Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — August 22, 2025

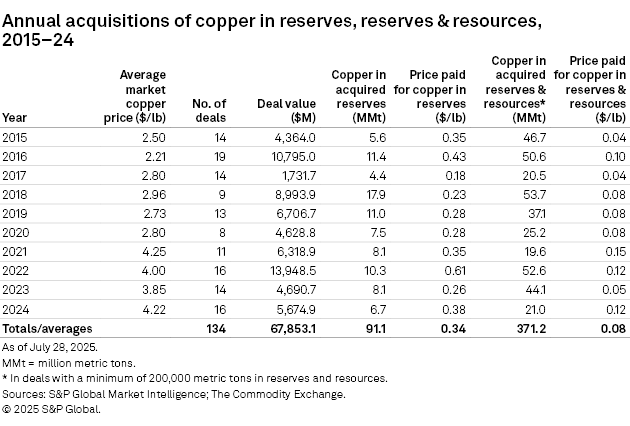

S&P Global Commodity Insights reports on major copper acquisitions with reserves and resources following the previous Copper Reserves Replacement M&A article to focus on the 2021–24 period. These acquisitions are defined by a deal value of at least $10 million and at least 200,000 metric tons of copper in reserves and resources.

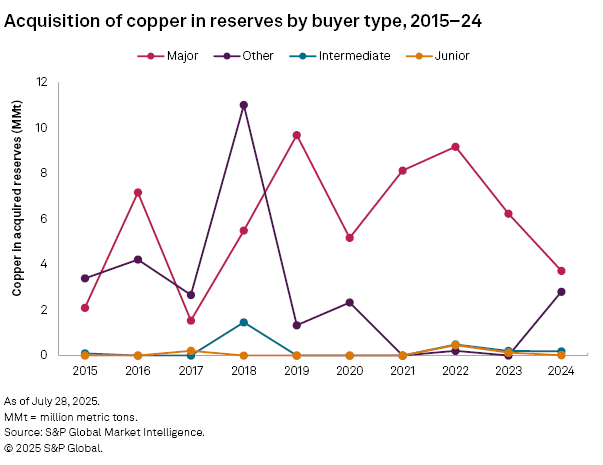

Fluctuating market conditions influenced copper M&A activity in 2021–24, which amassed a total of 57 deals collectively valued at $30.63 billion. A total of 137.3 million metric tons of copper in reserves and resources changed hands, primarily driven by major companies expanding and solidifying their pipelines. Continued acquisition and expansion of existing mines — combined with an increasing focus on nonproducing projects with defined reserves — could contribute to M&A growth in the second half of 2025.

Download the databook with a list of deals from 2011 to 2024.

After an expectedly lackluster copper M&A activity at the end of 2020, producing copper assets drove high-value deals in 2021. This came as business activity showed signs of recovery following the initial shock of the COVID-19 pandemic, while escalating green-energy efforts helped bolster copper prices to a 10-year record high in 2021. More recently, miners have shifted to targeting earlier-stage assets, securing deals with longer-term potential.

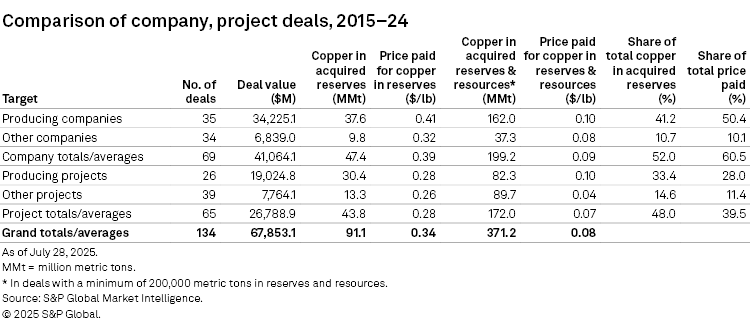

In 2021–24, 57 deals valued at a total of $30.63 billion met our criteria for this study, with around 137.3 MMt of acquired copper in reserves and resources through the four-year period. While targets were almost evenly distributed between companies and mining properties, company acquisitions represented 74% of the period's total deal value, spanning 29 deals.

Soaring copper prices buttress dealmaking

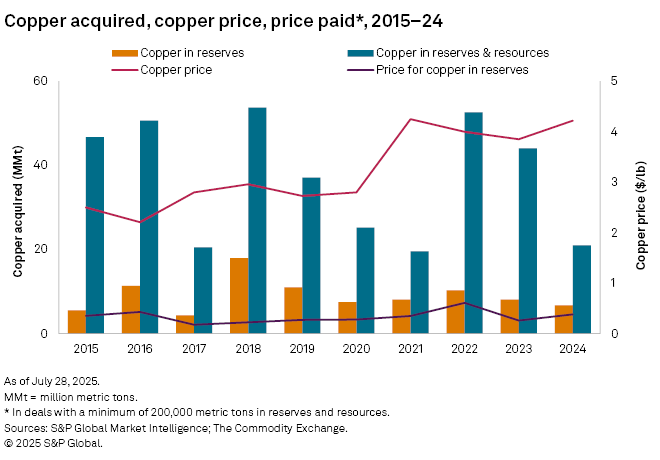

A year after the onset of the COVID-19 pandemic, copper M&A slightly recovered in 2021 with 11 deals — three more than in 2020 — marking a 36.5% increase in deal value. Many high-value deals were announced in the second half of 2021, driven by major buyers aiming to strengthen their production pipeline. Acquisitions peaked in 2022, with the total deal value reaching $13.95 billion, the highest in a decade, across 16 deals. This surge was influenced by the ongoing transition to green energy, emphasizing copper's critical role in this shift. Additionally, concerns over supply shortages for both refined and concentrate copper fueled market interest. Copper prices held above the market average, with buyers sustaining their interest in brownfield copper assets amid an impending supply deficit due to low copper discoveries.

Deal activity slowed significantly in 2023, with the total deal value dropping 66% due to copper prices declining due to lower demand, a stronger US dollar and challenging economic data from China, which persisted through the first half of the year. However, the long-term bullish outlook for copper prices reinforced confidence among major players, promoting strategic consolidation and brownfield development. This resulted in fewer speculative acquisitions headlined by junior and intermediate players.

M&A rebounded in 2024, with the total deal value increasing 21% to $5.67 billion across 16 deals, as copper prices stabilized at an average of $4.22/lb. The ongoing copper concentrate deficit and production cuts took center stage amid growing long-term demand from electrification, prompting miners to turn their attention to existing assets with identified reserves to keep pace with demand.

Nonproducing assets spark interest

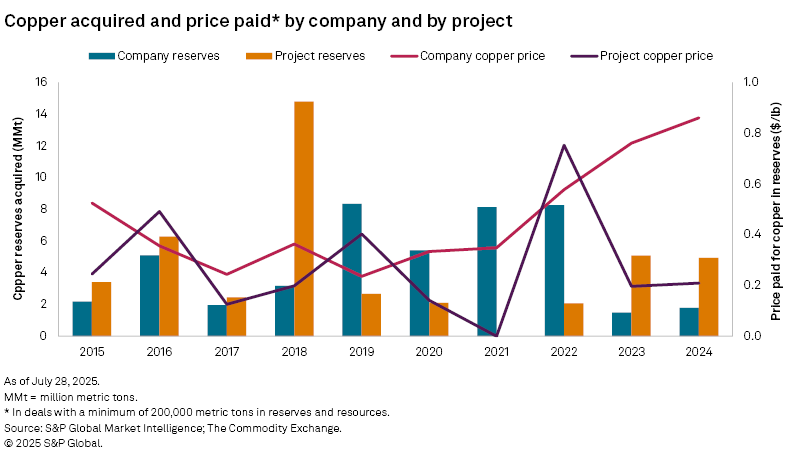

Total deal value in 2021–24 was also buoyed by two big-ticket acquisitions announced in 2022 — BHP Group Ltd.'s acquisition of OZ Minerals Ltd. for $5.94 billion, and Rio Tinto Group's move to consolidate the remaining 49.2% interest in Turquoise Hill Resources Ltd. for $3.25 billion, with an average price paid of 66 cents/lb and 42 cents/lb, respectively. Together, the two megadeals — the largest in the period — accounted for a total of 7.6 MMt in reserves, representing 73% of the total reserves acquired for 2022. Both deals underscored the drive for asset consolidation, which has been a recurring theme for miners looking to streamline governance over copper assets in strategic locations. The properties consolidated in the deals include the Prominent Hill and Carrapateena mines in Australia and Oyu Tolgoi in Mongolia.

Despite the impact of the megadeals, the total copper reserves acquired in 2021–24 amounted to 33.33 MMt, which was 19% lower than the 2017–20 period. In 2023, most of the buyers opted to target early-stage assets with little or no developed reserves, with future supply optionality becoming a more logical prospect. The acquired copper reserves dropped 22%, to 8.1 MMt from 10.3 MMt in 2022, signaling a normalization after 2021's high-value acquisitions. This carried over to 2024, with nonproducing assets comprising 69% of the year's targets, across 11 deals — the highest since 2017. The most expensive deal in 2024 was BHP and Lundin Mining Corp.'s joint acquisition of Filo Corp. for $3.03 billion, which resulted in the takeover of the Filo del Sol copper mine in Argentina. According to Lundin, the synergy meant the combined development of a total of 2.5 MMt of copper in reserves, establishing a large-scale copper district in Argentina and Chile, with shared infrastructure and economies of scale. Separately, BHP also acquired a 50% stake in the Josemaria project for $690 million in cash.

Another megamerger announced in 2024 — which did not materialize — was BHP's $33.39 billion bid for Anglo American PLC, aimed at consolidating their major copper assets. Had the deal gone through, it would have involved approximately 23 MMt of copper in reserves. After weeks of negotiations and multiple revised offers, Anglo American eventually rejected the bid due to the proposed deal structure, among other reasons. BHP officially walked away from the deal in May 2024.

Shifting player strategies

In anticipation of impending supply shortfalls, and on top of the long-term upside expected from nonproducing assets, copper exploration budgets have also continued to rise, with juniors raising around $1.06 billion in 2024. With only 17 acquisitions in 2015–24, juniors have largely carried the exploration burden, as majors continued to focus on consolidating near-production assets, reflecting a broader industry response to the persistent supply tightness and thinning pipeline.

Unsurprisingly, majors accounted for almost half of all acquisitions in the last 10 years, acquiring 241.6 MMt of copper in reserves and resources across 62 deals, followed by companies tagged as "Others," which include nonmining companies, governments and private entities. Majors paid $51.14 billion at 10 cents/lb of copper, representing 75% of the total price paid during the period.

High-value deals inflate price paid per pound

With the copper market price averaging $4.25/lb in 2021, the price paid for copper in reserves peaked in 2022 after a one-year lag, settling at an average of 61 cents/lb, the highest in the 2015–24 period. For project acquisitions, the average price paid for copper in reserves was 29 cents/lb in 2021–24, higher than the 2017–20 average, even with the absence of acquired assets with identified reserves in 2021. Expensive acquisitions boosted the average, such as MAC Copper Ltd.'s takeover of the producing, high-grade Cobar mine in Australia from Glencore PLC for $1.2 billion, which commanded the highest price paid for reserves among project acquisitions throughout the 2011–24 period at $2.08/lb.

Copper price paid for reserves across company acquisitions announced in 2021–24 averaged 48 cents/lb, supported by high-value company purchases in 2021–22 and led by Evolution Mining Ltd.'s acquisition of Ernest Henry Mining Pty. Ltd. at $1.76/lb.

The bigger picture

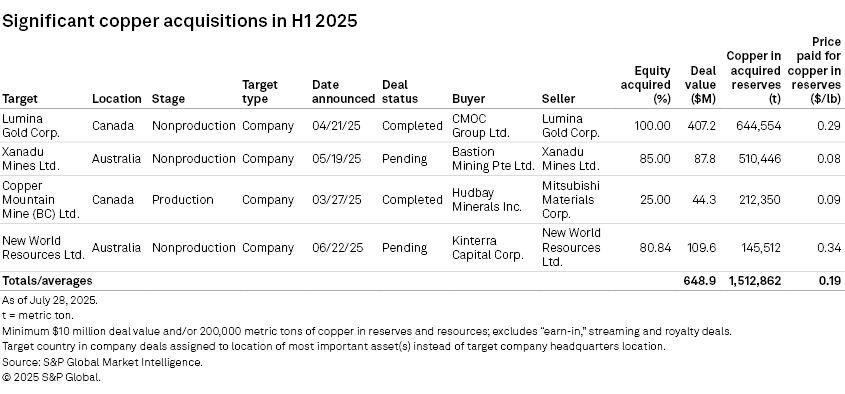

Transactions in the first half of 2025 were off to a slow albeit better start compared to 2024, with four qualifying company-level deals with a combined deal price of $648.9 million, surpassing the $532.9 million total deal price in the first half of 2024. Three deals involving nonproducing assets were announced in the June quarter of 2025, led by the acquisition of Lumina Gold Corp. by CMOC Singapore Pte. Ltd. for $407.2 million; even though the primary commodity was gold, the deal turned over 644,554 metric tons of copper in reserves. Hudbay Minerals Inc.'s consolidation of its ownership in Copper Mountain Mine (BC) Ltd. for $44.3 million represents the only deal involving a producing mine, its namesake Copper Mountain mine in Canada, which hosts a total of 849,400 metric tons of copper in reserves as of December 2024.

As the long-term demand for copper continues to encourage miners to gravitate toward strategic partnerships, there could be some forward momentum in the acquisition of development-stage mines with scalable reserves in lower-risk jurisdictions that offer supportive permitting regimes, potentially driving M&A in the second half of 2025. With prices still expected to rise in the long term, acquisitions of assets with large reserves could remain subdued, though the door is still open for major players seeking consolidation opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.