Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Apr 26, 2021

By Rajiv Biswas

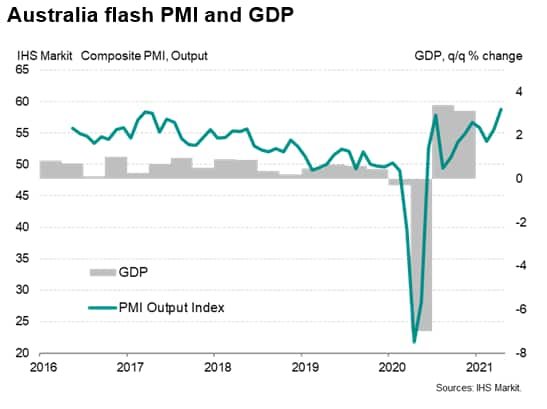

The Australian economy has rebounded in early 2021 from the impact of the COVID-19 pandemic restrictive measures that hit domestic demand during 2020. With economic growth momentum improving rapidly, the Australian economy is forecast to grow at a pace of 3.2% y/y in 2021, following an estimated GDP contraction of 2.4% y/y in 2020.

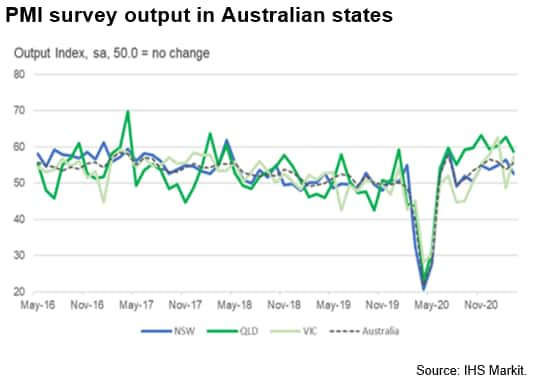

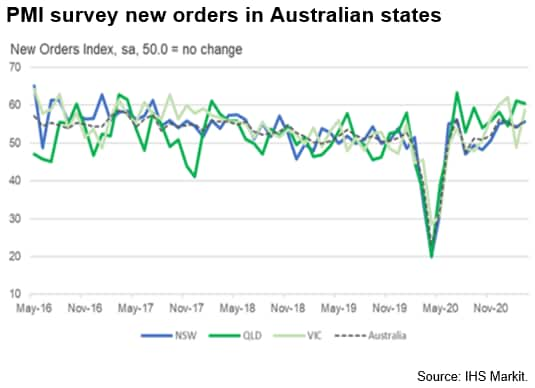

Latest flash IHS Markit PMI survey data for April have shown a significant upturn in both Australian manufacturing and services activity at the national level. State-level PMI survey data also showed strong expansion in output and new orders in New South Wales, Victoria and Queensland during the first quarter of 2021.

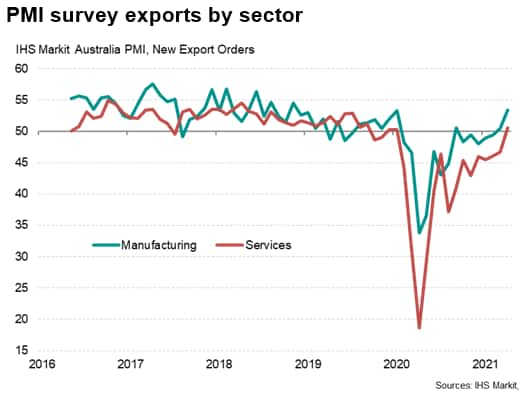

The latest IHS Markit survey data also shows early signs of renewed expansion of exports, after protracted headwinds due to the ongoing trade sanctions by China, which have continued to impact on many Australian exports of goods. Exports of services such as tourism and education have also been heavily disrupted by international travel restrictions related to the pandemic.

Australian economy bounces back

Despite several outbreaks of COVID-19 cases in various states in recent months, Australia has still managed to effectively contain its pandemic to very low levels of cases, allowing the reopening of the domestic economy to more normal operating conditions. However international borders remain largely closed, with severe restrictions on international travel, apart from a travel bubble that has opened between Australia and New Zealand in April 2021. The pace of COVID-19 vaccine rollout has also been relatively slow compared to the US, UK and EU, with only 1.8 million vaccine doses administered by mid-April, for a population of around 27 million persons.

Large-scale fiscal stimulus measures combined with ultra-loose monetary policy settings have helped to underpin economic activity despite the negative economic impact of the COVID-19 pandemic and associated lockdowns. During 2020, the Reserve Bank of Australia (RBA) lowered its policy rate from 0.75% to 0.1%, while also implementing quantitative easing measures for the first time.

The overall COVID-19 response from the Australian Federal Government has reached around AUD 507 billion, including health measures, the JobKeeper Payment, Boosting Cash Flow for Employers and the Coronavirus Supplement. The 2020-21 Budget also included AUD 98 billion in response and recovery support, including AUD 25 billion under the COVID-19 Response Package and AUD 74 billion under the JobMaker Plan.

Australian GDP growth in the fourth quarter of 2020 rose by 3.1% quarter-on-quarter, the second consecutive quarter of positive growth after Australia entered a recession in the first half of 2020 with two consecutive quarters of negative growth. The upturn in economic activity was driven by improving domestic final demand, as household final consumption expenditure was boosted by easing of lockdown conditions. Despite the rebound in economic activity in the second half of 2020, Australian GDP in the fourth quarter of 2020 was still down 1.1% y/y.

The Australian unemployment rate fell to 5.8% in February 2021, with the number of persons in employment having returned to pre-pandemic levels as the labour market recovered rapidly as lockdown measures were scaled back.

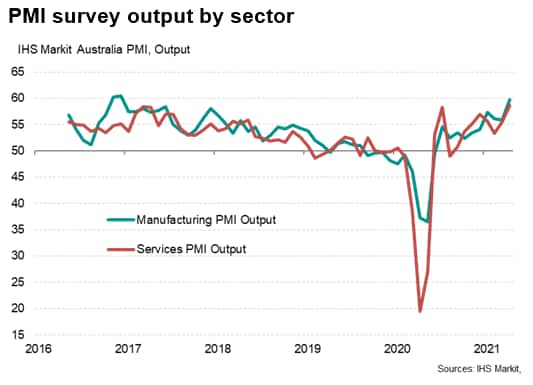

Economic recovery has continued during the first quarter of 2021, with the IHS Markit PMI survey readings for both manufacturing and services signaling expansionary conditions throughout the first three months of 2021.

The IHS Markit Flash PMI has since risen steeply at the outset of the second quarter, from a final reading of 57.0 in March to 58.8 in April. Private sector growth in Australia gathered considerable momentum in April, according to the Flash PMI data. The upturn was associated with improved client confidence, buoyant market conditions, strengthening demand, the easing of COVID-19 restrictions and low interest rates. Aggregate new orders increased at a survey-record pace.

The IHS Markit Flash Services Business Activity Index rose to 58.6 in April, from a final reading of 55.5 in March, signalling the strongest increase in service sector output in the survey history. The upturn was boosted by the quickest expansion in new business inflows on record.

The IHS Markit Flash Manufacturing PMI also showed a sharp increase in 59.6 in April, rising from 56.8 in March to its highest mark in the survey history. Strengthening demand conditions encouraged goods producers to step-up output in April. The pace of expansion was sharp and the fastest in close to four-and-a-half years.

The rise in total sales was supported by a recovery in new export orders. International demand for Australian goods and services increased for the first time since January 2020 and at the fastest pace in close to two-and-a-half years. Australian exports have been helped by the rebound in world commodity prices during the second half of 2020 and in early 2021. In the fourth quarter of 2020, Australia's terms of trade improved by 4.7% helped by higher export prices, notably for iron ore.

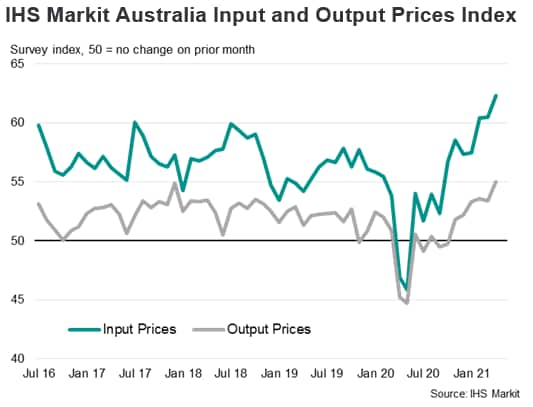

Input prices rose sharply in April, which firms attributed to supply shortages, escalating international shipping rates and increased employment costs. The overall rate of input price inflation reached a survey peak. Selling prices also rose at the fastest pace on record as companies sought to protect their margins by passing on to their clients part of the additional cost burden.

PMI survey signals expansionary state economic conditions

The latest IHS Markit state level PMI survey data show that economic activity has remained strong during the first quarter of 2021 in New South Wales and Queensland, with the Output PMI data remaining expansionary. In Victoria, economic activity temporarily weakened during February 2021 due to a renewed short period of restrictive measures in Melbourne to contain a new COVID-19 outbreak. However, the restrictions were of short duration, and economic activity rebounded strongly in March as restrictions were lifted.

The New South Wales Government has estimated that the size of the New South Wales economy will be largely unchanged in the 2020-21 financial year due to the impact of the pandemic, with a return to positive growth of 2.75% forecast for 2021-22. A key driver for economic growth will be from the large-scale public sector infrastructure pipeline, which amounts to AUD 107 billion.

Due to the significant second wave of the COVID-19 pandemic that impacted on the state of Victoria, the Victorian economy was substantially affected in the 2020-21 financial year by a protracted second lockdown during from July to October 2020, for a period of 112 days. Following the lifting of the lockdown, household spending by Victorian households rebounded, rising 10.4% quarter-on-quarter in the December quarter of 2020. The state government of Victoria have projected strong growth of around 5% for the 2021-22 financial year, reflecting low base year effects that will boost growth in output.

In contrast, the state of Queensland had managed to effectively contain the pandemic throughout most of 2020 and during early 2021, which has helped to underpin state economic activity levels throughout 2020, with momentum strengthening further in early 2021. The Queensland government have projected economic growth of around 3.5% y/y for the 2021-22 financial year in their State Budget 2020-21.

In Western Australia, successful containment of the pandemic has allowed relatively normal domestic demand conditions, with state commodities exports helped by strong world prices for iron ore and gold. The Western Australian state government has projected that Gross State Product will increase by 2.75% y/y in the 2021-22 financial year, with State Final Demand projected to rise by 3.75%.

Economic outlook

The Australian economy is showing improving economic momentum in the first half of 2021, helped by continued success during the first four months of 2021 in containing new COVID-19 pandemic cases.

The RBA has signalled that it intends to maintain extremely accommodative monetary policy settings to support economic recovery. The RBA has stated that it does not intend to increase tighten monetary policy until inflation is sustainably in the 2% to 3% range. This is expected to require significantly higher wages growth and further tightening of labour market conditions. The RBA does not expect these conditions to be met until 2024 at the earliest, signalling a protracted period of highly accommodative monetary policy settings.

Latest IHS Markit PMI survey data for April 2021 signals continued improvement in economic activity levels in the near-term, helped by strengthening domestic demand as well as the impact of improving world demand on Australian exports.

However, with COVID-19 vaccination rates still relatively low in Australia, the recovery remains vulnerable to risks of new pandemic outbreaks until a much larger share of the total population are able to be vaccinated.

Rajiv Biswas, Asia Pacific Chief Economist, IHS Markit

Rajiv.biswas@ihsmarkit.

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location