Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — JUNE 19, 2025

ASML Holding NV (NASDAQ: ASML), the Dutch semiconductor equipment company, is set to benefit from resurgent demand in 2025 as the semiconductor industry rebounds from a subdued year.

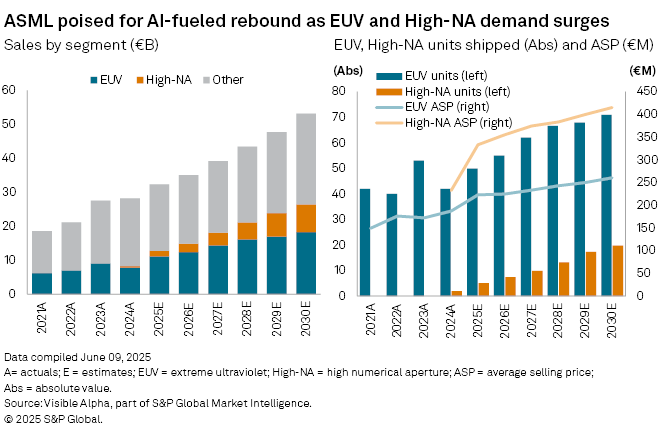

The company’s grip on the high-end lithography market — particularly in extreme ultraviolet (EUV) systems used to manufacture cutting-edge chips — places it at the heart of the AI boom. Analysts are closely watching ASML’s latest “High-NA” EUV machines, which enable even finer chip production, a capability increasingly vital for next-gen applications like AI, high-performance computing, and mobile processors.

After a -14% year-on-year decline in EUV sales last year, Visible Alpha consensus shows analysts expect a sharp recovery in 2025, with EUV revenues forecast to climb +41% year-on-year to €11.1 billion. High-NA sales are expected to triple, rising from €465 million in 2024 to €1.7 billion in 2025. In total, EUV including High-NA sales are projected to rise +49% in 2025.

This resurgence is expected to drive overall net sales up +14% in 2025 to €32.3 billion. However, the company continues to face headwinds in China, where export restrictions are set to weigh heavily. Sales from the region are forecast to fall-36% in 2025 to €5.7 billion, down from 9 billion last year.

|

– Learn about Visible Alpha | S&P Global. – Explore Visible Alpha Add-On for S&P Capital IQ Pro. – Access Visible Alpha estimates on ASML. – To receive email alerts for future Visible Alpha articles, select Visible Alpha Data Snapshots under the Authors section. |

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location

Products & Offerings

Segment