Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JULY 30, 2025

By Hardik Savla

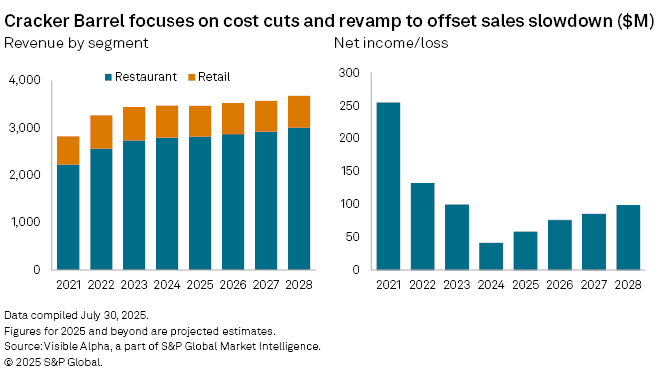

Cracker Barrel Old Country Store Inc. (NASDAQ: CBRL) is bracing for a third consecutive year of sluggish sales, with revenue expected to remain effectively flat in 2025. Consensus estimates from Visible Alpha forecast revenue of $3.47 billion, barely changed from 2024.

The US casual dining chain is pinning its hopes on a $700 million brand refresh, which will roll out over the next three years to 2027, alongside internal cost-cutting and operational streamlining. While top-line growth may take time to return, analysts expect profitability to begin recovering as these initiatives take hold.

Net income is forecast to rise to $58 million in 2025 from $41 million in 2024, a sharp drop from the $99 million reported in 2024. EBITDA is projected to improve to $194 million from $157 million in 2024, signaling early benefits from the company’s restructuring efforts.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Location

Products & Offerings

Segment