Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Oct 06, 2022

By Rajiv Biswas

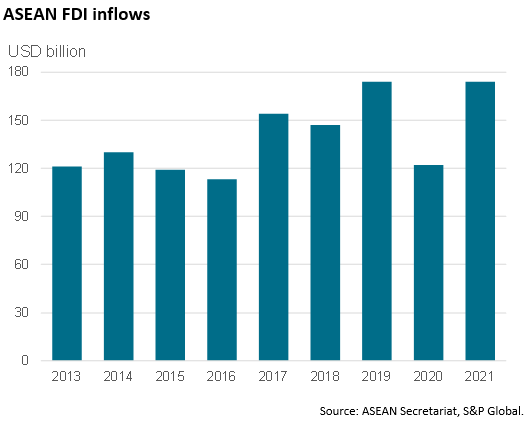

Foreign direct investment (FDI) inflows into the ASEAN region for the 2021 calendar year reached a record level of USD 174 billion, equaling the pre-pandemic high recorded in 2019.

Key drivers for rising FDI inflows into Southeast Asia include diversification of manufacturing supply chains by multinationals, as well as new investments to tap rapidly growing consumer markets in ASEAN.

Strong FDI inflows into electronics manufacturing, and also projects related to electric vehicles, were important contributors to the high level of FDI inflows recorded in 2021.

FDI inflows into the ASEAN region have grown steadily over the past decade, albeit temporarily disrupted during 2020 due to the pandemic. The total annual level of FDI inflows has risen from around USD 120 billion per year during 2013-2015 to an annual level of USD 174 billion in both 2019 and 2021.

Strong FDI investment inflows in 2021 were helped by rapid growth in manufacturing FDI, which rose from USD 19 billion in 2020 to USD 45 billion in 2021. This was boosted by large investments in electronics manufacturing as well as FDI into electric vehicle (EV) manufacturing and EV battery plants. Indonesia has become an important hub for EV battery manufacturing as it has the world's largest nickel reserves as well as a being a large Asian manufacturing hub for autos.

The electronics industry is already an important part of the manufacturing export sectors of a number of ASEAN economies, including Singapore, Malaysia, Thailand, Vietnam and Philippines. Consequently these countries have been attracting new FDI inflows into the electronics sector as multinationals try to expand their production capacity given strong growth in global electronics demand since 2020.

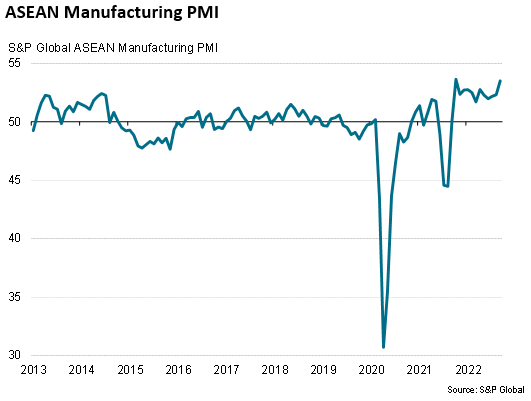

In the near-term, FDI inflows to the ASEAN region are also expected to be supported by the resilience of Southeast Asia to the slowdown in the US and EU during 2022. Manufacturing conditions across the ASEAN region improved at the quickest pace for nearly a year in September 2022, according to latest S&P Global PMI data. Companies signaled steeper increases in output, new orders, purchasing activity and employment, while business confidence remained historically strong. The headline ASEAN Manufacturing PMI rose from 52.3 in August to 53.5 in September, to signal an improvement in the health of the ASEAN manufacturing sector for the twelfth successive month.

Firms across the ASEAN manufacturing sector registered sharp and accelerated increases in production and new business at the end of the third quarter, according to the PMI survey data. Notably, the rates of expansion were the quickest seen since both output and sales returned to growth last October 2021. The surveys found improved demand conditions and increased production schedules led firms to expand their payroll numbers for the third month in a row.

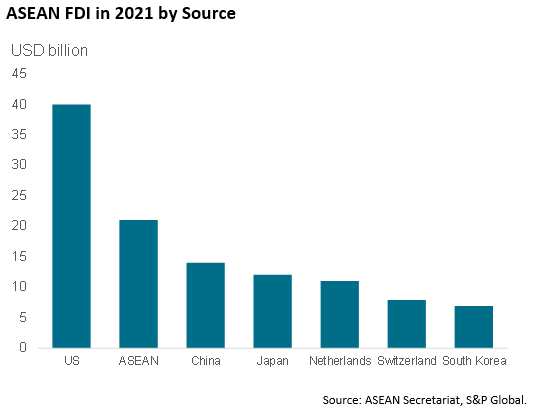

This highlights the increasing importance of domestic demand within the ASEAN region as growth driver, which has helped to mitigate the impact of weakening growth momentum in the US and EU. In 2020, an estimated 21% of total ASEAN merchandise trade was intra-regional trade between ASEAN nations. Intra-ASEAN investment also was the second largest source of FDI into ASEAN in 2021, amounting to an estimated USD 21 billion.

The importance of intra-regional trade between ASEAN and other countries in the Asia-Pacific region has also become increasingly important as a driver of ASEAN exports. Notably, China-ASEAN bilateral economic ties have grown at a very rapid rate over the past three decades. Bilateral trade in goods between mainland China and ASEAN has risen at a remarkable rate, increasing from just USD 9 billion in 1991 to USD 685 billion in 2020. In 2020, ASEAN also surpassed the EU to become mainland China's largest trading partner for the first time. From the ASEAN perspective, mainland China has already been the largest market for ASEAN exports for the past 12 years. In 2021, bilateral trade between China and ASEAN recorded strong growth of 19.1% y/y.

Bilateral investment ties have also strengthened significantly. China's direct investment in ASEAN rose from an estimated USD 7 billion in 2020 to reach USD 13.6 billion in 2021, according to ASEAN statistics.

Over the long term, the ASEAN region is expected to continue to be one of the fastest growing regions of the world economy. Total ASEAN GDP, measured in nominal USD terms, is forecast to more than double over the next decade, increasing from USD 3 trillion in 2020 to USD 6.4 trillion by 2030. Over the next decade, the ASEAN region will be one of the three main growth engines of the APAC region, together with mainland China and India. The rapidly growing size of the ASEAN consumer market will become an increasingly important magnet for FDI inflows as multinationals establish manufacturing and services capacity in Southeast Asia to tap the domestic demand in the region.

Supply chain diversification is also expected to be an important factor supporting FDI inflows into ASEAN over the medium-to-long-term. Faced with severe global supply chain disruptions in recent years due to natural disasters and more recently due to the COVID-19 pandemic, multinationals are increasingly focused on diversifying supply chains to reduce vulnerability to such disruptions. Supply chain problems due to the Russia-Ukraine war and the disruption of pipeline gas supplies for the EU may also reinforce diversification of some manufacturing supply chains towards the ASEAN region.

ASEAN nations will also benefit from their membership of the Regional Comprehensive Economic Partnership (RCEP), which is a positive regional trade liberalisation initiative that will help to boost trade and investment flows among the 15 nations that have agreed to the trade deal. The 15 Asia-Pacific economies that make up the RCEP membership together account for around 29% of world GDP. The RCEP members comprise the 10 ASEAN members, plus China, Japan, South Korea, Australia, and New Zealand.

Following considerable disruption to Asia-Pacific trade flows during 2018-2021 due to the US-China trade war and the impact of the pandemic, the implementation of RCEP will help to further reduce barriers to regional trade flows within the Asia-Pacific region over the medium to long-term. The RCEP also creates a trade liberalisation framework that can be built on and strengthened through further rounds of trade negotiations, including through the potential accession of other nations to the RCEP agreement.

Although tariff liberalization has already progressed significantly among the 15 RCEP members over the past decade through a wide network of FTAs, RCEP will further reduce tariff barriers. The scope of RCEP includes reducing tariffs on trade in goods, as well as creating higher-quality rules for trade in services, including market access provisions for service sector suppliers from other RCEP countries. The RCEP agreement will also reduce non-tariff barriers to trade among member nations, such as customs and quarantine procedures as well as technical standards.

One important advantage of the RCEP is its very favorable rules of origin treatment, which provide cumulative benefits that will help to build manufacturing supply chains within the RCEP region across different countries. This will help to attract foreign direct investment flows for a wide range of manufacturing and infrastructure projects into the RCEP member nations. A number of RCEP member nations with strong manufacturing hubs are well-positioned to benefit from increased foreign direct investment inflows into the APAC region due to the rules of origin benefits of the RCEP.

Therefore, the long-term outlook for FDI inflows into the ASEAN region remains very favorable across a broad range of industry sectors in manufacturing and services.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.