Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

ECONOMICS COMMENTARY — Jan 08, 2021

By Rajiv Biswas

Key drivers for APAC GDP growth in 2021

The APAC region's recession of 2020 was worse than either the Global Financial Crisis or the East Asian Financial Crisis, as measured by GDP growth in the APAC region as a whole. A key factor contributing to the contraction in APAC growth in 2020 was the sharp slowdown in China's economic growth rate to an estimated pace of 2.1% y/y. In contrast, during the East Asian Crisis, China recorded GDP growth of 7.9% y/y in 1998, while in the Global Financial Crisis China grew at 9.4% y/y in 2009.

Furthermore, India is estimated to have suffered a severe recession in 2020, whereas during the East Asian Crisis and during the Global Financial Crisis, India recorded positive annual GDP growth.

Pandemic-related lockdowns and travel bans had a severe negative impact on the economies of most APAC nations during the first half of 2020. However, during the second half of 2020, many Asia-Pacific economies had already been showing significant recovery in economic momentum. This upturn was driven both by strengthening global export demand as well as the rebound in domestic consumption spending as a result of the easing of pandemic-related restrictions in many countries.

IHS Markit's PMI survey index of manufacturing output in APAC has recovered strongly in recent months, signalling the strongest expansion n of production in a decade during the closing months of 2020, albeit with the rate of expansion cooling slightly in December, though this was in part due to shipping delays caused by the sheer strength of demand.

Economic recovery is forecast to continue during 2021, helped by the expected progressive rollout of COVID-19 vaccines in many OECD and APAC nations during the course of the year. This is expected to help to gradually contain the pandemic, allowing domestic economic activity to strengthen through 2021.

With world GDP expected to rebound to positive growth of 4.5% y/y in 2021 after a contraction of 4.0% y/y in 2020, this will provide a boost to the export sectors of many export-driven APAC economies. The rebound in economic growth in advanced economies such as the US, EU, UK and Canada linked to the rapid rollout of vaccination programs during the first half of 2021 is expected to support APAC new export orders to key export markets in North America and Europe.

However international travel restrictions are still expected to remain a major impediment to the recovery of international tourism and business travel in the APAC region during 2021. Consequently, APAC economies where domestic tourism accounts for a large share of total tourism, such as China, Japan and Australia, are likely to experience more rapid recovery in their tourism and travel industries than nations more reliant on international tourist visitors.

China's economic rebound

China's economy suffered a severe negative shock in the first quarter of 2020 due to the protracted shutdown of industrial production and severe restrictions on consumer expenditure due to lockdowns.

However, economic activity improved significantly during the second quarter of 2020, as industrial production rebounded and consumption spending gradually improved. The Chinese economy showed a strong recovery in economic momentum during the second half of 2020, helped by buoyant exports as well as a gradual normalization of domestic economic activity. China's industrial production grew by 7.0% y/y in November 2020, with manufacturing up 7.7% y/y while retail sales rose by 5% y/y.

China's merchandise exports rose by 21.1% y/y in November 2020, helped by strong demand for PPE equipment and electronics, with buoyant exports to key markets, notably the US and EU. This pushed China's trade surplus for November to USD 75.4 billion, the highest monthly trade surplus since 1981.

The latest Caixin China Manufacturing Purchasing Managers' Index for December 2020 was at 53.0, continuing to signal positive growth in the manufacturing sector, albeit moderating from 54.9 in November. The manufacturing new orders and export orders PMI series also continued to signal expansion.

The headline seasonally adjusted Caixin China General Services Business Activity Index also continued to show strong expansion in December, at a level of 56.3, albeit moderating from 57.8 in November. The rate of expansion continued to be among the steepest recorded over the past decade.

Japan faces new pandemic wave

The Japanese economy is meanwhile estimated to have contracted by 5.4% y/y in 2020, due to the impact of the pandemic both on domestic economic activity as well as on new export orders for Japanese manufacturing exports. During the first wave of pandemic cases during the second quarter of 2020, the Japanese government imposed a state of emergency to contain the pandemic, which was temporarily successful.

However, a major new upsurge in cases that intensified during December 2020 has resulted in the Japanese government imposing a second state of emergency decree on Tokyo and several nearby prefectures. National daily new COVID-19 cases exceeded 6,000 on 6th January 2021. The state of emergency is due to run from January 8th to February 7th 2021, although its scope will initially be relatively limited compared with the 2020 state of emergency. This is expected to have a significant impact on Japanese GDP in the first quarter of 2021, particularly on consumption expenditure on retailing and dining out.

Consequently, the rollout of COVID-19 vaccines is likely to play a critical role in the gradual economic recovery of the Japanese economy during 2021. Japan has sufficient orders in place for three vaccines that are already approved for use in the US, UK and EU, namely the Oxford/AstraZeneca, Moderna and the Pfizer/BioNTech vaccines. Sufficient quantities of vaccines are on order to make significant progress towards inoculating the population by mid-2021.

Based on the expected imminent commencement of Japan's immunization program, Japan's GDP is expected to return to positive growth of 2.6% in 2021. The latest headline au Jibun Bank Japan Manufacturing Purchasing Managers' Index rose from 49.0 in November to reach the 50.0 no-change threshold in December, the highest reading of Japan's Manufacturing PMI since April 2019.

Economic activity in Japan's services sector remained resilient during the fourth quarter of 2020 despite the latest pandemic wave. The seasonally adjusted Japan Services Business Activity Index dipped fractionally from 47.8 in November to 47.7 in December, and continued to signal a moderate contraction in activity, albeit at a much higher level of economic activity compared with the first half of 2020.

Indian economic recovery

The Indian economy also suffered a severe recession in 2020, with GDP in the fiscal year 2020-21 estimated to have contracted by 8.9% y/y. However, the worst contraction occurred during the period from March until August, with the economy having shown a strong rebound in economic activity since September. During the fourth quarter of 2020, India's industrial production and consumption expenditure have shown a rebound. October data showed that industrial production grew by 3.6% y/y, compared with a steep contraction of -55.5% in April 2020.

The seasonally adjusted IHS Markit India Manufacturing Purchasing Managers' Index was at 56.4 in December, a figure consistent with strong positive expansion and above the critical 50.0 neutral threshold for the fifth straight month. The latest figure was consistent with a marked improvement in business conditions across the manufacturing sector. Reflecting the loosening of COVID-19 restrictions, strengthening demand and improved market conditions, factory orders increased during December.

Although India faces a vast challenge to vaccinate its population of 1.4 billion people, it is about to commence its COVID-19 vaccination program. India's health regulator has approved the Oxford/AstraZeneca vaccine for emergency use. An important advantage for India is that the Oxford/AstraZeneca vaccine is already being manufactured in India by the Serum Institute of India, which projects that it will be able to manufacture 100 million COVID-19 vaccine doses per month by April 2021.

With the Indian economy already showing a significant improvement in domestic economic activity in the fourth quarter of 2020, the outlook is for Indian GDP growth to rebound by 8.9% y/y in the 2021-22 fiscal year.

Electronics sector output rebounds after COVID-19 related disruptions

The electronics manufacturing industry is an important part of the manufacturing export sector for many East Asian economies, including China, South Korea, Taiwan, Malaysia, Singapore, Philippines, Thailand and Vietnam. Furthermore, the electronics supply chain is highly integrated across different economies, with China being an important supplier of intermediate electronics parts for a number of Southeast Asian electronics sectors.

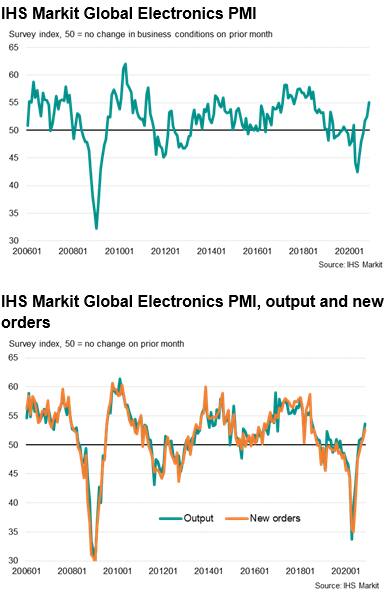

Despite severe disruptions to Asian electronics production and to global demand due to the pandemic during the first half of 2020, the IHS Markit Global Electronics PMI has signaled a significant rebound since mid-2020. The headline seasonally adjusted PMI rose to 53.4 in November 2020, up from 51.8 in October. The latest reading pointed to the quickest improvement in the health of the global electronics sector for over two years, amid stronger increases in both output and new orders.

Global electronics new orders rose from a calendar year-to-date low of 34.7 in May to a level of 52.8 by November, reflecting a significant recovery in new orders. The electronics sector rebound is making an important contribution to the recovery of manufacturing exports and industrial production in many APAC industrial economies. China's electronics exports rose strongly in November, up 24.8% year-on-year due to strong Christmas demand for consumer electronics in key global markets, notably the US and EU. In South Korea, semiconductor exports increased 16.4% y/y in November, boosted by newly launched mobile phone products as well as increasing sales of mobile phone parts.

Outlook: a year of uncertainty

Despite the expected rebound in global and APAC economic growth in 2021, there are considerable uncertainties about how rapidly vaccines will be deployed and how effective these may be in bringing the global pandemic under control, particularly given rising concerns about new strains of the virus that have been reported.

The Asia-Pacific region also faces considerable challenges with its vaccination programs due to the very large size of the population in many Asian nations, notably in China and India, the world's two most populous countries. Indonesia, Bangladesh, Philippines, Pakistan, Vietnam and Japan also have very sizeable populations.

Consequently despite the favorable economic outlook for APAC economic recovery at the outset of 2021, the speed at which different nations emerge from the pandemic is likely to vary considerably, depending on many factors including the size of population, access to large supplies of COVID-19 vaccines and ability to deploy large-scale immunization programs. There are also other critical unknown factors, including the duration of effectiveness of vaccinations for the various key vaccines that are under development.

Nevertheless, the central case economic scenario for 2021 is positive, with the world economy expected to be gradually emerging from the pandemic, with many APAC economies at the forefront of that recovery.

Rajiv Biswas, Asia Pacific Chief Economist, IHS Markit

Rajiv.biswas@ihsmarkit.com

© 2021, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Location