Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — Jan. 13, 2026

By Manraj Lamba

As Saudi Arabia accelerates its economic diversification under Vision 2030, the mining sector is emerging as a cornerstone of the Kingdom's new growth model. Ambitious reforms, increased exploration budgets and a strategic focus on gold and copper are positioning Saudi Arabia to become a global mining leader. However, the sector's rapid expansion faces challenges from resource constraints, workforce development and heightened environmental, social and governance expectations.

– Saudi Arabia's minesite exploration budget increased to $146 million in 2025 from $21 million in 2022.

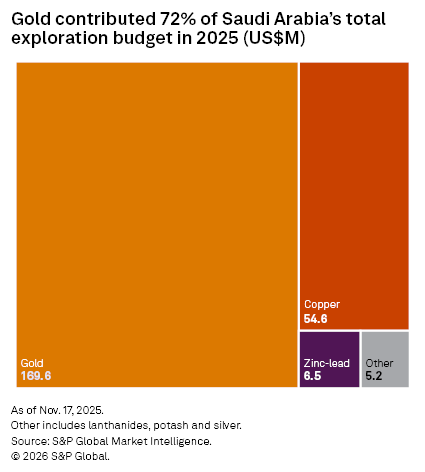

– In 2025, 72% of the total exploration budget went to gold and 23% to copper, reflecting the Kingdom's evolving priorities and global market demand.

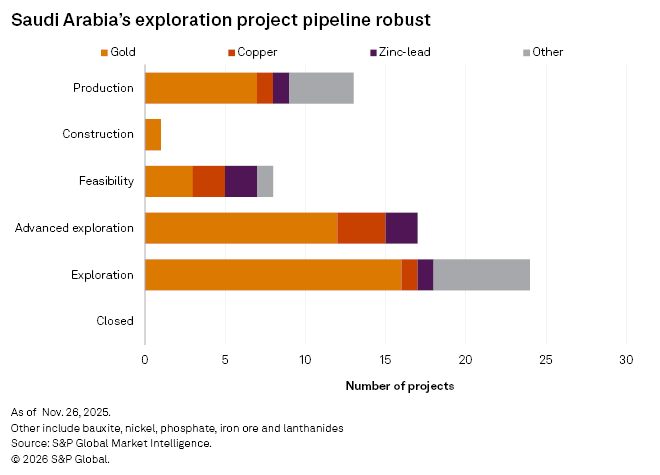

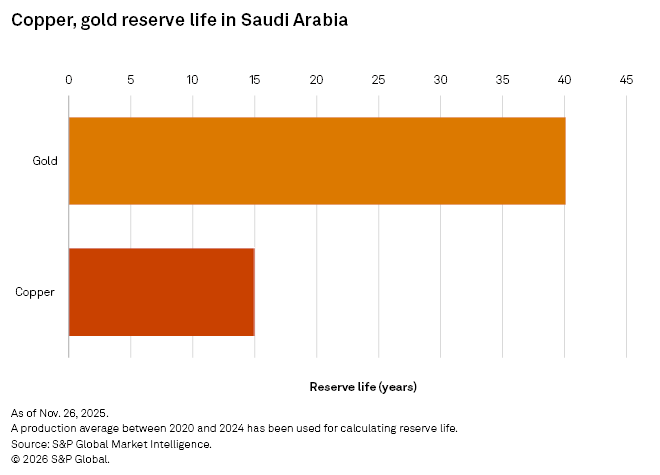

– The Kingdom hosts 24 exploration and 17 advanced projects, with copper and gold reserves expected to last 15 and 40 years, respectively, amid challenges in maintaining and expanding these reserves.

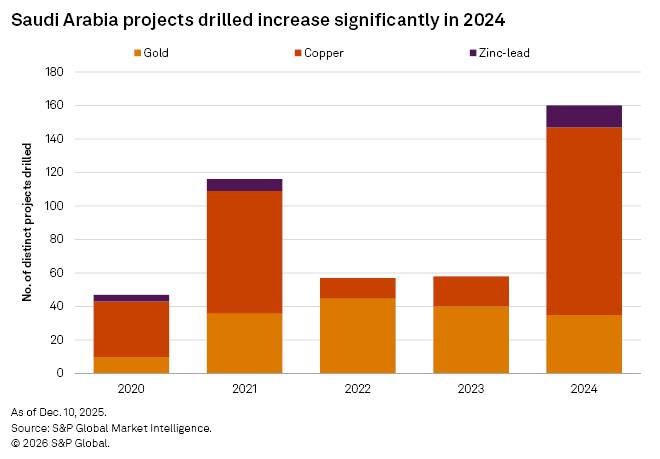

– The number of projects drilled in Saudi Arabia increased to 160 in 2024 from 58 in 2023, driven by Vision 2030 initiatives, regulatory reforms, heightened investor interest and improved infrastructure.

– Saudi Arabia is in the final implementation stage of launching a metals exchange to support the mining sector with financial tools, price stability and integration with global commodity markets.

Sector transformation and strategic focus

Saudi Arabia is experiencing a transformative shift in its mining sector, propelled by its Mining Strategy — a key pillar of the Kingdom's Vision 2030 aimed at diversifying its economy and reducing reliance on oil. Substantial increases in exploration budgets, particularly for gold and copper, reflect the Kingdom's strategic priorities and ambition to unlock new mineral resources. Supported by advanced technologies and a robust pipeline of projects, Saudi Arabia is positioning itself as an emerging leader in global mining, fostering sustainable growth and attracting significant foreign investment. The Kingdom's mineral wealth is now estimated at over $2.4 trillion, up 90% since 2016, following comprehensive surveys that have revealed new discoveries beyond traditional mineral belts, including rare earth elements and battery metals.

Exploration budget trends

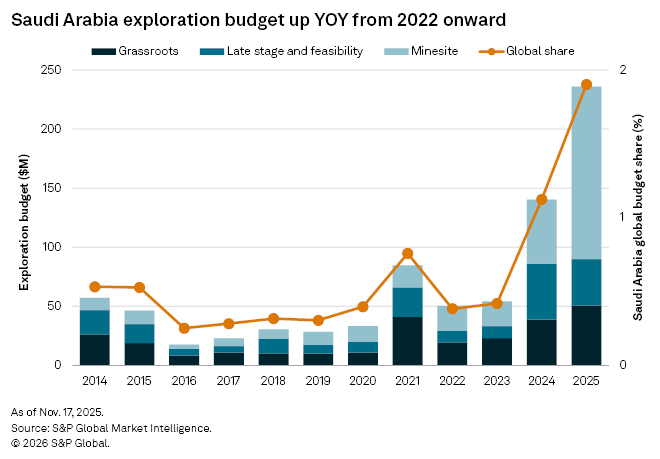

Saudi Arabia's commitment to expanding its mining sector is evident in the substantial year-over-year increases in exploration budgets since 2022. The minesite exploration budget surged 595%, reaching $146 million in 2025 from $21 million in 2022. This growth is driven by ongoing geological surveys, technological advancements and higher exploration budgets, all of which signal stability and opportunity, attracting foreign investment. While the growth is striking, exploration spending remains modest compared to established mining jurisdictions such as Australia and Canada, which typically allocate over $1 billion annually.

Commodity focus and market dynamics

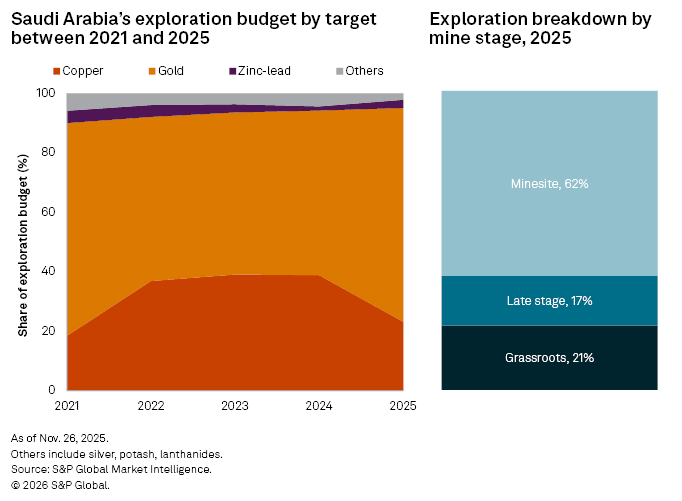

The allocation of exploration budgets by commodity has shifted significantly, reflecting Saudi Arabia's evolving priorities and market dynamics. Since 2022, the share allocated to gold has risen sharply, commanding approximately 72% of the total exploration budget in 2025. This underscores gold's importance as a driver of sector growth, foreign investment and economic diversification. Copper accounted for 23% of the 2025 budget, recognizing its rising global demand, especially for energy transition and infrastructure development. By prioritizing gold and copper, Saudi Arabia is positioning itself to capitalize on future market opportunities and drive long-term growth. Other commodities, such as silver, potash and lanthanides, still attract investment, but their relative share has declined, driven by promising new deposits and strategic responses to international market trends. Saudi Arabia aims to enter the top 20 for copper and gold producing countries globally.

Project pipeline and regulatory reforms

Minesite exploration accounted for 62% of the 2025 exploration budget, with these funds going toward expanding existing operations, increasing resource estimates and supporting near-term production growth. Focusing spending on minesite activities shows an emphasis on yielding quick results. It also allows reserves near ongoing operations to be brought into production more rapidly.

Saudi Arabia hosts a robust pipeline of 24 exploration and 17 advanced projects. Its proactive approach to geological surveys and resource assessment has uncovered significant potential across gold, copper, phosphate and bauxite. Substantial government investment and advanced technologies support this project pipeline. Additionally, a new mining investment law has reduced the tax rate to 20% from 45%, enhancing investor confidence and aligning regulations with global standards, which accelerates mineral development in line with Vision 2030. In its ninth licensing round, Saudi Arabia awarded 172 mining sites across three mineral-rich belts, attracting about 671 million Saudi Arabian riyals (US$179 million) in pledged investments and marking the largest licensing round in its history. The 10th round, covering 13,000 sq km, will be announced at the Future Minerals Forum in Riyadh on Jan. 13–15, 2026.

Mineral reserves and project activity

The Kingdom's mining sector is underpinned by substantial mineral reserves, with copper estimated at 15 years of reserve life and gold at 40 years, providing long-term security for ongoing operations and enhancing investor attractiveness. A lengthy gold reserve life enhances Saudi Arabia's role as a key player in the global gold industry.

In 2024, Saudi Arabia experienced a marked increase in drilling activity, with the number of projects rising to 160, from 58 in 2023. Vision 2030 targets increasing mining's GDP contribution to 240 billion Saudi Arabian riyals (US$64 billion) by 2030, creating 200,000 direct and indirect jobs, and attracting US$27 billion in new investment. Key policies include the new mining investment law, streamlined permitting, enhanced geological surveys and incentives for foreign investors. These measures are designed to foster a competitive, transparent and sustainable mining industry. The country is also leveraging its mineral wealth to develop downstream processing capacity and secure feedstock for green industrial projects, both domestically and through strategic investments globally, such as in Africa.

Ma'aden and international partnerships

State-owned Saudi Arabian Mining Co. (Ma'aden) is central to Saudi Arabia's mining ambitions, leading major projects and joint ventures. Key operations include the Jabal Sayid copper mine in Madina with Barrick Mining Corp.; the Al Ba'itha bauxite mine in Al Qassim province and the Ras Al Khair aluminum complex in Ash Sharqīyah (the Eastern province) with Alcoa Corp.; and large-scale phosphate mining at the Wa'ad Al Shamal mine in Al Ḩudūd ash Shamālīyah with The Mosaic Co. While Ma'aden and its established partners remain dominant, interest from Asia, Europe and North America is growing, with companies exploring partnerships, technology transfer and investment opportunities in gold, copper and industrial minerals. These international players are drawn by Saudi Arabia's resource potential, supportive regulatory reforms and the strategic importance of the Arabian Shield. A mineral-rich geological region in western Saudi Arabia, the Arabian Shield is known for its ancient rocks and significant deposits of gold, copper and other metals. Ma'aden has also established a joint venture with Hancock Prospecting Pty Ltd. to accelerate exploration in the Nabita Ad-Duwayhi Gold-Belt, covering over 24,000 sq km, further strengthening international collaboration and exploration efforts.

Challenges and outlook

Despite significant regulatory reforms that have elevated Saudi Arabia's position in the global mining industry, ongoing improvements in transparency and governance are essential to meet international standards. Sustained success will depend on overcoming several ESG challenges. The Arabian Shield, central to Vision 2030's diversification strategy, remains underexplored. High exploration spending does not always guarantee discoveries due to geological complexity, limited historical data and technical challenges. Operational risks are heightened by water scarcity and infrastructure gaps in remote mining regions, requiring substantial investment in desalination, recycling and the development of roads, power and communications. Additionally, workforce shortages and logistical issues could slow project timelines. Price volatility and the need for robust financial tools are being addressed through the new metals exchange, which aims to provide stability and attract global expertise. Ultimately, maintaining momentum and attracting investment will hinge on responsible resource management and effective ESG practices, as global investors increasingly prioritize environmental stewardship, workforce safety and community engagement.

As Saudi Arabia continues to implement reforms and attract global investment, the mining sector is poised for substantial growth. Overcoming ESG challenges will be critical to realizing Vision 2030's ambitions and establishing the Kingdom as a global mining leader. With the launch of the metals exchange, expanded licensing and high-profile events like the Future Minerals Forum, Saudi Arabia is advancing its vision to become a hub for mineral trading, processing and responsible supply chains — both regionally and globally.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Location

Segment

Language