Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

RESEARCH — Jan 17, 2026

Abstract: S&P Global Market Intelligence Dividend Forecasting projects global aggregate dividends to grow by 2.9% in 2026, reaching US$2.47 trillion. Macroeconomic uncertainties - trade tensions and geopolitical conflicts, continue to weigh on corporate earnings and, by extension, dividend growth.

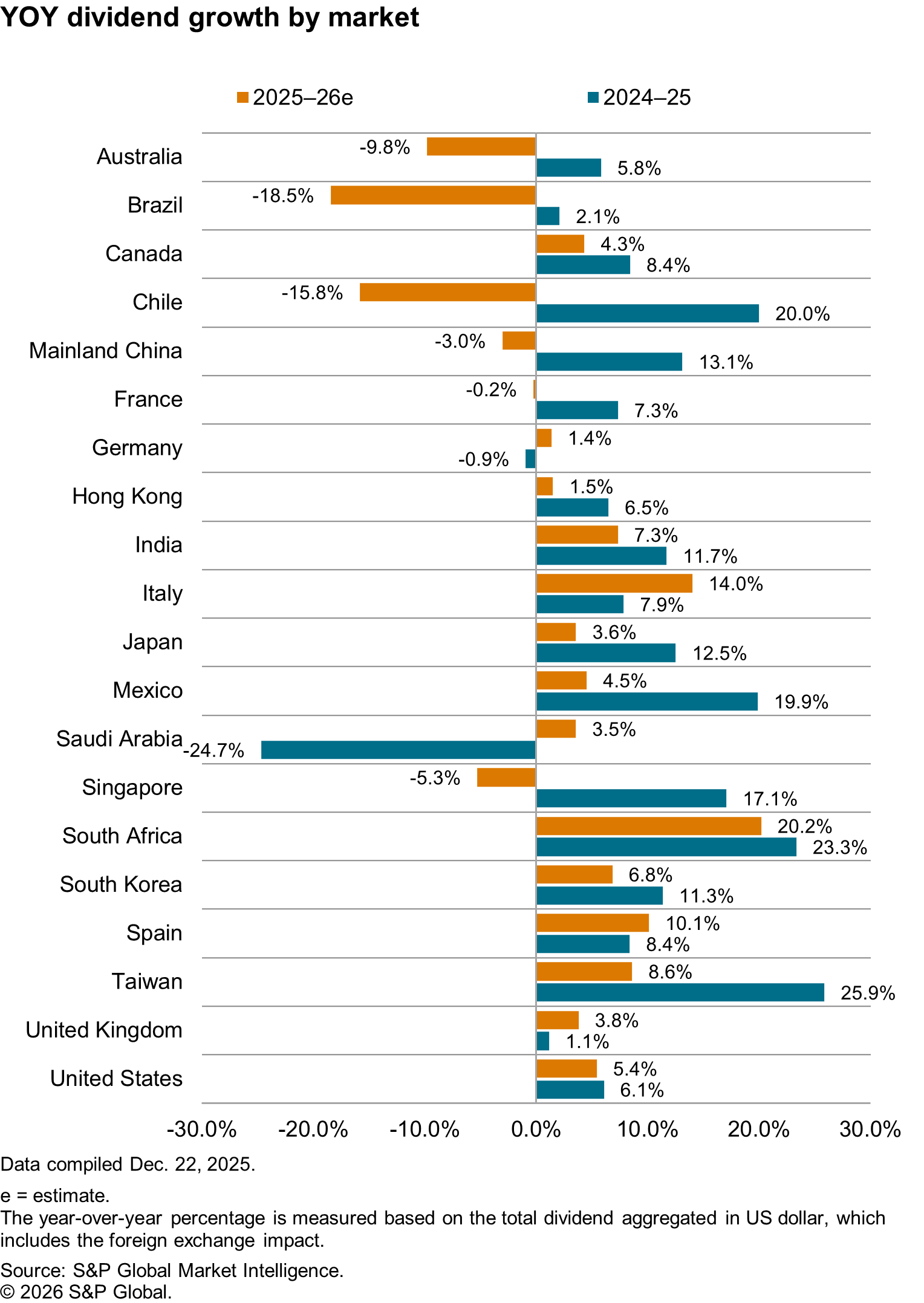

S&P Global Market Intelligence Dividend Forecasting projects global aggregate dividends to grow by 2.9% in 2026, reaching US$2,471 billion. While this represents a significant deceleration compared with the 4.7% growth observed in 2025, it aligns with longer-term trends. Since the post-COVID-19 pandemic rebound, dividend growth has been moderating, reflecting a return to normalized levels of shareholder returns.

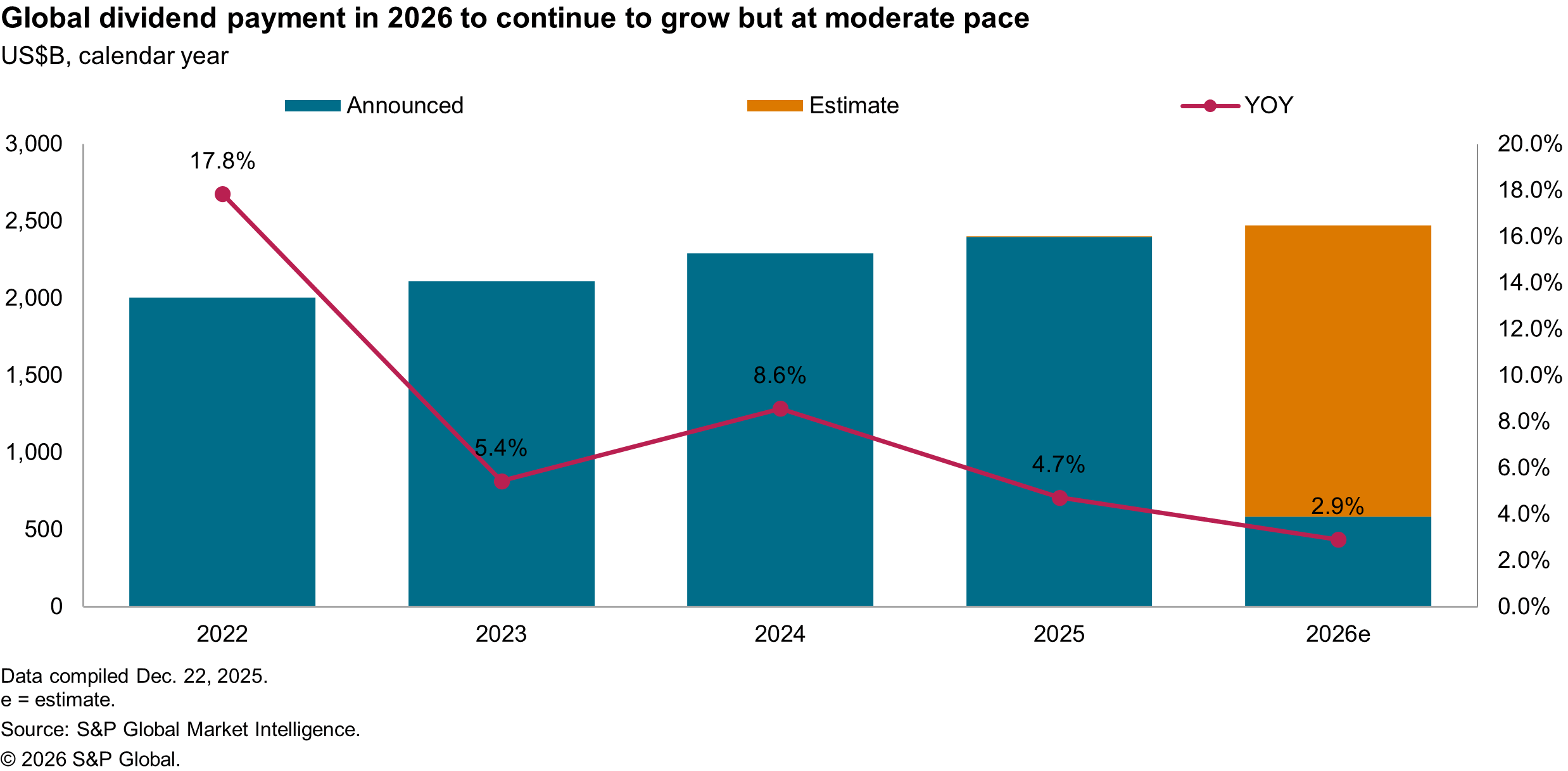

Macroeconomic uncertainties, including trade tensions, fluctuating interest rates, currency volatility and geopolitical conflicts, continue to weigh on corporate earnings and, by extension, dividend growth. The robust 4.7% payout growth in 2025 — far surpassing the initial forecast of 0.3% — was primarily driven by an unexpected surge in dividend payouts across Asia-Pacific. However, this pattern is unlikely to be replicated in 2026, and the moderating pace of dividend growth reflects broader market sentiment and economic conditions.

Continuing our annual series, we highlight seven key forecasts in the dividend landscape for institutional investors to monitor in the new year.