Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Oct 04, 2024

By Xylex Mangulabnan

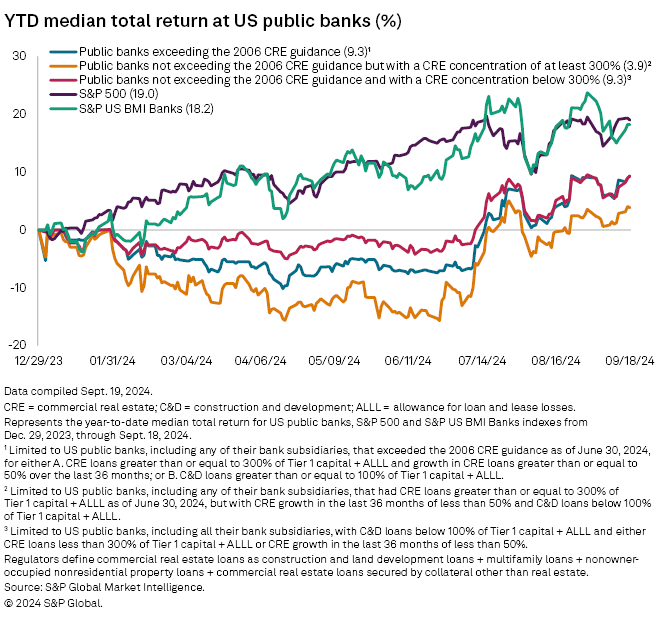

Stock prices of US banks with outsized commercial real estate exposures continue to underperform the rest of the bank industry, but the gap narrowed in recent months as the Federal Reserve inched closer to cutting interest rates.

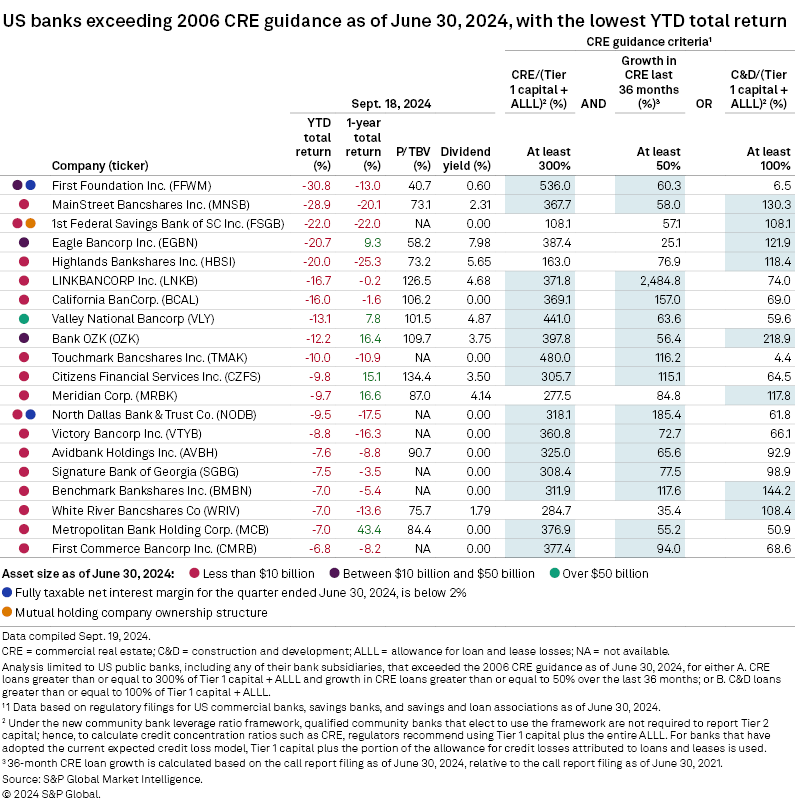

Public banks with commercial real estate (CRE) concentrations of at least 300% of risk-based capital that did not meet the overall 2006 regulatory CRE concentration guidance posted a 3.9% median total return from the start of the year through Sept. 18, the same day the Federal Reserve cut interest rate for the first time in four years and signaled that additional cuts are on the way, according to an S&P Global Market Intelligence analysis. In comparison, the S&P BMI Banks index, which includes all public US banks on a market-cap-weighted basis, increased 18.2% over the same period. The disparity in performance amounted to an underperformance of 14.3 percentage points compared to a 21.4-percentage-point underperformance through July 12.

Meanwhile, banks that met the 2006 regulatory CRE concentration guidance by exceeding the 300% threshold and having a 36-month CRE loan growth of at least 50% or construction loans totaling at least 100% of risk-based capital posted a median year-to-date total return of 9.3%, a 12.3 percentage improvement from July 12.

While the continued underperformance shows investors remain skeptical of banks above the key 300% regulatory threshold, the improvement shows investor skepticism has cooled in the lead-up to the Fed's rate cut. In addition to the improving rate environment, investors have grown more comfortable as disclosures from CRE-heavy banks around their loan portfolios have enhanced investor understanding of their credit quality, Raymond James analyst Steve Moss said in an interview.

"You've just got to keep providing disclosures," Moss said. "More portfolio analytics is, by far and away, the biggest thing a bank can do to help with investor understanding."

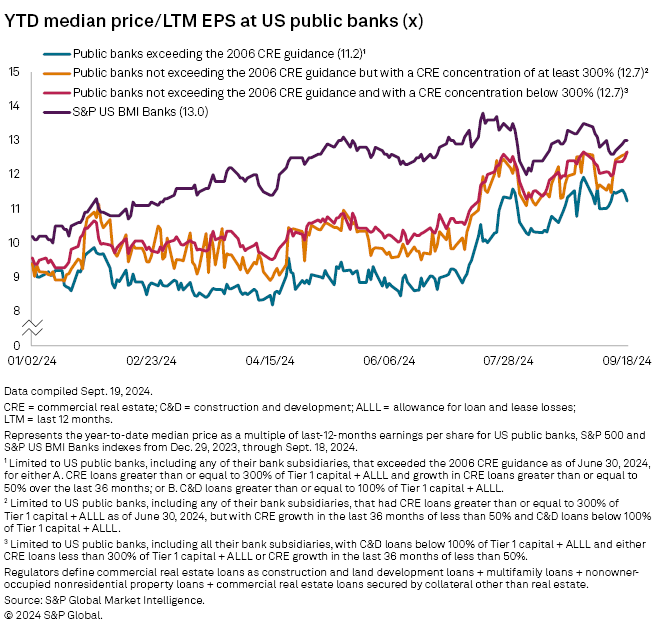

The improvement in CRE-heavy bank stock performance is evident in other stock performance metrics as well. For example, public banks exceeding the 2006 CRE guidance also closed the gap with peers in terms of their year-to-date median price-to-last-12-months earnings-per-share multiple. They had a median price to EPS of 11.2x as of Sept. 18, compared to 12.7x for CRE-concentrated banks that did not meet the loan growth criteria and 13.0x for the market cap-weighted US bank index.

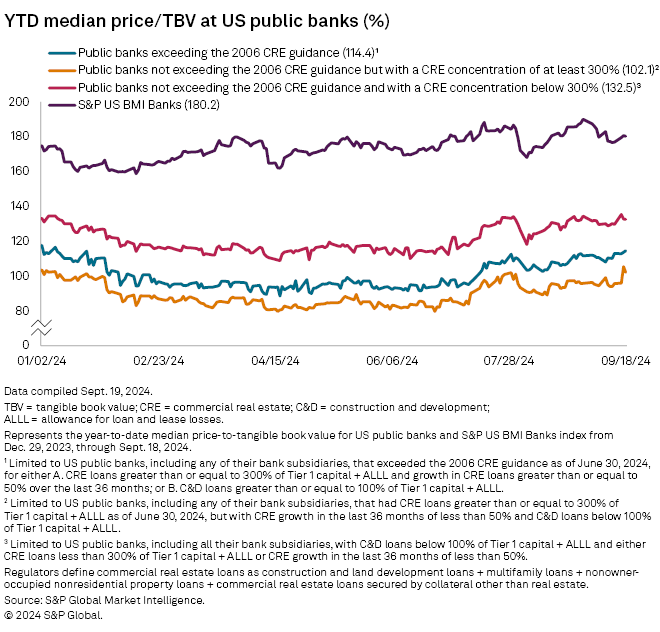

Additionally, CRE-concentrated banks are no longer trading at a median discount to their tangible book value (TBV). US banks exceeding the 2006 CRE loan concentration guidance traded at a median of 114.4% price to TBV as of Sept. 18. Meanwhile, public banks with CRE concentrations of at least 300%, but not meeting the overall CRE concentration guidance, traded at a slight premium with a median price to TBV of 102.1%.

Even so, the S&P US BMI Banks index continued to outperform CRE-heavy banks, with a 180.2% price to TBV.

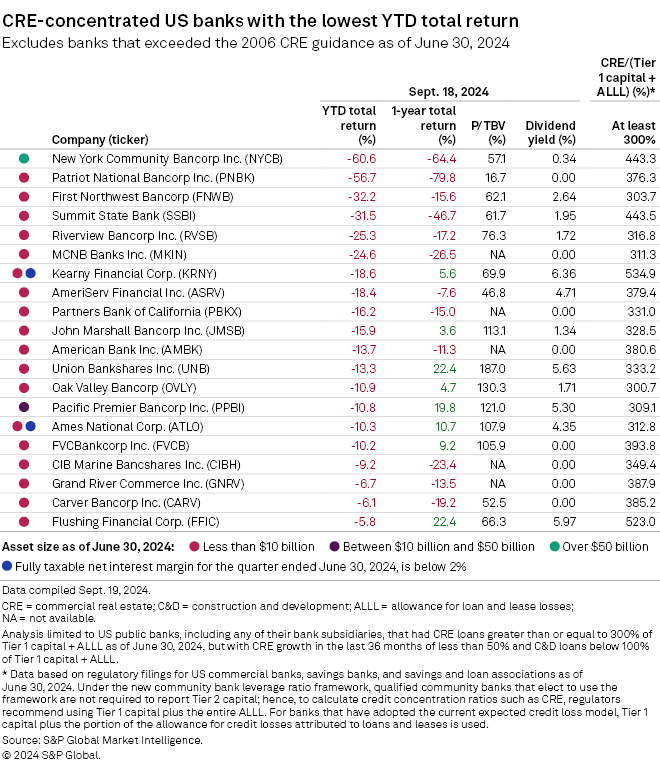

Improvement among individual CRE-heavy bank stocks

New York Community Bancorp Inc. had the lowest total year-to-date return among CRE-concentrated banks that did not exceed the 2006 regulatory guidance, at negative 60.6%. In comparison, the company's year-to-date total return on July 12 was negative 63.6%. In the week leading up to the Fed's announced rate cut alone, New York Community posted a return of 19.2%, according to a Market Intelligence analysis.

Raymond James' Moss upgraded New York Community to "market perform" from "underperform" in reflection of the more favorable rate environment and a decline in the five-year treasury rate, which he said supports a "relatively more positive" credit outlook, in a Sept. 17 research note. Specifically, the decline in the five-year treasury rate has improved banks' debt service coverage ratios, Moss said in an interview. Ahead of the Fed cut, the five-year treasury rate fell 86 basis points from the end of the second quarter through Sept. 18, according to Market Intelligence data.

"It's a better outlook today on CRE versus last spring when the five-year treasury is materially higher," Moss said.

Among US banks exceeding the 2006 regulatory guidance, First Foundation Inc. is still the bank with the worst stock price performance, with a year-to-date return of negative 30.8% through Sept. 18. Nonetheless, that is a marked improvement from July 12, when the company had a year-to-date stock price return of negative 41.4%. First Foundation is expected to benefit from a lower-rate environment.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.