Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

S&P Global Offerings

Featured Topics

Featured Products

Events

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Financial and Market intelligence

Fundamental & Alternative Datasets

Government & Defense

Professional Services

Banking & Capital Markets

Economy & Finance

Energy Transition & Sustainability

Technology & Innovation

Podcasts & Newsletters

Research — January 23, 2026

By Sneha Telge, Soumya Khandelwal, and Akash Jishnu

US gaming platform Roblox Corp. (NYSE: RBLX) is set for another year of strong growth, supported by rising global user engagement, improved monetization, and a thriving developer ecosystem. The company is scheduled to release its fourth-quarter results on Thursday, February 5.

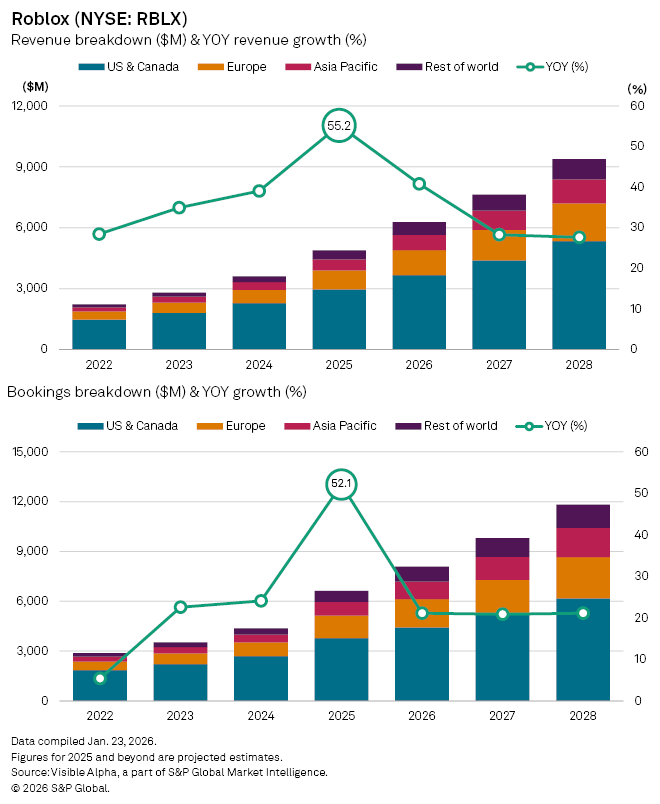

According to Visible Alpha consensus estimates, Roblox’s Q4 2025 revenue is expected to reach $1.4 billion, up 44% year-on-year, while bookings, a key measure of platform monetization, are projected to rise 53% to $2 billion. Daily active users (DAUs) are forecast at 137 million, reflecting steady engagement across the platform.

For the full year, revenue is anticipated to climb 36% year-on-year to $4.9 billion, with bookings expanding 52% to $6.6 billion. The growth is geographically broad-based: US & Canada bookings are set to rise 40% to $3.8 billion, while Europe is expected to see bookings surge 63% to $1.4 billion. Emerging markets are to drive particularly strong gains, with Asia-Pacific bookings projected up 77% to $819 million and the rest of the world rising 80% to $673 million.

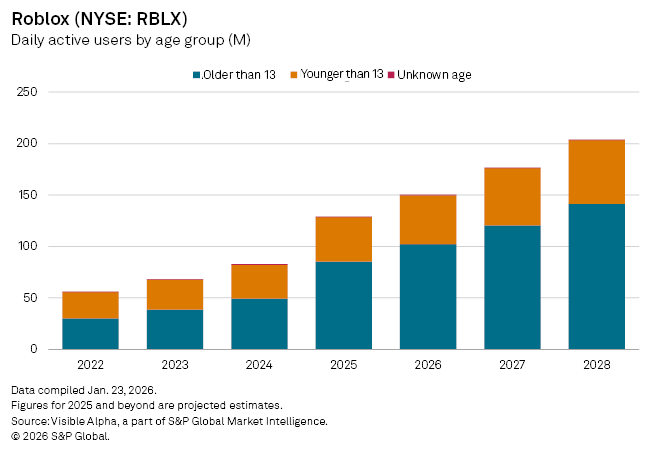

A key driver of Roblox’s outlook is the surge in user activity. DAUs are expected to reach 127 million in 2025, a 53% increase from last year. The platform’s demographic mix is also shifting. Users aged 13 and above are projected at 85.2 million in 2025, representing 67% of the total, up from 44% in 2020.

In comparison, users under-13 users are expected to decline to 44 million, or 34% of total users. The company has recently introduced mandatory age checks following multiple lawsuits over child safety concerns, reflecting increased regulatory scrutiny.

This article was published by Visible Alpha, part of S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

Content Type

Theme

Products & Offerings

Segment