Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — February 4, 2026

By Melissa Otto, CFA

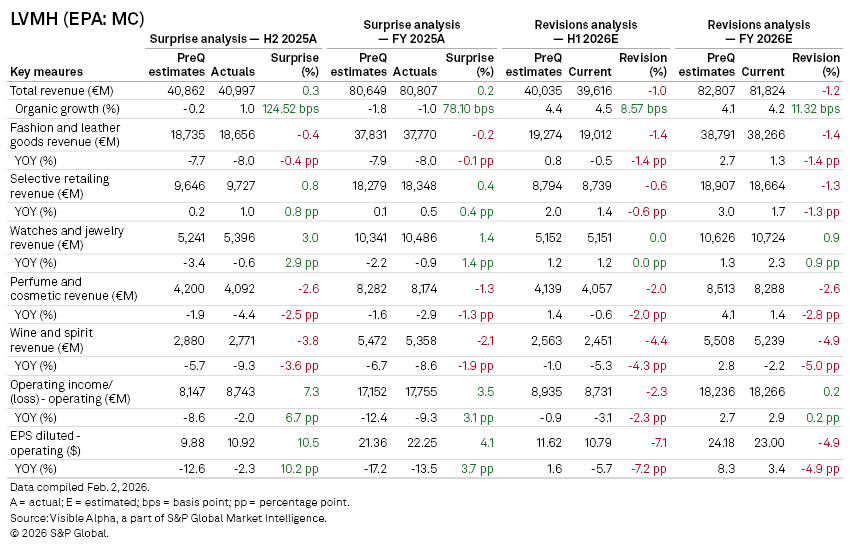

LVMH Moët Hennessy - Louis Vuitton Société Européenne (EPA: MC) reported fiscal 2025 results that slightly exceeded Visible Alpha's expectations on revenue and earnings, but forward-looking revisions suggest a more cautious outlook for 2026.

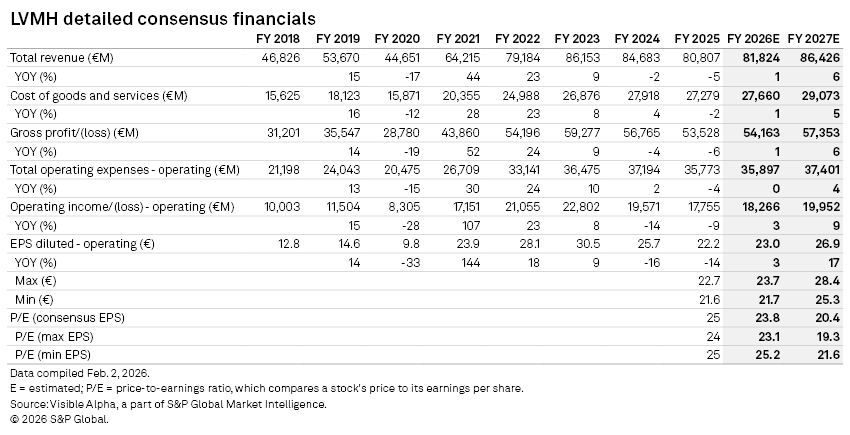

The luxury conglomerate reported full-year 2025 revenue of €80.8 billion, down 5% year-on-year and just above Visible Alpha consensus of €80.6 billion.

Management said reported sales were held back by the broad weakening of key invoicing currencies against the euro, notably the US dollar, Chinese renminbi, South Korean won and Japanese yen. On a constant currency and consolidation basis, organic growth declined by 1.0%, which was better than the negative 1.8% analysts had anticipated.

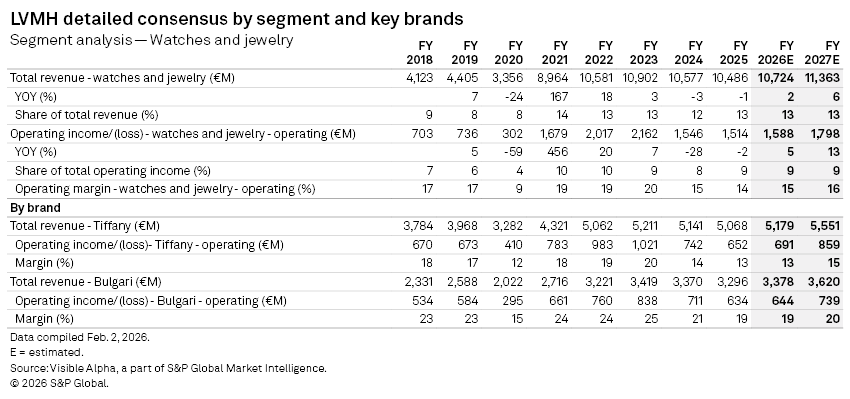

Operating income rose to €17.8 billion, exceeding Visible Alpha consensus expectations by 3.5%, supported by stronger margins in watches and jewelry and selective retailing, offsetting softer performance in fashion and leather goods, perfumes and cosmetics and wine and spirits.

Diluted EPS of €22.33 per share was also better than the forecast.

Segment breakdown

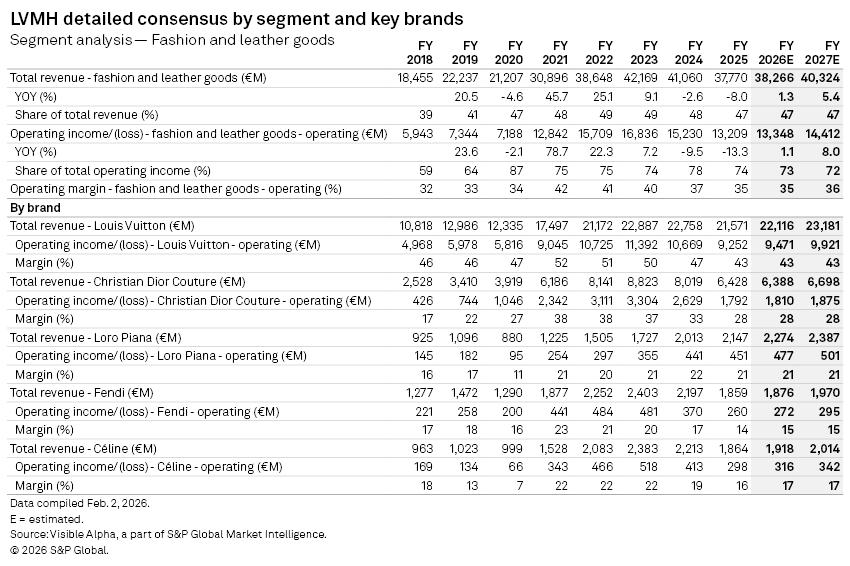

Results varied across the company's divisions. Fashion and leather goods, which brings in the bulk of its sales and profit, saw revenue decline 8% year over year to €37.8 billion and post a 35% margin, broadly in line with expectations.

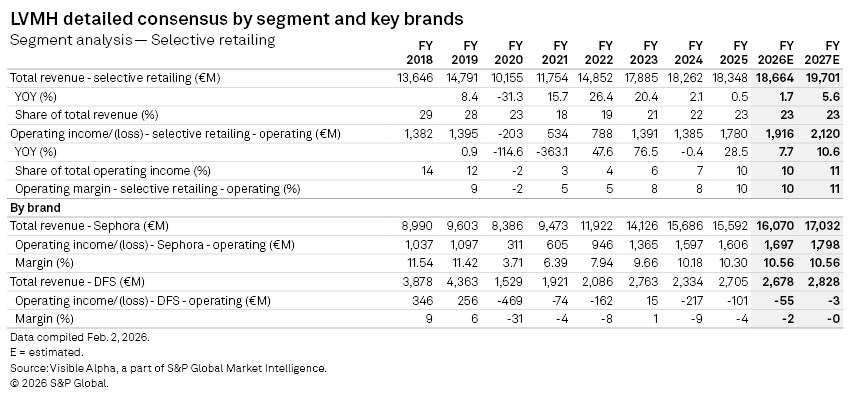

Selective retailing, which includes DFS and Sephora, generated sales of €18.3 billion and a 10% margin in 2025, modestly above expectations, supported by resilient travel retail and steady traffic in department stores. DFS recently agreed to divest its Greater China travel retail operations to China Tourism Group Duty Free, while retaining its luxury travel retail activities elsewhere. The two groups also signed a memorandum of understanding to explore broader retail cooperation across Greater China.

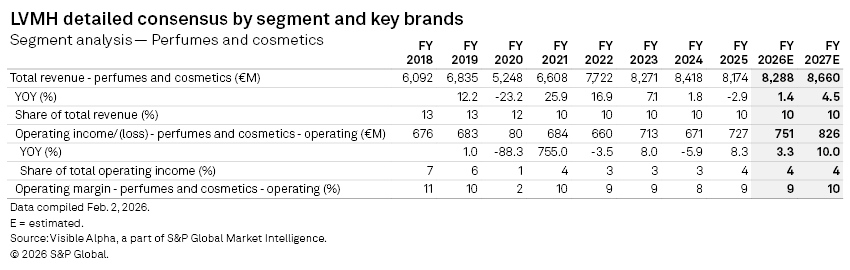

The watches and jewelry division outperformed expectations with revenue of €10.5 billion, exceeding forecasts by 1.4%. Perfumes and cosmetics lagged, with sales of €8.2 billion, down 2.9% year over year and short of consensus expectations by 1.3%.

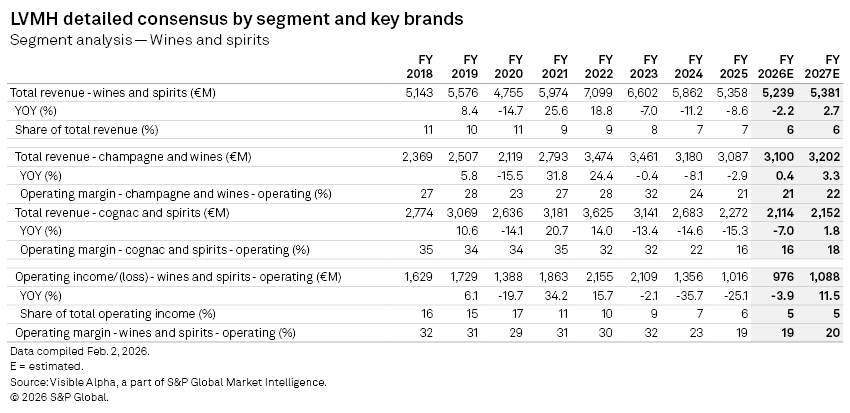

Wines and spirits was the weakest segment, with revenues sliding 8.6% year over year, impacted by tariffs and softer global demand for champagne and cognac.

Murkier outlook for 2026

Analyst revisions for first-half and full-year 2026 suggest a modest pullback in topline expectations. Total revenue is now projected at €81.8 billion for 2026, down 1.2% from prior estimates. Still, profitability is expected to outpace expenses.

EPS expectations have been trimmed to €22.98, but growth is still forecast to be marginally positive year over year.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Products & Offerings

Segment