Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Dec 18, 2023

By Rajiv Biswas

After protracted weakness in manufacturing output and exports for many APAC industrial economies through most of 2023, there are early signs of improving momentum as the year draws to a close, helped by improving electronics exports and strong production and exports of electric vehicles.

In East Asia, mainland China's exports in November showed marginal growth in November, the first increase since April. South Korea's exports for the month of November rose by 7.8 percent year-on-year (y/y), with semiconductors exports ending 15 successive months of contraction, posting growth of 12.9 percent y/y. Singapore's economy is closing the year on a high note, with manufacturing sector output rebounding by 7.4% y/y in October 2023, after 12 consecutive months of year-over-year contraction. Taiwan's exports grew by 3.8% y/y in November, after having shown sharp declines throughout the first half of 2023 before gradually improving during the second half. Meanwhile industrial production in India has continued to show strong momentum during 2023, rising by 11.7% y/y in October.

After showing contraction each month between April and October, mainland China's exports returned to positive growth in November, albeit marginal expansion of just 0.5% y/y measured in USD terms. The rebound in exports was helped by a 7.0% y/y rise in exports to the US. However, exports to the EU contracted by 14.5% y/y, reflecting continued weak economic conditions in Western Europe.

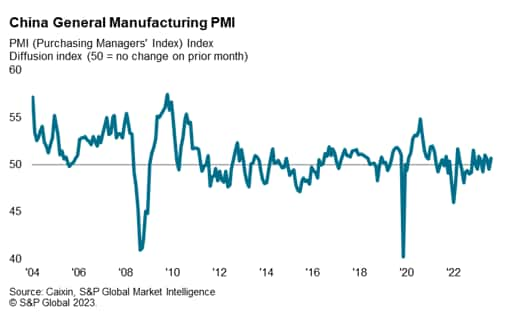

The headline seasonally adjusted Caixin General Manufacturing Purchasing Managers' Index (PMI) increased from 49.5 in October to a three-month high of 50.7 in November, to signal a renewed improvement in manufacturing conditions. Though only marginal, it marked the third time in the past four months that the health of the sector has strengthened. Supporting the positive survey reading for November was a sustained and quicker rise in overall new orders received by Chinese goods producers in November. Though modest, the rate of new order growth was the best seen since June, with firms often noting that firmer market conditions had helped to lift sales. However, new work from overseas continued to fall slightly, underscoring a relatively challenging external demand environment.

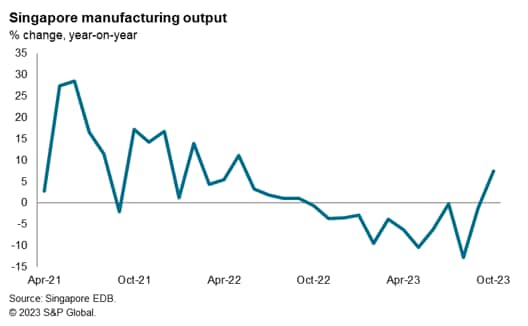

Latest statistics from Singapore's Economic Development Board (EDB) showed that manufacturing output rebounded strongly in October 2023. When measured on a month-on-month (m/m) basis, manufacturing output rose by 9.8% m/m.

A key factor driving the rebound in manufacturing output was the sharp upturn in electronics output, which rose by 14.8% y/y in October. Transport engineering output also rose strongly, up by 12% y/y, while biomedical manufacturing rose by 5.1% y/y. However, precision engineering output fell by 2.2% y/y while chemicals output showed a modest decline of 1% y/y.

The headline seasonally adjusted S&P Global Singapore PMI posted 55.8 in November, up from 53.7 in October. The latest reading signalled a ninth consecutive monthly expansion of Singapore's private sector economy and at the quickest pace since November 2022. Central to the latest improvement in conditions was stronger demand growth. New business expanded at the fastest rate in six months.

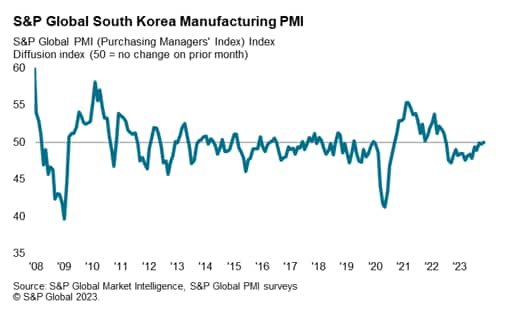

South Korea's Ministry of Trade, Industry and Energy (MOTIE) announced that South Korea's export value for the month of November advanced 7.8% y/y, reaching the highest monthly level for 2023 year-to-date.

A key factor supporting the rebound was an upturn in semiconductors exports, which ended 15 successive months of contraction, posting growth of 12.9% y/y, helped by a recovery in prices for memory chips. South Korean exports were also boosted by strong growth of 69.4% y/y in export value of Electric Vehicles, which account for 23.8% of the total automobile export value.

Reflecting the upturn in South Korean manufacturing exports, the seasonally adjusted S&P Global South Korea Manufacturing PMI rose slightly from 49.8 in October to 50.0 in November, signalling a return to neutral operating conditions in South Korea's manufacturing sector. The latest reading ended a 16-month sequence of decline.

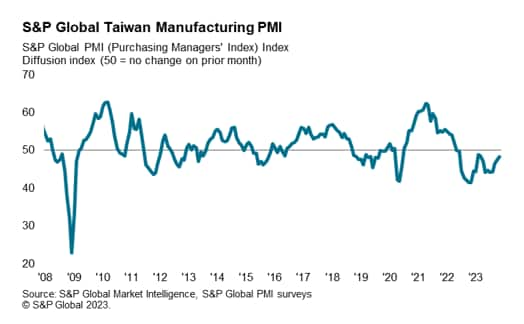

Taiwan's exports grew by 3.8% y/y in November, after having shown sharp declines throughout the first half of 2023 before gradually improving during the second half.

An important driver for the improvement was a 74% y/y rise in exports of information, communication and audio-video products. Key growth markets were the US, with exports to the US rising by 33% y/y in November, while exports to ASEAN rose by 13.8% y/y. However, exports to mainland China and Hong Kong SAR fell by 6.3% y/y. For the first eleven months of 2023, exports to mainland China and Hong Kong SAR fell by 19.1% y/y.

The S&P Global Taiwan Manufacturing PMI has gradually improved in the second half of 2023. The headline index picked up from 47.6 in October to 48.3 in November. Although the index still signalled moderate contractionary business conditions for the eighteenth successive month, the pace of reduction was the softest since March 2023.

India's industrial output has shown sustained strong growth during 2023, with the latest industrial production data showing an 11.7% y/y rise in October. Manufacturing output rose by 10.4% y/y in October, boosted by a 22.6% y/y rise in output of capital goods. Production of infrastructure/construction goods was also buoyant in October, rising by 11.3% y/y, while output of consumer durables rose by 15.9% y/y.

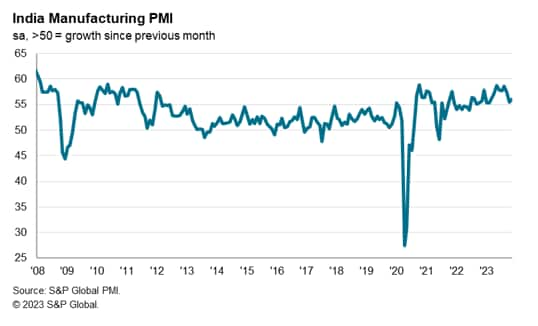

The S&P Global India Manufacturing PMI continued to show buoyant conditions in India's manufacturing sector in November, rising to 56.0 compared with 55.5 in October.

November data showed another substantial increase in overall levels of new orders received by Indian goods producers. Surveyed companies commonly reported positive demand trends, greater client requirements and favourable market conditions.

The outlook for 2024 is for continued resilient expansion in the APAC region, with robust domestic demand in many East Asian economies as well as India supporting manufacturing sector growth, helped by continued recovery in the key electronics sector.

The medium-term outlook for the APAC manufacturing sector is also supported by a number of positive factors.

Continued strong expansion in domestic consumer markets in large APAC economies, notably mainland China, India and Indonesia, will be an important factor supporting further growth in intra-APAC trade in raw materials, intermediate goods and final manufactured products.

The electronics manufacturing industry is an important part of the manufacturing export sector for many Asian economies, including South Korea, China, Japan, Malaysia, Singapore, Philippines, Taiwan, Thailand and Vietnam. Furthermore, the electronics supply chain is highly integrated across different economies in East Asia.

This includes continued 5G rollout over the next five years, which will drive demand for 5G mobile phones, as well as demand growth for electronics products driven by the impact of artificial intelligence. Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics.

APAC auto manufacturing hubs are also benefiting from the global transition to electric vehicles (EV), which is driving demand for EV exports produced in mainland China, Japan and South Korea. In early 2023, Hyundai started assembly of Ioniq 5 EVs at its new Hyundai Motor Group Innovation Centre in Singapore. Indonesia has also benefited from strong foreign direct investment flows from multinationals to build new electric vehicle battery plants.

The rapid growth of APAC exports is also expected to be strengthened by the APAC regional trade liberalization architecture. This includes the large Regional Comprehensive Economic Partnership (RCEP) and Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) multilateral trade agreements as well as the growing network of major bilateral FTAs involving APAC economies.

Access the PMI press releases here.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

© 2023, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location