Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 23, 2025

By Aman Gupta and Sonam Sidana

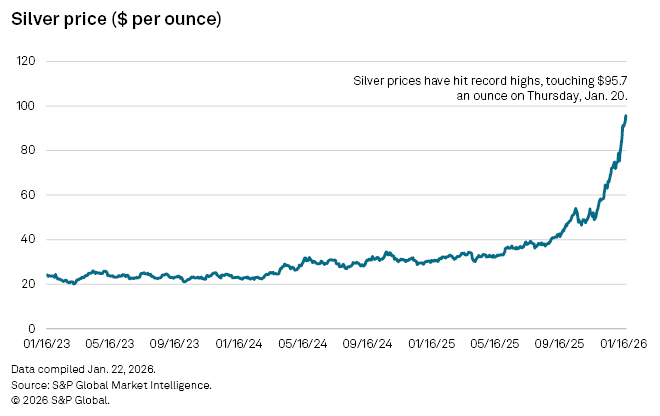

Silver has staged a scintillating rally, climbing to near record highs as investors see precious metals as safer assets amid persistent economic and geopolitical uncertainty. Silver prices have risen sharply over the past year alongside gold, buoyed by expectations of easier monetary policy and a weaker dollar. But silver’s story runs deeper than macro hedging. Industrial demand, particularly from solar panels, power electronics and electrification, continues to accelerate, exacerbating a structural supply deficit and adding fuel to the price momentum.

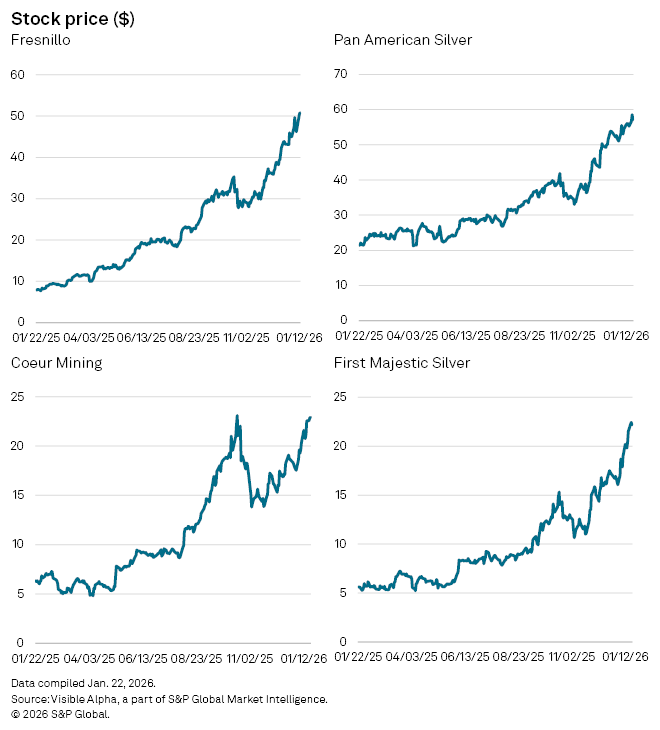

This price surge has also translated into extraordinary equity gains for listed silver producers. Among some of the largest silver-focused miners tracked by Visible Alpha, UK-based Fresnillo (LSE: FRES) and North American peers Pan American Silver (TSE: PAAS), Coeur Mining (NYSE: CDE) and First Majestic Silver (TSE: AG) have seen their share prices soar by 583%, 166%, 260% and 296% year-on-year respectively.

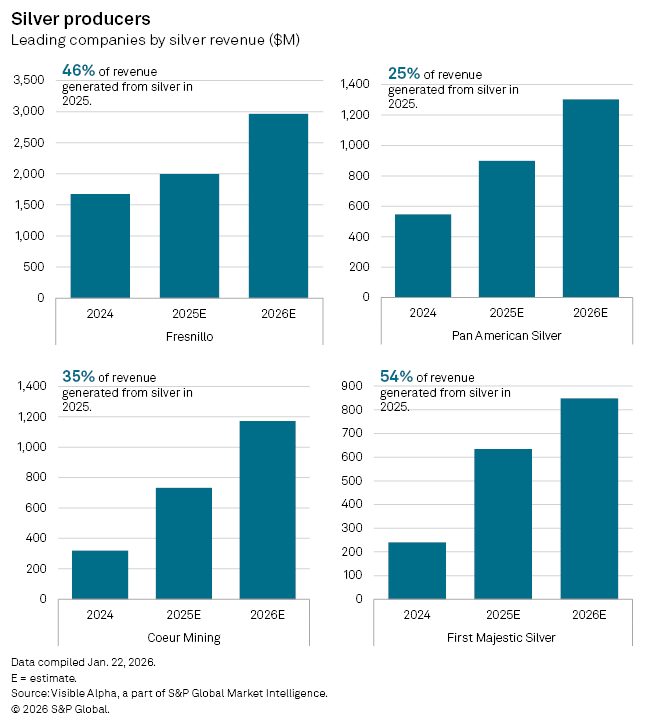

Visible Alpha consensus suggests the earnings tailwind is also beginning to show up in analyst forecasts. Fresnillo, the world’s largest primary silver producer, is expected to see a 23% year-on-year revenue growth in 2025 to $4.3 billion, according to Visible Alpha estimates. Silver, which accounts for about 46% of the group’s total revenue, is projected to generate roughly $2 billion of sales, up 19% from the prior year.

North American producers show an even sharper rebound in silver-specific revenues. Pan American Silver is forecast to see silver revenues jump 63% year-on-year to $891 million in 2025. Coeur Mining and First Majestic Silver are expected to post increases of 125% and 163%, lifting silver revenues to $717 million and $634 million respectively.

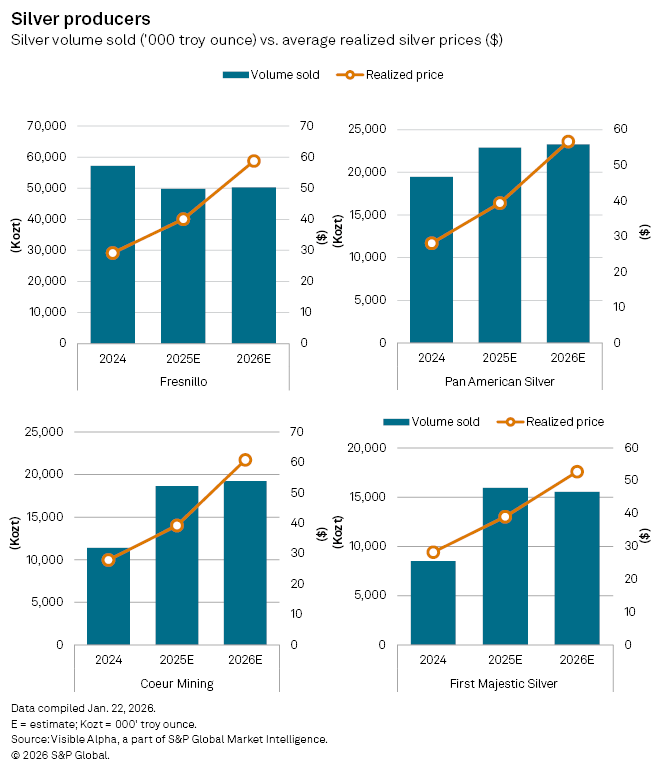

A closer look at price and volume dynamics reveals that much of this revenue growth is price-led, though the mix varies by producer. Realized silver prices are forecast to see a sharp increase across the peer group compared with recent trough levels, reflecting the powerful upswing in spot prices.

For Fresnillo, the uplift is almost entirely driven by pricing. Silver volumes sold are expected to fall 13% year-on-year from 57.2 million troy ounces in 2024 to 49.9 million troy ounces in 2025. Even so, silver revenue is projected to rise as realized prices climb 37% year-on-year, from $29.1 per troy ounce to about $40.

North American producers offer a more balanced picture. Pan American Silver is expected to benefit from both higher prices and modest output growth, with realized prices rising 39% year-on-year to $39.1 per troy ounce in 2025, alongside a 17% increase in volumes to 22.8 million troy ounces.

Coeur Mining and First Majestic Silver exhibit the greatest operational leverage to the rally, with production growth playing an outsized role. Coeur’s realized prices are projected to rise 37% year-on-year to $38.3 per troy ounce in 2025, while volumes are forecast to jump 64% to 18.7 million troy ounces. First Majestic is expected to see realized prices increase 38% to about $39 per troy ounce, with volumes surging 86% to 15.9 million troy ounces.

At current levels, the key risk is sustainability. Silver prices remain inherently volatile and highly sensitive to shifts in monetary policy expectations. While the recent rally has materially boosted earnings, a moderation in prices could quickly temper revenue growth.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment