bps, and Italy +6bps.

- iTraxx-Europe closed -2bps/56bps and iTraxx-Xover -9bps/278bps.

- Brent crude closed -0.5%/$68.87 per barrel.

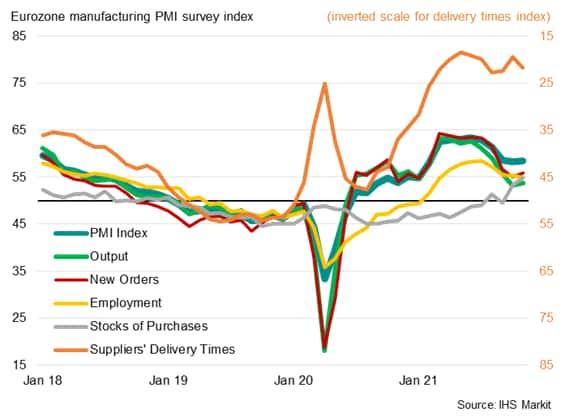

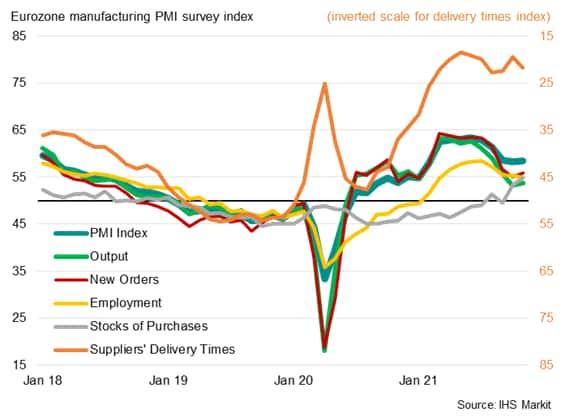

- A strong headline PMI reading masked just how tough business conditions are for manufacturers at the moment. Although demand remains strong, as witnessed by a further solid improvement in new order inflows, supply chains continue to deteriorate at a worrying rate. Shortages of inputs have restricted production growth so far in the fourth quarter to the weakest seen over the past year and a half. (IHS Markit Economist Chris Williamson)

- At first glance, manufacturers in the eurozone had a bumper month in November. The IHS Markit Eurozone Manufacturing PMI increased from 58.3 in October to 58.4, marking the first rise in the headline index since June. The latest reading was not only far above the 50.0 no change level, but also almost seven points higher than the survey's per-pandemic long-run average of 51.7

- The details behind the headline PMI tell a far more worrying picture. Although demand remained strong, as witnessed by a further solid improvement in new order inflows during November, supply chains continued to deteriorate at a worrying rate. Supply delays spiked to a record high in May 2021 and have since continued to deteriorate at rates surpassing anything ever seen prior to the pandemic.

- These shortages of inputs have restricted production growth so far in the fourth quarter to the weakest seen over the past year and a half. At 53.5, the average output index reading for far in the fourth quarter is only slightly above the pre-pandemic long-run average of 52.9.

- A record rise in inventories meanwhile reflected increased efforts by manufacturers to build safety stocks, in turn driven by fears of ongoing shortages of inputs in coming months.

- Infineon Technologies (Malaysia) has announced the acquisition of Malaysia-based electroplating company Syntronixs Asia, according to a company statement. The terms of the deal were not disclosed. Founded in 2006, Syntronixs Asia has a workforce of over 500 people and has been a major service provider for Infineon since 2009. It specializes in precision electroplating, a key process in assembling semiconductors, which is required to ensure the high quality and long-term reliability of Infineon's products. (IHS Markit AutoIntelligence's Jamal Amir)

- Both Mercedes-Benz and Stellantis have announced agreements on the development of solid-state battery technology with startup Factorial Energy. In the separate statements, each automaker also announced investment in Factorial, with the amounts undisclosed. Mercedes-Benz said it has the goal of testing prototype battery cells as early as 2022, looking to develop next-generation technology jointly with Factorial. Mercedes added that it aims to integrate the technology into a limited number of vehicles in a small series within the next five years. Mercedes said its goal for the partnership is to "start with the cell and extend development to include entire modules and integration into the vehicle battery". In a statement, Markus Schäfer, member of the board of management of Daimler AG and Mercedes-Benz AG, and responsible for Daimler Group Research and Mercedes-Benz Cars chief operating officer, said, "We will also play a leading role in the field of battery technology. With Factorial as our new partner, we are taking research and development in the field of promising solid-state batteries to the next level. To this end, we are investing a high double-digit million-dollar amount in Factorial. With this cooperation, we combine Mercedes-Benz's expertise in battery development and vehicle integration with the comprehensive know-how of our partner Factorial in the field of solid-state batteries. (IHS Markit AutoIntelligence's Stephanie Brinley)

- German freight and logistics business DB Schenker has placed an order for nearly 1,500 new electric trucks from Volta to use on final-leg deliveries in European cities, according to a joint company press release. Schenker, which is owned by state-owned German rail company Deutsche Bahn, will use prototype electric trucks on final-leg deliveries during the first half of 2022 and will gather data and feedback during these trial operations, with 1,470 production trucks then being delivered. The trucks will operate out of 10 DB Schenker locations in five countries across Europe. The trucks that will comprise the DB Schenker order will be built at the former MAN plant in Austria that has been acquired by Steyr Automotive. Volta Trucks plans to start production of the Volta Zero, a 16-ton electric truck, in 2022, and it will be this model that DB Schenker will use. (IHS Markit AutoIntelligence's Ian Fletcher)

- Following last year's release of its dual-crane wind turbine installation vessel design, and its design focused on converting obsolete drill ships into offshore wind turbine installation vessels capable of transporting and installing monopiles over 100 meters length, Spain-based Offshoretronic has announced a new fixed-bottom tripod foundation design that it touts can be installed in depths of up to 90 meters. (IHS Markit Upstream Costs and Technology's Melvin Leong)

- The foundations, called Tripod Plus, has been stated by the company to be adaptable to different types of seabed soil conditions, and is not limited to size for fabrication and onshore logistics. The tripod solution will comprise two components, namely a configurable tripod base and a monopile insert. The tripod base can be installed pre- of post-piled, or modified to use suction buckets. The company also has a small-sized suction bucket and post-pile solution which it claims allows faster installation in deeper waters.

- The monopile will have a suction bucket end to transfer the turbine loads to the soil and only required a single lift, without the installation of any further transition piece. Other features include integrated fiber optic load-cells for real-time monitoring of lateral forces. The company has stated that the new foundation design can be transported and installed by its Sustainable Installer Crane Vessel, with up to four 20 MW turbines per trip.

- Statistics Finland's latest preliminary quarterly national accounts data show that GDP volume in the third quarter of 2021 increased by 0.8% quarter-on-quarter (q/q), adjusted seasonally and for working days, following marginally upward-adjusted second-quarter growth of 2.2% q/q. Working-day adjusted year-on-year (y/y) growth settled at 4.2% after recording 8.2% y/y in the second quarter (adjusted from 7.5% y/y as reported previously), or 4.0%, adjusted seasonally and for calendar variation. (IHS Markit Economist Venla Sipilä)

- Private consumption volume continued to expand at a respectable pace, even if the rate of growth moderated to 3.1% y/y from 9.5% y/y in the second quarter and to 1.3% q/q from 2.0% q/q. Amid varied results, household expenditure on services and semi-durable goods grew, whereas consumption of durable goods contracted. Consumption of non-durable goods increased year on year, but decreased quarter on quarter.

- Government consumption expenditure increased at a decelerated pace of 2.8% y/y and 0.4% q/q. Public investments contracted both y/year on year and quarter on quarter.

- Performing decidedly weaker than consumption expenditure, gross fixed capital formation returned to contraction, sliding by 0.3% y/y and by a disappointing 3.1% q/q. In particular, after returning to growth in the second quarter following nine consecutive quarterly y/year-on-year contractions, private investment growth decelerated to 2.4% y/y from 5.9% y/y. Investments fell by 3.3% from the previous quarter.

- Further details showed that investments in residential buildings increased, but investments in other building construction and civil engineering decreased. Machinery, equipment, and transport equipment investment also fell.

- On a more positive note, especially regarding medium-term growth prospects, revised detailed data on capital formation showed that investments on research and development and software have performed stronger than previously estimated during the first half of the year.

- For the first time since the start of the pandemic, exports of goods and services began to show signs of true recovery, growing by 9.4% y/y and by 4.1% q/q.

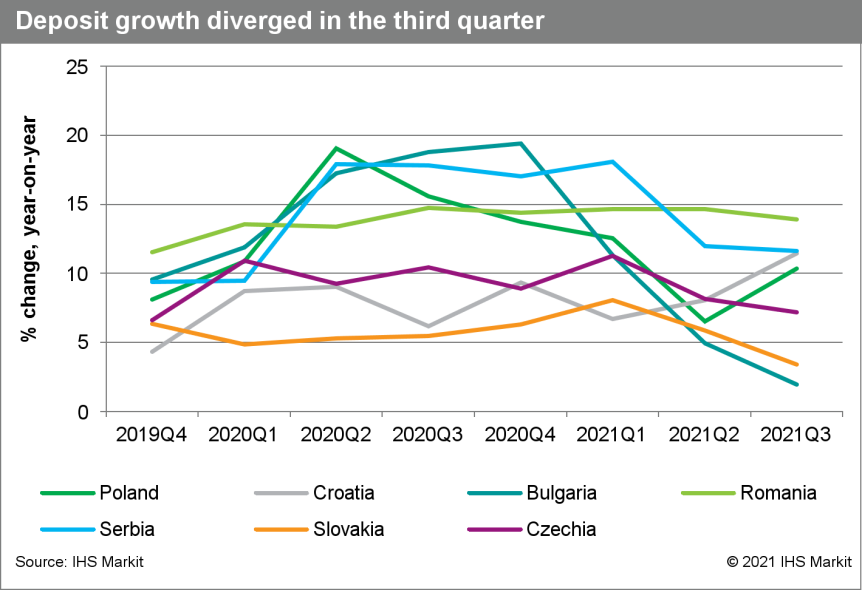

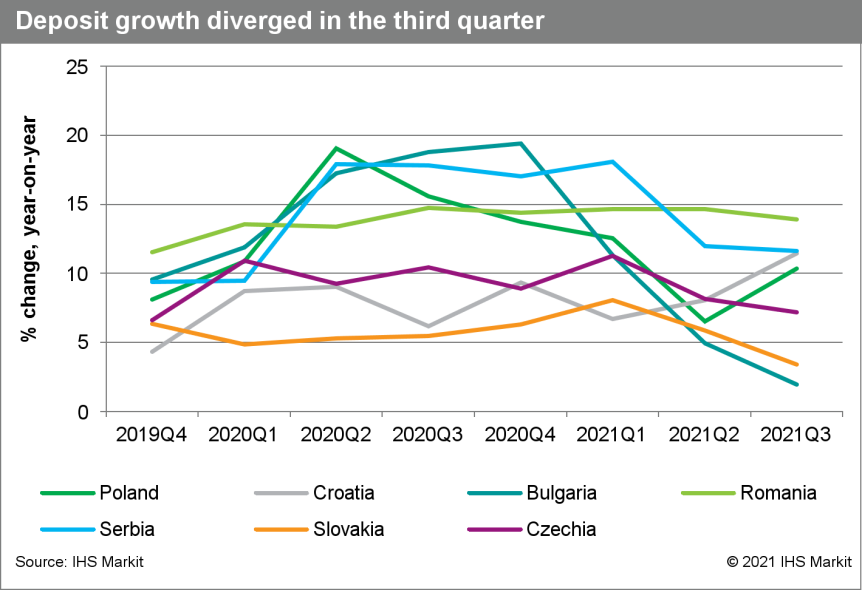

- Third-quarter 2021 data for banking sectors in Emerging Europe, including Bulgaria, Croatia, Czechia, Romania, Serbia, and Slovakia, highlight strong household lending, generally slowing deposit growth, improved asset quality, and robust capital positions. (IHS Markit Banking Risk's Natasha McSwiggan)

- A strong demand for credit and easing supply conditions in the household segment have sustained loan disbursements across Emerging Europe in the third quarter of 2021. Credit remained strong in most regions; IHS Markit estimates that the regional credit growth average was maintained at around 10% year on year (y/y) in the third quarter with the exception of Serbia, where the lending pace slowed slightly, reflective of tightening in the corporate loan segment. Credit surveys in the region have signaled an easing of standards in the household segment in the third quarter, yet the corporation (particularly the small and medium-sized enterprise [SME]) segment did not experience a strong credit easing.

- Non-performing loan (NPL) ratios have fallen in the banking sectors across the region and capital positions appear strong. Third-quarter NPL data for Czechia, Bulgaria, and Poland indicate that NPL ratios have fallen compared with the quarter before. Most sectors have returned to or fallen below their pre-COVID-19 pandemic levels. Czechia's NPL ratio stood at 2.59% as of the third quarter, although it had decreased since its fourth-quarter 2020 peak of 2.75%. In some countries, quarter-two data are the latest datapoint available but they also indicate a decrease in the rate across the board, largely supported by moratoria uptake. According to the European Investment Bank's Central, Eastern, and South-Eastern European (CESEE) Autumn Bank Lending Survey, 35% of banks indicate that 10-20% of outstanding loan portfolios were still affected by the moratoria. For other 15% of banks, moratoria covered between 20% and 70% of total outstanding loan portfolios. Serbia seems to be still particularly affected by the measure, with the same survey indicating that for 70-80% of banks in the region, over 70% of their household loans are still under moratoria, while more than 60% of corporate loans are still under moratoria in 40-60% of banks.

- Deposit growth developments have been mixed and appear highly dependent on macroeconomic prospects and uncertainly related to COVID-19-pandemic-related restrictions in the fourth quarter. Deposit growth developments were quite mixed, but appear to have slowed in many countries since the mid-2020 peak growth rates in the third quarter. Croatia and Poland are two exceptions to this, where deposit growth reached 10.4% year on year (y/y) and 11.5% y/y, respectively.

- In the third quarter, Turkish GDP grew by 2.7% quarter on quarter (q/q) in seasonally adjusted data from the Turkish Statistical Institute (TurkStat). Growth accelerated from the 1.5% q/q gain noted in the second quarter, when widespread lockdown measures to combat a resurgence of COVID-19 infections undermined overall economic activity. (IHS Markit Economist Andrew Birch)

- Shifting base effects brought down annual GDP growth substantially from the second quarter, although it remained extremely strong, at 7.4% year on year (y/y). In fact, Turkey registered the strongest growth among the G20, far surpassing both the UK and China. Expansionary economic policies - an approach that was intensified late in the quarter - sustained the vigorous expansion. Overall for January-September 2021, GDP was up by 11.7% y/y, well ahead of the anticipated pace.

- Base effects had a large impact on the contribution to annual headline growth in the third quarter. A strong recovery of domestic demand in the third quarter last year and a sharp deterioration of net exports severely colored the annual growth rates this year.

- In seasonally adjusted data, the expansionary economic policies of the government and the Central Bank of the Republic of Turkey (TCMB) facilitated a strong, 7.6% q/q expansion of household consumption in the third quarter. Heavy government spending was also apparent in government consumption that quarter, rising by 8.3% q/q.

- Both exports and imports of goods and services grew relatively robustly, by 3.7% q/q and 3.8% q/q, respectively, in the third quarter in seasonally adjusted data. However, imports had previously been contracting for three consecutive quarters. The result was a substantial divergence in the annual rate of change between exports, up 25.6% y/y, and imports, which were down 8.3% y/y, in the third quarter.

Asia-Pacific

- Most major APAC equity indices closed higher except for Australia -0.3%; South Korea +2.1%, India +1.1%, Hong Kong +0.8%, Japan +0.4%, and Mainland China +0.4%.

- SAIC Motor is considering a fresh round of fundraising for its mobility service platform, Xiangdao Chuxing, Bloomberg reported. According to the report, the company seeks to raise as much as CNY1 billion (USD157 million). SAIC will announce this plan, which is yet to be finalized, as soon as this month. In November 2018, SAIC launched Xiangdao, which is a holistic solution in the ride-hailing sector, providing vehicles, repairs, maintenance, automotive financing, and insurance services for its drivers. The service attracted more than 26 million registered users in 2020 and over 2,200 corporate clients. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- China's Zhejiang Petroleum and Chemical, or ZPC, plans to raise productions rates for its new No. 4 paraxylene unit to 100% following successful trial runs, according to market sources Wednesday. The company will increase rates at this 2.5 million mt/year PX unit to 100%, subsequently shutting its No.1 PX line, which has a 2 million mt/year capacity, for servicing. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- The No. 4 PX unit is the second PX unit of the company's phase-2, 400,000 bbls/day refinery that started up March 2021.

- It's No. 3 PX unit, heard to be operating normally, is also part of its phase-2 refinery, with 2.5 million mt/yr of PX capacity.

- ZPC's No. 1 and No. 2 PX units, each with 2 million mt/yr and both part of its phase-1 400,000 bbls/day, were heard operating at full capacity.

- The company aims to achieve a 100% production rate at its new fourth line within December, according to a market source.

- "The company has already achieved on-spec PX production at its new line. They might alter plans to service the No.1 unit, or turnaround other units after No.4 hits 100%, so we will have to see." the source added.

- According to financial statements for the third quarter of 2021, sales for all of Japan's industrial sectors, excluding finance and insurance, fell by 0.4% quarter on quarter (q/q). The q/q weakness was due to a 1.1 % q/q drop in manufacturing sales and a 0.1% decrease in non-manufacturing sales. (IHS Markit Economist Harumi Taguchi)

- While supply chain disruption and softer external demand led to the first q/q decline for manufacturing sales since the second quarter of 2020, the continued negative effects of containment measures drove a third consecutive quarter of q/q fall in non-manufacturing sales. Year-on-year (y/y) growth weakened to 4.6% largely because of declines in sales of transport equipment, wholesale and retail sales, amusement, and eating and drinking services.

- Ordinary profits fell by 7.4% q/q, with declines for manufacturing (down 8.2% q/q) and non-manufacturing (down 6.8% q/q). However, ordinary profits registered a 35.1% y/y rise thanks to continued increases in a broad range of industry groupings, particularly in information and communication electronics equipment, chemical and related products, iron and steel, and wholesale.

- The weaker y/y growth from a 93.9% y/y rise in the second quarter of 2021 largely reflected slowdowns in profits of transport equipment, transport and postal services, and electrical machinery/equipment/supplies, as well as declines in profits of construction, production/transmission/distribution of electricity, and petroleum and coal products. The weakness was due partially to base effects, but also slack sales and higher costs.

- Samsung Electronics introduced the Exynos Auto T5123 for 5G connectivity, the Exynos Auto V7 for in-vehicle infotainment systems and the ASIL-B certified S2VPS01 power management integrated circuits (PMICs) for the Exynos Auto V series, according to a company press release. "Smarter and more connected automotive technologies for enriched in-vehicle experiences including entertainment, safety and comfort are becoming critical features on the road," said Jaehong Park, executive vice-president of System LSI Custom SOC Business at Samsung Electronics, adding, "With an advanced 5G modem, an AI-enhanced multi-core processor and a market-proven PMIC solution, Samsung is transfusing its expertise in mobile solutions into its automotive lineup and is positioned to expand its presence within the field". The Exynos Auto T5123 is a 3GPP Release 15 telematics control unit designed to perform 5G connectivity in both standalone and non-standalone mode for connected vehicles. Information is delivered in real-time via high-speed download of up to 5.1 Gbps enabling high-definition content streaming and video calls on the go. (IHS Markit AutoIntelligence's Jamal Amir)

- Hyundai and Kia have chosen Siemens as their preferred bidder and strategic partner for next-generation engineering and product data management using Siemens' NXTM software and Teamcenter portfolio from the Xcelerator portfolio of integrated software, services, and development platform, according to a press release published on PR Newswire. The two automakers weighed in on a number of options, including incumbent solutions, before settling on Siemens' software. "Selecting NX software and the Teamcenter portfolio from Siemens' Xcelerator portfolio for our core design and data management platforms will introduce a new working environment for our teams that will pave the way for a leap forward in future car development," said Albert Bierman, head of R&D at Hyundai Motor Company. (IHS Markit AutoIntelligence's Jamal Amir)

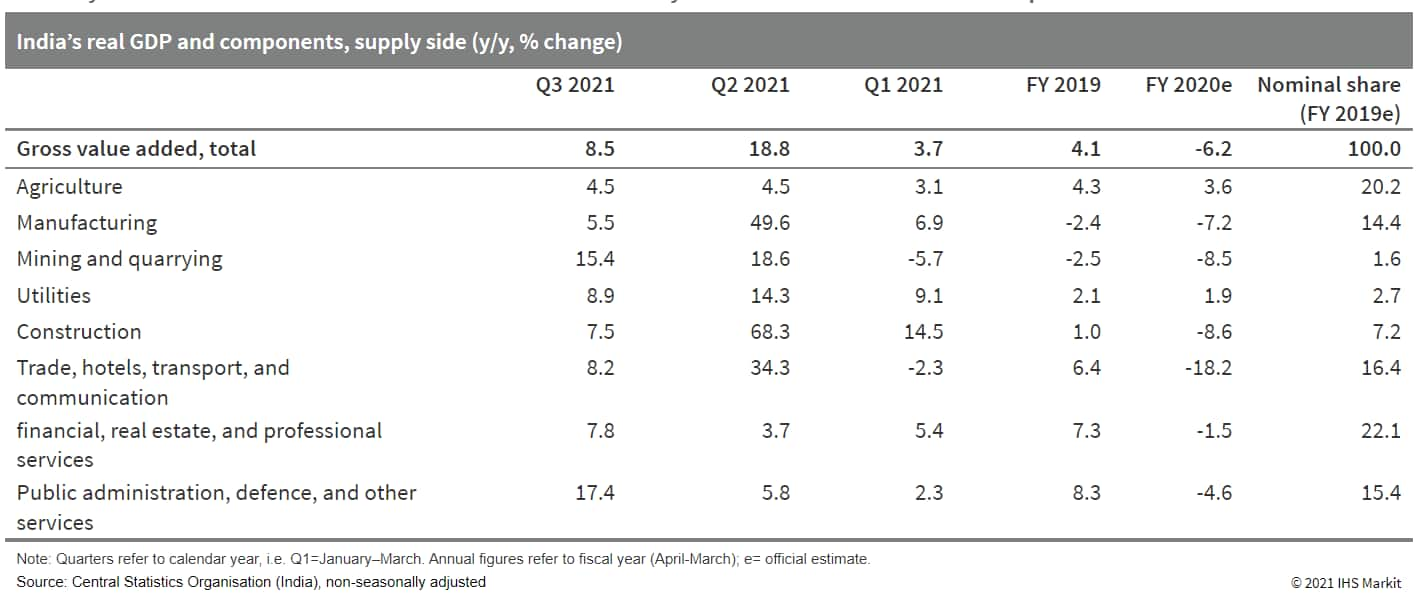

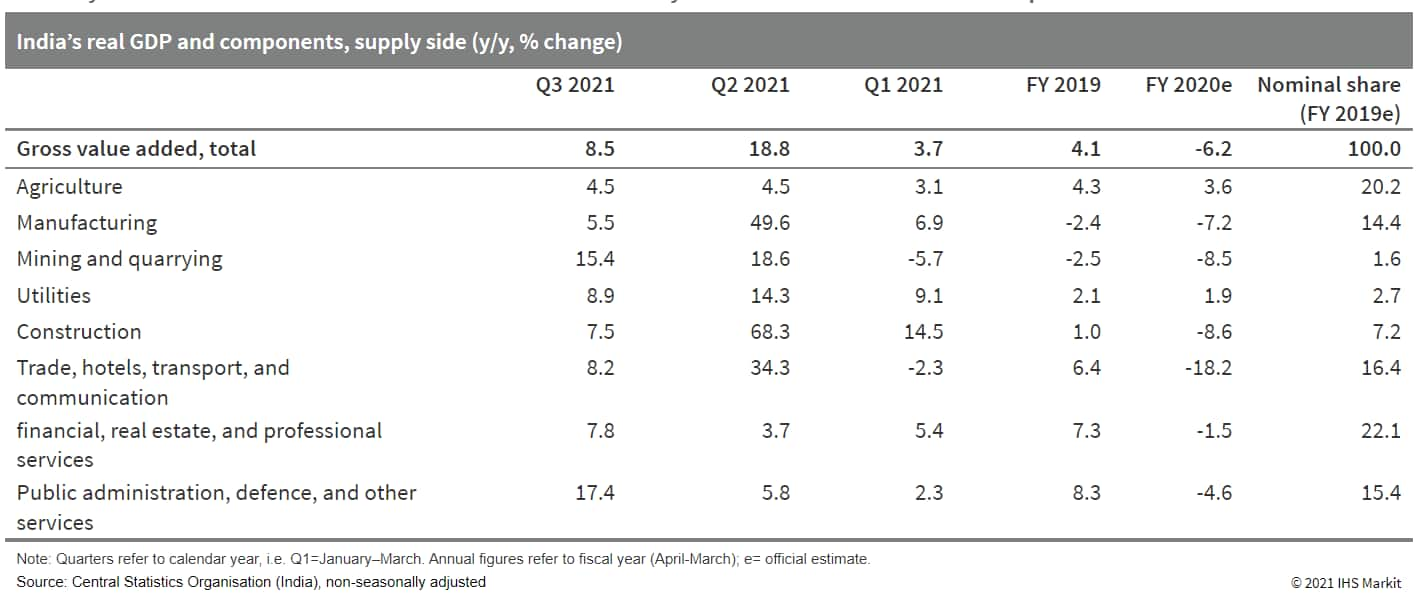

- India's GDP growth rebounded to 8.4% y/y in September quarter as disruptions ease after second wave of COVID-19. Easing lockdown restrictions, faster vaccination progress, and improving sentiment moved India's economy towards greater normalization in the June-September quarter - the second quarter of the fiscal year 2021 - after the recovery was interrupted by the second wave of the COVID-19 pandemic in the first fiscal quarter. The recovery is set to continue in the second half of the fiscal year, but momentum may slow amid persistent supply constraints and rising prices, particularly in the energy sector. The resurgence of the pandemic also remains a risk. (IHS Markit Economist Hanna Luchnikava-Schorsch)

- Private consumption, which constitutes the bulk of the demand-side GDP, grew by 8.4% year on year (y/y), while also showing a sequential recovery of 9.2% from the first fiscal quarter. With the second wave of the pandemic receding, vaccination rates rising, and the employment situation improving, consumer sentiment rebounded solidly towards the end of the quarter, with the household sentiment survey conducted by the Reserve Bank of India (RBI) showing the indices for the current situation and future expectations either exceeding or nearing their levels prior to the second wave.

- Improved manufacturing capacity and domestic approval of several foreign vaccines significantly boosted the vaccination drive during the quarter, with the double-dose vaccination rate sharply rising to approximately 17.5% of the total population by the end of the quarter from about 4% at the start. Vaccination rates have improved further since, with nearly 32% of the population being fully vaccinated at the end of November.

- Investment activity as measured by real gross fixed capital formation grew by 11.0% y/y and 11.8% sequentially, supported by the lifting of curbs, ample liquidity conditions, and improving demand. In absolute terms, however, investment levels remained below those observed prior to the second wave.

- Both real exports and imports grew strongly at 19.6% y/y and 40.6% y/y respectively, reflecting improvements in external and domestic demand. Sequential gains were also strong, but the pace of imports' recovery was nearly double that of exports, resulting in a negative contribution of net exports to growth.

- Ride-hailing firm Grab will list in the US on 2 December, after shareholders of the special purpose acquisition company (SPAC) Altimeter Growth Corp. approved the merger between the two companies at an extraordinary general meeting. The combined entity will trade on Nasdaq under the ticker symbol "GRAB". Altimeter Growth said there were virtually no shareholder redemptions, or shareholders voting to receive their investment back. The redemption rate was 0.02%. Official voting numbers will be made public after a form 8-K is filed with the US Securities and Exchange Commission, The Straits Times reported. Grab agreed to go public via an SPAC merger deal with Altimeter Growth at USD40-billion valuation earlier in 2021. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- VinFast parent Vingroup is reported to be seeking about USD1 billion in new investment and considering a possible US stock listing, according to media reports. Reuters has reported that Vingroup has been in talks with investor groups, including the Qatari sovereign fund Qatar Investment Authority (QIA) and BlackRock, as well as global private equity firms. Reuters has said that if the effort is successful, it could be the largest fundraising round for a Vietnamese company to date. Reuters sources have also reportedly said there is consideration for taking VinFast public with a US stock listing as soon as early 2022. The sources have declined to be identified as talks are reportedly ongoing, Reuters said. (IHS Markit AutoIntelligence's Stephanie Brinley)

Posted 01 December 2021 by Chris Fenske, Head of Capital Markets Research, Global Markets Group, S&P Global Market Intelligence

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.