Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

EQUITIES COMMENTARY — Feb 26, 2021

By Sam Pierson

Equity finance and short interest data are well known inputs for quantitative models which seek for forecast equity returns. The general concept is that equities with more short interest will underperform those with less. Similar signals can be derived for corporate bonds using the IHS Markit Securities Finance dataset for corporate bond borrowing. In this note we'll review some academic literature which supports this use case and discuss updated results including the volatile period in 2020.

Background:

Using corporate bond borrowing as a proxy for short positioning has been proposed by Hendershott et al (2018) in a paper published in the Journal of Financial and Quantitative Analysis. The authors used the IHS Markit Securities Finance dataset to test the theory that corporate bond short selling is a predictor of bond returns. The results, drawn from a sample period from 2007 to 2011, suggest that for high-yield corporate bonds there is a significant correlation between bond price returns and the level of bond borrowing.

There are multiple reasons to borrow and short a corporate bond, which may range from a broker-dealer borrowing to deliver against a long sale or a relative value trade between two bonds. The paper noted above cites a previously published paper, Asquith et al. (2013) using a single lender's dataset, which suggests that corporate bond borrowing is a suitable proxy for short positions in the bonds. More recent anecdotal evidence, including correlations between bond borrow costs and CDS pricing, reinforce that conclusion. An interesting agreement between the papers is the observation that there did not appear to be signal pre-GFC. While not every bond borrow equates to a directional short bet in that bond, there is evidence to support the theory that the signal is representative of short positioning in general.

Recent Results:

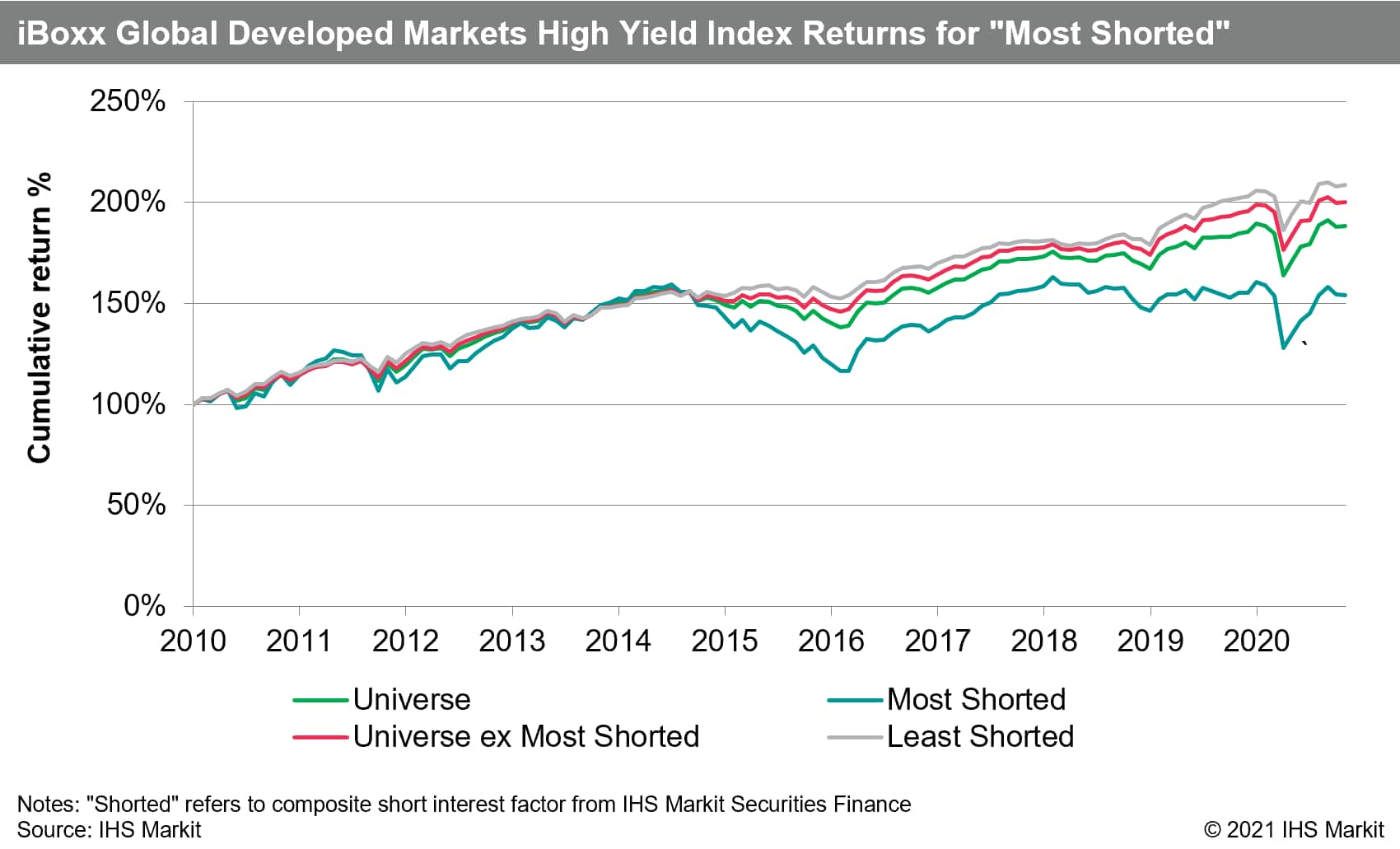

IHS Markit Securities Finance recently published updated results, which show the performance of the bond short factor for the iBoxx Global Developed Markets High-Yield Index. The key finding in the updated results is that the results for high-yield bonds highlighted in the academic research hold over the subsequent decade, notably improving results during the Q1 2020 market decline.

The most shorted HY bonds underperformed the least shorted by 19bps per month on average, from November 2009 through October 2020 (2.3% annualized). The existing index with the most shorted bonds, underperformed the index excluding those bonds by 4bps per month on average, or 48bps annualized.

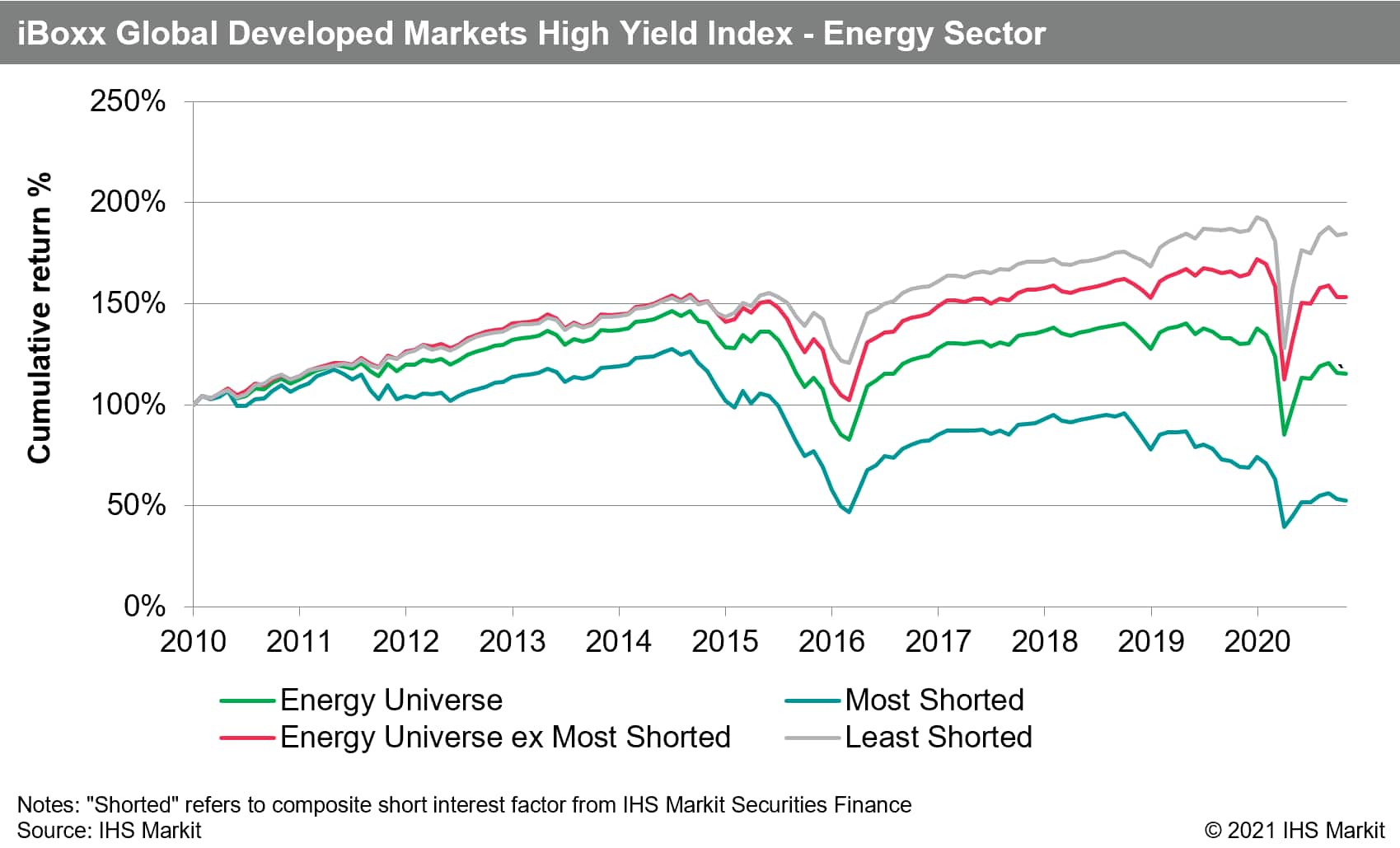

Part of the relative underperformance by most shorted bonds was driven by the Energy sector. Within HY Energy issuers, the most shorted bonds underperformed by 66bps per month, a staggering 8.2% annualized. The most shorted issues had a negative monthly return, -26bps on average, during the 10Y+ observation period.

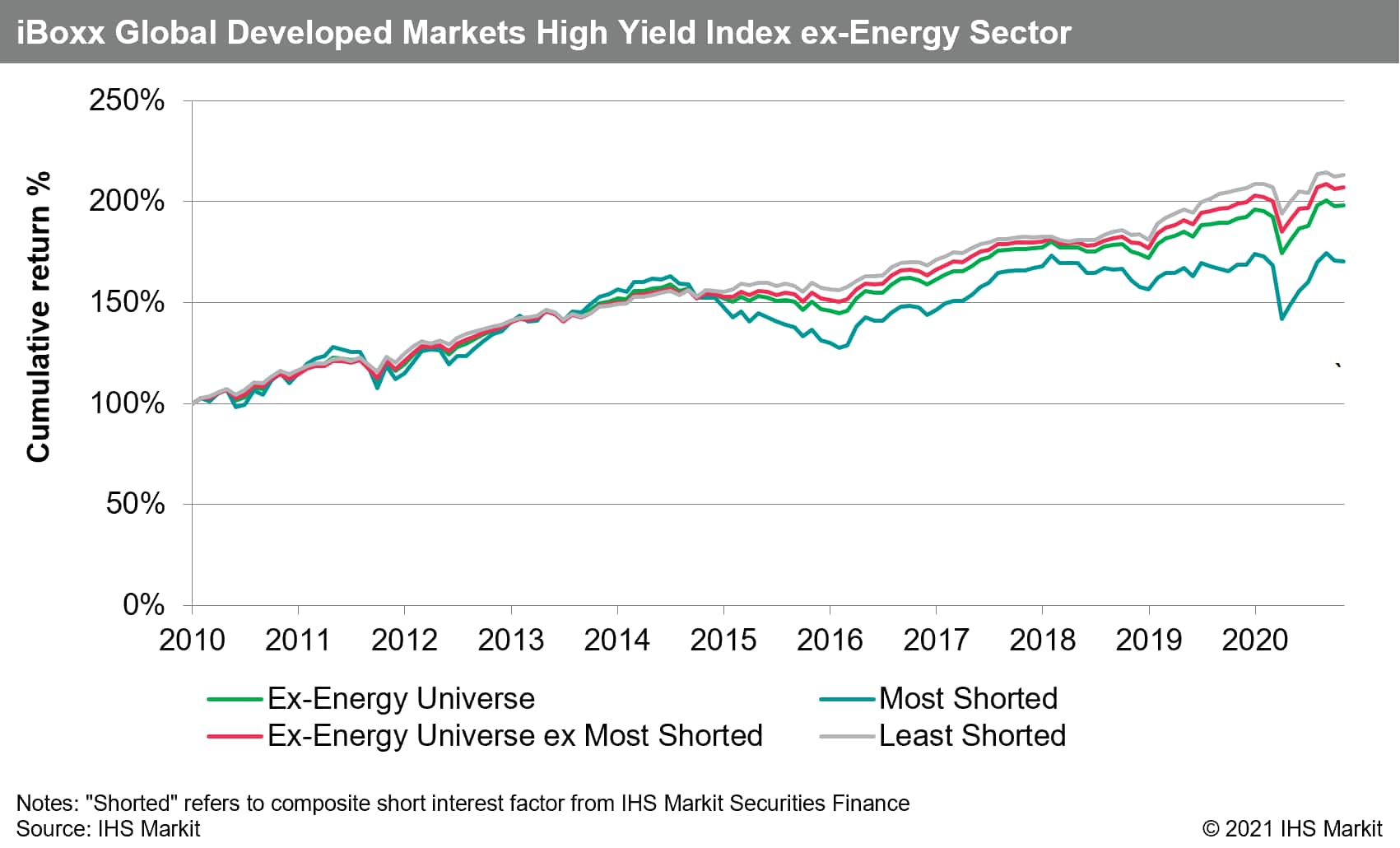

The relative underperformance of highly shorted HY Energy bonds contributes to the index level result, however a crucial finding in the updated research is that the index-level results do not rely solely on the Energy sector. Removing the Energy constituents from the backtest, the most shorted bonds underperform the least shorted by 13bps per month, or 1.57% annualized. The most shorted ex-Energy bonds underperform the full ex-Energy constituents by 2bps per month, or 24bps annualized.

The underperformance of the most shorted HY bonds is concentrated in the periods where the overall universe return was negative. The 19bps average monthly underperformance of most shorted bonds is the result of 187bps average underperformance in the 47 months with a negative return for the total universe, partially offset by the 75bps of relative outperformance on the part of the most shorted bonds in the 84 months where the universe return was positive. The takeaway is that the most shorted bonds underperform by enough in the relatively few down markets that the overall impact of removing them from the index is positive, even though the most shorted outperform on average in the more frequent periods where the universe has a positive return.

The Q1 2020 market decline provided an excellent test case for the corporate bond short factor. The most shorted HY bonds returned -16.6% in March 2020, while the least shorted returned -8.2%, a gap of 8.4% in a single month. During the Q2 2020 HY recovery the most shorted outperformed by 1.9% per month on average, culminating in June when the most shorted returned 2.6%, while the least shorted returned -0.5%. Overall, for the first three quarters of 2020 the most shorted HY bonds underperformed the least shorted by 39bps per month on average.

Conclusion:

With increasing electronic trading of corporate bonds, the possibility for systematic trading strategies is also increasing. Corporate bond borrowing data provides an unparalleled insight into short positioning at a security and issuer level. For high-yield investors avoidance of credits with elevated short demand has historically added to total returns. There is evidence to suggest factor models for quantitative corporate bond investors may benefit from incorporating bond borrowing signals. The results do not rely on a particular sector, however the stark performance in the Energy sector coinciding with the relative underperformance of the whole sector suggests there may be also be a sector rotation use case for systematic investment strategies. A key advantage compared with relying solely on CDS data is the coverage, where bonds from nearly all global issuers will be included in the securities finance dataset, but not all will have CDS pricing. The results suggest the IHS Markit Securities Finance dataset contains essential insights for credit investors in 2021.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.