Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Jan 21, 2026

Market Reaction to Presidential Announcement

Short loan value as a percentage of market capitalization across US financial stocks has increased notably from 0.8% to 0.92% as of January 12, 2026. This 15% increase in short interest follows President Donald Trump's recent announcement proposing a 10% cap on credit card interest rates.

On January 9, 2026, President Trump stated via Truth Social that effective January 20, 2026, marking the one-year anniversary of his second inauguration, he would implement a one-year cap on credit card interest rates at 10%. The President cited concerns about consumers being "ripped off" by rates as high as 30%. A follow-up message on January 11 preceded a significant decline in bank share prices when markets opened the following day.

Short Interest Analysis

The data indicates investors are positioning for potential downside in financial stocks, particularly those with exposure to consumer credit operations. This market reaction reflects concerns about the profitability impact on financial institutions if such a proposal were implemented, despite analysts noting that Congressional approval would likely be required for any mandatory nationwide cap.

Top Shorted Financial Stocks

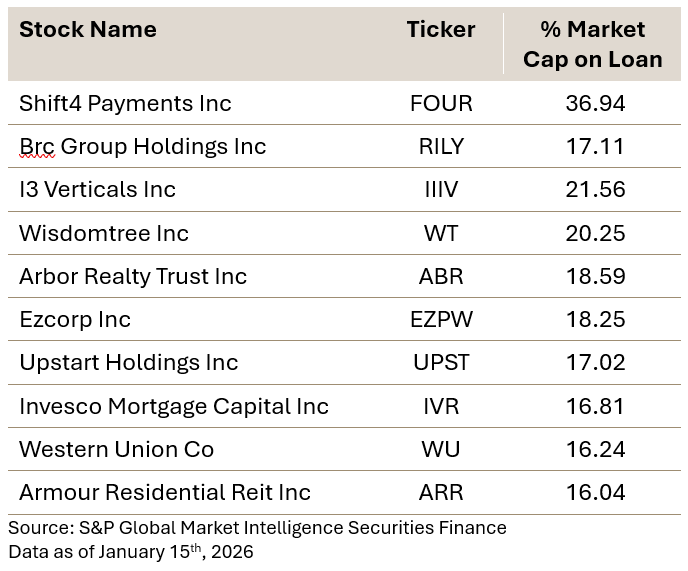

Top 10 most shorted US Financial Stocks

Among the most heavily shorted US financial stocks, several companies show particularly elevated short interest levels:

Potential Market Implications

Financial analysts note that the proposed interest rate cap could have several effects that short sellers appear to be anticipating:

The increased short interest in companies like Upstart Holdings is particularly notable as its business model specifically focuses on using alternative data to price credit risk, potentially charging higher rates to borrowers who might not qualify for traditional bank loans.

Sector Outlook

The rise in short interest suggests market participants are hedging against or speculating on further weakness in financial stocks as the regulatory landscape evolves. While the proposed interest rate cap would require legislative action to implement, the market reaction indicates investors are taking the possibility seriously enough to adjust positioning.