Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jul 15, 2021

By Rajiv Biswas

Global Rebound

World GDP is forecast to rebound to positive growth of 5.8% in 2021 after a contraction of 3.5% in 2020. The rebound in economic growth in advanced economies such as the United States, the European Union, the United Kingdom and Canada combined with continued strong economic momentum in China are linked to the rapid rollout of vaccination programs and containment of domestic new COVID-19 cases during the first half of 2021.

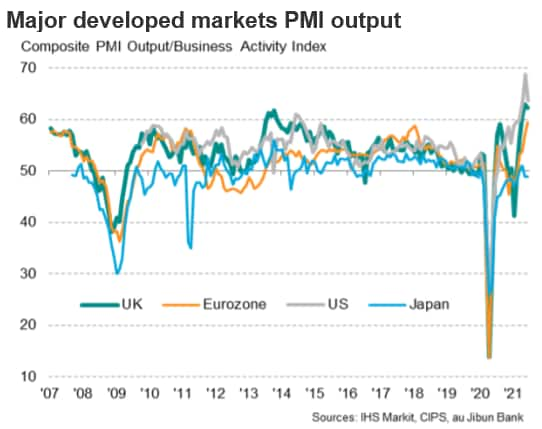

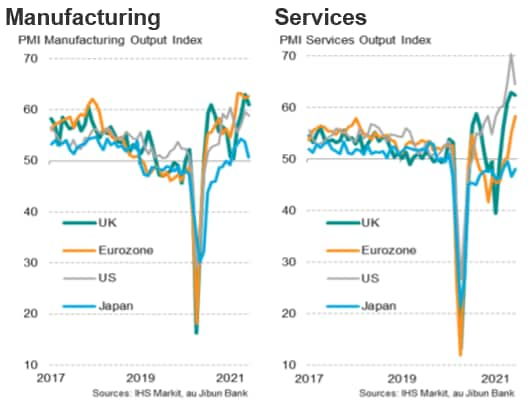

Growth momentum in the US, Eurozone and UK has been buoyant, with the IHS Markit PMIs for these nations having risen sharply in the second quarter of 2021 as rapid vaccination rollouts resulted in sharp declines in COVID-19 waves, easing of restrictive measures and reopening of economies.

APAC Economic Growth

The Asia-Pacific region experienced a recession in 2020 owing to the COVID-19 pandemic, with Asia-Pacific GDP contracting by an estimated 1.1%. Pandemic-related lockdowns and travel bans had a severe negative impact on the economies of most Asia-Pacific nations during the first half of 2020. During the second half of 2020, many Asia-Pacific economies had shown a significant recovery in economic momentum. This upturn was driven both by strengthening global export demand as well as the rebound in domestic consumption spending as a result of the easing of pandemic-related restrictions in many countries.

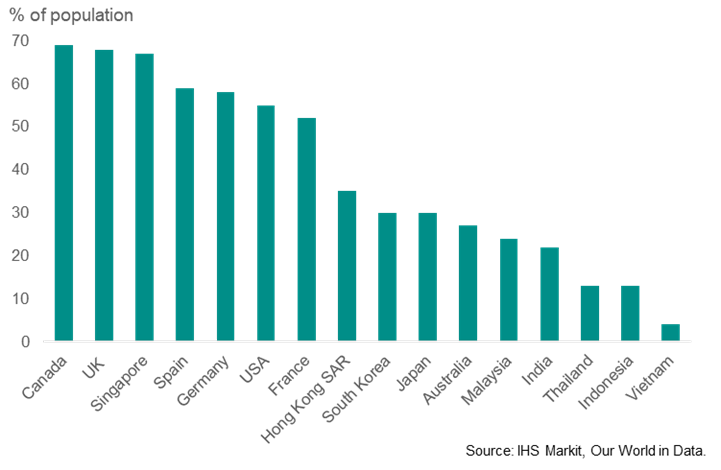

However, recovery momentum in the Asia-Pacific has suffered significant setbacks during the second quarter of 2021, as new COVID-19 waves driven by the highly transmissible Delta variant have resulted in renewed lockdowns being imposed in many Asia-Pacific countries. The situation has been aggravated by the relatively slow progress of COVID-19 vaccination rollouts in many Asia-Pacific economies compared with the US and Western Europe.

This APAC grouping, perhaps surprisingly, includes some developed Asia-Pacific nations that are OECD members, notably Japan, South Korea and Australia. However, they have made better progress in recent weeks, having ramped up their vaccination programs. In contrast, Singapore has been the leader amongst the APAC economies, with a first-dose vaccination rate as a share of total population that is amongst the highest in the world, on a par with the UK and Canada.

COVID Waves Roll Across Southeast Asia

Since April, a number of Southeast Asian economies have been hit by escalating COVID-19 Delta waves. Indonesia, Malaysia, Thailand, Vietnam, Cambodia and Myanmar are all currently experiencing significant COVID waves that have triggered lockdowns and are creating significant disruption to economic activity.

The latest IHS Markit Manufacturing PMI surveys for Southeast Asia have reflected the impact of these new lockdown measures, which have disrupted industrial production and consumption spending.

In Malaysia, the headline IHS Markit Malaysia Manufacturing Purchasing Managers' Index (PMI) fell sharply in June, to 39.9 compared with 51.3 in May. This pointed to a severe decline in business conditions in the Malaysian manufacturing sector. The renewed downturn in June reflected the recent steep rise in daily COVID-19 infections and associated containment measures, which again dampened demand, stymied production and disrupted supply chains.

Vietnam's economy has also been hit by the impact of the latest COVID wave, after its economy showed considerable resilience during 2020 as the domestic pandemic was successfully contained. The latest wave of COVID-19 cases in Vietnam led to a sharp decline in business conditions for manufacturers during June. The IHS Markit Vietnam PMI dropped sharply to 44.1 in June from 53.1 in May, pointing to the most rapid deterioration in business conditions for over a year and ending a six-month period of growth.

The pandemic, lockdown measures and temporary company closures were all mentioned by firms in Vietnam as factors leading to sharp reductions in both output and new orders during June. Meanwhile, new business from abroad also decreased as transportation issues and container shortages exacerbated the impacts of the rise in virus cases.

Output and new orders both decreased at the sharpest rates since the first outbreak of the pandemic in early-2020, while firms scaled back their employment and purchasing activity accordingly. The pandemic also impacted supply chains, resulting in a near-record lengthening of delivery times. For example, four industrial parks in Bac Giang province in northern Vietnam were temporarily closed in late May, due to outbreaks of COVID cases, which also impacted on some manufacturing facilities of Foxconn and Samsung.

In Indonesia, daily new COVID-19 cases have risen sharply during June and early July, reaching 40,400 by 12th July. As of July 12, 2021, an estimated 13.3% of the Indonesian population have received their first vaccinations.

The rapid escalation in domestic COVID-19 cases has led to a lengthening of lead times for Indonesian manufacturers in June, with supplier performance deteriorating at the fastest rate since January, according to the latest IHS Markit Indonesia Manufacturing PMI survey. The significant escalation in daily new cases is expected to continue to weigh on economic activity in the third quarter of 2021 until the latest COVID wave can be brought under control.

Indian Economy Hit by COVID Wave

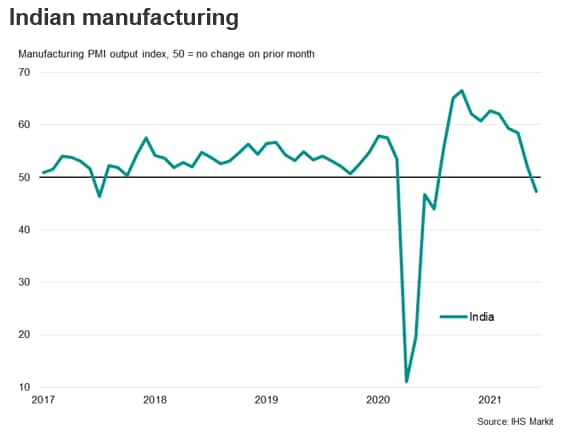

India's economic recovery momentum in early 2021 has also been badly impacted by the recent severe COVID-19 wave that hit the nation in May and June, although the severity of the latest wave appears to be receding as daily new cases have declined rapidly during recent weeks.

India's manufacturing industry fell back into decline during June, as the intensification of the pandemic and strict containment measures negatively impacted on demand. Falling new orders, business closures and the COVID-19 crisis triggered a reduction in output among Indian manufacturers.

The decline was moderate relative to those seen in the first half of 2020 but ended a ten-month sequence of growth. The seasonally adjusted IHS Markit India Manufacturing PMI fell from 50.8 in May to 48.1 in June. The latest results highlighted renewed contractions in factory orders, production, exports and quantities of purchases. With business optimism fading over the month, job shedding continued.

Near-term Economic Outlook

The central case global economic scenario for 2021-22 is positive, with the world economy forecast to show improving momentum as COVID-19 vaccination programs are increasingly widely rolled out globally. World GDP growth is forecast to rise by 5.8% y/y in 2021, with sustained expansion at a pace of 4.7% y/y in 2022.

Many of the world's largest economies, including the United States, the European Union, UK and China, have been rapidly progressing with vaccination programs during the first half of 2021. This has allowed domestic demand to rebound in these nations, as lockdown conditions have been progressively eased in many countries that had been experiencing severe COVID-19 waves at the outset of 2021.

In contrast, many Asia-Pacific economies are still facing severe COVID-19 waves by mid-2021, while vaccination rollout progress lags far behind the US and EU. This is delaying the pace of economic recovery, as new lockdown measures have been imposed in a growing number of APAC economies. Therefore, the roadmap to sustained recovery is expected to be closely linked to the timetable for vaccination of a high share of the total population of an economy.

Due to ongoing new COVID-19 waves in many Asia-Pacific nations in 2021, international travel restrictions are still expected to remain a major impediment to the recovery of international tourism and travel in the Asia-Pacific region during 2021. This is expected to result in a more protracted and gradual recovery path for trade in services for many Asia-Pacific economies. International tourism and travel is a key contributor to GDP in many Asia-Pacific economies

Despite these significant headwinds to the outlook, a key factor underpinning the strong economic rebound in the Asia-Pacific region has been buoyant economic growth in China, which is forecast to grow at 8.5% y/y in 2021. China's continued strong economic growth rate is expected to underpin the overall APAC regional growth rate in 2021, which is forecast to be 6.3% y/y. In 2022, progress of vaccine rollouts is expected to allow a wider group of Asia-Pacific economies to emerge from domestic pandemics and related restrictive measures. Consequently, continued rapid APAC regional growth at a pace of 4.9% is expected in 2022.

Rajiv Biswas, Asia Pacific Chief Economist, IHS Markit

Rajiv.biswas@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.