Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Sep 10, 2021

By Rajiv Biswas

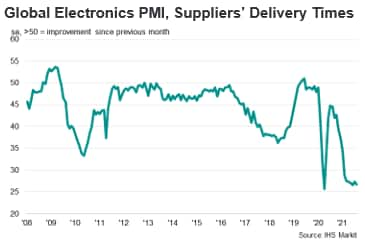

The new COVID-19 waves in East Asian electronics manufacturing hubs such as Vietnam, South Korea, Malaysia and Thailand have further increased supply chain disruptions at electronics plants due to escalating domestic pandemics. The latest IHS Markit Global Electronics Purchasing Managers' Index for August showed that global electronics manufacturers continued to face severe delays in receiving ordered inputs from suppliers. The rate at which lead times lengthened in August was again one of the highest on record and unprecedented prior to the COVID-19 pandemic.

The strength of global electronics demand is continuing to exacerbate semiconductors shortages for some manufacturing industries, notably the global automotive sector. Meanwhile, supply chain disruptions to semiconductors production have also impacted on the situation. Furthermore, the August IHS Markit Global Electronics survey continued to show evidence of sharp increases in electronics industry input prices as well as output prices, mainly due to shortages of essential raw materials.

The strong rebound in world consumer markets, notably in the US, China and Western Europe, are continuing to drive the growth in demand for electronics. This is resulting in buoyant growth in household spending on electronics products as well as products that are intensive users of electronics, notably autos.

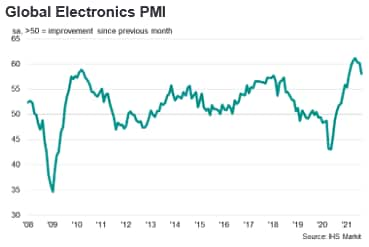

The headline seasonally adjusted IHS Markit Global Electronics PMI posted 58.1 in August, moderating from 60.2 in July but still signalling strongly expansionary operating conditions for global electronics manufacturers.

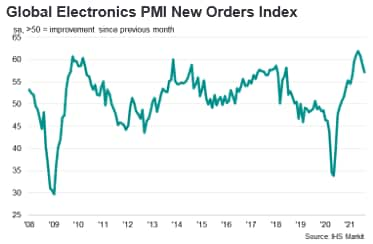

Global electronics manufacturers continued to record expansionary conditions for new orders in August, although the rate of expansion eased for the third month running. The IHS Markit Global Electronics PMI new orders index was at a level of 57.2 in August 2021, compared with a low of 35.0 in May 2020 when many of the world's largest consumer markets were in lockdown. In the August 2021 survey, anecdotal evidence pointed to ongoing increases in demand for semiconductors from around the world, with shortages of materials leading customers ramp up efforts to secure inventories of critical electronics items.

The electronics sector rebound has made an important contribution to the recovery of manufacturing exports and industrial production in many East Asian industrial economies. The electronics manufacturing industry is an important part of the manufacturing export sector for many Asian economies, including South Korea, China, Japan, Malaysia, Singapore, Philippines, Taiwan, Thailand and Vietnam. Furthermore, the electronics supply chain is highly integrated across different economies in East Asia.

Global electronics demand has risen strongly due to the global shift to remote working and online shopping. This has resulted in surging demand for consumer electronics products such as laptops, mobile phones and wearables.

China's total merchandise exports for the first seven months of 2021 continued to show strong growth, rising by 35.2% y/y according to trade data from China's General Administration of Customs. This reflected continued strong global demand for electronics and PPE equipment as well as the impact of base year effects due to global lockdowns a year earlier. China's exports of LCD panels in value terms were up 51.9% y/y in the first seven months of 2021, while exports of integrated circuits were up 31.1% y/y. Exports of mobile phones rose by 25.6% y/y in the same period.

South Korea's exports of information and communications technology (ICT) goods have also shown strong growth, rising by 30.2% y/y in July. South Korean semiconductor exports rose by 38.8% y/y, with exports of memory chips up 43.8% while exports of system chips rose by 35.8% y/y. Exports of displays rose by 34.9% y/y. Electronics exports to key markets showed large increases, with exports to the US up 47.3% y/y, while exports to the China were up 30.7% y/y.

Japanese exports of electronics have also performed strongly, with semiconductors exports up 27.8% y/y in July, while exports of integrated circuits rose by 24.4% y/y.

All four monitored sub-sectors of the global electronics industry continued to show firm expansion in August, according to the IHS Markit Global Electronics survey, although the pace of expansion of output moderated in all four segments.

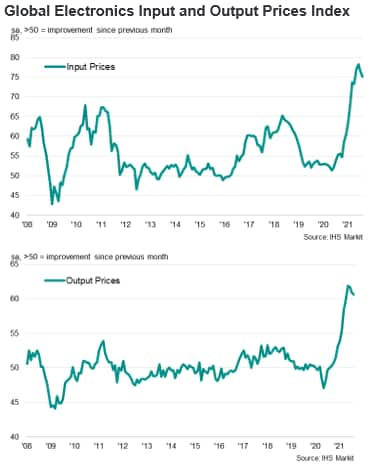

The rapid rise in electronics production has also triggered a sharp upturn in raw materials input prices for electronics firms during the second and third quarters of 2021. The IHS Markit Global Electronics Input Prices Index has continued to rise rapidly during the third quarter of 2021, at 75.1 in August. Widespread increases in costs for materials were reported by firms amid supply shortages, as well as rising shipping fees.

Reflecting the sharp increases in input prices, the IHS Markit Global Electronics Output Price Index continued to signal strong pricing pressures, at 60.6 in August.

The near-term pricing outlook for the remainder of 2021 according to IHS Markit Pricing & Purchasing analysis for semiconductors and components generally is that supply shortages are likely to continue to translate into price escalation. Printed circuit board assemblies are the most severely affected, but semiconductors, bare printed circuit boards, resistors, capacitors, and connectors are all expected to see price pressures. Escalation generally over the second half of the year will be greater than 10%. (See " Prices: Pricing Analysis - Semiconductors", by IHS Markit Pricing & Purchasing, 1st July 2021.)

In 2022 and 2023, capacity expansion will bring supply and demand closer to balance and lead to stabilizing prices. According to IHS Markit Pricing & Purchasing, moderating demand for electronic components and improving semiconductors production is expected to bring supply and demand closer to balance and lead to some price relief. Specific categories will show some resilience in pricing given the changing demand landscape. For example, the expansion of electronics in light vehicles will keep pressure on certain commodity electronic components.

In the electronics industry, the strength of global electronics demand is continuing to exacerbate semiconductors shortages for some manufacturing industries, notably the global automotive sector. This has been compounded by supply chain disruptions to production of semiconductors as well as other electronics components. According to analysis by IHS Markit Pricing & Purchasing, sporadic electronics production outages because of COVID-19 continue, and while many or most facilities which are open are operating at or near full capacity, the supply chain for electronic components is highly sensitive to disruptions.

Meanwhile the latest IHS Markit Global Electronics PMI survey shows evidence of sharp increases in electronics industry input prices as well as output prices, mainly due to shortages of essential raw materials.

Global auto manufacturers as well as smartphone producers are among the industry segments that have been impacted by semiconductors shortages. According to IHS Markit Automotive research, vehicle manufacturers have faced continuing disruption to the supply of systems using semiconductors in the first three quarters of 2021. Many automakers worldwide have reported disruptions to production due to shortages of semiconductors, including Ford, Toyota, VW Group, GM, Honda and Mazda.

According to IHS Markit Automotive research, reports of disruption within the supply chain of semiconductors to the automotive sector began in late 2020 and have continued in the first three quarters of 2021, with further disruption expected during the fourth quarter of 2021. These disruptions of supply of important electronic components have resulted in significant disruption of global auto production during 2021. IHS Markit's current assessment of light-vehicle production to be lost from the visible downtime during the third quarter of 2021 is at 2.54 million units, especially after Toyota's plans to make huge cutbacks to production in September (See " Semiconductor Supply Issue: Light Vehicle Production Tracker", by IHS Markit Automotive, 6th September 2021).

Global semiconductors shortages have also been impacted by temporary supply disruptions to semiconductors production in Texas due to power outages in February as a result of severe weather, as well as production disruptions in Japan due to a fire in a Renesas Electronics semiconductors plant in mid-March.

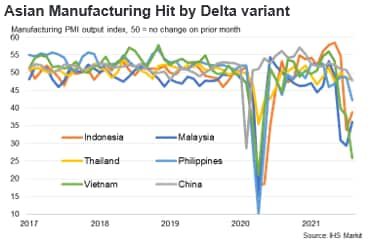

Since April, a number of Southeast Asian economies with large electronics manufacturing industries have been hit by escalating COVID-19 Delta waves, including Vietnam, Malaysia, Thailand and the Philippines. All are experiencing significant COVID waves that have triggered lockdowns and are creating significant disruption to economic activity.

The latest IHS Markit Manufacturing PMI surveys for Southeast Asia have reflected the impact of these new lockdown measures, which have disrupted industrial production and consumption spending.

In Malaysia, the headline IHS Markit Malaysia Manufacturing Purchasing Managers' Index (PMI) showed sharp contraction in manufacturing during June, July and August, and was at a level of 43.4 in August compared with 51.3 in May. This pointed to severe weakness in business conditions in the Malaysian manufacturing sector.

Vietnam's economy has also been hit by the impact of the latest COVID wave, after its economy showed considerable resilience during 2020 as the domestic pandemic was successfully contained. The latest wave of COVID-19 cases in Vietnam led to a sharp decline in business conditions for manufacturers during July and August. The IHS Markit Vietnam Manufacturing Purchasing Managers' Index fell to 40.2 in August, down from 45.1 in July and signalling the worst deterioration in the health of the sector since April 2020.

The impact of factory closures in Vietnam related to the pandemic has become increasingly widespread during July and August.

Samsung Electronics has reported that in Vietnam, which is a key electronics manufacturing hub for the firm, there were production disruptions in certain places during the second quarter of 2021 due to lockdowns that affected operations. However, the firm managed to mitigate the disruptions by shifting production to other parts of their global manufacturing supply chain.

Toyota has announced an estimated 40% drop in global auto production in September due to the impact of global semiconductor shortages as well as disruption to supply chains in Southeast Asian manufacturing hubs, including Vietnam. Toyota temporarily halted several auto assembly lines in Japan for periods during July and August due to disruptions to supply of auto parts from Vietnam.

There has also been disruption to electronics supply chains due to the lingering impact of the COVID-19-related shutdowns in Malaysia, where many back-end operations are performed, such as packaging and testing of chips.

With reported daily new cases having risen sharply in recent weeks in many Southeast Asian nations, there is still significant uncertainty about how protracted and severe the current Covid waves will be, posing continuing risks to electronics supply chains in the region.

During the first three quarters of 2021, global electronics demand has shown a strong rebound from the lows of the first half of 2020, when lockdowns in many major economies disrupted production and consumer spending. With economic recovery continuing in the US and EU as COVID-19 vaccines are progressively rolled out, demand for electronics products is expected to remain strong during the remainder of 2021.

The impact of the pandemic has accelerated the pace of digital transformation due to the global shift to working remotely, which has boosted demand for electronic devices such as computers, printers and mobile phones. The easing of lockdowns in many countries has also triggered a rebound in consumer spending, helping to boost demand for a wide range of consumer electronics. Spending on consumer electronics has also been boosted by fiscal stimulus measures in many OECD countries that have provided significant pandemic relief payments to support households in many large economies, including the US, UK, Japan and Australia. Meanwhile global auto demand has also shown a rebound after slumping during the first half of 2020, which is boosting demand for auto electronics, albeit contributing to intensifying supply-side problems related to semiconductors shortages.

The medium-term economic outlook is also supportive for the electronics industry, with sustained strong world economic growth forecast over 2022-2024.

With shortages of semiconductors disrupting manufacturing supply chains in 2021, the importance of having domestic electronics production capacity for critical electronics components has become a national priority for major industrial nations, including the US, EU and China. For the US and EU, reducing reliance on Asian semiconductors production has become a key strategic priority over the next decade.

A key risk is excessive global vulnerability to semiconductors supply from South Korea and Taiwan, which are major electronics production hubs but also potential geopolitical flashpoints in the Asia-Pacific region. Military tensions in the Taiwan Strait and South China Sea have escalated during 2021, highlighting these vulnerabilities.

The outlook for electronics demand is also supported by major technological developments, including 5G rollout over the next five years, which will drive demand for 5G mobile phones. Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics.

Competition amongst leading technology nations in strategic electronics production has also intensified. Consequently, strategic global competition amongst the world's leading high-technology nations is also likely to play a greater role in reshaping the global electronics industry landscape over the next decade.

Rajiv Biswas, Asia Pacific Chief Economist, IHS Markit

Rajiv.biswas@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.