Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — July 17, 2025

By Fatima Qasim and Ashish Negi

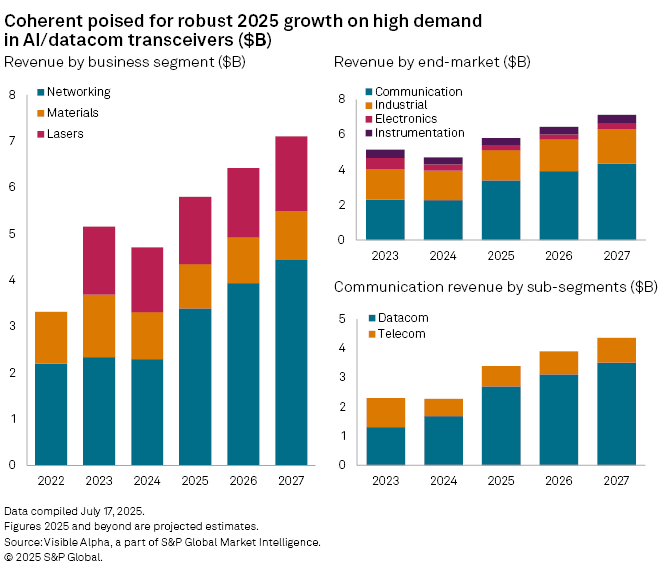

Coherent Corp. (NYSE: COHR) is poised for a sharp turnaround in 2025, with revenue projected to rise +23% year-on-year to $5.9 billion, after a -9% decline in 2024, according to Visible Alpha consensus estimates. The company’s bottom line is also expected to return to the black, with analysts projecting net income of $212 million following two consecutive years of losses.

By segment, the recovery is set to be led by its Networking division, where sales are forecast to surge 48% on strong demand from AI data centers. Lasers is expected to post modest growth of +4%, supported by demand in display technology and semiconductor manufacturing. The Materials segment, meanwhile, is forecast to decline -6.2%, a smaller drop than last year’s -25% contraction, as weakness in consumer electronics continues to weigh on performance.

Much of the company’s momentum stems from the Communications end-market, where revenue is projected to rise +50% to $3.4 billion in 2025. Within Communications growth is driven by strong Datacom demand for high-speed optical transceivers—particularly 800G and 400G modules—as hyperscalers race to upgrade their networks to handle AI-driven workloads.

Outside Communications, however, Coherent’s prospects are more tempered. Industrial sales are expected to inch up +2%, while the Electronics and Instrumentation markets are likely to remain subdued until 2026.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Products & Offerings