Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Blog — 17 May, 2023

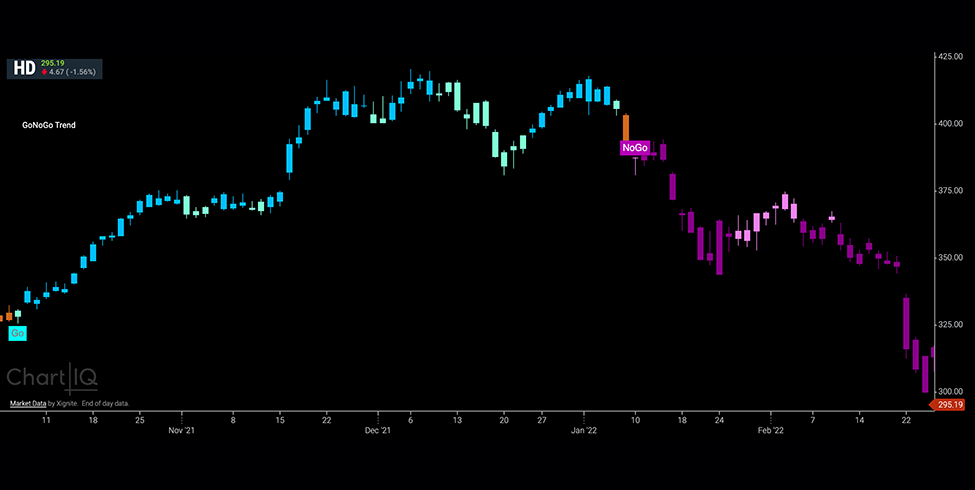

For illustrative purposes only

Uncertainty in the market is unavoidable, but for every trade decision where capital is at risk, making sure you have confirmation from multiple measurements that conditions are right gives you the highest probability of success.

Is it risk on or risk off? Is it time to enter a trade or stay out? Do you ever find yourself getting your indicator signals crossed? Maybe you have one too many moving averages on your chart, or a few different momentum indicators that are essentially tracking the same thing?

We’re proud to announce that we are now partnering with GoNoGo Charts to help make this uncertainty easier to manage.

GoNoGo helps traders and investors take the guesswork out of making important trading decisions. The name “GoNoGo” comes from the phrases “go” and “no go” used by NASA engineers to indicate space launch readiness. They take a weight-of-the-evidence approach working through rigorous checklists to put probabilities in their favor. Responsible investing is no different.

GoNoGo developers Alex Cole and Tyler Wood believe that trend identification is perhaps the most important concept in technical analysis. Based on a proprietary blend and weighting of the most widely used and statistically significant technical indicators, colored price bars on the GoNoGo trend chart allow the user to easily identify both the direction and strength of price trends in any market or timeframe – without cluttering their charts.

GoNoGo Trend® is available using the ChartIQ Technical Analysis solution. This core GoNoGo chart contains colored price bars that identify the direction and strength of price movement. A trade is a “Go” when the overall conditions of price trend are bullish, or a “NoGo” when overall conditions for the security are trending down. It also identifies when no clear trend is found, and it might be best to stand aside.

The purpose here is twofold: First, it drastically cleans up your chart, offering an unimpeded view of price action. Additionally, it paints the bars/candles in five easy to understand colors that represent the different levels of trend conditions that can occur. In this blog, we’ll break down how the GoNoGo Trend® can be utilized in your trading. First, however, a breakdown of the indicator.

The first thing you’ll note when you add the GoNoGo Trend® to your chart are the unique bar/candle colors; Purple, Pink, Amber, Aqua, and Blue. What does each color mean?

For illustrative purposes only

Purple: Strong No-Go

A deep purple color indicates a strong downtrend. The weight of the evidence within the calculations are at the most bearish conditions. A firm stop for long positions and a tool value investors use to delay entry while awaiting market confirmation.

Pink: Weak No-Go

A weak or weakening bearish trend turns the bars pink. By building sensitivity into the calculations, traders can identify areas of countertrend correction, consolidation, or potential trend reversal as securities go through a bottoming process.

Amber: Neutral “Go-Fish”

When painting amber bars, the security is exhibiting directionless conditions It’s not a good time to enter a trade to the short side or long side, but rather a time “to go fishing” as Jesse Livermore famously said.

Aqua: Weak Go

Lighter aqua bars appear when trend conditions weaken or become less bullish, as might happen at the beginning of a trend or as a strong trend is correcting or consolidating.

Blue: Strong Go

Bright blue bars indicate a strong trend. The unique blend of inputs are all measuring bullish conditions for the security’s price trend. Another interpretation (for derivatives traders) is the “cover shorts” signal.

Traders are all too familiar with information overload, not only from external market news but often of their own making. Traders often fill their price charts with numerous lines and indicators in an attempt to make and confirm or reconfirm their trading decisions.

Disciplined investing is simple, but not easy. Many traders and investors are overwhelmed by the often redundant, occasionally contradictory, and ever-complicated battery of indicators. GoNoGo Charts help investors understand the direction and continuity of price trends for any security, any asset class, across any time frame.

By blending objective principles of technical analysis and the most widely used statistical measures, GoNoGo Charts remove “indicator overload.” Investors remain focused on what matters most: Price!

By itself, GoNoGo Trend is a valuable trading tool that helps traders and investors determine whether to launch a new trade, stick with the trend or add to a position, and objectively exit when a trend ends or reverses. Financial markets can be complicated, but your charts don’t have to be.

Tomes have been written on trend following investment strategies and the persistent anomaly of momentum. Buying strength, buying breakouts, and momentum trading are all ways to describe this style. While simple, this style is not easy. Emotions supplant the rules of most human investors forcing them to cut winners too early, while averaging down losing trades.

GoNoGo Charts have developed a full suite of tools to provide investors with a complete understanding of any asset, over any timeframe, in terms of trend, momentum, volume and volatility. By blending objective, widely proven statistical indicators together with the foundational principles of technical analysis, GoNoGo Trend® colors the price action of any security according to the strength of its trend.

Momentum goes hand in hand with trend identification. GoNoGo Oscillator® blends several popular momentum ideas together helping investors understand the velocity of price change, giving valuable information about the strength of a trend and the market’s conviction in it.

Understanding the interplay between trend and momentum, GoNoGo Charts highlight low risk opportunities for trend continuation and alert investors to short- term countertrend corrections with intuitive GoNoGo Icons® placed directly in the price action.

When price action stagnates, volatility declines, and GoNoGo Oscillator® rests at the zero line. This volatility compression is highlighted by GoNoGo Squeeze®, a grid that climbs to a max with every bar the oscillator remains at zero. Like a coiled spring, researchers have shown that following these stalemates between buyers and sellers, a breakout can be expected.

The GoNoGo analytical tools were meticulously developed over many years with input from the world’s top institutional portfolio managers, traders, and analysts to equip professional investors with simple-to-read measurements about whether the market environment is a “Go” for launch in terms of an idea, strategy or investment. GoNoGo Charts is revolutionizing the way investors see the markets.